The Anatomy of an Overextended Market MoveMarket Context: When Momentum Accelerates

Markets periodically enter phases where price accelerates rapidly, often driven by a combination of macro catalysts, positioning imbalances, and behavioral feedback loops. In such environments, momentum can appear self-reinforcing: higher prices attract more participation, which in turn pushes prices even higher. While these phases can feel decisive and convincing, they also introduce an important analytical question — is the move being accepted by the market, or is it simply expanding faster than structure can support?

This distinction matters because strong momentum does not automatically imply durability. In fact, the most aggressive moves often carry the seeds of their own instability, particularly when price begins to disconnect from commonly observed reference points such as volatility envelopes, prior value zones, and resting order clusters.

The recent advance examined in this case study provides a clear example of this dynamic: a structurally bullish resolution followed by a sharp acceleration that raises legitimate questions about sustainability.

Pattern Resolution Versus Move Sustainability

Classical chart patterns are useful because they describe how markets transition from balance to imbalance. A double bottom, for example, reflects a failed attempt by sellers to extend lower prices, followed by renewed demand. Once the neckline is cleared, the pattern is considered resolved.

However, pattern resolution only explains directional bias — it does not guarantee how price will behave after the breakout.

In practice, many pattern completions coincide with:

Early participants reducing exposure

Profit-taking activity near projected objectives

New positioning that is more sensitive to short-term adverse movement

As a result, the completion of a pattern can sometimes mark the end of a clean directional phase rather than the beginning of an extended one. This is especially relevant when the breakout is followed by aggressive price expansion rather than gradual acceptance.

Volatility Expansion and the Bollinger Band Framework

Bollinger Bands® are commonly misunderstood as directional indicators. In reality, they function as volatility envelopes, providing context for how far price has deviated from its recent mean.

When price trades:

Outside the upper band

After a gap higher

And remains extended for multiple sessions

it signals volatility expansion, not necessarily trend continuation.

From a statistical perspective, such conditions indicate that price has moved beyond its recent distribution range. From a behavioral perspective, they often reflect:

Late participation

Emotional decision-making

Reduced liquidity on one side of the market

None of these imply that price must reverse immediately. What they do imply is that the informational risk of continuation increases, while the probability of mean reversion back toward equilibrium also rises.

Mean Reversion as a Structural Tendency

Mean reversion is not a prediction tool. It is a structural tendency observed across liquid markets, driven by the constant interaction between:

Value discovery

Liquidity provision

Inventory management by participants

When price moves “too far, too fast,” it stretches these mechanisms. Liquidity providers become more selective, directional participants begin to manage exposure, and resting orders closer to the mean regain relevance.

Importantly, mean reversion does not require a bearish narrative. It simply reflects the market’s natural inclination to revisit areas where participation was previously deeper and more balanced.

In this context, mean reversion should be viewed as a risk consideration, not a directional conviction.

Order-Flow Structure

A key element of this case study is the alignment between classical technical projections and observable order-flow structure, described here through the lens of UnFilled Orders (UFOs).

UFOs represent areas where prior activity suggests the presence of resting interest that has not yet been fully executed. These zones often coincide with:

Prior consolidations

Structural inflection points

Pattern-derived objectives

In the current structure:

o An upper zone near 1.18350 aligns with:

The projected objective of the resolved pattern

UFO resistance

Likely areas of trade closure and sell on-field activity

o A lower zone near 1.16875 aligns with:

UFO support

Areas where price previously attracted participation

A logical mean reversion destination

The importance of these zones lies not in their precision, but in their confluence. When multiple frameworks point to the same areas, they tend to attract attention from a broader range of participants.

Why Overextended Moves Become Fragile

Overextended markets often appear strongest right before they become most sensitive. This is because:

Positioning becomes one-sided

Liquidity thins as fewer participants are willing to transact at extremes

Small shifts in order flow can have outsized impact

In such conditions, price does not need a major catalyst to retrace. It often only needs:

A pause in aggressive buying

Routine profit-taking

A minor shift in expectations

This fragility is what makes mean reversion a relevant consideration after sharp extensions, even within broader bullish structures.

Illustrative Trade Framework (Case Study Only)

To translate these concepts into a practical framework, consider the following illustrative structure, presented strictly as a case study.

o Context

Price has resolved a bullish pattern

Volatility has expanded sharply

Price is trading outside the upper Bollinger Band

o Area of Interest - Upper reference zone near 1.18350, where:

Pattern objectives converge

UFO resistance is present

Trade closure activity is likely

o Mean Reversion Reference - Lower zone near 1.16875, aligned with:

Buy UFO support

Prior participation

The statistical mean

o Risk Definition

Invalidation occurs if price demonstrates acceptance above the resistance zone rather than rejection

This framework highlights an important principle: mean reversion trades are defined by risk first, not by direction. They require patience, flexibility, and a clear understanding of when the underlying premise no longer applies.

Standard and Micro Contracts

This case study can be examined using both standard and micro futures contracts, which offer different exposure profiles while referencing the same underlying market. Understanding their basic specifications is essential, particularly when volatility expands and mean reversion risk increases.

o Standard Futures Contract (6E)

Minimum price fluctuation (tick): 0.000050 per Euro increment = $6.25

Typical margin characteristics: ~$2,700 per contract

o Micro Futures Contract (M6E)

Minimum price fluctuation (tick): 0.0001 per euro = $1.25

Typical margin characteristics: ~$270 per contract

Margin requirements are dynamic, not fixed. They are influenced by market volatility, exchange risk controls, and clearing firm policies.

From a risk-management perspective, the availability of both standard and micro contracts enables traders to align position size with conviction and uncertainty, rather than forcing binary exposure decisions.

Risk Management Considerations

Mean reversion setups carry unique risks. Unlike momentum trades, they often involve entering against recent price direction, which requires:

Smaller position sizing

Wider tolerance for initial adverse movement

Strict invalidation criteria

It is also important to distinguish between being early and being wrong. Overextended markets can remain extended longer than expected. Risk management exists to ensure that such scenarios do not result in disproportionate losses.

Ultimately, the objective is not to capture every retracement, but to participate selectively when structure, volatility, and order-flow context align.

Data Consideration

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Overextended

Maximum Hypothesis TestI still believe Tesla is a great company with a lot of future ahead. However, seeing how aggressive price action has been lately, it would be wise to consider taking some profits. This would allow for the trade to keep going, and the previous winning trades will have room to grow into strong investments. It's unlikely that price will continue to uptrend in this manner, but it's great to finally see some life signs out of this company. I'm sure their future will be bright, but as of now we must stay realistic and expect price to uptrend in a normal manner and not in a bubble like form.

I believe it would be best to lay back and wait for more buying opportunities and look to dollar cost average the dip. If price does keep increasing then the unliquidated stocks should keep capturing returns and if it drops then dollar cost averaging would create a great scenario for catching a possible long term uptrend.

Does the USA sill have something left in the tank?With the recent news of the FED being close to a new rate cut, it's important to start considering the possibility of the market going even higher. However, it's hard for price to keep pushing up when it's already overextended. Not saying this doesn't happen because it does. Price does tend to break the rules of statistics, given the irrationality of people. However now that most stocks are currently in an uptrend, it's hard to believe this performance will continue for much. It's likely that several stocks will begin to start forming downtrends, pushing the percentage of stocks in an uptrend down. When looking at the chats, the cyclicality of growth spurts is quite notorious. However, not every time that a down turn in the index is followed, the vast majority of stocks being in an uptrend.

Although this does tend to happen, as I've circled here in many examples. However, other examples don't show this same pattern and instead see price move even higher. This is because using the percentage of stocks in an uptrend as an indicator is not painting a full picture. Even if many stocks being going into downtrends, the force and extent of which these trends form is what actually drives price action in the index. So we should expect several stocks to begin underperforming in the next couple of days. But if the stocks that have just recently entered an uptrend keep providing strong results, it's still possible for the index to keep on going higher. The direction of the index will depend on the strength of the new form trends and the soon-to-be formed downtrends.

Nvidia Is waaay too hotEven though it is possible for price to go beyond the 3rd STD, It usually doesn't remain there for long before it has to cycle back to test lower levels. However, hype stocks can lead people to keep buying in fear of missing out. We all know that is a rookie mistake. That's why, even though NVIDIA is an awesome company, I would instead prefer to buy at a discount.

No one knows what price will do tomorrow. But it's best to have the odds on our side. And when a situation seems risky, even though it's promising, it's usually the best just to step back. Even if you have to let go a great opportunity where price rises, you will still be better off. Because a strategy consisting of chasing the trend will inevitably end poorly. The correct approach is trying to find opportunities where the price isn't too hot, and you believe in the future of the company.

One must look for ways to determine if a new trend is forming. Not trying to catch the current one. If the price is already in a clear trend, it's best not to jump in right away, but look for a cool off before taking a position. Also, when considering individual stock's it's important to study the related indices as they will give more context to where the stock is in contrast to its pears with similar situations.

By looking at the CME_MINI:ES1! and CME_MINI:ES1! It's noticeable that these indices are also overheating. Just to be clear, I don't believe we are at the peak yet, but we will soon be there. Just be patient, don't tell price what to do, let it hit you about its next move and prepare for all scenarios.

Follow up on the ES1! overextensionAnyone who has read my recent post will have noticed that we are tracking the increasingly over-expansive market in the CME_MINI:ES1! . If the trend is indeed our friend, then prices should remain moving upwards. Which is what I expect will happen. But in order to go into a strong uptrend, first some levels of support must be tested, or else we risk overexpanding even more. At which point, buying would become extremely dangerous. To avoid this risk, it's better to buy at discounted prices and hoping the price does indeed go ballistic. This is much preferable to buy while price is increasing, as many novice traders do due to FOMO.

With a new local maximum in place, we can safely say that a solid support has been created, yet it hasn't been tested. This in combination with the short term MA and the 2nd STD could provide additional support to the area. Making it a safe bet it won't go through. However, if this were to occur, then this would be a sign of a debilitating stock market and could potentially cause a crash. As there is a very large gap between our current supports and the previous ones. Which could lead markets to panic. I don't believe it's time yet, I think we are still missing a strong and not so long-lived final wave before we lose momentum and then crash.

GE Aerospace Needs to CorrectAfter many years of struggle due to the Banking Debacle of 2008, this venerable old company is finally showing strength again. Spinning off divisions to focus on and drive growth in the key businesses was exactly what was needed.

NYSE:GE Aerospace is over-speculated now. The run up from the heavy accumulation during the last half of 2023 is too steep to sustain. Smaller funds have been driving it upward since March, causing the more volatile action recently.

It had a small gap up on earnings this week but it still needs to correct, either down or sideways . It has the look of a stock with short-term topping risk at the moment, but extended sideways action could adjust out the overextended uptrend instead.

Bitcoin ETF: Sideways Action to Pattern Out Excessive GainsProbably the most popular Stock Exchange Traded Bitcoin Trust at this time, AMEX:GBTC has started a consolidation that may turn into a small triangle formation. Triangles are a form of a consolidation that can work to pattern out excessive price gains without a run or correction down.

This is the weekly chart where we can see that GBTC is now above its previous all-time highs. It is still affordable and poses less risk than the actual Bitcoin, which is very expensive.

SHIBUSD need to rest LONG again laterShiba Inu has pushed quite hard. I can only think of sled dogs ona long marathon push over a

sun prepared snow trail. The ride might be frictionless but nonetheless grueling and perhaps

time for a rest. The chart shows the breakout and then extension above the VWAP lines that

are trying to catch up. In proper risk management. I will take half the position off here and

have it ready to add at least part of it back if the rest is a stable consolidation in the upcoming

day.

NASDAQ 100 Short Term Correction Risk AnalysisIt is important to know when the NASDAQ:NDX and a few of its components are overextended and that a minor correction, aka retracement, is imminent. It doesn't really matter if you can guess the exact day, but it does matter that you can see the risk coming so that you can plan to take action on open positions and plan ahead for new positions for swing or position trading.

The Weekly Chart above shows where very strong support will kick in. Somewhere within the Green Rectangle, the index is highly likely to find support. This is a very strong support level since it is a yearly high, and that defines where fundamentals were before this earnings season. The only thing that could derail it is an UNKNOWN negative event for the Buy Side Institutions. That is a very RARE event. So that is the long-term view.

Just for fun, let's check the Monthly DPO Cycle chart. Exactly the same line as weekly but in a more stark perspective. The cycle line is bending which is a good pattern, but it can easily peak and go sideways, which would create a dip into the index's support level if a correction goes all the way to or into that rectangle.

Okay, now the daily chart to determine the short-term or intermediate-trend support level. The first higher Rectangle is weak support. Second, lower Rectangle is moderate. There are heavily weighted stocks that have fundamentals at or within these levels as well.

EUR/USD Short Term Outlook (Quick trade setups)EUR/USD is showing signs of overextension on the daily. With an RSI reading of 24 and nearing the bottom of a declining trend line, we should start to see some calls for liquidity from sellers, opening up the opportunity for buyers to recover slightly.

I identified our upper supply zone which which sits right at our Major CHoCH level. I’m expecting price to rebound toward the fib 61.8/70.7% level for a mitigation and pull of liquidity.

Our two trade opportunities are:

1. Short-Term +- 3 R:R trade to the upside riding with the buyers toward mitigation and liquidity levels

2. Long-Term short trade once we mitigate these levels and grab liquidity for the sell-off

NAS100NASDAQ is been on great great run in last couple of days. Is the correction due in NAS100?

Will NAS100 give room to the buyers who missed this rally ?

N

Stock Market Logic Series #1The purpose of this series is to provide insight into what price is likely to do...

and more vital... what price is not likely to do... (since X is the cause and X is not existing, hence Y will not happen...)

The chart is self-explanatory.

IF no-one cares about the stock THEN no one will put money into it (no volume) THEN it will not rise.

The BIG question is, at a certain overextended place, the price is rising, even though, everyone is at a loss on this stock. why NOT crush into a price of $1 in one sharp move?

Can we "KNOW" that we are in an overextended place?

When you have stock market logic behind you, you will be more confident to take trades.

Is OXY topping at resistance ? ( Possible Reversal )OXY has run up quite well, especially with the help of heavy buying from Warren Buffet and his conglomerate.

Is it set up for a downturn?

On the chart, the red horizontal line is the market high pre-Covid.

The MACD a lagging indicator has the K and D lines in early convergence

well above the histogram.

Time will tell but OXY might be pulling back into a better price for buying.

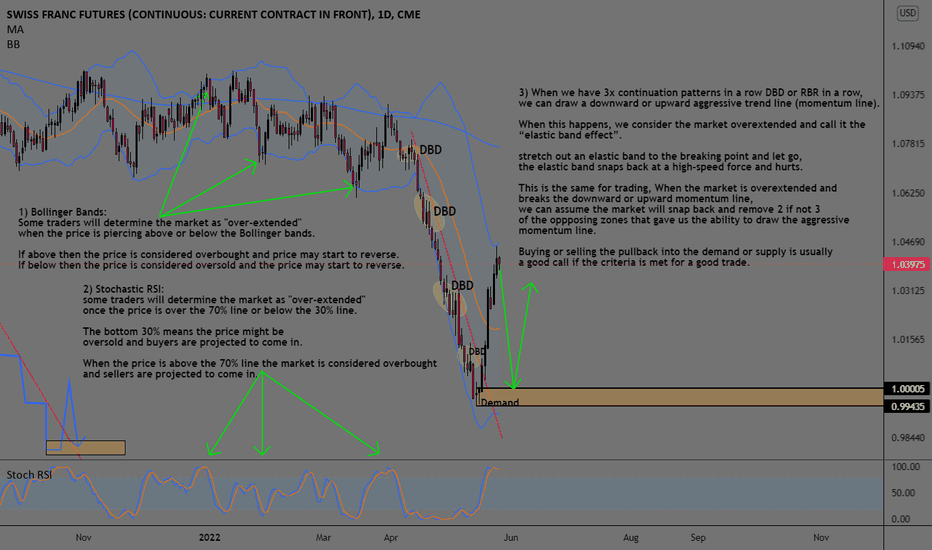

Overextended Markets (Overbought And Oversold)1) Bollinger Bands:

Some traders will determine the market as "over-extended"

when the price is piercing above or below the Bollinger bands.

If above then the price is considered overbought and price may start to reverse.

If below then the price is considered oversold and the price may start to reverse.

2) Stochastic RSI:

some traders will determine the market as "over-extended" once the price is over the 70% line or below the 30% line.

The bottom 30% means the price might be oversold and buyers are projected to come in.

When the price is above the 70% line the market is considered overbought and sellers are projected to come in.

3) Supply And demand

When we have 3x continuation patterns in a row DBD or RBR in a row, we can draw a downward or upward aggressive trend line (momentum line).

When this happens, we consider the market overextended and call it the “elastic band effect”.

stretch out an elastic band to the breaking point and let go, the elastic band snaps back at a high-speed force and hurts.

This is the same for trading, When the market is overextended and breaks the downward or upward momentum line, we can assume the market will snap back and remove 2 if not 3 of the opposing zones that gave us the ability to draw the aggressive momentum line.

Buying or selling the pullback into the demand or supply is usually a good call if the criteria are met for a good trade.

NZDJPY Daily TargetDownside targets highlighted - with multiple targets in between. This is just an forecast - real entries will be based off H4 or H1. We can have targets in between around 85.500, 85.000 then potentially 84.000-83.000. Entries are based off PA. More conservative stops will be above 88.000.

IBM short setupIBM overextended on monthly Bollinger Bands and hitting trend line resistance. If this plays out similar to history I'm expecting a 20% drop within the next 200 days and about 40% drop in the next 2-3 years. Fundamentals also looking weak with declining revenues, lower margins, and burning cash. Cleary a breakout that holds to the upside will negate this bear setup. Monthly MACD about to crossover so might end up turning into a uptrend. I'm not in this trade, keeping on watch.

SPY- Bearish Reversal - UpdateSPY looking very bearish here, frankly, the markets have been overextended for quite some time and all technicals are bearish on almost every timeframe- Some FIB levels and RSI-based supply and demand zones to keep an eye on-

- Bearish ABCD Harmonic Pattern Formed

- Spinning Top Candlestick Pattern (Reversal Pattern, Bearish in This Case)

- Bearish Butterfly Harmonic Pattern Also Formed (See Attached Chart)

- Buyer Volume Drying Up

- RSI way in Overbought Territory

- MACD Death Cross on the 4-Hour

Previously Charted

What Is An Overextension In The SIMPLEST Terms?A lot of times we get away from simply keeping it simple. When it comes to trading, simplicity will be your best friend. I consider Price Action the "OG" of all technical analysis.

On the same note, I don't knock anyone who uses indicators to make a profit. I do have a few myself that I originally started with, that I still plug in from time to time.

I will ALWAYS keep the Volume indicator on my chart, it's the most important indicator there is to use. Because price may tell you when & where it's happening, but volume will tell you how it's happening. Is there commitment basically.

The other indicators are: VWAP, 21MA, 200MA (I also plug in Camarilla Pivot Points set to "Traditional" using the Pivot with R1-R4/S1-S4 levels only, if price has entered into a voided area).

I use Pivot Points in voided areas to shortcut the calculation & measurement of the potential move & set R1(resistance) for my 1st target on a breakout & I use S1(support) for my 1st target on a breakdown. With the PIVOT(P) level being where price may react either way.

But here with #PNC, I'm highlighting the breakout that happened. The point in this chart is to show an overextension within price itself. The technique is rather simple and quite frankly elementary but effective & that's just to count the bars.

When you begin to see price pushing 3,4,5,6,7,8,9 bars up or down!!! THAT IS NOT A TIME TO GET IN THE TRADE!!...IF YOU ARE IN THE TRADE, REAAALLLLYYY THINK ABOUT TAKING PROFIT SOONER OR SOONER!!

Novice traders sometimes have the misconception that when they see a multitude of green candles pushing up or a multitude of red candles pushing down, that NOW is the time to get in & it's not. You're asking for nothing but small profit, tough managed trades, reversals, anxiety, emotional & financial pain. The people who are already in those trades are the ones making money & taking profit, YOU are the one that needs to sit on your hands, but you choose greed sometimes. Trading is about probabilities, high probabilities and low probabilities. You have a higher probability of price stalling out or reversing on you after 6 or 7 bars up or down vs. A higher probability of the trade pushing ANOTHER 4, 5 or 6 bars up or down.

In closing, just play the higher probability no matter the timeframe.

AMD Overextended heading into ResistanceAMD has been on a tear lately, but we are now extended and expanded pretty good now. Weekly resistance sits around 122, so I wouldn't be surprised if AMD has a price correction here soon.

I have a side by side comparison with the weekly and Daily chart. With the weekly showing a nice 3 week run after the bounce.

I have support around 112. If price pulls back there and begins to turn, I will be looking to grab a contract or two. Until then. I'll be watching, but AMD is too overextended right now on the Daily Chart.

NZD/CAD Daily analysis We can expect the price to come down Because we have an over extended W formation. If we take the fibonacci on the impulse we have a confluence of structure on the previous leg of extended W formation. We could expect a .5 fibonacci retracement . If you want to take an entry make sure you follow the rules of your strategy. For a better entry use lower time frames