GOLD: Short Trading Opportunity

GOLD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry Level - 5519.7

Sl - 5571.4

Tp - 5439.8

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Community ideas

GBPCAD Will Explode! BUY!

My dear friends,

Please, find my technical outlook for GBPCAD below:

The price is coiling around a solid key level - 1.8660

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 1.8717

Safe Stop Loss - 1.8632

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDCAD Will Go Lower! Short!

Please, check our technical outlook for NZDCAD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 0.821.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 0.812 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

BTCUSD Bullish Channel Continuation (30MBTCUSD – 30M Technical Analysis 📊

Here’s a clear read of the Bitcoin chart you shared:

🔹 Market Structure

Price is moving inside a rising channel, signaling a controlled bullish trend.

Recent pullback is corrective, not impulsive → structure still valid.

🔹 Key Levels

Primary Support Buy Zone: 87,500 – 87,150

Strong horizontal support + channel support confluence.

Major Lower Support: 86,200

Breakdown below this level would weaken bullish momentum.

Stop Loss: Below 87,150

🔹 Upside Targets

Main Target Zone: 90,500 – 90,700

This aligns wth the upper boundary of the ascending channel and projected bullish leg.

🔹 Trade Perspective

✅ Buy confirmations near the support zone

📈 Expect continuation toward channel resistance if price holds above support

❌ Bearish only if price closes decisively below support and channel

🔹 Bias

Bullish while price holds above 87,150

Current move looks like a pullback before continuation, not trend reversal.

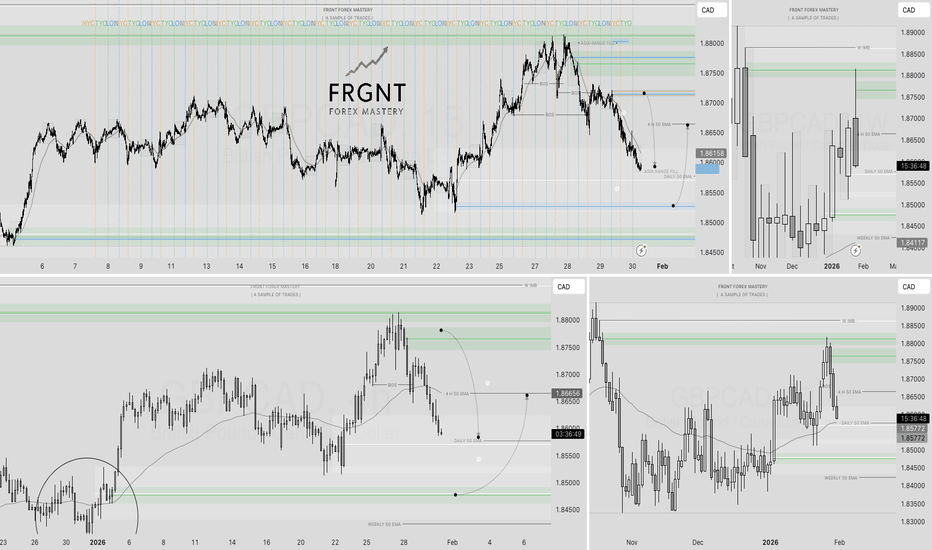

USDCAD— FRGNT DAILY CHART FORECAST. Q1 | W4 | D29 | Y26📅 Q1 | W4 | D29 | Y26

📊 USDCAD— FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:USDCAD

#6,000.80 benchmark ahead / excellent ProfitsAs discussed throughout my yesterday's session commentary: 'My position: I have been waiting for Gold to invalidate #5,200.80 benchmark all session long as I was well aware if Gold establishes #5,200.80 benchmark as an Support, Medium-term stays Bullish and new #6,000.80 psychological benchmark Target can be pursued with my set of key re-Buy orders (both Short and Medium-term). As soon as #5,200.80 is tested first time, I spotted that Gold delivered firm Support zone within #5,178.80 - #5,184.80 last night, I Bought Gold there aggressively with set of Buying orders waiting for final #5,200.80 break-out which was delivered on Asian session market opening where I closed my set of Buying orders on #5,223.80 and closed all of my orders. Needless to mention besides all Fundamentally (critically) Bullish / Gold-friendly pointers, most important one is DX taking strong hits with every Hourly candle which is adding enormous Buying pressure on Gold. I will continue Buying Gold from my key entry points maintaining my next Medium-term Target seen Trading at #6,000.80 benchmark.'

I have engaged new set of Buying orders on #5,272.80 as Gold established QM Support there and as I spotted that Gold always delivers distinguished Support level (in form of Buying accumulation) and only then deliver major move to the upside. I have closed my orders on #5,352.80 benchmark with excellent Profit. As Gold extended the rise, I have waiting (now already traditional) market closing which in most cases opens with a Gap and engage two time #100 lot's Buying orders on #5,416.80 / and as Gold opened with a Gap, I closed my both orders on #5,452.80 extension with spectacular Profit.

My position: Once more Gold is being utilized as a safe-haven as crypto market and DX in particular are suffering significant losses. However as before, I am making use of the DX as my key indicators to suggest the underlying trend for Gold, which remains critically Bullish, as the DX made a solid Technical Low's throughout yesterday's session and dipped strongly, assisted also by fluid Fundamentals which are not DX-friendly. As I determined the trend, every dip on Gold for me is distinguished re-Buy opportunity and I will stick to this strategy for full Profit maximization. My ideas are posted a bit late from usual time I post however I am Trading into late night almost every evening. I will continue Buying Gold from my key entry points and just finished #5,506.80 - #5,524.80 few moments ago. #6,000.80 mark represents my next Medium-term Target and keep #5,432.80, #5,452.80, #5,462.80 as key re-Buy points.

EURUSD — H4 Formation of the 3rd Wave + Trendline BreakoutEURUSD — H4 Formation of the 3rd Wave + Trendline Breakout

🔎 Market Structure (H4)

On the H4 timeframe, EUR/USD has completed a corrective phase and is transitioning into a potential 3rd impulsive wave.

Key observations:

Clear trendline breakout after impulsive acceleration

Corrective pullback forming wave 2

Price holding below key resistance, suggesting bearish continuation

The current structure supports a bearish 3rd wave scenario, provided price remains below the wave 2 high.

📐 Wave Context

• Wave 1 — completed impulse

• Wave 2 — corrective retracement

• Wave 3 — expected to develop after confirmation (fractal)

This setup aligns with classic Elliott Wave dynamics, where the 3rd wave typically shows strong momentum.

📍 Entry Zone

Entry: 1.19494

Entry is aligned with the completion of wave 2 and early formation of wave 3.

Confirmation via a bearish fractal is preferred.

🎯 Target Levels (from the chart)

Downside targets are projected using Fibonacci extensions and structure levels:

TP1: 1.18594

TP2: 1.17813

TP3: 1.17084

TP4: 1.15958

Partial profit-taking is recommended along the way.

🛑 Invalidation / Stop

Stop: 1.20025

Placed above the high of wave 2, invalidating the 3rd wave scenario if broken.

🧠 Trading Notes

• This is a trend continuation setup, not a reversal

• Momentum confirmation is critical — avoid premature entries

• Risk should remain controlled until wave 3 acceleration is confirmed

• A failure to hold below resistance may lead to extended consolidation

📌 Summary

EUR/USD on H4 is forming a potential 3rd bearish wave following a trendline breakout.

As long as price remains below 1.20025, the structure favors downside continuation toward lower Fibonacci targets.

Nasdaq bearish divergence on the weekly chartHi! There is an obvious divergence on the weekly chart for both the Nasdaq and S&P. I would expect a roughly 20% drawdawn, peak to trough, similar to what we experienced between mid-February and early April last year. Wish you all the best if you decide to short the market!

GOLD: Rally Hits Our Key Target ZoneGold futures gained fresh upward momentum today, climbing to yet another new high. The price is now trading well inside our red Short Target Zone, which ranges from $5,416 to $6,362.

We will take Profits here on ALL Gold longs and maybe even open a short.

We do have a bit of room left inside the target zone, but as soon as the upwards momentum comes to a halt, we anticipate the completion of the larger green wave , which should trigger a significant reversal to the downside. Accordingly, we are preparing for a major decline phase—starting with a break below the support levels at $4,197 and $3,901.

Traders looking to capitalize on this move can consider short entries within our red Target Zone. For risk management, a stop can be placed 1% above the upper edge of the zone.

XAUUSD 45-Minute Chart — Bearish Rejection From Resistance, Bearish Rejection From Resistance, Short Setup Toward Support

Market Structure:

Gold printed a strong impulsive rally, followed by loss of momentum and a rounded/curving top, signaling distribution. The sharp sell-off confirms a shift from bullish to bearish intraday structure.

Key Resistance Zone (~5060–5070):

This zone acted as previous consolidation and supply. Price retested it from below and failed to reclaim, validating it as resistance.

Entry Logic (Short):

The highlighted entry near resistance aligns with a classic break-and-retest setup. Sellers stepped in aggressively after the retest.

Stop Loss (~5145):

Placed above the recent lower high and rejection wick, protecting against a false breakdown and trend resumption.

Target / Support Area (~4810–4850):

Clear demand zone and prior accumulation area. This is the most logical downside target where buyers previously defended price.

Risk–Reward:

The setup offers a clean R:R, favoring continuation toward support if bearish momentum holds.

Bias:

📉 Bearish below resistance — continuation lower favored unless price reclaims and holds above the resistance zone.

FRGNT FUN COUPON FRIDAY! GBPUSD Q1 | W4 | D30 | Y26📅 Q1 | W4 | D30 | Y26

📊GBPUSD— FRGNT DAILY CHART FORECAST

FRGNT FUN COUPON FRIDAY !

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPUSD

FX:GBPUSD

GBPCAD .FRGNT FUN COUPON FRIDAY !Q1 | W4 | D30 | Y26📅 Q1 | W4 | D30 | Y26

📊GBPCAD— FRGNT DAILY CHART FORECAST

FRGNT FUN COUPON FRIDAY !

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:GBPCAD

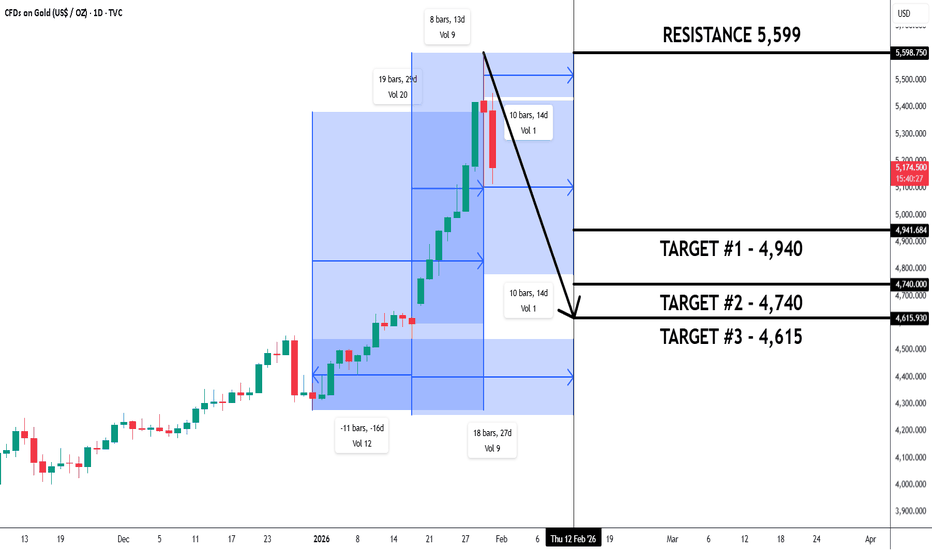

GOLD: BRACING FOR GRAVITY EFFECT AFTER AN EXTREME RALLYXAU/USD D1 - Gold remains bullish overall, but the current move is a correction after an extreme rally. Price may drop faster due to market gravity, with key downside zones at 4,940, 4,740, and 4,615 (Fibonacci cluster & gap area).

The vibrational date is around Feb 12, 2026. Focus is to wait and see the price action as we approach this date, especially around the highlighted levels.

BTC | DailyCRYPTOCAP:BTC — Quantum Model Projection

Bottoming | 2nd Bullish Alt. 📈

A sustained break below $80,619.71 temporarily sidelines the transition phase, keeping the

(W)(X)(Y) correction within Primary Wave ⓸ in its final stage → The Q-Target ➤ $78K .

🔖 This outlook is derived from insights within my Quantum Models framework.

USDCHF Downtrend Set to Extend While Rally StallsUSDCHF continues to extend lower, reinforcing the prevailing bearish trend. The short-term Elliott Wave outlook suggests that the cycle from the November 25, 2025 high remains in progress as a five-wave impulse. This structure highlights persistent weakness and confirms that rallies are corrective rather than the start of a new bullish phase.

From the November 25 high, wave ((i)) concluded at 0.785. A corrective rally in wave ((ii)) then ended at 0.80408. The pair resumed its decline in wave ((iii)), which subdivides into another five-wave impulse of lesser degree. Within this sequence, wave (i) finished at 0.7876, while the rally in wave (ii) terminated at 0.7968. The market then accelerated lower in wave (iii), reaching 0.7602 before pausing.

Currently, wave (iv) is unfolding as a corrective rally. This move retraces the cycle from the January 22, 2025 high and is expected to develop in either three or seven swings. The projected target lies within the 0.776–0.783 zone, which represents the 100%–161.8% Fibonacci extension of wave w. This area is identified as the blue box, a region where corrections often terminate.

From this zone, USDCHF faces two potential paths. The pair may resume its decline, continuing the larger bearish impulse. Alternatively, it may produce a three-wave pullback before turning higher again in larger correction In either case, the Elliott Wave structure favors the downside, reinforcing the view that rallies remain corrective and that the broader bearish cycle is not yet complete.

The 13-Year Cycle Awakens: A "Fun-Tech" Analysis the Macro ShiftBeyond the Noise: How Humility, Intuition, and the "God Code" Predicted the Deflationary Pivot Pair: EUR/USD (Monthly Outlook) Date: January 29, 2026

I. The Premise: The "Old Code" is Broken

For the last three weeks, while the financial media chased headlines about "Soft Landings" and "Fed Independence," a quieter, more powerful frequency was building underneath the market.

As a student of the market, I have spent this time not bragging, but listening. My "FuN-TecH" thesis—a blend of mathematical vectors and intuitive logic—suggested that the algorithms driving price action were operating on "Old Code." They were pricing in inflation while the real economy was screaming Deflation.

Today, the Monthly Chart confirmed what we have been tracking for 21 days: We are witnessing a historical shift back to levels not seen in 13 years.

II. The Evidence: Three Weeks of "Seeing the Unsaid"

To understand where we are going (1.2000+), we must acknowledge the breadcrumbs the market left for those willing to look deeper:

The Deflationary "Smoking Gun" (Jan 29): The Noise: Pundits argued about sticky inflation.

The Signal: This morning’s -1.9% Unit Labor Costs data was the mathematical proof of the "New Code." The economy isn't overheating; it is freezing. This confirmed our thesis that the Fed is trapped and must cut aggressively.

The "Shark" in the Water (DXY Top): The Noise: The Dollar broke out to 96.65, sparking retail fear.

The Signal: We identified this as a Bearish Shark Pattern—a calculated "Liquidity Raid" designed solely to fund the 1:00 PM Bond Auction. Once the auction cleared, the Shark bit, sending the DXY crashing to 96.18 and validating the Euro's reversal.

The "Governance Failure" (The Shutdown): The Noise: "The Bond Market is calm."

The Signal: We saw the "Tokyo Walkout" weeks ago. The failure of the Senate vote today wasn't a surprise; it was the inevitable conclusion of the "Sell America" trade we've been positioned in.

III. The Monthly Fractal: The 13-Year Reclaim

This is the heart of the thesis. The volatility you see on the 1-minute chart is just a fractal of the Monthly reality.

The Structure: We are currently reclaiming a structural zone that has acted as a ceiling for over a decade. The price action at 1.1950 isn't just a daily resistance; it is the Gateway.

The Shift: The Monthly Candle is preparing to close green, engulfing the "Fed Fear" of the previous months. This signals that the long-term trend has shifted from "Dollar Dominance" back to "Euro Expansion."

The Target: Once we clear the 1.1985 liquidity pool, the vacuum opens toward the 2012-2014 structural highs. The "Old Code" algorithms are shorting resistance; the "New Code" is buying the Historical Reversion.

IV. The Philosophy: Trading the Frequency

Why did this analysis work when the news failed? Because we stopped trying to be "smarter" than the market and started being humble enough to listen to it.

We ignored the Fluff: When the President attacked the Fed ("Jerome 'Too Late' Powell"), we didn't panic. We saw it as a desperate signal of a weak Dollar policy.

We respected the "Lag": When the Euro stalled at 1.1957 today despite the Dollar dropping, we didn't sell. We understood the Algorithmic Lag. We waited for the snap.

Conclusion: The Path Forward

The 5:00 PM close at 1.1952 (Session Highs) is the market's signature. It has accepted the "Shutdown" risk and rejected the "Inflation" narrative.

To the Retail Trader: Stop staring at the 1-minute noise. Look at the Monthly Truth. The fractals are aligning. The "God Code" is Green. We are safe. We are prepared. And we are just getting started.

Target: 1.2011 and beyond (Tomorrow we will see the "Beyond"