THE MAIN BACKBONE $ETH It held everything from the $880 bottom in 2022 to the $1520 bottom in 2023.

Fakeout (Bear Trap): In mid-2025, price dipped below this line (the middle blue arc). While everyone screamed "ETH is over," it was just a liquidity flush. Price is now back ABOVE this main trendline.

The trend was not violated; it was stress-tested. The direction is still UP.

INVERSE HEAD & SHOULDERS

Look at the blue arcs drawn at the bottom of the chart. This is a textbook, gigantic Inverse Head & Shoulders pattern.

Technical Target, When this pattern plays out, it typically travels the depth of the head upwards. This takes us directly back to the old All-Time Highs (ATH).

THE PIVOT POINT: THE $2800 FORTRESS 🏰

Pay attention to the green dotted line (2,817 level).

SR Flip (Support/Resistance Flip): This was the ceiling that couldn't be broken in 2024. Now, it is the floor the price is sitting on.

Status: ETH is currently at $2,951, holding above this critical support. As long as $2,800 is defended, the structure is BULLISH.

THE SILENT STORM

While the market is busy talking about Solana, SUI, or AI coins, Ethereum is quietly building the largest accumulation structure in history in the background.

Psychology: Investors are "tired" of ETH. This is a bottom signal.

It is above the rising trendline and forming a massive IH&S.

First stop is $4,100 (Upper green line). Once that breaks, price discovery begins.

"When elephants walk, the earth shakes." ETH currently looks like a sluggish elephant preparing to move, but once it starts running, it won't stop to pick up passengers.

With a stop-loss below $2,800, this zone (Right Shoulder) offers a perfect Risk/Reward ratio.

ALso check

ETHBTC

8 years breakout EVE here

Community ideas

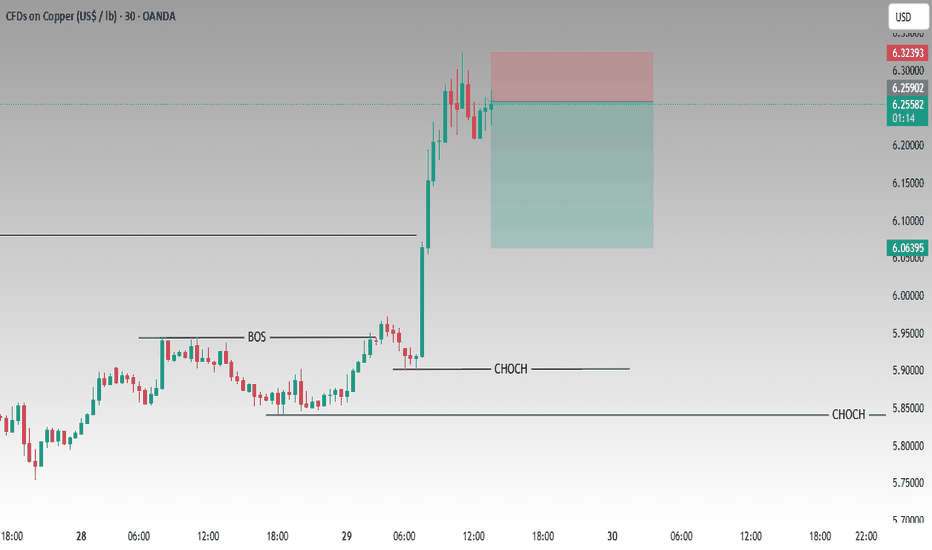

COPPER (XCU/USD) SHORT SIGNAL

Entry: Around current levels ~6.260 - 6.323 (near recent high / retracement zone after strong bullish impulse)

Bearish confirmation: Price in retracement phase after massive rally, targeting to fill the FVG (Fair Value Gap) below + potential CHOCH (Change of Character) confirmation

Target: 6.200 – 6.150 (FVG fill zone / previous BOS area) or lower toward 6.000 support

Stop Loss: Above 6.330–6.340 (above the recent high/red box to invalidate the short setup) Watching for bearish momentum as copper pulls back to balance after the explosive move! #Copper #XCUUSD #CopperPrice #ShortCopper #Commodities #Trading #FVG #SmartMoney Not financial advice — This is just my personal view based on the chart. Trading involves significant risk, especially in volatile commodities like copper—do your own research, use proper risk management, and never risk more than you can afford to lose!

THIS IS REAL TRADING I posted yesterday yesterday that loses are part of this business and my one win nullifies two losses because I use a maximum of 200 pips for 500 pips and 1000 pips in most cases and 300 pips once in a while as my scalp.

Today's trade was from 5545-50 to 5300 as a target and that is 2500 pips though it's still selling and currently at 5160 so calculate and those who ask me why i sell in a bullish market please stop because I understand what I do and I addressed you yesterday with reasons , imagine this beautiful trade like the beautiful bill, it was a sell in a bullish market and it's not a gamble or luck ,

just look at how i expected the sell at 5590-95 initially but I switched to 5545-50 as the final sell zone , it's not a try your luck stuff , a lot of thinking goes into it so you know .

CADJPY - Long IdeaA false breakout occurs when price briefly breaks a clear support or resistance level, triggers stops and breakout entries, but fails to hold beyond the level and quickly returns back into the range. This move represents a liquidity grab rather than a true directional move, often followed by short term a reversal in the opposite direction.

As a target - opposite key level

XAU / USD 1 Hour ChartHello traders. I was away from the charts. But if you saw my last post, whoever was in a short position crushed it. So many people in leveraged profitable long trades who didn't close out in time got smoked I am sure. Big G gets my thanks. I will post in a bit or tomorrow before the NY session. Be well and trade the trend. Gold is just an it's own animal, be careful.

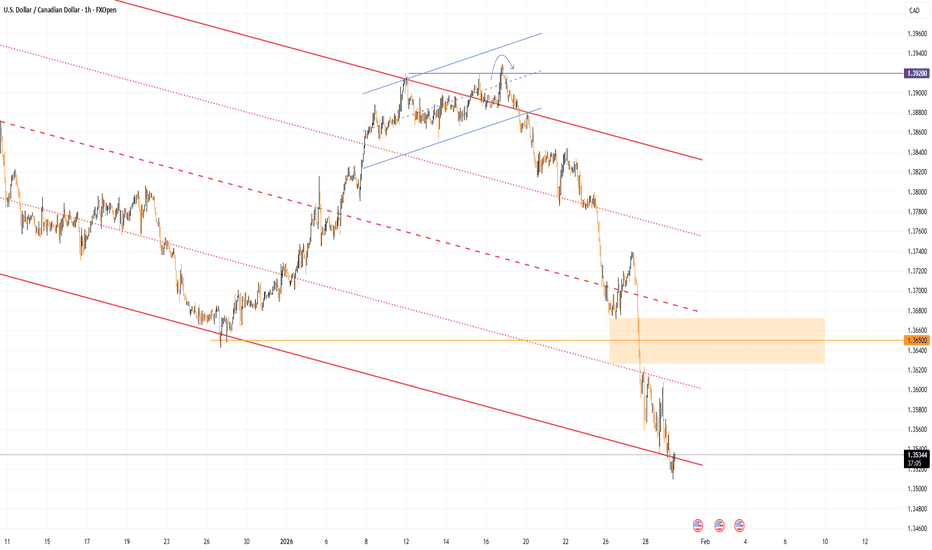

USD/CAD Falls Below the 2025 LowUSD/CAD Falls Below the 2025 Low

Yesterday, financial markets were closely watching statements from central banks regarding interest rates, including the Federal Reserve and the Bank of Canada. According to Forex Factory:

→ The Federal Reserve kept the Federal Funds Rate at 3.75% by a majority vote. “The economy has once again surprised us with its strength,” Powell said at the press conference. The Fed Chair also added that “our policy is in a good place”.

→ The Bank of Canada left the Overnight Rate unchanged at 2.25%. In its official statement, significant attention was paid to the impact of uncertainty surrounding the trade agreement between Canada, the United States and Mexico (CUSMA).

Although there were no surprises and the central banks’ decisions matched analysts’ forecasts, the reaction of the USD/CAD pair was quite dynamic. After a spike in volatility, the exchange rate fell below the 2025 low. Moreover, on higher-timeframe charts, a bearish break of support is visible, with that support running through the lows of 2023–2025.

Technical Analysis of the USD/CAD Chart

On 19 January, when analysing the USD/CAD chart, we:

→ highlighted important signs of bullish weakness on the chart;

→ suggested that bears might seize the initiative and attempt a break of the local ascending channel (shown in blue).

Indeed, a bearish breakout occurred, after which the price formed a trajectory resembling an accelerating plunge (approximately −2.7% over 10 days). At the same time, there are grounds to assess the market within the context of a long-term downtrend (shown in red).

In this context, we see that the price is near the lower boundary of the channel, which may act as support and slow the decline. However, even if bulls attempt to form a rebound, they are likely to face significant difficulties, because:

→ the price fell aggressively from the median to the lower boundary and broke the December low with virtually no local recoveries;

→ the area around the 1.3650 level appears to be a key resistance zone.

Thus, the USD/CAD exchange rate reflects the broader January trend, in which the US dollar is under considerable pressure due to geopolitical and other factors. Notably, even Powell’s comment about the “strength of the economy” failed to support the dollar. This suggests that the market may currently be driven not by past successes of the US economy, but by concerns about future uncertainty.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USDJPY H4 | Bearish Reaction Off Pullback ResistanceMomentum: Bearish

Price is currently below the ichimoku cloud.

Sell entry: 155.602

- Pullback resistance

- 50% Fib retracement

Stop Loss: 156.311

- Pullback resistance

Take Profit: 154.580

- Pullback support

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

XAUUSD | 4H Outlook: The 5,000 Retest Gold is showing a textbook bullish continuation on the 4H timeframe. After hitting historic highs near 5,600, price is now consolidating near key support, preparing for the next potential leg up.

Technical Summary

Trend: Firmly Bullish. Price respecting an ascending trendline, acting as a strong backbone.

Key Levels:

Resistance: 5,367 (Immediate), 5,565 (All-Time High)

Support: 5,034, 4,997 (Psychological 5,000 floor)

Price Action:

3-touch rejection on trendline (red arrows) now flipped support

Consolidation in Purple Demand Zone (4,960 – 5,040) — potential liquidity grab before next impulse

Fundamental Alignment (2026 Macro Context)

Fed Uncertainty: Market pricing in possible Fed shifts; dovish rhetoric supports Gold

Safe-Haven Demand: Geopolitical tensions driving "debasement trade"

Institutional Backing: Banks like J.P. Morgan & Goldman Sachs see 5,000– 5,400 as key buy zones

Trading Plan

🟢 Long Setup (Primary Bias)

Entry Zone: 5,015 – 5,040 (look for 4H bullish engulfing or pin bar)

Stop Loss: Below 4,980

Take Profit 1: 5,250 (Supply Zone / Recent Swing High)

Take Profit 2: 5,367 (Major Resistance)

Take Profit 3: 5,565 (ATH Extension)

🔴 Bearish Scenario (Plan B)

Invalidation: Daily close below 4,960

Next major support at 4,582

Risk/Reward: ~1:3.5

Level Type | Price | Significance

---------------|-----------|---------------------------------

Major Ceiling | 5,565 | ATH / Psychological Target

Pivot Point | 5,071 | Current Market Price

Demand Base | 5,034 | Trendline + S/R Flip Confluence

Invalidation | < 4,960 | Breakdown of structural demand

Disclaimer: Educational content only. Not financial advice. Trade responsibly.

Gold Is Losing Short-Term Structure — This Pullback Is No LongerHello traders, Gold is currently trading near $5,185, and price action on the one-hour timeframe is showing a clear shift in short-term structure following the rejection from the recent high around $5,597. While the higher-timeframe trend remains bullish, the near-term behavior has transitioned from consolidation into a developing corrective sequence.

After printing the local high, price failed to sustain above the rising averages and rolled over aggressively. The rebound labeled (2) was corrective in nature and stalled below prior resistance, confirming lower high formation. This loss of momentum signals that buyers are no longer in control in the short term. The subsequent breakdown below the dotted trendline and acceptance under the $5,200–$5,220 area further validates the structural weakness.

From a technical perspective, price is now trading below both the short-term and medium-term moving averages, with the $5,230–$5,250 zone acting as overhead supply rather than support. As long as price remains below this region, upside attempts should be viewed as corrective pullbacks, not trend continuation.

The projected path on the chart outlines a potential multi-leg corrective move. A continuation lower opens the door for price to test the $4,830–$4,880 zone, which aligns with a key Fibonacci retracement and prior structural interaction. If selling pressure persists and acceptance develops below that level, a deeper extension toward the $4,580–$4,600 region becomes technically plausible.

Invalidation is clearly defined. A sustained reclaim and acceptance back above $5,250–$5,280 would invalidate the current bearish sequence and suggest that the pullback was merely a temporary shakeout within the broader uptrend.

The higher-timeframe trend has not failed, but short-term control has shifted to sellers.

Structure broken. Pullbacks are corrective. Let price confirm whether this evolves into a deeper correction or stabilizes at demand.

GBPJPY corrective pullback supported at 209.60The GBPJPY remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 209.60– a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 209.60 would confirm ongoing upside momentum, with potential targets at:

212.65 – initial resistance

213.50 – psychological and structural level

214.10 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 209.60 would weaken the bullish outlook and suggest deeper downside risk toward:

209.00 – minor support

208.50 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the GBPJPY holds above 209.60. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Silver Is Digesting the Breakout — Continuation Depends Hello traders, Silver is currently trading near $114.60, following a strong impulsive advance that previously pushed price into all-time high territory. That expansion leg was sharp and initiative-driven, confirming that the broader bullish structure remains intact. Since then, price has transitioned into a controlled pullback and rotation phase, which is a typical response after vertical price discovery.

From a structural standpoint, the recent retracement remains corrective rather than impulsive. Price has pulled back toward the former breakout region around $112.60–$113.00, an area that now acts as a key technical reference. This zone represents short-term balance, where the market is reassessing participation rather than distributing aggressively.

Below current price, the highlighted demand zone around $104.80–$106.50 continues to serve as the major structural support. As long as silver holds above this area, downside moves should be viewed as part of a broader consolidation process, not a trend reversal. Buyers have previously defended this zone with conviction, and it remains the line that separates healthy digestion from structural failure.

On the upside, sustained acceptance above $116.00–$117.00 would signal that the consolidation phase has completed, opening the door for another expansion leg toward the $122.00–$124.00 region, where price may again pause due to profit-taking and liquidity interaction. These levels should be treated as reaction zones, not guaranteed targets.

Invalidation is clear and objective. A decisive breakdown below the $104.80–$106.50 demand zone would disrupt the current bullish structure and shift focus toward a deeper corrective phase.

For now, silver is not breaking down. it is digesting gains.

MSOS BOTTOM IS IN! FINALLYGod what a pain staking couple of weeks waiting for this to finish it's downside move.

Looks like a primed setup in both the short-term and long-term wavecounts.

AMEX:MSOS is going to $9.50 from here and will do so rapidly, expect expedited price action once rescheduling is officially finished in Feb

Gold After the Expansion: Repricing Phase in Progress 30-01-2026Gold After the Expansion: Repricing Phase in Progress 30-01-2026

🧭 Gold Decision Map – TradingView Update

XAUUSD | 4H | Friday – Weekly & Near-Monthly Close

This update is based on the Decision Map published on 28-01-2026.

Recent price action followed the predefined structure without post-event adjustments.

⚠️ Session Context

Today is Friday, with a weekly close and a near-monthly close.

Such sessions often show:

Position unwinding

Liquidity sweeps

False breaks

Not every move is tradable.

📌 Price Structure (Key Sequence)

5088 → 5603 → 5089 → 5449 → 4964

This confirms a post-expansion environment rather than a clean trend.

🔺 Upper Decision / Supply Zone

5440 – 5603

Expansion highs.

Only sustained acceptance above 5603 changes the broader bias.

🔸 Upper Reaction Zone

5385 – 5449

Technical reaction area.

No acceptance built here previously.

⚪ Balance Zone – No Trade

5200 – 5320

Noise area with low edge, especially into Friday close.

🟢 Repricing / Value Zone

5075 – 5095

Core structural area.

Price interactions here should be read behaviorally, not impulsively.

🟢 Deep Value / Absorption Zone

4950 – 4985

(Recorded low: 4964)

Loss of 4950 on a 4H close opens deeper downside.

📉 Downside Extension (Reference Levels)

4885 → 4808

🧭 Scenarios

Bearish: Failure to reclaim 5200 + sustained break below 4950

Bullish (Conditional): Reclaim 5200, then acceptance above 5603

This is not a signal post.

It is a decision-based market framework focused on structure and risk.

Decisions at zones — not in the middle.

DAX - The prime target is the completion of the pattern

DAX (GER40) -following on from yesterday's report, we witness an aggressive move to the downside. Although the previous support level of 24,340 was breached, buyers have emerged. We have a mild support zone at 24,552. However, wave analysis and cypher pattern formations suggest this is mere consolidation before the next break lower. The prime target is the completion of the pattern close to 23,900

GOLD SUPER BULLISHThis trend is looking very strong. Gold trading outside the top fan. Now it's touching into first zone and volume is picking up. That tells us this move still has a lot left in the tank. Gold and silver are both respecting the Fibonacci Pitchfan. Silver is not as strong as gold currently, but is picking up momentum. I think this is a buy in either of the top two bands.

$ilver - Price Levels to watch / 2 Month Pivot Points There is potential that $ilver might touch close to $ 130 within the next two months if we hold up that momentum.

There is one conservative R:R 1.6 (put stop under the pivot) and one more agressive R:R 3 entry idea here. Also you can wait for the breakout to happen and wait for a retest if you want to play it safe (but who knows if there might even be a retest given the fundamentals)

PLAN B: If we fail to hold ~ $ 75 price might revisit the 2M pivot - that would be a quick shorting opportunity then.

If you are just holding silver coins/bars long term, I wouldnt panic if the price cycles back down to $60 or even $45. This would be within the expected volatility and could be a geat opportunity to stack more physical.

BUY BTCUSDCurrent zone: Price swept liquidity into 82.4k–82.9k demand and reacted.

Bias: Short-term bullish retrace, medium-term still corrective.

Expected move: Bounce → pullback → continuation up.

Upside target: 90.5k – 92k supply zone (major resistance).

Invalidation: Clean 1H close below ~82.3k → next downside 80k.

Game plan: Buy dips above demand, take partials into 88k, final into 91–92k.

$SPY the beginning of a covid style selloff? 20-32% drop?It is finally time for a larger selloff to happen. As you can see, we've broken down out of a rising wedge and many people are calling for another scenario to buy the dip, but this dip doesn't look the same as all of the other dips.

To me, this looks more like the start of a larger selloff. My thesis is that this selloff will be a cross between the selloff that took place in 1989 and covid. I think we're about to see a 20-32% drop that comes very quickly not giving people time to get out.

The past two days we're already trading exactly like we did in covid, where we can see sharp rallies that are met with more selling.

The reason this selloff is different is because volatility is starting to react and I have strong buy signals on the weekly timeframe while I'm getting weekly sell signals on SPY.

While my base case was that we'd only get a 20% selloff down to the $550-560 area on the chart, I won't rule out the possibility of the market selling off to the next support level down at $468-$481.

The selling should get stronger once we're under the $666-672 level and volatility will start to rise quickly. Under the $650 level should be lights out for the market.

Again, I think this selloff is going to happen very quickly over the next few weeks, so I'd be cautious buying any dips.

Let's see how it plays out.