Solana (SOL) — 1H: Bearish Structure Remains in FocusOn the 1-hour chart, Solana may appear to be forming a reversal after an extended decline. However, the current structure does not yet support this view.

Price action remains weak, with downside risk still present. A move toward the 125-125,5 area could allow for short-term consolidation, followed by a rotation into the 116–118 zone.

From there, continuation toward 108 remains a level to monitor.

This scenario would change if price reaches the 127 level.

Community ideas

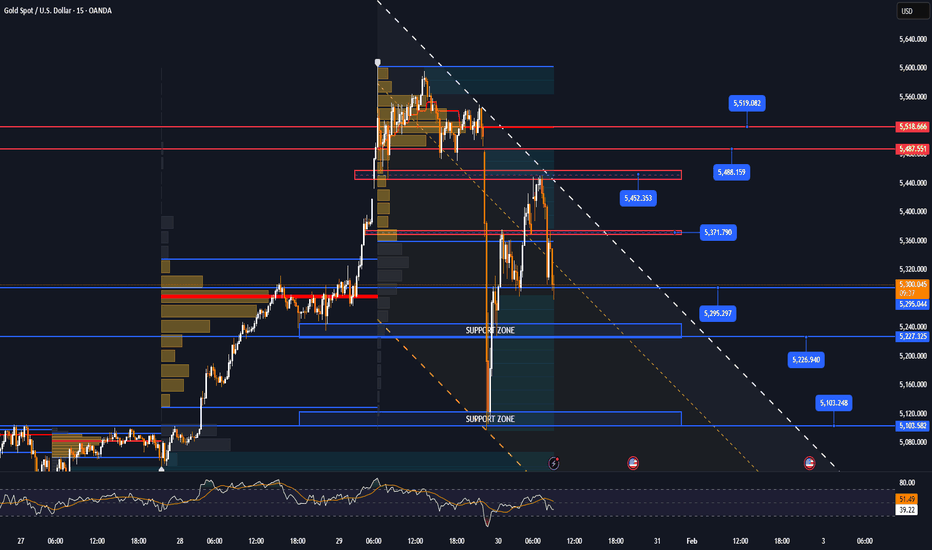

XAUUSD Bearish Continuation Setup – 15M Descending ChannelGot it — here’s a clean technical breakdown of the chart you shared (XAUUSD, 15-min) 👇

🔍 Market Structure

Price is clearly moving inside a descending channel (lower highs & lower lows).

Overall bias remains bearish unless the channel top is broken with strong momentum.

📉 Key Levels

Resistance / Sell Zone

5,060 – 5,065

Marked resistance + channel mid/top rejection

Your highlighted ENTRY POINT makes sense here

Support / Target

5,885 – 4,880

Lower channel boundary + prior liquidity zone

This aligns with the projected -2.9% move

🧠 Price Action Read

Price retraced back into resistance after a weak bounce

No impulsive bullish structure formed

Consolidation under resistance = distribution, not accumulation

Bearish continuation favored while below 5,065

📌 Trade Idea (Based on Chart Logic)

Bias: Sell on rejection

Entry: 5,055 – 5,065

Invalidation: Clean breakout & close above channel top

Target: 4,885 area (channel support)

RR: Solid, continuation setup

⚠️ Invalidation Scenario

Strong bullish candle closing above 5,070

Channel break + retest → bearish idea fails

✅

GBPCAD - Short IdeaA false breakout occurs when price briefly breaks a clear support or resistance level, triggers stops and breakout entries, but fails to hold beyond the level and quickly returns back into the range. This move represents a liquidity grab rather than a true directional move, often followed by short term a reversal in the opposite direction.

As a target - opposite broken key level

MNQ Friday Outlook | Equilibrium Chop ExpectedExpecting equilibrium chop today on MNQ.

Key observations:

✅ London swept the Asian range (25,725)

✅ Breaker held clean at 25,800

⚖️ Now sitting at EQ ~25,865

Upside: BSL at 26,032 is the magnet

Downside: Break below 25,800 = discount retest

Opening range will confirm direction. Friday typically sees consolidation after mid-week moves.

PriceCipher indicator mapping the PD arrays.

#NQ #Futures #ICT #Trading

USOIL BEARS WILL DOMINATE THE MARKET|SHORT

USOIL SIGNAL

Trade Direction: short

Entry Level: 65.09

Target Level: 63.63

Stop Loss: 66.05

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USAR — Building America’s Rare Earth-to-Magnet Supply ChainCompany Overview

USA Rare Earth NASDAQ:USAR is developing a fully domestic, vertically integrated rare earths + permanent magnet supply chain—anchored by the Round Top (TX) resource and the Stillwater, OK magnet facility slated for commercial production in early 2026. The model spans mine → refine → finished magnets for EVs, wind, and defense—directly aligned with U.S. supply-chain security.

Key Catalysts

Round Top Acceleration: One of North America’s largest heavy REE deposits; PFS targeted for late 2026 brings forward project value and funding optionality.

Magnet Plant Ramp: U.S.-based NdFeB capacity addresses a critical domestic gap, enabling offtakes with auto, energy, and defense OEMs.

Policy Tailwinds: U.S. industrial policy and defense priorities support onshore materials, permitting, and potential grant/loan access.

Vertical Integration Advantage: Internalized processing + magnet making can improve margins, quality control, and supply assurance vs. import dependence.

Investment Outlook

Bullish above: $16.50–$17.00

Target: $42–$44 — supported by magnet plant commercialization (2026), Round Top de-risking, and strong geopolitical/DOE-DoD tailwinds.

📌 USAR — from ore to magnet, a strategic U.S. cornerstone for EVs, wind, and defense.

Elite | XAUUSD – 15M – Corrective Phase After SellOANDA:XAUUSD PEPPERSTONE:XAUUSD

The aggressive drop appears corrective within a broader bullish environment rather than a full trend reversal. Price is consolidating above a key demand area after liquidity was swept to the downside. As long as this base holds, a recovery toward higher resistance remains valid.

Key Scenarios

✅ Bullish Case 🚀 →

Holding above 4,950 – 4,980 may trigger a bullish rotation back into the range.

🎯 Target 1: 5,190

🎯 Target 2: 5,320

🎯 Target 3: 5,600

❌ Bearish Case 📉 →

A clean breakdown and acceptance below 4,950 could extend selling toward 4,800.

Current Levels to Watch

Resistance 🔴: 5,190 – 5,320, then 5,600

Support 🟢: 4,950 – 4,980

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice

XAU / USD 30 Minute ChartHello traders. Happy Friday. I have marked the 30 min. chart with my area of interest that I am currently watching. I can say that for me, it is the end of the month, volatility is high, candles, even on the 30 min. chart are just ripping in both directions, and I am not trying to force or rush a trade. Saying that, let's see how the current 30 min. candle plays out. We have pre NY volume starting here in the US at 7:20am (est). Big G gets a shout out. Be well and trade the trend. I can see scalp trades in either direction. Trade carefully.

GOLD XAUUSD LONDON/NEWYORK PERSPECTIVE GOLD ,the buyers goes into correction after the current all time high at 5595.185 during Sydney session and London came for retest before correction.

current supply roof was a previous demand floor at 5189.029 on 1hr am looking for break of structure for buy continuation.

key support zones will be 5108.316-5098.251

key support zone 4966.244 with a 50pips above and below for sniper entry or switch to 15min for clear directional bias.

key demand floor 4839.428-4832.573

GOLD will continue to rise after 4000pips-50000pips correction.

my forecast is 10000 for the year 2026.

what is gold ???

Gold is a precious metal and chemical element (Au, atomic number 79) prized for its rarity, malleability, luster, and resistance to corrosion, serving as currency, jewelry, and industrial material for millennia. Central banks buy and store gold primarily as a safe-haven reserve asset to diversify portfolios, hedge against inflation and currency devaluation, and mitigate geopolitical risks.

Key Properties

Gold's density (19.3 g/cm³), conductivity, and chemical inertness make it ideal for electronics, dentistry, and investment bars/coins. Unlike fiat currencies, its fixed supply prevents arbitrary expansion, preserving value over time.

Central Bank Motivations

Central banks hold about 36,000 tonnes globally (over 20% of all mined gold) for these reasons:

Diversification: Reduces reliance on USD or bonds; gold inversely correlates with the dollar, rising when it falls.

Inflation hedge: Fixed supply counters money printing that erodes currency value.

Geopolitical stability: No counterparty risk; neutral and seizure-resistant amid tensions

Liquidity and credibility: Easily swapped for any currency, bolsters national economic confidence.

Gold is a precious metal prized for its scarcity, durability, and role as a store of value, chemically inert and historically used in currency, jewelry, and reserves. Under Basel III banking regulations, physical allocated gold (bullion in vaults) is classified as a top Tier 1 asset with 0% risk weighting for capital requirements, equivalent to cash or sovereign bonds.

Basel III Treatment

Basel III, post-2008 reforms, upgraded gold from Tier 3 (previously discounted 50% for liquidity) to Tier 1 High-Quality Liquid Asset (HQLA) status as of July 2025, allowing banks to count it at 100% market value toward core reserves. This applies only to allocated physical gold, not unallocated "paper gold" like ETFs, which face higher funding costs.

Reasons for Tier 1 Status

Zero Risk: No credit or counterparty risk, unlike bonds tied to issuers.

Liquidity: Easily sold globally during crises, with deep markets.

Diversification: Negative correlation to fiat currencies and stocks, hedging inflation/systemic shocks.

Stability: Fixed supply bolsters bank solvency without maturity or default worries.

This elevates gold's institutional demand, tying into central bank buying trends and physical backing .

Gold prices exhibit a strong inverse relationship with both the US Dollar Index (DXY) and the 10-year US Treasury yield (US10Y), driven by opportunity cost, dollar strength, and safe-haven dynamics—rising yields/DXY typically pressure gold lower, while falls support it. Divergences occur when this expected inverse pattern breaks, signaling potential reversals or regime shifts like policy changes or crises.

Core Mechanisms

Higher US10Y yields raise the "opportunity cost" of non-yielding gold, making interest-bearing assets attractive; real yields (nominal minus inflation) matter most, with negative values bullish for gold. DXY strength (from yields attracting capital) makes dollar-denominated gold costlier for foreigners, adding downward pressure—historical correlations: gold-DXY at -0.63, gold-real rates at -0.82.

Divergence Examples

Divergences signal anomalies:

Yield-DXY split: US10Y falls (e.g., 6% drop below 4.5% in Feb 2025) while DXY rises (testing 107.6), pressuring gold despite lower yields due to dollar dominance.

Decoupling periods: 60-day DXY-US10Y correlation dips as seen in 2020-2021 crises.

Breakdowns: Extreme risk-off rallies both gold and bonds, or central bank buying overrides yields.

GOLD IS THE NEW MONEY AND HAS ALWAYS BEEN MONEY,SO IF YOUR DONT HAVE PHYSICAL GOLD YOU DONT HAVE GOLD ,FORGET ABOUT PAPER GOLD YOU ARE TRADING.

#GOLD #XAUUSD

Silver After the BlowOff Top: Liquidity Is Pulling Price Silver has just printed a blow-off move into a new all-time high near one hundred twenty-one, followed by a sharp rejection that confirms exhaustion at the top of the trend. From a Dow Theory perspective, this is a clear failure to hold higher highs, while Elliott Wave structure suggests a completed impulsive sequence, with price now transitioning into a corrective phase. The rejection aligns precisely with the Fibonacci extension zone, while the current pullback is already trading below the EMA ninety-eight and threatening the rising trendline that supported the entire markup phase from below one hundred. This shift tells us momentum has flipped from expansion to distribution and corrective re-pricing, not continuation.

From a liquidity and macro standpoint, this move makes sense. The rally into the all-time high aggressively cleansed buy-side liquidity, trapping late breakout buyers just as U.S. dollar stability, elevated real yields, and cautious risk sentiment reduce demand for leveraged precious-metal exposure. Liquidity is now concentrated below one hundred five and one hundred, with deeper sell-side liquidity resting toward the ninety-six to ninety region. Psychologically, the market has moved from “fear of missing out” to risk reduction, and unless silver can reclaim acceptance above one hundred twelve, rallies are likely corrective. The higher-probability path remains a multi-leg pullback, allowing the market to reset structure and rebuild demand before any sustainable upside can return.

OIL What will happen given the tensions?Brent crude oil should reach around 70 dollars, and in my opinion, with rising tensions in the Middle East, it could even hit 80 dollars. There are two scenarios, and both would lead to higher oil prices. The first is that the United States might block Iran’s oil exports, which would push prices up. The second is the possibility of a war in the Middle East, which on its own would be a strong reason for energy prices—including oil—to rise.

From a technical perspective , the price is moving within a bullish flag or wedge pattern, which typically leads to an upward breakout and a continuation of the uptrend. Additionally, with the corrective waves coming to an end, we should expect the formation of new bullish waves.

Best regards CobraVanguard.💚

BCH/USD [BITCOIN CASH] EWP FIB TC ANALYSIS WEEKLY TFBCH – Weekly Structure Overview (Update 2)

BCH appears to have completed a major W-X-Y multi-zigzag corrective structure to the downside. Price has since transitioned into a motive phase, advancing within the rising green channel and breaking above the former bearish channel, signalling a potential trend reversal.

As long as BCH remains within this ascending structure, the path of least resistance points higher. If bullish momentum continues, price could challenge the next key resistance zones near $870 and $1,645, which align with higher-degree Fibonacci projections and prior structural levels.

Invalidation occurs on a sustained breakdown below the lower boundary of the green channel.

Like and follow for more charts like this.

The uptrend is complete. Forum adjustments are now underway.1️⃣ Market Context

Gold remains in a confirmed higher-timeframe uptrend, but price is currently in a short-term corrective / distribution phase following a strong impulsive rally.

Momentum has clearly slowed, and the market is transitioning from expansion to range–pullback behavior. There is no major high-impact macro catalyst driving strong directional flows at this moment, meaning technical levels and liquidity reactions are in control.

👉 Context Summary:

HTF bias: Bullish

Intraday condition: Correction / consolidation

2️⃣ Technical Breakdown

Market Structure

After a sharp sell-off from the highs, price found strong demand and produced a technical rebound.

On M15, structure shows lower highs, indicating the current move is a corrective pullback, not a fresh impulsive leg.

Buyers are active at demand zones, but upside continuation requires a clean break above key intraday resistance.

Trend & Momentum

Price remains below the descending trendline, which continues to cap bullish attempts.

Each approach into the trendline has triggered selling pressure.

RSI has recovered toward the 50–53 zone, confirming neutral momentum, not overbought conditions.

3️⃣ Key Levels

Resistance (Supply Zones)

5,370 – 5,375

Intraday supply + trendline confluence. Strong reaction area.

5,445 – 5,455

Higher supply zone. Only valid for shorts on clear rejection.

5,485 – 5,520

Major distribution zone. No long entries at this level.

Support (Demand Zones)

5,295 – 5,300

Intraday support. First level for potential bullish reaction.

5,225 – 5,235

Stronger demand zone. High-probability buy area if swept.

5,103 – 5,120

Major demand base. Only relevant if panic selling occurs.

4️⃣ Trading Bias

Primary Bias: Buy the pullback

Secondary Bias: Short-term counter-trend sells at resistance (scalp only)

The dominant trend remains bullish, but entries must be selective and based on price reaction, not anticipation.

5️⃣ Trade Execution Plan

🟢 BUY GOLD 5239 - 5237

↠ Stop Loss 5234

→ Take Profit 1 : 50 ~ 100 pips

→ Take Profit 2 : 200 pips

→ Take Profit 3 : Opennn

🔴 SELL GOLD 5488 - 5486

↠ Stop Loss 5491

→ Take Profit 1 : 50 ~ 100 pips

→ Take Profit 2 : 200 pips

→ Take Profit 3 : Opennn

6️⃣ Risk & Discipline Rules

⚡️ Psychology, discipline, and capital management are the three pillars that turn analysis into consistent profitability. ⚡️

📌 Daily Summary

Gold is in a corrective phase within a broader bullish trend. The plan is to buy dips at demand zones with tight risk and sell only short-term reactions at resistance. Discipline and execution quality will determine performance today.

GOLD XAUUSD DAILY5590-5596 SELL ZONE FROM MY FIB STRATEGY.

Geopolitical Tensions

US President Donald Trump's insistence on acquiring Greenland, including threats of force and tariffs on opposing European nations, has sparked US-Europe friction. French President Macron's rebukes and potential suspension of US-EU trade deals have weakened the dollar, boosting gold's appeal to foreign buyers.

Economic Factors

A softer US dollar makes gold cheaper globally, while expectations of steady Federal Reserve rates—despite labor improvements—favor non-yielding assets like gold. Central banks in China and India continue aggressive gold buying, adding structural support.

Future Outlook

WHAT IS GOLD ???

Gold (Au) is a chemical element and dense, malleable transition metal prized for its lustrous yellow hue, exceptional conductivity, and resistance to corrosion.

History as Store of Value

Gold has served as a store of value for over 6,000 years, from ancient Egyptian tombs (c. 4000 BCE) symbolizing immortality to Lydian coins (600 BCE) enabling standardized trade across empires like Rome (aureus) and Byzantium (solidus, stable 700+ years). The 19th-century gold standard anchored global currencies until 20th-century abandonments, yet gold retains purchasing power

Tier 1 Status Clarification

Gold classifies as a Tier 1 asset under Basel III banking rules , with 0% risk weighting for physical bullion, equivalent to cash for capital reserves, enhancing bank balance sheets amid fiat volatility. This elevates it from prior Tier 3 status, affirming its role as "money again.

HOW DOES THE DOLLAR INDEX AFFECT THE PRICE ACTION AND DIRECTIONAL BIAS ??

The US Dollar Index (DXY) exhibits a strong inverse relationship with global gold prices, where a stronger dollar typically depresses gold values and a weaker dollar boosts them.

Core Mechanism

Gold trades in US dollars worldwide, so dollar strength raises gold's cost for non-US buyers, curbing demand and lowering prices. A weaker dollar reduces this barrier, making gold cheaper and spurring purchases from international investors.

Correlation Strength

Historical data shows a negative correlation coefficient of -0.40 to -0.80, meaning 40-80% of gold's movements often align inversely with DXY changes. Interest rate differentials amplify this: Fed hikes strengthen the dollar and hurt non-yielding gold, while cuts weaken it and favor gold.

Influencing Factors

Geopolitical risks or inflation can override the link temporarily, but dollar dynamics remain the primary driver in most cycles. For instance, recent dollar weakness from de-dollarization trends has fueled gold rallies.

the brics nation are busing buying GOLD.this is the year of GOLD as the new money backed by physical GOLD ,this is why all BRICS CENTRAL BANKS are stocking the yellow bullion.

#GOLD #XAUUSD

GOLD XAUUSD 5590-5596 SELL ZONE FROM MY FIB STRATEGY.

Geopolitical Tensions

US President Donald Trump's insistence on acquiring Greenland, including threats of force and tariffs on opposing European nations, has sparked US-Europe friction. French President Macron's rebukes and potential suspension of US-EU trade deals have weakened the dollar, boosting gold's appeal to foreign buyers.

Economic Factors

A softer US dollar makes gold cheaper globally, while expectations of steady Federal Reserve rates—despite labor improvements—favor non-yielding assets like gold. Central banks in China and India continue aggressive gold buying, adding structural support.

Future Outlook

WHAT IS GOLD ???

Gold (Au) is a chemical element and dense, malleable transition metal prized for its lustrous yellow hue, exceptional conductivity, and resistance to corrosion.

History as Store of Value

Gold has served as a store of value for over 6,000 years, from ancient Egyptian tombs (c. 4000 BCE) symbolizing immortality to Lydian coins (600 BCE) enabling standardized trade across empires like Rome (aureus) and Byzantium (solidus, stable 700+ years). The 19th-century gold standard anchored global currencies until 20th-century abandonments, yet gold retains purchasing power

Tier 1 Status Clarification

Gold classifies as a Tier 1 asset under Basel III banking rules , with 0% risk weighting for physical bullion, equivalent to cash for capital reserves, enhancing bank balance sheets amid fiat volatility. This elevates it from prior Tier 3 status, affirming its role as "money again.

HOW DOES THE DOLLAR INDEX AFFECT THE PRICE ACTION AND DIRECTIONAL BIAS ??

The US Dollar Index (DXY) exhibits a strong inverse relationship with global gold prices, where a stronger dollar typically depresses gold values and a weaker dollar boosts them.

Core Mechanism

Gold trades in US dollars worldwide, so dollar strength raises gold's cost for non-US buyers, curbing demand and lowering prices. A weaker dollar reduces this barrier, making gold cheaper and spurring purchases from international investors.

Correlation Strength

Historical data shows a negative correlation coefficient of -0.40 to -0.80, meaning 40-80% of gold's movements often align inversely with DXY changes. Interest rate differentials amplify this: Fed hikes strengthen the dollar and hurt non-yielding gold, while cuts weaken it and favor gold.

Influencing Factors

Geopolitical risks or inflation can override the link temporarily, but dollar dynamics remain the primary driver in most cycles. For instance, recent dollar weakness from de-dollarization trends has fueled gold rallies.

the brics nation are busing buying GOLD.this is the year of GOLD as the new money backed by physical GOLD ,this is why all BRICS CENTRAL BANKS are stocking the yellow bullion.

#GOLD #XAUUSD

BITF | WeeklyNASDAQ:BITF — Quantum Model Projection

Bullish Alternative 📈

There has been no specific change since the prior BITF analysis. Following the advance in Minor Wave 1, the price has pulled back through Minor Wave 2, holding at the Q-Structure λ₂ along the divergent zone—setting the stage for an impulsive advance in Minor Extension Wave 3 of Intermediate (5) within the Primary Wave ⓷ uptrend.

The Q-Target ➤ $28.88 🎯 remains valid, with a probable timing window into mid-June.

🔖 This outlook is derived from insights within my Quantum Models framework. Within this methodology, Q-Targets represent high-probability scenarios generated by the confluence of equivalence lines. These Quantum Structures also serve as structural anchors, shaping the model's internal geometry and guiding the evolution of alternative paths as price action unfolds.

#CryptoStocks #CryptoMining #QuantumModels

TXN - The Move ContinuesSince November 2018, a large wave 3 has been developing.

Within this wave, only the fifth sub-wave remains to be completed, and the impulsive move has already begun.

Key targets:

238 - local pullback

270

296

Estimated upside potential from current levels:

25–37%

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

#XCUUSD COPPER - Price Is In A Clear UptrendCopper is in a clear uptrend (bullish structure).

Price broke above old resistance (green zone = support now) also a previous ATHs, pulled back into it, and is holding higher lows inside an ascending channel.

That support area is a buy-the-dip (long) zone, with upside targets toward ~7.00 if the trend continues. Which is a round number and a strong psychological level that has been acting like a magnet for the price.

NSDQ100 oversold bounce back support at 25610Key Support and Resistance Levels

Resistance Level 1: 26230

Resistance Level 2: 26500

Resistance Level 3: 26690

Support Level 1: 25610

Support Level 2: 25366

Support Level 3: 25200

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.