BTC/USDT 4H — Liquidity Sweep at Support Followed by Bullish RetMarket Structure

Overall structure:

Price was in a descending / consolidation phase, then formed an ascending channel (bullish corrective structure).

You marked a BOS (Break of Structure) earlier → confirms prior bearish pressure.

The move down into the support zone was followed by a fake breakout (liquidity sweep), which is typically bullish.

👉 This suggests smart money accumulation below support before moving price up.

2. Support Zone & Fake Breakout

Support zone: ~87,400 – 87,000

Price dipped below prior lows, triggering stop-losses (fake breakout), then reclaimed the zone.

This is a classic liquidity grab, often followed by a strong impulse move.

✅ This strengthens the bullish bias as long as price holds above the support zone.

3. Current Pullback

After reaching the target point (~90,500 – 90,600), price rejected and pulled back.

The pullback is healthy and aligns with:

Previous structure

Channel support

Demand zone

🔍 This looks like a retest, not a trend reversal (yet).

4. Trade Idea Shown on Chart

📈 Long Setup Logic

Entry zone: ~87,400

Stop loss: ~86,050

Target: ~90,500 – 90,600

📊 Risk–Reward:

Roughly 1:2.5 to 1:3, which is very solid.

5. Bullish Scenario (Preferred)

Price holds above 87,000

Forms a bullish 4H confirmation (engulfing / strong close)

Continuation toward:

89,500 (minor resistance)

90,500+ (major liquidity & resistance)

6. Bearish Invalidation

🚨 The setup fails if:

4H candle closes below 86,000

Support zone is lost decisively

If that happens, next downside targets could be:

84,800

83,500 (higher timeframe demand)

7. Summary

✅ Fake breakout + reclaimed support = bullish signal

✅ Structure favors continuation upward

⚠️ Still a retest phase, confirmation matters

🎯 Target zone aligns with liquidity & resistance

Community ideas

The key is whether it can rise above 17.07 ~ 32.06

Hello, fellow traders.

If you "Follow" me, you'll always get the latest information quickly.

Have a great day.

-------------------------------------

(Vale S.A. Sponsored ADR 1M Chart)

The key is whether the price can break above the Fibonacci level of 0.618 (17.07) on the left and 0.618 (32.06) on the right.

-

(1D Chart)

To do this, we need to see if the price can sustain above 15.40 and rise.

If it falls, we need to check for support around 12.72 to 14.0.

To break above a key point or level and continue the uptrend, the StochRSI, TC, and OBV indicators must show upward trends.

If possible,

1. The StochRSI indicator should not be in an overbought zone. 2. The TC indicator should remain above the 0 level.

3. The OBV indicator should remain above the High Line.

-

Thank you for reading.

I wish you successful trading.

--------------------------------------------------

GOLD: Rally Hits Our Key Target ZoneGold futures gained fresh upward momentum today, climbing to yet another new high. The price is now trading well inside our red Short Target Zone, which ranges from $5,416 to $6,362.

We will take Profits here on ALL Gold longs and maybe even open a short.

We do have a bit of room left inside the target zone, but as soon as the upwards momentum comes to a halt, we anticipate the completion of the larger green wave , which should trigger a significant reversal to the downside. Accordingly, we are preparing for a major decline phase—starting with a break below the support levels at $4,197 and $3,901.

Traders looking to capitalize on this move can consider short entries within our red Target Zone. For risk management, a stop can be placed 1% above the upper edge of the zone.

AUD/JPY Price Outlook – Trade Setup📊 Technical Structure

OANDA:AUDJPY AUD/JPY remains in a short-term bullish structure after staging a strong impulsive rally from the lower range. Price is currently pulling back toward the 107.85–108.05 support zone, which aligns with the prior breakout area.

The broader structure suggests continuation higher as long as the pair holds above support. The projected path indicates a potential dip for liquidity before buyers attempt another push toward the 108.65–108.85 resistance zone.

🎯 Trade Setup (Bullish Bias)

Entry Zone: 108.05 – 107.85

Stop Loss: 107.80

Take Profit 1: 108.65

Take Profit 2: 108.85

Risk–Reward Ratio: Approx. 1 : 3.01

📌 Invalidation:

A sustained break and close below 107.80 would invalidate the bullish setup and signal weakening upside momentum.

🌐 Macro Background

AUD/JPY is supported by persistent weakness in the Japanese Yen amid fiscal uncertainty and political developments in Japan. Discussions around potential tax pauses and election-related spending have pressured the currency.

Meanwhile, the Australian Dollar remains relatively resilient, benefiting from stable risk sentiment. Although intervention concerns from Japanese authorities may slow the rally, the near-term macro environment still favours upside continuation.

🔑 Key Technical Levels

Resistance Zone: 108.65 – 108.85

Support Zone: 107.85 – 108.05

Bullish Invalidation: Below 107.80

📌 Trade Summary

AUD/JPY is undergoing a healthy pullback after a strong bullish impulse. As long as price holds above the support zone, the bias favours a buy-on-dips strategy, targeting a continuation toward the upper resistance band.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

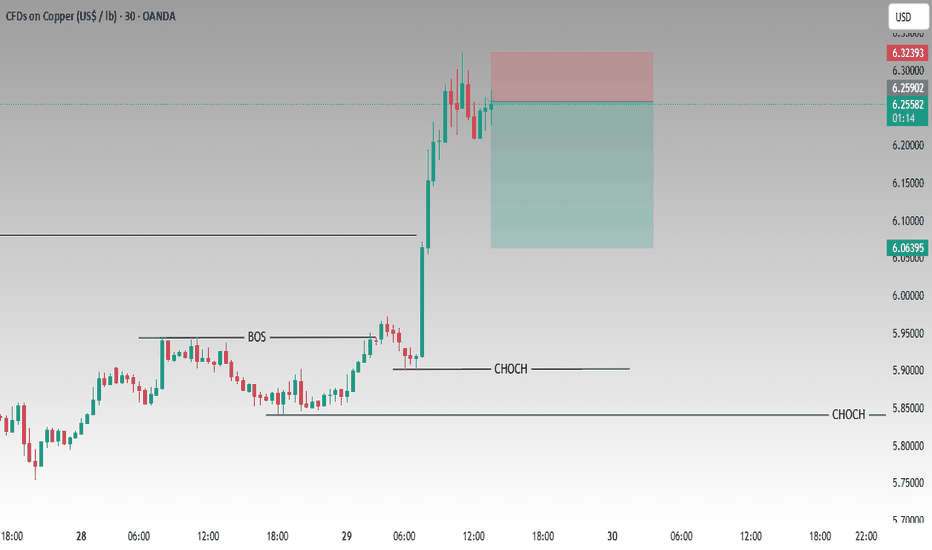

COPPER (XCU/USD) SHORT SIGNAL

Entry: Around current levels ~6.260 - 6.323 (near recent high / retracement zone after strong bullish impulse)

Bearish confirmation: Price in retracement phase after massive rally, targeting to fill the FVG (Fair Value Gap) below + potential CHOCH (Change of Character) confirmation

Target: 6.200 – 6.150 (FVG fill zone / previous BOS area) or lower toward 6.000 support

Stop Loss: Above 6.330–6.340 (above the recent high/red box to invalidate the short setup) Watching for bearish momentum as copper pulls back to balance after the explosive move! #Copper #XCUUSD #CopperPrice #ShortCopper #Commodities #Trading #FVG #SmartMoney Not financial advice — This is just my personal view based on the chart. Trading involves significant risk, especially in volatile commodities like copper—do your own research, use proper risk management, and never risk more than you can afford to lose!

What Looks Like Weakness Is Actually Trend RepairHello traders,

Bitcoin is currently trading near eighty-eight thousand nine hundred, following a sharp downside sweep that briefly broke below the prior support zone before being aggressively reclaimed. That breakdown did not transition into acceptance. Instead, price was quickly absorbed and pushed back above support, signaling a failed breakdown and liquidity grab, not the start of sustained bearish control.

The recovery that followed was decisive. Price rotated back into a well-defined ascending channel, reclaiming both structure and directional bias. This behavior is important: strong trends often shake out late sellers before resuming higher. The impulsive rebound from the lows suggests demand stepped in with intent, repairing the structure rather than merely bouncing.

Since reclaiming the channel, price has shifted into a controlled consolidation phase near the mid-channel region. This pause should not be mistaken for rejection. Overlapping candles and reduced volatility indicate acceptance and rebalancing, allowing momentum to reset after the sharp recovery. As long as price continues to hold above the reclaimed support and channel base, the broader bullish structure remains valid.

Looking ahead, the upper boundary of the ascending channel near $91,000 stands out as the next key technical reference. This zone represents a likely reaction area, not a guaranteed target, where price may pause again if reached.

Invalidation remains clear. A sustained loss of the reclaimed support zone and a breakdown back below the channel would challenge the current bullish bias and reopen the door for deeper corrective price action.

For now, the message is straightforward:

The breakdown failed. Structure was reclaimed. Trend repair is in progress let behavior confirm continuation.

Tough reality Who would have known in this part of the dominance cycle your fav alts would be back at the 2023 lows … outside sol and XRP lucky if you held them from the 2023 bottom.

If indeed this is the start of the bear market this means your alts that are already 90% in the red will go down another 90 once BTC. Falls over not sure what can save the market here.

Need one of those Roger’s hail Mary’s

Protect yourself

Good luck

GOLD (XAU/USD) – Bullish Continuation Toward Higher Highs🔍 Technical Analysis (H1):

Market Structure:

Gold remains in a strong bullish structure with clear higher highs & higher lows ✔️, firmly respecting the ascending trendline 📈.

Breakout & Momentum:

Multiple clean breakouts above previous resistance zones confirm strong buying pressure 💪. Each breakout is followed by healthy pullbacks, showing controlled bullish momentum.

POI → Pivot Support:

Previous POI zones have successfully flipped into support 🔄, and price is currently holding above the Pivot Point zone, which strengthens bullish continuation bias 🟢.

Current Price Action:

Price is consolidating above the pivot area, suggesting a brief pause before the next impulsive move higher ⏳➡️⬆️.

🎯 Upside Targets:

Target 1: 5,300 🎯

Target 2: 5,330 🎯🎯

Extended Target: 5,360+ 🚀 (if bullish momentum accelerates)

🛡️ Invalidation / Support to Watch:

Bullish bias remains valid as long as price holds above the Pivot Point zone. A break below may trigger a deeper pullback, not trend reversal ⚠️.

📌 Conclusion:

Overall trend is bullish, structure is healthy, and price action favors a continuation toward the marked target zone after minor consolidation 📦➡️🚀.

✨ Trade with the trend & manage risk wisely! 💼📊

Bullish bounce off?S&P500 (US500) has bounced off the pivot and could potentially rise to the 1st resistance.

Pivot: 6,953.78

1st Support: 6,888.85

1st Resistance: 7,054.81

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

GBP/CHF BEARS ARE STRONG HERE|SHORT

GBP/CHF SIGNAL

Trade Direction: short

Entry Level: 1.060

Target Level: 1.055

Stop Loss: 1.063

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/USD Bearish SetupGBP/USD is showing signs of a potential bearish reversal after failing to hold above a strong resistance zone. Price formed a clear double-top structure near the highs, indicating weakening bullish momentum and increasing selling pressure. The breakdown below the cloud confirms a shift in market bias from bullish to bearish. Sellers are gaining control as price struggles to reclaim resistance, suggesting further downside continuation. If the current structure holds, the first downside target is 1.37594, where short-term support may appear. A sustained move lower could extend toward 1.37219. In case of strong bearish momentum, the final target is 1.36834, aligning with prior support levels. Proper risk management is advised.

If you found this XAUUSD analysis helpful, don’t forget to LIKE 👍 and COMMENT 💬!

BTCUSDT LONG BASED ON NSD-MFR STRATEGYPrice completed a sell-side displacement into a key nodal zone.

According to NDS sequencing, downside momentum is consumed and price is transitioning into stabilization.

Long execution is based on MFR rules: location first, structure stabilization, then reaction from the node.

Risk is fixed, execution is rule-based. No indicators used.

$SPY & $SPX — Market-Moving Headlines Friday Jan 30, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Friday Jan 30, 2026

🌍 Market-Moving Themes

🛒 Mega Cap Save

AMZN and AAPL lift Nasdaq after hours as cloud demand and product certainty calm markets

📉 Goldilocks Inflation

Cooling PCE resets rate fears as yields fall and risk appetite broadens

🧠 AI Hardware Wins

Capex spending funnels into suppliers with NVDA and ANET leading on data center buildouts

🏥 Obesity Buyout Chatter

VKTX spikes on takeover rumors as pharma M and A focus returns to weight loss

📅 End of Month Flows

Window dressing dynamics dominate as January closes after a catalyst-heavy week

📊 Key U.S. Economic Data Friday Jan 30 ET

8:30 AM

- Producer Price Index Dec delayed: 0.3%

- Core PPI Dec delayed: 0.3%

- PPI YoY

- Core PPI YoY

9:45 AM

- Chicago Business Barometer PMI Jan: 44.0

1:00 PM

- Fed Gov Stephen Miran TV interview

1:30 PM

- St Louis Fed President Alberto Musalem speech

5:00 PM

- Fed Vice Chair for Supervision Michelle Bowman speech

⚠️ Disclaimer: For informational purposes only. Not financial advice.

📌 #SPY #SPX #PPI #Inflation #Earnings #AMZN #AAPL #AI #Macro #Markets #Stocks #Options

One last leg higher for BTC before the bears take overI think there is still enough steam for BTC to push higher once more before the bears come in.

This is just technical and on the basis of its negative correlation with dxy.

If you've a $200 or 100 you're not using, this will be a good trade for you, what is life without a small gamble here and there?

Enjoy

TP 1 @ 98k

TP 2 @ 108k

Then a new ATH

Let's wait for the trade to play out

XAUUSD - ASIA & LONDON SESSION 📊 XAUUSD – ASIA & LONDON SESSION SCENARIOS (POST‑NEWS CONTEXT)

Higher Timeframe Bias: 1H

Execution Timeframe: 5m–15m

Market State: Post‑news liquidity reset

🧭 Market Context

The recent high‑impact news created a liquidity sweep rather than a true directional move.

Price has taken liquidity on both sides and is now in a rebalancing phase, where structure needs to be rebuilt.

➡️ Priority is patience and structure confirmation, not aggressive trading.

🌏 ASIA SESSION SCENARIOS

🟡 Scenario A – Post‑News Consolidation (Preferred)

Expectation:

Low volatility and narrow range

Small candles with long wicks

No clear directional commitment

Plan:

No trades during Asia

Mark Asia High and Asia Low

Use this range as a reference for London session setups

🔴 Scenario B – False Breakout

Expectation:

Price briefly breaks Asia range

No candle close confirmation

Quick rejection back into range

Plan:

Avoid breakout trades

Do not scalp or chase price

Stay flat and protect capital

🌍 LONDON SESSION SCENARIOS

🟢 Scenario 1 – Trend Continuation (Primary Setup)

Conditions:

Higher‑timeframe structure remains intact

Asia session forms a clear range

Expected Behavior:

London sweeps Asia Low

Strong bullish displacement follows

Trade Idea:

Buy from a Demand Zone after confirmation

Wait for a confirmation candle (bullish engulfing / strong rejection)

🟡 Scenario 2 – Expanded Range

Expectation:

Price breaks Asia range but lacks follow‑through

Momentum indicators remain weak

Plan:

Reduce position size

Trade only at range extremes with high RR

If conditions are unclear, stay out

🔴 Scenario 3 – Short‑Term Reversal

Conditions:

H1 candle closes below a key structure level

Failed retest confirms bearish intent

Plan:

Look for short setups only after retest and rejection

Trade with reduced risk as this is counter‑trend

✅ ANTI‑OVERTRADING CHECKLIST

Before entering any trade, all conditions must be met:

Price is at a key zone (Demand or Supply)

A clear confirmation candle is present

Risk‑to‑Reward is at least 1:2

Trade aligns with the 1H bias

Entry is based on the plan, not emotion

➡️ If any answer is “NO”, no trade.

🧠 Trading Mindset

After major news, the market rewards patience, not speed.

No trade is better than a low‑quality trade.

SILVER FREE SIGNAL|SHORT|

✅SILVER taps a higher-timeframe premium supply and shows bearish displacement, confirming rejection from an ICT POI. Expect continuation lower toward resting sell-side liquidity.

—————————

Entry: 116.45$

Stop Loss: 121.69$

Take Profit: 109.00$

Time Frame: 1H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Upper trendline break on BBAI!?OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!