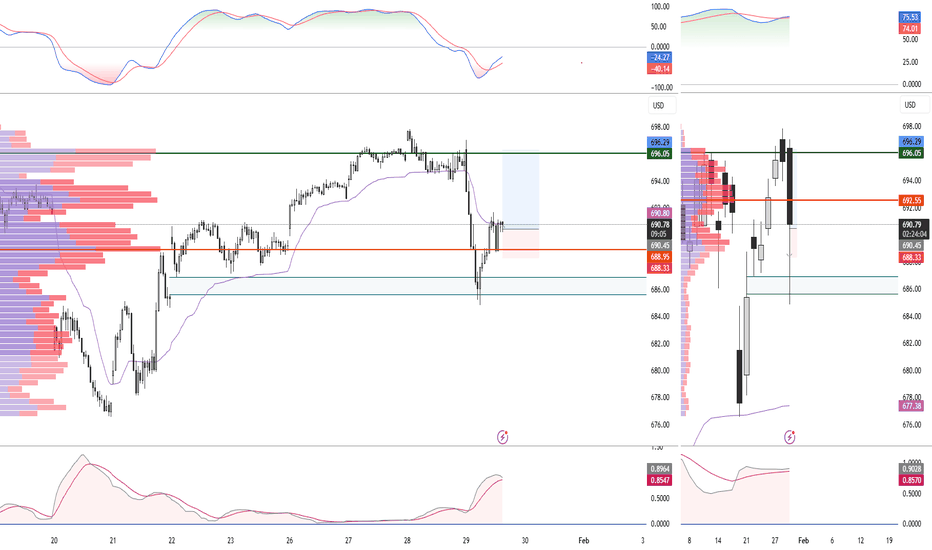

ATOM / USDT - A QUICK SELL SET UP - 29-01-2026ATOM-USDT G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

ATOM / USDT still kinda on the "move" and continue DOWN...

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

Community ideas

PHANTORIAN INTELLIGENCE: BUY ZONE ACTIVE STATUSTeam, the data has aligned with our "Max Pain" models. We are now deploying capital based on a High Probability Reversal Setup.

📊 THE DATA CONVERGENCE We are rebuying our holds because the statistical edge is now in our favour:

Target Achieved: We projected a potential floor at $84,380. The market respected this level, wicking to $83,355 and bouncing.

Sentiment Extremes: Perpetual premiums hit -175, indicating the crowd is aggressively shorting the lows. Historically, this often precedes a squeeze.

Relative Strength: While BTC made a new low, key assets like ETH,DOT and STRK showed "Seller Exhaustion" by holding their structure.

⚖️ THE RISK PROFILE (1:10) We are taking this setup because the Asymmetric Reward justifies the risk.

The Thesis: The "Flash Crash" liquidation appears statistically complete.

The Invalid: A sustained 4-Hour close below $83,000 invalidates this setup. If that happens, we cut immediately.

The Reward: If the reversal holds, we capture the swing low before the recovery.

⚔️ OFFICIAL ORDERS: SCALE IN

SUMMARY: The risk/reward ratio at these levels signals a Green Light for re-entry. We are buying the fear with defined risk.

EXECUTE. 👻

BTC still within range.BTC has confirmed a bearish short-term structure with a lower high followed by a lower low. The break of the rising diagonal signals momentum shifting against bulls.

Price is now trading below the high-volume node, suggesting acceptance at lower levels rather than a quick reclaim. This puts pressure on any upside attempts.

Key levels

Major resistance remains near the prior supply zone, where price was previously rejected.

BTC is currently reacting inside a high-demand area, where buyers are expected to defend.

Momentum

Momentum is showing early bullish divergence from oversold conditions, opening the door for a short-term relief bounce.

However, momentum is still in a weak regime, any upside is corrective unless structure flips.

Thesis

Below resistance, the bias remains bearish continuation.

A bounce from demand is possible, but without a reclaim, it’s likely a sell-the-bounce environment.

Watching how BTC reacts here will be key.

BTC 69K INCOMINGBitcoin will almost certainly hit the 69k mark which was more or less the previous all time high. Once this happens, we should wait for signs of a reversal and pour all funds into the ride back to 100k+.

If 69k does not hold, we will look to purchase on the way back down to the golden fibonacci zones.

BTC in BUY ZONEMy trading plan is very simple.

I buy or sell when at either of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow volume spikes beyond it's Bollinger Bands

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at bottom of channels

Money flow momentum is spiked negative and at bottom of Bollinger Band

Entry at $83,500

Target is moving average at $89K or upper channel around $93K

Set your own stop.

Bitcoin (BTC/USD) Bearish Outlook: Rejection at Strong High & MaThis 1-hour chart for BTC/USD highlights a potential bearish continuation following a rejection from a significant supply zone. After a period of consolidation within a descending channel, price action attempted a recovery but failed to sustain momentum above the $88,000 - $90,000 range.

Key Technical Observations:

• Market Structure: The LuxAlgo Smart Money Concepts indicator has identified a "Strong High" near the top of the recent range. We are seeing a clear Change of Character (CHoCH) to the downside, followed by multiple Break of Structure (BOS) levels, signaling a shift from bullish to bearish sentiment.

• Supply & Demand: Price is currently reacting to a heavy supply zone (highlighted in red). The aggressive red arrow indicates a projected move toward the lower liquidity pools.

• Targets: The primary downside target sits within the yellow demand zone, specifically looking at the $84,000 level where previous support and buy-side liquidity reside.

• Trend: The hourly trend remains bearish as long as price stays below the $88,394 resistance level.

Summary: The setup suggests a "sell the rip" scenario. Traders should watch for a retest of the immediate BOS level for a potential short entry toward the $84k psychological floor.

Pandora (PNDORA) - Reversal PlayOMXCOP:PNDORA

My Thesis in 4 Bullets:

The market fears $112/oz silver costs, but the CFO just confirmed they are >75% hedged for 2026 (likely locked near ~$35/oz).They will also have time to adjust jewelry`s silver to metal ratio.

Valuation Dislocation: Pandora trades at ~7.5x P/E while peers like Signet and Richemont trade at ~26x. A simple reversion to 12x doubles the stock.

The "India" Call Option: The EU-India Free Trade Agreement (FTA) is a hidden catalyst. It eliminates tariffs on gems/jewelry, lowering component costs and unlocking the Indian luxury market.

Silver Mean Reversion: Commodities are cyclical. If silver drops in H2 2026, today's "headwind" becomes a massive earnings explosion for 2027.

DCF Analysis: Professional Models Confirm the Upside

Alpha Spread's DCF valuation (updated Jan 24, 2026) shows a Base Case fair value of 1,611.59 DKK, a 237% upside from the current 478.7 DKK price. The model shows the stock is undervalued by 70%.

Current Price: 483 DKK

DCF Fair Value (Base Case): 1,611.59 DKK | Upside: +234%

Conservative Target (12x P/E): ~850 DKK | Upside: +76%

Even if you haircut the DCF model by 50% to account for the current crisis, fair value is 800 DKK, still 66% upside from here.

My Trade: I'm entering with 1/3 position at 483 DKK today (along side Blackrock). I'll add more if Feb 5th guidance scares weak hands down to 450-400 DKK. My target is 850 DKK by Dec 2026.

All thoughts are appreciated! Best.

ICT BTC Bull Trap:The Journey to 77K

HTF Bias: Weekly FVG Rebalance (Magnet at 77K) | 주봉 FVG 리밸런싱 (77K 자석 효과)

Execution: 1H MSS + Displacement | 1시간봉 구조 붕괴 및 하락 변위 확인

Target: 81,000 → 77,000 (1W C.E.)

1. HTF Narrative (1W) | 상위 프레임 서사

Price is currently seeking rebalance after a sweep of psychological highs. 고점 사냥 후, 알고리즘은 불균형 해소를 위한 리밸런싱을 진행 중입니다.

DOL (Draw on Liquidity): Massive 1W FVG.

Final Target: 77,000 (Consequent Encroachment / 50% of FVG).

유동성 목표: 주봉 FVG의 평형점인 77,000까지의 되돌림을 예상합니다.

2. LTF Confirmation (1H) | 하위 프레임 확정

Institutional order flow has flipped to Sell-side. 기관의 주문 흐름이 매도 주도로 전환되었습니다.

MSS: 1H structure shattered with Displacement. | 1시간봉 구조가 강력한 장대 음봉으로 붕괴되었습니다.

OB Failure: Breached 87K Bullish OB confirms the bearish shift. | 87K 상승 오더블럭이 뚫리며 하락세가 확정되었습니다.

3. Invalidation Criteria | 무효화 조건

Level Breach: Body close above 1H Bearish OB. | 1시간봉 매도 오더블럭 저항 몸통 돌파 마감.

Bias Neutralization: Break of the origin of displacement cancels the short setup. | 하락의 시작점

돌파 시 숏 시나리오 무효화.

Order Flow Shift: Price back above the Mean Threshold confirms bullish strength. | 오더블럭 중심값(50%) 위 안착 시 매수세 회귀 확정.

This analysis is for educational purposes only and does not constitute financial advice. All trading decisions and risks are your own. 본 분석은 교육적 목적을 위해 작성되었으며, 투자 권유가 아닙니다. 모든 매매의 책임은 본인에게 있습니다.

Second Test of High Could Trigger Double Top ReversalIf price revisits the previous high and fails to establish acceptance above it, this would complete the second peak of a double top structure. Historically, this pattern reflects buyer exhaustion and often precedes a reversal.

What I’m Watching:

Price reaction at the prior high

Signs of rejection (long upper wicks, bearish close, loss of momentum)

Failure to break and hold above resistance

ADAUSDT - A QUICK SELL SET UP - 29-01-2026ADAUSDT - G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

ADAUSDT - still kinda on the "move" and continue DOWN...

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

Gold Session: Spot Price Hits $5,310.99 Amid Bullish MomentumGold (GC) futures for the U.S. dollar pair saw active trading, opening at $5,283.61 and reaching a high of $5,312.16 before settling at $5,310.99—up 0.52% (+27.39). The session displayed firm bullish sentiment, with price action holding above key support levels. Current quotes show a sell price of $5,511.50 and a buy price of $5,512.17. The depth of market indicates strong buying interest around $5,480–$5,500, while resistance appears near the $5,560–$5,620 zone. This upward movement suggests continued investor confidence in gold amid broader market conditions, with traders closely watching for a potential test of the $5,600 resistance level in upcoming sessions.

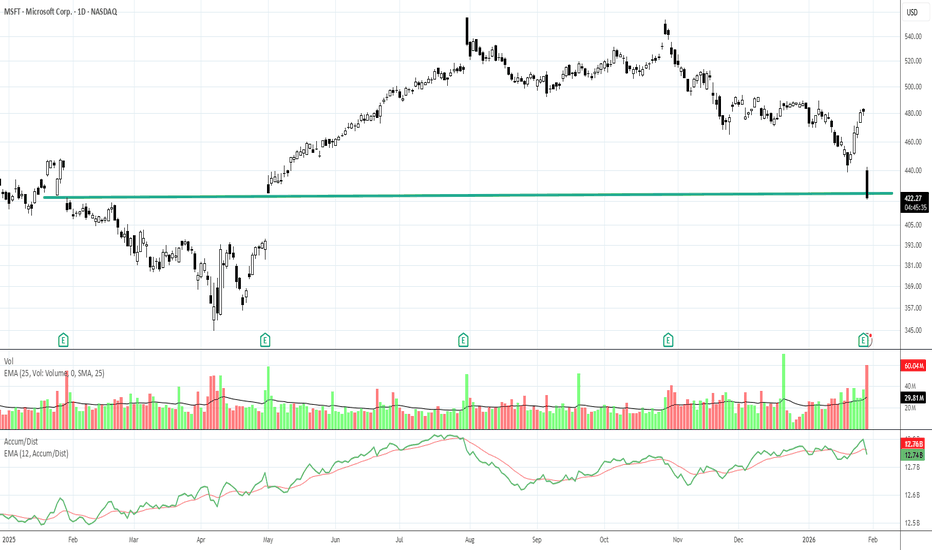

$MSFT: Correction Just Getting Started?NASDAQ:MSFT on the monthly chart really looks like the party might be over for a while. It’s tempting to step in here: price is tagging the 0.618 retracement from the April 2025 low, and today alone it’s down nearly 12%.

But what if that top (5) actually marked the end of Elliott wave 5?

In that case, this drop would be the start of wave A of a larger correction, likely targeting somewhere in the 0.618–0.786 zone. Then a smaller bounce (wave B) could retrace toward 0.382 — slightly above the wave 3 peak — followed by another leg down (wave C) that, in theory, shouldn’t break below the wave 1 top.

In practice, it would also resemble a head-and-shoulders forming right now.

If this structure holds, new ATHs probably aren’t coming back anytime soon. Thoughts?

XAUUSD Bullish Structure | Trendline + DemandGold is in a strong bullish trend (clean higher highs & higher lows).

Price respected the ascending trendline, showing buyers are in control.

The green zones mark demand / buy-on-dip areas where price previously reacted.

After a strong impulse up, price is doing a healthy pullback into demand.

The arrow up shows expectation of trend continuation toward the upper liquidity / target zone.

Trading Logic:

Bias: Bullish

Setup: Impulse → Pullback to demand + trendline → Continuation

Entry idea: Buy from the demand zone / trendline support

Invalidation: Clear break below the demand zone

Target: Previous highs and the upper green (premium) area

BTC - WEEKLYINDEX:BTCUSD

The rebound attempt from the 80k correction low failed near 98k, with a clear price rejection.

Price is currently trading around 84k, below the short-term averages and above the long-term average, reflecting hesitation and weak momentum.

The 80k level remains critical, and a break below it could open the way toward the 73–74 key support zone.

Watching the next price reaction ..

This is not financial advice.

Microsoft Flash Crash. What comes next?In this tutorial, you will learn how retail news distorts and provides misinformation and false information that IF you listen to it, you will perpetuate your losses and lower profits.

Dark Pools have established the fundamental level months ago that they determined was appropriate for the current conditions of MSFT as it build infrastructure which is necessary normal and an ASSET to the company improving its Balance Sheet.

News claims "investors drove prices of MSFT down in after hours trading".

Totally false information.

After hours is highly illiquid for all stocks.

HFTs and Hedge Funds saw an opportunity before the US stock market opened and filled the queues with small lot orders to gap the stock down for their profit on selling short to buying to cover orders.

Smaller Funds VWAPS triggered at open and the HFTs and Hedge funds filled those orders way below their original sell shorts.

Dark Pools are NOT selling MSFT. They are waiting to see how low the price will go, then they will start accumulation as MSFT will be at bargain prices.

Gold breaks $5593! Geopolitical risks and Fed's next moveGold finally broke $5593 this morning! I am a Japanese hobby trader living in Chiang Rai, Thailand. I am very surprised by this move. Fed kept rates 3.50-3.75% yesterday. Powell said wait for more data, but the market eyes a June cut.

The biggest driver is Middle East tension. Everyone is buying gold for a safe haven. If tonight's US GDP is weak, Gold will break $5600 and head to $6000 very fast. I use my Gold Analytica tool for my analysis. Sentiment is still very bullish.

Key Levels & Bias — XAUUSD (Gold)Timeframe: 1H

Date: 30 Jan 2026

Update: Intraday

🔹 Bias

Bullish Reversal (Buy the Dip – Conditional)

🔹 Key Levels

Resistance / TP Zone: 5514.30

Major Supply Above: 5580 – 5600

Strong Demand / Support Zone: 5000 – 5100

Current Price Area: ~5087

🔹 Technical Context

Price corrected sharply after a parabolic rally.

Market is testing a high-probability demand zone.

Trendline broken → focus shifts to horizontal structure.

Projection suggests W-formation / double bottom potential.

🔹 Trade Idea (Not a Signal)

Prefer buy confirmation from demand.

Entry only after bullish structure shift / confirmation.

Conservative traders wait for 15m confirmation candle.

⚠️ Risk Note

Strong bearish momentum recently.

Avoid blind entries — confirmation is key.

Disclaimer ⚠️: This is not a financial advice

Gold trying to build a momentum for another bullish movemenAs you can see on chart gold have a strong sell resistance in top where we can see the volume profile area, also in down we see a strong support which the price try to breakout in thursday and trying now also in asia session.

It you can read this chart you will have a lot of opportunities helping you in your trading.