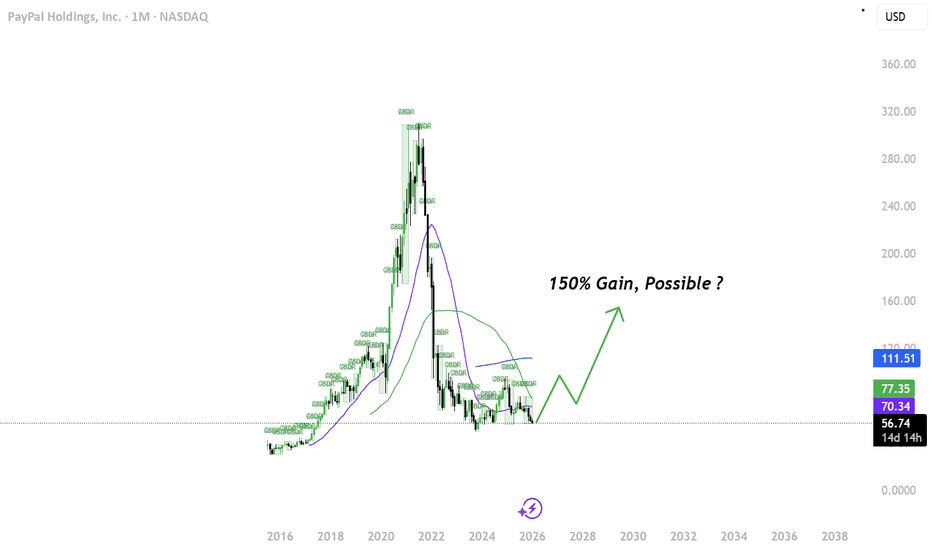

PayPal (Revised) | PYPL | Long at $42.00*** This is a revised analysis from December 2024:

***I am still a holder at $64.00.

Technical Analysis

High probability of a continued decline for PayPal NASDAQ:PYPL , albeit over time / dead-cat bounces, into the low $30s to close out the remaining two open price gaps on the daily chart (dating back to 2016). Stock "crash" level is currently between $14 and $17. Fair value = $22.00. I believe the $14-17 or lower range will only be reached when the market tanks. Otherwise, my predicted "low" from a company perspective would be low $30s to high $20s. Regardless. I encourage everyone to look at the company fundamentals, growth, and health and ignore the news.

Growth

Continued growth for both revenue and earnings-per-share through 2029.

Health

P/E = 9.7x

Debt-to-equity: 0.5 (healthy)

Quick ratio / short-term debt: 1.3 (fairly good, ideal = 1.5 to 3)

Altman's Z Score / bankruptcy risk: 2.1 (minor risk, ideal = 3+)

Dividend Yield: 1.1%

Action

Just look at what happened to Facebook NASDAQ:META in 2022. Everyone said the company was dead, every analyst thought it was the end, etc. Nope. PayPal NASDAQ:PYPL will likely be the same story as "business reinvention" emerges. I suspect the last lower remaining price gaps will eventually be closed in the $30s before a true move up. That will be another major personal entry location. One was made today at $42.00. Market "crash" could lead to $10-$20. Buy a stake in a $33 billion company when no one wants it. I truly believe patience will eventually pay exponentially (or, a buyout...).

Targets into 2029

$64.00 (+52.4%)

$80.00 (+90.5%)

Paypalstock

Is Paypal a good buy ? - AnalysisWhy PayPal Stock Has Dropped ~80% From Its Highs

PayPal’s share price decline has been driven by several structural and market factors:

1. Growth Slowdown After Pandemic Surge

After booming during the pandemic, PayPal’s revenue growth slowed considerably, more moderate growth rather than rapid expansion. Growth that was double digits slowed to mid-single digits.

2. Loss of eBay Exclusive Payments

PayPal lost eBay as a major payments partner in 2021, a business that had contributed a large share of transaction volume historically.

3. Heavy Competition

PayPal faces strong competition from modern fintechs and big tech players:

-Stripe and Square (Block) in online payments

-Apple Pay & Google Pay in digital wallets/contactless

This has pressured growth and margins.

4. Investor Sentiment and Market Expectations

Even when PayPal beat earnings forecasts, the stock has often fallen, because investors want faster growth and more aggressive new-revenue drivers.

5. Macro and Regulatory Risks

Broader macro pressures and regulatory uncertainty in key markets have added volatility and risk.

The Bullish Case:

PayPal trades at a low forward P/E relative to its history and the market.

Solid Cash Flow & Share Buybacks

The company continues generating strong free cash flow and has committed significant capital to share repurchases and a small dividend, which returns value to shareholders.

Growth in Core Areas

Venmo and branded checkout volumes are growing, Venmo especially shows solid user and revenue expansion (Paypal owns Venmo).

Strategic Initiatives

Management is making bets on:

-embedded/AI-driven commerce

-wallet/crypto integration

-higher-margin branded processing services

These could eventually accelerate growth.

Risks & Cons:

Growth Still Slow

Revenue and transaction volumes are improving but not at the pace investors typically reward in tech.

Competition Remains Intense

Big tech wallets and fintech processors may win share, particularly in mobile and contactless payments.

Potential Further Downside

Analysts and some commentators argue PayPal could decline further if growth falters or execution slows, this risk makes it look like a value trap if the turnaround doesn’t materialize.

Market Sentiment Still Weak

Recent downgrades and neutral analyst ratings reflect caution about the pace of improvement under current leadership

Disclaimer:

This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Asset prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not a licensed financial advisor or professional trader. I am not personally liable for your own losses; this is not financial advice.

PayPal: Step by StepPayPal has recently moved one step lower as anticipated, but then entered a sideways motion. We believe that the stock is merely taking a breather here and will soon regain its downward momentum. Below the support at $50.18, the larger correction of the beige wave II is expected to complete, necessitating further significant sell-offs. However, there's a 39% chance that PYPL has already completed the beige wave alt.II at $54.78. In that case, the stock would be working on a turquoise upward impulse, potentially breaking above the resistances at $82.50 and $94.97 ahead of schedule.

PayPal Under Pressure! Bearish WMA Break Signals Downside🎯 PYPL: The "Weighted MA Breakout Heist" 💰 | Bears Taking Control

📊 Asset Overview

PayPal Holdings Inc. (NASDAQ:PYPL) - Digital payments heavyweight showing bearish signals after weighted moving average breakdown.

🔍 The Setup: When Moving Averages Tell Tales

The chart's singing a bearish tune, folks! 🎵 We've got a Weighted Moving Average breakout to the downside — and when WMA breaks, it usually doesn't ask for permission to keep falling. Think of it like gravity... but for stock prices! 📉

💡 Trade Blueprint

🚪 Entry Zone

Flexible entry approach - Current market price works as entry. The beauty of this setup? The trend is your friend, so catching this wave at various levels could work. Just don't chase it blindly!

💭 Pro Tip: Scale in rather than going all-in at once. Dollar-cost averaging on the way down can be your best friend in bearish plays.

🛡️ Risk Management (The "Safety Net" Level)

Stop Loss: $68.00 🚨

Look, I'm calling this the "thief SL" because if price touches this level, you need to exit stage left — no questions asked! This isn't financial advice, just a technical level where the bearish thesis breaks down.

⚠️ Important: Set YOUR OWN stop loss based on your risk tolerance and account size. This is just a technical reference point, not a commandment carved in stone!

🎯 Profit Target (The "Escape Route")

Target: $60.00 💵

Why $60? Three compelling reasons:

📍 Moving Average Support Zone - Historical MA convergence area

📉 Oversold Territory - RSI/momentum indicators suggest potential bounce zone

Liquidity Trap Alert - Big money often parks orders here

⚠️ Reality Check: Markets don't move in straight lines. Take profits along the way! Suggested approach: Scale out 30% at $63, another 40% at $61.50, and let the final 30% ride to $60.

🔗 Related Pairs to Watch (Correlation Play)

Keep your eyes on these tickers — they often move in sympathy with PYPL:

SET:SQ (Block Inc.) - Fellow fintech, similar payment space dynamics 🔄

$V (Visa) - Traditional payment processor, inverse correlation during fintech weakness 💳

NYSE:MA (Mastercard) - Same logic as Visa, watch for divergence 🏦

NASDAQ:COIN (Coinbase) - Crypto exposure correlation with digital payment sentiment 🪙

NASDAQ:SHOP (Shopify) - E-commerce correlation, PYPL's merchant base overlap 🛒

Key Correlation Note: When fintech stocks sell off, traditional payment processors often see inflows. Watch the $V and NYSE:MA strength as potential confirmation of PYPL weakness!

📈 Technical Highlights

✅ Weighted Moving Average breakdown confirmed

✅ Volume supporting the bearish move

✅ Lower highs and lower lows pattern forming

✅ Key support zones identified below

✅ Risk-reward ratio favors the short side

⚡ The "Thief Style" Philosophy

This isn't about being greedy — it's about being strategic! 🎭 We identify the setup, execute with precision, and exit with profits before the crowd realizes what happened. That's the art of tactical trading!

Remember: The market doesn't care about your opinion. Price action is king 👑

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#PYPL #PayPal #DayTrading #BearishSetup #TechnicalAnalysis #MovingAverageBreakout #SwingTrading #StockMarket #TradingView #ThiefStyle #PriceAction #RiskManagement #Fintech #NASDAQ #ShortSetup #TradingStrategy #ChartAnalysis #MarketAnalysis #TradingIdeas #StockTrading

PayPal: Further Downside ExpectedPayPal initially extended its decline as anticipated, before a modest upward rebound began to emerge. Overall, bearish momentum should primarily persist, likely pushing price below the $50.18 support level and completing the broader correction of the beige wave II. However, there is also a 39% probability that beige wave alt.II has already concluded. In that scenario, the stock would currently be developing a magenta upward impulse and would be in the process of forming (or would have already formed) the low of wave alt. . Wave alt. would then bring further gains, potentially breaking through resistance at $94.97.

Breaking: Paypal ($PYPL) Gearing for A 500% Breakout PayPal Holdings, Inc. (NASDAQ: NASDAQ:PYPL ) a fintech company is set for a 500% breakout amidst bouncing off of support point setting sail for $300 zone.

As of the time of writing, the stock is up 8% with the RSI at 49, there is more room to capitalize on the low buying pressure.

In recent news, the company is integrating its wallet into OpenAI’s ChatGPT.

Beyond that headline-grabbing news, PayPal’s third-quarter earnings results, released before the market opened, revealed some puts and takes. Several key metrics, such as overall account growth, remained in single-digit territory, with some areas of acceleration in other parts of the business.

About PYPL

PayPal Holdings, Inc. operates a technology platform that enables digital payments for merchants and consumers worldwide. It operates a two-sided network at scale that connects merchants and consumers that enables its customers to connect, transact, and send and receive payments through online and in person, as well as transfer and withdraw funds using various funding sources, such as bank accounts, PayPal or Venmo account balance, consumer credit products, credit and debit cards, and cryptocurrencies.

PayPal: Trading Sideways Amid VolatilityPayPal has recently experienced notable volatility but has continued to trade sideways within a certain range. Our primary expectation is that further downward momentum will dominate, potentially driving price below both support levels at $54.78 and $50.18 to complete the correction of beige wave II. However, there is also a 37% chance that PYPL has already finished beige wave alt.II at $54.78. In that scenario, the stock would already be building a sustained magenta upward impulse and could break out above the resistance levels at $80.65 and $94.97 during wave alt. .

PayPal: Stuck in Consolidation—Breakout or Breakdown Ahead?We expect PayPal to eventually break out of its current consolidation to the downside to complete the larger correction of beige wave II below the $50.18 support level. Alternatively, it’s possible that PYPL already finished wave alt.II back in April, which could set the stage for an early upside breakout—first above the $78.86 resistance and then even beyond the higher $94.97 level (probability: 30%).

paypal holding can see its gloriuos days againpay pal has capacity to restore what has been retrace throghout past years if it can hold throuh next 3 weeks. 67$ and 55$ will be significant support at under any circumtances better should not fall. if it can see this targaet after that we coul see if its momentum strong enough to hold for long term like next year

"PYPL Money Grab – Ride the Bull Wave Before the Reversal!"🔥 PAYPAL HEIST ALERT: Bullish Loot Grab Before the Trap! 🔥 (Thief Trading Tactics)

👋 Greetings, Market Bandits & Cash Pirates! 🏴☠️💰

This is not financial advice—just a strategic robbery blueprint for PayPal (PYPL).

🎯 THE MASTER PLAN (Day/Swing Heist)

🔑 Entry (Bullish Swipe):

*"The vault’s cracked—bullish loot is ripe! Enter at ANY PRICE or snipe pullbacks (15m/30m swing lows/highs)."*

🛑 Stop Loss (Escape Route):

Thief’s SL: Recent swing low candle body/wick (3H TF).

Your SL = Your Risk. Adjust for lot size & multiple orders.

📈 Target: 82.00 (or escape earlier if bears ambush!)

⚡ SCALPERS’ NOTE:

Longs ONLY. Hit quick profits? Run. Still hungry? Ride the swing heist!

Trailing SL = Your Getaway Car. 🚗💨

⚠️ DANGER ZONE (Yellow MA):

Overbought | Consolidation | Bear Trap | Trend Reversal Risk!

Take profits early—greed gets caught! 🏆💸

📡 FUNDAMENTAL BACKUP (DYOR!):

Check: COT Reports | Macro Trends | On-Chain Data | Sentiment Shifts 🔍🔗 (.Linnkkss. 👉 is there to read!)

🚨 NEWS ALERT (Volatility Warning!):

Avoid new trades during news.

Trailing SL = Survive the Chaos.

💥 BOOST THE HEIST!

👊 Smash "Like" & "Boost" to fuel our next robbery! More loot = More plans! 🚀

🔔 Stay tuned—next heist coming soon! 🤑🎉

PayPal: Bears Losing Control – AgainPayPal (PYPL) has faced renewed downside pressure since our last update, but the bears failed to maintain control for long. The stock quickly rebounded toward key resistance at $78.86. If this level is decisively breached, we will consider the broader correction complete with the alternative low of beige wave alt.II. This would position the stock in the early stages of a new bullish impulse – wave alt.1 – with a 45% probability assigned to this scenario. However, under our primary scenario, we still envision wave II reaching its regular low below support at $50.18. Thus, renewed selling pressure is expected to push the price beneath that level in the near term. Once the low is in place, we reckon with a new impulsive advance.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

PayPal: Upward PressurePYPL has remained under upward pressure, moving significantly closer to the important resistance at $78.86. If the price rises above this level directly, we will have to assume that it has already completed the beige wave alt.II —and thus the overarching corrective movement—with the last notable low. Consequently, in this 45% probable case, the stock would have already entered a new upward cycle, specifically the first wave alt.1 of a turquoise upward impulse. Primarily, however, we expect the stock to imminently reverse downward to complete the regular wave II below the support at $50.18. Only afterward should a new sustainable upward impulse begin—initially driving rises above $94.97.

PayPal: Slight Recovery!In recent days, PYPL shares showed a significant recovery, raising the central question of whether the price will indeed dive into deeper territories once more, as assumed in our primary scenario. In this case, we expect the stock to fall below the support at $50.18. There, the stock should form the final low of the overarching beige wave II, thus laying the foundation for a sustainable trend reversal. Alternatively, the overarching low may have already been settled at the beginning of the month. In this 45% likely scenario, the recovery would imminently gain momentum, allowing PYPL to sustainably rise above the resistance levels at $78.86 and $94.97.

PayPal | PYPL | Long at $64.00From a technical analysis perspective, PayPal NASDAQ:PYPL is in the early stages of a potential downward trend reversal/stabilization based on my selected simple moving averages. With a current P/E of 15x, recent earnings beat, low debt, and earnings growth potential/estimates, PayPal is in a personal buy zone at $64.00.

Target #1 = $72.00

Target #2 = $85.00

Target #3 = $93.00

Target #4 = $117.00

PayPal Analysis: A Strong Surge Fueled by Market InnovationsPayPal (NASDAQ: NASDAQ:PYPL ) continues to make significant strides, as demonstrated by its recent partnership with Amazon, which is propelling the stock's impressive rally. In its latest update, Amazon announced the integration of PayPal into its *Buy with Prime* feature, allowing shoppers to pay using PayPal while leveraging Amazon’s Prime benefits. This partnership is a huge win for PayPal, as it will likely lead to broader usage across e-commerce platforms, giving more consumers and businesses access to its services.

Overview

The *Buy with Prime* feature allows Prime subscribers to make purchases on non-Amazon websites, offering free delivery and returns—enhancing the overall e-commerce experience for both merchants and buyers. Now, with PayPal in the mix, the payment experience becomes even more seamless. By 2025, Prime members will be able to link their Amazon accounts to PayPal, effectively bridging two e-commerce giants to create an easier, faster checkout experience.

PayPal’s new positioning as a strategic payment gateway on such a massive platform as Amazon could open doors to a larger customer base. The partnership builds on Amazon’s success with *Buy with Prime*, which has seen a 45% year-over-year increase in orders through merchant websites and a 16% increase in revenue per shopper since its expansion.

This also follows PayPal’s rollout of its own stablecoin, PYUSD, which is pegged to the U.S. dollar and brings it deeper into the realm of digital currency solutions. With the additional integration of the Ethereum Name Service (ENS) to their crypto services, PayPal (NASDAQ: NASDAQ:PYPL ) is diversifying its offerings across both traditional and digital finance, positioning itself as a leader in the evolving fintech landscape.

Technical Analysis

At the time of writing, PayPal (NASDAQ: NASDAQ:PYPL ) stock is up 6.24% during Thursday’s market trading session, reflecting strong investor sentiment following this string of developments. Technically, the stock is currently overbought, with the RSI (Relative Strength Index) standing at 73.88, signaling that the stock may be due for a short-term pullback or consolidation phase. However, this overbought level should not immediately deter investors, as the upward momentum suggests a continuation of bullish trends.

PayPal (NASDAQ: NASDAQ:PYPL ) has consistently performed well this year, with several key developments driving its upward trajectory. The RSI level could hint at potential price corrections or cooling periods, but it also signifies strong demand in the market. The stock has been trending upwards steadily since mid-summer and shows no signs of slowing down, especially with the positive news surrounding Amazon’s integration and the company's own innovations in digital payments.

It’s worth noting that gaps in the stock's price chart created earlier in the year might signal a possible retracement to fill those gaps. Nevertheless, the overall trend remains bullish, and PayPal’s stock could consolidate before pushing higher. The robust fundamentals supporting PayPal’s growth, including strategic partnerships and innovations in the fintech sector, could provide a solid foundation for sustained long-term growth.

Conclusion

PayPal’s integration into Amazon's *Buy with Prime* program, combined with its recent innovations like PYUSD and ENS integration, sets the stage for sustained growth in the fintech and e-commerce sectors. While technically the stock appears overbought and could be due for a brief pullback, its long-term prospects remain strong due to these strategic partnerships and advancements. Investors should keep an eye on any potential consolidation phases, which could present attractive entry points for those looking to capitalize on PayPal’s continued success in both the traditional and digital finance spaces.

PayPal’s Stellar Q2 Report: Revenue & Earnings Beat ExpectationsPayPal Holdings (PYPL) has reported impressive second-quarter results, with earnings and revenue surpassing analyst expectations. The digital payments giant’s robust performance has led to a positive market response, with its stock climbing over 7% following the announcement. Here’s an in-depth look at PayPal’s Q2 achievements, strategic moves, and future prospects under the leadership of new CEO Alex Chriss.

Q2 Financial Highlights

- Earnings and Revenue: Under new accounting rules, PayPal’s earnings for Q2 rose 36% to $1.19 per share on an adjusted basis. Revenue increased by 8% to $7.9 billion, exceeding the FactSet consensus of 98 cents per share on $7.82 billion in revenue. This marks a significant turnaround for the company, which had seen its stock fall by 4% in early 2024.

- Transaction Gross Profit: The transaction gross profit grew 6.5% to $3.2 billion, beating analyst estimates by 1%.

- Total Payment Volume (TPV): The total payment volume processed from merchant customers increased by 11% to $416.8 billion, just shy of the $417.5 billion analysts had projected.

Strategic Moves and Leadership Changes

New CEO Alex Chriss has been proactive in steering PayPal towards sustainable growth amidst rising competition from tech giants like Apple and Google. Despite fears of market share erosion, PayPal’s branded checkout business has outperformed, easing competition worries.

- Maintaining Market Share: Chriss highlighted that PayPal has maintained its market share in desktop/web checkouts, which constitute 40-50% of all checkouts, over the past four years despite the competitive landscape.

- Profit Forecast Upgrade: For the second time this year, PayPal has raised its forecast for full-year adjusted profit, now expecting a "low to mid-teens percentage" increase in 2024, up from the "mid-to-high single-digit" growth forecasted in April.

Key Performance Metrics

PayPal’s Q2 results have demonstrated the effectiveness of its strategic initiatives and operational efficiencies:

- Adjusted Earnings Per Share: The company’s adjusted earnings per share rose to $1.19, up from 87 cents in the same period last year.

- Revenue Growth: Revenue climbed 9% to $7.89 billion on a foreign exchange-neutral basis.

- Transaction Margin Dollars: Transaction margin dollars surged by 8% to $3.61 billion, far exceeding expectations of a nearly 1% gain.

- Operating Margins: Adjusted operating margins expanded by 231 basis points to 18.5%, driven by cost-cutting measures and restructuring efforts.

Branded Checkout and Key Business Segments

PayPal’s branded checkout, Braintree, and Venmo have all contributed to the highest transaction margin dollars growth rate since 2021. CFO Jamie Miller emphasized that the company is focusing on high-quality profitable growth, which involves prioritizing higher-margin transactions over sheer volume.

- Branded Checkout Growth: Despite investor concerns, branded checkout grew by approximately 6% in the second quarter.

- Braintree and Venmo: Both platforms have seen significant improvements in profitability and user growth. Venmo, in particular, continues to be a major growth driver.

Future Outlook

Looking ahead, PayPal is betting on the resilience of American consumer spending, especially during key shopping seasons such as back-to-school and the holidays. The company’s strategic focus on maintaining market share, enhancing profitability, and driving user growth is expected to yield positive results.

- Profitability Focus: PayPal’s plan to prioritize high-quality, profitable growth is evident from its strategic moves and financial performance in Q2.

- Market Confidence: The market’s positive response to PayPal’s Q2 earnings report underscores confidence in the company’s ability to navigate competitive pressures and drive long-term growth.

Conclusion

PayPal’s impressive Q2 performance, underpinned by strong earnings, revenue growth, and strategic leadership, has set a positive tone for the rest of 2024. With CEO Alex Chriss at the helm, the company is well-positioned to leverage its strengths, navigate market challenges, and continue delivering value to its shareholders.

As PayPal ( NASDAQ:PYPL ) continues to adapt and innovate in the dynamic digital payments landscape, its focus on high-quality growth and operational efficiency will be crucial in sustaining its competitive edge and achieving long-term success.

Former PayPal Chief Predicts Bitcoin Lightning as the FutureFormer PayPal ( NASDAQ:PYPL ) Chief David Marcus has predicted that Bitcoin Lightning Network will become the world's most widely used payment network. Marcus believes Bitcoin ( CRYPTOCAP:BTC ) is a neutral platform ideal for transactions, making it a prime candidate for integration into daily financial operations. The Lightning Network, an overlay on the Bitcoin blockchain, aims to expedite transactions and lower costs, making them more economical and appealing to both individuals and businesses.

Marcus's vision for Bitcoin Lightning suggests a significant enhancement in payment methods, ensuring broader access and integration of cryptocurrency into the global economy. Coinbase, a leading U.S. cryptocurrency exchange, has already adopted the Lightning Network, demonstrating the industry's shift towards faster and more efficient blockchain technologies. Before this integration, Bitcoin transactions on Coinbase were processed directly on the blockchain, taking anywhere from 10 minutes to two hours and incurring high fees during peak periods.

Viktor Bunin, a protocol specialist at Coinbase, believes this integration will expedite Bitcoin transactions and enhance its utility and accessibility globally. Marcus has previously been supportive of Bitcoin, suggesting it could become the preferred currency of Artificial Intelligence (AI) systems, placing BTC at the forefront of future technological advancements and highlighting its potential role in the new digital economy. The combination of Bitcoin and AI technologies could lead to innovative applications and efficiencies in transaction processes, solidifying Bitcoin's position within the tech industry.

PayPal - Is the stock dead?Hello Traders and Investors, today I will take a look at PayPal.

--------

Explanation of my video analysis:

With the Covid-Crash in 2020 we saw a beautiful bullish break and retest on PayPal in confluence with a retest of an ascending trendline. This retest was followed by a rally of +200% towards the upside. From there, PayPal stock declined more than 80% and it is likely that we will never ever see the previous highs again. If you decide to take a trade though, make sure to properly manage your risk.

--------

Keep your long term vision,

Philip (BasicTrading)