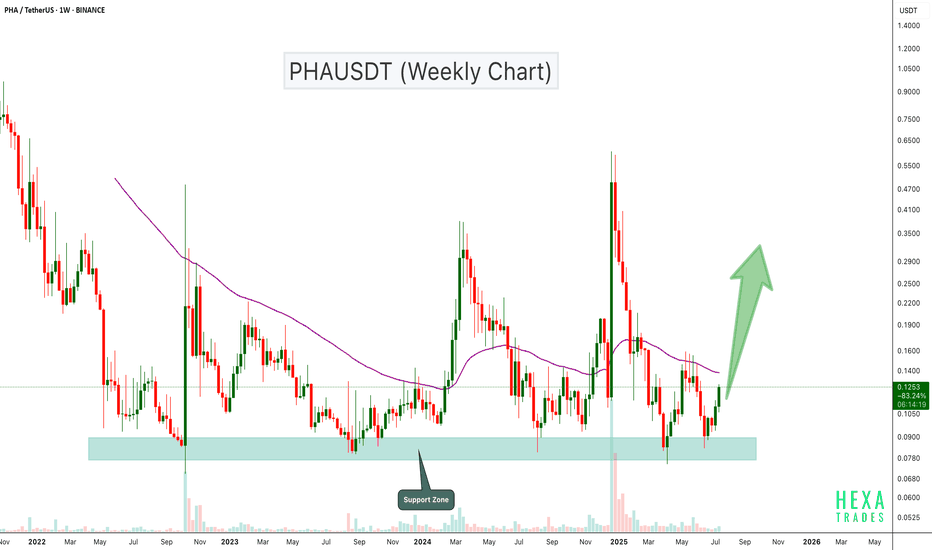

PHA/USDT – Multi-Year Accumulation at a Critical Demand Zone!

Overview:

PHA/USDT has been in a long downtrend since its 2021 peak. However, since mid-2022, price action has consistently formed a multi-year base around the 0.07 – 0.10 USDT demand zone (yellow box). This level has been tested several times, yet buyers continue to defend it, signaling strong accumulation interest.

Each dip into this zone has resulted in sharp rebounds toward the 0.30–0.38 region, though rallies have failed to sustain. This highlights that the market is still in a waiting phase, seeking a strong catalyst before confirming a major breakout.

---

Key Technical Levels

Primary Support (Demand Zone): 0.070 – 0.097

Step-by-Step Resistances:

0.1357 → first breakout confirmation level

0.1897 → psychological barrier and potential rejection zone

0.3149 – 0.3790 → strong mid-term resistance cluster

0.6207 → major resistance, previous heavy supply zone

1.0666 – 1.2452 → long-term bullish targets if a full market cycle develops

---

Pattern & Market Structure

Current Formation: Accumulation Range (0.07 – 0.10)

Price Action: Long lower wicks at support show repeated liquidity grabs and aggressive buyer re-entries.

Conclusion: Market is consolidating sideways, building a potential base for the next major trend.

---

Bullish Scenario

1. Trigger: A decisive 6D close above 0.1357 with strong volume.

2. Upside Targets:

Target 1 → 0.1897

Target 2 → 0.3149

Target 3 → 0.3790

With strong momentum, expansion toward 0.62 – 1.06 is possible.

3. Catalyst: A broader crypto market uptrend could fuel a breakout from this prolonged consolidation.

---

Bearish Scenario

1. Trigger: A 6D close below 0.0703 → breakdown of the multi-year demand zone.

2. Risk: Opens the door to new lows with potential panic selling.

3. Outcome: Such a breakdown often leads to a “capitulation bottom” before recovery.

---

Investor & Trader Perspective

Long-Term Investors: The 0.07–0.10 zone offers one of the best risk-reward opportunities for gradual accumulation, but patience and volatility tolerance are required.

Short-Term Traders: Range trading works well here → buy near demand, sell near 0.135–0.19 with tight risk management.

Trend Confirmation: Only a breakout above 0.1357 with volume validates a healthier bullish structure.

---

Conclusion

PHA is currently at one of the most critical turning points in its price history.

If the 0.07–0.10 demand zone continues to hold, it could serve as the launchpad for the next major rally.

But if it breaks down, PHA may face a deep bearish extension toward uncharted lows.

In short: PHA is standing at a crossroads — either the beginning of a new bullish chapter, or a descent into capitulation.

---

#PHA #PHAUSDT #CryptoAnalysis #Altcoin #PriceAction #SupportResistance #CryptoTrading #Accumulation #BreakoutSetup #RiskManagement

Phausdtlong

PHAUSDT at Make-or-Break Zone Is This the Calm Before the Storm?📍 Chart Overview (6D Timeframe – Binance)

PHA/USDT is currently retesting a major historical demand zone between $0.0703 - $0.0986, highlighted by the yellow box. This zone has acted as a strong base since mid-2022, repeatedly absorbing selling pressure and bouncing the price back up.

Over the past two years, this accumulation zone has consistently held, forming a classic sideways structure, typically seen before a major breakout. However, the inability to break through the upper resistances suggests persistent bearish pressure.

Now, the market is nearing a make-or-break moment that could lead to a decisive move in either direction.

---

🔎 Pattern Identified: "Extended Accumulation + Volatility Compression"

The price is trading inside a long-term accumulation range, indicating that smart money might be quietly buying.

We're seeing signs of volatility compression, a precursor to breakout volatility.

Repeated lower wicks near the demand zone show strong buying interest on dips.

This setup may produce a “spring” scenario, where a false breakdown triggers a strong reversal rally.

---

🟢 Bullish Scenario (Rejection From Demand Zone):

If the price continues to hold above $0.0986 and forms a higher low structure:

Bullish Targets:

1. $0.1357 – Minor historical resistance

2. $0.1897 – Key horizontal resistance

3. $0.3790 – Mid-range breakout target

4. $1.0666 – Long-term retracement target

Bullish Confirmation Signals: ✅ Break and daily close above $0.1357

✅ Increased volume on breakout

✅ Bullish candle structure near support

---

🔴 Bearish Scenario (Breakdown of Accumulation Zone):

If the price fails to hold $0.0703 – $0.0986 and breaks down with strong volume:

Bearish Targets:

1. $0.0590 – Psychological support

2. Below $0.0500 – Open downside

3. Trend shifts into bearish continuation structure

Bearish Confirmation Signals: ❌ Strong close below $0.0703

❌ Volume spike on red candle

❌ Lack of bullish response

---

🧠 Strategic Notes for Traders & Investors:

This zone offers a low-risk, high-reward opportunity for speculative positioning, with a tight stop-loss below $0.0703.

Due to prolonged compression, any breakout (up or down) could be explosive.

Be cautious of false breakouts. Wait for confirmation via volume and price action.

---

🗣️ Conclusion:

PHA/USDT is sitting at a technical inflection point that has historically triggered strong market reactions. After two years of coiling price action, this extended accumulation phase is nearing its resolution.

What happens next will likely define the long-term trajectory for this asset. Don’t sleep on this setup — whether you’re bullish or bearish, this is where attention should be focused.

#PHAUSDT #PHA #CryptoAnalysis #AltcoinSetup #TechnicalAnalysis #BreakoutWatch #AccumulationZone #StrongSupport #CryptoTrading

PHA Bounce from Historical Support ZonePHA is showing signs of a potential bullish reversal after bouncing off a long-standing support zone. Price has consistently respected this support level since mid-2022, creating a strong base. Now, we’re seeing bullish momentum building as the weekly candle breaks above the 50-week EMA, which had acted as dynamic resistance in the past.

A break above the recent swing high could trigger a larger move toward the $0.25–$0.35 resistance area. As long as the support zone remains intact, the structure remains bullish.

Cheers

Hexa

PHAUSDT Nearing Breakout Zone!PHAUSDT technical analysis update

PHAUSDT has been ranging for the last 1100 days and is now moving towards the range resistance line for a breakout. A strong bullish move can be expected once a breakout is confirmed on the daily chart. An increase in volume near the resistance is also observed.

Stop loss : $0.18

Take Profit 1: $0.41

Take Profit 2: $0.61

Take Profit 3: $1.23

Phala Network (PHA) completed a setup for upto 20% pumpHi dear friends, hope you are well and welcome to the new update on Phala Network (PHA) coin.

Recently we caught almost 20% pump of PHA as below:

Now on a 4-hr time frame, PHA has formed a bullish BAT move for the next pump.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

#PHA/USDT#PHA

The price is moving in a bearish channel pattern on a 12-hour frame,

which it adheres to perfectly.

We have stability above the moving average of 100.

We have a downtrend on the RSI indicator that supports the rise and is about to break higher

Entry price is 0.2444

The first target is 0.2724

The second target is 0.3228

The third target is 0.3650

PHA/USDT - Phala Network: TrendLine Touch◳◱ On the $PHA/ CRYPTOCAP:USDT chart, the Trendline Touch pattern suggests momentum building up for a significant move. Traders might observe resistance around 0.1094 | 0.1151 | 0.1277 and support near 0.0968 | 0.0899 | 0.0773. Entering trades at 0.1098 could be strategic, aiming for the next resistance level.

◰◲ General info :

▣ Name: Phala Network

▣ Rank: 358

▣ Exchanges: Binance, Kucoin, Huobipro, Gateio, Mexc, Hitbtc

▣ Category/Sector: N/A

▣ Overview: Phala Network project overview is currently unavailable. I'll try to update this in the upcoming analysis.

◰◲ Technical Metrics :

▣ Mrkt Price: 0.1098 ₮

▣ 24HVol: 7,690,549.656 ₮

▣ 24H Chng: 1.761%

▣ 7-Days Chng: 2.70%

▣ 1-Month Chng: 11.65%

▣ 3-Months Chng: 31.91%

◲◰ Pivot Points - Levels :

◥ Resistance: 0.1094 | 0.1151 | 0.1277

◢ Support: 0.0968 | 0.0899 | 0.0773

◱◳ Indicators recommendation :

▣ Oscillators: BUY

▣ Moving Averages: STRONG_BUY

◰◲ Technical Indicators Summary : STRONG_BUY

◲◰ Sharpe Ratios :

▣ Last 30D: 2.31

▣ Last 90D: 1.60

▣ Last 1-Y: -0.22

▣ Last 3-Y: 0.75

◲◰ Volatility :

▣ Last 30D: 0.59

▣ Last 90D: 0.59

▣ Last 1-Y: 0.82

▣ Last 3-Y: 1.76

◳◰ Market Sentiment Index :

▣ News sentiment score is N/A

▣ Twitter sentiment score is 0.60 - Bullish

▣ Reddit sentiment score is 0.47 - Bearish

▣ In-depth PHAUSDT technical analysis on Tradingview TA page

▣ What do you think of this analysis? Share your insights and let's discuss in the comments below. Your like, follow and support would be greatly appreciated!

◲ Disclaimer

Please note that the information and publications provided are for informational purposes only and should not be construed as financial, investment, trading, or any other type of advice or recommendation. We encourage you to conduct your own research and consult with a qualified professional before making any financial decisions. The use of the information provided is solely at your own risk.

▣ Welcome to the home of charting big: TradingView

Benefit from a ton of financial analysis features, instruments and data. Have a look around, and if you do choose to go with an upgraded plan, you'll get up to $30.

Discover it here - affiliate link -