Pointofcontrol

XAU Selling Model #1Hello everyone, Welcome to the XAU-SYNDICATE...

This is my entry model #1 for selling. so I'll wait for my zone, as soon as the price reaches my zone I'll look for a Liquidity hunt and bearish candle confirmation and plan my trade accordingly. 5-MIN, MSS after liquidity grab is most important part and extra confirmation.

#XAU-SYNDICATE

XAU Selling Model #2Hello everyone, Welcome to the XAU-SYNDICATE...

This is my entry model for selling. If the price holds within the bearish trendline and print a clean 15 min rejection candle backed by strong volume. I'll take that as my cue to execute sell positions from this zone, aiming for a short-term downside move.

#XAU-SYNDICATE

XAU Mid Buying ModelHello everyone, Welcome to the XAU-SYNDICATE...

This is my entry model for buying. so I'll wait for my zone, as soon as the price reaches my zone I'll look for a INT.IDM hunt or M15 single bullish candle close above 3916 second confirmation and plan my trade accordingly.

#XAU-SYNDICATE

XAU Selling Model #1Hello everyone, Welcome to the XAU-SYNDICATE...

This is my entry model #1 for selling. so I'll wait for my zone, as soon as the price reaches my zone I'll look for a Liquidity hunt and bearish candle confirmation and plan my trade accordingly. 15-MIN, MSS after liquidity grab is most important part and extra confirmation.

#XAU-SYNDICATE

Balances and Imbalances in Gold🔴 Why Point of Control (POC) Acts as Strong Support or Resistance to Create a Balance

In a Volume Profile, the Point of Control (POC) represents the price level where the highest traded volume occurred during a specific period. This level attracts attention because it reflects the fairest price accepted by both buyers and sellers.

➥ In an Uptrend:

When the market is trending higher, previous POCs often act as strong support zones. Traders who missed earlier entries tend to buy when price revisits these high-volume levels, believing them to be fair-value areas within the broader uptrend. Moreover, institutional participants often reload positions near the POC since liquidity is abundant there.

In short, when price revisits a past POC during an uptrend, demand tends to emerge again, creating a bounce from that level.

➥ In a Downtrend:

Conversely, in a downtrend, previous POCs act as strong resistance zones. What was once a fair price for buyers now becomes a fair price for sellers. Market participants who were trapped at higher levels use these zones to exit or add fresh short positions. Thus, when price rallies toward a prior POC, supply often re-enters, leading to rejection or a pullback. In this backdrop, let's discuss Gold chart.

🔴 Gold Chart Analysis in This Context

In the above 1H chart of Gold, the relationship between price and POC is clearly visible.

➥During the earlier part of the chart, Gold is in an uptrend. Each time the price retraced, it found support around the previous session’s POC. These levels acted as liquidity zones, where strong buying interest reappeared, helping the price continue its upward leg. This repetitive structure created a classic “staircase” pattern - each rally was followed by a controlled pullback to the prior POC, confirming the zone as a demand base.

➥However, as momentum shifted, Gold entered a downtrend. In this phase, the same POC logic flipped - price began reacting bearishly around previous POCs. Each time the market attempted to rally, it stalled or reversed near those old value areas, signaling that sellers were defending the former fair-value levels. This behavior turned prior supports into resistance shelves, reinforcing the bearish control.

➥Currently, price seems to be retesting one such POC zone near the $4000 zone. If sellers maintain control, the next leg lower could unfold toward the next lower-volume pocket or untested POC zone. But before that we need some sign of weakness near 4000- shortening of the thrust/lack of buying interest/impulsive selling etc. before pulling the trigger or else 4125 to 4150 might be on the cards.

What do think at this point? Will it pass through the resistance zone or react sharply back to 3900.

Do comment and 🚀

Tesla: Guided by the Point of Control🔎Understanding How Stocks React at Key Volume Profile Levels

In this post, let’s study how a stock can react around important Volume Profile levels and how we, as traders, can take advantage of this behavior.

🔘 A Quick Look at Volume Profile

The Volume Profile shows how much trading took place at each price level. Think of it like a sideways histogram that highlights where buyers and sellers were most active. It helps identify price zones that the market accepted (heavy trading) and those it rejected (light trading).

In between a Volume Profile is the Point of Control (POC) - the price level where the highest trading volume occurred. This is often considered as the market’s fair value zone, where buyers and sellers found the most agreement.

The POC tends to act like a magnet for price. When price moves too far away from it, it often returns to test that level since it represents strong trading interest. That’s why traders use POC zones to mark key supports, resistances, and potential entry areas.

In short:

The Volume Profile shows where trading happened. The POC shows where it mattered the most.

🔘 Overview: TSLA’s Story

After printing a high of $414 in 2021, Tesla (TSLA) has been trying to decisively break that level for almost four years. It made two attempts - first in December 2024, which was quickly faded, and again in September 2025.

🔘 The Fall and Bottom Formation

The stock went through a major bearish phase from $414 down to $101 in 2022 - a massive 75% drop. Then came a sharp V-shaped rally from the bottom - a 194% rise over about 28 weeks, retracing roughly 60% of the entire fall in a short span.

🔘 Why It’s Hard to Catch the Bottom

Catching a stock at the exact bottom is one of the hardest things in trading. No one really knows when the real bottom is forming.

At that point, fear is high, sentiment is negative, and the trend still looks weak. Most traders wait for confirmation - but by then, the bottom is already behind.

Catching the exact low becomes more like a luck than skill. No doubt 'smart traders' focus on catching the early reversal and not the perfect bottom, there are others who wait for pullback opportunities to a fair price.

🔘 April 2024 Bottom Formation

After rallying sharply, TSLA began to pull back from around $300 in July 2023. Traders who had missed the earlier move were waiting patiently with their limit orders for a healthy correction.

But the question was - where should those limit orders be placed?

◽️At the breakout zone around $218?

◽️Near the 50% or 61.8% Fibonacci retracement?

◽️Or below the April 2023 low near $152 for a possible liquidity grab?

The truth is - nobody actually knows the exact level because nothing works all the time.

However, the POC can often help identify a probable fair value zone where accumulation tends to happen.

Although we can’t pinpoint the exact level where a pullback will end, the area 'around' the POC often serves as one of the most reliable zones to accumulate a bullish stock.

And that’s exactly what happened in April 2024. The stock dipped below the previous rally’s POC, grabbed liquidity under $152, and then reversed sharply.

🔘 The Sharp Rally to New Highs

After that, TSLA entered a strong bullish phase, rallying from the April 2024 low to new highs above $414 in December 2024 - a massive 252% rise.

If you observe the Range Tool on the chart, you’ll notice a pattern - bearish phases take longer, while bullish rallies happen faster.

A question here arises: Was this rally sustainable above previous highs?

🔘 The Quick Fall

In January 2025, the stock saw a sharp fall from $488, wiping out 78% of the previous rally.

Interestingly, this decline didn’t stop at a typical breakout retest level - instead, it halted exactly at the POC of the prior bullish rally and began consolidating there.

Since then, the stock has climbed back near its previous highs.

But note this - the January 2025 fall lasted only 16 weeks, while the recovery has taken over 25 weeks without new highs, suggesting a slight loss of upside momentum compared to earlier rallies (early 2023 and late 2024)

🔘 What to Watch Next

If TSLA pulls back again in the future, we can draw a new Volume Profile over the latest bullish leg to locate its POC (I have drawn till the current high of the rally)

That level could once again serve as a potential fair value area and possibly repeat the same price behavior we’ve seen before.

What is your thought on point of control as a tool for investment purpose?

Share your views and hit the boost for more educational posts in future.

📣Disclaimer:

Everything shared here is meant for education and general awareness only. It’s not financial advice, nor a recommendation to buy, sell, or hold any asset. Do your own research, manage your risk, and make sure you understand what you’re getting into.

Your money, your responsibility; and if you’re unsure, ask a qualified financial professional. (Or at least run it by your pet - they’re great listeners 🐶).

Bitcoin Update

Bitcoin — Pre-New York Session (Daily)

By CORE5DAN | October 21, 2025

Bitcoin tests the edge — bearish range meets its make-or-break moment.

Price is pressing against the bearish range’s lower boundary, after rejecting the naked Point of Control (POC) at 111.086. Yesterday’s POC also declined to the same level — a sign of sustained supply pressure. We’re now trading down from bearish discount levels, approaching yesterday’s low at 107.449. If the Dollar holds its bullish bias, cross-markets could see heavier declines. The structure remains Locally bearish with range limits set between 116.077 (high) and 103.516 (low).

🧭 Technical Map

If today’s daily close prints below 107.449, it confirms a heavy bearish mode by algorithmic logic. Order flow flipped strongly bearish from the POC, with an aggressive reaction in the discount zone.

Momentum remains one-sided — patience over prediction.

🌐 Fundamental Pulse

A data-heavy U.S. week continues:

• Retail sales and housing data show mixed resilience.

• Yields stay near recent highs — tightening liquidity across risk assets.

• Fed speakers on deck later today may reinforce higher-for-longer tone.

Dollar strength keeps weighing on crypto sentiment as liquidity risk persists.

🎯 Plan

Hold positions aligned with structure.

Watch macro + order flow for alignment.

Avoid reacting to short-term bounces — the market is thinning, not turning.

💭 Mindset Pulse

“Markets are like Washington press briefings — lots of noise, little truth. Keep your logic, not your loyalty.”

Note:

Long-term, BTC remains in a weekly and monthly bearish macro range.

Stay patient, disciplined, and avoid greed as volatility expands.

Institutional Logic. Modern Technology. Real Freedom!

Potential Bullish Reaction at POI _ $DOGE/USDT (4H).Description:

Bias: Long / Bullish reversal potential

Setup details:

• Price has entered a key Point of Interest (POI) zone and shown rejection candles at that area.

• Likely support confluence based on prior structure.

• If bulls manage to hold this zone, price could target ~$0.30+ in the coming sessions.

Why it matters:

• Good risk/reward entry if stop loss is placed just below POI.

• Useful for futures / swing traders waiting for confirmation.

Timeframe: 4H

Trade idea type: Long

Feel free to leave your thoughts on alternative targets / SL placements! #DOGE #Crypto #Trading

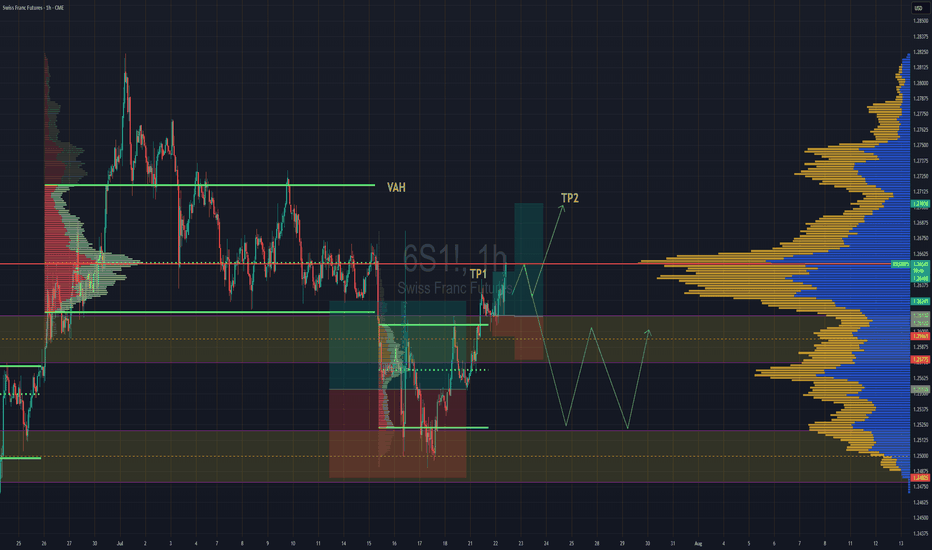

Swiss Gaining Momentum Against The DollarSwiss futures gaining strength against the dollar. We have broken back into previous rotation that was somewhat balanced, but still leaning towards a "b" style volume profile . If we are able to get above the POC, then we''ll go straight for TP2 close to Value are high.

If the POC is really strong and we reject hard from the POC then we might lose the value area and fall back down to previous value area to continue consolidation there until further notice.

Deeper Retrace if previous monthly high and VAH are lostBTC has made a strong move up recently, but we’re now trading just above key contextual levels that could act as a tipping point if lost. Do we look for a failed auction?

🧭 Key Levels on Watch:

• PW/MHIGH (Previous Week and Month High): ~109,988

• VAH (Value Area High): ~105,573

• POC (Point of Control): ~96,815

• VAL (Value Area Low): ~87,198

• Anchored VWAP from the April low is rising steadily and currently converging with the POC.

🔍 What to Watch For:

We’ve wicked above the monthly high and are now showing signs of stalling. If BTC fails to hold above the VAH (~105.5k), it would suggest acceptance back inside the prior value area. This could open the door for a rotation lower toward the POC (~96.8k) — the area with the highest historical volume and strong structural support.

🟢 Anchored VWAP Support

The anchored VWAP from the April low continues to rise and is on a collision course with the POC. This area could become a magnet for price, offering confluence for a potential bounce or reaccumulation zone.

⚠️ Scenario Outlook:

• Lose PW/MHIGH → Caution

• Lose VAH and hold below → Expect rotation to POC

• VWAP + POC convergence could be a key buy zone if tested

This is a classic example of auction market theory in action: acceptance back into value often leads to a revisit of the point of control.

Ethereum's Potential Bottom: Could $5000 Be Next?Ethereum has experienced a significant 56% drop over the last 84 days. Has ETH found its bottom, or is more downside ahead? Let's break it down.

🔹 Fibonacci Retracement from October Low (2023) to December High (2024)

Starting with the Fibonacci retracement from the low of $1520.85 on 12th October 2023 to the high of $4109 on 16th December 2024, ETH recently hit the 0.886 Fib retracement at $1815.9 and saw a bounce. This area aligns with the Point of Control (POC) from previous price action, a potential signal that this could be a major support zone.

However, the real question is whether this is the final bottom, or if ETH will retest lower levels.

🔹 Further Fibonacci Retracement Analysis

Next, we take a larger Fibonacci retracement, from the low of $879.8 on 18th June 2022 to the high of $4109. The 0.786 Fib retracement at $1570.85 appears to be a critical support zone, as it also coincides with the POC in the volume profile of the entire market structure. This indicates that the $1570-$1600 region is a significant area of interest for buyers to step in.

🔹 Log Scale Fibonacci Confluence

To further strengthen this analysis, applying the same Fibonacci retracement on a log scale shows the 0.618 Fib retracement at $1585.17, very close to the POC and 0.786 Fib level, reinforcing this region as a major support zone.

🔹 High-Probability Long Setup

If ETH revisits the $1570-$1600 zone, this forms an ideal high-probability long setup with excellent risk/reward potential. A potential R:R ratio of more than 20:1 could materialise if this setup plays out and price targets $5000 as a take-profit level. The stop loss placement will determine the exact risk-to-reward, but the reward could be massive if this level holds.

💬 What are your thoughts? Will Ethereum find its bottom around these key levels? Excited to see how this develops! 🚀

HNT/USDT Trading ScenarioThe price chart of the asset shows a significant increase in trading volumes within a broad range from $2.875 to $11.153. From a volume analysis perspective, despite pronounced volatility, market participants continue to accumulate the asset within the current price corridor. At the moment, the asset's price is below the POC (Point of Control) level and has bounced off the support level at $2.875, which marks the lower boundary of the active range.

Given the current dynamics, a gradual price movement toward the upper boundary of the range can be expected, which may lead to a breakout of this level and further development of the upward trend. Such scenarios are supported by the fact that increasing trading volumes in the direction of the current trend typically signal its stability and the likelihood of continuation.

ABC Correction perfection A Beautiful ABC pattern

Lines up perfectly with :

- Previous range Point Of Control

- Previous month Value Area Low

- A Daily Naked

- The 1 to 1

- Global Swing Low Avwap

Elliot wave theory

I expect early next week being hit. Then target the highs for a wyckoff distribution pattern.

People are already positioning EU swing longs, without a spring.

We need to punish dem early bulls 🏌️♀️

CAPITALCOM:DXY OANDA:EURUSD CME:6E1! ICEUS:DX1!

APT/USDT Trading Scenario UpdateThe current APT price has dropped significantly, reaching a low of $4.7, which marks a decline of over 69% from its recent peak. This sharp drop could be seen as a buying opportunity for market participants, potentially offering future profit prospects.

From a trading volume perspective, a bullish divergence is forming: despite the price decline, trading volumes are increasing. This suggests growing investor interest, as they perceive the current price levels as favorable entry points. Additionally, volume profile analysis indicates that the asset is trading below the Point of Control (POC), but with higher-than-usual volume, further confirming market participants’ interest in accumulating at these lower levels.

Given these factors, a price rebound toward the POC level and a continuation of the upward trend seem likely. It's also important to monitor Bitcoin dominance, which currently stands at around 60%. A decline in Bitcoin’s dominance could impact the performance of other cryptocurrencies and the overall market sentiment.

KAVA/USDT Trading ScenarioThe asset's price, like most altcoins, has undergone a significant correction and is currently trading near its local low. However, despite the decline in quotations, the market is experiencing a noticeable increase in trading volumes, indicating strong demand from buyers. A confident absorption of supply during the downturn suggests potential interest in KAVA from large players.

From a volume analysis perspective, the price is within the Point of Control range, reflecting the highest trading volume in the current price corridor. This confirms substantial market participant interest and the formation of a liquidity zone, which may act as support if consolidation continues. If volumes continue to rise and the price holds above key levels, this could signal a trend reversal and the development of an upward momentum.

XAUMO: The Ultimate Multi-Timeframe Gold Analysis ReportXAUMO: The Ultimate Multi-Timeframe Gold Analysis Report

Period: January 27 – February 2, 2025

📊 Daily Chart (Long-Term Trend)

🔍 Ichimoku Analysis:

• Clouds (Kumo):

• Thick Kumo ($2,744-$2,752) providing strong long-term support.

• Future Kumo: Steep bullish slope with (Senkou Span A > Senkou Span B), reinforcing the bullish trend.

• Tenkan/Kijun (TK/KS) Crosses:

• Type of Cross: Bullish cross above the Kumo.

• Support Levels:

• Tenkan ($2,774): Dynamic short-term support.

• Kijun ($2,761): Key support during pullbacks.

• Chikou Span:

• Positioned above price and Kumo, confirming strong bullish control.

• Stable slope, suggesting minor consolidation.

📈 Regression Channel Analysis:

• Price is moving within an upward channel, with resistance near $2,785-$2,790, signaling potential overbought conditions.

🔗 Support and Resistance Levels (VRP):

• POC: $2,771 (Pivot point for accumulation).

• VAH: $2,785 (Supply zone).

• VAL: $2,756 (Demand zone).

📦 Supply and Demand Zones:

• Supply: $2,785-$2,790.

• Demand: $2,744-$2,752.

⏳ Sushi Kinko Cycles:

• 26-Period Cycle: Confirms bullish continuation toward $2,800.

📌 Tradeable Levels:

• Upside: $2,785-$2,810 (Fibonacci Extension 161.8%).

• Downside: Below $2,756 targeting $2,740 (VWAP).

⏳ 4-Hour Chart (Swing Trading)

🔍 Ichimoku Analysis:

• Clouds (Kumo):

• Moderate thickness supporting price at $2,744-$2,752.

• Steep bullish slope confirming momentum.

• Tenkan/Kijun (TK/KS) Crosses:

• Bullish cross above the Kumo, reinforcing the trend.

• Key Supports:

• Tenkan ($2,774): Immediate support.

• Kijun ($2,761): Major support.

• Chikou Span:

• Positioned above price and Kumo, signaling strong bullish pressure.

• Upward slope, enhancing bullish momentum.

📦 Supply and Demand Zones:

• Supply: $2,785-$2,790.

• Demand: $2,744-$2,752.

⏳ Sushi Kinko Cycles:

• 9-Period Cycle: Minor pullback toward $2,771.

• 26-Period Cycle: Signal for a move toward $2,800.

📌 Tradeable Levels:

• Upside: $2,785-$2,810.

• Downside: $2,756-$2,744.

⏳ 1-Hour Chart (Intraday)

🔍 Ichimoku Analysis:

• Clouds (Kumo):

• Weak clouds with support near $2,774-$2,771.

• Moderately bullish slope.

• TK/KS Crosses:

• Tenkan ($2,777): Immediate support.

• Kijun ($2,773): Key support level.

📦 Supply and Demand Zones:

• Supply: $2,785-$2,790.

• Demand: $2,773-$2,765.

📌 Tradeable Levels:

• Buy: $2,773 targeting $2,785.

• Sell: Rejection at $2,785 targeting $2,773.

⏳ 30-Minute Chart (Scalping)

🔍 Ichimoku Analysis:

• Thin clouds supporting upward momentum.

• Tenkan ($2,777): Immediate support.

• Kijun ($2,773): Major support for scalping.

📌 Tradeable Levels:

• Buy: $2,773 targeting $2,785.

• Sell: Rejection at $2,785 targeting $2,773.

🔑 Summary:

• Bullish Bias: Above $2,785 targeting $2,800-$2,810.

• Bearish Bias: Below $2,756 targeting $2,740.

• Pivot Point: $2,771 (POC).

📌 Session Insights:

• Tokyo: Scalping at $2,773.

• London: Rejection at $2,785 or breakout opportunities.

• New York: Breakout above $2,785 or correction toward $2,771.

🔗 A blend of analytical tools for a precise and balanced trading strategy.

APE/USDT Trading ScenarioThe asset is currently trading 95% below its all-time high (ATH). Unlike most cryptocurrency market categories that are showing growth despite significant corrections, the NFT and metaverse segments remain in the shadows, not showing significant dynamics.

APE is currently near its all-time low, and in terms of volume profile, there is interest from market participants, as well as accumulation of positions in the current range. Fundamentally, the token is still associated with one of the most famous projects in the NFT sphere – Bored Ape Yacht Club (BAYC), as well as with the Otherside metaverse. However, it has fallen outside the zone of active investor attention amid the rapid growth and popularity of meme coins.

This asset deserves close attention, as it has the potential for significant upward movement.

POL/USDT Trading ScenarioIn November, POL showed confident growth driven by euphoria following the U.S. presidential election results. The asset's price surged from $0.2852 to $0.7705, marking a gain of over 160%. However, profit-taking by market participants soon followed, resulting in a correction that now exceeds 46%.

Currently, seller activity appears to be waning, with a support level forming at $0.4104, from which the price has rebounded twice. Volume profile analysis indicates that POL has stabilized within a zone of market interest.

Further declines may occur as liquidity from short-term players is absorbed, potentially setting the stage for a trend reversal. The recovery dynamics and subsequent growth of the asset are largely influenced by U.S. macroeconomic indicators. Special attention is being paid to the Federal Reserve's decisions on adjusting the key interest rate, which are revised based on current data.

Daily Market Review and Analysis for BTC: January 13, 2025BTC (2h)

The price scenario from my review of January 8, 2025 was implemented. As expected, the #BTC price after several days of manipulation in the sideways channel ($91,160 - $95,800) eventually removed the sellers' liquidity at $90,500 and approached the next liquidity pool at $88,722. Thus, the almost 5% drop in price was also worked out.

Now, regarding the further price movement:

– #Bitcoin will most likely strive for the level of $96,258. This is the nearest point of interest (POI).

– Further, if the price consolidates at this level, it is possible to move up to the middle of the 4-hour gap ($ 99,443) and then roll back down to remove liquidity at the level of $ 88,722. In other words, we are now entering the phase of another manipulation of the tops, the end result of which will be another fall in the price.

An alternative to the above is a continuation of the downward movement with a highly probable withdrawal of liquidity to the $85,000 mark.

An important point - despite the fact that globally we are in a bull market, we should not forget that the price is currently undergoing a correction. Thus, the fundamental level at the bottom in the middle of the weekly gap ($ 85,000) after breaking through the level of $ 88,722 should also not be ignored.

I will confirm that in order to reach the next historical maximum (ATH), Bitcoin will need to clear the sellers' liquidity pool levels at $ 88,722 and $ 85,000 in the medium term.

In particular, there is an even more gloomy scenario for Bitcoin based on candlestick analysis. I'll write about this in tomorrow's review.

LTC/USDT Trading Scenario UpdateAgainst the backdrop of overall optimism in the cryptocurrency market during November and early December, LTC showed confident growth, reaching a price level of $147.32. This was followed by a correction exceeding 40%.

Interestingly, the asset's price retraced and rebounded from the upper boundary of a consolidation range that has persisted for over two years. This range has become an accumulation zone for a significant number of participants and continues to attract new ones, as LTC is trading in close proximity to this level.

Given the current dynamics, further developments in the altcoin market could be anticipated, with the potential for a strong upward trend and a possible multi-fold growth.