Breaking: Perpetua Resources Corp. (PPTA) Spike 13% Yesterday Perpetua Resources Corp. (NASDAQ; NASDAQ:PPTA ) spike 13% yesterday albeit market sentiment. The stock broke out almost 15% trading above key moving averages defying market odd.

present market metric shows if NASDAQ:PPTA breaks above the $30 resistant a bullish continuation pattern will precede eyeing the $40- $50 pivot.

The stock is already up 1.24% in Friday’s premarket session further validating our bullish thesis on the asset.

In another news, Perpetua Resources Corp. (Nasdaq: PPTA) announced that it has entered an agreement with the Idaho National Laboratory ("INL") via Battelle Energy Alliance LLC ("Battelle") for the INL to host, commission, and operate a flexible, modular pilot processing plant expected to be capable of recovering various critical and defense-related minerals, including antimony from the Company's ores.

This initiative is intended to demonstrate the feasibility of producing high-quality, military specification antimony trisulfide using material from Perpetua's Stibnite Gold Project ("Project"). In addition, it will provide opportunities to advance domestic defense mineral processing capabilities and strengthen workforce training in Idaho.

About PPTA

Perpetua Resources Corp., a development-stage company, engages in the acquisition of mining properties in the United States. The company explores for gold, silver, and antimony deposits. Its principal mineral project is the 100% owned Stibnite Gold project, which includes 1,674 unpatented lode claims, mill sites, and patented land holdings covering an area of approximately 11,548 hectares located in Valley County, Idaho.

Premarket

Breaking; Aimei Health Technology Co., Ltd (AFJK) Spiked 1000%The price of Aimei Health Technology Co., Ltd (NASDAQ: NASDAQ:AFJK ) saw a noteworthy uptick of 1000% in yesterday's market session. However, the reign was short-lived as the asset is down 45% in premarket trading today.

The last recorded RSI is 93, which is clearly overbought setting the stage for a cool off to the $50 support zones.

About AFJK

Aimei Health Technology Co., Ltd does not have significant operations. The company intends to effect a merger, share exchange, asset acquisition stock purchase, reorganization, or similar business combination with one or more businesses. It also intends to acquire small cap businesses in the biopharmaceutical, medical technology and device industries, as well as in the diagnostic and other services sector. Aimei Health Technology Co., Ltd was incorporated in 2023 and is based in New York, New York.

Breaking: Confluent, Inc. (NASDAQ; $CFLT) Spike 28% Today Confluent, Inc. (NASDAQ; NASDAQ:CFLT ) experience a noteworthy uptick of 28% today amidst amidst breaking out of a bullish symmetrical triangle pattern.

The asset broke the ceiling of the triangle near the $23 resistant aiming for a move to the $50 resistant. However, with the RSI at 78, the asset might col off a bit at the ceiling it recently broke in order to pick liquidity up.

In recent news, Confluent, Inc. (NASDAQ: CFLT), today announced they have entered into a definitive agreement under which IBM will acquire all of the issued and outstanding common shares of Confluent for $31 per share, representing an enterprise value of $11 billion. Confluent provides a leading open-source enterprise data streaming platform that connects, processes and governs reusable and reliable data and events in real time, foundational for the deployment of AI.

IDC estimates that more than one billion new logical applications will emerge by 20281, reshaping technology architectures across industries. To fuel meaningful outcomes and drive productivity in operations, these applications, as well as AI agents, need access to connected and trusted data – in real time. IBM and Confluent will enable end-to-end integration of applications, analytics, data systems and AI agents to drive intelligence and resilience in hybrid cloud environments.

About CFLT

Confluent, Inc. operates a data streaming platform in the United States and internationally. The company provides platforms that allow customers to connect their applications, systems, and data layers comprising Confluent Cloud, a managed cloud-native software-as-a-service (SaaS); and Confluent Platform, an enterprise-grade self-managed software.

Breaking: Cemtrex, Inc. (CETX) Spike Over 200% TodayThe price of Cemtrex, Inc. (CETX) saw a notable uptick of over 200% albeit market turmoil. the stock broke out of a bullish falling wedge setting the coast for $20 resistant zone.

With next estimated earnings date set for Monday, December 29, 2025, after market close, The stock price has decreased by -92.89% in the last 52 weeks with the last recorded RSI at 39 making it oversold but prior to this surge, the asset is set for $20 resistant zone move.

In a recent news, Cemtrex Enters into Agreement to Acquire Invocon, Adding Proven Aerospace & Defense Engineering Capabilities.

The company has entered into a definitive agreement to acquire Invocon, Inc., a Texas-based systems-engineering firm with a 40-year history designing, manufacturing, and supporting mission-critical instrumentation, wireless sensing systems, and flight hardware for aerospace, defense, and advanced government programs.

About CETX

Cemtrex, Inc. operates as a technology company in the United States and internationally. It operates through Security, Industrial Services, and Cemtrex Corporate segments. The company offers browser-based video monitoring and analytics-based recognition systems, cameras, servers, and access control systems for security and surveillance in industrial and commercial facilities, federal prisons, hospitals, universities, schools, and federal and state government offices.

51Talk Online Education Group ($COE) Set for Earnings Report51Talk Online Education Group (NYSE; AMEX:COE ) is slated to release her earnings results today Monday, December 8, 2025, before market open.

The stock price has increased by +207.76% in the last 52 weeks setting the coast for the $50 resistant that connotes to the 1-month high of the stock. However, to achieve that stunt, the stock has to break the 50% fib retracement level and failure to break that level might resort to consolidation to the 1-month low axis.

News coming in now confirms that the company has announced the earnings report.

The company today announced that its board of directors has authorized a new share repurchase program under which the Company may repurchase up to US$10 million worth of its shares (including American Depositary Shares) over the next 12 months, ending on December 7, 2026.

The share repurchases may be effected from time to time on the open market at prevailing market prices, in privately negotiated transactions, in block trades and/or through other legally permissible means, depending on market conditions, and will be implemented in accordance with applicable rules and regulations. The Company expects to fund the repurchases out of its existing cash balance.

Financial Performance

In 2024, COE's revenue was $50.69 million, an increase of 86.98% compared to the previous year's $27.11 million. Losses were -$7.24 million, -51.87% less than in 2023.

About COE

51Talk Online Education Group, through its subsidiaries, engages in providing online education platform with English language education services to students in the People's Republic of China, Hong Kong, the Philippines, Singapore, Malaysia, and Thailand.

Breaking: PACS Group, Inc. (PACS) Spike 45% in 24 hours PACS Group, Inc. (NYSE: NYSE:PACS ) stock saw a noteworthy uptick of 45% in yesterdays extended market trading. With the asset set to break the $16 resistance, should it achieve that fit, the $25 resistant isn’t far fetched .

With the RSI at 71, this connotes NYSE:PACS is sparsely overbought however, with increased buying momentum, NYSE:PACS will nullify that thesis.

In the same vein, failure to bridge the $16 resistant might resort to a consolidated move to the $10 support.

In another news, PACS Group Intends to Release Third Quarter 2025 Earnings and Submit SEC Filings on November 19, 2025.

About PACS™

PACS Group, Inc. is a holding company investing in post-acute healthcare facilities, professionals, and ancillary services. Founded in 2013, PACS Group is one of the largest post-acute platforms in the United States. Its independent subsidiaries operate 320 post-acute care facilities across seventeen states serving over 30,000 patients daily.

YM (Dow), Short idea (30-minute+3-minute TF)See the bottom two charts for the red bear zone I have for today. While it's entirely possible (due to TFs above 30 minutes) for the market travel up past this bear zone, it's a great risk/reward opportunity to take a shot short this morning.

Look for an interaction with the red zone, and momentum shift based on your rules for entry.

Happy trading!

-StoicTrader

Cleveland-Cliffs Inc. (NYSE: CLF) Gearing For A Breakout Cleveland-Cliffs (NYSE: NYSE:CLF ) is scheduled to announce its earnings on Tuesday, October 21, 2025.

Analyst anticipate the company will reveal quarterly revenues close to $5.2 billion, propelled by rising steel prices and increased shipment volumes.

However, we predict that the company will report a loss of approximately $0.30 per share, as margins continue to be pressured by elevated energy and labor expenses.

Technically, NYSE:CLF stock is set to breakout of a bullish symmetrical triangle should favorable reports surface today. additionally, the asset is up 9% in premarket trading on Monday morning.

About CLF

Cleveland-Cliffs Inc. operates as a flat-rolled steel producer in the United States, Canada, and internationally. The company offers hot-rolled, cold-rolled, electrogalvanized, hot-dip galvanized and galvannealed, aluminized, galvalume, enameling, and advanced high-strength steel products.

Total Valuation

CLF has a market cap or net worth of $6.59 billion. The enterprise value is $14.56 billion.

Stock Price Statistics

The stock price has increased by +2.07% in the last 52 weeks. The beta is 1.97, so CLF's price volatility has been higher than the market average.

Just In: Ally Financial ($ALLY) Is Set to Breakout of A Wedge Ally Financial (NYSE: NYSE:ALLY ) is gearing up for a 35% surge that will break the ceiling of a falling wedge formed since April, 2025 amidst bullish sentiments.

The asset is trading in tandem to the moving averages with the RSI at 52, we might experience consolidation to the base of the wedge at $30 zone before picking liquidity up to the upside.

In another news, Ally Financial reports third quarter 2025 financial results.

Net income attributable to common shareholders was $371 million in the quarter, compared to $171 million in the third quarter of 2024. Net financing revenue was $1.6 billion, up $64 million year over year. Net interest margin (“NIM”) of 3.51% and net interest margin excluding core OIDA of 3.55% were up 22 and 23 bps year over year, respectively.

Other revenue decreased $31 million year over year to $584 million including a $27 million increase in fair value of equity

securities in the quarter compared to a $59 million increase in the third quarter of 2024.

Noninterest expense increased $15 million year over year.

View full press release in PDF: mma.prnewswire.com

Rigetti Stock (RGTI) May Retraced After Breaking Out of A Wedge The share price of Rigetti Computing, Inc. (NASDAQ: NASDAQ:RGTI ) is poised to retraced to the 61.8% fib. retracement level after a wonderful stint- The computing giant spike 218% in the past 1 month to break out of a bullish symmetrical triangle to reclaim the $50 zone.

With the last recorded SI at 55, NASDAQ:RGTI might consolidate more pushing the RSI to 35 amidst bearish sentiment.

The stock was down 14% in yesterday's trading session further pushing the loss to premarket trading currently down 1.48%.

Further adding to the bearish sentiment is the fact that the founder- Subodh Kulkarni, has no stake whatsoever in the quantum technology company.

In May, Kulkarni exercised options to acquire 1,000,000 shares, only to sell them immediately – leaving him with zero ownership in RGTI.

About RGTI

Rigetti Computing, Inc., through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally. The company offers quantum processing units (QPUs) and quantum computing systems through the cloud in the form of quantum computing as a service (QCaaS) products. It also provides 9- ubit quantum processing unit under the Novera QPU trade name; 84-qubit Ankaa-3 system under the name Novera QPU; and sells access to its quantum computers

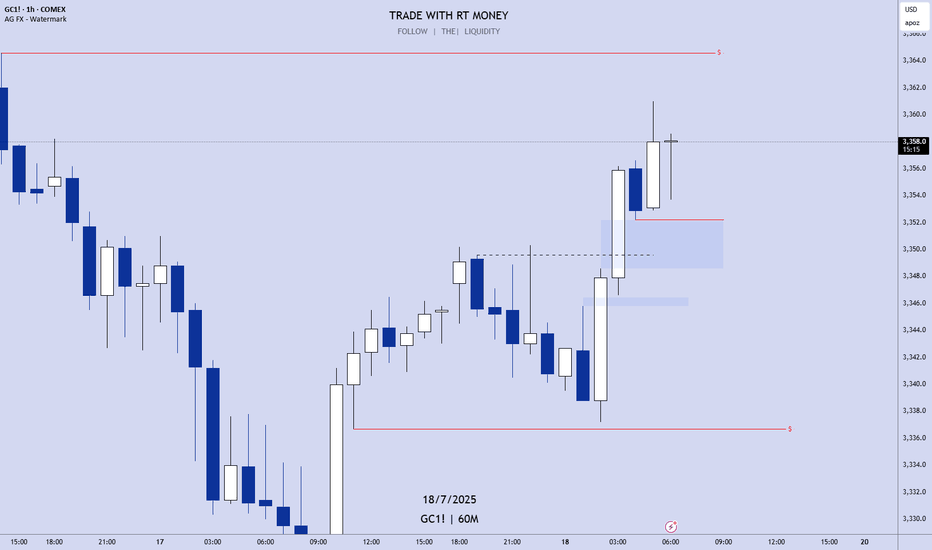

GOLD! Pre-Market Analysis For Friday July 18th!In this video, we'll present pre-market analysis and best setups for Friday July 18th.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

US30 MAY 15What kind of birds stick together? Velcrows! And we shall stick together as we conquer this market. Today price is stuck between 2 key areas (41,973 and 41797).

I am going to wait for price to break and retest one of those areas before I get into a buy or sell respectfully. on the 1m timeframe.

And I'm trading level to level. If it goes for the sell, it is evident that price will try to fill in the price gap that it left behind and few days ago. 41,527 level

And if price decides that it wants to go for the buy, I'll buy up to the next level where price last stopped on the hourly, 42,139 level.

But, like a 21-year-old girl, 5 shots in off of Tequilla, price will do whatever it wants, so trade responsibly. And have fun!!!

#NIFTY Intraday Support and Resistance Levels - 29/04/2025Gap up opening expected in nifty near 24450 level. After opening if nifty starts trading and sustain above 24500 level then possible strong upside rally towards the 24750+ level in today's session. Any downside or reversal expected near 24450 level. Downside 24250 level will act as a strong support for today's session.

BTC TARIFF TALKAs President Trump steps up on the stage to deliver his tariff plan BTC had a steady price rise going into the talk, a nice HH & HL LTF structure up into range high/ last weeks high, then as the speech began all of the progress made throughout the day wiped in less than 2 hours to reset BTC's price to Tuesdays low.

In the end the news event gave volatility as expected but ultimately the structure remains the same, rangebound. As the Tax year comes to an end it would be a hard ask for this choppy price action to shift bullish when institutions are going to be window dressing their portfolios for the next financial year.

In essence A continued LTF range with an overall HTF bearish trend looks to continue, this is compounded by yet another failed attempt at the 4H 200 EMA which had temporarily been broken but sent back below by the tariff announcements.

The SPX, DJI & NASDAQ Futures pre-market is looks dreadful so a revisit on the range low is probable on the cards at some stage today.

Breaking: QUALCOMM ($QCOM) Shares Dip 5% In Premarket tradingShares in Qualcomm fell more than 5% in Thursdays premarket trading as a disappointing forecast for no growth in its patent licensing business overshadowed a higher-than-expected outlook for sales and profits.

The shares fell 4.2% in extended trading on Wednesday, having closed up 1.6% on the day in regular hours. Qualcomm stock is up 14.5% this year.

Despite the poor results It is pertinent to note that In 2024, QUALCOMM's revenue was $38.96 billion, an increase of 8.77% compared to the previous year's $35.82 billion. Earnings were $10.14 billion, an increase of 40.24%.

Analyst Forecast

According to 27 analysts, the average rating for QCOM stock is "Buy." The 12-month stock price forecast is $207.25, which is an increase of 17.85% from the latest price.

Technical Outlook

As of the time of writing, (NASDAQ: NASDAQ:QCOM ) stock is down 5.11% in Thursday's premarket trading with recent trading session closing with a moderate RSI of 66 however there will be an impediment today on the growth of NASDAQ:QCOM as a gap down is inevitable which is a bearish pattern that leads to further dip.

In the case of extreme selling pressure, immediate support lies in the 61.8% fib retracement level. A dip to this could set NASDAQ:QCOM on a bullish course as liquidity has being swept on recent dip.

[INTRADAY] #BANKNIFTY PE & CE Levels(06/01/2025)Today will be gap up opening expected in banknifty. After opening if it's sustain above 51050 level then possible upside rally upto 51450 in opening session. 51450 level will act as a resistance for upside movement. If banknifty gives breakout of this level and starts trading above 51550 then further bullish movement expected upto 400-500+ points. Major downside expected below 50950 level.

Stock Market Logic Series #11If you are not adding the pre-and-after-hours of trading on your chart, you don't actually see the full picture of your trading analysis.

A lot of times, the market makers will push the price on the pre/after-hours times on a light volume, and will define the true low or high of the day, where you could have gotten inside with a much better price and stop placement, so when the trading hours starts, you don't feel lost that you don't have a close risk point to put your stop at.

Also, in those outside-hours, you can clearly see a much more sensible picture where the trendlines are much more clear and it is clear what the price is doing.

Also, I don't even talk about when EARNINGS are happening... and there is a high chance for gap to happen in one direction or the other.

After a gap happens, if you only look on the trading hours, you have only the information of the first 5 min of the day so you have some estimation of what could be the high or low of the day, but looking at the pre-market you could see what are the possible true high or low of the day, which is completely different.

Also, after a gap happens, your indicators are "wrong", since they miss information.

As you go into a higher frame this becomes less important, but still... some crazy huge moves start in the pre/after-hours and the price just never comes back, it just flies to the moon. So why not position yourself at a better price with better stop placement?

The logic behind it, is that if BIG money wants a stock badly... he will buy it whenever it is possible and available before the other BIG money will snatch it from it...

Look how clear price action looks in this chart:

TradeCityPro | AEVO : Accumulation Box with Potential for Growth👋 Welcome to TradeCityPro!

In this analysis, I’m going to review the AEVO coin. This project operates in the Premarket space, providing users with charts of coins before they are listed, enabling them to trade within this market.

📅 Daily Timeframe: Accumulation Box

On the daily timeframe, we observe a ranging accumulation box that, unlike most altcoins, has not been broken yet and remains below the resistance level of 0.6160.

💪 There is a critical zone at 0.4472 that acted as a strong resistance prior to being broken. After the breakout, during a market correction, this zone prevented a deeper price drop and provided a strong recovery for the coin.

✨ The RSI indicator has shown a very strong positive divergence since the beginning of the chart, featuring five lows. Currently, this divergence is active and could reflect its influence on the chart.

🛒 The key area right now is 0.6160. If this level is broken, the accumulation box will also break, and we can expect the divergence to manifest its effect on the price action.

📈 Upon breaking this level, the next resistance levels are 0.7776 and 1.0775. The next major resistance is the ATH, located at 3.6599. Considering the project's low market cap, reaching this target is plausible if sufficient buying volume enters the market.

🤝 If you already hold AEVO and are in profit, I recommend continuing to hold, as the coin has not moved significantly yet. Given its high potential, it’s worth holding at least until 0.7776 or 1.0775.

🔽 Correction Scenario

If the price corrects, the first significant area is 0.4472, which has been tested once and has proven to be very robust. In the event of a deeper correction, 0.2823 is the most critical level on this chart and represents the coin’s final stronghold.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Daily Pre-Market Analysis: GOLD & SILVER BUY Watch!Tuesday Oct 29th

I have a bullish bias on the day for both Gold and Silver.

A pullback on the 1H TF to a +FVG, and we may get the buy entry I am looking for.

Check the comments section below for updates regarding this analysis throughout the week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

#NIFTY Intraday Support and Resistance Levels - 20/08/2024Today will be slightly gap up opening in nifty. If nifty starts trading above 24650 level then possible upside rally upto 24850+ in today's session. Similarly if it's starts trading below 24500 then downside fall expected. 24500-24650 will act as a consolidation zone in today's session. Any strong movement only expected breakout of this zone.

$GEO Border Detention Facilities - Profiting off of incompetenceGood morning everyone, Today I am evaluating a stock I have legitimately found valuable for a few months. With the escalation at our border (Record numbers of crossings in October) It is time to consider how we can profit from such a tragic situation. I've been invested in stocks like NYSE:GEO and NYSE:CXW for the past year or so, however, I think right now might be the most bullish I've been on them in a while. In this video, I lay out potential price targets for NYSE:GEO and show some of the methodology behind my trading strategy.

Here are my outlined Targets / Resistances and supports

Strong Support Level: $8.30

Strong Resistance Level: $9.95

Resistance 2: $12.35

Target 1: $14.31

Target 2 / Resistance 3: $17.58

Target 3: $19.82

Remember, both targets and resistances represent solid points to take profit.

Don't get greedy

The GEO Group (GEO) operates special-purpose, state-of-the-art residential centers on behalf of U.S. Immigration and Customs Enforcement (ICE).

All ICE Processing Centers operated by GEO have a long-standing record of providing high-quality, culturally responsive services in safe, secure, and humane environments that meet the needs of the individuals in the care and custody of federal immigration authorities.