Pricemovement

DOLLAR BEARS ARE UNSTOPPABLEThe market remains bearishly dominant, with no valid reversal signals observed at this stage.

Price engineered a buy-side liquidity sweep during at the London Killzone, followed by a confirmed Break in Market Structure (BMS) to the downside during the New York session. This shift in structure reinforces the prevailing bearish bias.

The price is expected to reach the price gap and trade lower

Trade Smart. Trade Responsibly.

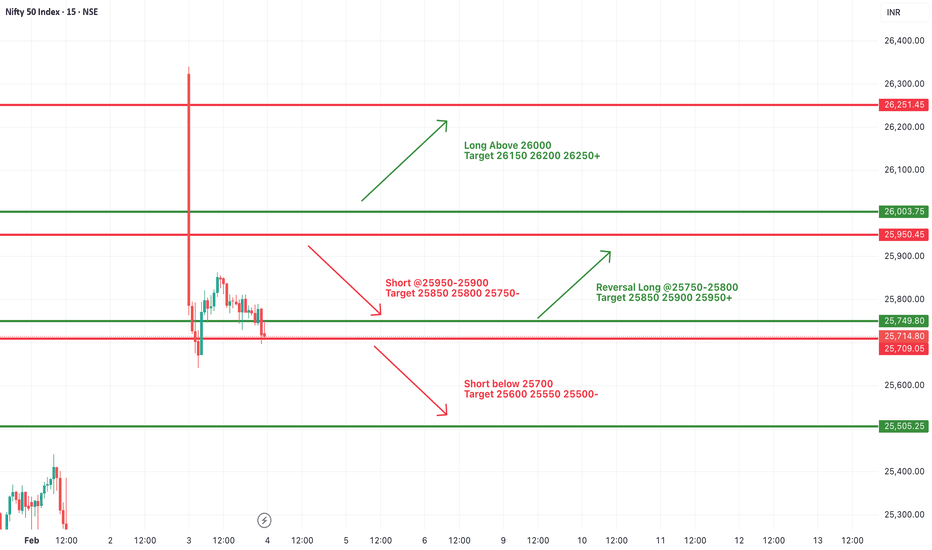

#NIFTY Intraday Support and Resistance Levels - 10/02/2026Nifty is expected to open flat, reflecting a calm and balanced start to the session with no strong overnight cues. Such an opening usually indicates that the market is in a wait-and-watch mode, where traders are cautious and price action remains range-bound in the initial phase. Early volatility may be limited, and the index is likely to respect the previously defined support and resistance zones before making any directional move.

On the bullish side, the 25750 level is the immediate pivot to watch. If Nifty sustains above this zone with stable price action, it can attract fresh buying interest, leading to a gradual upside move. Holding above 25750 opens the door for targets around 25850, 25900, and 25950+. Further strength above the psychological 26000 mark would be a strong bullish confirmation, where positional longs can aim for 26150, 26200, and 26250+. However, traders should continue to trail stop losses as upside zones may witness profit booking.

On the bearish side, the 25950–25900 zone acts as a strong supply and reversal area. Any rejection from this zone, especially with bearish candles or volume spikes, can lead to a reversal short setup, dragging Nifty back towards 25850, 25800, and 25750. A decisive breakdown below 25700 would weaken the structure further and may accelerate selling pressure towards 25600, 25550, and 25500, where buyers are expected to re-emerge.

Overall, the market structure suggests a range-bound session with selective opportunities on both sides. With a flat opening, the best approach is to trade only after confirmation near key levels, avoid chasing moves, and focus on level-to-level setups with disciplined risk management. Patience will be crucial, as clearer direction is likely to emerge only after Nifty decisively breaks out of its current consolidation range.

Nykaa Breaks the Ceiling: Consolidation to Fresh Upside MomentumFSN E-Commerce Ventures Ltd (Nykaa) has finally delivered a decisive technical signal after spending months trapped in a broad consolidation range. The stock recently printed a strong bullish candle that cleanly pushed price above a well-tested resistance zone, signaling a potential shift in market structure. This breakout is important because it comes after repeated rejections from the same resistance area, indicating that supply at higher levels has now been absorbed.

For a long time, Nykaa was trading within a downward-sloping support structure while facing horizontal resistance overhead. This kind of setup often reflects accumulation beneath resistance, where smart money builds positions quietly while volatility compresses. The recent expansion in price, combined with a strong close above resistance, suggests that this accumulation phase may be complete and that a new directional move has begun.

The breakout candle itself stands out clearly on the chart. Its strong body and close near the highs reflect aggressive buying interest rather than a slow drift higher. Such candles, when they appear after prolonged consolidation, often act as ignition points for momentum-driven moves. As long as price holds above the breakout zone, the former resistance now becomes an important demand area.

From a structure perspective, the projected move aligns with the measured height of the earlier range. Based on this pattern projection, the stock opens up room toward the 290 zone as an initial objective, followed by a broader extension toward the 310+ region if momentum sustains. These levels are not just arbitrary targets but are derived from prior price structure and expansion behavior.

Risk management remains critical even in bullish setups. The bullish view remains valid only as long as price holds above the 263 region, which now acts as a clear invalidation level. A sustained move back below this zone would indicate a failed breakout and could drag the stock back into consolidation. Until that happens, dips toward the breakout area are more likely to attract buyers than sellers.

Overall, Nykaa appears to be transitioning from a corrective and range-bound phase into a potential trending leg higher. The key focus in the coming sessions will be whether price can maintain acceptance above the breakout zone. If it does, the stock may be entering a phase where momentum traders and positional participants align on the long side, increasing the probability of follow-through toward higher targets.

#NIFTY Intraday Support and Resistance Levels - 09/02/2026Nifty is expected to open slightly gap up, indicating a mildly positive start but not a strong trending open. Despite the gap-up bias, the structure still reflects a consolidation phase, so early volatility and two-way moves are likely. Traders should avoid chasing the opening move and instead wait for price acceptance near key levels before taking positions.

On the upside, 25750 is the first important trigger. A sustained move above this level can activate a bullish setup with immediate targets at 25850, 25900, and 25950+. If strength continues and Nifty decisively breaks 26000, it can extend the rally toward 26150, 26200, and 26250+. These zones are major resistance areas, so partial profit booking is recommended on the way up.

On the downside, 25700 remains a crucial support. A breakdown below this level can lead to renewed selling pressure, dragging the index toward 25600, 25550, and 25500. Additionally, a reversal short near 25950–25900 is possible if price shows rejection, with downside targets at 25850, 25800, and 25750. These levels should be watched closely for price behavior and volume confirmation.

Overall, the market is likely to remain range-bound with a slight positive bias. Clear direction will emerge only after a strong breakout above resistance or a decisive breakdown below support. A level-based and disciplined approach with strict stop-loss management is advised for the session.

Silver Isn’t Weak — It’s Reloading for the Next MoveSilver has transitioned from an explosive bullish phase into a cooling-off period, and this shift is being widely misunderstood as weakness. In reality, the market is showing signs of controlled consolidation rather than a trend breakdown. After a sharp impulse rally, price often needs time to absorb supply, allow late buyers to exit, and prepare for the next directional move. That is exactly the structure Silver is currently building.

From a broader perspective, the long-term trend remains intact. The previous rally was strong, fast, and emotional, which naturally leads to profit booking and sideways price action. The large weekly red candles with extended wicks indicate distribution by smart money, not panic selling. This behavior usually appears before continuation phases, not at the start of long-term reversals.

The current price action is compressing between a well-defined demand zone near the 72–75 region and a major supply zone around 92–95. This range is acting as a pressure chamber. As long as price respects the support band and continues to form higher lows on lower timeframes, the market is signaling accumulation rather than exhaustion. Such structures often precede powerful breakouts once resistance is decisively cleared.

If Silver manages to sustain above support and eventually closes strongly above the 92–93 zone, it can unlock a fresh bullish leg with upside potential extending toward 110 and beyond. This would confirm that the consolidation served as a base-building phase rather than a topping structure. Momentum traders should wait for confirmation rather than anticipation, as premature entries during consolidation often lead to frustration.

On the flip side, bearish scenarios only gain credibility if price fails to hold the 72 level on a weekly closing basis. A breakdown below this zone would suggest that the prior rally needs a deeper reset, opening the door for a broader corrective phase toward lower ranges. Until that happens, downside moves should be treated as corrective pullbacks within a larger trend.

In summary, Silver is not breaking down — it is pausing. Markets rarely move in straight lines, and powerful trends often disguise themselves during consolidation phases. The next major move will not come from guessing, but from letting price confirm its intent. For now, this is a classic case of patience before expansion.

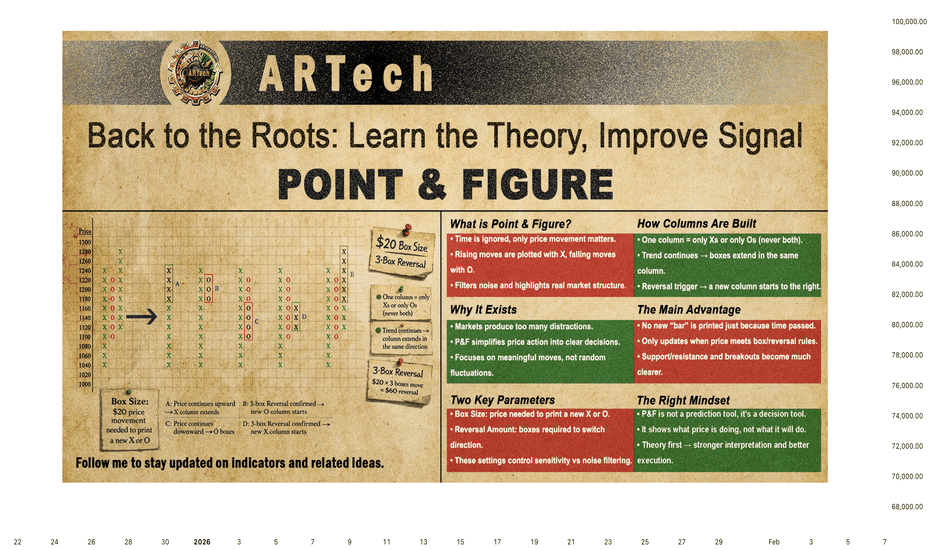

POINT & FIGURE🔸🔸🔸 1 - Back to the Roots: Learn the Theory, Improve Signal 🔸🔸🔸

Many traders believe that history repeats itself. Others think past performance can clearly explain what will happen next. The most common mistake is believing that technical indicators, calculated only from past data, can predict the future.

In reality, price charts do not show the future. They show only what has already happened and what is happening right now. Nothing more.

For this reason, we do not use charts as prediction tools. We use them as decision tools. Their purpose is not to tell us what will happen, but to help us build a roadmap in an uncertain future - a strategy, not a forecast.

To do this properly, we must understand the theory behind price behavior. Without theory, charts become pictures. With theory, they become structure.

That is why learning theory comes first.

🔸🔸🔸 2 - Point & Figure 🔸🔸🔸

Financial markets produce more information than traders can process. Prices move constantly, news never stops, and decisions must often be made under pressure. The real challenge is not accessing data, but turning that data into something useful.

Point & Figure (P&F) charts were created to address this problem. Instead of reacting to every small fluctuation, they record only meaningful price movement. By removing time and minor noise, Point & Figure charts provide a clear and structured view of market behavior.

Point & Figure charts display price movement only. Time is completely ignored. This is the main difference between Point & Figure charts and traditional bar charts.

In bar charts, both price and time are part of the structure. The vertical axis shows price, while the horizontal axis represents time. As time passes, new bars are added to the right side of the chart. Even if price stays the same, a new bar is still printed for each time period.

Point & Figure charts work in a very different way. There is no time axis. The horizontal space does not represent days or hours. The chart grows only when price moves enough to matter.

Price is plotted using fixed price boxes.

When price rises, Xs are added.

When price falls, Os are added.

If price continues moving in the same direction, the chart stays in the same column. For example, if price rises continuously for 5 days without a pullback equal to the reversal amount, this entire move appears as a single column of Xs. In a bar chart, the same move would create 5 separate bars.

If price does not meet the predefined rules, nothing is added to the chart. No X, no O. In contrast, time-based charts will always print a new bar simply because time has passed.

🔸🔸🔸 3 - Point & Figure Graph 🔸🔸🔸

Before drawing a Point & Figure chart, two parameters must be defined:

Box Size

The box size determines how much price movement is required to add a new X or O.

In this example, the box size is set to $20 . This means:

Every $20 rise adds one X upward.

Every $20 drop adds one O downward.

Reversal Amount

The reversal amount defines how many boxes price must move in the opposite direction to start a new column.

In Point & Figure charts, Xs and Os never appear in the same column. Each column contains only Xs or only Os.

In this example:

Box size = $20

Reversal amount = 3 boxes

This means a reversal requires a $60 move in the opposite direction.

Graph A

If the current column is an X column and price continues to rise, new Xs are added to the same column as long as the box size rule is met.

Graph B

When price falls by 3 boxes ($60), a new column begins to the right. Three 0s are placed starting one box below the highest X of the previous column.

Graph C

If price continues to fall, additional Os are added downward in the same column.

Graph D

If price then rises by 3 boxes ($60), another new column starts. Three Xs are placed one box above the lowest O of the previous column.

Graph E

As long as price continues higher without another 3-box reversal, Xs keep extending in the same column.

🔸🔸🔸 4 - The Rules for Plotting Point & Figure Charts 🔸🔸🔸

Before drawing a Point & Figure chart, a few basic rules must be defined. These rules determine which price source will be used and how price movement will be measured. The chart can be built using Close prices or High–Low data , and the box size can be calculated in different ways, such as Fixed value, Percentage, or ATR-based methods.

Each choice affects how sensitive the chart is to price movement and how much noise is filtered out. Understanding these rules is essential, because a Point & Figure chart only reacts when price movement meets the predefined conditions - nothing more, nothing less.

📌 4.1- High-Low Price Source

Preference is always given to price movements that continue the current trend. The price in the opposite direction is considered only if the trend cannot be extended.

The process starts by defining two key parameters: box size and reversal amount. In this example, the box size is set to $20, and the reversal amount is 3 boxes. These values determine when the chart should update.

The algorithm first reads the high and low prices of the current timeframe candle. The next step depends on the current column direction.

4.1.1 - When the Current Column Is Xs (Uptrend)

If the chart is currently in a column of Xs , preference is given to upward price movement.

The algorithm first checks whether the current candle's high is at least one box above the previous high.

If this condition is met and the box is fully filled, new Xs are plotted in the same column.

If the price does not move high enough to extend the X column, only then is the low price checked.

If the candle's low falls at least three boxes below the previous high, a reversal occurs:

A new column begins to the right.

Three Os are plotted, starting one box below the highest X of the previous column.

If neither condition is met, the chart remains unchanged.

4.1.2 - When the Current Column Is Os (Downtrend)

If the chart is in a column of Os , preference is given to downward price movement.

The algorithm first checks whether the current candle's low is at least one box below the previous low.

If the box is fully filled, new Os are added to the same column.

If the price does not extend the O column, the algorithm then checks the high price.

If the candle's high rises at least three boxes above the previous low, a reversal is triggered:

A new column starts to the right.

Three Xs are plotted, starting one box above the lowest O of the previous column.

Again, if neither condition is met, no action is taken.

📌 4.2 - Close Price Source

When the Close Price is used as the price source, the same plotting algorithm applies without any structural changes. The only difference is that high and low values are ignored. All decisions - box extensions and reversals - are made using closing prices only . If the close fills a box in the direction of the current column, new Xs or Os are plotted. If the close reaches the reversal amount in the opposite direction, a new column is started.

📌 4.3 - Box Size Method

Box size defines how much price must move before a new X or O is plotted on a Point & Figure chart. For this reason, box size directly controls the sensitivity of the chart. A small box size produces more signals and more noise, while a larger box size filters noise but reacts more slowly.

Choosing the correct box size is one of the most important decisions in Point & Figure charting. Markets differ in price level and volatility, and these characteristics can also change over time. A single box size cannot work equally well for every instrument or every market condition.

Each method has its strengths and weaknesses. The key is not finding a "perfect" box size, but choosing a method that matches the behavior of the market and the objectives of the trader.

To address this, Point & Figure charts commonly use three different box size methods:

4.3.1 - Fixed Box Size

The box size is defined as a fixed price value (for example, $20 per box). This method is simple and easy to understand, but it does not adapt to changing volatility.

4.3.2 - Percentage Box Size

In the percentage box size method, each box represents a constant percentage of the current price rather than a fixed price value.

Using a percentage-based box size helps normalize charts across markets with different price ranges and makes long-term comparisons more meaningful. However, because the box size is recalculated as price changes, the chart effectively adapts continuously. Rising prices increase the reversal distance, which can delay reversals and extend trends. Falling prices reduce the reversal distance, potentially triggering reversals more quickly.

While this method improves adaptability compared to fixed box sizes, it does not directly measure volatility. In markets where volatility changes sharply without large price changes, fixed percentage-based box sizing may still produce inconsistent signals.

4.3.3 - ATR-Based Box Size

The ATR Box Size method adjusts the box size based on market volatility rather than price alone. Instead of using a fixed value or a percentage of price, each box is calculated as a multiple of the Average True Range (ATR).

ATR measures how much price typically moves over a given period. As volatility increases, ATR rises and box sizes become larger. When volatility decreases, ATR falls and box sizes become smaller. This allows the Point & Figure chart to adapt naturally to changing market conditions.

For example, if the 50-period ATR of an instrument is 8 points and the ATR multiplier is set to 1.0, each box represents 8 points. A 3-box reversal would therefore require a 24-point move. If volatility later doubles, the box size increases automatically, filtering out noise during highly volatile periods.

ATR Box Size does not predict price direction. It simply ensures that the chart reflects meaningful price movement relative to current volatility, keeping the focus on true supply and demand rather than random fluctuations.

🔸🔸🔸 5 - Point & Figure on TradingView 🔸🔸🔸

This section explains how to open Point & Figure charts on TradingView and how to adjust the key parameters properly. Before discussing trading techniques, it is important to understand how to enable Point & Figure charts and configure their settings correctly.

📌 5.1 - Enable Point & Figure from Chart Type Menu

Point & Figure charts can be enabled directly from the Chart Type menu on TradingView. To activate it, open the chart type selector and choose Point & Figure from the list.

Note: Point & Figure charts are available only on TradingView Plus and higher plans.

Good news 🚀 At the end of this article, you can find the link to the indicator I developed based on Point & Figure logic.

📌 5.2 - Chart Settings

To change Point & Figure settings, right-click on the chart and select Settings from the menu. Then, open the Symbol tab to adjust the Point & Figure parameters. These settings allow you to control both the visual appearance of the chart and the logic used to build it.

Up Bars

Customize the color of rising columns (X columns).

Down Bars

Customize the color of falling columns (O columns).

Projected Up Bars

Represents potential rising columns (Xs) based on the current price before the bar is closed.

Projected Down Bars

Represents potential rising columns (Os) based on the current price before the bar is closed.

Source

Selects which price data is used for Point & Figure calculations (such as Close or High/Low). The logic and differences between these source types are explained in Section 4 .

Box Size Assignment Method

Choose how the box size is calculated:

Traditional: A fixed, user-defined box size

Percentage (LTP): Box size is calculated as a percentage of the last closed price

ATR: Box size is based on the Average True Range

The logic and usage of each method are explained in detail under the Box Size Methods section in Section 4.

ATR Length

If the ATR method is selected, this defines the look-back period used to calculate volatility.

Box Size

When using the Traditional method, this value defines the fixed price movement required to add one box.

Reversal Amount

Defines how many boxes price must reverse before a new column is created. The most common setting is a 3-box reversal.

Percentage

When using the Percentage (LTP) method, this value defines the box size as a percentage of the last closest price.

🔸🔸🔸 6 - Point & Figure Trading Technique 🔸🔸🔸

In this section, we will focus on three core trading techniques that are commonly used with Point & Figure charts: Reversal-based entries, Vertical Count, and Horizontal Count. Each method approaches the market from a different perspective - risk control, trend projection, and consolidation analysis - while remaining fully consistent with Point & Figure principles.

📌 6.1 - Reversal Based Entries

Point & Figure trading is based on breakouts to new highs and new lows. The most basic signals are simple and well defined:

Buy when the current column of Xs breaks one box above the previous X column.

Sell when the current column of Os breaks one box below the previous O column.

Using these basic rules, the trader is almost always in the market, reversing positions when an opposite signal appears (except in long-only stock trading).

In the figure above:

A new high is formed by breaking one box above the top of the previous O column, generating a buy signal. The stop-loss is placed one box below the lowest level of the prior column.

Price fails to show sufficient continuation and reverses downward with a 3-box reversal. When price breaks one box below the bottom of the previous X column, a sell signal is triggered, stopping out the previous long position.

After the pullback that follows the breakout, price turns upward again. A new buy signal occurs when price rises one box above the top of the previous O column. The stop-loss is placed one box below the lowest X in the current column.

However, many traders prefer alternative entry techniques to reduce risk and avoid false breakouts. One of the most common approaches is to enter after a pullback, rather than buying immediately at the breakout. This method limits risk while still respecting the Point & Figure structure.

Instead of buying at the first breakout, the trader waits for a reversal and enters at a lower price (or a higher price for short positions) that aligns with an acceptable risk level. This approach aims to reduce risk by waiting for a pullback, allowing entry closer to the stop-loss level. However, this comes with a trade-off: while risk is reduced, some trading opportunities may be missed if price continues in the breakout direction without a meaningful pullback.

📌 6.2 - Horizontal Count

In Point & Figure charting, the time price spends in a consolidation area is considered related to the size of the next price move. The longer the consolidation, the larger the potential breakout.

The horizontal count method is used to estimate price targets based on this idea.

6.2.1 - Upside Horizontal Count

To calculate an upside price objective:

Upside Target = Lowest price of the base + (Width × Reversal Value)

Lowest price of the base is the lowest box in the consolidation area

Width is the number of columns in the base (excluding the breakout column)

Reversal value is the box size multiplied by the reversal amount (for example, 3 (boxes) x 20$ = 60$)

Steps:

Identify the base after the breakout has occurred.

Count the number of columns across the base.

Multiply this number by the reversal value.

Add the result to the lowest price of the base.

This gives a projected upside price target.

6.2.2 - Downside Horizontal Count

The downside objective is calculated in the same way, but in the opposite direction:

Downside Target = Highest price of the top − (Width × Reversal Value)

Highest price of the top is the highest box in the distribution area

Width is the number of columns in the top formation

Reversal value is the box size multiplied by the reversal amount (for example, 3 (boxes) x 20$ = 60$)

Steps:

Identify the top formation after a downside breakout has occurred.

Count the number of columns across the top formation (do not include the breakout column).

Multiply the width by the reversal value.

Subtract the result from the highest price level of the top formation.

Key Notes

Wider bases or tops produce larger price objectives.

Smaller formations usually lead to shorter moves.

Multiple possible widths can be selected; closer targets are easier to reach, while wider counts often align with major support or resistance levels.

Horizontal counts provide price objectives , not guarantees, and should be used together with trend analysis and risk management.

📌 6.3 - Vertical Count

The vertical count is a simpler and more direct method than the horizontal count. It is used to estimate a price objective based on the strength of the first move away from a top or bottom. While the horizontal count measures accumulation or distribution, the vertical count measures volatility and momentum.

Like the horizontal count, the vertical count allows enough time to identify the formation and calculate the target before it is reached.

Purpose of the Vertical Count

Measures the initial price thrust after a confirmed top or bottom

Estimates how far price may travel in the direction of the new move

Often used to project retracements or continuation targets after major reversals

The vertical count relies on the idea that a strong first reversal often leads to a move of proportional size.

6.3.1 - Upside Vertical Count

To calculate an upside vertical count:

Confirm a bottom formation

Identify the first reversal column of Xs after the bottom.

Count the number of boxes in that first reversal.

Multiply this number by the minimum reversal value.

Add the result to the lowest box of the bottom.

Upside Vertical Count = Lowest box + (First reversal boxes × Minimum reversal boxes)

6.3.2 - Downside Vertical Count

The downside vertical count follows the same logic, but in the opposite direction:

Confirm a top formation.

Identify the first reversal column of Os after the top.

Count the number of boxes in that first reversal.

Multiply this number by the minimum reversal value.

Subtract the result from the highest box of the top.

Downside Vertical Count = Highest box − (First reversal boxes × Minimum reversal boxes)

Key Notes

The vertical count is based on volatility , not time.

It often provides conservative targets and may underestimate very strong trends.

Multiple vertical counts from nearby highs or lows can confirm each other.

Vertical counts are price objectives , not predictions, and should be used together with trend analysis and risk management.

🔸🔸🔸 7 - Conclusion 🔸🔸🔸

Finally, it is important to remember a principle that applies to all forms of technical analysis: Point & Figure charts, like any other method, are not a complete buy–sell system on their own.

Point & Figure does not predict the future, and it does not eliminate uncertainty. What it offers is something far more valuable: a structured way to interpret price behavior, free from time-based noise and emotional distraction. It helps us understand where supply and demand are truly in control, where risk is defined, and where decisions can be made logically.

For this reason, trading decisions should never be based on Point & Figure alone - or on any single technique. A robust trading strategy is built by combining multiple tools, perspectives, and confirmations. Trend analysis, support and resistance, market context, volatility, and risk management must all work together.

Even if Point & Figure charts are a core part of your approach, they should be seen as one weapon in a larger arsenal, not the entire strategy. The goal is not to find a perfect indicator, but to build a disciplined process where each tool supports and confirms the others.

Returning to theory gives us that discipline. And with theory in place, Point & Figure becomes not just a chart - but a framework for decision-making in an uncertain market.

#NIFTY Intraday Support and Resistance Levels - 05/02/2026Nifty is indicating a flat opening, and structurally there are no major changes compared to yesterday’s levels, which clearly suggests a continuation of the consolidation phase. The index is currently trading within a well-defined range, and price action shows balance between demand and supply. Such sessions typically start slow, with whipsaws around key levels, and a directional move is usually seen only after a decisive breakout or breakdown with volume support.

On the upside, the 26000 level remains a critical psychological and technical resistance. A sustained move and acceptance above 26000–26050 can trigger fresh long positions, with upside targets placed at 26150, 26200, and 26250+. This zone represents a higher timeframe resistance, so follow-through buying is essential for continuation. Until price sustains above this area, aggressive longs should be avoided.

In the immediate range, 25750–25800 acts as a key reversal and demand zone. If the index shows stability and reversal signs from this area, a short-term pullback rally can be expected towards 25850, 25900, and 25950+. This move would be more of a range play rather than a trending rally, so partial profit booking is recommended near resistance levels.

On the downside, 25950–25900 remains a supply zone. Rejection from this area can lead to short-term selling pressure, pushing the index towards 25850, 25800, and 25750. A decisive breakdown below 25700 will be a bearish signal, opening the path for deeper correction towards 25600, 25550, and 25500, where stronger support is placed.

Overall, the market structure clearly favors a range-bound strategy rather than a trending approach. Traders should focus on buying near support and selling near resistance, avoid chasing breakouts without confirmation, and maintain strict stop-loss discipline. A clean directional move will only emerge once Nifty breaks out of this consolidation zone with strong volume and follow-through.

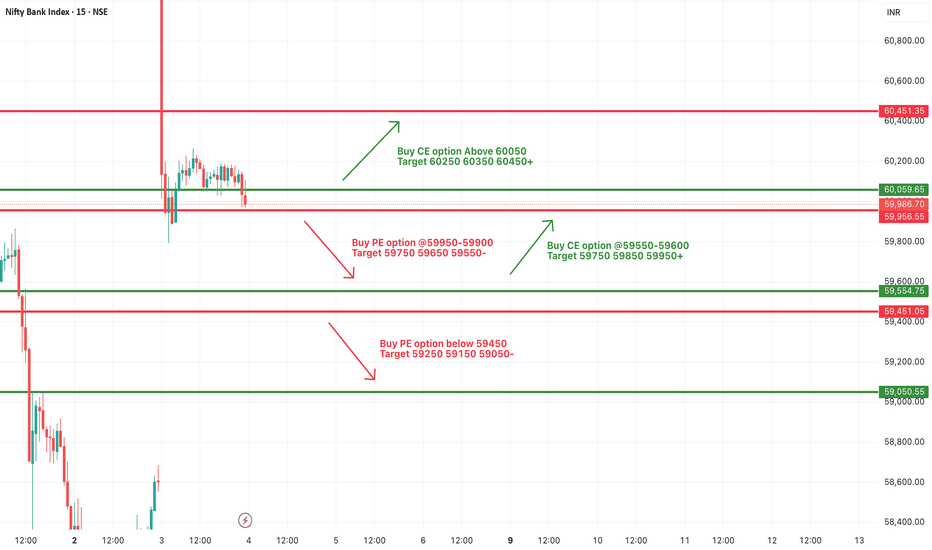

#BANKNIFTY PE & CE Levels(05/02/2026)Bank Nifty is indicating a flat opening, which signals indecision in the market after the recent sharp moves and wide-range volatility. This kind of opening generally reflects balance between buyers and sellers, where neither side has clear control at the start. In such sessions, the first hour often remains range-bound, and directional clarity usually emerges only after a decisive breakout or breakdown from the marked levels.

On the upside, the 60050–60100 zone is acting as an immediate resistance-cum-trigger area. A sustained move and acceptance above this zone can attract fresh buying momentum, opening the path towards 60250, 60350, and 60450+. If Bank Nifty manages to hold strength above 60550, the bullish momentum can further extend towards 60850–60950+, indicating trend continuation rather than just a pullback. These levels are crucial as they align with previous supply zones where profit booking can emerge.

On the downside, 60450–60400 remains an important reversal zone. Failure to sustain above this area may invite selling pressure, leading to a corrective move towards 60250, 60150, and 60050. If weakness deepens and the index breaks below 59950, it could accelerate the downside towards 59750, 59650, and 59550, suggesting that bears are regaining control for the intraday to short-term perspective.

Overall, the structure clearly suggests a range-bound to mildly volatile session unless Bank Nifty breaks decisively above resistance or below support. Traders should avoid aggressive positions in the opening minutes and focus strictly on level-based trading. Confirmation near key zones, strict stop-loss discipline, and partial profit booking are essential, as flat-opening sessions can quickly turn directional once liquidity and volume step in.

#NIFTY Intraday Support and Resistance Levels - 04/02/2026Nifty is indicating a flat opening, which clearly reflects consolidation after the recent sharp volatility and wide-range moves. Such an opening generally suggests that the market is taking a pause to absorb earlier price action, with both bulls and bears waiting for confirmation before committing aggressively. In flat-opening scenarios, early price movement is often choppy, so patience becomes crucial during the first 15–30 minutes.

On the upside, the 26000 level remains the most important psychological and technical hurdle. A sustained move and acceptance above this zone can trigger fresh long positions, with upside potential towards 26150, 26200, and 26250+. This zone represents a higher supply area, so breakout confirmation with volume is essential. If Nifty manages to hold above 25750–25800 after testing lower levels, it can also act as a reversal long zone, supporting a recovery move towards 25850, 25900, and 25950+.

On the downside, 25950–25900 is acting as an immediate resistance-cum-supply area. Failure to sustain above this zone can invite short-term selling pressure, pushing Nifty towards 25850, 25800, and 25750. If weakness continues and the index breaks below 25700, it may accelerate the downside move towards 25600, 25550, and 25500, indicating that bears are regaining control for the intraday session.

Overall, the structure suggests a range-bound market with a slight negative bias unless a clear breakout occurs. Traders should avoid overtrading during consolidation and focus on level-based trades only, entering positions after confirmation near key support or resistance. Strict stop-loss management and partial profit booking are advised, as flat-opening sessions can quickly turn volatile once a directional move begins.

#BANKNIFTY PE & CE Levels(04/02/2026)Bank Nifty is indicating a flat opening, which suggests a pause after the recent high-volatility and gap-driven sessions. A flat start usually reflects indecision at higher levels, where buyers and sellers are both cautious. In such conditions, the market often spends some time consolidating within a defined range before giving a clear directional move. Traders should avoid impulsive entries at the open and instead wait for price to react around the marked support and resistance zones.

On the upside, the 60050 level remains the most important trigger for bullish continuation. If Bank Nifty manages to sustain above this zone with good volume, it can open the door for a gradual upside move towards 60250, 60350, and 60450+. Even below that, a sustained hold above 59550–59600 can still support intraday long trades with targets placed around 59750, 59850, and 59950+, indicating that bulls are still active as long as key supports are respected.

On the downside, the zone around 59950–59900 acts as an immediate resistance-turned-supply area. Rejection from this region may lead to short-term weakness, pushing Bank Nifty towards 59750, 59650, and 59550. A decisive breakdown below 59450 will be a bearish signal and can accelerate selling pressure towards 59250, 59150, and 59050, especially if broader market sentiment turns negative.

Overall, the structure suggests a range-bound to mildly volatile session unless a clear breakout or breakdown occurs. Flat opening days reward patience more than aggression, so it is advisable to trade only after confirmation near key levels, maintain strict stop-loss discipline, and avoid overtrading until the market clearly chooses a direction.

Price ActionPrice action focuses on how price behaves as buyers and sellers interact in real time. Every candle reflects a negotiation between participation, urgency, and resistance. The size of the body, the length of the wick, and the way candles form in sequence reveal intent that cannot be captured by indicators alone. When observed within proper context, price action becomes a direct expression of market behavior rather than a derived interpretation.

Individual candles carry limited information in isolation. Their relevance depends on what preceded them and where they appear within the broader structure. A rejection only becomes meaningful when it occurs near a level where liquidity has been taken or where the market previously made a decision. Context transforms movement into information by tying price behavior to location and sequence.

The relationship between candles matters more than their individual appearance. Strong impulses followed by shallow, orderly pullbacks show that one side is willing to defend progress. Overlapping candles, repeated wicks, and slow advancement indicate hesitation and balanced pressure. When price struggles to advance despite repeated attempts, tension builds beneath the surface. When price moves cleanly with little opposition, control is visible without further confirmation.

Shifts in price action often precede visible reversals. Momentum gradually weakens, extensions fail to follow through, and ranges begin to compress. These changes develop over time and reflect evolving participation rather than abrupt transitions. Traders who focus on static patterns often miss these developments because they emerge through subtle changes in sequence and tempo.

Alignment across timeframes provides clarity. Lower timeframe price action reveals execution detail and entry precision, while higher timeframes define context and directional bias. Reading lower timeframe behavior without reference to higher timeframe structure leads to unnecessary activity and inconsistent outcomes. When both align, execution becomes cleaner and decision-making stabilizes.

Price action communicates how the market is behaving in the present moment. It shows where effort is being absorbed, where pressure is building, and where participation is thinning. Interpreting these signals requires patience, repetition, and structured review. Over time, this process sharpens the ability to recognize active conditions, uncertain phases, and emerging opportunities before they become obvious.

This skill develops through observation and feedback rather than shortcuts. As familiarity with price behavior deepens, reactions give way to informed responses, and execution becomes more deliberate. That progression marks the transition from reactive trading to structured decision-making grounded in how the market actually moves.

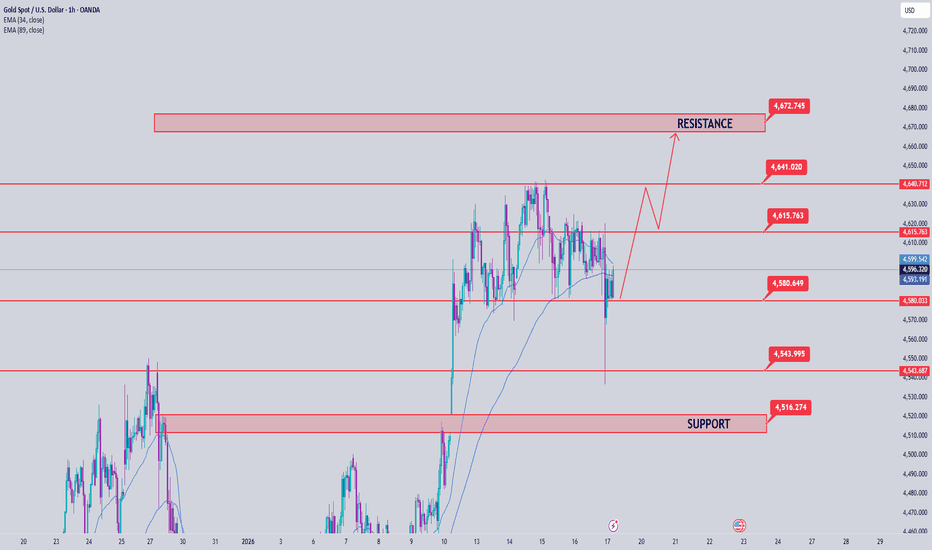

Gold price analysis, January 22ndGold (XAUUSD) on the H1 timeframe maintains a strong uptrend. The price is trading above the 34-89 EMA, with the EMAs stacked in ascending order, indicating that bullish momentum remains dominant. The current dip is seen as a technical correction after the price reached its historical peak around 4,889. With this correction, Gold will soon regain its upward momentum without reversing to a downtrend.

Currently, the price is consolidating above a key support zone. There is no signal of a breakout from the uptrend structure (no lower low has been created). This suggests that the main trend has not been broken; the market is in a "pause" phase before continuing.

BUY GOLD 4722-4720 Stoploss 4716

BUY GOLD 4765-4763 Stoploss 4759

SELL GOLD 4820-4822 Stoploss 4826

SELL GOLD 4850-4852 Stoploss 4856

Gold trading strategy for week 3After a very strong liquidity sweep on Friday, the gold market quickly rebounded, indicating that buying pressure is still controlling the main trend. Currently, the price is approaching the important resistance zone around 4600, which is considered a major psychological barrier for the market.

Observing the H1 timeframe, the price structure shows that the uptrend is gradually being re-established, and it is highly likely that gold will soon approach its all-time high again if buying pressure remains stable.

In the scenario where buying pressure shows signs of weakening and short-term price corrections occur, the liquidity zones created on Friday will act as important support, continuing to support the BUY side returning to the market.

Trading plan

BUY zone:

BUY 4575 – 4573 | SL 4569

BUY 4551 – 4549 | SL 4545

SELL zone:

SELL 4620 – 4622 | SL 4626

SELL 4640 – 4642 | SL 4646

Manage capital carefully, patiently wait for price reaction in the zone, and only enter a trade when there is a confirmation signal.Wishing you effective trading and maintaining discipline!

USDJPY M15 HTF Liquidity Sweep and Bullish Setup📝 Description

USDJPY after a sharp sell-off has swept sell-side liquidity and is now reacting positively from a discount FVG zone. Price action shows stabilization and early signs of bullish absorption rather than continuation of impulsive downside.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish recovery toward intraday PD arrays

Preferred Setup:

• Entry: 157.887

• Stop Loss: Below 157.810

• TP1: 158.032

• TP2: 158.171

• TP3: 158.321 (BPR / HTF reaction zone)

________________________________________

🎯 ICT & SMC Notes

• Clear sell-side liquidity sweep below recent lows

• Downside move shows exhaustion, not continuation

• Upside targets aligned with BPR and prior imbalance

________________________________________

🧩 Summary

As long as price holds above the swept liquidity low and respects the M15 FVG, a bullish retracement toward higher PD arrays remains the higher-probability scenario.

________________________________________

🌍 Fundamental Notes / Sentiment

With no immediate risk-off catalyst and USD stability, short-term flows favor a corrective bullish move in USDJPY.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

BTCUSDT H4 HTF Supply Rejection and Corrective Bearish Pullback 📝 Description

CRYPTOCAP:BTC is currently reacting inside a higher-timeframe H4 supply zone after a strong impulsive bullish leg. The recent upside move has stalled within HTF resistance, and price action shows signs of distribution rather than continuation. The structure suggests a corrective bearish phase developing within higher-timeframe PD arrays.

________________________________________

📈 Signal / Analysis

Primary Bias: Bearish while price holds below the H4 supply zone and recent rejection high

Preferred Setup:

• Entry: 91,400

• Stop Loss: Above 92,520

• TP1: 90,315

• TP2: 89,581

• TP3: 88,262 (HTF draw / lower liquidity)

________________________________________

🎯 ICT & SMC Notes

• Clear rejection from HTF H4 order block

• Current move classified as a corrective pullback within a broader range

• Lower liquidity pools remain unfilled and act as downside magnets

________________________________________

🧩 Summary

CRYPTOCAP:BTC is showing weakness after tapping a major H4 supply zone. As long as price remains capped below this HTF resistance, the expectation favors a controlled bearish pullback toward lower PD arrays before any potential re-accumulation or structural shift.

________________________________________

🌍 Fundamental Notes / Sentiment

Market sentiment remains neutral-to-slightly risk-off, with no strong bullish catalyst supporting continuation at current highs. In such conditions, reactions from HTF supply are more likely to extend into corrective bearish moves rather than immediate trend continuation.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

Bullish – SQD🐂 LONG – SQD

Price is accelerating on the 15m timeframe, accompanied by a clear expansion in trading volume—confirming strong short-term buying pressure. On the 1h timeframe, this move still appears to be a healthy pullback within a broader structure rather than a distribution phase. As long as price holds this level, the probability of a momentum continuation to the upside remains high.

This setup reflects a classic pullback + volume expansion scenario, where buyers are stepping in early ahead of the next impulsive leg.

🎯 TP: 0.0934

🛡️ SL: 0.05463

📊 RR: 1 : 7.58

A high-RR momentum long: intraday strength + higher-timeframe structure support → asymmetric upside potential.

XAUUSD BUY Opperunity With Patience At This Time Gold Move in Internal Structure, price May be possible lit bite move up near at 4332.999 Area. if any one want to SELL that is a Great AREA for SELL on On your confidence and Conformation, they SELL Target is 4304.536 and that is point where Price again move Up for BUY Direction on a Maximum Higher side, ( have Look a Chart for BUY Side R:R) above 4374.852 as per Technical Analysis

High Probability Setups: Divergence in Price and VolumePrice defines direction, but volume defines participation. High probability setups emerge when both align. When they separate, conditions change. Divergence between price and volume is one of the clearest tools for assessing whether a move is supported by real commitment or driven by diminishing participation.

In strong market conditions, impulsive price movements are accompanied by stable or increasing volume. This shows that traders are actively committing capital in the direction of the move. Pullbacks during these phases typically show reduced volume, confirming that counter-moves are corrective rather than a shift in control. This alignment between price expansion and volume participation supports continuation.

Divergence forms when price continues to extend while volume contracts. The market is still moving, but fewer participants are involved. This shift indicates that momentum is weakening beneath the surface. The move becomes more fragile, and continuation requires increasingly less resistance to fail. These conditions often develop before structural changes become visible on price alone.

The relevance of divergence increases at key locations. When price reaches major highs or lows, premium or discount zones, or obvious liquidity pools, declining volume signals absorption. Orders are being filled without follow-through. Late participants provide liquidity rather than fuel. This explains why many apparent breakouts stall or reverse shortly after forming.

Volume behaviour also clarifies breakout quality. Breaks that occur with low or declining volume often lack acceptance. Price may move beyond a level, but without participation the market struggles to sustain the new range. When price quickly re-enters the prior structure, divergence explains the failure before structural confirmation appears.

During consolidation phases, volume provides insight into preparation. Falling volume reflects compression and balance. Rising volume within a range reflects active engagement and positioning. Divergence during these phases often precedes resolution, especially when combined with liquidity interaction at range boundaries.

High probability setups form when divergence aligns with location and structure. Volume refines what price presents. It helps identify whether a move is being supported, absorbed, or exhausted. Reading this relationship consistently improves timing, reduces false entries, and keeps execution aligned with real market participation rather than surface-level movement.

How to Use Simple Moving Averages (SMA) to Predict Price TargetsIn this video, you’ll learn exactly how to use the Simple Moving Average (SMA) to find both short-term and long-term price targets.

I explain which SMA settings work best, how to spot trend direction, and most importantly:

When you should take a trade and when you should stay OUT of the market to avoid losses.

What You’ll Learn:

How the Simple Moving Average works (SMA 9, 21, 50)

How to use SMA for short-term and long-term price targets

Best SMA crossover strategies

When to enter a trade using SMA

When to stop trading / avoid traps

How institutions use SMA to set levels

Tips to improve your accuracy and timing