QTUMUSDT Forming Falling WedgeQTUMUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 90% to 100% once the price breaks above the wedge resistance.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching QTUMUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal.

Investors’ growing interest in QTUMUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Qtum

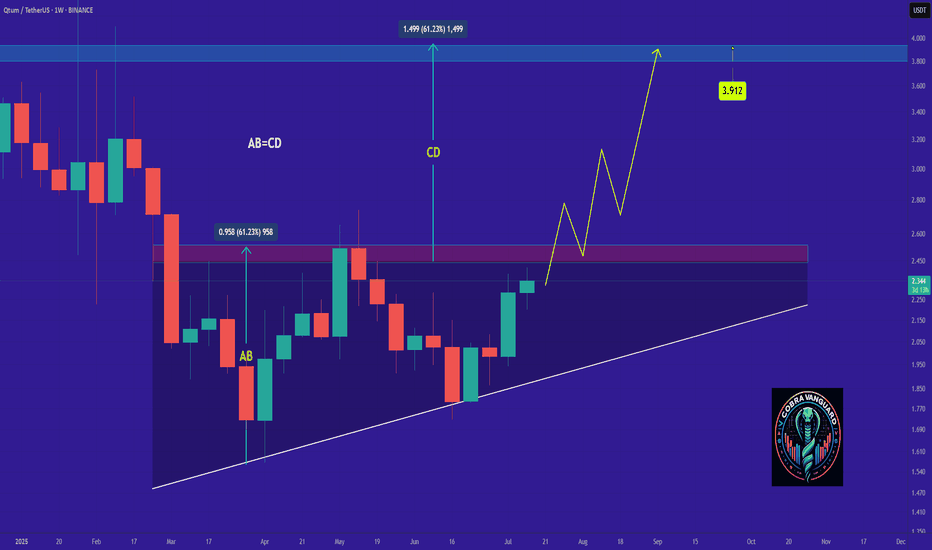

QTUMUSDT Forming Bullish ContinuationQTUMUSDT is currently showing a bullish continuation pattern, signaling strong potential for the next leg of upward movement. After a healthy consolidation phase, the price appears to be gearing up for a breakout, supported by consistent trading volume and renewed investor interest. The market structure suggests that QTUM is maintaining higher lows — a key indicator that bullish momentum is gradually building strength and preparing for a significant upside move.

With increasing buying pressure and stable liquidity, QTUMUSDT could be positioned for a 70% to 80% price gain in the short to medium term. The pattern formation reflects ongoing confidence among traders who are accumulating during this consolidation phase, anticipating a breakout that aligns with broader market recovery signals. This setup is often seen before major impulsive rallies in trending markets.

Investors have been showing growing interest in QTUM due to its consistent performance and strong fundamentals within the blockchain ecosystem. The current price action aligns with market optimism, suggesting that once resistance is broken, momentum could accelerate quickly, driving prices toward new local highs.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

QTUMUSDT — Testing Historical Support, Accumulation or BreakdownQTUM/USDT is now sitting at one of the most crucial levels in its entire price history. The pair is once again retesting the $1.60 – $2.20 historical support zone, a level that has acted as a strong foundation multiple times since 2020. How price reacts here will determine whether QTUM enters a new accumulation phase with upside potential, or finally breaks down into fresh historical lows.

---

🔎 Technical Structure & Historical Context

Long-Term Trend:

Since the 2021 all-time high, QTUM has been in a persistent downtrend with a clear pattern of lower highs. Despite this, the $1.60 – $2.20 zone has held strong for over 5 years, acting as a major demand zone.

Key Support Zone:

$1.60 – $2.20 (yellow box). Every major retest since 2020 has resulted in a significant bounce, making this one of the most critical levels for QTUM.

Important Resistance Levels (Upside Targets):

$2.70 → nearest resistance, first bullish checkpoint.

$3.53 → major confirmation level; a breakout above could signal a structural reversal.

$4.93 → medium-term target and strong supply zone.

Higher-term resistances: $8.70 → $17.36 → $27.58 (only achievable in a macro bullish cycle).

Critical Downside Support:

If $1.60 fails, QTUM could revisit $1.00 and potentially its all-time low at $0.71.

---

📈 Bullish Scenario (Potential Accumulation & Reversal)

1. Price holds above $1.60 – $2.20 and prints a strong bullish weekly candle with rising volume.

2. Breakout above $2.70 would serve as the first reversal signal.

3. Stronger confirmation comes with a close above $3.53.

4. Upside targets: $2.70 → $3.53 → $4.93. If $4.93 is broken, momentum could carry QTUM to $8.70+.

Interpretation:

This would complete a multi-bottom accumulation pattern, often the foundation of a larger bullish cycle after prolonged sideways action.

---

📉 Bearish Scenario (Descending Triangle Breakdown)

1. Price fails to hold $1.60 – $2.20.

2. Weekly close below $1.60 confirms breakdown.

3. Downside targets: $1.00 → $0.71 (historical low).

4. The chart currently resembles a descending triangle, with a flat support and lower highs pressing down. A breakdown here could trigger heavy selling pressure.

Interpretation:

Losing this support would likely mark a continuation of the multi-year downtrend that began in 2021.

---

🧭 Conclusion & Trading Strategy

The $1.60 – $2.20 support zone is QTUM’s “life or death” level.

Bullish bias confirmed on a weekly close > $2.70, with stronger reversal above $3.53.

Bearish bias confirmed on a weekly close < $1.60, targeting $1.00 → $0.71.

Swing Trading Approach:

Consider scaling entries within $2.00 – $2.20.

Place stop-loss just below $1.55.

Take profit targets: $2.70 / $3.53 / $4.93.

If breakdown occurs → cut losses quickly or look for short setups after a retest.

Investor Perspective:

This zone could be an attractive accumulation area given its historical significance. However, risk management is critical: if $1.60 breaks, QTUM could revisit historical lows.

---

📊 Key Takeaways

Weekly close is far more important than intraday wicks.

Watch volume and momentum indicators (RSI, OBV) for confirmation of strength.

QTUM is at one of its most critical levels in the past 5 years: either a major accumulation base for a bullish cycle, or a breakdown into historical lows.

---

#QTUM #QTUMUSDT #Crypto #Altcoin #TechnicalAnalysis #SupportResistance #CryptoTrading #ChartAnalysis

Qtum Confirms Altcoins Market Bullish Bias · Bitcoin & MoreThis chart looks great and it is a chart that we have seen hundreds of times before, literally. It will be great to prove our point and also for us to reinforce our current map of the market. We know where the market is headed; here we have the proof.

QTUMUSDT hit a low 7-April 2025, the same with most of the altcoins market. This is the main low and even though there are different dates, some in March and February while others in June and August, the main 2025 low comes as the end of the correction from the peak in 2024.

Back in 2024 there was a consolidation period (blue lines) very similar to what we are seeing now. The end result of the consolidation period was a bullish jump of course but this move was corrected by more than 100% and this led to today's chart.

The beyond 100% correction is good because it opens the doors for a new bullish cycle. Growth potential becomes unlimited because the previous move was fully corrected.

This is the same chart we saw hundreds of times before but something is different. QTUMUSDT is no longer trading within the "opportunity buy zone." Look at it. QTUM is not trading at bottom prices. So the same, but prices are higher.

A low in April then sideways and while sideways we get higher lows. Notice how the breakout from the consolidation range produces really high volume. This is what shows this is a real move.

Then we have the upper-trendline of the range, it was broken and six days later tested as support and it holds. This is the confirmation.

Moving above resistance is a bullish development. After a break of resistance such as the consolidation pattern we have here, there is always a small retest and this is what you see after 24-Aug. 29-Aug support is found and today prices start to grow. Resistance has been flipped support and this is the confirmation.

We can also compare QTUM to BTC as we did with DOGE and SKL.

Bitcoin peaked 14-August and started to move lower, etc. Until this day.

Qtum was trading low already, near the lower boundary of the trading range on 14-August. From this point, it started to grow and produced a major high 24-Aug. The highest prices since February 2025, 7 months ago.

Most of the altcoins we track and trade have the same chart. With this, you can predict what will happen with the rest of the market, and you also have confirmation about Bitcoin's next move.

It is like cheating and it is just too easy... All the information is available on the charts. The Cryptocurrency market will continue growing. Here you have the proof.

Namaste.

QTUM Market Update📊 NASDAQ:QTUM Market Update

NASDAQ:QTUM is now testing the red resistance zone 🔴 where sellers remain active.

If buyers achieve a confirmed breakout, it could signal the continuation of the bullish trend ✅

👉 The first target on breakout is the green line level 🎯

👉 Clearing this zone would show strong buyer momentum and open the path for further upside.

⚠️ Reminder: Always wait for confirmation — resistance zones often trigger fakeouts before a true move.

QTUM/USDT – Golden Pocket Retest as Key Decision Zone!Summary:

QTUM has just made a major breakout from its long-standing range and tapped into strong resistance around 3.10–3.50. Currently, the price is pulling back into the Golden Pocket confluence zone (Fibonacci 0.5–0.618 at 2.55–2.77), which previously acted as a strong resistance and is now being tested as support (SR-Flip). The reaction at this zone will be the key driver for the next big move.

---

🔍 Structure & Pattern

Range Breakout: QTUM escaped months of sideways consolidation.

Golden Pocket (2.55–2.77): former resistance, now tested as support.

Wick Rejection: the last candle rejected around 3.10, showing near-term supply pressure.

BOS (Break of Structure): new higher-high is formed; validation requires a higher-low above 2.55–2.77.

---

🚀 Bullish Scenario

1. Successful Retest at Golden Pocket (2.55–2.77)

Strong bounce confirms structure shift.

Targets: 3.107 → 3.503 → 3.770.

Extended targets if momentum sustains: 4.00–4.181 → 4.974 → 5.72–5.75 (previous high).

2. Reclaim of 3.10 Resistance

A daily close above 3.10 would strongly favor further bullish continuation.

---

🩸 Bearish Scenario

1. Failure to Hold Golden Pocket (daily close < 2.55)

Breakout becomes a false breakout, price falls back into the old range.

Downside targets: 2.30 → 2.05 → 1.80 → 1.57 (major low).

2. Lower High Formation at 3.10–3.50

Repeated rejection here forms a lower high, increasing breakdown risk back to 2.55–2.30.

---

⚖️ Conclusion

QTUM is now at a critical decision zone. The Golden Pocket (2.55–2.77) will act as the “last defense” for bulls. If it holds, the bullish structure remains intact with upside potential toward 3.50–4.00+. If it breaks down, sellers could take back control and drag the price back into the old range.

> Note: Always wait for daily close confirmation before making trading decisions. This is technical analysis only, not financial advice.

#QTUM #QTUMUSDT #Crypto #Altcoins #PriceAction #TechnicalAnalysis #Breakout #SupportResistance #Fibonacci #CryptoTrading

QTUMUSDT Forming Descending ChannelQTUMUSDT is currently trading within a descending wedge pattern, which is generally considered a bullish reversal signal in technical analysis. The price action has been consolidating while forming lower highs and lower lows, but with decreasing momentum on the downside. This setup indicates that selling pressure is weakening and a potential breakout to the upside could be on the horizon. Based on the chart structure, a 40% to 50% upside move is expected once the wedge resistance is breached.

The trading volume supports this outlook, as steady participation from investors suggests accumulation rather than panic selling. This type of volume behavior is often seen before strong breakout rallies. The project is also beginning to attract increasing investor interest, which further strengthens the probability of a bullish move once technical confirmation is achieved.

For traders and investors, QTUMUSDT presents an opportunity to position ahead of a potential reversal. If the breakout occurs with strong momentum, the pair could quickly achieve the projected 40% to 50% gains. The descending wedge pattern, combined with favorable volume conditions, makes this setup worth watching closely for those looking to capture short to mid-term profits.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

QTUM/USDT – Make or Break? Testing the Edge of Accumulation?🧠 Overview:

After going through a volatile multi-year cycle, QTUM is now back at one of the most critical historical support zones. This demand area has acted as a strong reversal point multiple times since 2020 and is once again being tested as price consolidates near the bottom of its macro range.

---

📉 Price Structure & Key Levels:

📍 Major Support Zone (1.70 – 2.10 USDT):

A proven accumulation zone based on multiple long wicks and price rejections in the past.

This is where smart money tends to accumulate during market uncertainty.

📍 Layered Resistance Levels (Bullish Targets):

2.70 USDT → Initial breakout validation

3.53 USDT → Mid-range resistance

4.93 USDT → Key structural level

8.70 USDT → Mid-term breakout target

17.36 USDT → Peak from previous macro cycle

---

🧩 Current Pattern: "Sideways Accumulation Range"

QTUM is clearly in a range-bound accumulation phase, with tight price action within a key support area. Historically, such patterns often precede large impulsive moves, especially when accompanied by volume surges and breakouts from structure.

> ⚠️ Important Note: Sideways movement at historical support, combined with increasing accumulation volume, often leads to a breakout into the markup phase.

---

📈 Bullish Scenario: Potential Upside Momentum

Trigger: A confirmed breakout and weekly candle close above 2.70 USDT.

Additional Confirmation: Strong bullish candle with increased volume.

Targets:

3.53 USDT (local resistance)

4.93 USDT (mid-range structural level)

8.70 USDT (swing target)

17.36 USDT (macro cycle high)

🎯 High reward-to-risk potential if entries are made near support with a stop-loss under 1.70 USDT.

---

📉 Bearish Scenario: Breakdown Risk

Trigger: Weekly candle closes below 1.70 USDT.

Implication: Breakdown from long-term demand zone.

Downside Targets:

1.20 USDT → Minor horizontal support

0.71 USDT → Historical all-time low

Warning Sign: High volume breakdown = likely sign of institutional selloff or panic exit.

---

📊 Strategic Summary:

> QTUM is at a pivotal crossroads.

The 1.70 – 2.10 USDT range is a decisive area.

A bullish breakout could spark a major recovery rally,

while a breakdown may lead to a deeper capitulation.

This is a “calm before the storm” situation. Traders should monitor closely as the next few weekly candles could define the trend for the rest of 2025.

#QTUMUSDT #QTUM #CryptoAnalysis #AltcoinSetup #TechnicalAnalysis #AccumulationPhase #SupportAndResistance #BreakoutPlay #CryptoBreakout

#QTUM/USDT#QTUM

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 2.25, acting as strong support from which the price can rebound.

Entry price: 2.30

First target: 2.35

Second target: 2.41

Third target: 2.47

QTUM is almost ready...NASDAQ:QTUM -@qtum

Qtum is a smart contract platform forked from Bitcoin Core and Ethereum.🔐

#QTUM rejected the $2 support level and round number.

For the bulls to take control in the medium term, a break above the inverse head and shoulders neckline marked in orange at $2.47 is needed.🚀

QTUM for a LONGQTUM looking good today on a pullback to FVG on the 4H chart at $3.00, maybe even to $2.95 , for a LONG. aVWAP's (Purple and White Lines) are at 3.60-3.68 but I would be looking for a take profit at ~4.23

Need to see volume and open interest at these levels though - sentiment is good for QTUM with hard fork success this week.

Important support and resistance zones: 2.950-3.403

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(1D chart)

The M-Signal indicators of 1D, 1W, and 1M charts are concentrated in the 2.950-3.403 section.

Accordingly, when the StochRSI indicator shows a downward trend in the overbought section, whether there is support near this section is an important issue.

-

(30m chart)

In order to change the trend, the MS-Signal indicator must rise above the price and maintain the price.

If the MS-Signal indicator rises above the price, the BW (100) indicator is formed at the 3.922 point and the HA-High indicator is formed at the 4.033 point, so the point to watch is whether this section can be broken upward.

When the StochRSI indicator enters the oversold zone and then rises, you should check for support near the 2.950-3.403 zone.

When you meet the HA-Low and BW(0) indicators, it is natural to enter a buy (LONG) position because there is a high possibility of an increase.

However, as I mentioned earlier, you should respond based on whether there is support near this area because you need to break through the MS-Signal indicator upward.

-

Rather than deciding how far it will fall or rise, it is important to consider which points are important support and resistance points and create a trading strategy based on whether there is support at those points.

Then, if you have traded according to the price movement, you can respond with a split transaction.

We are not analyzing charts, but trading to make profits, so you can respond appropriately and go with the flow.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, you can see that the upward trend is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, I expect that we will not see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------

Quantum Computing vs. TechIntroduction:

Technological advancements continue to reshape markets, with artificial intelligence (AI) dominating headlines in recent years. However, the next major frontier appears to be quantum computing. The ratio between the quantum computing sector NASDAQ:QTUM and technology AMEX:XLK provides a unique perspective on this emerging trend.

Analysis:

Key Breakout: The QTUM-to-XLK ratio has recently broken out of a rounding bottom formation, a classic bullish reversal pattern. This breakout signals growing investor enthusiasm and capital flow into quantum computing, suggesting it may be the next major growth story in tech.

Higher Highs and Higher Lows: The ratio is printing a series of higher-highs and higher-lows, confirming a bullish trend. As long as this structure remains intact, quantum computing warrants serious attention.

Healthy Consolidation: After the recent surge, a pause or slight pullback would be a healthy consolidation within the broader uptrend. Such moves often precede the next leg higher.

Implications for Investors:

The breakout highlights quantum computing's increasing importance and potential. This sector could mirror the early stages of AI adoption, suggesting substantial long-term growth opportunities for QTUM-related investments.

Trade Setup:

Bullish Scenario:

Entry: Look for pullbacks to support levels or a continuation of higher-highs for confirmation of trend strength.

Target: Watch for the ratio to continue trending upward, signaling outperformance of QTUM over XLK.

Stop Loss: Place stops below recent lows to manage risk in case of a deeper correction.

Bearish Scenario:

A breakdown below the trendline or failure to print higher-highs would signal potential weakness, warranting caution.

Conclusion:

Quantum computing is emerging as the market’s next big focus, with the QTUM-to-XLK ratio breakout suggesting robust momentum in the sector. While a pullback could offer better entry opportunities, the long-term growth story for quantum computing remains compelling. Are you ready for the quantum revolution? Let’s discuss in the comments below!

Charts:

(Include charts showing the QTUM-to-XLK ratio breakout, the rounding bottom formation, and key levels of support and resistance. Highlight the trendline and any recent consolidation zones.)

Tags: #QuantumComputing #Technology #QTUM #XLK #EmergingTrends #TechnicalAnalysis #GrowthInvesting

Is Quantum Computing the next Big Boom? QUBT, QBTS, QTUM, IONQQuantum Computing ( NASDAQ:QUBT ) rose 65% yesterday. QUBT is only around $11. Is this the start of a boom for quantum computing? Google came out with news of the Willow Quantum computing chip. Did this news swing the focus over to quantum computing? Will the big trade houses start to invest? We will see? Add QUBT to your watchlist along with GOOGL, QBTS, IONQ, QTUM. This could be the start of something big?

3 Altcoins Pumping Again Soon!Since you enjoyed my previous post about 3 Altcoins Rejecting the $5 mark!

Here's an interesting one about altcoins in a deep correction phase after an aggressive pump:

BINANCE:NEOUSDT

After a 200% surge, NEO is currently in a correction phase and rejecting the $15 demand zone.

As long as the $15 support holds, a expect a bullish continuation towards the $21 supply and then $25.5 previous major high.

BINANCE:TRXUSD

After a 180% surge, TRX is currently in a correction phase and rejecting the $0.25 mark.

As long as the $0.25 holds, a expect a bullish continuation towards the $0.33 supply and then $0.43 previous major high.

BINANCE:QTUMUSDT

After a 180% surge, QTUM is currently in a correction phase and rejecting the $3.5 demand zone.

As long as the $3.5 holds, a expect a bullish continuation towards the $4.8 supply and then $5.7 previous major high.

Which altcoins would you like me to cover next?

All Strategies Are Good; If Managed Properly!

~Rich

QTUMUSDT Approaches Rectangle Pattern ResistanceQTUMUSDT Technical analysis update

QTUMUSDT has been trading within a rectangle pattern for the last 150 days at the bottom yearly support. The price is now moving toward the rectangle resistance, and once a breakout occurs, a strong bullish move can be expected. The price is trading above the 100 and 200 EMAs, and there has been a noticeable rise in volume over the past few days.

Regards

Hexa