Roblox - Not the Same GameCorrection continues - fast and sharp, impulsive wave A .

On the uptrend chart, we see an extended 5th wave. During the correction, the move should ideally retrace a similar distance in the opposite direction - just like it did on the smaller wave.

Key targets:

First unfinished target: around 75

Then: 70 -> 63 -> 50

---

Please subscribe and leave a comment.

You’ll get new information faster than anyone else.

---

RBLX

Roblox - is it going to zero?Roblox Should Go to H — And Take Its Stock With It

I don’t want this company to go to zero.

I want it to go to -15 — just like the mental state it leaves in kids after an hour of toxic gameplay.

What was supposed to be a platform for creativity, coding, and collaboration has turned into one of the most psychologically damaging ecosystems for children online.

Let’s call it what it is:

A digital warzone masked as education.

• Games that reward scamming

• Mechanics built around stealing

• Rage cycles disguised as “fun”

• Social toxicity coded into gameplay loops

My own son went from calm to chaotic in minutes.

That’s not learning. That’s corruption.

Now look at the chart — it speaks louder than PR:

• Rejected at $131.82

• Dumped below $113.02

• Struggling under $100.13

• Major support: $53.40

And if justice ever catches up? This thing goes to -15 , morally and mentally.

The Lawsuits Are Real — And Growing:

1. Child Exploitation & Grooming Allegations:

Families have sued Roblox over claims their children were groomed on the platform.

The courts are allowing these cases to proceed — refusing to sweep them under arbitration.

That’s not noise. That’s systemic failure.

2. Robux Gambling & Financial Harm:

Class action suits are targeting Roblox’s in-game economy — alleging it enables gambling-like behavior in minors, with no protection or refund mechanisms.

3. Content Moderation Collapse:

Despite “kid-safe” branding, Roblox has allowed sexually explicit, violent, and manipulative content into its ecosystem — including games where stealing and trolling are core mechanics.

Parents aren’t just angry. They’re organizing.

Roblox isn’t just negligent.

It’s liable — morally and increasingly, legally.

Perspective Shift

We track risk on charts.

But what about emotional risk? Psychological risk? Developmental risk?

What’s the cost of a game that teaches kids to scam, steal, lie, rage, and lose?

If you're a trader AND a parent, this chart should make your blood boil.

Roblox had one job — to build a better future for our kids.

Instead, it weaponized their attention spans, monetized their trust, and left parents picking up the pieces.

One Love,

The FXPROFESSOR

Disclaimer: I’m OK with my son playing GTA, COD, etc etc!!! But this shit? NO!!!

RBLX Roblox Corporation Options Ahead of EarningsIf you haven`t bought RBLX before the rally:

Now analyzing the options chain and the chart patterns of RBLX Roblox Corporation prior to the earnings report this week,

I would consider purchasing the 130usd strike price Puts with

an expiration date of 2026-1-16,

for a premium of approximately $13.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Weekly Chart Review | Oct 6-10, 2025I wasn’t able to post my analysis on TradingView last week, so here’s a structured summary of my ticker reviews from Oct 6–10, segmented by sector with brief commentary. Each includes an update on trend structure and a link to both the original chart and the latest revision as of Friday’s close.

Technology

NASDAQ:AMD – Clean follow-through off mid-term support into the upper band of resistance. Strong rejection increases the odds that a mid-term top for the uptrend since April is being formed. Any lower-high formation next week should be approached with caution.

Chart:

Previously:

• Upside potential to resistance (Oct 7):

• Downside potential:

• On resistance & bounce potential (Aug 6):

• On macro resistance (Jul 29):

• On macro bottoming potential (Apr):

NASDAQ:NVTS – Followed the Aug–Sep setup and delivered a strong breakout Friday, but late-day reversal increases the odds of a longer consolidation into 7.80–6.80 support.

Chart:

Previously:

• Breakout and local support (Oct 10):

• Consolidation and upside potential (Sep 30):

• Higher-low potential (Sep 26):

• Mid-term support (Aug 25): www.tradingview.com

NASDAQ:MRVL – Reached the key mid-term resistance zone outlined earlier. Friday’s rejection increases odds of a pullback into 80–72 support over the coming weeks.

Chart:

Previously:

• On mid-term top (Oct 10):

• On resistance zone (Oct 2): www.tradingview.com

NASDAQ:WDC – Orderly follow-through to the downside into the 21 EMA.

Chart:

Previously: downside potential to 21 EMA –

NYSE:RBLX – Rejected at local resistance, aligning with the downside structure.

Chart:

Previously: downside potential (Oct 8):

NASDAQ:REKR – Shows strong relative strength with steady consolidation at support; constructive base-building continues.

Chart:

Previously: follow-through and support (Oct 7):

NYSE:AI – Friday breakout attempt faded back into support, increasing odds of prolonged base-building and a potential deeper pullback to 17–16.

Chart:

Previously:

On continuation potential (Oct 8):

NYSE:BB – Failed on immediate continuation and returned to support.

Chart:

Previously:

On continuation potential (Oct 8):

NASDAQ:OPEN – Constructive consolidation stalled as failed breakouts shifted odds toward a deeper pullback into mid-term support.

Chart:

⸻

Blockchain

NASDAQ:BITF – Tagged the ideal macro resistance zone; odds rise for at least a mid-term top/base formation here.

Chart:

Previously:

On upside continuation (Oct 7):

NASDAQ:HIVE – Rejection at the top of mid-term resistance; probabilities favor the start of a reversal phase.

Chart:

Previously:

On macro resistance (Oct 6):

On more immediate upside potential (Sep 24): www.tradingview.com

•On bullish potential (Sep 10): www.tradingview.com

• On bullish trend structure (Jul 21): www.tradingview.com

NYSE:BKKT – No follow-through on continuation setup, but key local support still holds; structure remains intact while above it.

Chart:

Previously:

On continuation (Oct 9):

NASDAQ:BULL – Rotating back toward macro support near 11; monitoring for higher-low formation and reversal trigger.

Chart:

Previously:

On reversal and macro support (Oct 8):

On immediate bullish potential (Sep 26): www.tradingview.com

• On macro support (Sep 19): www.tradingview.com

• On macro support (Sep 4): www.tradingview.com

• On mid-term resistance (Aug 6): www.tradingview.com

• On support and bounce potential (Jul 30): www.tradingview.com

NASDAQ:BTM – Bullish setup invalidated by breakdown into mid-term support.

Chart:

Previously:

On bullish follow-through if LOD holds (Oct 6):

⸻

Biotechnology / Healthcare

NASDAQ:VKTX – Strong follow-through from September update; watching for consolidation back into key EMAs to reset momentum.

Chart:

Previously:

On follow-through (Oct 6):

• On break-out potential (Sep 30): www.tradingview.com

• On resistance zone (Aug 11): www.tradingview.com

• On upside momentum continuation (Jul 18): www.tradingview.com

• Original setup (Jun 30): www.tradingview.com

• Follow-up (Jul 8): www.tradingview.com

NASDAQ:NTLA – Clean follow-through into mid-term resistance; rising odds for a topping/base formation.

Chart:

Previously:

On break-out to resistance zone (Oct 8):

On support and bullish trend-structure (Sep 26): www.tradingview.com

NASDAQ:PGEN – Couldn’t stage a recovery yet but remains within mid-term support; stabilization needed for a constructive setup.

Chart:

Previously:

On potential reversal (Oct 8):

On mid-term support (Sep 15): www.tradingview.com

NASDAQ:ABCL – Momentum attempt resumed but failed to follow-through; still constructive above 21 EMA.

Chart:

Previously:

On local support and continuation potential (Oct 8):

On support and bullish trend-structure (Oct 7):

⸻

Energy

AMEX:GTE – Impulsive advance at risk of morphing into a diagonal correction; elevated probability of retesting September higher lows.

Chart:

Previously:

On constructive looking consolidation (Oct 6):

⸻

Miscellaneous / Other

NASDAQ:SLDP – Rising risk of a local top after Friday’s distribution; while above 21 EMA, a final push into resistance remains possible.

Chart:

Previously:

On follow-through and resistance zone (Oct 6):

On mid-term support and bullish potential (Sep 19): www.tradingview.com

NASDAQ:DPRO – Solid 2.5-day follow-through from the Oct update; Friday’s action suggests increased consolidation or reversal risk.

Chart:

Previously:

On local support and continuation (Oct 7):

NASDAQ:DLO – Disappointing fade after a promising start; must hold above 50-DMA to reassert upside momentum.

Chart:

Previously:

On break-out potential (Oct 8):

On pullback potential (Sep 22): www.tradingview.com

• On downside potential and support (Sep 3): www.tradingview.com

Thank you for your attention and have a great start of the week!

ROBLOX RBLX 211% explosive predictionRoblox has been accumulated since 2022. It is ready to take off.

How long it will take to get to 211% gain? Who knows, end of the year or may be middle 25

This a swing trade idea, buy and forget for at least six months

I added some important levels if you want to take profits along the way

Sharing is caring.

GLGT

-roosgart

RBLX Targeting the Hights--$141 Target in SightHere’s your **RBLX swing trade** rewritten for **TradingView viral style** — fast to read, chart-ready, and built for engagement:

---

## 🎮 RBLX Swing Trade Setup (2025-08-09) 🎮

**Bias:** 📈 **Moderate Bullish w/ Caution** — momentum up across timeframes, but volume is weak.

**🎯 Trade Plan**

* **Ticker:** \ NYSE:RBLX

* **Type:** CALL (LONG)

* **Strike:** \$141.00

* **Entry:** \$1.04 (open)

* **Profit Target:** \$3.85 (+270%)

* **Stop Loss:** \$0.72 (-31%)

* **Expiry:** 2025-08-22 (2W)

* **Size:** 1 contract

* **Confidence:** 75%

**📊 Key Notes**

* RSI 56.9 → neutral, falling from highs

* Multi-timeframe momentum ✅

* Volume only 1.0x avg = weak conviction ❌

* Options sentiment neutral → no big institutional push yet

* VIX 15.88 = calm enough for swings

Insiders are selling Roblox ! Heres the levels you need to knowIn this video I lay out a solid plan for a move to the downside for Roblox after a 100% move to the upside since April of this year .

I demonstrate why I believe we will take a 30% retracement and provide confluent evidence to support this theory.

There are some fundamental reasons that I also did include alongside the technical analysis which is not my regular style but important given the context.

Tools used in the video 0.382 Fib , Standard Fib pull, Trend based fib and pivots .

RBLX WEEKLY TRADE IDEA – JULY 21, 2025

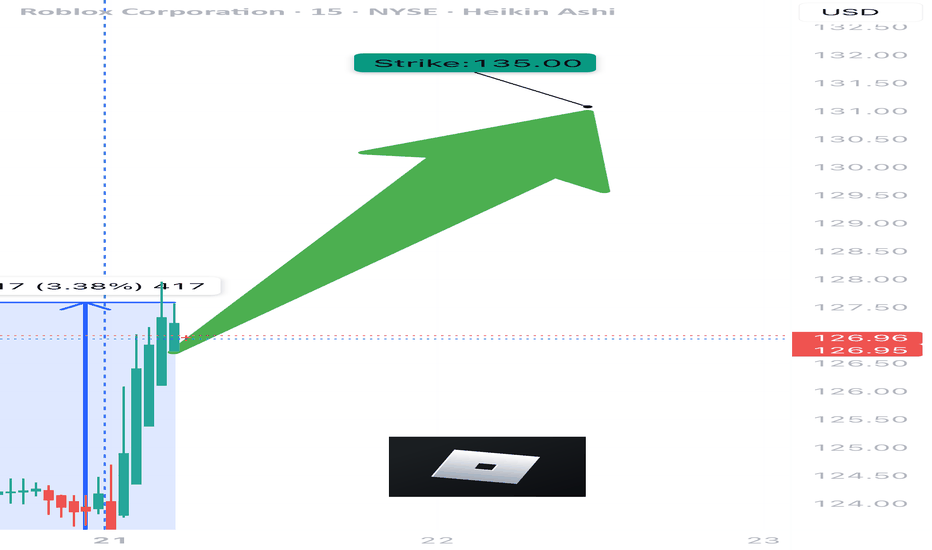

🎮 NYSE:RBLX WEEKLY TRADE IDEA – JULY 21, 2025 🎮

📈 RSI MAXED. Volume Pumped. Call Flow on 🔥

This is a full-send momentum setup.

⸻

📊 Trade Setup

🔸 Direction: Long Call

🎯 Strike: $135.00

📆 Expiry: July 25, 2025 (4DTE)

💰 Entry Price: $0.63

🎯 Profit Target: $1.25 (💯%)

🛑 Stop Loss: $0.30 (~50% risk)

📈 Confidence: 🔵 85%

🕰️ Entry Timing: Market Open Monday

📦 Size: 1 Contract (2–3% of account)

⸻

🧠 Why This Trade?

✅ Daily RSI: 84.9 / Weekly RSI: 89.5 → 🔥 Overdrive

✅ Volume = 1.5x last week → Institutional buildup

💥 Call/Put Ratio = 3.42 → Unusual bullish options flow

📉 VIX at 16.7 → Smooth gamma conditions for calls

🧩 5/5 Momentum Signals Confirmed across models

⸻

⚠️ Key Risks to Watch

• RSI = 🚨 Overbought → Monitor for fakeouts

• Exit by Thursday to dodge Friday decay trap

• Watch news headlines – unexpected events can swing this

• Be ready to scale profits early if $137–138 tested quickly

⸻

🛠️ Execution Strategy

🔹 No spreads. Naked call only for max gamma upside

🔹 Trail profit >30% if price spikes early

🔹 Keep stop hard at $0.30 to guard against fade

⸻

🏁 Final Word:

This is a textbook breakout + flow setup.

Let the call ride early-week momentum, but exit smart before theta kicks in.

NYSE:RBLX 135C — Risk $0.30 to Target $1.25 🚀

Don’t chase. Enter clean. Manage tight.

⸻

#RBLX #OptionsTrading #CallOption #WeeklyMomentum #BreakoutTrade #UnusualOptionsActivity #TradingViewIdeas #BullishFlow #InstitutionalOrderFlow #Roblox

#RBLX (Y25.P2.E1). strong chartHi traders,

This ranged for years and I missed the breakout. I'm monitoring this chart for a study case and using my methodology to see if its accurate to forecast key level targets.

If I do see an opportunity to enter a long, so be it but its not giving any at the moment.

Elliott wave suggests extended 5th wave due to wave 2-3 being short. We will monitor this on our forum for opportunities in the coming weeks.

Anyway, its one of the charts that hit my interest.

All the best,

S.SAri.

RBLX: Price Nearing Major Resistance ZonePrice is approaching a key level within the macro resistance zone (around 109). A mid-term correction may begin to unfold soon.

Key support zone to watch for continuation of the macro uptrend: 77–61.

Thank you for your attention and I wish you successful trading decisions!

When You Bought the Farm: PLTR, BRB, CALM, ROBLOX, ADMA, PLMRI am not in a market for super stocks in this environment at the moment. Also, I am looking beyond the trade war and into quality companies:

Fundamentals:

Warren Buffet says, "When you bought the farm, you looked at what the farm would produce".... "...the potential of the farm"..."You don't need a quote on it."

PLTR's May 14, 2024 Investment Update for April 21, 2025:

See the following chart. Fundamentals are still good:

(BellRing Brands, Inc.) BRBR - think protein bars and shakes: A recent investment:

Cal-Maine Foods (CALM): Speaking of farms and chicken eggs! Cal-Maine Foods is "the largest producer and distributor of fresh shell eggs in the United States, committed to offering our customers a wide range of quality egg and egg product choices produced in a safe, cost-effective and sustainable manner." (www.calmainefoods.com). It has good ROE and the quality of institutional investment has steadily grown legs into this company. It meets basic parameters of an investment.

ROBLOX (RBLX): I did my own personally survey and contacted several hundred of family and friends from the globe, and not only are Gen-Z playing ROBLOX, but even young adults are into it. It is true that with its immersive platform, "every day, millions of people come to Roblox to create, play, and connect with each other in experiences built by our global community of creators." Another company that I mentioned is Take-Two (TTWO) with Grand Theft Auto 6 coming out around August or September 2025 this year, I think it also will continue to surprise and do well. I shall invest in both; however, I like ROBLOX better.

I mentioned other companies in the video that are minor investments and the technical aspects of entry: Marex Group (MRX), Palomar Holdings (PLMR) and ADMA.

Did you add these stocks to your profile as I told you?RBLX did almost 100% and HMAX even more. BABA, GOTU, Xinyi and PYPL are still in the accumulation phase and ready to move hopefully this year.

Ethereum and Altcoins offered good entry two days ago. I will be targeting 15-20K for Ethereum.

Disclaimer: Do your own analysis. Not a financial advice

Roblox | Where Kids Thrive, Stocks Pump and Gamers High FiveRoblox Economics: Teaching 13 Year Olds How to Out Monetize Wall Street

RBLX surges 50% since our first signal so let’s explore its potential upside

From PlayStation to Paychecks: How Roblox Gamified the Economy

From hosting virtual concerts with millions of participants to offering user generated games rivaling major studios, Roblox has evolved into a cultural phenomenon nearly 20 years after its PC debut. It is reshaping the social gaming and entertainment landscape.

CEO Baszucki Says Roblox Saves Lives; Haters Say It Destroys Wallets!

Founder CEO David Baszucki shared:

“Our mission is to connect 1 billion people with optimism and civility. This resonates deeply with me, as several parents have told me their children’s lives were saved through connections made on Roblox”

Roblox was already a standout in last year’s Future 50 ranking for its unique value. Currently, over 3 million creators develop games and experiences using Roblox Studio, its proprietary development tool. The platform’s economy thrives on its in-game currency, Robux, rewarding creators based on user spending. For instance, Uplift Games, a Roblox-exclusive studio, supports a 60 person team.

Two core growth drivers

-Content loop:High quality content attracts users, who then inspire the creation of even more content.

- Social loop:Increased participation enhances the platform's appeal to new users.

Exploring Roblox’s Expanding Universe

-User Generated Content (UGC):Like YouTube, Roblox empowers creators of all skill levels to share their visions.

- A Growing Metaverse:Beyond gaming, it hosts virtual events and educational activities, positioning itself as a hub for social interaction.

-Broadening Demographics: Once dominated by young users, Roblox now attracts older audiences. In Q3 2024, users aged 13+ made up 60% of its user base, up from 57% the previous year.

Roblox by the Numbers

-Daily Active Users (DAUs):89 million, up 27% YoY, with strong growth in APAC (+37%) and a 59% rise in Japan.

-User Engagement:20.7 billion hours logged, growing 29% YoY.

-Q3 Bookings:$1.1 billion (+34% YoY), reflecting robust user spending.

-Regional Bookings:North America (62%) and Europe (19%) dominate.

The October 2023 PlayStation launch doubled Roblox’s console presence, boosting both users and bookings. To attract console studios, Roblox announced a 70% revenue share for items priced $49.99 or higher, aiming to encourage premium content.

Challenges and Opportunities

-Short Seller Allegations: In October, Hindenburg Research accused Roblox of inflating metrics and neglecting child safety, highlighting its ongoing unprofitability. Despite initial concerns, the claims lacked substantial evidence.

-Profitability Issues: Operating margins remain negative (-30%), with high infrastructure, safety, and AI costs. Expense management is critical for turning a profit.

- Advertising Growth: Partnerships with DoubleVerify and Shopify pave the way for in-platform ads and merchandise. With users averaging over two hours daily, this represents untapped potential.

-Virtual Economy Improvements: Enhanced discovery features increased payers by 30% to 19 million, with a 6% rise in bookings per DAU.

- Cash Flow Strength: Free cash flow hit a record $218 million (+266% YoY), driven by efficient cost management.

- Stock-Based Compensation (SBC): SBC equals 29% of revenue, diluting shares (~3% annually). While common in tech, this high level raises concerns for long-term investors.

Future Outlook

Roblox raised its FY bookings guidance to $4.36 billion (+24% YoY). Achieving sustainable growth while tackling profitability challenges, content moderation, and investor dilution will determine its long-term success. The company’s ability to navigate these issues will shape its legacy in gaming and beyond.

Roblox $RBLX Weekly Chart Break Out🚀 **Roblox ( NYSE:RBLX ) Weekly Chart Breakout!** 🚀

Roblox is making waves with a bullish breakout on the weekly chart. Eyes on volume and follow-through as momentum builds. Potential for upside acceleration if key resistance levels turn to support. 📈

#SPX500 AMEX:SPY NASDAQ:QQQ #BITCOIN #CRYPTO

A classic break and retest on RBLX! 🔉Sound on!🔉

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Roblox Corporation (RBLX) AnalysisCompany Overview:

Roblox Corporation NYSE:RBLX is a trailblazer in the gaming and metaverse sectors, offering a platform that enables users to create, share, and play immersive experiences. Its user-generated content model drives high engagement while keeping operational costs low, positioning the company for sustained growth in the evolving digital entertainment space.

Key Drivers of Growth:

Strategic Partnerships:

Roblox’s partnership with Monarch focuses on enhancing operational efficiency and customer satisfaction, key factors that can improve both user retention and financial performance.

User-Generated Content (UGC):

The platform thrives on UGC, ensuring a constant flow of new and engaging experiences while minimizing content development costs. This model not only drives long-term engagement but also fosters a community-centric ecosystem that scales naturally with user activity.

International Expansion:

Localization efforts and targeted marketing in international markets open new revenue streams. By tailoring the platform to diverse demographics, Roblox aims to capture significant market share in regions where gaming and metaverse adoption are on the rise.

Platform Monetization:

The introduction of enhanced monetization tools, including developer incentives and virtual item sales, contributes to revenue diversification and aligns platform success with creator growth.

Investment Outlook:

Bullish Stance: We are bullish on RBLX above $45.00-$46.00, supported by its innovative business model, expanding global footprint, and strong user engagement.

Upside Target: With the company’s strategic initiatives and robust growth prospects, we target $75.00-$77.00, reflecting the potential for significant gains as Roblox scales its metaverse ambitions.

📈 Roblox—Leading the Future of Immersive Entertainment! #Metaverse #GamingInnovation #UGC

RBLX - UniverseMetta - Analysis#RBLX - UniverseMetta - Analysis

Exit from a protracted sideways trend and consolidation beyond the upper boundary of the channel, which may indicate potential growth to levels of 105 per share. Also, on the monthly timeframe, you can see an exit from a triangular formation with the formation of a 3-wave structure. The nearest target is 60. Then you can consider the levels by targets. It will also be possible to increase purchases during correction and retest of the support level.

Target: 60 - 105

When Virtual Worlds Collide: The Price of Digital Illusions?In the ever-evolving landscape of digital entertainment, a storm is brewing that challenges our perceptions of virtual reality and corporate responsibility. Roblox, a titan in the gaming industry, finds itself at the epicenter of a controversy that transcends mere numbers and pixels. As allegations of inflated user data and compromised child safety measures emerge, we are compelled to question the very foundations upon which our digital utopias are built.

This saga serves as a stark reminder of the delicate balance between innovation and integrity in the tech world. It challenges us to look beyond the dazzling facades of virtual playgrounds and confront the sobering realities that may lurk beneath. As investors, parents, and digital citizens, we are called to critically examine the metrics and safeguards that shape our online experiences and those of our children.

The Roblox controversy is not just a cautionary tale; it's a catalyst for a broader dialogue about the future of digital platforms and their impact on society. It prompts us to envision a world where transparency and user safety are not just buzzwords but the cornerstones of technological progress. As we stand at this crossroads, the choices we make and the standards we uphold will determine whether our digital futures will be defined by illusion or authenticity, by profit or protection.

In this pivotal moment, we are all stakeholders in the outcome. The questions raised by this controversy challenge us to become more discerning consumers, more vigilant guardians, and more engaged participants in shaping the digital landscapes we inhabit. As we ponder the true cost of our virtual indulgences, we must ask ourselves: Are we ready to demand more from the architects of our digital worlds, and in doing so, forge a path towards a more transparent and secure online future for all?