Predictions and analysis

If you haven`t bought RBLX before the previous earnings: Then analyzing the options chain and the chart patterns of RBLX Roblox Corporation prior to the earnings report this week, I would consider purchasing the 40usd strike price Calls with an expiration date of 2024-7-19, for a premium of approximately $3.60. If these options prove to be profitable prior to...

🔉Sound on!🔉 Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

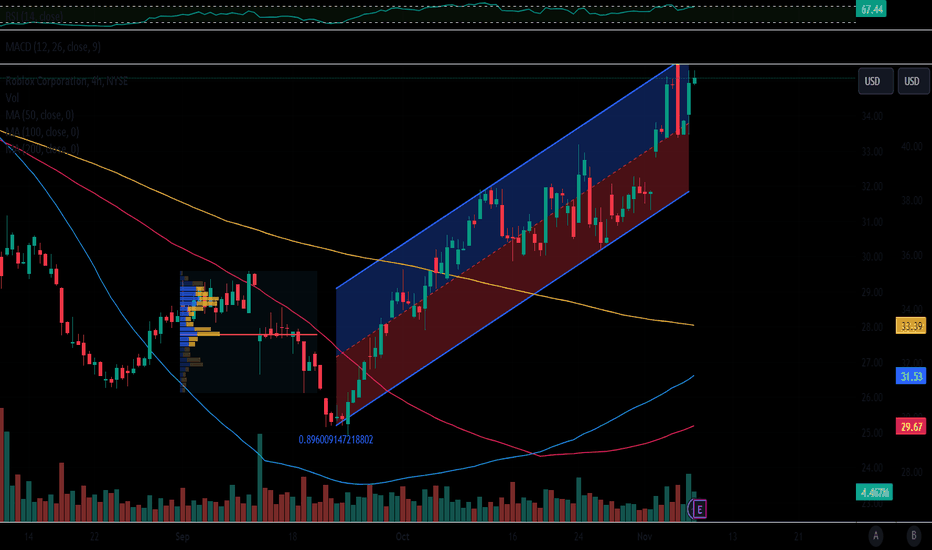

NYSE:RBLX Roblox Bearish to Bullish Reversal Trend Line Break. The technical analysis for Roblox indicates a transition from a bearish to a bullish trend, marked by a breakout above a key trend line. This reversal suggests a shift in market sentiment from negative to positive, potentially signaling further upward movement in the stock's price.

A World of Endless Possibilities Roblox ( NYSE:RBLX ) isn't just a game; it's a universe where users become creators, architects of their own virtual realms. With its user-generated content model, Roblox ( NYSE:RBLX ) empowers millions to build, share, and explore immersive experiences. From bustling metropolises to fantastical realms, Roblox ( NYSE:RBLX ) fosters...

Thank you as always for watching my video. I hope you learned something very educational. Remember! Trading is very risky. Only risk what you are willing to lose.

Not quite 1%. BUT $45 is a STRONG roadblock. RBLX HAS BEEN trading sideways for a while. The longer it chops around, the better for this covered call. If I get called away at $50 - I will be profitable on this position.

I have some shares in my son Gabe's long term account. I am NOT scared if we sell them for a gain at $53 Buy low, sell high. If your kid plays RBLX, get some money back....

If you haven`t bought the dip on RBLX before the previous earnings: Then analyzing the options chain and the chart patterns of RBLX Roblox Corporation prior to the earnings report this week, I would consider purchasing the $42.5usd strike price Calls with an expiration date of 2024-3-15, for a premium of approximately $2.79. If these options prove to be...

See text on daily chart. TLDR; gap up on ER to top end of a huge stage 1 base. May need some time, but if it goes, it has potential to go far & go quickly.

Roblox ( NYSE:RBLX ), the youth-centric gaming platform, has sent shockwaves through the market with its latest earnings report, surpassing analyst expectations and painting a promising picture for its future. With a surge in daily active users and robust revenue growth, Roblox ( NYSE:RBLX ) is not just a gaming platform anymore; it's a glimpse into the burgeoning...

is it going up, Are any comment folks do you guys think it will break 45 and go more up to 60

RBLX is looking really good after bouncing off the 200 EMA, holding above the 50 and 20 EMAs and now working on a double inside candle day. MACD about to flip bullish as well. If the market doesn't totally collapse this looks like an A+ setup to me. Targets $44 and then $48 breaking that resistance.

Analyzing the options chain and the chart patterns of RBLX Roblox Corporation prior to the earnings report this week, I would consider purchasing the 35usd strike price Calls with an expiration date of 2024-1-19, for a premium of approximately $4.20. If these options prove to be profitable prior to the earnings release, I would sell at least half of them. Looking...

Roblox is seeing favorable earnings estimate revision activity as of late, which is generally a precursor to an earnings beat. After all, analysts raising estimates right before earnings — with the most up-to-date information possible — is a pretty good indicator of some favorable trends underneath the surface for RBLX in the report. Price Momentum RBLX is...

As you can see here on the 15-minute chart we are in a channel. I drew this channel on the hourly time frame. We have recently formed a double bottom on the daily chart and we had a massive green day today. I am looking for a breakout and retest on the resistance-turned-support bounce with high-volume calls. As always thank you for reading my analysis.

Roblox has seen a move higher with gaming-related stocks this week on the heels of creating an inverted head and shoulders pattern. Price is trending above all MAs(8,21,34,50,100,200) wiht the short MAs rising and crossing above the long MAs indicating a short-term bullish trend. The PPO indicator shows the green PPO line rising and above a rising purple...

There is money up there? Wow. $12 higher than the stock price? GEEZE. Now granted it is over earnings, but I believe RBLX is one you could begin to leg into, own some shares of (because your kid is playing RBLX *right now* and eventually sell for higher than it is presently.

bullish engulfing bounce off .382 fib which was retrace bounce off .618 fib which was retest of pennant breakout, which ripped through 8/21 EMA and 50 SMA on exploding volume. stop loss should be daily close at the fib at $39.