Rigetti's $600 Million Cash RunwayAs Rigetti Computing (RGTI) advances into 2026, it does so armed with one of the most robust balance sheets in the pure-play quantum computing sector. This financial strength serves as a key differentiator, setting the company apart from many peers that remain heavily reliant on frequent and often dilutive capital raises to fund their operations. With liquidity now surpassing the $600 million mark—bolstered by a series of warrant exercises completed during the second half of 2025—Rigetti has secured multi-year financial visibility. This substantial war chest significantly reduces the near-term risk of shareholder dilution and provides the company with the flexibility to pursue its ambitious technological roadmap without being forced to compromise on timelines simply to preserve cash. Financial Flexibility Fuels Roadmap Ambitions

Management has consistently reiterated that its current capital resources are more than sufficient to fund the development and launch of its planned next-generation quantum systems.

This next phase of innovation is expected to unfold as the company's commercialization efforts continue to gain traction and extend throughout 2026.

This financial flexibility is particularly critical given the inherently uneven and project-based nature of Rigetti's revenue profile. The company's income remains largely tied to contracts with government agencies, national laboratories, and academic research institutions. While recent momentum in securing new contracts—including expanded international engagements and growing demand for on-premise quantum systems—reinforces Rigetti's long-term relevance in the quantum ecosystem, it does little to smooth out the quarterly volatility that characterizes the sector. The sales cycles are long, deployments can be delayed, and revenue recognition is often lumpy.

Against this backdrop, the company's substantial liquidity acts as a strategic buffer. It allows Rigetti to absorb potential headwinds such as delayed government deployments, necessary recalibrations of its product roadmap, or the increased costs associated with customer-specific customization—all without being forced to seek external financing on unfavorable terms. In an industry where technological execution timelines are notoriously prone to slippage, a strong balance sheet has evolved from a mere footnote in investor presentations into a genuine competitive asset.

Taken together, Rigetti's 2026 setup suggests the company is financially equipped to sustain a high intensity of research and development spending, support the scaling of its manufacturing capabilities, and weather the inherent lumpiness of its revenue streams, all without needing to tap the public markets for additional capital in the near term.

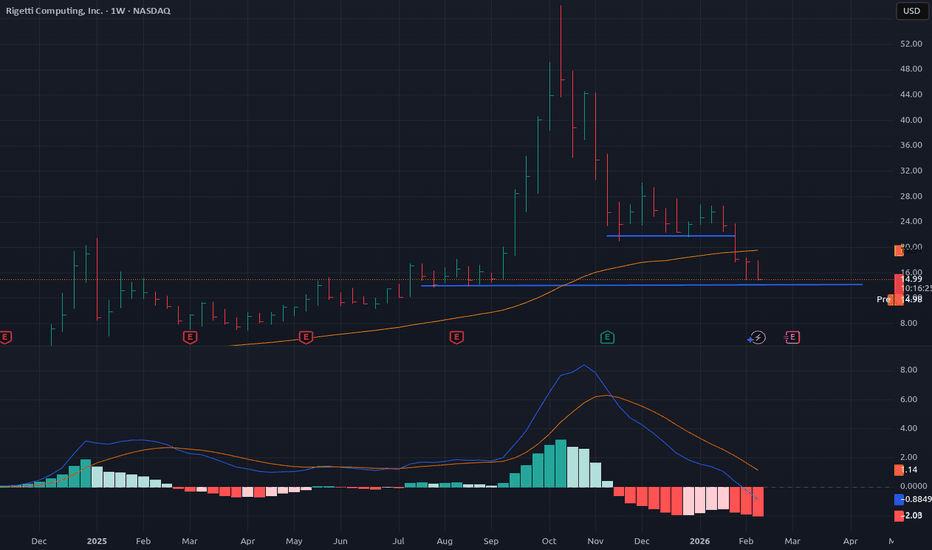

Stock Performance, Valuation, and Key Support Levels

Despite the positive narrative surrounding its financial health and technological prospects, Rigetti's stock has faced significant headwinds in recent months. Shares of RGTI have declined by 16.6% over the last six-month period. This performance, while challenging, actually compares slightly favorably to the broader industry group, which has seen an average decline of 20.3% over the same timeframe.

From a valuation perspective, Rigetti currently trades at a price-to-book (P/B) multiple of 13.31. This figure sits above the industry average, indicating that the market is still assigning a premium to its assets, likely due to its perceived leadership position and improved financial footing. However, according to standard investment metrics, RGTI carries a Value Score of F, suggesting that on traditional valuation measures, the stock may appear expensive relative to its fundamentals.

For traders and investors monitoring technical levels, the stock has established a notable support zone between $10.00 and $13.00. This range is being closely watched as a potential area where buying interest could emerge to stabilize the price and potentially reverse some of the recent downward momentum.

RGTI

RGTI CRACK!RGTI is up 3,240% in a bit over a year, with A complete wave 3 up with a hook, Rising F flag that CRACKED, with a broken H&S within it, followed by a low base consolidation flagging out.

RGTI has already lost about -57% of its total value. Don't be surprised if it loses another 50% from here given the run it has had. (And no, I am not doing Trump math. hahah!)

THANK YOU for getting me to 5,000 followers! 🙏🔥

Let’s keep climbing.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

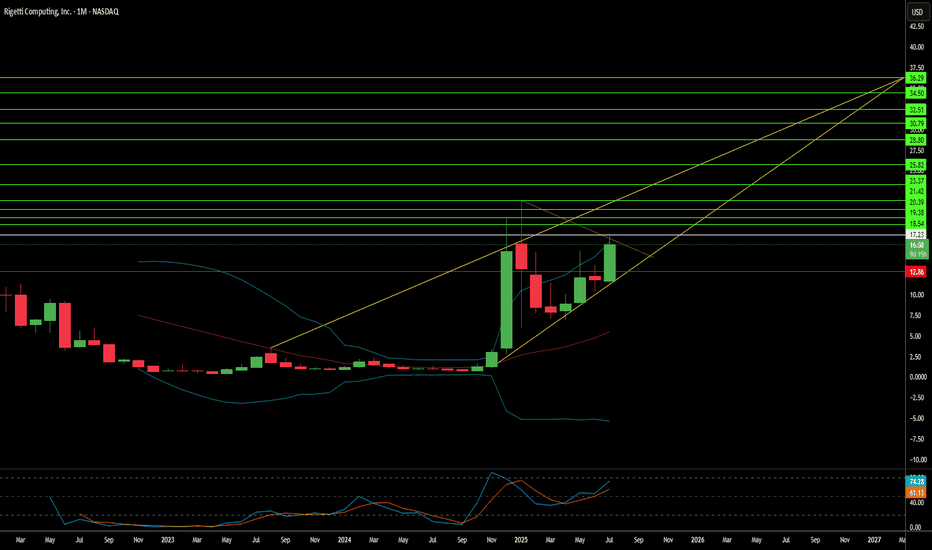

RGTI: The Bullish Dragon Awakens for 2026

The Bull Case:

Technical Setup: The Dragon Pattern We are witnessing a textbook Bullish Dragon formation on the Rigetti chart, signaling a major trend reversal.

The Head: Formed at the previous swing high before the initial decline.

The Feet: We have two distinct lows—the "Left Foot" followed by a higher "Right Foot." This higher low indicates that selling pressure is exhausted and buyers are stepping in earlier than before.

The Hump: The mid-pattern peak that provides our primary resistance level.

The Trigger (Tail): A breakout above the trendline connecting the "Head" and the "Hump" confirms the pattern. With the stock recently showing resilience around the $23.60–$25.00 level, a move above the hump will confirm the "Tail" extension toward targets at $35.00 and $50.00.

Fundamental Bull Case:

2026 Technology Roadmap: Rigetti is on track to deploy its 150+ qubit system by late 2026, targeting a 99.7% median two-qubit gate fidelity. This is a critical step toward their 1,000+ qubit goal in 2027.

Strong Liquidity: As of late 2025, Rigetti fortified its balance sheet with roughly $600 million in cash and equivalents, providing a substantial runway for R&D without the immediate need for dilutive financing.

Strategic Partnerships: Recent support for NVIDIA’s NVQLink platform positions Rigetti at the intersection of AI supercomputing and quantum processing, a high-growth hybrid niche for 2026.

Commercial Momentum: The company secured $5.7 million in purchase orders for its Novera systems in late 2025, with deliveries scheduled for the first half of 2026, marking a shift from pure research to commercial hardware sales.

The Verdict: The confluence of a confirmed "Dragon" reversal pattern and a well-funded 2026 roadmap makes RGTI a high-conviction play for the next phase of the quantum revolution.

RGTI forecast, utilizing volatility ETFsLooking for RGTI to retest lows again imminently before pushing to 32.6$ level into late q1 2026.

RGTZ expected to have a decent 25% move off these lows to 19+ range as RGTI pulls back. Then switching to hold RGTU for the buy wave on RGTI to 32-33$ gap fill target, as RGTZ slides back to 12.85-13.1 discount range.

Time-wave cycles analysis indicates we will have another strong sell wave for RGTI back to 19-20$ zone once gap at 32-33$ is filled, so plan is to on ride RGTZ again from 12.85-13.1 entry zone to 26$ target sometime in q2 2026.

still lots of froth in the quantum space imo so this type of range bound action seems likely to me

Quantum Leap: $QTUM Continuation Pattern has triggered.The Defiance Quantum ETF (QTUM) is showing a classic bullish continuation pattern after a spectacular 2025. Following a sharp rally, the price has been consolidating in a tight range near its 52-week high of $117.12.

The Technical Setup: We are seeing a clear consolidation phase—likely a cup and handle / or continuation inverse head and shoulders Both have the same price objective—just above the 50-day moving average ($114.36).

This 'pause' in the trend is healthy and suggests that the previous uptrend is ready to resume.

FUNDAMENTAL DRIVER:

2026 is being labeled a potential 'inflection year' for the industry.

IBM is targeting quantum advantage by the end of this year with its 120-qubit Nighthawk processor, while IonQ aims for systems up to 256 qubits.

Diversified Exposure: Unlike betting on a single stock, QTUM holds 84 different companies, spreading risk across hardware, software, and machine learning leaders like Microsoft, Alphabet, and NVIDIA.

Massive Market Growth: Analysts estimate the quantum computing market could grow from $0.8 billion in 2025 to over $1 billion in 2026, with some projections suggesting a nearly $2 trillion value creation potential by 2035.

Sustained Inflows: The ETF has seen net AUM growth of over $2.39 billion in the last year, proving that institutional capital is rotating heavily into this sector.

What's your take? Is the quantum sector ready for another parabolic move?

Understanding Rigetti ComputingRigetti Computing is a high-tech company that builds Quantum Computers. While normal computers (like your phone or laptop) use "bits" (0s and 1s), quantum computers use "qubits." This allows them to solve mathematical problems that are too complex for even the world's fastest supercomputers.

In 2025, Rigetti’s stock price became a "hot topic" because it grew by thousands of percentage points. However, as a new trader, it is important to understand why the price moved and why many experts are now careful.

Why the Stock Rose: The "Quantum Hype"

Several factors pushed Rigetti’s stock higher during the AI boom:

* Technology & Innovation: Rigetti is "vertically integrated." This means they make their own chips and their own software. This is a very professional and efficient way to build a company.

* Geopolitics: The United States government wants to win the "Quantum Race" against other countries. Because of this, companies like Rigetti often receive government support and contracts.

* Industry Trends: As Artificial Intelligence (AI) grows, it needs more power. Quantum computing is seen as the next step to make AI even smarter.

The Risk: Is the Price Too High?

When a stock grows too fast without having enough sales (revenue), traders call it " overbought." Here is the current situation for Rigetti:

* The Valuation Gap: Rigetti’s "Price-to-Sales" ratio is very high. This means the stock price is much higher than the actual money the company is making.

* High Cash Burn: Building quantum computers is very expensive. The company spends a lot of money on science and research, but does not yet have many paying customers.

* Market History: Professional traders remember the "Dot-Com" bubble of the year 2000. Back then, many internet stocks rose quickly and then crashed by 90%. Some experts fear Rigetti might follow a similar path.

Market Impact and 2026 Prediction

If you are trading this stock, you should expect high volatility. This means the price can go up or down 10% or 20% in a single day.

What to expect by the end of 2026:

Many analysts believe the "hype" will slow down and the price will return to a more realistic level. Predictions suggest the stock could settle between $3 and $7 by the end of 2026. This would be a "correction," where the market moves from trading on "dreams" to trading on "real financial results."

RGTI Rigetti Computing Options Ahead of EarningsIf you haven`t bought RGTI before the rally:

Now analyzing the options chain and the chart patterns of RGTI Rigetti Computing prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2027-1-15,

for a premium of approximately $6.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RGTI : First Long Position AreaNASDAQ listed Rigetti Computing Inc. stock is currently trading above the 50 and 200 period moving averages.

Once it gained momentum, it later lost it but its outlook is not weak at the moment.

Right now, if the Iran-Israel war uncertainty is overcome and if there is no bad news affecting the index, the gap may close.

Risk/Reward ratio of 3.00 is a very valuable ratio to try with small position amounts.

Risk/Reward Ratio : 3.00

Stop-Loss : 9.91

Take-Profit : 18.2

Regards.

$RGTI - Rigetti Corp - $36 Short PTNASDAQ:RGTI is showing loss of momentum and we're currently leveraging RGTZ to hold into this consolidation back to the $34-$36 Price Levels if it continues to consolidate and retest the $42.30. It's rejected $48.06 consistently and is continue to follow these downward targets.

Rigetti Stock (RGTI) May Retraced After Breaking Out of A Wedge The share price of Rigetti Computing, Inc. (NASDAQ: NASDAQ:RGTI ) is poised to retraced to the 61.8% fib. retracement level after a wonderful stint- The computing giant spike 218% in the past 1 month to break out of a bullish symmetrical triangle to reclaim the $50 zone.

With the last recorded SI at 55, NASDAQ:RGTI might consolidate more pushing the RSI to 35 amidst bearish sentiment.

The stock was down 14% in yesterday's trading session further pushing the loss to premarket trading currently down 1.48%.

Further adding to the bearish sentiment is the fact that the founder- Subodh Kulkarni, has no stake whatsoever in the quantum technology company.

In May, Kulkarni exercised options to acquire 1,000,000 shares, only to sell them immediately – leaving him with zero ownership in RGTI.

About RGTI

Rigetti Computing, Inc., through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally. The company offers quantum processing units (QPUs) and quantum computing systems through the cloud in the form of quantum computing as a service (QCaaS) products. It also provides 9- ubit quantum processing unit under the Novera QPU trade name; 84-qubit Ankaa-3 system under the name Novera QPU; and sells access to its quantum computers

$RGTI - Rigetti Computing - $43 PT?NASDAQ:RGTI has been on a run, pushing from $0.72 to $21.42 going into 2025, consolidating and pushing into this continuation over the course of the remaining, breaking above that $21.42 Level of Resistance, now identifying resistance $34.40, where we will be looking for new strong support above those levels before pushing on to the $43 PT.

Rigetti broke ATH to $21.88Rigetti broke previous ATH to $21.88

Rigetti Computing Incorporated had a positive push up of 10% today, and that pushed the stock to an all-time high of $21.88. It broke its previous high of $21.50 to reach this all-time high.

If you look at the chart, you'll see a blue ascending trend line and a horizontal green line, with a confluence around the $21.54 zone.

So, looking at this stock, if this breakout of this zone is sustainable, we might see it push further upward. However, this zone is critical, and the sustainability of this push depends on it staying above this level. If it falls below, we might see it retest the $20 zone.

For me, I'll remain patient to see a clear price action for the direction I'll follow. Remain positive, and let's see how this plays out. Thanks!

Rigetti: Quantum Mirage or Computing's Next Frontier?Rigetti Computing, a pioneer in quantum computing, recently commanded market attention with a significant 41% surge in its stock. This jump followed a critical technological breakthrough: achieving 99.5% median 2-qubit gate fidelity on its modular 36-qubit system. This represents a twofold reduction in error rates from previous benchmarks, a vital step toward practical quantum applications. Rigetti's superconducting qubits offer gate speeds over 1,000 times faster than competing modalities like ion traps, leveraging semiconductor industry techniques for scalability. The company plans to launch its 36-qubit system by mid-2025 and aims for a 100+ qubit system by year-end, underscoring its rapid technological roadmap.

Beyond technical achievements, strategic partnerships and government contracts bolster Rigetti's position. A substantial $100 million manufacturing deal and a $35 million equity investment from server giant Quanta validate Rigetti's modular architecture. Government backing also provides a stable revenue stream, including a $1 million DARPA award for developing "utility-scale quantum computing" and a $5.48 million Air Force consortium award for advanced chip fabrication. The company further secured three UK Innovate awards for quantum error correction. These collaborations signal confidence from both private industry and national defense initiatives, crucial for a sector still in its nascent stages of commercialization.

Despite these positives, Rigetti's financial metrics reflect the high-risk, high-reward nature of quantum investment. While its market capitalization stands at a robust $5.5 billion, Q1 2025 revenue declined over 50% year-over-year to $1.5 million. Operating expenses remain substantial, with the company operating at a loss. Rigetti's valuation hinges on future potential rather than current profitability, trading at a high price-to-sales ratio. This places immense pressure on the company to meet ambitious technological milestones and rapidly scale revenue in the coming years, transforming speculative bets into tangible commercial success.

The broader quantum computing landscape is marked by intense competition and geopolitical implications. Giants like IBM and Google, also leveraging superconducting qubits, race alongside Rigetti. The sector's projected market size varies wildly, reflecting ongoing uncertainty about widespread commercial adoption. From a geostrategic perspective, quantum computing poses both a national security threat to current encryption and an opportunity for military advancement, driving a global race in post-quantum cryptography. Rigetti's extensive patent portfolio, comprising 37 quantum computing patents, underscores its intellectual property differentiation. However, macroeconomic factors, including rising interest rates, could tighten venture capital funding for speculative high-tech ventures, adding another layer of complexity to Rigetti's path forward.

RGTI Heading to $17+ Good evening trading family

So currently due to price action it appears we are on our way to 17 dollar target however we expect a little bit of a correction at the 15 range.

However worst scenario if we go below 11 dollars be prepared for a sinker down to 8.

Trade Smarter Live Better

Kris/ Mindbloome Exchange

Rigetti's Quantum Leap: Can RGTI Ride the Hype to $100?Rigetti Computing Inc. (RGTI) is a notable company in the quantum computing space, focused on developing superconducting qubit systems. As of late May 2025, the stock is trading around $14.19, marking a sharp rise from its earlier levels this year.

The stock has rallied more than 1,200% over the past six months, pushing RGTI toward the upper boundary of its current ascending channel. The $15.00–$15.50 range is acting as a psychological resistance area. After such a strong move, a technical pullback toward the $12.50 zone would be considered healthy, potentially allowing the stock to reset while remaining within its bullish structure. If $12.50 fails to hold, the next notable support sits near $7.59, a previous area of accumulation.

Rigetti’s growth outlook is supported by several key drivers:

Technological Innovation: The company is on track to roll out more advanced quantum systems, including a 36-qubit system by mid-2025 and a 100+ qubit system by year-end. These advances are built on its modular chip architecture, aimed at scaling performance.

Strategic Collaborations: Rigetti has been expanding its reach by partnering with leading cloud platforms, making its quantum systems more widely accessible and integrated with broader tech ecosystems.

Government Support: The company is also involved in government-backed quantum initiatives, strengthening its credibility and positioning in the national quantum strategy.

As the global quantum computing market continues to gain momentum, Rigetti is well-positioned to benefit. If the bullish trend persists, some forecasts suggest the stock could potentially reach the $100 level by the end of 2026.

Traders and investors should watch key levels: $12.50 and $7.59 on the downside as support, and $15.50 as the immediate resistance to confirm momentum or identify pullback opportunities.

Rigetti Computing (RGTI): Potential Buying OpportunityRigetti fails to hold the $9.80 support, it could continue its decline toward the $5.50 zone.

Till then we can see:

Rigetti Computing (RGTI) is at a pivotal moment, currently trading around $8.90 after a 56% drop from its $16 peak to a recent low of $7. The stock failed to hold the critical $9.80 support level, raising concerns about further downside pressure. However, this decline also presents a short-term buying opportunity before the next major move.

Short-Term Buying Scenario

If buying momentum picks up from $8.90, we could see a rebound toward $12–$13.

This level is a key resistance zone, and failing to break above $13 will confirm that the downtrend remains intact.

Bearish Breakdown Possibility

If RGTI struggles to hold $9.80 and fails to sustain the $12–$13 recovery, it would signal continued weakness.

This could trigger a further drop toward $5.50, and in a worst-case scenario, it could even reach $5.

Key Levels to Watch

$9.80 Support (Broken) → Previously a strong support, now acting as resistance.

$12–$13 Resistance → If RGTI fails here, it confirms further downside potential.

$5.50–$5.00 Support Zone → The next major target if bearish momentum continues.

Conclusion: Decision Point for RGTI

Rigetti Computing is at a critical turning point. A rebound from $8.90 toward $12–$13 is possible, but failure to break above this range will likely confirm the bearish trendline. If that happens, we could see another major drop to $5.50 or even $5. Investors should watch how the stock behaves around $12–$13, as this will determine the next big move.

Can RGTI go for a new ATH?The stock reclaimed the IPO VWAP (purple line) every time sellers tried to press the stock, signaling strong buyer interest and establishing a new base. The ATH VWAP (black line) remains overhead, but immediate resistance is now at $11.95.

A clean break above $12 could ignite a momentum squeeze, with minor resistance at $12.97 before a potential run toward $15. The stock’s resilience above IPO VWAP suggests bullish control; watch for volume confirmation on a move through $12.

A Stop Loss level is set at $10.33.

With the NVDA event, the news can quickly become highly volatile, so it’s advisable to trade with caution.

What Lies Beneath Rigetti’s Quantum Ambitions?Rigetti Computing, Inc. stands at the forefront of quantum innovation, chasing a future where computational power reshapes industries. Yet, allegations of securities fraud have cast a formidable shadow over its aspirations. The Rosen Law Firm’s investigation, sparked by claims that Rigetti may have misled investors with overstated progress or understated risks, intensified after a 45% stock drop on January 8, 2025—triggered by Nvidia CEO Jensen Huang’s assertion that practical quantum computers remain 20 years distant. This collision of legal scrutiny and market shock prompts a tantalizing question: can a company’s bold vision endure when its foundation is questioned?

The securities fraud allegations strike at the heart of Rigetti’s credibility. As the company advances its cloud-based quantum platform and scalable processors, the probe—echoed by The Schall Law Firm—examines whether its disclosures painted an overly rosy picture, potentially luring investors into a speculative abyss. Huang’s sobering timeline only amplifies the stakes, exposing the fragility of trust in a field where breakthroughs are elusive. What does it mean for a pioneer to navigate such treacherous waters, where technical promise meets the demand for transparency? This riddle challenges us to dissect the interplay of innovation and integrity.

For Rigetti’s investors, the unfolding drama is both a cautionary tale and a call to action. With millions of shares and warrants poised for market entry amid a $0.515 stock price, the allegations fuel uncertainty and ignite curiosity about resilience in crisis. Could this investigation, if resolved favorably, strengthen Rigetti’s resolve and refine its path? Or will it unravel a quantum dream deferred? As the company balances cutting-edge pursuit with legal reckoning, the enigma deepens, urging readers to ponder the price of progress and the courage required to sustain it against all odds.

Rigetti Computing to breakout soonRigetti Computing Inc NASDAQ:RGTI – Breakout Trade Setup 💪🔥🚀

Entry: Above $12.50 for confirmation

Stop Loss: $10.50 to manage risk

Target: $31.63 based on measured move projection

Risk-Reward Ratio: High potential reward compared to risk

Why This Trade? 📚💡

The stock has been consolidating under a descending trendline and is attempting a breakout. High volume suggests strong buying interest. The measured move target shows significant upside potential.

Risk Management ☔

Use a tight stop below $10.50 in case of a false breakout. Consider scaling out profits near $20 to lock in gains before reaching the full target. Monitor price action for confirmation.

Final Thoughts ✅

RGTI presents a strong breakout opportunity with high growth potential. Watch for sustained momentum before entering the trade.

Rigetti Computing Inc. (RGTI) Long SetupRigetti Computing Inc. (RGTI) price appears to be completing ABC correction in the 15min chart, possibly completed wave (2) of an impulse wave structure and is set for a potential bullish continuation into wave (3).

Setup:

RGTI is completing wave (2) correction and is poised to enter wave (3), targeting higher levels.

Strategy:

Enter at current levels or wait for confirmation of bullish momentum breaking above $11.79.

Trade Plan:

Entry: $10.46, or confirmation entry $11.79

Stop Loss: $9.70

Take Profit: $18.26

Position Size: Adjust to limit risk to 1-2% of account equity.

Risk-Reward Ratio:

Entry at $10.26 with a stop at $9.70 and target at $18.26 offers an RRR of approximately 1:10.

Confirmation Entry RRR is ~1:3

Confirmation:

Monitor for bullish candlestick patterns or a breakout above the $11.70 level to confirm the start of wave (3).

Disclaimer:

This analysis is for educational purposes only. Trading financial markets involves risk, and you should not trade with money you cannot afford to lose. Past performance is not indicative of future results. Consult a licensed financial advisor before making any trading decisions.

Trade Advice:

Stick to your risk management rules and avoid overleveraging.

If the price breaks below $9.70, then the trade is not valid for confirmation entry.

Use alerts to monitor key levels ($11.7 for confirmation and $9.70 for the stop loss).