XRP Jumps 7% After Surge in Network Activity & Whale BuyingXRP, the digital asset associated with Ripple Labs, has recently experienced a notable price surge, climbing approximately 7% amidst a flurry of on-chain activity and substantial whale accumulation.1 This resurgence has reignited discussions within the crypto community regarding XRP's potential for further growth, particularly in light of a significant uptick in active addresses and evolving regulatory landscapes.

The recent price movement follows a period of relatively stagnant performance, prompting analysts to scrutinize the underlying factors driving the renewed interest in XRP. A key catalyst appears to be the dramatic increase in network activity, with active addresses reaching their highest level since April 2023.2 This surge in transactional volume suggests a heightened level of engagement and utility within the XRP ecosystem, potentially indicating growing adoption and demand.

Furthermore, reports of significant whale accumulation have fueled speculation that large-scale investors are positioning themselves for a potential price rally. These whales, often possessing substantial market influence, are known for their ability to trigger price movements through strategic buying and selling activities.3 Their recent accumulation of XRP suggests a strong conviction in the asset's future prospects.4

The combination of increased network activity and whale buying has created a bullish sentiment among many XRP holders. However, the question remains: will this surge in activity translate into sustained price appreciation? While the current momentum appears promising, several factors could influence XRP's trajectory in the coming weeks and months.

One of the most significant factors influencing XRP's price is the ongoing regulatory landscape, particularly concerning the Securities and Exchange Commission (SEC) lawsuit against Ripple Labs.5 While a partial victory was achieved in the summer of 2023, the SEC's case is not fully resolved. The ongoing legal battle has cast a shadow over XRP's price for several years, creating uncertainty and hindering its potential for wider adoption.

Recently, analysts have begun speculating that the SEC may ultimately drop its four-year lawsuit against Ripple Labs, citing the potential for a more crypto-friendly regulatory environment under a potential Trump administration. This perspective suggests that the market may have already "priced in" the expectation of a favorable resolution, given the potential for significant policy shifts.

The notion that the SEC's actions were anticipated based on potential political shifts adds another layer of complexity to XRP's price dynamics. The argument suggests that market participants have been anticipating a change in regulatory stance, leading to a gradual accumulation of XRP in anticipation of a favorable outcome. If this proves accurate, the recent price surge could represent the beginning of a more sustained upward trend.

However, it is crucial to acknowledge that the regulatory landscape remains fluid and subject to change. While a Trump administration might usher in a more lenient approach to cryptocurrency regulation, there is no guarantee that the SEC will definitively drop its lawsuit. The legal proceedings could continue, potentially leading to further volatility and uncertainty.

Beyond the regulatory environment, XRP's price is also influenced by broader market trends and investor sentiment.6 The cryptocurrency market is known for its volatility, and sudden shifts in sentiment can significantly impact asset prices.7 Therefore, even with positive developments in network activity and whale accumulation, XRP's price could still be affected by external factors.

The utility of XRP within the Ripple ecosystem also plays a crucial role in its long-term price potential. Ripple Labs has positioned XRP as a bridge currency for cross-border payments, aiming to facilitate faster and cheaper transactions.8 The adoption of XRP by financial institutions and payment providers could significantly increase its demand and drive its price higher.

However, widespread adoption has been hindered by the regulatory uncertainty surrounding XRP. As the legal battle with the SEC progresses, potential partners may hesitate to integrate XRP into their operations. A favorable resolution could remove this barrier, paving the way for wider adoption and increased utility.

In conclusion, XRP's recent 7% price jump, fueled by a surge in network activity and whale buying, reflects a renewed interest in the digital asset.9 While the potential for a more crypto-friendly regulatory environment under a potential Trump administration has fueled speculation of a favorable resolution to the SEC lawsuit, the legal landscape remains uncertain.

The increase in active addresses to the highest level since April 2023 indicates a growing level of engagement and utility within the XRP ecosystem.10 Coupled with significant whale accumulation; these factors suggest a potential for further price appreciation. However, the volatility of the cryptocurrency market and the ongoing regulatory uncertainty require a cautious approach.

Ultimately, XRP's long-term price potential will depend on a combination of factors, including regulatory clarity, broader market trends, and the continued adoption of its utility within the Ripple ecosystem. While the recent surge provides a glimmer of optimism, investors should remain vigilant and consider the various factors that could impact XRP's future performance.

Ripple

XRP Price Outlook: Is a Deeper Correction on the Horizon?XRP remains in a descending channel, facing strong resistance levels. The price has recently rejected the moving average, signaling potential downside movement. Fibonacci retracement highlights key support at $2.31 (0.786 Fib) and $2.02.

If bearish momentum persists, a retest of the lower trendline is likely. The daily chart shows significant supply zones around 2.3265-3.4106 and 2.5032-2.6487, with additional selling pressure expected between 2.6487 and 3.0153. If the RSI remains below 60-65 within these ranges, XRP could roll over, initiating another bearish impulse wave. Monitoring lower timeframes for signs of trend reversals or uptrend violations can help confirm short entries and long exits.

Should sellers regain control, daily demand zones are identified at 1.5414-1.2843 and 1.1222-1.0033, with Fibonacci retracements reinforcing these levels. Given XRP’s explosive rally in 2024, the monthly and weekly charts feature "tradeable voids" due to expanded-range candlesticks. While these large candles suggest momentum, they also indicate gaps in order flow, which could lead to rapid price movements if a correction occurs.

If XRP sells off, price may decline quickly due to the lack of unfilled orders to absorb movement. Traders should remain cautious and use micro-timeframes to spot early signs of trend shifts and potential entry opportunities.

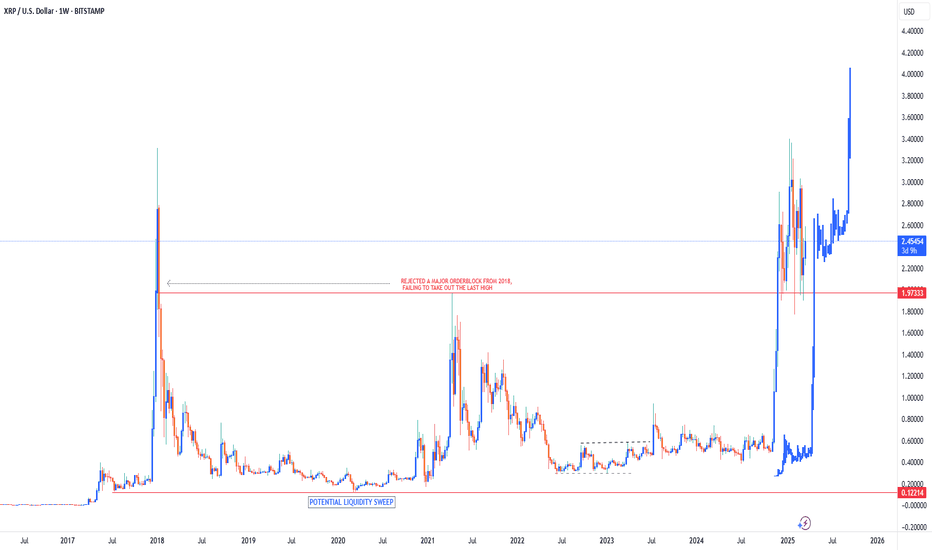

Xrp - Destroying All Hopes For Bears!Xrp ( CRYPTO:XRPUSD ) is heading for new all time highs:

Click chart above to see the detailed analysis👆🏻

Literally all cryptocurrencies are currently creating pump and dump like price action with swings of two digits within a couple of minutes. But if we look at the higher timeframe - specifically also on Xrp - markets are still 100% bullish and heading for new all time highs.

Levels to watch: $2.0, $5.0

Keep your long term vision,

Philip (BasicTrading)

Navigating XRP Regulatory Winds and Technical TidesThe crypto sphere remains fixated on XRP, a digital asset perpetually caught between regulatory scrutiny and promising technological advancements. Recent developments, including the delayed decision on a potential XRP ETF, the nearing conclusion of the SEC vs. Ripple lawsuit, and the launch of CFTC-regulated XRP futures, have injected fresh volatility and speculation into XRP's price trajectory.

ETF Delay and SEC Lawsuit: A Tale of Two Catalysts

The anticipation surrounding a potential XRP Exchange-Traded Fund (ETF) has been palpable. However, the recent delay in the SEC's decision has tempered immediate expectations. While a positive verdict would undoubtedly trigger a massive price surge, the postponement underscores the regulatory hurdles still facing the cryptocurrency market.

Conversely, the long-standing legal battle between Ripple and the SEC is seemingly approaching its denouement. Reports suggest the SEC is considering dropping the case against Ripple, a development that has already spurred significant price appreciation. The dismissal of the lawsuit, even if partial, would provide much-needed regulatory clarity, significantly boosting investor confidence. This potential resolution drove XRP up 12+% to $2.50, indicating the market's sensitivity to legal outcomes.

Technical Analysis: Charting a Course to New Highs

From a technical standpoint, XRP's price action displays a complex interplay of support and resistance levels. A critical resistance zone lies between $2.60 and $2.89. Overcoming this barrier is crucial for XRP to unlock its full potential and embark on a sustained upward trend. However, XRP has shown resilience, maintaining support above the $2.0 mark, which suggests underlying strength.

Analyzing the Elliott Wave theory, some analysts suggest XRP is currently in a corrective Wave 4. Within this framework, the $2.66 level emerges as a pivotal point. Breaking above this level would signal the completion of Wave 4 and the initiation of Wave 5, potentially leading to new all-time highs. This wave count, while speculative, provides a valuable framework for understanding potential price movements.

Conversely, trading below the 100-day moving average (MA) presents a significant setback for XRP buyers. This would signal a potential shift in momentum and could lead to further downward pressure. Investors should closely monitor this MA as a key indicator of short-term price direction.

Bitnomial's XRP Futures: Bridging Traditional and Crypto Markets

The launch of Bitnomial's CFTC-regulated XRP futures marks a significant milestone for the asset. This development provides institutional investors with a regulated avenue to gain exposure to XRP, potentially increasing liquidity and market depth. This regulated futures market may also provide more price stability, while also providing a tool for shorting XRP.

How High Can XRP Price Go After a Ripple Victory?

The question on everyone's mind is: how high can XRP soar if Ripple secures a decisive victory against the SEC? Predicting exact price targets is inherently challenging, but several factors suggest a bullish outlook.

Firstly, regulatory clarity would remove a major overhang that has suppressed XRP's price for years. This newfound certainty would attract a wave of institutional and retail investors who have previously been hesitant to invest due to legal uncertainties.

Secondly, Ripple's continued expansion and adoption of its technology, particularly in the cross-border payments sector, positions XRP for long-term growth. The increasing demand for efficient and cost-effective payment solutions could further fuel XRP's price appreciation.

Thirdly, the psychological impact of a legal victory should not be underestimated. It would validate XRP's legitimacy as a digital asset and potentially trigger a FOMO (fear of missing out) rally.

Based on these factors, some analysts speculate that XRP could potentially retest and surpass its previous all-time high, potentially reaching double-digit valuations. However, the timing and magnitude of such a surge remain subject to market dynamics and regulatory developments.

Why Is XRP Surging? The Convergence of Catalysts

The recent surge in XRP's price can be attributed to a convergence of positive catalysts. The nearing conclusion of the SEC lawsuit, coupled with the launch of CFTC-regulated XRP futures, has created a perfect storm of bullish sentiment.

Furthermore, general market sentiment towards cryptocurrencies has been improving, with increasing institutional adoption and growing awareness of the technology's potential.

Navigating the Volatility: A Word of Caution

While the outlook for XRP appears promising, investors should remain cognizant of the inherent volatility of the cryptocurrency market. Regulatory developments, market sentiment, and technical factors can all significantly impact price movements.

Therefore, investors should conduct thorough research, manage their risk prudently, and avoid making impulsive decisions based on short-term price fluctuations.

In conclusion, XRP is navigating a complex landscape of regulatory headwinds and technological tailwinds. The nearing conclusion of the SEC lawsuit, coupled with the launch of regulated futures, presents a compelling case for a bullish outlook. However, investors should remain vigilant and exercise caution as they navigate the volatile crypto market. The interplay of legal outcomes, technical analysis, and market sentiment will ultimately determine XRP's future trajectory.

Bearer of Bad News - Short $XRPI originally posted this idea several days ago, but it was flagged b/c I linked one of my social media accounts. Apologies for any typos - the format of my post got jacked up after copying/pasting. Crypto's going to break one way or another from current levels. Bitcoin has a wide supply zone (not super strong) 86267.86-92920.42, so watch how it reacts...

Strictly technical setup here. Near-term demand/buy zones were good for bounces across the crypto space. However, buying has been fairly tepid. Given the technical structure for many crypto underlyings, this is unsurprising (addressed in CRYPTOCAP:DOGE ( COINBASE:DOGEUSD ), CRYPTOCAP:BTC , CRYPTOCAP:TOTAL ideas). Barring a catalyst, it seems more likely that crypto (and risk assets generally) will trade lower before higher.

Unfortunately for bulls, BITSTAMP:XRPUSD has levels of daily supply near current price. Per the 1D chart, sell zone = 2.3265-3.4106, 2.5032-2.6487. Additional sellers are likely lurking between 2.6487 and 3.0153, though LTFs need to be analyzed for identification. If the RSI is printing < 60/65 if/when price reaches the abovementioned ranges, CRYPTOCAP:XRP could roll over and commence another bearish impulse wave. Use micro-timeframes to watch for signs of uptrend violation/termination + to confirm any short entries/long exits.

To bolster positional confidence, observe other cryptos, especially larger market caps. Correlative behavior can be a very helpful trading "odds enhancer". If other majors rally w/ significant volume/momentum, XRP will likely follow. Conversely, if BITSTAMP:BTCUSD , BITSTAMP:ETHUSD ( CRYPTOCAP:ETH ), etc. fizzle out, expect XRP to do the same.

If this idea materializes and shorts regain control, daily demand = 1.5414-1.2843, 1.1222-1.0033. Fib retracements reinforce the aforementioned buy zones. Because of the explosive nature of XRP's 2024 rally, the monthly/weekly charts have "tradeable voids" (expanded-range candlesticks). While traditional technicals tout large candles, they're a double-edged sword. Their elongated nature is often reflective of limited trading and gaps in order flow, which can have a vacuum-like effect if/when prices correct. It's great when you're on the right side of the trade creating the candles, but there's also not a lot of unfilled orders to stop price from moving rapidly in the opposite direction. So, if XRP sells off, don't be surprised if price moves quickly.

I'm a fan of confirmation entries vs. "catching a falling knife". Referencing RSI momentum + using micro-TFs to ID trend reversal signals can help prospective buyers reduce risk (and/or increase position size). When volatility strikes, preservation is paramount.

Thanks for reading! Feedback/engagement welcome.

Jon

SEC Officially Drops Ripple $XRP Lawsuit XRP Up 13%In a shocking news today the US SEC officially drops Ripple CRYPTOCAP:XRP lawsuit a move that saw CRYPTOCAP:XRP surged nearly 15% today amidst the market dip to $2.54 pivot. in a similar events, CRYPTOCAP:ETH likewise reclaims the $2k pivot albeit CRYPTOCAP:BTC trading at FWB:83K point.

Garlinghouse called the move “a resounding victory for Ripple, for crypto, every way you look at it.” Moreover, the move was one in a string of similar actions taken by the revamped agency this year. The arrival of 2025 has come with a completely overhauled cryptocurrency policy embraced by the returning Trump administration.

The lawsuit was originally filed four years ago, under the previous Gary Gensler-led SEC. Ripple CEO Brad Garlinghouse called the lawsuit “doomed from the start” in a statement following the dropped appeal.

“In many ways, it was the first major shot fired in the war on crypto,” Garlinghouse added. “I truly felt that I knew then that Ripple was not only on the right side of the law, but I felt that we were also going to be proven to be on the right side of history.”

The landmark decision has proven Garlinghouse and the company right in the end.

Technical Outlook

As of the time of writing, CRYPTOCAP:XRP is up 11% trading within over bought territory with the RSI of 73. For the altcoin, the 65% Fibonacci retracement point is serving as a support point should CRYPTOCAP:XRP cool off. Similarly, a break above the $2.64 price pivot that connotes with the 38.2% Fibonacci level could spark a move to $5 as more buyers will feel convicted and step in.

XRPUSD breaking upward from invh&sTarget is $3. Very likely to hit the full target based on the bullish momentum from the sec ripple appeal being ofifcially dropped. Likely to continue upward from there as well but for this current idea I only wanna focus on the inv h&s target. *not financial advice*

XRP’s Bullish Setup: Why I’m Targeting $3 with a 1:4 Risk-RewardAfter its recent impressive rally to $3, XRP has shown remarkable resilience during the correction, establishing a strong support level around the $2 mark.

Despite the broader downturn in the crypto market, XRP has held up well, demonstrating significant strength.

Last week, XRP tested this $2 support level once again and rebounded, reinforcing its stability. The current price action is shaping a bullish flag pattern, which suggests that a new upward move could be on the horizon.

With this in mind, I am looking to buy XRP, anticipating a potential breakout.

Given my target of around $3, I am aiming for a 1:4 risk-reward ratio for this trade

XRP/USD Skyrockets to the MoonXRP/USD Breakout Alert! After consolidating below key resistance around $2.107, XRP has surged to $7.25, hitting a target gain of 7.25x! The price has broken through multiple resistance levels, showing strong bullish momentum. Are we heading for new all-time highs? Let’s discuss!

Correction Is Not Over For Ripple XRPHello, Skyrexians!

It's time to update our BINANCE:XRPUSDT analysis because the previous one caused a lot of misunderstanding. Today we will clarify our point of view for this fundamentally strong crypto.

Let's take a look at the weekly chart. Here we can see that price is forming Elliott waves cycle in the current bull run. Looking at the Awesome Oscillator we can say that wave 3 has been just finished and now XRP is in wave 4. Wave 4 will be finished when Awesome Oscillator crosses zero line, so now we have some space to continue correction. The Fibonacci target for wave 4 has been reached, but it can be retested again.

Wave 5 target is located at $3.88. In next to this price we will see the red dot on the Bullish/Bearish Reversal Bar Indicator it's going to be the strong reversal signal for the bear market start.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

XRP: Current SituationYou asked, and we delivered:

XRP is trading at $2.23, down from recent highs and caught in a choppy phase amid a broader crypto market dip (total market cap down 4.4% in the last 24 hours). Some traders point to a breakout from a descending channel, hinting at bullish potential, while others flag whale selling and weak volume, suggesting bearish risks. The breakout lacks strong volume, raising doubts about its staying power. External factors, like the ongoing SEC lawsuit and ETF rumors, add volatility but remain speculative. For now, XRP is testing immediate support at $2.20-$2.23, with the market awaiting a decisive move.

Technical Indicators and Key Levels

Short-Term (1-Hour Chart):

Support: $2.20-$2.23 (current test), $2.00

Resistance: $2.33, $2.50

Indicators: RSI at 49 (neutral), MACD bearish. The breakout needs volume to confirm; otherwise, a retest could push XRP back to $2.00.

Long-Term (Weekly Chart):

Support: $1.90 (critical), $1.50

Resistance: $2.50, $3.00

The 200-day MA is falling, reflecting long-term pressure, but holding $1.90 is key for bulls.

Potential Scenarios

Bullish Case: Hold $2.20, break $2.33 with volume → target $2.50. Long-term, clear $2.50 → aim for $3.00.

Bearish Case: Drop below $2.20 → test $2.00; below $1.90 risks $1.50.

Volume is critical—watch for spikes to validate moves.

Broader Context and Tips

XRP’s utility in cross-border payments and ETF whispers keep long-term optimism alive, but regulatory uncertainty looms. Traders should focus on $2.20, a hold keeps bulls in play, a break signals caution. Use tight stops (e.g., below $2.20 for longs) and stay alert for news on the SEC case or ETF developments. Long-term, $1.90 is the line to watch for bullish continuation.

XRP Next Move !... $4 XRPUSD Ripple Just A Matter Of Time? $€£¥This space seems a bit quite now but if you liked XRPUSD / XRPUSDT at $3 what has changed now?

When the hype is around thats the time to be ⚠️ cautious IMO.

When there is little attention of the said market thats when 🟢SeekingPips🟢 likes to get to work.

⚠️This time is NO different⚠️

NOT SURE WHERE THE NEXT LOW WILL FORM❓️

ME NEITHER❗️❕️❗️

🟢 You don't need to know❗️ You just need to HAVE A PLAN ✅️

My current XRP 'flash crash in April' thesis chartThis is the current chart that I'm using, which includes approximate areas and an approximate timeline for my coming 'flash crash in April' thesis. This involves XRP bottoming out very soon, then going on a 'false breakout' heading into April, followed by a flash crash sometime in mid to late April. This will then mark the low of this area of the chart, and the real breakout will occur sometime in May, which I believe will take XRP to a new all-time high and true price discovery.

Keep in mind that this is a theory, which is developing day by day, and may or may not actually come to fruition. It's based on a chart I've released in the past called 'THE XRP BREAKOUT CHART.'

*** The yellow line on the chart is a simple wave count, and not affiliated with Elliot Wave Theory, just for clarification.

Enjoy the ride.

Good luck, and always use a stop loss!

the Head and Shoulders of the Month!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 This week, XRP rejected the $2 support level and has been trading higher.

Today, XRP formed an inverse head and shoulders pattern and broke its green neckline upward.

🏹 As long as the bulls hold, a movement towards the upper bound of the falling red channel would be expected.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

XRP will explode in valuePrice Movement and Trends

Initial Consolidation (August 2024 - November 2024):

XRP starts the chart trading sideways around $0.50 to $0.60. This period shows low volatility with small candlesticks, indicating a lack of strong directional momentum. It suggests a consolidation phase where buyers and sellers were in balance.

Breakout and Uptrend (Late November 2024 - January 2025):

Around late November 2024, XRP breaks out of its consolidation with a sharp upward move. The price surges from $0.60 to a peak of around $4.00 by early January 2025, a massive increase of over 500% in a short period.

This rally is characterized by large green candlesticks, indicating strong buying pressure. The consistent higher highs and higher lows confirm a strong bullish trend.

Volume likely increased during this period (though volume bars aren’t visible), as such a significant price move typically requires high participation.

Peak and Correction (January 2025 - February 2025):

XRP reaches a high of approximately $4.00 in early January 2025, followed by a sharp correction. The price drops to around $2.50 by mid-February 2025, a decline of about 37.5% from the peak.

This correction is marked by large red candlesticks, showing strong selling pressure. The drop suggests profit-taking by traders who entered during the earlier rally, possibly triggered by overbought conditions (though no RSI or similar indicators are visible to confirm this).

Stabilization and Recovery Attempt (February 2025 - March 2025):

After the correction, XRP stabilizes between $2.50 and $3.00. The price shows smaller candlesticks and some consolidation, indicating a pause in the downtrend.

Toward early March 2025, XRP attempts a recovery, climbing back to $2.837 by March 13, 2025. The smaller green candlesticks in this phase suggest cautious buying, but the momentum isn’t as strong as the earlier rally.

Key Levels and Support/Resistance

Support: The $2.50 level acted as a support during the correction in February 2025. This level held multiple times, indicating buyers stepping in to defend it.

Resistance: The $4.00 level was a significant resistance, as it marked the peak of the rally before the correction. If XRP attempts another upward move, this level may act as a barrier.

Current Price: At $2.837, XRP is trading above the recent support but far below its January peak, suggesting it’s in a consolidation phase with potential for either direction.

Technical Observations

Volatility: The chart shows periods of both high and low volatility. The rally in November-December 2024 was highly volatile, while the consolidation phases (August-November 2024 and February-March 2025) show lower volatility.

Trend: The overall trend from November 2024 to March 2025 is bullish, despite the correction. The price is still significantly higher than its starting point in August 2024.

Candlestick Patterns: The large green candles during the rally and large red candles during the correction indicate strong momentum in both directions. The smaller candles in March 2025 suggest indecision in the market.

Potential Scenarios

Bullish Case:

If XRP breaks above $3.00 with strong volume, it could signal the start of another uptrend, potentially retesting the $4.00 resistance.

A move above $4.00 could open the door for new all-time highs, especially if market sentiment for cryptocurrencies remains positive.

XRP | Head and Shoulders Pattern.

Head: $3.4.

Left Shoulder: $2.9.

Right Shoulder: $3.0.

The Neckline: $2.00.

Components of the Pattern:

Left Shoulder: Represents the first peak at $2.9, where the price rose and then retreated to the neckline at around $2.00.

Head: The highest peak at $3.4, the topmost point of the pattern, followed by a retreat to the neckline at $2.00.

Right Shoulder: The second peak at $3.0, lower than the head, followed by a retreat to the neckline at $2.00.

Neckline: Remains at approximately $2.00, a horizontal support level connecting the lows after the left shoulder and the head and the right Shoulder.

Implications of the Pattern:

The pattern remains a bearish reversal pattern, indicating a weakening of bullish momentum after reaching the head at $3.4.

If the price breaks below the neckline ($2.00) with increased volume, this confirms the pattern’s completion and signals a significant decline.

Current Situation (March 2025):

The current price ($2.2) is very close to the neckline ($2.00), making a breakout likely in the coming days.

The potential crossover of the moving averages (blue and red lines) supports the possibility of a trend change.

NOTE:

If the price bounces off the neckline ($2.00) with increased volume, this invalidates the pattern.

In this case, the price might attempt to retest resistance at $3.0 (right shoulder peak) or even $3.4 (head peak).

Conclusion:

The Head and Shoulders pattern: indicates a strong potential for a bearish reversal, if the price breaks below the neckline ($2.00). Confirmation of the breakout with increased volume is essential, while considering fundamental news that might influence the market.

XRP on the BrinkXRP is currently trading at $2.095, reflecting a volatile period for the cryptocurrency amidst a broader market downturn. The crypto market has faced significant challenges recently, with the total market capitalization dropping by 4.4% in the past 24 hours, and major altcoins like Bitcoin, Ethereum, and Solana also experiencing declines. For XRP specifically, recent price action has been a rollercoaster: it surged by an impressive 34.21% on March 2, only to be followed by two sharp corrections that erased those gains and pushed the price below its early March levels. This volatility sets the stage for a cautious approach on the 1-hour timeframe, as XRP navigates both its own dynamics and the broader market's bearish sentiment.

Technical Indicators and Key Levels

From a technical perspective, the short-term trend on the 1-hour chart leans bearish, with the price positioned below the 50-day moving average, indicating weakening momentum. The local support level to watch is $2.0872, just below the current price, which has acted as a near-term floor in recent hours. Should this support fail, the next significant levels are $2.00 and $1.90, where stronger buying interest might emerge based on historical price action. On the upside, immediate resistance lies between $2.10 and $2.15, a zone that has capped recent recovery attempts. A break above this could pave the way for a test of $2.20, though the broader market pressure suggests that any upward move might lack the strength for a sustained rally without a notable shift in sentiment or volume.

Potential Scenarios and Trading Considerations

Traders should consider two primary scenarios on this 1-hour chart. If the $2.0872 support holds firm, XRP could enter a phase of consolidation or stage a minor bounce toward the $2.10-$2.15 resistance zone, potentially offering a scalping opportunity for nimble traders. Conversely, a break below $2.0872 could accelerate selling pressure, targeting $2.00 or even $1.90, especially if accompanied by rising volume, which would confirm bearish conviction. Volume is a critical factor to monitor here: an uptick on downward moves signals stronger selling, while a surge on upward moves could hint at a reversal. Given the market's current state, downside risks appear more pronounced, but a sudden catalyst, like positive news on the ongoing SEC lawsuit against Ripple, could flip the script.

Broader Context and Final Tips

The bigger picture adds nuance to this 1-hour analysis. XRP’s longer-term trends, such as the falling 200-day moving average since March 7, reinforce a cautious outlook, while the unresolved SEC lawsuit remains a wildcard that could spark volatility at any moment. For now, the focus is on these near-term levels and volume cues. Traders should stay alert for external triggers, like upcoming US CPI data or market-wide shifts, that could sway XRP’s direction. Keep your stops tight, watch the $2.0872 support closely, and be ready to act if volume confirms a breakout or breakdown. This setup offers opportunities, but patience and discipline will be key in this choppy market.

Key Levels to Watch

Immediate Resistance: $2.10 - $2.15

Next Resistance: $2.20

Immediate Support: $2.0872

Next Support: $2.00, $1.90

Potential Price Movements

Bullish Scenario: If the price breaks above $2.15, it could rise to $2.20.

Bearish Scenario: If the price drops below $2.0872, it might fall to $2.00 or even $1.90.

Note: Look for higher trading volume during breakouts or breakdowns to confirm the move’s strength.

This Pattern Could Return Ripple (XRP) Where It Started Rally Textbook, beautiful symmetric Head & Shoulders reversal pattern emerged on Ripple

approaching the Neckline.

Head is the highest peak among three on the chart

Neckline is built through valleys of the Head.

Price already tested Neckline support and was rejected yesterday.

Bearish trigger is on the clear breakdown.

Target is located at 0.55

It was calculated by subtracting the height of the Head from the Neckline.

It is the support area where XRP started its rally before.

"What goes up should come down"

RIPPLE MASSIVE LONG|

✅RIPPLE will be retesting a support level soon of 2.00$

From where I am expecting a bullish reaction

With the price going up but we need

To wait for a reversal pattern to form

Before entering the trade, so that we

Get a higher success probability of the trade

LONG🚀

✅Like and subscribe to never miss a new idea!✅