Rivian Automotive: Navigating High Hopes and Market RealitiesShares of Rivian Automotive (NASDAQ: RIVN) have been on a remarkable trajectory, more than doubling in value over the past eight months and currently trading near a two-year high of approximately $22.64. This surge reflects growing investor optimism about the company's path to operational maturity and its strategic positioning within the competitive electric vehicle (EV) landscape. However, as the stock approaches these elevated levels, a nuanced debate emerges between bullish catalysts and significant valuation concerns. This analysis delves into the key drivers behind the rally, the divergent views from Wall Street, and the critical factors that will determine Rivian's performance in 2026 and beyond.

The Bullish Thesis: Strategic Catalysts and Operational Momentum

The optimistic narrative for Rivian is championed by analysts like Dan Ives of Wedbush Securities, who recently maintained his "Outperform" rating and raised his price target to $25. This suggests a further potential upside of about 11% from current levels. Ives's constructive outlook is anchored in several pivotal developments:

The Accelerated Push into Autonomy and AI: A primary catalyst is Rivian's recently unveiled strategy at its inaugural "Autonomy & AI Day." The company announced ambitious plans, including the launch of its proprietary Rivian Autonomy Processor (RAP1) and a forthcoming autonomy subscription service in 2026. According to Ives, this accelerated focus on self-driving technology is not merely a feature enhancement but a strategic move that could unlock new, high-margin revenue streams (via software subscriptions) while simultaneously improving vehicle efficiency and helping to manage long-term manufacturing costs through technological integration.

The Crucial R2 Platform Rollout: The successful launch and ramp-up of the R2 vehicle platform are seen as central to Rivian's growth story in 2026. The R2, targeting a more accessible price point than the flagship R1T and R1S models, is expected to significantly expand Rivian's addressable market. A smooth production and delivery ramp for the R2 is critical for improving volume metrics, achieving economies of scale, and demonstrating the company's ability to execute on its growth roadmap.

The Volkswagen Joint Venture as a Game-Changer: Rivian's multibillion-dollar strategic joint venture with Volkswagen is widely viewed as a transformative partnership. For Rivian, it provides a massive infusion of capital, validates its next-generation electrical architecture and software stack, and offers a pathway to global scale through access to Volkswagen's manufacturing expertise and supply chain. This alliance substantially de-risks Rivian's balance sheet and long-term capital needs, strengthening its competitive moat against both legacy automakers and pure-play EV rivals.

Attractive Relative Valuation and Technical Strength: Despite the sharp rally, proponents argue Rivian remains attractively valued on a relative basis. At approximately 5x forward sales, it trades at a significant discount to Tesla's multiple of over 16x, suggesting room for expansion if execution improves. Technically, the stock is trading decisively above all its major moving averages (50-day, 100-day, 200-day), a pattern that typically signals sustained bullish momentum and indicates buyers are in control across multiple timeframes.

The Cautious Counterpoint: Consensus Skepticism and Lofty Expectations

Despite these compelling drivers, a significant degree of skepticism persists on Wall Street, presenting a stark contrast to the bullish outlook. The broader analyst consensus, as aggregated by services like Barchart, currently sits at a "Hold" rating, with a mean price target of approximately $16. This implies a potential downside of roughly 28% from current levels, highlighting a deep-seated concern that the recent rally may have overshot the company's near-term fundamentals.

The primary concerns underpinning this cautious stance include:

Execution Risk: The automotive industry is notoriously difficult, and Rivian must flawlessly execute the R2 launch, ramp up new production lines, and integrate complex autonomy technology—all while managing cash burn.

Intensifying Competition: The EV market is becoming increasingly crowded, with price wars and rapid innovation from both established giants and new entrants putting pressure on margins and market share.

Macroeconomic and Demand Headwinds: Higher interest rates and potential consumer softening could impact demand for big-ticket items like vehicles, testing Rivian's pricing power and delivery targets.

Valuation Stretch: At current prices, skeptics argue the stock is pricing in a near-perfect execution of its multi-year plan, leaving little room for operational missteps or market disruptions.

Technical Framework and Seasonal Considerations

From a chart analysis perspective, key levels are coming into focus:

Major Support Zone: A critical area of historical buying interest and structural support is identified around the $8.00 level.

Major Resistance Zone: The next significant hurdle and potential profit-taking zone for the current uptrend lies near $28.00.

Additionally, some traders note a seasonal tailwind, with historical data indicating Rivian shares have averaged a gain of over 6% in the month of January. While past performance is no guarantee, this pattern can influence short-term trading sentiment.

Conclusion: A High-Stakes Inflection Point

In summary, Rivian Automotive stands at a high-stakes inflection point as it heads into 2026. The bullish case, led by analysts like Dan Ives, is powerful and forward-looking, built on strategic differentiators in autonomy, a pivotal new vehicle platform, and a landmark partnership that provides financial stability. The stock's technical posture and relative valuation add to this appeal.

However, the substantial gap between the bullish price targets and the conservative consensus "Hold" rating underscores the exceptional execution required to justify current valuations. The market is effectively asking: Can Rivian transition from a promising story to a sustainably profitable, high-volume automaker before the capital runs thin or competition intensifies further?

For investors, the decision hinges on conviction in management's ability to navigate this complex transition. The upcoming year will be critical, with milestones around the R2 launch, autonomy developments, and joint venture progress serving as key catalysts that will either validate the bullish thesis or reinforce the skeptics' caution. The path forward promises significant volatility, with the stock likely oscillating between the forces of high-growth optimism and the gravity of automotive industry realities.

RIVN

RIVN - Bullish Triangle Breakout SetupPrice action has formed a clear contracting bullish triangle , completing waves a–b–c–d–e and breaking above the upper trendline with strong momentum. This breakout suggests the market is shifting from consolidation to a new bullish phase.

As long as the breakout holds and price stays above the triangle resistance, I expect continuation toward the $30–$33 target zone , which aligns with the measured move of the pattern and the next major resistance area.

Rivian Automotive (RIVN) — Scaling EVs with Software UpsideCompany Overview:

Rivian NASDAQ:RIVN builds adventure-ready electric trucks, SUVs, and commercial vans, giving investors clean exposure to the EV + sustainable transport megatrend.

Key Catalysts:

Record Quarter: 13,201 deliveries in Q3’25; revenue $1.56B (+78% YoY)—evidence of strong demand and improving operations.

Turning the Corner on Profit: First-ever positive gross profit: $24M, driven by cost reductions and a 324% surge in software & services—marking Rivian’s shift toward a software-enhanced platform.

Mass-Market Expansion: R2 at ~$45,000 slated for early 2026, broadening TAM and supporting multi-year volume growth.

Why It Matters:

✅ Proven ability to ramp production

✅ Improving unit economics with software tailwinds

✅ Clear catalyst with R2 launch

Investment Outlook:

Bullish above: $14.00–$15.00

Target: $23.00–$24.00, supported by volume growth, margin improvement, and platform monetization.

📌 RIVN — from premium adventurers to mass-market momentum.

RIVN 1D — It’s Time to Buy: Setup UpdateThe setup on Rivian (RIVN) just got upgraded from “interesting” to “strategically significant.” We’re looking at a textbook symmetrical triangle that’s been developing since July 2023, with a clean breakout and retest on the weekly trendline.

The breakout was followed by a bullish retest, right at the intersection of the triangle base and the key trendline. Volume kicked in, price held — and that’s what smart money calls confirmation.

Now, the Golden Cross is live: the 50-day MA just crossed the 200-day MA from below. Price is confidently holding above both — momentum is shifting hard. Fibs from the bottom (10.22) to the last local top (17.05) project the first target at $17, and the extended Fibonacci confluence gives us $25.64 as a long-range goal (2.618 extension).

The weekly trendline — which acted as resistance for over a year — has flipped to support. Price action respects it, bulls are loading, and structure is clean.

This is not just a bounce. It’s a technical rotation from accumulation to expansion.

The time to talk about potential is over — price action has spoken.

$RIVN – Long-Term Base Breakout Setup + Sector Rotation PotentiaRivian ( NASDAQ:RIVN ) is finally showing signs of life after years of basing out. This is one of those setups that comes along only once every few years — a multi-year base breakout forming as speculative money rotates back into the laggards.

🔹 The Setup:

Big earnings pop ignited the first real move in months.

After that surge, NASDAQ:RIVN has been flagging tightly for 3 days, digesting gains with constructive price action.

The structure here is clean — it’s coiling just under breakout levels, setting up a potential long-term trend shift.

🔹 Macro + Sector Context:

The alt-energy sector is heating up — solars have been leading, and that strength could spill into EV names next.

We’re in a speculative phase of the market where beaten-down names are catching rotation money.

NASDAQ:RIVN fits that bill — it’s been left for dead, but the tape is finally turning.

🔹 My Trade Plan:

1️⃣ Entry: Building a position off the flag near current levels.

2️⃣ Stop: Using the 9 EMA on the weekly chart as my stop — giving it room to breathe.

3️⃣ Account: Tossing this one into the longer-term accounts — not a scalp, this is a swing for the fences type play.

Why I Like It (Even Though It’s a “Turd”):

Multi-year base = massive stored energy.

The chart finally aligns with the macro rotation.

It’s not about loving the company — it’s about recognizing when the cycle flips in its favor.

RIVIAN Triangle to give one more rally?Rivian Automotive (RIVN) has been trading within a 1.5 year Triangle pattern, with the price currently consolidating just below both the 1D MA50 (blue trend-line) and 1D MA200 (orange trend-line).

All previous Higher Lows of the pattern have been priced on at least the 0.786 Fibonacci retracement level, which is currently just below or when the 1D RSI approaches the 30.00 oversold level.

As a result, we expect a rebound near the bottom of the pattern, targeting its top (Lower Highs trend-line) at $15.75.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

$RIVN bottoming? Long term 10x+?The RIVN chart is starting to look good here. As you can see from the chart, we've broken out of a falling wedge. The next challenge is for price to flip the $15.27 resistance level as support and retest it.

If it can do that, then I think we can start to see a sustained uptrend. If it tests $15.27 or briefly breaks above it and rejects, then I think there's a possibility of one more retest of the lows prior to the move starting.

That said, the chart is starting to look really good over the long term. I think this has 10X+ potential over the coming years.

Rivian major consolidation coming to a decisionRivian is in my opinion coming closer to a decision on a breakout or breakdown. I personally love Rivian - I own one, and it's my favorite car I've ever owned. Next year they're planning on launching a much more affordable mid size SUV (R2) that I think will drastically increase their sales. It brings everything that is great about R1S/R1T to a more affordable platform without losing all the great technology and things we love about the more expensive R1.

I see that opportunity and want to be in on it, however as a trader, I need a deal and Rivian at $12 is not it. So I'm hoping this consolidation will break down for an opportunity at $7. There have been people holding this stock for so long betting on another Tesla, and with any luck some of them will finally throw in the towel if this obvious symmetrical triangle breaks down.

And if not, and it breaks up then I'm happy for all those loyal fans who've been holding for years. I love my SUV and am excited for Rivian to keep making even greater cars.

It's hard to predict how this pattern will play out, that's why I'm personally waiting on the sidelines.

Good luck!

RIVN Rivian Automotive Options Ahead of EarningsIf you haven`t bought RIVN before the previous earnings:

Now analyzing the options chain and the chart patterns of RIVN Rivian Automotive prior to the earnings report this week,

I would consider purchasing the 10usd strike price Puts with

an expiration date of 2025-10-17,

for a premium of approximately $0.39.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

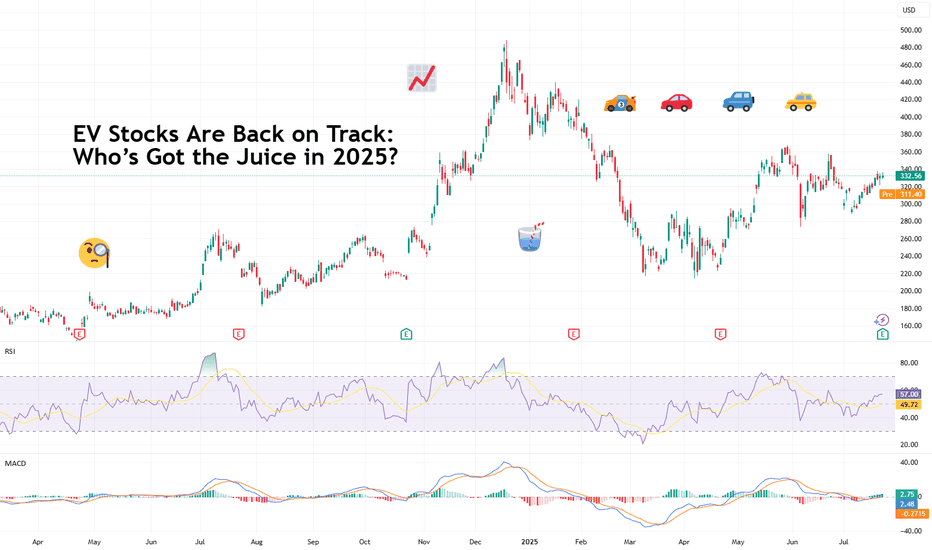

EV Stocks Are Back on Track: Who’s Got the Juice in 2025?This year is big for the EV sector so we figured let’s do a piece on it and bring you up to speed on who’s making moves and getting traction — both in the charts and on the road.

What we’ve got here is a lean, mean lineup of real contenders. Let’s go for a ride.

🚗 Tesla: Still King of the Road (for Now)

Tesla NASDAQ:TSLA isn’t just an EV company. It’s a tech firm, an AI shop, a robotaxi rollout machine, and an Elon-flavored media event every quarter. Even so, when it comes to margins, global volume, and name recognition, Tesla is still the benchmark everyone else is chasing.

In 2025, Tesla’s bounceback is fueled not just by EV hype but by its push into autonomous driving and different plays into the AI space.

The stock is down about 13% year-to-date. But investors love a narrative turnaround. Apparently, the earnings update didn't help the situation as shares slipped roughly 5%. Well, there's always another quarter — make sure to keep an eye on the Earnings Calendar .

🐉 BYD: The Dragon in the Fast Lane

BYD 1211 is calmly racking up sales, expanding across continents, and stealing global market share without breaking a sweat. The Chinese behemoth is outselling Tesla globally and doing it with less drama and more charge… literally .

Vertical integration is BYD’s secret weapon — they make their own batteries, chips, and even semiconductors. The West might not be in love with BYD’s designs, but fleet operators and emerging-market governments are. And that’s where the real growth is.

⛰️ Rivian: Built for Trails, Not Earnings (Yet)

Rivian NASDAQ:RIVN still feels like the Patagonia of EV makers — rugged, outdoorsy, aspirational. Its R1T pickup truck has cult status, but the company had to tone down its ambitions and revised its guidance for 2025 deliveries to between 40,000 and 46,000. Early 2025 projections floated around 50,000 .

The good news? Rivian is improving on cost control, production pace, and market fit. The bad news? It’s still burning cash faster than it builds trucks. But for investors betting on a post-rate-cut growth stock rally, Rivian may be the comeback kid to watch. It just needs a few solid quarters.

🛋️ Lucid: Luxury Dreams, Reality Checks

Lucid NASDAQ:LCID , the one that’ll either go under or make it big. The luxury carmaker, worth about $8 billion, came into the EV game promising to out-Tesla Tesla — with longer range, more appeal, and a price tag to match.

But here’s the rub: rich people aren’t lining up for boutique sedans, especially when Mercedes and BMW now offer their own electric gliders with badge power and a dealer network.

Lucid’s challenge in 2025 is existential. The cars are sleek, the tech is strong, but the cash runway is shrinking and demand isn’t scaling like the pitch deck promised.

Unless it nails a strategic partnership (Saudi backing only goes so far), Lucid could end up as a cautionary tale — a beautifully engineered one, but a cautionary tale nonetheless. Thankfully, Uber NYSE:UBER showed up to the rescue ?

💪 NIO : Battling to Stay in the Race

Remember when NIO NYSE:NIO was dubbed the “Tesla of China”? Fast forward, and it’s still swinging — but now the narrative is more about survival than supremacy. NIO's battery-swap stations remain a unique selling point, but delivery volumes and profitability are still trailing.

The company’s leaning into smart-tech partnerships and next-gen vehicle platforms. The stock, meanwhile, needs more than just optimism to get moving again — it’s virtually flat on the year.

✈️ XPeng: Flying Cars, Literally

XPeng’s NYSE:XPEV claim to fame used to be its semi-autonomous driving suite. Now? It's working on literal flying vehicles with its Land Aircraft Carrier. Innovation isn’t the problem — it's execution and scale.

XPeng is beloved by futurists and punished by spreadsheets. It’s still getting government love, but without a clear margin path, the stock might stay grounded.

🏁 Li Auto: The Surprise Front-Runner

Li Auto NASDAQ:LI doesn’t get the headlines, but it’s quietly killing it with its range-extended EVs — hybrids that let you plug in or gas up. A smart move in a country still building out its charging infrastructure.

Li is delivering big numbers, posting improving margins, and seems laser-focused on practicality over hype. Of all the Chinese EV stocks, this one might be the most mature.

🧠 Nvidia: The Brains of the Operation

Okay, not an EV stock per se, but Nvidia NASDAQ:NVDA deserves a spot on any EV watchlist. Its AI chips are running the show inside Tesla’s Full Self-Driving computers, powering sensor fusion in dozens of autonomous pilot programs, and quietly taking over the brains of modern mobility.

As self-driving becomes less sci-fi and more of a supply-chain item, Nvidia's value-add grows with every mile driven by data-hungry EVs.

🔋 ChargePoint & EVgo: Picks and Shovels

If you can’t sell the cars, sell the cables.

EV charging companies were once seen as the “safe bet” on electrification. Now they’re just seen as massively underperforming.

ChargePoint BOATS:CHPT : Still the leader in US charging stations but struggling with profitability and adoption pacing. Stock’s down bad from its peak in 2021 (like, 98% bad).

EVgo NASDAQ:EVGO : Focused on fast-charging and partnerships (hello, GM), but scale and margin pressures remain.

Both stocks are beaten down hard. But with billions in infrastructure funding still flowing, who knows, maybe there’s potential for a second act.

👉 Off to you : are you plugged into any of these EV plays? Share your EV investment picks in the comments!

RIVIAN Huge 1-year Triangle about to break. Trade the break-out.Rivian Automotive (RIVN) is trading within a 1-year Triangle pattern since the April 15 2024 Low. Right now the price is on the 1W MA100 (green trend-line), almost hitting the top (Lower Highs trend-line) of the pattern.

This is the second time ever that the 1W MA100 is tested, the previous on was on the last Lower High in late December 2024, giving slightly more probabilities for a bullish break-out above it.

If this is materialized, buy the break-out and target the 2.0 Fibonacci extension on the long-term at $26.50.

If it fails to break and instead is rejected back towards the Triangle's bottom, wait for a confirmed break of the Higher Lows trend-line and sell towards the -1.0 Fibonacci extension at $6.50.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Is the trend changing for Rivian?NASDAQ:RIVN 's stock price, which has dropped by nearly 80% since September 2022, has started to move upward again in November 2024 with renewed demand.

The possibility of retesting the trendline formed during the 2022-2024 period has strengthened with the demand seen in the past month.

If this upward movement continues, the initial price target could be $19. Should the trend persist, price movements could extend to $28 and even $41.

RIVN Rivian Automotive Options Ahead of EarningsIf you haven`t sold RIVN after the recalls:

Now analyzing the options chain and the chart patterns of RIVN Rivian Automotive prior to the earnings report this week,

I would consider purchasing the 16usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $0.93.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RIVIAN LOOKS PRIMED! 120% UpsideNASDAQ:RIVN

Is it finally time for Rivian to break out of the multi-year downtrend?

-Falling wedge

-Symmetrical triangle

-Inverse H&S

-Williams CB formed

-H5 is GREEN

TRADE once we get B/O

Breakout: $16

SL: $9.52

Targets: $28/ $36

Risk/Reward ratio: 3

Not financial advice

Rivian - Where is this truck running to? 100%+ Upside PotentialChart #29/ 40: NASDAQ:RIVN 🔋🛻

-Falling Wedge needs to breakout at $16

-H5 Indicator needs to flip to Green

-Williams Consolidation Box needs to break -80 and then create support for form the consolidation box.

-AVP Shelf to launch off with volume GAPs

🎯$28📏$36⏳ Before 2026

NFA

RIVIAN Is this EV maker dead??Rivian is bearish on its 1D technical outlook (RSI = 42.757, MACD = -0.170, ADX = 26.255) as it is extendint today yesterday's massive rejection on the 1D MA200. The long term pattern is a Channel Down and we are on the latest bearish wave and about to form a 1D MACD Bearish Cross. The two previous bearish waves of the pattern reached the 1.618 and 2.0 Fibonacci extension respectively, so a progressive lower low is identified there potentially. In any event, we expect at least the 2.0 Fibonacci level to be tested (TP = 8.65).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

PSNY - Adjusting the short-term vision onlyThe stock closed last week with a clear reversal candle, showing weakness in the technical indicators after achieving 95% of the target for the current first wave. We expect the stock to aim for a deep correction in wave 2 or a , and if it holds above the 61% Fibonacci level around the 1.10 - 1.00 area, it will continue its bullish wave in the medium term. In the short term, there is a shift towards a bearish outlook, while positivity remains on the medium-term horizon,

Hence, we see the current rebound as an opportunity to close speculative positions, while maintaining investment positions unchanged.

RIVIAN giving highly accurate signals within this Channel Down.Rivian Automotive (RIVN) couldn't have been giving us more accurate signals since May (see charts below), as not only did we get a timely entry at the bottom (chart 1, May 17) but also sold at the very top (June 26 chart 2) of the Channel Down:

Right now we face a technical similarity with September 2023, exactly 1 year ago, where the price failed to utilize the 1D MA50 (blue trend-line) as Support and started a new long-term Bearish sequence.

However we do realize the potential long-term trend changing effect that a potential new cycle of interest rate cuts might have in two weeks, so again our trading plan will prepare for both scenarios with clear break-out signals and levels.

Obviously as long as the price remains within the 2-year Channel Down, the trend is bearish and the action will be 'sell on every high'. The Sell Signal on the September 2023 fractal was given when the 1D RSI hit the 60.00 level (red arrow, Sep 14 2023). Naturally we will wait for another such trigger to sell and Target 10.55 on the 0.5 Fibonacci retracement level, which is where last year's sell signal bottomed (October 30 2023).

If on the other hand, the price closes a 1W candle above the 1W MA100 (yellow trend-line), we will buy that clear long-term bullish break-out signal and Target 28.00 (just below Resistance 2). This could emerge as a Channel Up pattern.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇