Sawit

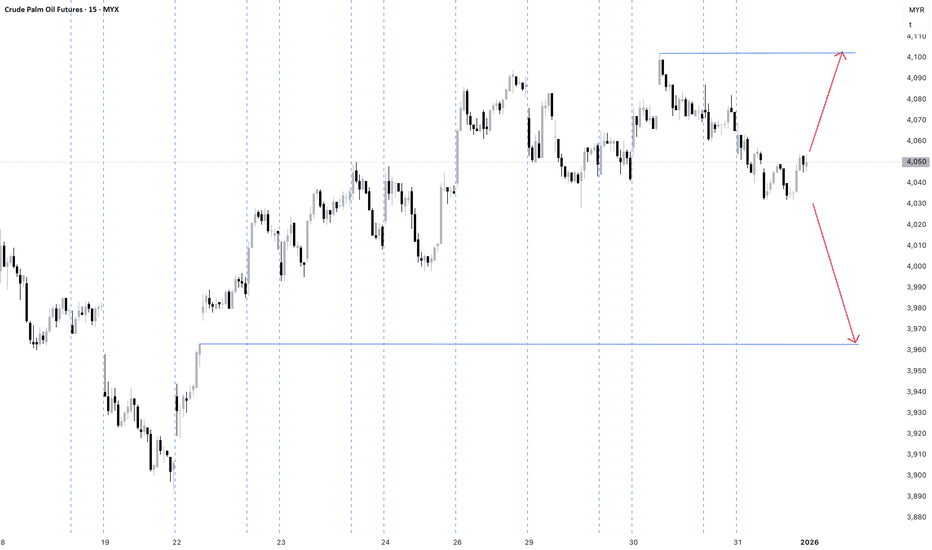

FCPO: New Year update.Bullish push is valid but the overall macro tilt is still bearish until proven otherwise. With bullish view a close above 4055 will open for further bullish to potentially 4100 level. This bullish will be invalidated if price close below 4032 then bearish is preferred with a target to 3965.

FCPO Xmas Update: Pullback to 3979 area.Based upon our Directional Efficiency model, the current bullish price action is lacking the bullish energy. It is not an expansion but rather a distribution/absorption. It seems that the bearish price action is still in dominance. The model expecting that price making a pullback towards 3979 price area. If bullish efficiency didn't improve then this area is not a bullish pullback but instead it would be a support and a break will signal a bearish continuation.

Happy trading!

FCPO Week 48 205: Another consolidation mode?Still in bearish mode but the move lower is losing a little bit of momentum even though Friday push lower look impressive. Look at 4H and you will see a bullish divergence that might indicate that price will retrace in a bearish macro trend. Another consolidation period is also possible. So bearish on higher timeframe but bearish in 4H is losing momentum and retracement or consolidation is a possibility.

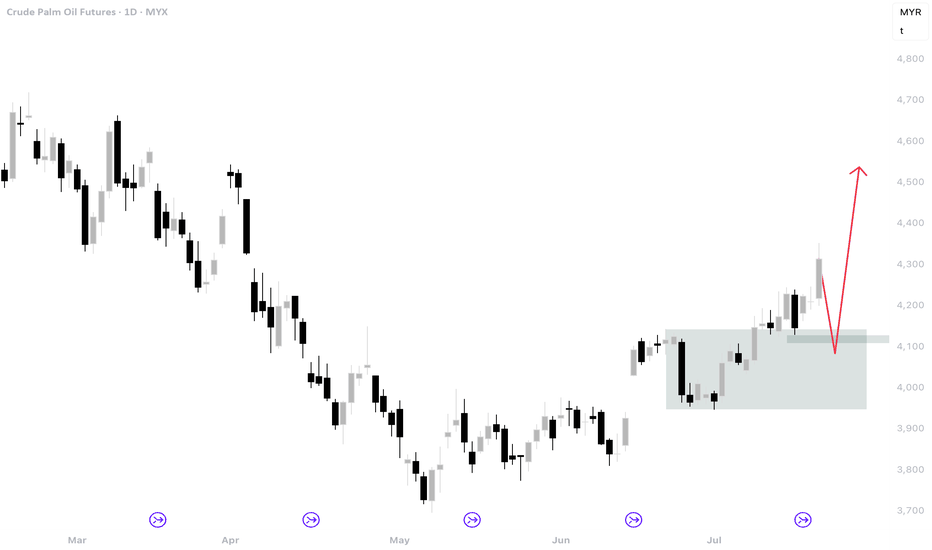

FCPO Week 47 2025: Transition to bullish?Price is in consolidation. It has 2 weeks to follow through on the double top but so far it held. This might indicate that it is in transition to possibly going higher and bearish is losing momentum. Two options next week:

1) Price close and stay above 4200 then we might see price going bullish towards 4300 and 4400.

2) Price close and stay below 4070 then price possibly continue lower towards 3900.

Option 1 is most likely and have higher probability.

Happy trading.

FCPO Week 45 2025: Retrace or consolidation to continue bearish.Bearish overall. However there is a sign of bearish exhaustion.Price making swing lows but the momentum has declined thus signalling that price might retrace before resuming lower. However looking at 15m chart this retracement is not started yet. Still no higher low or higher high yet. Monday session might give a bit more idea. Retracing towards 4300 is possible but next week would probably where price going into consolidation then retracement before continuing lower.

Happy hunting!

FCPO Week 43 2025: Consolidation or bearish to 4300?Happy Deepavali!

Price has shifted from bullish to a potential bearish. Momentum to go higher has been greatly reduced. A key reversal created on Friday could be the Lower High for a bearish move.

There is a potential of double top. Still early since it is yet to confirm. If price can break and close below 4490 then bearish could go and test 4300. Price will confirm double top once if break below 4270 area.

If there is no momentum this week then another consolidation is expected with a view for a break to a lower price.

Happy trading.

FCPO Week 41 2025: 4100 or 4600?2 scenarios next week MYX:FCPO1! :

1) Bullish: if price close above 4490 then it is bullish towards 4600.

2) Bearish: if price close below 4330 then it is bearish towards 4100.

3) Consolidation: If you trade consolidation there are about plus minus 150 points in between bullish and bearish scenarios.

Happy trading and good luck!

FCPO Week 35 2025: Retracement?The concept is that price didn't go up in a straight line. Therefore I'm expecting that price will retrace a bit towards 4330 area before continuing higher with 4600 as target. However if price fail to defend the support area (as shown in chart) then there is likelihood that price is going lower towards 4200.

Happy trading.

FCPO WEEK 21 2025: BEARISH.I think the price will continue lower next week. There is a brief retracement higher last week but the price went back lower immediately. Look at the weekly candle. A bearish key reversal that almost cancelled out the bullish reversal from the previous week. At this moment bearish is still strong therefore expecting price to go lower to test 3600 area.