SPY/QQQ ES/NQ 5 Mayo 2025QQQ Liquidity Map Analysis – May 5, 2025

Data Source: SpotGamma + Price Action + Option Walls

🔍 Key Levels and Zones:

Zone Type Price Level NQ Equivalent Commentary

Call/Put Wall (Major) 490 20230 NQ 🔴 Strong Sell Zone. High probability of reversal.

Target Area 3 488.33 20160 NQ 🎯 Possible intermediate resistance level.

Target Area 2 486.77 20100 NQ 🎯 Watch for reactions; aligns with “RB Head.”

Target Area 1 485.00 20030 NQ 📌 First bullish target; aligns with strong option wall.

Zero Gamma 484.00 — ⚠️ Equilibrium level — market may flip bias around here.

RB Bottom 483.69 19980 NQ ✅ Key reaction zone. Below here, bias turns bearish.

Put Wall (3) 480.00 19840 NQ 🟡 Strong support — possible bounce zone.

📈 Scenario 1: Bullish Case

If price holds above RB Bottom 483.69, we could see:

485 → First long target.

486.77 → Second long target.

488.33 → Momentum continuation.

490 → Final target & major sell zone.

🔼 Bias: Long above 484 / Confirm above 485

📉 Scenario 2: Bearish Case

If price fails to hold Zero Gamma (484) and breaks below:

482.14 → Short-term bearish target (19900 NQ).

480.6 → Extended target (Put Wall 3, 19840 NQ).

🔽 Bias: Short below 484 / Confirm below 483.7

🧠 Psychological Zones:

490: "Sell the rip" level — high call wall pressure.

484-485: Market equilibrium zone, pivot level.

480: Last stand for bulls. Below this, bears gain control.

🚨 Strategy Tips:

Use confirmation candles on the 15–30min for entries.

Combine with volume spikes or order flow data (Bookmap/Footprint).

Watch for reactions near RB Zones and Walls for intraday scalps.

💬 Summary Quote:

“The market moves where options dealers are forced to hedge. Identify their pain points, and you'll find your edge.” — JP Investment

Search in ideas for "BookMap"

Ethereum (ETH/USD) at a Crossroads: Technical and Macro AnalysisEthereum (ETH) is currently trading at a critical support zone around $2,800 - $2,850, facing key technical levels that could determine its next major move. However, beyond technicals, a significant macroeconomic event—the new U.S. tariffs on Canada, Mexico, and China—could introduce further volatility into the market.

These tariffs, announced by the Trump administration, include a 25% levy on Canadian and Mexican imports and a 10% tariff on Chinese goods. With potential ripple effects on global trade, inflation, and Federal Reserve policy, traders must factor in both technical and macro elements to navigate the Ethereum market effectively.

Ethereum’s Technical Landscape

Long-Term Structure (2W & 1W Charts)

• Ethereum is forming a falling wedge, a traditionally bullish reversal pattern if it breaks to the upside.

• The $2,800 - $2,850 region is a major support zone, with a key resistance area at $3,175 - $3,200.

• Breakout targets could extend to $3,600+, while a breakdown risks testing $2,500 - $2,600.

Medium-Term Outlook (3D & 1D Charts)

• ETH has tested the lower boundary of its descending wedge multiple times, showing strong buying interest.

• Volume has been increasing near support, indicating possible accumulation.

• The RSI (Relative Strength Index) is forming a bullish divergence—while price is making lower lows, RSI is making higher lows, a potential sign of reversal.

Short-Term (4H & 1H Charts)

• Ethereum recently rejected from $3,175, showing continued downward pressure.

• The Stochastic RSI is deeply oversold, suggesting a bounce is possible.

• The Bookmap heatmap shows strong buy liquidity around $2,800, reinforcing support at this level.

Macroeconomic Factors: U.S. Tariffs and Federal Reserve Policy

1. The New U.S. Tariffs

The Trump administration has announced new tariffs on Canada, Mexico, and China, including:

• 25% tariff on Canadian and Mexican imports.

• 10% tariff on Chinese goods.

• Canadian energy exports face a reduced tariff of 10%.

These tariffs are set to take effect on February 4, 2025 and could disrupt global trade, potentially leading to increased production costs in the U.S. economy.

2. Will Inflation Rise?

Historically, tariffs increase costs for businesses, potentially fueling inflationary pressure. However, it’s important to note that:

• During Trump’s first term (2017-2021), similar tariffs did not lead to major inflation.

• Inflation remained relatively stable until COVID-19 supply chain shocks and Federal Reserve monetary expansion in 2020-2021.

However, in the current environment, the impact could be different. With higher baseline inflation and ongoing Federal Reserve concerns, new tariffs may create additional inflationary stress.

3. Federal Reserve Response: Interest Rates & Market Liquidity

• If tariffs cause inflation to rise, the Federal Reserve may delay interest rate cuts—which could strengthen the U.S. dollar (DXY) and pressure risk assets like Ethereum.

• A stronger dollar historically leads to lower ETH prices, as crypto trades inversely to DXY.

• If the Fed maintains high interest rates longer than expected, liquidity in crypto markets may remain tight, limiting ETH upside.

Confluence of Technical and Macro Factors: What’s Next for ETH?

Given both technical and macroeconomic insights, here’s what traders should watch:

Bullish Scenario

✅ $2,800 support holds, leading to a breakout from the falling wedge.

✅ If ETH breaks above $3,175, next resistance at $3,600 comes into play.

✅ A weaker DXY (U.S. dollar) and Fed rate cuts could fuel a major rally.

Bearish Scenario

❌ A break below $2,800 could send ETH down to $2,500 - $2,600.

❌ If tariffs increase inflation and delay Fed rate cuts, ETH could face macroeconomic headwinds.

❌ If the dollar strengthens, ETH may see downward pressure.

Final Thoughts

Ethereum is currently at a major inflection point, both technically and fundamentally. While the falling wedge pattern suggests a potential breakout, macroeconomic factors—including new U.S. tariffs and Federal Reserve rate decisions—could significantly impact price action.

For traders, the $2,800 support zone is critical—holding above this level could fuel a rally, while breaking below it could signal further downside.

Key Levels to Watch:

✅ Support: $2,800 → $2,600 → $2,500.

✅ Resistance: $3,175 → $3,600 → $4,000.

Given the confluence of technical and macroeconomic factors, Ethereum remains a highly volatile asset. Traders should monitor economic data, Federal Reserve statements, and global liquidity trends to stay ahead of the next major move.

📊 What’s your ETH outlook? Share your thoughts below! 🚀

MATICUSD - Pivot Points - LIVE ORDER FLOW UPDATECorrelation with VARA is strong, MATIC price action drawn down by FUD pulling price into a bullish pocket.

Order Flow (Bookmap) Pivot Levels

$0.62 (Bearish Pivot)

$0.3751 (Bullish Pivot)

65% PLUS LONG POTENTIAL

VARAUSD - Levels, Bullish Squeeze Entry PointHere are my levels:

Bearish

.022

Bullish

.017

I tried to do a video to go over bookmap levels and demonstrate the squeeze live but I cannot speak well enough right now. I am tired and it still hurts to talk.

I have the 4-hour time frame on my screen which would be unusual for me usually but I want to show you before the breakout occurs, how a squeeze looks. Notice how the B-Bands have tightened very tightly at the far end. This is what it looks like before the price explodes.

In the video I was talking about how buying squeeze is more reliable than buying based upon wicks or 80/20 candles or hammers because in a falling knife pattern these candles can form there over and over, but with a squeeze, a tightening is an actual market event that precedes a price explosion.

You have heard the saying don't catch a falling knife, if you do it is a gamble. With trading everything is a gamble, but you can up your success rate by choosing signs that are more reliable statistically speaking. I have done a lot of my own statistics, some of the statistics others have already written about but with squeezes they are probably my most reliable indicator of a price explosion.

Alright, I am going back to bed, trade safe my friends.

VARAUSD - Bullish Fan PatternThe purple lines are order block levels represented on the micro 4 hour chart; these are subsequently minor resistance and support levels however order flow data from BOOKMAP confirms an order block of over 6.3 million coins exists at $0.025 up to $0.03. So, someone is protecting that level and also $0.02. So, with this being said we VARA is still rangebound as it has been for several months, since at least August when it first came up on my radar.

The yellow line is a bullish fan pattern and represents diagonal support regions. Typically on the micro such as this the gradient is too steep to maintain so the asset will pull back to what is in this case the next area of support $0.02. The asset will likely move sideways for a little while however, I cannot stress this enough...

Trade the range till the range breaks.

In saying that, don't listen to anything other than the chart. If the chart says, as it does, that the asset is range bound then the asset has moved into an accumulation. If you see on the micro as I have demonstrated that the asset has continued to bounce around in the micro range, zoom out to the weekly and turn on the BBands and look for squeezes.

Now for the good news.

VARA is confirmed in a bullish squeeze on the weekly. What we want to happen here is that it stays flat for a long period of time not exiting $0.03 and not exiting the bottom of the range and just bouncing between the general area of these levels for as long as possible eventually tightening into a long period of very flat indecision candle that will show hopefully on the monthly. Once this occurs, breakout to the upside is very, very likely.

I am not a financial advisor, trade safely my friends. Make that money.

MATICUSD vs VARAUSD - Correlation ReviewAs of today VARA is very close to being perfectly correlated with MATIC finally. It took a lot of bouncing around within the range but after Polygon posted losses and VARA's posted gains it is very close to exactly correlated. This IS bullish by the way for both assets because both assets share one common theme and that is that those very large order blocks have moved up, for VARA to approximately $.018 from $.0158 so a massive gain in support. Not only that but the order wall that was at $0.02 has dissolved. Short term these things don't mean much but long term as whales continue to accumulate coin volatility will be the name of the game. There will be a lot of movement so the only thing I can tell you is trade the range, don't do anything else. Shorting at the bottom of a range is just a bad idea, unless you are just desparate to get out and need the money for food, I would say go long at the bottom, short TP1 at least at one of the resistance areas. If you need help finding resistance lines, please download Bookmap or a similar order flow application, it is the only way you can see order walls. And, while price action doesn't always bounce off of order walls, (sometimes they collapse) most of the time they are of some use. Now, a TP1 is not a massive percentage of your coin, that is an insurance short, insurance because you want to have some of your coins liquidated in case the price pulls back, because as you are aware most of the time there is some pull back, no always but most of the time, that is until it doesn't which is why I said TP1 is not a large share of the coin. You hang on to TP2, 3, 4, 5 , 6, however many TP orders you want just in case the price moons. How many times have you sold a coin only for it to go way up and you FOMO in? Yah, exactly. So, insurance my friends, always use insurance which in this case is your TP levels. Look at it this way, if you TP1, and the price goes up you still have 80-90% of your coin. Cut your losses on that one, but look for TP2. If it still goes up you still have a large amount of coin. I hope this helps.

I am not a financial advisor.

VARAUSD - Bullish ReversalVARA is currently still quite behind in correlation so I believe a lot of catch up is going to occur within the next 24 hours. The weekly 80/20 candlestick that I've been eyeballing and expecting to turn green has flashed green multiple times as the red indecision hammer begins to signal a bullish Thor's hammer in which case would signal not only a bullish reversl but a substantial movement upward of the order wall below. This would mean, if backed by orderflow data within BookMap's heatmap that a drop below the current floor of this channel becomes very unlikely. Anytime price action taps a large order wall at the bottom of a channel something to watch for is absorption and breakage of the order wall. Some assets that tend to be bearish over a long period of time such as in the case of VARA whales who already own a massive bank of coin will buy the coin at discount prices creating a floor. This is not coordinated although in watching the market in these circumstances it feels as though the market is an Artificial Intelligence as similar minds think alike creating a group who is bullish at the bottom while also giving liquidity to the fearful or less experienced traders who focus way too much on assumptions, such as the assumption that unlocked coins would crash a coin further, even though there is no evidence of this and in fact the dump, if there was one, is actually over and happened upon initial listing of this coin on Coinbase. This is a similar story I have seen such as when I first bought SHIB when it was listed on Coinbase. Most coins that are listed now will crash because investors no longer see listings as bullish so don't believe for one second listing this coin on any number of platforms will be bullish, it is not necisarily true.

Trade the range until the range breaks...

When the range breaks, trade the new range...

Fud at the bottom is bullish...

Fud at the top is bearish...

This asset is bullish...

No news is good news for a new asset...

Unlocked funds will in large be staked...

This range is a whale accumulation range...

I am not a financial advisor, trade safely my friends...

BTCUSD - Large Order Block Candle PatternsThis common looking candlestick that I've circled here is a type of indecision candle can indicate the presence of a large bullish order block below it. When we do a quick overview of the order flow data available through BookMap's heatmap we can clearly confirm that a massive order block does indeed exist and support spans a substantial area below current price action. For this asset class this can justify marking the candle with a green dot which indicates a long entry was taken. The green dot which is substantiated by not only correlation between this asset and the DXY index but confluence from actual order flow data.

gold idea hidden orders sitting a bit higher $$$ #BookMap "Your income is directly related to your philosophy, not the economy." — Jim Rohn

This emphasizes the importance of mindset and attitude in achieving financial success.

We have orders sitting at the the top, you probably could see them if you were using book map

so I would buy and set a trailing stop loss as price rises up

VWAP will help us enter and exit so no need to list entry and exit

THanks and out

- Trade God

NQ idea $$$ no need for MapBook "Perseverance is not a long race; it is many short races one after the other." — Walter Elliot

I predict will be heading back to the support level where market makers left sellers looking very sad.

(19415 area)

If you were looking at Bookmap which I am not 9 times out of 10 it would show there are orders waiting in at area.

They have to drop price and come back and get that liquidity they left down in the 19415 area. (W) formed

Thanks and hopefully this information benefits you .... like share and follow chat !!!!

#TradeGod

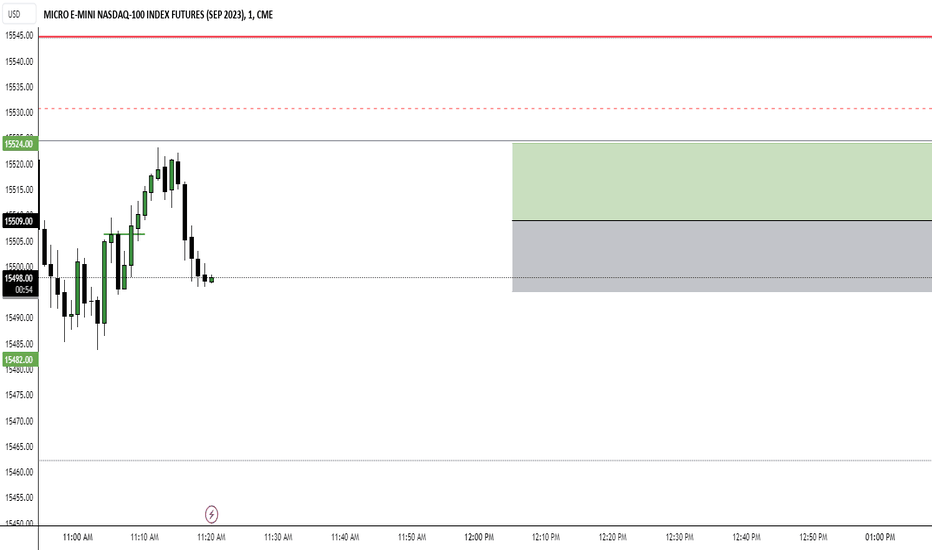

/MNQ - April 2nd, morning review

Interesting levels on bookmap

- 18425 for short

- 18380 for long (price just hit that premarket)

My levels

- 18450 for short?

- see how price reactions around 18380 at open for potential long

this is for trading in first hour of the open.

If we break and close below the 1D 20 SMA on the 1H, could slowly go lower for a little bit.. but expect alot of fighting ..

Price is flushing premarket as we post this.. so, lets see what the open brings.

BTC This cycle might actually be different.Bitcoin this cycle looks completely different than any previous one. We have never in the past gone up so high before the halving. There is no saying what BTC will do if we brake ATH pre-halving. Also the price mostly is driven by retail and ETF's no institutional buys yet. Google searches for "BTC" "Bitcoin" "Crypto" is still almost at all time lows.

When we try to chart, from now on DO NOT LOOK AT THE PAST CYCLES. It will mislead you.

Also indicators will try to screw us soon, so focusing on using more advanced tools than basic RSI will be needed. One advice - Learn to you Bookmap to understand what and how to follow BTC on there.

BTC weekend forecast into 12/25-12/26 - expect 44250So far, price has done almost exactly as I've predicted in my previous idea, which you can see right here:

We have made to drop to the level I forecasted according to historical bookmap orderflow analysis.

I predict we are on the verge of our shot up into the 44250 range. You should be going long now.

BITCOIN analysis for week of 12/24/23 - WITH ORDERFLOW ANALYSISThe previous week's analysis went to hell in a handbag fairly quick. Which is alright, not every single week's analysis will pan out, and one of the hallmarks of trading that many of you will learn is to be able to learn from what went wrong.

LINK TO SEE THE CURRENT ORDERFLOW HEATMAP ON BITCOIN FROM MY ANALYSIS:

imgur.com

Couple of things to note for next week's analysis. I am using Bookmap software to analyze order flow, and based on what I'm seeing on orderflow, I can match those clues up with the chart to see if I am able to piece together a broader picture.

In short, you cannot have one without the other. Charting by itself is dead, we live in a technologically ruled world, without order information, you cannot make a complete coherent analysis anymore. The big fish trade with algorithms, the key is to recognize their patterns that is visually represented on historical order flow and be able to make key observations about what levels the moves are at.

1) Based on order flow analysis, I am currently concluding that the 43900 - 44000 area is likely a good candidate for a reversal.

2) The orderflow analysis is confirmed by chart analysis that that price area will break above TWO separate channels, and is in an area where previous kill zones have trapped traders before.

3) It is also an area where the weekly 1st STD DEV upper band comes into play.

All three of these data points lead me to believe there is a likely long trap being set up in that area.

My current theory leads me to believe that price will challenge the recent bottom, and likely even crossing below it. There are some indicators already in play that is showing us that that lower level around 43300 has been consistently tested and defended by market makers.

Therefore I am currently of the theory that price will likely bounce around the trading range we have created since the 20th, for now. This can change during the week, because I expect a heavy shakeout to be a scenario for the upper and lower ranges of the trading range we are currently in.

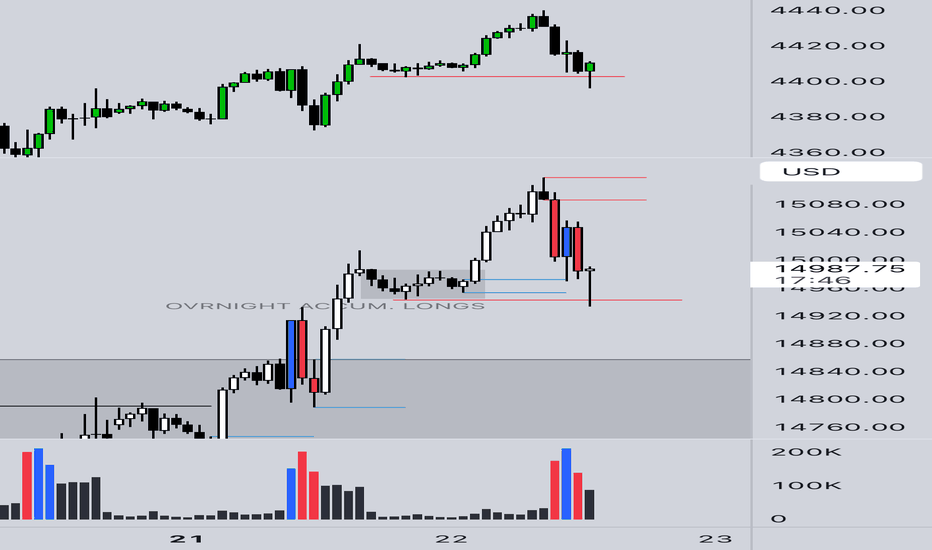

Nasdaq/NQ Prediction for NFP DayRefer to my previous forecast where I called for buys near September Low to above the daily highs from last week.

NFP, if you're still long, you can use the release to take profit and get out of your position.

Daily downtrend will resume after. You can look for safe selling entries around the Supply zone shown (high volume on market profile).

Wait for the Lower time frame/Bookmap to give a clear entry. If you made a good profit on the buy, then dont attempt to trade the sells til next week.

Back to Charting Again!* NQ1! Chart for 6/12 S/D LevelsTargeting R1 as a push through this resistance supply 4hr zone. I skipped the NY opening bell, and when I hopped on later in the morning, we were making bull strides to move up. VWAP and EMAs continued up by following PA so it didn't seem to waiver that we would fail dramatically to the downside. However, looking back for possible demand zones for later this week as we have FOMC and CPI/PPI being released. Looking for small points between 5-20 pt moves to avoid being chopped to much and using range/liquidity areas for targeting. I recommend using bookmap for your further conviction in seeing the order flow.

Throughout this week looking for BEAR targets at S1 14625 or lower to fill the gap we created to 14520. BULL target throughout the week is 15100 or 15231 *nearing* the double top resistance of Jan/March 2022.

Link for chart: www.tradingview.com

NQM2023 5/8-5/9 S/D LevelsManipulation is coming into affect as CPI is Wednesday and PPI is Thursday. My trade idea stands as mentioned in yesterdays post. We may have some further rejection from this strong 1HR supply zone or as we have found ourselves inside of it twice now, we may have enough push for the bulls. No specific targets aside from the pivot P, R1, and S1 as areas of interest. Also liquidity levels found on bookmap intraday but as of time of posting, staying open minded for this week is full of reported numbers.

BTC inverse Head and shouldershey waaasup everyone,

If you have been following me lately you would of already seen my TA on BTC.

Heres an update, It has played out as expected so far and BTC is very close now to that red vector range and big volume gap.

It is still in its range (blue box).

I have now spotted a much bigger inverse haead and shoulders pattern (light blue) but also some confluence of the small decending wedge that BTC is in right now. That would put BTC very close to the liquidity above.

Bookmap is showing Liquidity for BTC at 23K, 24K, 24.35K, 24.65K, 25K.

also at 21.7k but there is over 339 btc at 23 K so thats a wall right there and also 456 btc at 24 K, so thats the range 23-24K.

I am still bullish on BTC, Happy Sunday everyone, and enjoy the rest of your weekend :)

Daily plan ES/SPX 18NOVGamma Pin Level AT 4000 (SPX) (primary tgt)

Bias: Leaning longs to touch Gamma Wall. 2nd scenario 3900 Putwall (SPX)

Vol trigger: 3940

Putwall: 3900 (Secondary taret)

Trades are based on Pivot reversal points, Volume profile and Gamma option levels.

Look at these trades for potential areas of intrest. Marked are the most probable ranges where a window of opportunity can be found and traded.

I use bookmap as a tool to optimise the entries based on Volume profile.

No bias here, and will always let price-action dictate