Search in ideas for "CANDLESTICK"

Gold ConsolidationGold is consolidating between a rising wedge pattern at the moment. It is still in an undecided territory at the moment because the momentum in the past few days has been clearly down, but yesterday's daily candle managed to close above the previous daily resistance level of 3,345. If we see healthy candles closing below that level (which will also break the lower boundary of the wedge pattern), then we can start looking for sells. I will look for buys only if the price closes above the resistance level (marked as a red zone in the chart) at around 3,380.

US30 Scalping Ideas for NYSE open todaySince the NYSE brings a lot of volume, we can look for both buy and sell ideas depending on how the candles behave. I will wait for the first 5-minute candle after the NYSE open to plan my trade.

Higher timeframes (weekly, 4H, and the hourly) all look bearish except for the bullish close yesterday, so my bias is still bearish. Unless we see some tariff related good news or any other fundamental news release, the continuation most likely can be towards the downside.

Happy trading!

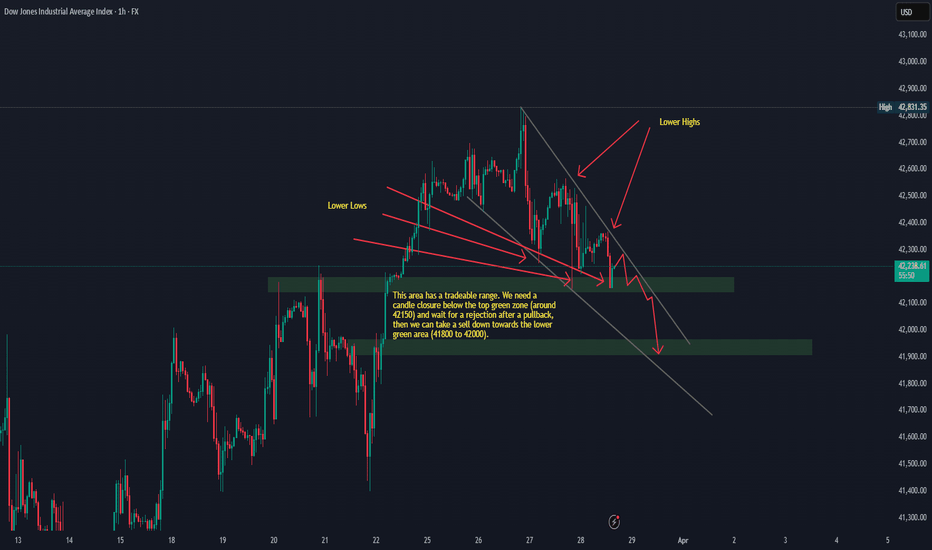

US30 Sells Idea for the New York SessionUnless we see some news come out on tariffs, we could see some downside on US30 today. It is falling inside a wedge pattern right now, and I expect the price action to fall within that wedge with a potential to go down during the New York session. I will be waiting for a break of the upper green zone (around 42150), then a pullback and rejection, to take sells down towards the 42000 (and possibly lower) areas.

I am not looking for any buys on US30 today, unless I see some really big green candles towards the upside during the 9:30 am EST.

Gold Bulls Again!Following significant buying activity during the Asian session today, spurred by Trump's announcement on auto tariffs, gold prices have begun to cool off and are retracing towards the 3050 region. If the price reaches this level and forms support on the lower timeframes (30-minute to 1-hour charts), there may be an opportunity to take quick buy positions similar to yesterday's trades.

At present, selling gold is not advisable, as tariff-related news could trigger volatility at any moment. For buy positions, it is recommended to wait for the price to retrace and confirm that buyers are actively stepping in. This approach minimizes risk and ensures a favorable risk-to-reward ratio.

Wishing you a successful trading session and a fantastic Friday ahead!

Bitcoin Intraday Trading IdeaBitcoin has been selling off throughout the day today and looks set to tap into a major support level at 84500 to 85000. If we see a bounce from that level then we can anticipate price to reach around 86200, which could give us a good opportunity to ride the train down again.

If the major support area does not hold, then we can look for candle closure below that to possibly take bitcoin towards the region of 83000 to 84000 today.

Gold Bullish Continuation and 3037 RetestAs highlighted in today's earlier update, the price has successfully retested the 3030 level and subsequently tested the 3037 level, which serves as a 30-minute resistance. If the price closes above this level and retraces to gather liquidity around the 3035 area, it could provide greater potential for upside scalping opportunities.

For those who entered around the 3030 mark based on the earlier analysis, keep an eye on the 3037–3040 range for any notable reactions. If the price closes above 3037, we could see a smooth continuation. However, if the price falters and forms a strong bearish candle, consider partially closing your position while setting the remainder to breakeven. This approach leaves room for a fresh attempt during the New York session. Cheers!

Gold Daily Update - Looking Bullish!Gold has successfully broken above the critical 3030 level, at least on the shorter time frames of 30 minutes and 1 hour. It has closed above this level and is now retracing slightly, possibly to test the area again. If the price holds above this level during the London session, further upward momentum is likely. The first target could be a retest of the 3050 level, and depending on the volume during the New York session—particularly at the New York Stock Exchange's opening at 9:30 AM EST—it might even attempt to retest its all-time high.

Given this price action, the downside appears limited for now, and I wouldn't recommend shorting this market at the moment. Even though we're approaching the end of the month and quarter, when fund managers often rebalance portfolios or book profits from recent gains, the momentum currently seems firmly bullish. Shorts would only become a consideration if the price closes decisively below 3030, fails to reclaim that level, and gradually breaks below 3015. Until we see such developments, the current trend favors the bulls.

Wishing you a great day and week ahead! Don't forget to like and subscribe to my channel to keep receiving free analysis and content.

Gold Trade Idea for today - March 25, 2025Gold has been in a strong uptrend recently, but towards the end of last week and the beginning of this week, selling pressure has emerged, leading to increased downside momentum. It’s worth noting that this week marks the final full week of March 2025, signaling the end of the first quarter. During this period, money managers and funds may rebalance their portfolios, potentially taking profits on their long positions.

For the remainder of the week, gold is likely to exhibit bearish tendencies unless it manages to break above the green downward-sloping channel (potentially resembling a flag pattern). Price action may test the 3,000 level, and there's a possibility of breaking below it. However, if gold finds support around the 3,000 area and holds steady, it could present an opportunity to consider long positions.

Potential 30 minute quick scalp on GER30.Price has broken below the previous support after some consolidation. So watch out for retracement to the support (now turned into resistance level) and continuation downwards.

This idea is valid if the 30 minute candle closed below the red resistance level. It is important to wait for a pullback to that zone again to allow price to pick liquidity before moving down.

GBPJPY Daily AnalysisPrice action has not been clean, and the recent upside has found a resistance at around 195 level. We are not keen on any sells at the moment but will look for buys if 195 level breaks and price sustains there for some time (30 minute of 1 hour closure should be enough). That will open doors for price to target around 197 levels. Alternatively, if price drops towards the green support zone, then we can look for buys again after watching for any reaction in that zone (30 minute of 1-hour bullish candle). We need more information for any sells at the moment.

Gold Daily AnalysisPrice has been ranging in the lower timeframes after making a fresh high of around 3057. There are no significant data releases today so it could range further between the red resistance and green support zone. However, since today is Friday, we could see an end of week profit booking, which could make the way for some sells. But beware that gold has been in a massive uptrend fueled by geopolitics, and it could make a way up at any time. Any sells may have to be accompanied by regular profit booking and continuous monitoring since price to spike up at any time based on war tensions or tariff news.

BTC Daily AnalysisPrice has been forming a bearish flag pattern and it may bounce around in the parallel channel before making any significant move towards either side. But, based on the bearish momentum over the last couple of weeks and the previous daily, it is increasingly likely that the next move could be downwards at the break of this channel.

Potential longs on USDJPYUSDJPY has surged higher following the release of lower-than-expected CPI and PPI data over the past two days. The pair is currently heading into a resistance zone at the 149.2 level. If it manages to close above that level, then it could retest 150 and then eventually to 151.2.

For shorts, I would not be thinking about shorting it at the moment and would only consider it if it manages to close below 148.2 and fails to break above it.

Happy weekend and happy trading guys! Please do not forget to like and subscribe so that I can continue bringing more free analysis to you on a daily basis.