XAUUSD (Gold) daily market analysisThe momentum is still up and it looks like gold is poised to retest the 2950 levels again, unless we see some healthy candle closures towards the 2895 levels.

Join me, a CFA charterholder, as I breakdown the daily market scenario for XAUUSD (GOLD). Whether you're a beginner or an experienced trader, this video is packed with insights to help you improve your trading game. Don't forget to like, comment, and subscribe for more trading tips and strategies!

Search in ideas for "CANDLESTICK"

GBPJPY analysisAfter two days of bullish candles, GBPJPY is still within the ranges of 189 to 193. However, it could present some good intraday trading opportunities during the London and NY session today. As I write this, the price has already broken below the 192 level and is hanging around the 191.2 level. If we see then level break, then we could see it make its way towards 190.2. If it finds suport at this level and goes up to the 192 level again, then it coulf present with a nice shorting opportunity to test the 191.2 levels again. The momentum seems to be towards the downside today and I would not buy this market unless I see some really healthy bullish candles towards the upside. At the moment, it is about waiting for the retracement to sell again.

There is big data release during the NY session today, so the overall direction could be dictated by what the data is like at that time.

BTC Bears?The momentum seems to be clearly down for Bitcoin at the moment. There was a spike up after Trump announced that Bitcoin could be used as a strategic reserve in the US, but then made its way down again showing weakness in the market. For today, there is an inverse head and shoulder pattern coming to play, where the neckline is failing to break above the 84,200 levels. As it hangs around there, there could be more shorts opportunity towards 81,000 and possibly down. However, if it breaks above that neckline and then manages to close above, then it could open the way for price to move towards 86,200.

There is big data release today during the NY session, so it could range before the data is released.

Quick update on XAUUSD (Gold)As posted earlier in my analysis, we were looking for an entry around the support formed during the Asian session. If you took that, please consider taking some profits now. The overall target for today is 2050 but we will have to watch out for 2045 level, which is the previous level of resistance.

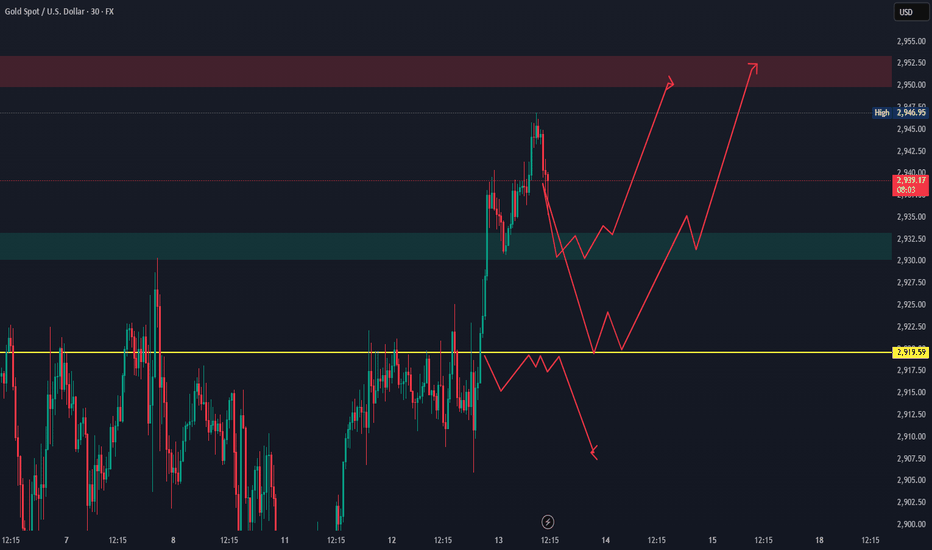

Gold BullsGold (XAUUSD) finally managed to close above the 2930 resistance level at the back of the weak CPI data yesterday. We have already seen it trying to retest the 2950 level during the Asian session today and as I write this during the pre-London session it is pulling back a little bit to make what seems like a big move up again.

The momentum is clearly up and I would not short this market at the moment, even if it is nearing the all time high levels. During the London and NY session today, the best best would be to wait for a pull back around the 2930 or 2920 level, wait for support to be made before taking it towards the high again. There is a chance that it could range before another data realease today during the NY session, so the move could be delayed after the NYSE open at 9:30 NY time.

Gold resistance at 2922Gold is fighting with the 4H resistance at 2922, which also marks the neckline of its head and shoulder pattern. Best entry will be for it to close above 2522, retest that level again. That will open the doors for the 2525/26 area and possibly higher for today. Conversely, if gold starts breaking below the 2,890 level then it should open door for more downside.

Gold daily updateAfter yesterday's bullish move during the London session, we saw some some predictable profit taking during the New York session. The move is still towards the upside though.

The Asian session today is hovering around (and starting to break below) yesterday's hourly trendline, which indicates that a retest to the 2,890 area is on the cards. This will take the price towards the top (or the base if you look at it upside-down) of a reverse head and shoulder pattern.

If we see price make a support around that area, then gold is poised for another move up to retest the 2,920 area. However, if price fails to make a support at 2,890 and breaks further down then we could see some more movement downwards towards the 2,860 region.

BTC BearsYesterday's bears cancelled out the buying during the weekend and the crypto reserve news from Trump. Makes sense for another leg down..either a sell position from around 86,200 with a stop loss around 87,000 or if it breaks below 83,015 with a stop loss at 84,800 with 82,500 as a watch zone. target will be 80,700 followed by 79,200.

JPM shortJPM demonstrated a weakness at its bottom part of the month candlestick. For now it is in the bearish area, where from it could be started down rally.

It is reasonable to follow after best entrance point with small stop and good R:R.

The idea cancel is month close above 222.50

Will be updated later.

NZDUSD: Head and Shoulders Pattern CompletedThe NZDUSD pair has completed a head and shoulders pattern on the daily timeframe, with two bullish engulfing candlestick patterns appearing in the last shoulder,

indicating strong momentum pushing the price higher. On the 4-hour timeframe, we can see that the price has broken out of the downtrend and failed to make any lower lows, supporting our view that the price has reversed from a downtrend to an uptrend. However, the price needs to break above the neckline and resistance level at 0.62680, which it failed to do last week. Also, the 200-period moving average on the 4-hour timeframe may act as resistance. Therefore, we expect the price to dip slightly to the area between 0.62243 and 0.61925 before waiting for a buy signal to push the price towards 0.63550. If the price does not bounce off the support area and breaks above the neckline, that would be a signal to buy towards 0.63550.

-------------------------------------------------------------------------

Let me know your thoughts in the comments, and show your support by liking the idea.

Please follow if you're interested in more ideas like this.

Your support is greatly appreciated!

EURUSD sideways amid conflicting forcesEURUSD is currently influenced by two forces: the head and shoulders pattern and the bearish engulfing candlestick from March 15th.

However, it is also moving sideways due to market indecision in recent weeks. Looking at the 4-hour chart for future price analysis, the price appears to be moving between two levels, 1.0692 and 1.0535, as shown in the dark grey box on the chart. I expect the next price movement to bounce off the upper end of the sideways range at 1.06900, which is also a previous resistance level and the 61.80 Fibonacci level, before heading downwards towards the previous support level at 1.05350. If it breaks this support level, the head and shoulders pattern will be confirmed and we can expect further downward movement. If it fails to break the support level, it will move in another wave within the sideways range.

If it doesn't bounce down from 1.06900, its first target will be at 1.07503, and then continue to rise. This is because the 4-hour chart shows a triple bottom pattern with slight divergence in momentum indicators.

-------------------------------------------------------------------------

Let me know your thoughts in the comments, and show your support by liking the idea.

Please follow if you're interested in more ideas like this.

Your support is greatly appreciated!

Gold Price Analysis for Next WeekThe weekly chart for XAUUSD has formed a bullish engulfing candlestick pattern, indicating that the overall trend for gold in the upcoming days, or at least for this week, is bullish. We can also see these signals on the daily chart. Thus, we have identified the general trend for gold.

To determine and analyze its movement during this week, we move to lower time frames (from 8 hours to 1 hour), where we find that the price is moving in an upward channel.

It has reached the upper edge of the channel, which is also located in a supply zone and resistance level. We expect the price to correct towards at least 1846 before resuming its upward movement. It may correct further towards the level of 1830, and this scenario is not unlikely, especially since major economic institutions and banks prefer to enter at the lowest possible price to achieve maximum benefit. The price may then rise again, targeting the level of 1865 or even 1870.

It is strongly not recommended to trade against the trend unless with extreme caution.

-------------------------------------------------------------------------

Let me know your thoughts in the comments, and show your support by liking the idea.

Please follow if you're interested in more ideas like this.

Your support is greatly appreciated!

NDX Hanging Man DojiNDX has a 1D Hanging Man candlestick. Could this be a signal that prices may start falling?

1D RSI is overbought but has been to 80 in August and March 2020. It could have a little bit of juice left but not much.

Candle closed within BB so not over extended there.

NDX has been on a great climb with no healthy correction. I see more potential for profit taking vs entering at this elevated level.

Good Luck

Long Entry for XAUUSDGold is struggling to break above 1795.000.

You will see two candlesticks that I drew on that line.

A & B: 30-MIN Timeframe, we want price to break and close above 1795.000 with a strong bullish candle.

C: Go down to the 5-Min Timeframe, this is where we will look for entry.

D: We want the 5min candlestick to close and look similar to the one I drew, The candlestick must retest 1795.00 with only the wick, and close above that level. When 5 min candle has closed we can then take our entry.

20 pips in profit, move SL to Break even.

TP 1812.500

BTC MOVING IN THE SAME PATTERN: A MUST SEE Consolidation Sideways at the top.

I've conformed two candlesticks are look alike for price action.

Laid out pivot zigzags which I found on a 50 minute time frame.

First candlestick has a high rate value which in my trading qualifies as a body hammer.

Both patterns are trending in the same pivot format.

PIVOT PATTERN reads $71,557.60

LONG - AUDNZD - 30MPAIR:- AUDNZD

INSTRUMENT:- Forex

POSITION:- Long

TIMEFRAME:- 30 minutes

STRATEGY:- Dow Theory + Bullish Reversal Candlestick Pattern

REASON:-

* Multiple bullish reversal candlesticks in uptrend

* Downtrend pattern changed to uptrend

* Large bullish candles, sentiment towards upside

Entry @ CMP

Take Profit @ 1.10788

Stop loss @ 1.10139

Risk to Reward:- 2:1

Hammer Time!!!Not many analysts on Trading View study candlestick patterns which is why I've started doing this. Hammer candlesticks are quite rare on the daily timeframe, but are almost always bullish for the following days when found at the bottom of a downtrend. As long as this doesn't change too much and we close like this in a couple of hours time, we should start scaling our FIAT back in as its likely we have seen the bottom of this healthy market correction.