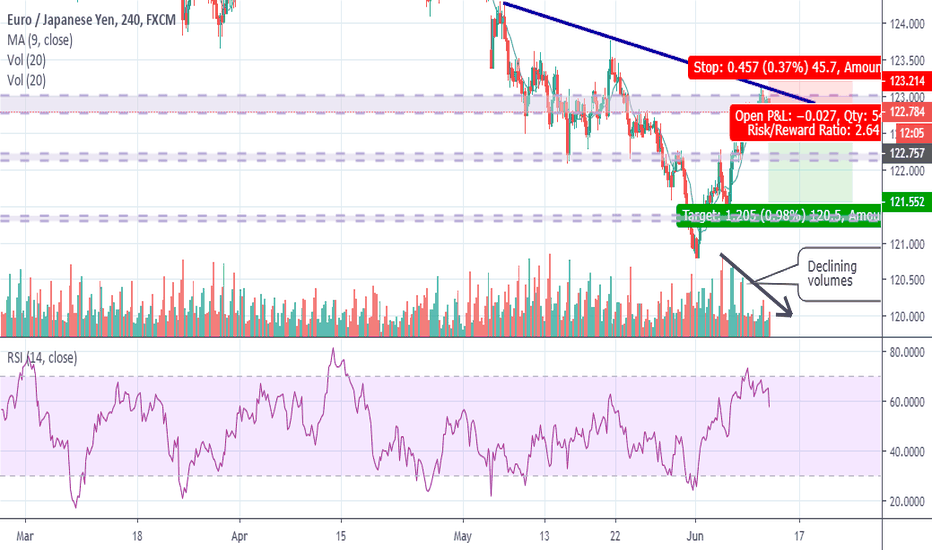

forexTrdr EURJPY - BACK AT RESISTANCE TIME TO HEAD LOWERMorning traders,

Nice short setup on Euro versus Japanese Yen on our trading view chart with the pair running up to resistance levels around 123 and at the same time trading volumes are heading south just as the overall market goes risk off again. Using this as the perfect opportunity to position for more risk off headlines from China trade talks after the remarkable bounce in tone last week on the Mexico trade deal - which no one cared about before!

Keeping it simple with this trade, tight stop loss just above resistance levels and aiming for a move back down to 21 day moving average around 122.4 and further break towards 121.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

Search in ideas for "FOREX"

forexTrdr GBPAUD- POUND BOUNCE FALTERING, NEXT STOP 1.80 AREAMorning traders,

Looking at the setup on British Pound versus Aussie dollar which we played from long side last week and are now looking to play from the short side with British Pound running out of upward momentum back at the resistance area highlighted in our trading view chart and looking likely to head lower again.

The price action also shows up on the indicators with RSI failing to break 50 again and Stochastic turning lower from this resistance level around 1.82. We are looking for a retest of lower support around 1.80 over the next week

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr EURJPY - GROUND HAS FALLEN AWAY- NEXT STOP YTD LOWMorning traders,

Looking at the setup on Euro versus Japanese Yen which after breaking below support at 123.5 area, and more importantly holding below as per our trading view chart, the pair is opening up a retest of year to date low at 118 area.

The break below 123.5 area leaves very little in the way of near term support providing a great risk reward setup with resistance to upside at 123.5 to 123.7 and the next level of support at 118 area.

We have also highlighted on our chart the RSI bearish trend line and the inability to break above 50.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr NZDUSD - CLEAN EASY SHORT ON STRONG RESISTANCEAfternoon traders,

Looking to enter a short trade on New Zealand Dollar versus US dollar after the pair have failed on numerous occasions to breach resistance just under 1.06.

Add to this that the pair is extremely overbought on stochastic and the price patterns pointing to a move lower as per out trading view charts.

Clean simple trade with a the ability to trade with a very tight stop loss just north of resistance and look for a retest of March lows around 1.03

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr AUDUSD- KANGAROO GOES UP BUT MUST COME DOWNMorning traders,

After a positive surprise for the market on Australian elections as Conservatives keep power via coalition and the polling companies have yet another shocker after predicting in the last 50 polls that Labour would come to power. This mild positive and the oversold nature of AUD led to a large short squeeze with AUD trading up 70 pips from Fridays lows.

We are looking to sell this short squeeze and look for a move back down to mid 68 area. This is confirmed by the formation of a hanging man on the candles, the oversold nature of Stochatics and failure to trade and hold above 50 (bullish) on RSI.

As always we try to keep our analysis clean and easy for anyone to be able to follow but should you want to learn more then please do get in touch.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr EURJPY - SHORT THEN LONG ON DIVERGENCE BREAKOUT COMINGMorning traders,

Looking at Euro versus Japanese Yen and stochastic divergence forming to suggest we are looking at a move lower withing the channel then a break out higher over the coming trading sessions. As per our trading view chart we have higher highs forming on stochastic with lower highs on pricing. When this occurs it tends to point to a breakout higher in pricing over medium term but with a pull back first.

We are going to play the short down here within the range then look to get long to catch the breakout. We can play this with a tight stop loss should price break out earlier than the pattern would suggest and look to switch directions should that happen.

Comments and feedback are always appreciated from anyone in the trading community

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr short Gold - FALSE BREAKOUT YESTERDAY?Morning traders,

Yesterday we caught the gold long from 1285 up to 1297 before taking profits and we are now looking to switch the trade to play it from a short side with both RSI and stochastics overbought and at levels where we have seen a pull back. Additionally the pair is at resistance level around 1300 which we have highlighted on our trading view chart work.

Clean simple trade backed up with Trumps tweet overnight of feeling like China talks will be successful and markets moving back to a risk on tone.

Comments and feedback are always appreciated from anyone in the trading community

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr GBPAUD - HEAD SHOULDERS, KANGAROOS & TEAMorning traders,

Looking at British pound versus Aussie dollar here where we see the right shoulder forming on a potential head and shoulder pattern which points to British pound dropping lower in value versus Aussie dollar.

On our trading view chart we have highlighted the break higher yesterday and overnight failed to breach a prior high of 1.8669 in late April and has since turned lower forming multiple hourly candles below.

Despite even more negative rhetoric from Trump on China overnight British pound failed to hit the prior highs of 1.90 or the resistance level mentioned at 1.8669. This adds as a confirmation of our view that this pair will turn lower down to 1.85 area and potentially lower.

As always we try to keep our analysis clean and easy for anyone to be able to follow but should you want to learn more then please do get in touch for more trades.

Comments and feedback are always appreciated from anyone in the trading community

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr USDCHF -OVERSOLD FINALLY PLAYING OUT? 3.5x RISK REWARD

Morning traders,

We have been watching US dollar versus Swiss Franc for sometime and even been burned on a prior short as the pair has continued to trade deeper and deeper into overbought territory over the past couple of weeks. But the market appears to be finally turning lower with the past 5 days trading sideways to lower as volumes have dried up and the move higher has ran out of steam.

We can see this turning lower from the high represented clearly on RSI and stochastics with a crossover and turn lower. Additionally given the recent high we are able to trade this pair on a high risk reward (3.5x) should we be correct with a stop loss set just above the previous high

As always comments and feedback are always appreciated from anyone in the trading community

Have a good week trading!

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr AUDUSD - OVERSOLD, 2X BULLISH HARAMI & UPTURN IN STOCHMorning traders,

Lovely technical set up in Aussie Dollar versus US dollar after the recent strength in US Dollar taking this pair to the bottom of its recent 70 to 72 range including what looks like a false breakout yesterday down to 0.6988.

Looking to enter a long at the market following a combination of technicals adding to support. Firstly we saw two back to back bullish harami candle formations yesterday which suggest a future bullish trend. Secondly the pair failed to close below key technical level of 0.70 on the daily and formed a doji candle pointing to a change in future direction. Thirdly RSI has been stuck in very oversold levels and lastly Stochastics is showing a turn higher from oversold levels.

Our only issue is that later today we have US GDP data which may provide US dollar strength. As such the higher risk news event should be considered on sizing this trade.

As always this is not a trade recommendation and simply technical observation.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr Gold- DESCENDING TREND, 3X LOWER HI + OVERBOUGHTGood morning traders,

Looking at gold versus US dolllar here after the weekend news of Trump looking to escalate trade tensions with China, completely against what the business media had been suggesting last week of a deal being finalised this week. Fake news it appears! Needless to say markets were risk off and gold has spiked back up to resistance levels around 1282-1285 where it has steadied.

On our trading view chart we have highlighted a descending trendline forming on the upper wicks from three spikes forming a series of lower highs. Unusually for us we have provided a secondary chart down at the bottom of our trading view chart to show hourly moves which show the market has met resistance around 1283 area today and is currently pulling back slightly from that region. This is in line with a trend forming on RSI and an overbought status on stochastics.

This week looks like it could be a challenging week driven by Trump China headlines so we will be looking to keep our lot sizes low playing risk close to home. If the trade plays out as we expect we would be looking at levels around 1272 to take profits giving us a 2.4 risk/reward.

As always we try to keep our analysis clean and easy for anyone to be able to follow but should you want to learn more then please do get in touch for more trades.

Comments and feedback are always appreciated from anyone in the trading community

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr GBPUSD- ARE TRENDLINES THE POUNDS FRIEND?Morning traders,

Looking at Great British Pound versus US dollar which has come up to resistance levels around 1.31 as highlighted in our trading view chart. This idea comes from a combination of price action and technicals.

On our chart we have RSI and bollingers both forming bullish trendlines to match price action of higher lows since late April. We also have added a trendline dating back to the February low which may come into play should the pair pull back.

Keeping this trade simple but as always with British Pound our worry is we are always one headline away from Brexit noise which could impact our trade for better or worse.

Comments and feedback are always appreciated from anyone in the trading community

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr GBPAUD - OVERSOLD & MILES ABOVE THE CLOUDSmorning traders,

New day but similar story across multiple G10 forex pairs with many at extreme oversold levels whilst at resistance levels and the market questioning if the moves continue or we see a reversal. One such pair is British Pound versus Australian Dollar.

We had entered this pair yesterday but poor data out overnight on Australian building permits took the pair through our stop loss but since then we have had results out of British local elections which are pointing to the electorate being extremely fed up with the two major parties around Brexit. Conservatives in particular have had a very poor result which will only result in more pressure mounting for the party to remove May as Prime Minister. A such British pound has been heading lower since the Aussie permits data.

We are looking for British pound to continue to head lower pulling back from extreme overbought levels and levels which are some 50-60pips above where the Ichimoku cloud is. As per our chart work on trading view you can see both RSI and stochastics at extreme overbought levels and additionally the turn down starting to occur. We specifically waited for this for confirmation that the pair is heading lower to minimise the downside risk.

Market is also expecting to hear a positive outcome from US and Chinese trade talks next week with CNBC runnign multiple stories of a positive conclusion expected by the end of next week.

As always we try to keep our analysis clean and easy for anyone to be able to follow but should you want to learn more then please do get in touch.

Follow us on tradingview under forexTrdr to get our sample ideas free and immediately - its free to setup a profile and the charting tools and software is easier to use than Metatrader and most broker platforms.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr USDCAD- CLEAN SIMPLE BOUNCE FROM EXTREME OVERSOLDMorning traders

On what is likely to be a slow day with Japan still out for golden holidays and most of continental Europe out for May day holidays those that are in the market are in a holding pattern for tonight's US central bank meeting. Speaking of which anyone looking to trade USD is advised to ensure their stop losses are well managed and set at appropriate levels just before the event to limit any downside or losses.

With that being said we are looking at a long on US dollar versus Canadian dollar driven by multiple technicals pointing to a likely turn up higher from current levels. The pair sold off overnight down to support levels around 1.34 where it has steadied any selling volumes have subsided. This also coincides with RSI trading around 30 which points to an oversold nature and stochastics crossing over and ticking up from an extreme oversold basis.

As above the caveat with what looks to be a great setup on our tradingview chart for a move back to 1.3450 and potentially 1.35 is the US central bank meeting later tonight.

As always comments and feedback are always appreciated from anyone in the trading community

Have a good week trading!

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr EURUSD- MAGA GDP OUT THE WAY LETS BOUNCE Afternoon traders,

US GDP smashing estimates yet again with a 3.2% growth versus expectations for 2.3% but this pair, Euro versus US dollar failed to trade (and hold) near yesterdays lows giving us confirmation that a near term bottom is in for the time being and that Euro is likely to head higher from here.

US GDP is a high impact event and for all traders it is something you want to avoid setting any new USD trades in the other prior to it unless you have high conviction and multiple indicators to back it up. Now that GDP is confirmed we are able to enter the market with a clearer view on what this pair is likely to do.

As per our trading view chart RSI is extremely oversold and the market appeared to find a bottom on a close level around 1.1125-1.1130 from which we have at least one candle bouncing higher from- the lower wick on the prior 4 hour candle.

We are looking to play a combination of profit taking into the weekend on shorts on Euro Dollar and looking to play the oversold nature of this pair.

As always this is not a trade recommendation and simply technical observation.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr AUDJPY Afternoon traders,

Looking at Aussie dollar taking advantage of the golden week Japanese holiday and its bounce back from oversold status against US dollar. The pair is trading at 100 day moving average (78.85) having found support around low 78 area and the formation of two bullish candles on the 4 hourly highlighted in our trading view chart.

This isn't the highest of conviction trades and is less technical driven than previous trades but we are looking at price action and looking for a move back into the 79.5-80 trading range after a period of consolidation around 79.2 as highlighted in our chart.

As always this is not a trade recommendation and simply technical observation.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr SundaySetups GOLD - TO RESIST OR TO SUPPORT

Good afternoon traders,

As part of our #SundaySetups we are taking a look at gold and its recent wild ride from 1350 area all the way back to the high 1270s. Looking at our trading view chart we have tried to cut out the noise, zoom out to the daily charts and highlight the support line that Gold has found at the 1275 area. Gold traded sideways for the large majority of last week before breaking higher to test resistance around 1287 closing at the top of the candle daily range suggesting we may see a break higher into next week.

Mondays trading will be key for gold, a move higher breaking through both price resistance at 1287 area and the RSI declining trendline we have highlighted would lead to a retest of the descending trend line around 1298 before a likely pull back and a fall back into the higher lows pattern and closing the week at a similar price to Fridays close. Both the volume on Fridays move higher and the stochastics crossover and turn up higher from last weeks oversold nature add weight to the potential retest of resistant around 1298-1299.

Quick clean technical analysis that hopefully everyone can follow.

As always comments and feedback are always appreciated from anyone in the trading community

Have a good week trading!

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr SundaySetups GBP- WANT A CUPPA OF GREAT BRITISH POUNDGood afternoon traders,

As part of our #SundaySetups we are taking a look at the good old British Pound versus the Aussie Dollar. Unlike our gold setup we are sticking to our 4 hour favoured time frame and highlighting the formation of a Cup pattern on our trading view chart and potential break out higher for the pound.

So looking at our chart we started last week in a consolidation pattern with many market participants out for Easter holidays, by Wednesday we had a strong break out higher after inflation data from Australia and since then we have had a lower higher lower lows pattern forming. The key part of this however is that we had a bounce and close above support around 1.8315 then a close higher on the daily and weekly. Now since 8th of April we have started to form a Cup pattern, a U shaped pattern forming over the 2 week pattern with periods of consolidation and closing with a strong break higher followed by a series of lower highs and lower lows forming the handle part of a cup. When cup patterns form the handle part is followed by a breakout higher- in this case we would be looking for a retest of upper resistance around 1.8460 to 1.85 providing upside of 150 pips.

Secondly on RSI front we have been able to close above 50 since last Monday and maintaining this into early part of next week gives further confidence to the idea that the pair are due to break higher towards that 1.85 resistance area. However we would look for confirmation of this both on RSI front and stochastic crossover and turning higher before pulling the trigger on a long.

As everyone is well aware British pound is dominated by political headlines around Brexit and a (never ending story of) potential leadership change within the Conservative party so capital at risk has to be reduced to account for a higher risk of the unknown.

As always this is not a trade recommendation and simply technical observation.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr EURNOK- NOK THAT PAIR BACK DOWN FROM EXTREME LEVELSMorning traders,

This morning we have had the Swedish central bank come out and delay interest rate rises with market now pricing no rise until early 2020 (from mid 2019). This has had a secondary effect on the Norwegian Krona leading to a 700 pips drop versus the Euro. We are looking to capitalise on this move into extreme overbought territory and looking for a pull back into the previous trading range of 9.55 to 9.60.

The spike bounced off of resistance levels dating back to early 2019 and forming a descending trendline from previous high levels in April and early February as shown in our Trading View charts.

Simple clean trade on event driven news.

As always this is not a trade recommendation and simply technical observation.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr EURNZD- TESTING RESISTANCE ON DYING VOLUMESMorning traders,

Looking at a great short setup on Euro versus New Zealand Dollar on the recent move higher coming up against resistance dating back to early January at the same time as volumes are dying out- suggesting this rally up to the resistance level is running out of power to break any further higher.

This coupled with multiple indicators showing overbought levels presents a great opportunity to place a high risk reward trade.

Our chart on trading view shows the resistance level dating back to January, the RSI at overbought levels and stochastics at extreme levels near to 90. We are looking for a pullback to 1.68 area before a period of trending sideways then further weakness down to 1.67.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr EURAUD- SHORT POST CPI SPIKEMorning traders,

Looking at a short setup on Euro versus Australian dollar after last nights inflation data out of Australia coming in at 1.3% versus 1.5% expectation leading to a 140 pip spike higher in this pair. The miss on inflation suggests, in simple terms, points to slowing growth and creates a lower expectation of the Australian central bank raising interest rates. In fact there is growing expectations that they may instead need to cut interest rates due to a slowing economy and a housing market that is extremely overheated.

Back to the technicals on this pair, so the spike of 140 pips has taken the pair up to a resistance level that dates back to early March. The spike itself was on very low volumes when compared to recent trading and as such was not able to break through resistance and is currently 40 pips off the headline spike. Unsurprisingly the move shows as over valued on every technical indicator. We are looking to take advantage of a pull back from these highs with expectation that the bulk of the move back lower will occur overnight during the Sydney trading session.

As always this is not a trade recommendation and simply technical observation.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr GBPJPY - OVERSOLD POUND BLOCKBUSTER Morning traders,

After overnight success with our Euro versus Japanese Yen trade to the tune of 85 pips profit on top of the Australian Dollar versus US dollar racking up 40 pips profit we are today looking at the British Pound vs Japanese Yen.

On our trading view account we have charted out the two resistance channels that we are looking to trade between with the pair currently at the lower support level around mid 145. Why are we looking to enter? After positive retail sales out of the UK the pair has bottomed out and is holding here at this support whilst lining up with multiple technical indicators pointing to a correction higher.

Firstly on our chart we have shown Stochastics is at extreme oversold readings sub 25 and is turning up; RSI is in the mid 30s and at previous levels where the pair have headed higher; Ichimoku cloud is providing lower support at this level whilst Bollinger bands are showing oversold readings. All lining up to suggest a corrective move higher near term. Therefore as per our chart work on tradingview we are looking for a move back up to the upper resistance of this channel around 147.

As with all British Pound trades currently the risk is higher than normal with elevated political headline risk around Brexit and as such it is sensible to set risk accordingly and only look to enter trades on this currency when multiple indicators give the green light.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings

forexTrdr USDCHF - HEADS SHOULDERS DOLLARS & FRANCSGood Morning traders,

Taking a look at US dollar and the Swiss franc and looking on a year to date basis we can see a head and shoulders pattern starting to form, which if confirmed opens up significant downside for this pair.

Not only do we have a naked trading pattern forming but we have technicals backing up the trade with multiple indicators pointing to a turn lower being on the imminent timeline. Firstly on the chart we have the left hand shoulder formed around mid February where the pair reached just short of 1.01 before pulling back to mid 0.99. This area formed a low before the pair reached a year to date high in low 1.01's before again turning lower towards 0.99 and bottoming out in early April. The final part of this pattern formation is the right shoulder which the market is currently peaking at around 1.0080.

Why do we think this will be the peak of the right hand shoulder and allow the market to retreat to 0.99? We can look to traditional technical indicators such as RSI, bollinger bands, stochastics or Ichimoku clouds. The first three all showing the pair are overbought and suggesting a correction lower is on the cards whilst on Ichimoku clouds the pair is significantly above the cloud and likely to retreat back towards top of the cloud around 1.0030 very near term.

As always this is not a trade recommendation and simply technical observation.

Good luck trading

from the Team at forexTrdr

find us on instagram, twitter and Alexa flash briefings