SOL, Finding support for a bottom?CRYPTOCAP:SOL took a hit last week on the capitulation event, printing a strong bottoming candle with a long lower wick.

Price has now reached my wave 4 ytarget of the 0.382 Fibonacci retracement at the major High Volume Node support, between the S1 nd S2 pivot.

Daily RSI hit oversold, but with no divergence. The trend remains down, below the daily pivot and daily 200EMA, but could be finding a bottom soon.

Safe trading

Season

HBAR Macro Chart, Wave 2 complete, ATH incoming?CRYPTOCAP:HBAR wave C of 2 ended in the expected area, the 0.786 Fibonacci retracement of wave 1, at a high volume node. This is the altCoin golden pocket where low-caps have the highest probability of reversing from. A long weekly lower wick was left on daily bullish engulfing candles.

If that was wave 1 then wave 3 should be powerful and take price into all-time high and beyond, with targets of the weekly R3-R5 pivots, $0.6-$0.8.

Weekly RSI has a little room to push lower into oversold but also gives it roo to produce a weekly bullish divergence. First target s the weekly pivot at $0.2.

Safe trading

ONDO Wave 2 survived, just...LSE:ONDO is having a significant pullback compared to other alts despite the RWA narrative, which is frustrating.

It came just shy of making a lower low, but did not make one, keeping wave 2 alive.

A bottom is likely in on crypto, let's see if Ondo can come back to life or if it shows relative signs of weakness.

Safe trading

AVAX at significant lows, is this the end of AVAX?CRYPTOCAP:AVAX has dropped below its 2021 and 2023 lows without ever attaining a new all-time high. Not good for the bulls.

Weekly RSI still has room to fall, and the next target is the High Volume Node support at $3.49, with no support zones from here until there. This move would likely spell the end of AVAX, after years of weakness.

Weekly pivot and 200EMA is at ~$22 and would need to see that recovered for renewed faith.

Safe trading

AAVE dump may not be over, macro triangle invalidatedCRYPTOCAP:AAVE macro triangle analysis was finally invalidated with the thrust lower. Instead, wave B of an ABC seems to be underway with an initial target of the altCoin golden pocket 0.786 Fibonacci retracement and High Volume Node support, $70.

Weekly RSI has a little room to fall until oversold. There is bullish divergence from July 1st 2024 bottom.

AAVE is again demonstrating its abnormal distribution of price action.

Safe trading

HBAR Wave 2 complete, All time high next stop?CRYPTOCAP:HBAR has finally reached my target, the altCoin golden pocket 0.786 Fibonacci retracement in wave 2, a highly probable area for altcoins to reverse downtrends. It is also a major High Volume Node and the daily S1 pivot.

Weekly RSI has tapped oversold but as a little ways to get in there. Daily RSI is oversold but with no divergences yet.

We need to see the orange trend-line break and the daily pivot hold for confirmation of a reversal. The first target would be the descending daily 200EMA and High Volume Node at $1.4. Getting above this will be very bullish and suggest wave 3 is truly underway.

Wave 3s are the most powerful Elliot Waves and could see price reaching $1+

Safe trading

SOL $80 bottom?CRYPTOCAP:SOL is accelerating in wave C of 4 and now coming into a major High Volume and 0.382 Fibonacci retracement zone where wave 4 has a high probability of ending.

Wave Cs are characteristically scary for investors and come with extreme negative sentiment and quick drops to add fuel to the fear. Thats why they are capitulation events.

Losing $80 bring up the weekly S1 pivot at $8.

Weekly RSI has hit oversold but with no divergence.

Safe trading

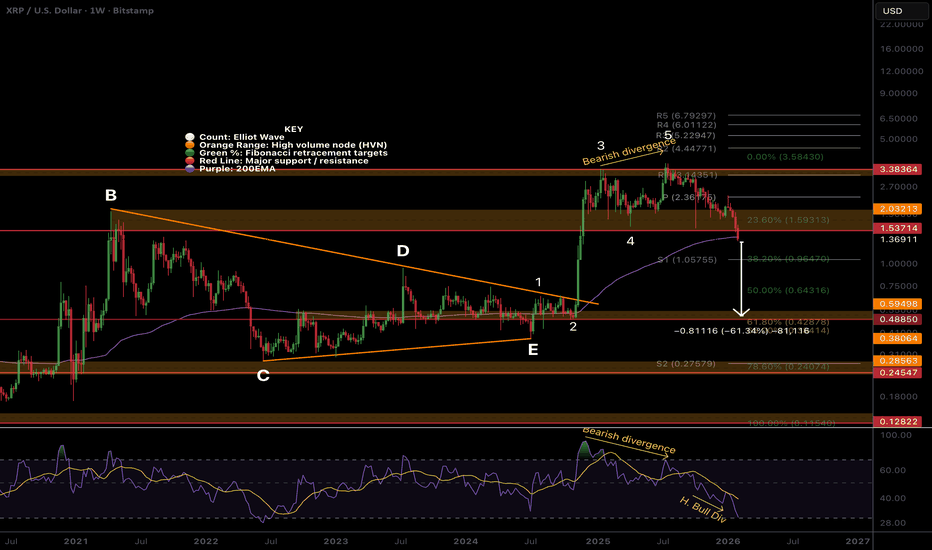

XRP Macro triangle was complete!CRYPTOCAP:XRP

Triangles are patterns found before a terminal move in Elliot Wave theory. We can see 5 waves up on weekly bearish divergence completing that terminal move.

Price is expected to retrace to the triangle EQ after that move. Thats the $0.51 High Volume Node, 60% lower form here.

Don't shoot the messenger.

Safe trading

PLATINUM winrate 87% close day above open priceBasic rules:

If we have a high probability of a BUY, this means that the asset will close above the current day's opening price by the end of the day.

If we have a high probability of a SELL, this means that the asset will close below the current day's opening price by the end of the day.

The probabilities for other assets are lower:

No Ticker TREND WIN %

1 AUDCAD BUY 53

2 AUDCHF SELL 53

3 AUDJPY BUY 53

4 AUDNZD SELL 60

5 AUDUSD SELL 53

6 CADCHF BUY 53

7 CADJPY SELL 53

8 CHFJPY SELL 60

9 EURAUD SELL 53

10 EURCAD BUY 67

11 EURCHF BUY 67

12 EURGBP BUY 80

13 EURJPY BUY 53

14 EURNZD BUY 53

15 EURRUB SELL 80

16 EURUSD SELL 53

17 GBPAUD SELL 67

18 GBPCAD SELL 80

19 GBPCHF SELL 67

20 GBPJPY SELL 53

21 GBPNZD SELL 60

22 GBPUSD SELL 73

23 NZDCAD SELL 60

24 NZDCHF BUY 60

25 NZDJPY SELL 53

26 NZDUSD SELL 53

27 USDCAD BUY 53

28 USDCHF SELL 53

29 USDJPY BUY 67

30 USDRUB SELL 73

31 XAGUSD BUY 53

32 XAUUSD BUY 60

33 NASDAQ100 BUY 67

34 S&P500 BUY 60

35 DOW30 BUY 67

36 RTSI BUY 80

37 AFLT BUY 87

38 BRENT BUY 60

39 BTCUSD FLAT 50

40 COPPER BUY 60

41 WTI BUY 53

42 DAX BUY 60

43 GAZP BUY 87

44 GMKN BUY 67

45 HEATINGOIL BUY 60

46 LKOH BUY 67

47 MTSS BUY 60

48 NATURALGAS SELL 73

49 NVTK BUY 73

50 PALLADIUM BUY 53

51 PLATINUM BUY 87

52 ROSN BUY 80

53 SBER BUY 80

54 COCOA BUY 60

55 COFFEE SELL 67

56 CORN BUY 60

57 SOYBEANS BUY 53

58 SUGAR BUY 67

59 WHEAT SELL 60

60 USD Index BUY 60

61 NIKKEI225 BUY 53

62 USDPLN SELL 60

Now, a news feed of analytical agencies' expectations and an analysis of individual indicators for today, along with what to expect during the main trading sessions. We'll also highlight the current strength or weakness of the US dollar. The direction of the pair itself will depend on the US dollar's underlying conditions.

NEWS today:

The US dollar is strong (watch for possible changes)

10:00 MSK - Expectations of partial weakening of the EUR

12:30 - Expectations of partial strengthening of the GBP

15:00 - Expectations of partial strengthening of the GBP

16:15 - Expectations of partial strengthening of the EUR

16:30 - Expectations of a weakening of the US dollar

Key events this week:

Friday: Canadian labor market data. US labor market data (non-farm payrolls).

I wish everyone profits and a great day!

SUI at the macro golden pocketCRYPTOCAP:SUI has only printed series of 3 wave structures on the weekly time frame showing no impulsive motif wave despite large returns. This suggests its all corrective or a leading diagonal.

Wave (B) is underway and currently at the golden pocket Fibonacci retracement, finding support in a High Volume Node. The altCoin golden pocket, 0.786, sits at $0.646, a likely terminal target.

Weekly RSI is printing unconfirmed bullish divergence but has not yet reached oversold. The bears are in control.

I think we are going to see bottoms soon enough. Dumping on a low liquidity Saturday is a suspicious move that could trigger a capitulation event.

Safe trading

SOL, holding up well but short term weakness continuesCRYPTOCAP:SOL weekly bearish divergence continues to play out until we get oversold are a bullish divergence to negate. There is room to fall. The running flat is negated and the pattern looks like a normal ABC correction.

Price lost the weekly 200EMA and pivot, bears are in control.

Wave 4 has a terminal target of the 0.38 Fibonacci retracement at $72, where we expect a bottom and move to new highs, $600 target.

I think we are going to see bottoms soon enough. Dumping on a low liquidity Saturday is a suspicious move that could trigger a capitulation event.

Safe trading

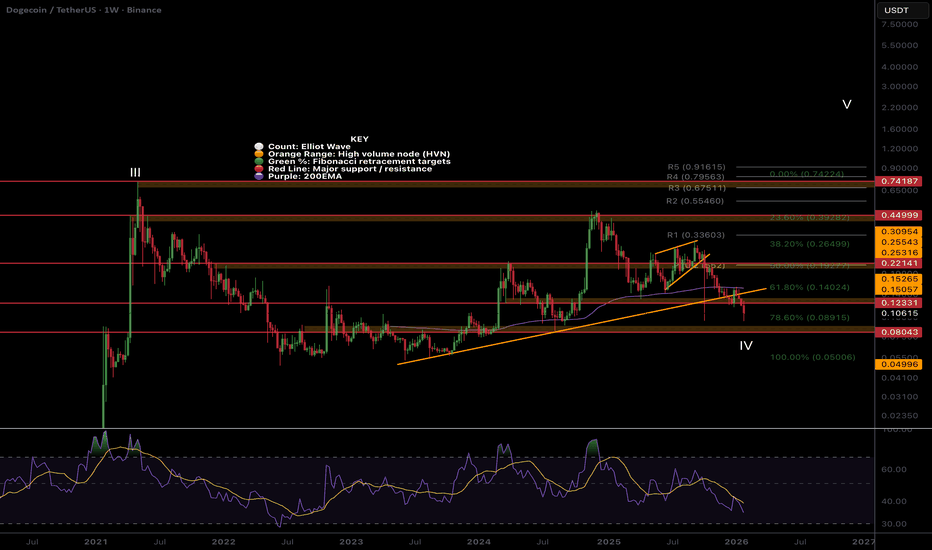

DOGE, not impulsiveCRYPTOCAP:DOGE weekly support line is lost, wave 4 appears to still be alive. NOthing impulsive, heavy overlapping price action.

Weekly RSI has room to fall until oversold. Price is approaching the altCoin golden pocket 0.786 Fibonacci retracement where it is likely to find support.

Safe trading

ONDO, so much for the RWA narrativeLSE:ONDO is almost at all time low. the Real World Asset (RWA) narrative is still around but never really took and instead punishing anyone with capital who belives.

Weekly RSI is oversold, the Fibs have nearly be ran completely. Its the last stand for ONDO. No weekly 200EMA and well below the weekly pivot.

I think we are going to see bottoms soon enough. Dumping on a low liquidity Saturday is a suspicious move that could trigger a capitulation event.

Safe trading

HBAR almost at altCoin golden pocketCRYPTOCAP:HBAR hit my short term downside target $0.1 and is heading to the altCoin golden pocket 0.786 Fibonacci retracement, a high probability wave 2 bottoming area for low cap , volatile assets. Vol-70.

This is also a major High Volume Node, $0.7

Weekly RSI is getting oversold but with no divergence.

I think we are going to see bottoms soon enough. Dumping on a low liquidity Saturday is a suspicious move that could trigger a capitulation event.

Safe trading

ETH Hitting the golden pocket in wave 2, high prob bottomCRYPTOCAP:ETH

ETH weekly bearish divergence has been playing out since the test of the previous all time high. This is a high probability terminal point for Elliot wave 1. Wave 2 is expected to at least pullback to the golden pocket, .618 Fibonacci retracement, where price sits now.

Price lost the weekly 200EMA and pivot and closed below, not good, but could also sweep this area and turn around.

Weekly RSI has room to fall but is getting to oversold with no divergence.

Wave 3 should be powerful move into price discovery.

Safe trading

XRP, 200EMA rejection, local uptrend intactCRYPTOCAP:XRP

🎯Price printed a bullish engulfing 3 white knight candle pattern, reclaiming the daily pivot now being tested as support. The daily 200EMA served as resistance as price was swiftly rejected. Overcoming this is the goal for the bulls.

📈 Daily RSI negated bearish divergence, RSI is resting quickly, a good sign for the bulls.

👉 Analysis is invalidated below the swing low $1.8, keeping the downtrend alive.

Safe trading

SUI, volatile, but local uptrend intactCRYPTOCAP:SUI

🎯Price printed a 3 white knight bullish engulfing pattern, reclaiming the daily pivot, now being tested as support. Wave 2 of a new uptrend appears to be underway. Wave 3 has a first target of the daily 200EMA, followed by $3.1

📈 After negating the bearish divergence, daily RSI has unconfirmed hidden bullish divergence forming.

👉 Analysis is invalidated below $1.31, keeping the downtrend alive

Safe trading

SOL, uptrend intactCRYPTOCAP:SOL

🎯Price caught a bid moving bullishly above the daily pivot, now being tested as support. Wave 2 of a new motif wave appears to be underway with an inital target of the daily 200EMA.

📈 Daily RSI is back to the EQ, restting quickly. A good sign for bullish continuation.

👉 Analysis is invalidated below wave C, $110

Safe trading

ONDO, rekt, fresh low...LSE:ONDO

🎯Price printed a 3 white knight bullish engulfing pattern, jumping above the daily pivot before being rejected hard to fresh lows, keeping the downtrend intact. The 0.786 Fibonacci retracement has been penetrated as price loses the High Volume Node support. S1 pivot is the next target, $0.3.

📈 Daily RSI is showing unconfirmed bullish divergence.

👉 Analysis is invalidated above $0.5 swing high.

Safe trading

HBAR, Bears in control, strong rejectionCRYPTOCAP:HBAR

🎯Price caught a strong bid on bullish divergence, but was rejected just as hard. Price is below the daily pivot and 200EMA, which is bearish, showing the downtrend is intact. The next downside target is the S1 pivot at $0.0893.

📈 Hidden bearish divergence played out at a High Volume Node. Bullish divergence is now forming, but unconfirmed.

👉Analysis is invalidated below the swing low, keeping wave 2 alive. We are very close to this level.

Safe trading

FET looking for new lows, downtrend in tact, h. bear divNYSE:FET

🎯The downtrend is intact, with wave 2 appearing complete. Wave 3 down is strong and hard. Price appears to want to continue lower to test the altCoin golden pocket at 0.786 Fibonacci retracement.

📈 Daily RSI went too high, too fast, and printed hidden bearish divergence at a High Volume node. The rejection was hard and swift.

👉 Analysis is invalidated above wave 2 swing high, $0.3.

Safe trading

ETH, trying to breakout, multiple attempts 200EMA and R1 pivotCRYPTOCAP:ETH

🎯Wave 1 appears to have completed a leading diagonal. Wave 2 appears complete with the recent higher low, but we need to break above wave 1 for confirmation. Price was rejected at the daily 200EMA and R! pivot, but is attempting to break through again. Overcoming this will be very bullish, especially as we are above the daily pivot.

📈 Daily RSI is printed hidden bearish divergence, followed by another bearish divergence. A move above wave (1) is essential to negate this, or prices could head to new local lows.

👉 Analysis is invalidated below wave (2)

Safe trading

DOGE, testing daily pivot as support, not much changed in a weekCRYPTOCAP:DOGE

🎯 Price printed a bullish engulfing 3 white knight candle pattern. It is above the daily pivot, yet testing as support. A critical level to hold. DOGE is still below the daily 200EMA. Overcoming this will be very bullish. The Elliot wave count remains tricky, so I will await more confirmation.

📈 Daily RSI printed bullish divergence, then negated the bearish divergence. The RSI shot up too hard and fast, which often results in a reversal. The reversal took place and tested the daily pivot as suggested last week.

👉 Analysis is invalidated below the swing low, keeping the downtrend alive

Safe trading