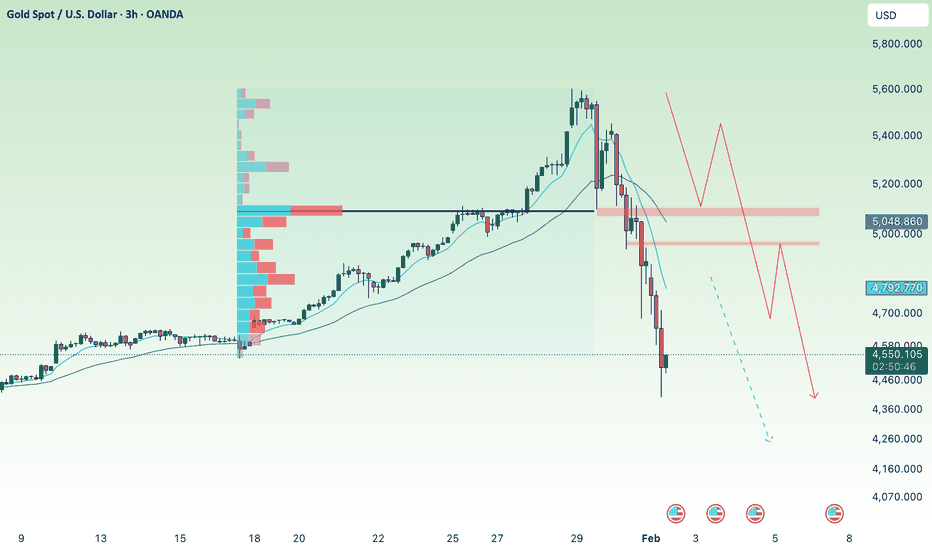

Downtrend - Gold corrects at the end of the week.GOLDEN INFORMATION:

Gold price (XAU/USD) faces some selling pressure around $4,910 during the early Asian session on Friday. The yellow metal tumbles over 3.50% on the day, with algorithmic traders appearing to amplify the precious metal’s sudden drop. Traders will closely monitor the release of the US Consumer Price Index (CPI) inflation report for January, which will be released later on Friday.

Concerns about Artificial Intelligence (AI) spurred a sell-off across financial markets, with margin calls also likely adding to the downtick. “Margin calls also likely added to the selloff, with some investors forced to exit positions in commodities, including metals to provide liquidity,” said Nicky Shiels, head of metals strategy at MKS PAMP SA.

⭐️Personal comments NOVA:

Gold broke through 5040 and fell below 5000. The downtrend continues, with consolidation and sideways movement expected in the long term.

⭐️SET UP GOLD PRICE

🔥SELL GOLD zone: 5038 - 5040 SL 5045

TP1: $5020

TP2: $5000

TP3: $4980

🔥BUY GOLD zone: 4890- 4888 SL 4883

TP1: $4904

TP2: $4920

TP3: $4940

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Shortposition

Gold prices recover - consolidating below 5180⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) attracts some sellers near $5,035 during the early Asian session on Tuesday. The precious metal edges lower amid improved risk sentiment and some profit-taking. Traders brace for key US economic data later this week, including delayed employment and inflation reports.

The yellow metal retreats after rising over the previous two days, as traders returned to equities on improved risk sentiment. The S&P 500 extends the rally to near its all-time highs following a volatile week. Additionally, hopes for the United States (US)-Iran negotiations could undermine a traditional asset such as Gold. Iran’s President Masoud Pezeshkian described the Friday nuclear talks with the US as “a step forward,” even as he pushed back against any attempts at intimidation

⭐️Personal comments NOVA:

Gold prices are stable, trading sideways around 5000, consolidating below resistance levels of 5080 and 5182.

⭐️SET UP GOLD PRICE

🔥SELL GOLD zone: 5180 - 5182 SL 5187

TP1: $5160

TP2: $5140

TP3: $5120

🔥BUY GOLD zone: 4903- 4901 SL 4896

TP1: $4920

TP2: $4940

TP3: $4955

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Selling pressure on gold is following the trend line.⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) tumbles to around $4,680 during the early Asian session on Friday. The precious metal extends the decline as traders cover losses from equities and adjust positions. The preliminary reading of the Michigan Consumer Sentiment Index report for February is due later on Friday.

The Chicago Mercantile Exchange Group (CME), the world's leading derivatives marketplace, has raised initial margin requirements for Gold and Silver futures contracts again, increasing the amount of collateral traders must post to open and maintain positions. Additionally, falling technology stocks have forced some traders to liquidate gold positions to meet margin requirements, exerting some selling pressure on the yellow metal.

⭐️Personal comments NOVA:

Gold prices are consolidating and moving downwards along a trend line, below 5000. Gold prices are consolidating and moving downwards along a trend line, below 5000.

⭐️SET UP GOLD PRICE

🔥SELL GOLD zone: 4940 - 4942 SL 4947

TP1: $4925

TP2: $4910

TP3: $4880

🔥BUY GOLD zone: 4653- 4655 SL 4648

TP1: $4670

TP2: $4690

TP3: $4715

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Accumulation around 5000 - gold price⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) jumps to around $5,005 during the early Asian session on Thursday. The precious metal rebounds following a period of intense volatility. Traders weigh the next round of US economic signals and the broader demand for safe-haven assets.

The rally of the yellow metal is bolstered by a safe-haven demand after the US military shot down an Iranian drone that "aggressively" approached the USS Abraham Lincoln aircraft carrier in the Arabian Sea, sparking fears of US-Iran escalation. Iranian and US officials confirmed on Wednesday that talks between their countries would be held in Oman on Friday. Traders will closely monitor the developments surrounding the negotiation.

⭐️Personal comments NOVA:

Gold prices are consolidating around the key 5000 mark, with the market stabilizing after a recent sharp rise and significant profit-taking.

⭐️SET UP GOLD PRICE

🔥SELL GOLD zone: 5281 - 5283 SL 5288

TP1: $5260

TP2: $5240

TP3: $5220

🔥BUY GOLD zone: 4745- 4747 SL 4740

TP1: $4760

TP2: $4785

TP3: $4806

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Short on Soybeans CFD (Ticker SOYBNUSD)

OANDA:SOYBNUSD

Technicals:

- short trade in horizontal channel

- price dived under 10.50-10.70 ressistance zone following false breakout

- intended target at support zone 9.83-9.93

- scenario invalidated if 2 bars close above 10.68

Fundamentals:

- seasonality criteria: soybean usually had descending movements in periods february - april if bear / accumulation and ascending movements while bull / distribution phase

- since we are still in bear market and there is no confirmation of phase change yet it is assumed that price will move downwards for next 2-3 months

Conclusion:

- the trade is based on the soybean season in South America (50% of global production), and by the end of April the market will have enough information for further decisions to be made

- therefore current trade is calculated for a maximum of 2-3 months

# - - - - -

⚠️ Signal - Sell ⬇️

✅ Entry Point - 10.496

🛑 SL - 10.722

🤑 Partial TP 50% - 10.17

🤑 Final TP 100% - 9.85

⚙️ Risk/Reward - 1 : 2.8 👌

⌛️ Timeframe - 3 months 🗓

Good Luck! ☺️

# - - - - -

DISCLAIMER: Not financial advice. Everyone must make trading decisions at their own risk, guided only by their own criteria and strategy for opening or not opening a trade

Gold prices recover above 5100.⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) trades in positive territory near $4,985 during the early Asian session on Wednesday. The precious metal extends the rebound after a historic and volatile sell-off last week. Traders weigh the next round of US economic signals and the broader demand for safe-haven assets.

CNBC reported on Tuesday that the US military shot down an Iranian drone that "aggressively" approached the USS Abraham Lincoln aircraft carrier in the Arabian Sea. The incident occurred as tensions in the Middle East are high, with US President Donald Trump weighing potential military strikes against the Islamic Republic.

⭐️Personal comments NOVA:

Gold prices recover - buying pressure returns. The market is gradually stabilizing and consolidating more around 5000.

⭐️SET UP GOLD PRICE

🔥SELL GOLD zone: 5253 - 5255 SL 5260

TP1: $5230

TP2: $5210

TP3: $5185

Note the minor resistance zone around 5133-5138.

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Short on JD.com Inc (Ticker JD)

NASDAQ:JD

Technicals:

- price in range 28.50 - 30.20 accumulation power for a movement

- as price is in long-term bear trend, the short breakout to the long-term retest zone at 25.50 - 25.80 before rebounce is logical

- put TP 1 on 27.40 in case of squeeze and rebounce.

- slow penetration and slow close below 28.00 opens a path for a deeper movement to 24.00 - 24.40

- scenario invalidated if 2 bars close above 30.25

Fundamentals:

- the company is no longer only ''chinese delivery service'' but earns new markets by expanding its business to Europe and North America

- because of this fact the operating margin grows for last 13 consecutive months

- but a late entry in food delivery sector led to enormous cash burn (but still reducing tax payments)

- geopolitical hardness and weakening consumer sentiment hardens the price recovery

Conclusion:

- the company is definitely undervalued and might double its price

- uncertainty in geopolitics as well as internal competition within China still may let the bears push the price to retest zone

# - - - - -

⚠️ Signal - Sell ⬇️

✅ Entry Point - 29.07

🛑 SL Long term - 30.53

🤑 TP Long Term - 25.78

⚙️ Risk/Reward - 1 : 2.25 👌

⌛️ Timeframe - 2 month 🗓

# - - - - -

Good Luck! ☺️

# - - - - -

DISCLAIMER: Not financial advice. Everyone must make trading decisions at their own risk, guided only by their own criteria and strategy for opening or not opening a trade.

Selling pressure and large price fluctuations.⭐️GOLDEN INFORMATION:

Since the announcement, Gold prices have reaccelerated their losses, while the Greenback recovered, despite being poised to sustain losses of over 1.42% in January, based on the US Dollar Index (DXY).

The DXY, which measures the US currency performance versus six peers, surges 0.74% to 96.87, a headwind for Bullion prices.

Long-dated US Treasury yields are rising in a sign that speculators see fewer odds that Warsh could cut rates “indiscriminately” to please the White House. The US 10-year Treasury note yield is up one-and-a-half basis points at 4.247% as of writing.

In the meantime, Fed speakers are crossing the wires, led by Atlanta’s Fed Raphael Bostic, Fed Governors Christopher Waller and Stephen Miran.

⭐️Personal comments NOVA:

The downtrend is dominant - a sharp decline and correction at the beginning of the week with a very large price fluctuation range.

⭐️SET UP GOLD PRICE

……….

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BITCOIN | DANCING ON THE EDGE OF FAILURE Traders,

First of all, happy new year. I hope everyone had a great holiday season. Going into the new year, I think there is a real chance that Bitcoin is setting up for a meaningful dump. To understand why, we need to look beyond price and ask the real question: who is actually driving this move?

Market context

Since January 1st, Bitcoin has been grinding higher again. Not through impulsive expansion, but through a slow, overlapping auction into the highs. This type of price action often appears near transitions rather than continuation.

Participation and flow

Looking under the hood, participation tells an important story:

Aggregated CVD across major venues continues to make higher highs, showing persistent aggressive buying

Price, however, is not expanding with that aggression and is starting to stall

Spot participation is present, but remains reactive rather than initiatory

Derivatives are clearly the dominant driver of this move, meaning aggressive buying is getting absorbed

On top of that, we now have a hidden bearish divergence on aggregated flow. Price is printing a lower high into resistance, while aggregated CVD, especially stablecoin margined futures, continues to push higher. More aggression with less progress is typical behavior during absorption and distribution.

Structural confluence at the highs

Structurally, price is trading at a major confluence area. The current high aligns with the 1.618 Fibonacci extension of the prior impulse leg, measured from the swing low into the retracement that pulled back into the golden pocket between 0.618 and 0.65. From a mathematical perspective, this is a classic harmonic sequence where reactions are statistically common.

Price failed to accept above this level. Instead, we printed a clear SFP and liquidity sweep, briefly trading above prior highs to trigger stops before rotating back below. This suggests upside liquidity was collected rather than defended.

Higher timeframe structure and weak lows

Zooming out to the higher timeframe adds another important layer. On the daily chart, multiple weak lows stand out.

The April 7 low is weak. It is defined by multiple wicks into the same area, shows no meaningful excess, and sits just above an unfilled FVG. From an auction perspective, this is unfinished business.

In addition, there is another weak low above, formed in similar fashion with repeated tests and no clean excess. This reinforces the idea that downside structure has not been properly resolved yet.

Weak lows rarely hold indefinitely. Once distribution higher up is complete, the market tends to revisit and sweep these levels to finish the auction.

Levels and expectations

Downside expectations:

Sweep of the more recent weak lows

Continuation toward the April 7 weak low

Expansion into the lower liquidity pocket

Final downside target around 64k

Upside levels to watch:

The first overhead supply zone marked by the lower grey box (around 98k)

The higher resistance zone marked by the upper grey box (between 103-105k)

Any move into these areas without acceptance would further support a distributional environment

Conclusion

In summary, we have leverage driven upside, aggressive buying being absorbed, a hidden bearish divergence, a failed acceptance at a 1.618 extension, a confirmed liquidity sweep at the highs, and multiple weak lows below price. Until price can reclaim and hold above the current resistance area, the path of least resistance remains downward.

Remember: markets do not move because of opinions. They move to finish auctions and punish those who mistake activity for progress.

---------

If you find value in viewing the market through the lens of auctions, structure, and participation, feel free to leave a like or a comment. It helps more than you might think.

From the sands before the storm,

- ThetaNomad

Short on Silver CFDTVC:SILVER

Short on Silver

Technicals:

- oscillators like RSI and other on weekly and monthly timeframes are in extreme overbought territory, signaling an imminent need for a correction.

- large institutional players (Smart Money) typically begin taking profits at peaks, and the current environment presents an ideal window for this.

- price neared 3.618 on fibo (120$ per OZ), whereas asset prices rarely breakout this level.

- target 0.382 on fibo

- scenario invalidated if two bars close above 122.00

Fundamentals:

- the massive influx of retail investors and extreme market hype often precede a "flush out" of positions and a sharp collapse.

- commodity has shown anomalous growth, gaining about 150% in 2025 and another 40% in the first weeks of 2026; however, no rally can last forever.

- high asset prices will trigger an increase in secondary market supply (scrap/recycling), which will ultimately lead to a cooling of demand and price suppression.

⚠️ Signal - Sell ⬇️

✅ Entry Point - 112.75

🛑 SL - 122.34

🤑 TP - 84.62

⚙️ Risk/Reward - 1 : 3.2 👌

⌛️ Timeframe - 3 months 🗓

Good Luck! ☺️

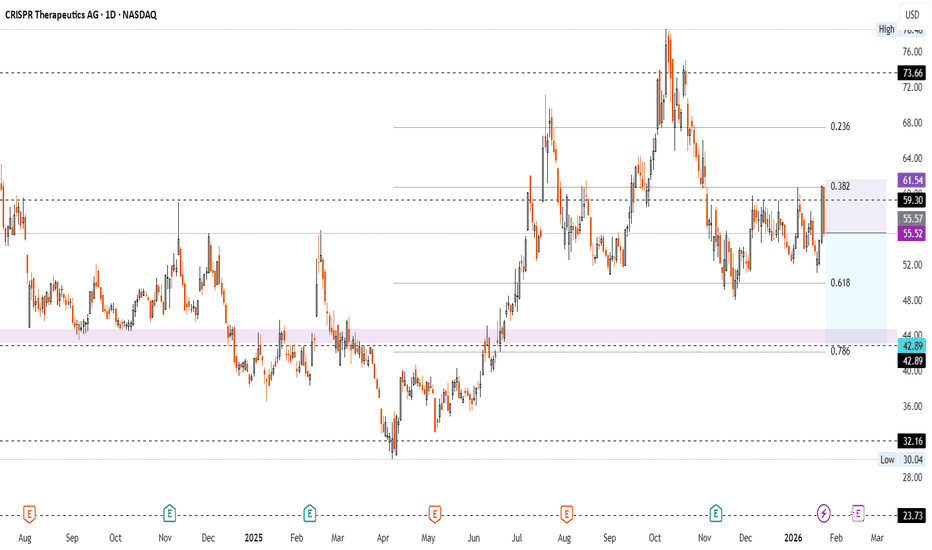

Short on CRISPR Therapeutics AG (Ticker CRSP)NASDAQ:CRSP

Technicals:

- 5 touches of 59.30 ressitance since 5 Dec. without breakout

- ressistance on 0.382 fibo after breaking to 0.618. Measure since 8 Apr.

- potential downside to 43.00 - 44.50 support zone matching 0.786 fibo

- ыcenario invalidated if two bars close above 61.12

Fundamentals:

- local uncertainty after insider sales by CEO. Average price 60.19 per share

- long term development remains promising, taking into account industry's defensive profile in a recession

# - - - - -

⚠️ Signal - Sell ⬇️

✅ Entry Point - 55.52

# - - - - -

🛑 SL - 61.54

🤑 TP - 42.89

⚙️ Risk/Reward - 1:2.1 👌

⌛️ Timeframe - 1 month 🗓

# - - - - -

SOXS LongPublishing from my phone, so perhaps this will not be as detailed as desired.

That said, I believe AMEX:SOXS can play out to some further daily extensions. At the very least, it should act as a good hedge for a potentially AMEX:SOXS AMEX:SOXS weakening market.

I am long currently in a positive position. Would like to hold until some of those further extensions into the $6-7 range. I may trim and buy back along the way.

EURCAD - Anticipating the Price to FallThis image displays a technical analysis chart, specifically for the EUR/CAD (Euro/Canadian Dollar) currency pair, illustrating a potential trading setup. 💴

The chart uses common trading terms to show a transition from a potential bullish (uptrend) to a bearish (downtrend) market bias, suggesting an opportunity to initiate "short" positions.

Chart Analysis 📊

Bullish Phase: The price initially moved in an upward-sloping channel or triangle, indicating buying pressure.

Bearish Transition: The price hit a "supply" zone, an area where selling interest is strong enough to potentially reverse the upward momentum. 📉

Recommendation: The chart suggests that as the price respects this resistance area, traders should "look for shorts," meaning they anticipate the price to fall (a bearish move) and can position their trades to profit from this decline. ⬇️

Rising Wedge Pattern S&P 500There is clear a Rising Wedge Pattern formed on S&P 500 4h chart .

There was even a retracement from all-time highs of 6979 back inside the wedge before the weekend.

My suggested SL is 7030-7050 and TP 6500-6550 for the short-to-mid term.

On a larger scale, there is also a huge channel that we are testing the top of right now:

Going all the way back to 2008..

It could easily end up like this:

So for longer term I can see 6100, 5500, 5000 and if recession hits than even 3500.

There has never been such a major Fed hiking and cutting cycle that did not eventually cause a recession. Also, the labor market is weaker than the headline numbers make it seem. Lots of massive downward revisions on NFP. Even the unemployment number is growing slowly, mostly because Labor Force Participation is dropping. If we account for that, then the real unemployment rate is more like 5.5%.

Here are some more examples of rising wedges going back to the pandemic:

AUD/NZD – Monthly Mean Reversion SHORTTrade Plan (Monthly Timeframe)

Direction: Short

Execution style: Scale-in / position trade

Time horizon: 3-6 months

Entry (Short)

Sell zone: 1.1450 – 1.1600

(Current price is already inside this zone)

Optional scale-in if price extends:

1.1680

1.1750 (final add)

Stop Loss at Monthly close above: 1.1800

A sustained monthly close above this level invalidates the mean-reversion thesis.

Take Profit Targets

TP1: 1.1200 (partial take profit)

TP2: 1.0950 (mean reversion to range value)

Rationale

Price is at a valuation extreme

Carry and rate differentials are fully priced

Monthly structure shows distribution, not breakout acceptance

Historically, AUD/NZD reverts slowly but decisively from these zones

This trade is managed on monthly closes only.

Daily and weekly noise is ignored.

Patience > precision on macro timeframe trades.

Not financial advice. For educational purposes only.

Gold is consolidating lower ahead of NFP news.⭐️GOLDEN INFORMATION:

Friday’s US December jobs report will be in focus for signals on the policy outlook. Payrolls are expected to rise by about 60K, with the Unemployment Rate seen edging down to 4.5%. A softer-than-forecast print would strengthen expectations for Fed easing, lending support to Gold by lowering real yields and reducing the opportunity cost of holding the non-yielding asset.

⭐️Personal comments NOVA:

Gold prices remain sideways - selling pressure continues to push gold back below 4400. Accumulation ahead of this week's NFP news.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4478 - 4480 SL 4485

TP1: $4460

TP2: $4445

TP3: $4430

🔥BUY GOLD zone: 4387 - 4385 SL 4380

TP1: $4400

TP2: $4415

TP3: $4430

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Selling pressure - correction below 4300✍️ NOVA hello everyone, Let's comment on gold price next week from 01/05/2026 - 01/09/2026

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) accelerated its recovery on a holiday-thinned session on Friday, with markets in Japan and China closed for the New Year lantern. The precious metal is 1.75% up on the day, reaching levels near $4,400, after bouncing from $4,274 earlier this week.

A combination of market expectations of lower interest rates in the US and growing geopolitical frictions has underpinned support from precious metals over the last few sessions. Russia has announced the revision of its stance at the peace talks with Ukraine, after an intentional drone attack in one of President Vladimir Putin's residences, while US President Trump has raised his tone against Iran.

⭐️Personal comments NOVA:

Investor sentiment remains pressured to sell and take profits at the start of the new year - however, global military concerns continue to provide upward momentum for gold prices.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $4402, $4453

Support: $4274, $4237

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Downtrend towards the end of the year, below 4300⭐️GOLDEN INFORMATION:

In the wake of the FOMC Minutes release, market-implied expectations for a rate cut at the January meeting edged lower, with federal funds futures now assigning roughly a 15% probability to an easing move, according to the CME FedWatch tool. The shift suggests a modest recalibration of near-term policy expectations among traders.

Separately, the Chicago Mercantile Exchange (CME) Group—one of the world’s largest commodity trading venues—announced an increase in margin requirements for gold, silver, and other metal contracts, as outlined in a notice published on its website last week. The higher margins compel traders to post additional collateral to cover positions, aiming to mitigate counterparty risk in the event of delivery and often prompting position adjustments across the metals complex.

⭐️Personal comments NOVA:

Gold prices are under selling pressure at the end of the year, with a major decline potentially returning below 4300.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4401 - 4403 SL 4408

TP1: $4390

TP2: $4380

TP3: $4365

🔥BUY GOLD zone: 4249 - 4246 SL 4242

TP1: $4260

TP2: $4275

TP3: $4290

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold will adjust downwards below 4500!⭐️GOLDEN INFORMATION:

Gold (XAU/USD) retreats modestly from its fresh record peak at $4,526 during early European trading on Wednesday, as short-term traders lock in profits following the recent sharp rally. The pullback is further reinforced by stronger-than-expected US Gross Domestic Product data, which tends to underpin the US Dollar and, in turn, creates headwinds for USD-denominated assets such as Gold by increasing their relative cost for non-US investors.

That said, downside risks for the yellow metal appear contained. Ongoing geopolitical uncertainty—most notably surrounding tensions between the United States and Venezuela—continues to support safe-haven demand, providing an underlying bid that may help limit deeper corrective moves.

⭐️Personal comments NOVA:

Gold is consolidating and correcting downwards after reaching its all-time high of 4526.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4524 - 4526 SL 4531

TP1: $4515

TP2: $4500

TP3: $4485

🔥BUY GOLD zone: 4404 - 4406 SL 4399

TP1: $4420

TP2: $4435

TP3: $4450

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Going Short TESLA HereTrading Fam,

I'm taking my first ever short here since implementing my new indicator. It has been killing it on the long side. We've exited our last 17 trades, all for wins, with an average profit of 30% per trade and our portfolio is up over 86% on the year. Now, it's time to test the short signals. We received two here on TSLA. I've taken a small entry since this is my first short, representing around 9% of the portfolio total. I'm going to target $350 but will not take more than a 7% loss, thus my stops are set at $476 bring the rrr on this trade entry to 1:3. Let's see how this goes.

✌️Stew