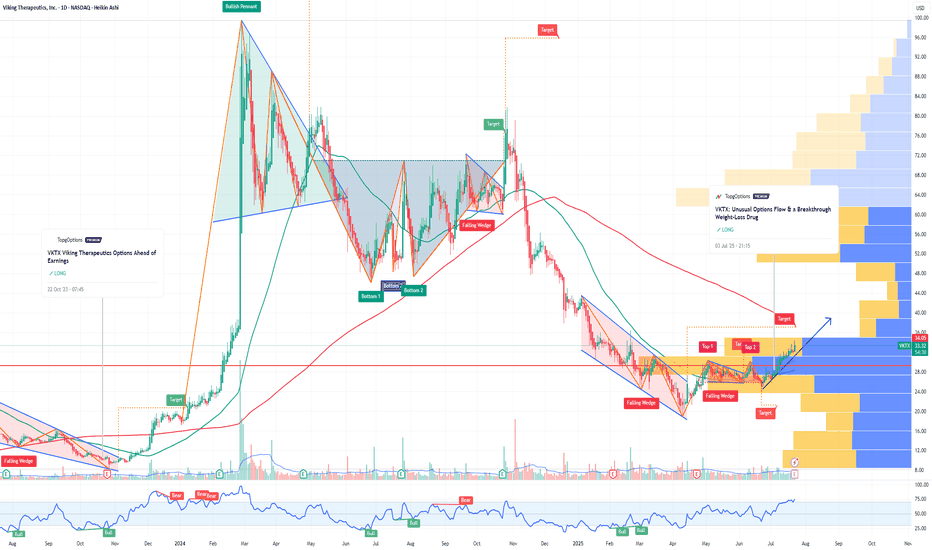

VKTX Viking Therapeutics Options Ahead of EarningsIf you haven`t bought VKTX before the breakout:

Now analyzing the options chain and the chart patterns of VKTX Viking Therapeutics prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Signalsfree

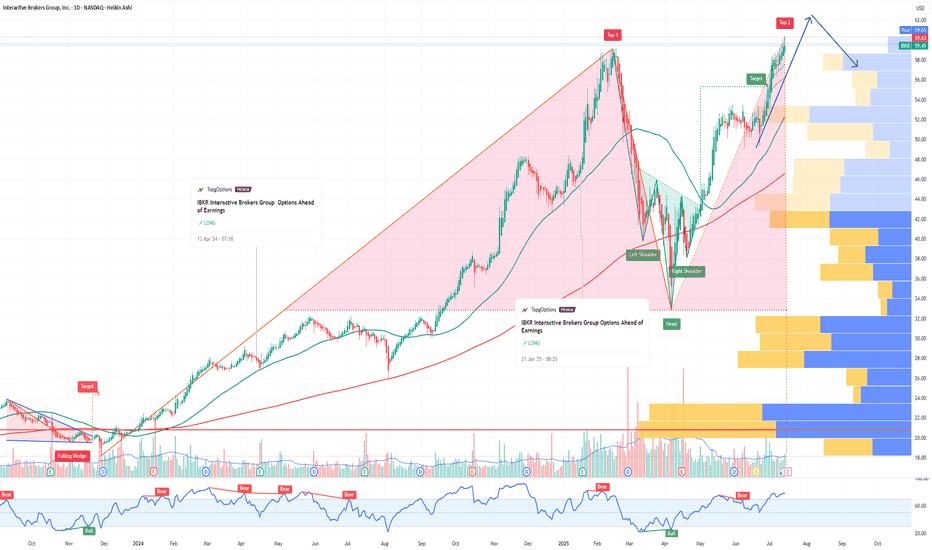

IBKR Interactive Brokers Group Options Ahead of EarningsIf you haven`t bought IBKR before the rally:

Now analyzing the options chain and the chart patterns of IBKR Interactive Brokers prior to the earnings report this week,

I would consider purchasing the 60usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $3.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

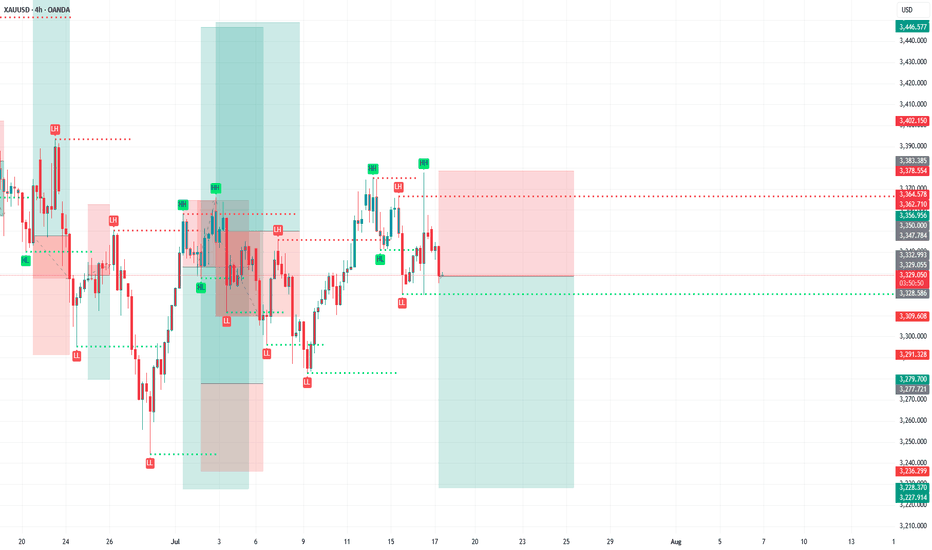

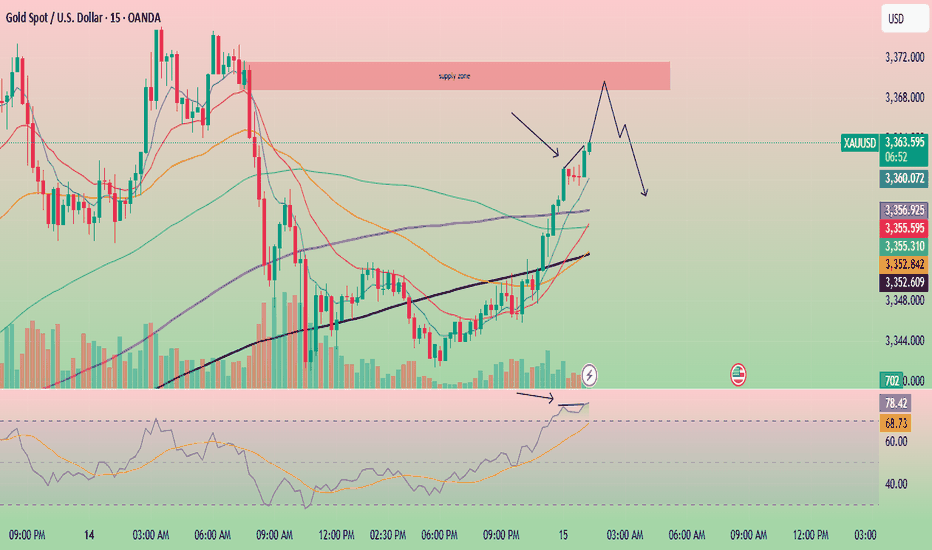

Gold is showing signs of bearish RSI divergence.🚨 Gold Update – Potential Selling Opportunity Ahead 🚨

Gold is showing signs of bearish RSI divergence on the 15-minute chart, while the RSI is already in the overbought zone. The price is also approaching a key supply zone, which could trigger a reversal.

📉 Multiple confirmations are pointing toward a potential sell setup:

Bearish RSI divergence

Overbought RSI condition

Approaching a strong supply zone

If price breaks below the 8 EMA with a bearish engulfing candle, it may confirm downward momentum.

⚠️ Watch closely — This setup is shaping up with solid confluence.

🔍 Always do your own research (DYOR) – This is not financial advice.

Bullish Thesis: Why Oscar Health OSCR Could Rally Strong in 2025Oscar Health, OSCR, a technology-driven health insurance company, is positioned for a significant stock price appreciation in 2025. Despite some mixed short-term sentiment, the long-term outlook and recent analyst forecasts suggest a potential rally that could more than double the current share price. Here’s why OSCR could be a compelling bullish opportunity this year:

1. Strong Analyst Price Targets Indicate Upside of Over 125%

According to recent forecasts, OSCR is expected to reach an average price of $31.40 in 2025, with some analysts projecting highs as much as $41.31—a potential upside exceeding 125% from the current price near $13.95.

Monthly forecasts show a steady upward trajectory, with July 2025 targets around $37.24 and December 2025 targets near $34.67, highlighting sustained bullish momentum throughout the year.

The average 12-month price target is around $34.40, representing a 146% upside, signaling strong confidence in OSCR’s growth prospects.

2. Innovative Business Model and Growth Potential

Oscar Health leverages technology and data analytics to offer user-friendly, transparent health insurance plans, differentiating itself in a traditionally complex industry.

Its focus on member engagement, telemedicine, and cost-effective care management positions it well to capture market share as healthcare consumers increasingly demand digital-first solutions.

The company’s expanding footprint in both individual and Medicare Advantage markets provides multiple growth avenues.

3. Long-Term Vision and Market Opportunity

Beyond 2025, forecasts remain highly bullish, with OSCR projected to reach $53.77 by 2027 and nearly $100 by 2030, reflecting strong secular growth potential in the health insurance and digital health sectors.

Analysts see Oscar as a disruptive force with the potential to reshape healthcare delivery, driving substantial long-term shareholder value.

4. Improving Financial Metrics and Operational Execution

Oscar has been improving its loss ratios and operating efficiencies, which are critical for sustainable profitability.

The company’s investments in technology infrastructure and data-driven care management are expected to translate into better margins and revenue growth over time.

5. Market Sentiment and Analyst Ratings

While some platforms show mixed short-term sentiment, the dominant analyst consensus is a "Buy" or "Moderate Buy," supported by strong price targets and growth forecasts.

The stock’s current undervaluation relative to its growth potential creates a favorable risk-reward profile for investors.

GBPUSD SHORT FORECAST Q2 W24 D13 Y25GBPUSD SHORT FORECAST Q2 W24 D13 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block

✅15' order block

✅Intraday 15' break of structure

✅Tokyo ranges to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

GBPCAD SHORT FORECAST Q2 W24 D13 Y25GBPCAD SHORT FORECAST Q2 W24 D13 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside intraday confirmation breaks of structure.

💡Here are some trade confluences📝

✅Weekly highs POI

✅1H order block rejection

✅4H order block rejection

✅15’ order block identification

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

LULU Lululemon Athletica Options Ahead of EarningsIf you haven`t bought LULU before the previous earnings:

Now analyzing the options chain and the chart patterns of LULU Lululemon Athletica prior to the earnings report this week,

I would consider purchasing the 325usd strike price Puts with

an expiration date of 2025-6-6,

for a premium of approximately $10.05.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

TECHNICAL APPROACH - USDCAD SHORT FORECAST Q2 W23 D23 Y25🔥👀USDCAD SHORT FORECAST Q2 W23 D23 Y25

TECHNICAL HOTPICK ! 💥💥

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

💡Here are some trade confluences📝

✅4H order block rejection

✅HTF 50 EMA

✅Intraday bearish breaks of structure to be identified

✅15’ order block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

ELF Beauty Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ELF Beauty prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2025-5-30,

for a premium of approximately $5.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TTD The Trade Desk Options Ahead of EarningsIf you haven`t bought TTD before the recent rally:

Now analyzing the options chain and the chart patterns of TTD The Trade Desk prior to the earnings report this week,

I would consider purchasing the 55usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $6.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CMCSA Comcast Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CMCSA Comcast Corporation prior to the earnings report this week,

I would consider purchasing the 37.5usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NZDJPY - Potential bounce to 85.300 from SupportOANDA:NZDJPY has reached a major support level, an area where buyers have previously shown strong interest. This zone has acted as a key zone, increasing the likelihood of a bounce if buyers step in.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would strengthen the case for a move higher. If buyers take control, the price could bounce toward the 85.300 target. However, a decisive breakdown below this support would invalidate the bullish scenario and could lead to further downside.

This isn’t financial advice, just my take on how I approach support and resistance zones. Best to wait for clear confirmation, like a strong rejection or a volume spike, before making a move.

Every trader has a unique perspective. Let’s discuss this setup within the TradingView community!