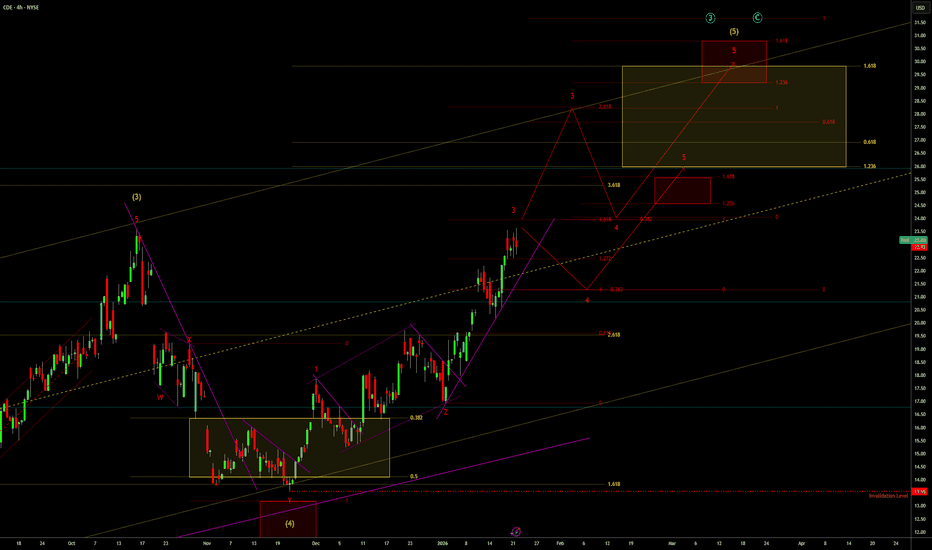

Coeur Mining (CDE) Elliott Wave Outlook - Count 1 Alt1 (4H)This is an alternate outlook which sees that NYSE:CDE is already in the red wave 3 which again is approaching a typical wave 3 target at the 1.618 extension. I prefer the red wave 2 as a running flat on this outlook compared to the expanding leading diagonal count previously used, and with silver approaching $100, this outlook allows for the completion of this 5 wave sequence quicker than the previously posted 4H outlook.

That last comment suggest I have one eye on a reaction at $100 silver (I suppose I can’t rule it out also Gold approaching $5K), and that I’m preparing for a larger pull back. Well once I anchor red wave 5, yellow (5), and cyan 3 or C this does suggest a larger pullback. I am going to review this count based on my higher timeframe outlook on silver, but looking at CDE in isolation, I think this leg potentially completes a 5 wave sequence higher and the potential for pull back still exists. A pull back that I may not want to hold all of my current holding through, so may trim a little more from CDE and other miners based on correlation as this wave progresses.

The situation is of course fluid, and something could happen tomorrow that changes that sentiment.

Silverminers

Missed the Silver Run? The Miners Are Finally Waking Up.📝 The Second Chance Setup If you followed our analysis on the WDC AI Vault and the Silver Supercycle , you caught the initial move. But if you missed those entries, don't chase the top. Look for the lag.

The "Catch-Up" Trade ( NYSE:CDE ) While Spot Silver has gone vertical to $80.00 (ATH), the miners have been asleep at the wheel. Coeur Mining ( NYSE:CDE ) is still trading near $20.40.

The FOMO Cure: You aren't buying extended highs here. You are buying a coiled spring that hasn't released yet.

The Valuation Gap: At $80/oz Silver, CDE is a cash-flow monster. The market is pricing it like Silver is still $30. That gap must close.

1. The Chart:

Daily Squeeze (Symmetrical Triangle) 📉 I’ve attached the Daily Chart.

It doesn't get cleaner than this:

The Pattern: A tight Symmetrical Triangle. We are coiled.

The Pressure: Price is pinned between the $20.50 Resistance and the rising support.

The Momentum: My "Fear & Greed" gauge is hitting 76 (Extreme Greed). Even though price is flat, the buyers are aggressive underneath.

📌 The Trade Plan We are playing the "Catch-Up."

Trigger: I am waiting for a Daily Candle Close above $20.55 to confirm the breakout.

Target 1: $23.60 (Recent Swing Highs).

Target 2: $28.00+ (Re-rating based on cash flow).

Invalidation: A close below $19.40 kills the setup.

Disclaimer: Just sharing my read on the sector rotation. Not financial advice.

💬 Discussion: Do you think the miners will outperform the metal in Q1? Let me know below. 👇

Argenta Silver Corp Daily OutlookI have taken an initial position on TSXV:AGAG

I'm looking for price to continue higher following a small retracement in wave (ii) in orange. It's quite possible the retracement could develop further in time and price but irrespective based on this count, I consider this a worthwhile initial entry.

A potential target zone for this next leg higher is the green zone. After which we could see some consolidation in red 2. although it would be a little frustrating to hold the position, assuming red 2 retraces towards my entry, i think it will be short term pain for longer term upside as red wave 3 unfolds.

More comments on the chart

Coeur Mining (CDE) Elliott Wave Outlook - Count 1 (4H)Since the previous weekly outlook on NYSE:CDE , price has moved pretty much in line with the expectation, with wave (3) and wave (4) playing out. The pull back in wave (4) was more aggressive and deeper than I would have liked, but wave (2) was fairly flat, so based on the guideline of alternation it does suggest a sharper correction in wave (4), it did run just beyond the 50% fib retracement which is getting a little deep.

In this interpretation I have the chart moving higher in wave (5) with red wave 1 underway. I'll add a caveat, there are alternative wave counts available and should we see an aggressive sell off in silver, then CDE may get hit alongside it. in that scenario this recent up move from $13.55 may instead be a corrective wave, which would mean more consolidation in wave (4), and potentially a break below $13.55 (which is the invalidation level for red 1), unless a triangle pattern forms and we instead go sideways.

XAGUSD Silver Outlook (Count 2)Here is my primary view on FX_IDC:XAGUSD . This is an updated view taking in to account the monthly time frame chart which i have recently shared, i may work on publishing the monthly idea soon.

In this outlook silver is currently close to working through a series of wave 4's and 5's. As I mention on the chart if the projected levels change but the sequence is accurate then I’ll be happy with that.

I have added some more comments in the chart regarding the Elliott wave guideline of alternation, which we should consider when forecasting future price action.

In line with the monthly chart, this outlook now shows the $87 target, and the analysis behind it. I have changed the wave degrees to reflect this current impulsive rally being in the cyan primary degree sitting under the purple cycle degree wave III.

More comments on the chart.

XAGUSD Silver Outlook (Count 2)Here is my primary view on FX_IDC:XAGUSD . This is a slightly different count compared to my last outlook; however the ending goal is pretty much the same. I will work on a higher time frame outlook to show what structure exists above the weekly time frame.

In this outlook silver is currently close to working through a series of wave 4's and 5's. As I mention on the chart if the projected levels change but the sequence is accurate then I’ll be happy with that.

Having just looked at my monthly chart, it’s possible that this current impulsive wave sequence could extend the yellow wave (5) completion target up to around $87. If so, then I will have to go through the chart and change the wave degrees accordingly. As my yellow intermediate degree would become the cyan primary degree sitting under the purple cycle degree.

More comments on the chart.

Daily Outlook on GSVR Guanajuato Silver CompanyThis is my updated daily outlook on TSXV:GSVR . The last outlook has played out pretty well so far (see linked publications), will the next leg?

We are at the point in the chart were yellow wave (3) could be underway, if so we should see a strong move higher with GSVR potentially moving 150+ %.

More comments on the chart.

14 Year HVF that still offers 7X upside. SILVER Miner. $EXKEndeavour Silver is a mid tier producer with 4 mines in Mexico and Peru.

Focusing on exploration projects across the Americas.

EXK aims to become a leading senior silver producer.

It's Terronera reached commercial production last month and is forecast to process 350k tonnes over the next 6 months with avg grades of 120g/t Silver and 2.5g/T of Gold

EXK has a extensive pipeline of exploration projects.

The company expects free cash flow in Q4 2025 and Q1 2026

Management targets 30M ounces by 2030

EXK is in growth phase by higher production and new mine outputs but has faced earnings pressure due to derivative losses and rising costs. It has a solid asset base, and future earnings outlook anticipate improved cash flows.

#JX - Bull Market about to resume, massive inv Head & Shoulders.The Canadian venture index

After completing one Inverse Head and Shoulders that made target and overshot into expected resistance.

Has now setup a massive larger inverse head and shoulders that projects to previous all time high's last seen nearly 20 years ago.

The venture index is full of junior miners and commodity companies that have a letter .v Suffix

Once it has done retracing I expect it to attack the neckline for the Big pattern breakout.

Why Silver Miners Are Poised for a Historic Breakout...After 14 long years of being left in the dust by the S&P 500, the silver mining sector is finally signaling that its time has come. The chart of the SIL/SPX ratio tells a powerful story, suggesting we're on the brink of a massive capital rotation.

The Technical Evidence Is Clear

The long-term downtrend, which has defined this ratio for well over a decade, is officially over. Following the completion of a classic Inverse Head and Shoulders pattern, the ratio has now logged a decisive monthly close above its crucial "Capital Rotation Trendline." This isn't just a minor blip; it's a major technical breakout that signals a fundamental shift in market sentiment.

The Fundamental Logic Is Unstoppable

For years, capital has overwhelmingly funneled into technology and the broader S&P 500. Now, as those sectors look increasingly overvalued, the money has to go somewhere. The asymmetry here is staggering: the sheer difference in market capitalization means that even a small percentage of funds rotating out of tech and into silver miners could trigger an explosive price move in the silver mining sector.

Physical Silver Is Providing the Catalyst

This breakout isn't happening in isolation. It's being confirmed by the price of physical silver itself, which is pushing past key resistance levels at $40 and has its sights set on $50. This move provides the perfect fuel for the miners, as higher silver prices dramatically increase their profit margins and overall value.

The situation is clear: the smart money is likely already moving. The question is, are you ready to join them?

Daily Outlook on GSVR Guanajuato Silver CompanyThis is my Daily chart outlook for TSXV:GSVR I have added in tranches during the decline looking for the up move which I believe is unfolding now. The chart could unfold in ABC or 12345. Price currently looks like it is ready to breakout of the wave 2 consolidation.

$NAK Trump tweeted about itThe win story is American mining jurisdiction which is world class "Alaska" Pebble Project that's one of the World's largest undeveloped resources of copper, gold, molybdenum, silver, and rhenium. Trump tweeted about the company and making America great again. This will be through the development of Natural resources and their companies.

Opportunity? A fall in the USD dominance is coming. BRICs can potentially challenge the USD. Money being linked back to a hard asset appears on deck whether it be BTC/Gold/Silver. This bodes well for all North American jurisdiction gold and silver resource companies. Strikepoint has huge potential in massive Walker Lane, Nevada property with an interesting private partner located at the center. As well as two high grade assets in the legendary Golden Triangle.

Silver miners looking bullishThis monthly chart of the Golbal X Silver Miners looks bullish. After a decade of pullback and consolidations, silver miners seem ready to rise.

We like the recent increase in volume and the bullish structure on the MACD.

A break above $39 would exit the downtrend line linking the tops and would confirm the exit of this long wedge.

Next resistances at $53then $94.

A break below $22.50 would invalidate this view.

--------------

In the context of gold and copper making new all time highs , the devaluation of currencies by countries around the world, starting with the US, and the increasing needs of silver for industrial production of alternative energies solutions, we think that silver and silver miners are due for a catch-up.

This little guy is about to rocket 700% minimumThis is a great leveraged silver miner play. I can see this easily doing more than 700% when silver breaks its ATH, which this miner wasn't even around for, so I can say that it can do 1400%. Obviously do your own research, this is NOT financial advice. I also own this miner myself so I put my money where my mouth is...

Endeavor Silver is about to blast off!This has broken out of two downward trends and Powell is about to be dovish with the dollar and let inflation rip again for Biden to get reelected.

I see a VERY ATTRACTIVE options play right now - Endeavor's May Call contract at $2.50 is .20 right now and the O/I is off the charts. $5 is .05 or $5 a call. If silver blasts off like I think then these guys could rocket past that was they hit $12 in 2011. August is the next options expiration month, and has some high volume, but not as high as May.

I think buying calls here would be a good choice. If you're concerned then brake up your months from May and August. I expect miners and metals to get pummeled this summer when BOJ announces rate CUTS when they implode. I'd diversify into the dollar or USDJPY or USDCNY at that point cause China will devalue their currency after the BOJ cuts rates to negative (to stay competitive).

THIS ISN'T FINANCIAL ADVICE!! I am making a purchase into these securities as well, so I'm putting my money where my mouth is.

🚨🚨🚨Oh boy - Silver is gonna 🚀A TTM Squeeze on the Daily, Weekly and Monthly = a huge move is coming.

I believe Powell will talk about adjusting the acceptable inflation rate in his speech tomorrow from 2% to 4%. He will appear dovish and inflation will rocket in the dollar starting April when the gamma has rolled off the quarter.

I've also been noticing that precious metals are higher priced in China's SGE Exchange and rises in the morning and gets hit down during NY time. This means China is setting the prices of silver and gold and that the FED has lost control of inflation.

In June the FED will end up hiking to 8% and the markets will take a dive. Then a false flag will be used to to justify the FED lowering rates as the dollar TVC:DXY ascends to 120-160. This will explode hyperinflation after the Dollar implodes (2026-2027), just in time for the FED to roll out the CBDC's under social credit scores. Please stock up on freeze dried food, water, ammo and physical silver and gold - and stay away from the cities. There's a good possibility the election will be called off under Martial Law.

I will release a stock pick I think has some peculiarities I noticed that will exponentially skyrocket if this happens. Kinda a lottery ticket. It's not financial advice so beware - and I also will be investing in this stock as well so I'll have skin in the game.

If by any chance the market interprets what Powell says as Hawkishness, like NO interest rate cuts this year FOR SURE, and that they're still targeting 2% inflation rate than all bets are off and precious metals will sell off before some summer event that causes the FED to cut rates (the false flag attack). Either way, precious metals will be the canary in the coalmine to watch going forward.

FCX: Monthly Diamond Top Bearish Break Down FCX has formed and confirmed the break down of a Diamond Top pattern and looks to be preparing to come down to around $14, which would align with the 0.786 Fibonacci Retrace. I suspect many other mining stocks will also go down pretty significantly with this.