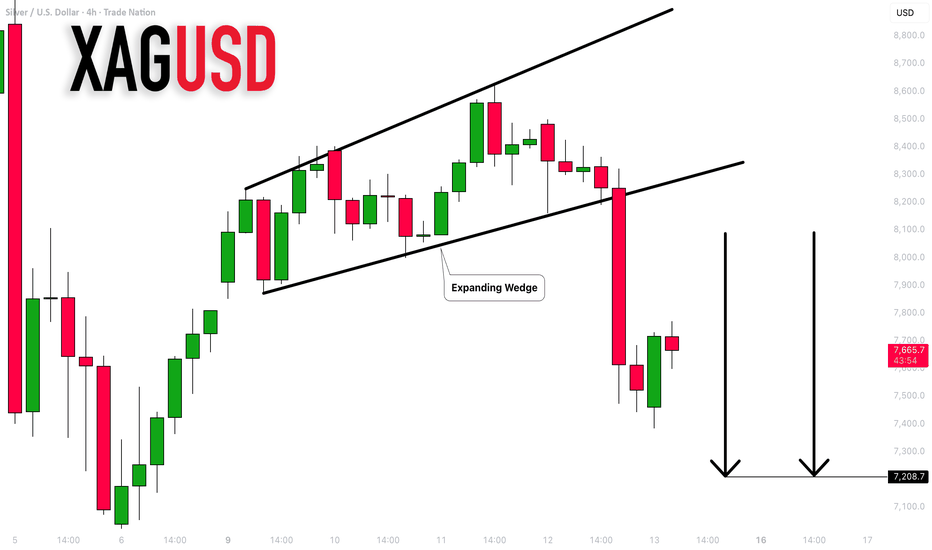

SILVER (XAGUSD): Also Bearish?!

Silver looks bearish too.

With a breakout of a support line of an expanding wedge pattern

on a 4h time frame, there is a high probability that the price will drop even lower.

Next goal for the sellers is 72.08.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silversignals

Silver Hits Major Resistance — $78.6/$74.6 Next?Silver ( OANDA:XAGUSD ) is currently moving in the resistance zone($92.76-$82.77).

In terms of Elliott Wave theory, it seems that silver has completed the 5-wave impulse, and we should wait for corrective waves.

Additionally, we’re noticing a Regular bearish Divergence(RD-) between the price peaks, which adds to the bearish sentiment.

I expect silver to fall to at least $78.63. If the support zone($79.00-$77.50) is broken, we can expect silver to fall to $74.63.

First Target: $78.63

Second Target: $74.63

Stop Loss(SL): $90.73(Worst)

Points may shift as the market evolves

Note: For silver to reach the targets, it must break through an important trading level($82.00-$81.20).

Note: If you would like to follow my long-term view on silver, I suggest you follow my long-term silver idea . I hope it is helpful.

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Silver/ U.S. Dollar Analyze (XAGUSD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

SILVER (XAGUSD): Gap Will Be Filled Soon

I think that Silver will fill a gap up opening soon.

A breakout of a rising trend line on an hourly time frame

indicates a local change of the market sentiment.

Goal - 78.14

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver- Gap Filled. Are New ATHs Next?Silver once again did what it often does best:

1️⃣ it was the first one to signal a reversal, and

2️⃣ it acted in a more technical and disciplined way, by filling the gap and resolving the imbalance.

That alone makes Silver cleaner to read than Gold at the moment.

Now that the gap is filled and the market is “rebalanced”, the natural question becomes:

👉 Are we going straight back to new ATHs again?

❓ My View: Not Yet

Just like in the case of Gold, I don’t think the next move is an immediate continuation higher.

In my opinion, the more probable scenario is:

➡️ a revisit toward the 90 zone

and potentially

➡️ another wave of selling just around the corner

The structure is starting to behave like a market that needs a deeper reset before it can trend again.

✅ Bigger Picture Still Bullish (But Context Matters)

To be clear:

- on the medium-to-long term, I remain more bullish Silver than Gold

- Silver’s macro trend is still strong

But we can’t ignore reality:

📌 Silver has almost doubled in value since late December last year

Moves like that rarely continue in a straight line without meaningful corrections.

✅ Conclusion

Silver is still a bullish market long-term — but short-term, I expect:

👉 more downside pressure

👉 a possible move back to 90

👉 and only after that, we can talk seriously about new ATHs again 🚀

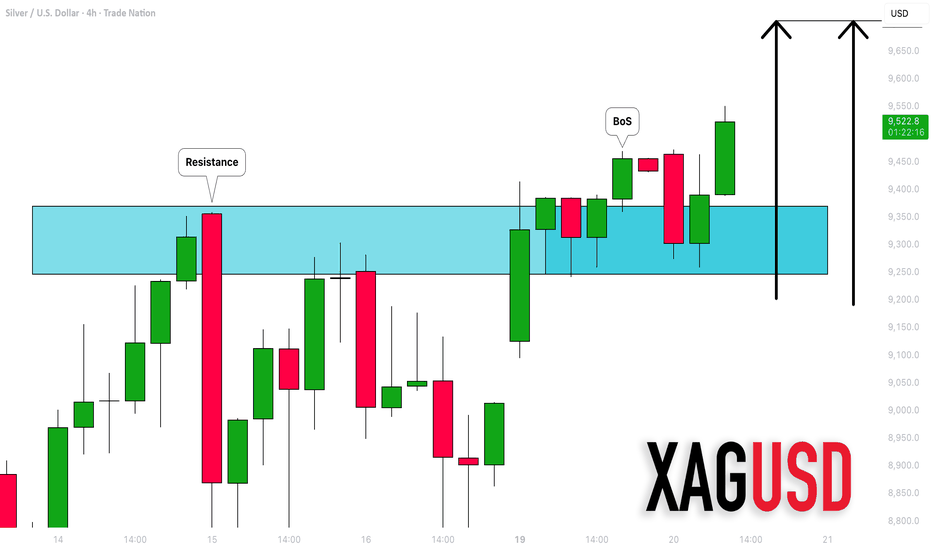

SILVER (XAGUSD): Bullish Continuation

Silver will likely rise more, following

a confirmed bullish break of structure on a 4H time frame.

The next strong resistance is 97.0

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER current Supporting Region, holds or not??#SILVER.. everybody concerns about silver price and here is current areas , region with expected move.

now market have current supporting region around 89.50 to 90.50

you know according to market volatility we should consider 80 to 120 pips for making a region or area either support or resistance.

so guys keep close that supporting region because next move will start above that..

NOTE: we will only change our buying mind set below 89.50 not before and there will be our cut n reverse area on confirmation.

good luck trade wisely

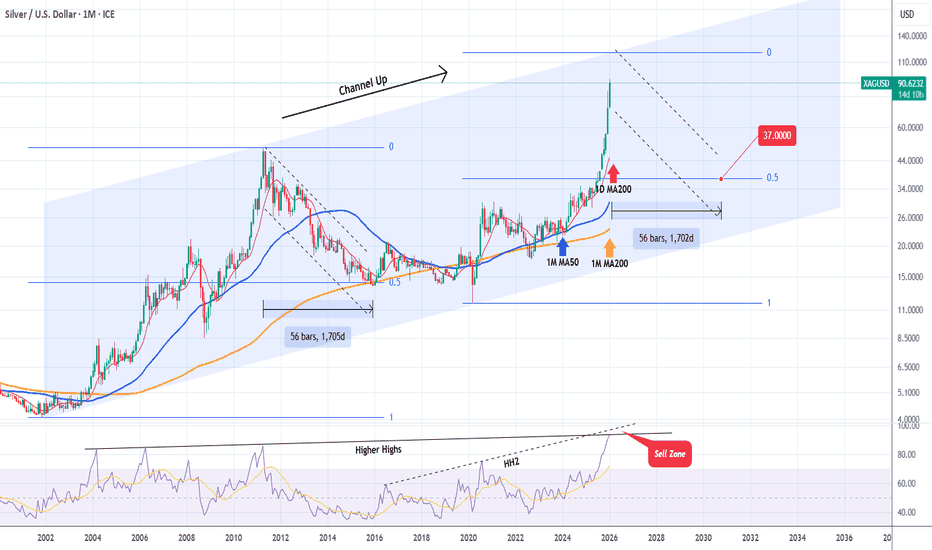

XAGUSD Is this insane Bull Cycle coming to an end?Silver (XAGUSD) has been on a remarkable rally since the April 2025 low when a period of consolidation ended. This is technically the Bullish Leg of Silver's 24-year Channel Up and it may be coming to an end as it is approaching the top (Higher Highs trend-line) of that pattern.

On top of that, the 1M RSI just hit the Higher Highs trend-line that has been in effect since the March 2004 High but since the Bearish Leg isn't exhausted yet, we may see it rise up to Higher Highs 2, which is the trend-line of its own RSI Bull Cycle.

When the previous Bull Cycle topped in April 2011, it started the new Bearish Leg (Bear Cycle) that bottomed after 56 months on both the 0.5 Fibonacci retracement level and the 1M MA200 (orange trend-line).

As a result, if we are to make a very long-term macro estimate of where Silver may correct to and turn into a buy again (long-term),that would be $37.000.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

SILVER (XAGUSD): Waiting for Breakout

I see a bullish accumulation pattern on Silver on a daily time frame.

The price is currently testing a significant horizontal resistance

based on a current ATH.

Its breakout and a daily candle close above 84.0 level

will provide a strong signal to buy.

I will expect another wave up then at least to 90.0 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

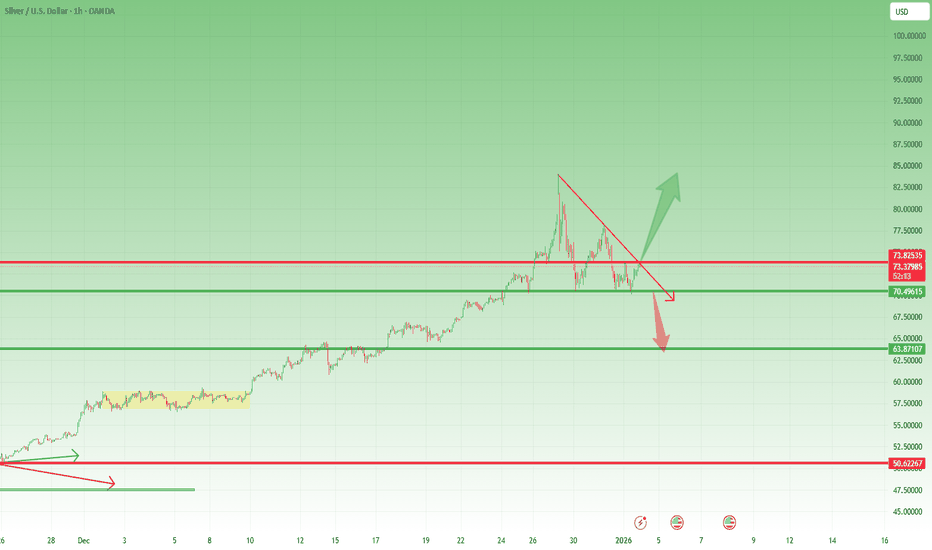

Silver — Strong Bull Trend, but Is the Correction Really Over?After the explosive rally to a new all-time high near the 84 zone, OANDA:XAGUSD experienced a sharp correction, dropping nearly 15,000 pips — a natural reaction after such an extended move.

Buyers eventually regained control just above the 70 zone, where the market established a solid floor.

However, the first rebound produced a lower high, and the following high was also lower — which currently shapes what appears to be a potential descending triangle structure (still unconfirmed at this stage).

❓ Key Question: Is the Correction Finished?

From a long-term perspective, there is no doubt about the dominant trend — Silver remains strongly bullish over the macro horizon.

But the short-term issue remains:

👉 Has the correction already ended, or is there more downside risk ahead?

Right now, the answer depends on two critical levels.

⚖️ Decision Levels to Watch

1️⃣ 74 Resistance Zone

A clean breakout above 74 would

✔️ invalidate the current corrective structure

✔️ confirm bullish continuation

✔️ open the door toward further upside extensions

2️⃣ 70 Support Zone

A breakdown below 70 would

⚠️ strengthen the descending-triangle scenario

⚠️ expose Silver to a deeper correction

➡️ potentially toward the 63 zone

📌 Trading Stance for Now

Given today’s low-liquidity environment, the prudent approach is:

👉 wait for confirmation rather than forcing a position

Price action around 70 and 74 will likely provide the next major directional clue. Until then — patience remains the best strategy. 🚀

SILVER (XAGUSD): More Growth is Coming?!

Silver had a very bullish opening today.

The market violated a minor intraday horizontal resistance

with a buying imbalance candle.

I think that the price has great potential to rise more.

Next resistance is 77.5

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver Analysis (XAG/USD)CAPITALCOM:SILVER

Chart Structure

From December 6 to 26, the price followed a strong uptrend.

On December 27, silver peaked near $84 and then corrected sharply.

A strong support zone around $70 formed after the drop.

The current price is $74.53, and a recovery appears to be forming with bullish candles.

Key Support & Resistance Levels:

Level | Price

Resistance 1 | ~$76.5

Resistance 2 | ~$80

Support 1 | ~$72

Support 2 | ~$70 (major)

Patterns & Price Behavior:

Higher Lows are forming → indicating bullish structure.

A V-shape recovery pattern is visible → suggesting a strong rebound.

Buyers are stepping in aggressively after the pullback.

Fundamental Analysis

Factor | Status | Impact on Price

Global Inflation | Still elevated | Bullish for silver

Fed Interest Rate Outlook | Expected cuts in early 2026 | Bullish for silver

Geopolitical Tensions | Ongoing risks in ME/EU | Increases safe haven demand

Industrial Demand for Silver | Stable or increasing | Supports price

China’s Economic Recovery | Gradually improving | Boosts industrial demand

Conclusion: The fundamental outlook supports bullish continuation for silver.

Momentum Analysis

Strong bullish momentum after bouncing off the $70 support.

Recent candles show high volume and strong green bodies, signaling fresh buying interest.

If momentum holds, resistance at $76.5 could be tested and potentially broken.

XAG/USD Price Forecast

Timeframe | Expected Move

Short-Term | Likely move to $76.5–$78

Medium-Term | If resistance breaks, $80–$82 target

Long-Term (Weeks) | $88–$92 possible with strong fundamentals

Warning:Any losses are entirely your own responsibility. This is solely an analysis and **not** a recommendation to buy or sell.

Silver’s 2025 Explosion — How High Can It Go?In 2025, Silver ( OANDA:XAGUSD ) has experienced a remarkable surge, making it one of the most notable assets of the year. As we approach the end of 2025, I’ve decided to analyze silver to see how far its bullish trend might continue. So, stay with me as we delve into the reasons behind silver’s rise and explore how far this upward momentum could go.

Let’s begin by looking at the fundamental factors driving silver’s increase in 2025. After that, we’ll move on to the technical analysis.

Fundamental Drivers Behind Silver’s Massive 2025 Rally:

Structural Supply Deficit — Multi‑year deficits draining inventories, tight physical market.

Strong Industrial Demand — Solar, EVs, semiconductors & data centers consuming silver at record levels.

Rate Cut Expectations — Anticipated Fed easing lifts non‑yielding assets like silver.

Safe‑Haven Flows — Geopolitical risk, inflation, and a softer dollar boosting precious metals demand.

Liquidity & Momentum — Smaller market vs gold( OANDA:XAUUSD ) amplifies swings, attracting speculators.

Silver has surged ~ 150–165% YTD , setting fresh all‑time highs as both an industrial metal and investment hedge.

-----------------------

Technical Analysis:

Now, considering the technical side, with less than five days remaining before the six-month and one-year candles close, I’ll focus on a higher time frame for silver’s analysis. Recently, silver achieved a new all-time high, capturing widespread attention, and many prominent figures are now discussing silver’s potential.

From a classic technical analysis perspective on the six-month time frame, it appears that silver has formed a bullish continuation pattern, specifically a cup and handle pattern, and the recent six-month candle has broken the neckline/resistance zone($50-$34) with strong volume. This suggests that the bullish trend for silver is likely to continue.

From an Elliott Wave perspective, it seems that silver is completing wave 3, potentially within an ascending channel and a Potential Reversal Zone(PRZ) .

I expect that silver, upon entering this Potential Reversal Zone(PRZ) , will undergo a correction. If you’re considering adding silver to your portfolio, it’s wise to wait for that correction, as buying at all-time highs can be riskier due to the strong upward momentum.

What do you think? How far can silver’s bullish trend extend, and what levels might we see in 2026?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Silver/ U.S. Dollar Analyze (XAGUSD), 6-month time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

SILVER (XAGUSD): Another BoS

Silver did it again.

The price updated the ATH yesterday, breaking and closing above

a major horizontal resistance.

It opens a potential for more growth.

Next resistance will be 68.0

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver Weekly TimeFrame Analysis 01/02/2021as we can see we have few resistance areas and a heavy zone before reaching our Fibonacci projection parallel leg levels and we have specified it as our TP areas

if the price continue its rally in the specified Chanel the Arrows so does the date for our TP occur ON time as we have specified them by Fibonacci time Zones

i believe this commodity is under valued so we have some chance to purchase it and invest on it

it has a long term horizon yet worth of thinking abut it

please comment your opinon

Silver Hits New ATH — Major Reversal Zone Ahead? Bearish SetupSilver( OANDA:XAGUSD ) managed to increase by more than +20% over the last 10 trading days, creating a new All-Time High(ATH) and attracting the attention of many traders in the financial markets.

Silver is currently near Potential Reversal Zone(PRZ) , Yearly Resistance(5), Monthly Resistance(1), and the round number $60.00.

Silver also managed to break the support line, which indicates weakness in the uptrend.

In terms of classic technical analysis, silver managed to rise with the help of the ascending triangle pattern, but we must keep in mind that this pattern is a weak continuation.

In terms of Elliott Wave theory, silver is completing the main wave 5, and this wave could complete at PRZ.

Additionally, we’re noticing a Regular bearish Divergence(RD-) between the price peaks, which adds to the bearish sentiment.

I expect silver to drop to at least $55.10 after breaking the support zone($56.83-$56.37).

First Target: $55.10

Second Target: $53.73

Stop Loss(SL): $61.63(Worst)/$60.54

Do you think silver can go above $60?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 Silver/ U.S. Dollar Analyze (XAGUSD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

SILVER (XAGUSD): Consolidation & Trading Plan

Silver keep coiling within a narrow range on a daily.

Depending on the side of its breakout, I expect 2

potential scenarios.

If the market breaks and closes above 59.0 - the resistance

of the range, expect a bullish continuation to 60.0 level.

If the market breaks and closes below 56.2 - the support

of the range, expect a down movement to 54.5

Alternatively, keep trading the market within the range,

buying from the support and selling from the resistance.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAGUSD Is it on the brink of a Bear Cycle?Silver (XAGUSD) has formed the same kind of 1W RSI peak pattern as the one that marked the August 2020 Top of the previous Bull Cycle.

The confirmation signal for the Top on that Bull Cycle following an impressive 4-month rally (similar to the July - September 2025 one), was the price breaking below the 1D MA50 (red trend-line).

When that took place, the price violently dropped to the 0.382 Fibonacci retracement level. As a result, if we get again a 1D MA50 break-out (which is being tested persistently and holding), we expect Silver to start a new Bear Cycle and quickly decline to 38.000 (Fib 0.382). On the longer term, we may even see a bottom as low as 30.500 (Fib 0.618) based on the July - October 2022 bottom formation of the previous Bear Cycle.

Perhaps the most optimal indicator to call the bottom, hence the most optimal long-term buy, is the 1W RSI getting oversold at 30.00 as it happened perfectly another 3 times in the past 7 years.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

SILVER (XAGUSD): Bullish Continuation After Pullback

There is a high chance that Silver will go up from the underlined support.

A bullish breakout if a neckline of an inverted head & shoulders pattern

provides a strong confirmation.

Expect a rise to 53.2 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER (XAGUSD): Correction is Over?!

Silver shows some strength after a test of a key intraday support.

A formation of a rejection candle followed by a buying imbalance

suggests a highly probable rise.

Goal - 50.15

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER (XAGUSD): New ATH & What is Next

Silver successfully broke through a historic resistance

based on a previous ATH.

Bullish keep pushing strong and the market may continue rising easily.

The closest strong psychological resistance is 55.0 level.

It can be reached soon.

❤️Please, support my work with like, thank you!❤️

SILVER (XAGUSD): ALL-TIME HIGH AHEAD!

A bullish rally may temporarily stop soon as Silver

is approaching a major resistance cluster based on a current All-Time High.

48.0 - 50.0 zone will be an important structure from where the market may retrace.

After a pullback from that, be ready for another bullish wave and a breakout of the underlined area.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver Near PRZ – Bearish Reversal Incoming?Today I want to share with you an analysis of SILVER ( OANDA:XAGUSD ). In my opinion, in terms of technical analysis , Silver has a more regular chart than Gold( OANDA:XAUUSD ) these days.

Silver is currently trading near the Resistance line , Important Resistance lines , Yearly Resistance(2) and Potential Reversal Zone(PRZ) .

In terms of Elliott wave theory , it seems that Silver has managed to complete microwave 3 of the main wave 5 , and after the support lines are broken, we can expect a decline and completion of microwave 4 . The end of microwave 4 could follow Fibonacci levels .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect Silver to fall to at least $40.51(First Target) AFTER breaking the support lines .

Second Target: $39.81

Stop Loss(SL): $42.18

Note: Today's US data release could cause a shock to Silver, but ultimately, Silver will continue its downward trend (at least to the first target).

Please respect each other's ideas and express them politely if you agree or disagree.

Silver/ U.S. Dollar Analyze (XAGUSD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.