Sandisk - Final PushLooking at the chart, we see that we are drawing the 5th and final wave of the uptrend.

Remaining movement: 3-18 %.

Key targets:

395

454

After reaching these targets, we expect a correction

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

SNDK

Sandisk TRADE IDEA $SNDKNASDAQ:SNDK SanDisk stock is up nearly 1100% over the last 365 days, and while there are several factors contributing to this massive move, the most important reason is that the rally has been driven by price action and hype. The stock has been forming a strong rising wedge pattern, which is clearly visible on the chart.

This rising wedge has provided well-defined structure, making risk management much easier. Price has respected both the upper and lower trendlines multiple times, offering clean entries and well-placed stop-loss levels. Traders can look to take advantage of moves within this pattern by buying pullbacks near the lower trendline and managing risk just below it.

Alternatively, for a more conservative and potentially high-probability setup, one could wait for a decisive break of the bottom trendline. A confirmed breakdown could present an easier short opportunity in the future, especially if accompanied by strong volume and follow-through. Overall, this chart presents a well-structured trading opportunity with clear levels, making it an attractive setup for both active traders and swing traders. What do you think about this trade idea?

Breaking: Sandisk Corporation (NASDAQ: $SNDK) Spike Over 80%The price of Sandisk Corporation (NASDAQ: NASDAQ:SNDK ) saw a noteworthy uptick of over 75% in Tuesday's trading, extending gains to extended market trading by 27%.

The asset has broken out of a falling wedge albeit market structure. With RSI at 87, NASDAQ:SNDK might cool off before picking liquidity up.

In recent news, SanDisk (NASDAQ: SNDK) soared another 22% this morning as talks of “memory chip shortage” and the related price hikes continued to drive investors to the multinational based out of Milpitas, CA.

NASDAQ:SNDK is broadly seen as a major enabler of artificial intelligence (AI) – a narrative that’s, in fact, catalysed a near-9x rally in its stock price in the trailing 12 months.

About SNDK

Sandisk Corporation develops, manufactures, and sells data storage devices and solutions using NAND flash technology in the United States, Europe, the Middle East, Africa, Asia, and internationally. The company offers solid state drives for desktop and notebook PCs, gaming consoles, and set top boxes; and flash-based embedded storage products for mobile phones, tablets, notebook PCs and other portable and wearable devices.

SNDK - Bullish Scenario Since 04 Sept, Momentum Still Intact!SNDK - CURRENT PRICE : 228.47

🔥 Bullish Scenario Supported by Trend Structure & Fibonacci Reactions

SNDK began showing early signs of a bullish scenario when price respected a rising support line , indicating steady accumulation and higher lows forming. The major bullish confirmation occurred on 04 September , when price broke above the 55.55 level (look at red arrow), triggering strong momentum and leading to a rapid vertical rally. As with many fast-moving stocks, a healthy retracement followed, and SNDK pulled back precisely toward the Fibonacci 38.2% golden ratio, where the stock found support and began forming a new base. This behavior suggests the prior uptrend remains intact, and the uptrend may resume as long as the stock continues to hold above this retracement zone.

Some Elliott Wave practitioners may also interpret the current structure as a developing Wave 5, suggesting the potential for another upside leg if the trend continues to follow impulsive wave behavior.

Take note that I'm using logarithmic scale chart because the share price has already risen more than 300% since the 04 September breakout, making it more suitable for analyzing large percentage moves and trend structure.

ENTRY PRICE : 228.47

FIRST TARGET : 270.00

SECOND TARGET : 324.00 (Projected based on Fibonacci extension)

SUPPORT : 183.00 (The low of 21 Nov HAMMER candle)

Is SanDisk Building the Foundation for the AI Economy?SanDisk Corporation (NASDAQ: SNDK) has emerged from its February 2025 spin-off from Western Digital as a pure-play flash memory powerhouse perfectly positioned for the AI infrastructure boom. The company's stock has surged toward $230 per share, with Morgan Stanley projecting targets as high as $273, driven by a rare convergence of technological innovation, geopolitical maneuvering, and macroeconomic tailwinds. The separation unlocked significant shareholder value by eliminating the conglomerate discount, allowing SanDisk to pursue an aggressive strategy focused exclusively on flash memory. At the same time, the hard disk drive business operates independently.

The company's BiCS8 technology represents a breakthrough in 3D NAND architecture, utilizing CMOS Bonded to Array (CBA) design that achieves 50% higher bit density and I/O speeds reaching 4.8Gb/s—critical capabilities for AI training and inference workloads. This technological leap, combined with strategic manufacturing partnerships with Kioxia in Japan and a calculated divestiture of Chinese assets to JCET, positions SanDisk to navigate the US-China semiconductor conflict while maintaining access to critical markets. The NAND flash market is experiencing a structural supply shortage following years of underinvestment, with contract prices surging by more than 60% in some categories and manufacturers unable to bring new capacity online until late 2026 due to the 18-24-month construction timeline for advanced fabs.

SanDisk's financial performance validates this strategic positioning, with Q4 2025 revenue reaching $1.901 billion (up 8% year-over-year) and cloud segment revenue growing 25% annually to $213 million. The company achieved a net cash position of $91 million ahead of schedule while expanding non-GAAP gross margins to 26.4%. Enterprise SSDs like the 122.88TB SN670 UltraQLC and the PCIe Gen5 DC SN861 are displacing traditional hard drives in data center architectures, as AI workloads demand the density of HDDs combined with flash speed. The company is also pioneering High Bandwidth Flash (HBF) technology, which could offer petabyte-scale capacity at significantly lower costs than traditional High Bandwidth Memory (HBM), potentially revolutionizing AI inference economics and solidifying SanDisk's role as a critical infrastructure provider for the AI economy.

Sandisk Corporation ($SNDK) Jumps as Company Joins the S&P 500 Sandisk Corporation (NASDAQ: NASDAQ:SNDK ) delivered a strong performance as the stock closed at $223.28, gaining 3.83% on November 28. After-hours trading settled slightly lower at $222.99, yet the overall structure remains bullish. The momentum came as Sandisk officially entered the S&P 500, a major milestone only months after separating from Western Digital.

Fundamentals: S&P 500 Inclusion Sparks Heavy Interest

Sandisk’s addition to the S&P 500 triggered immediate enthusiasm. Shares spiked almost 11% during the morning session, driven by institutional positioning. Many funds tracking the index must now include SNDK, creating short-term buying pressure that typically follows S&P 500 entry.

The slot opened after Omnicom Group completed its acquisition of Interpublic Group. Sandisk now joins other recent index entrants born from corporate spinoffs, signaling a trend of newly independent tech companies gaining index-level recognition.

The excitement aligns with Sandisk’s explosive growth in 2025. Since its February spinoff, the stock has surged more than 500%, supported by soaring demand across the AI and cloud ecosystem. Companies building advanced AI models require high-speed, high-capacity storage, and Sandisk sits directly in that supply chain. With a market cap of $32.72 billion, the company is becoming a core player in data-intensive infrastructure.

Why This Matters for Investors

Index inclusion provides more than short-term flows. It lifts long-term visibility, attracts passive and active fund exposure, and reinforces confidence in Sandisk’s role in next-generation data architecture. With AI adoption accelerating, the company’s broader exposure to institutional capital arrives at a strategically perfect moment.

Technicals: Bullish Structure Intact

Price action shows SNDK holding firmly above the key $205–$210 support zone, confirmed on strong volume. Buyers defended the area during the recent pullback, keeping structure bullish.

Resistance: $284.52

As long as price stays above support with sustained volume, SNDK remains positioned for continuation.

$SNDK – “Last Man Standing” Short Setup After a 500% RunNASDAQ:SNDK – Last Strong Memory Stock Now Showing Cracks

NASDAQ:SNDK has been an absolute monster — up nearly 500% in just a few months — and it’s the last man standing in the memory-stock mania. But today, we finally have the first real sign of exhaustion.

🔹 The Setup:

This name has not closed below the 9 EMA for more than a day in months — pure trend monster behavior.

Today we’re printing a reversal candle with a long upper wick — the kind of signature you look for when a parabolic trend loses steam.

After such a massive run, even a normal retracement could be 20–30% down.

🔹 Sector Context:

Other memory names have already cooled off.

NASDAQ:SNDK is the last stronghold, and that’s usually the one that gets hit hardest when the tide finally turns.

When the leader cracks, the rest of the sector often unwinds together.

🔹 My Trade Plan:

1️⃣ Entry: Initiated a short in the mid-$260s.

2️⃣ Stop: Using today’s high of day — clean and tight.

3️⃣ Target: Looking for a sustained break below the 9 EMA, something we haven’t seen in months. First downswing could be brutal.

Why I Like This Short:

Reversal wick at peak extension.

Parabolic trend with no real pullback in months.

Sector softening while NASDAQ:SNDK is overstretched.

Clean stop, massive potential reward.

This is exactly the type of high-reward mean reversion trade I take after extreme exhaustion runs.

SNDK Bullish Continuation: Breakout Toward 285–305On the 1D chart, SNDK has shifted from months of range-bound trade into a powerful uptrend, with price riding well above the 20/60/120-day MAs in a classic bullish stack. Momentum is hot and volatility has expanded, but the market now faces near-term resistance at $270.91 (the latest swing high). The nearest structural demand sits around $185.00—the October “ledge” that launched the current leg.

Primary path: a decisive daily close above $271 confirms a breakout and resumes price discovery. If buyers hold that break, upside extension toward $285 is the first objective, with a continuation push into the $303–$305 area aligning with the recent measured move and psychological magnet. In this scenario, shallow retests of $270.91 turning into support would reinforce the trend.

If $270.91 rejects, expect digestion or a deeper fade before another attempt. A cooling phase could trap price between roughly $265–$270; a heavier unwind risks a drive toward $245 and even $225 if profit-taking accelerates. The bullish idea is invalidated on a daily close back below $185.00, which would mark a clear character change and open room for a broader correction toward the rising 20-day MA ($181.91).

This is a study, not financial advice. Manage risk and invalidations

SanDiskIt seems that everyone typically looks toward the magnificent 7 for easy returns because they are so prevalent in our day to day lives. However, many people overlook companies like NASDAQ:SNDK mainly because their brand isn't shoved in our faces 24/7. But that's okay, SanDisk still controls about 1/4 of all small device storage market share, meaning they more than likely are here to stay for a while. Even though the stock is volatile, I have taken a substantial position in this company with the intent to sell for a nice profit.

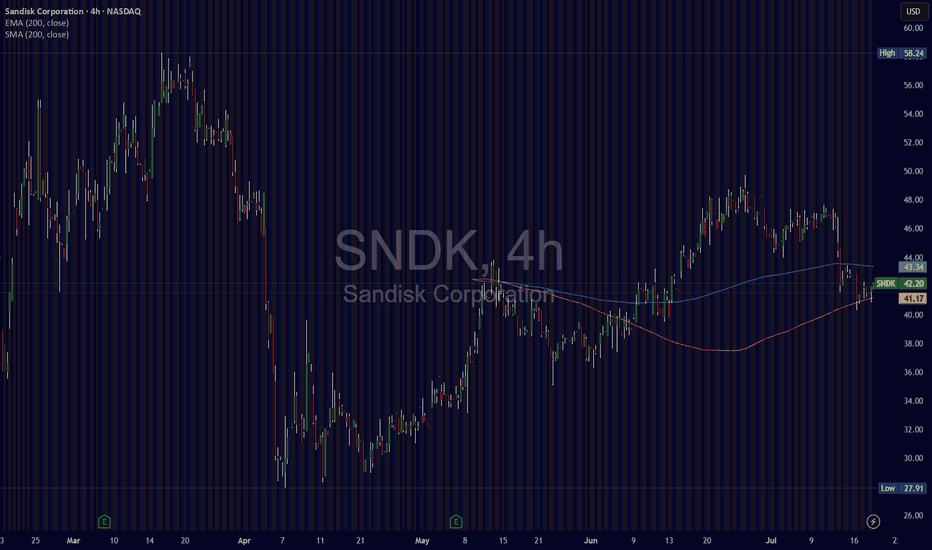

My current position:

Buy 1 @ 45.39 ( July 7, 2025)

Buy 2 @ 42.15 ( July 14, 2025)

Currently the stock is trading above or near the 4 Hour 200 EMA and 200 SMA both of which are clearly moving at an uptrend. As for the industry itself, storage cards are always in demand especially for small consumer devices which has and absolutely gargantuan market. Most large institutions and rating agencies have this tock as a buy with some targets raising as high as $80 per share. Although that is optimistic this trade is aiming for a timeframe of 3 to 5 months, which could work out with that price target.

Here's the goal, sell 90% to 100% of the entire position with a price target of $62. It's just that simple.