Agro Commodity Watch: Soybean Sets Stage for Bullish Expansion🏦💰 SOYBEAN HEIST: The Cash Flow Caper! | SOYBEAN/USD Strategic Entry Plan

🎯 THE SETUP: Agricultural Gold Rush Edition

Market: SOYBEAN vs USD (Agro Commodity - Cash Flow Management Strategy)

Trading Style: Swing/Day Trade Hybrid

Mission Status: 🟢 BULLISH BIAS ACTIVATED

📊 THE MASTER PLAN: Triangular Moving Average Breakout Strategy

🚀 Entry Conditions:

Wait for the Triangular Moving Average (TMA) breach to the upside — this confirms our bullish trend validation! Once we see that clean break above resistance, we're ready to "acquire our positions" strategically.

⚠️ CRITICAL: Set price alerts on your trading platform to catch the breakout in real-time!

💎 Layered Entry Zones (Scaling In Like Pros):

Strategic accumulation levels for risk management:

Layer 1: $10.050 🎯

Layer 2: $10.100 🎯

Layer 3: $10.150 🎯

Layer 4: $10.200 🎯

Pro Tip: You can choose ANY price level entry after the breakout confirmation — these layers simply optimize your average cost basis!

🛡️ RISK MANAGEMENT PROTOCOL

⛔ Stop Loss Zone: $10.000

Important Disclaimer: This is MY personal risk tolerance level. As traders, YOU must determine your own risk appetite and stop-loss placement. Trade at your own risk and only risk capital you can afford to lose!

🎯 PROFIT EXTRACTION TARGET

💰 Primary Target: $10.400

The "Police Barricade" Analysis:

This zone presents multiple confluences:

🔴 Strong resistance acting as psychological barrier

📉 Oversold conditions may trigger reversals

Potential bull trap zone — time to secure profits!

Exit Strategy: Consider scaling out positions as we approach $10.400. Don't get greedy — secure gains incrementally!

Important Note: This target is MY analysis. YOUR profit-taking strategy should align with your personal trading plan and risk management rules. Always secure profits at YOUR comfort levels!

🌾 RELATED AGRICULTURAL COMMODITIES TO MONITOR

Watch these correlated markets for confirmation signals:

CORN ( CBOT:ZC1! ) 🌽 - Direct grain market correlation, often moves in tandem with soybean fundamentals

WHEAT ( CBOT:ZW1! ) 🌾 - Grain sector sentiment indicator, affects overall agricultural commodity flows

SOYBEAN MEAL ( CBOT:ZM1! ) 📦 - Derivative product, reflects processing demand and crush spreads

SOYBEAN OIL ( CBOT:ZL1! ) 🛢️ - Key byproduct, influenced by biodiesel and cooking oil demand

DBA (Invesco DB Agriculture ETF) 💵 - Broad agricultural sector strength gauge

Dollar Pairs for Macro Context:

DXY (US Dollar Index) 💵 - Inverse correlation: weaker USD = stronger commodity prices

DX1! (Dollar Futures) - Real-time currency strength affecting agricultural export competitiveness

Key Correlation: Soybeans typically exhibit negative correlation with USD strength. Monitor the Dollar Index for macro tailwinds supporting our bullish thesis!

🔑 KEY TECHNICAL CONFLUENCES

✅ Triangular Moving Average breakout confirmation

✅ Multi-layered entry approach minimizes timing risk

✅ Clear risk-defined stop loss below psychological support

✅ Target aligned with technical resistance + overbought zones

✅ USD weakness could provide fundamental tailwinds

Risk Warning: Commodity futures and options trading carries significant risk and may not be suitable for all investors. You could lose more than your initial investment.

"Thief Style" Context: The playful "heist" terminology is purely thematic storytelling to make technical analysis engaging — it does NOT encourage or endorse any illegal activities or unethical trading practices. All strategies discussed involve legitimate, legal market participation.

📣 COMMUNITY ENGAGEMENT

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#SOYBEAN #Commodities #AgricultureTrading #SwingTrading #DayTrading #TechnicalAnalysis #PriceAction #BreakoutStrategy #CashFlow #RiskManagement #TradingSetup #FuturesTrading #GrainMarkets #USD #ForexCorrelation #MovingAverages #SupportAndResistance #TradingPlan #MarketAnalysis #CommodityFutures

Soybeansfutures

Soybeans vs USD: Breakout Robbery in Progress – Join the Escape!🚨💰🌱 Soybeans vs. US Dollar Commodities CFD Heist Plan (Swing/Day) 🕶️⚡

👋 Dear Ladies & Gentlemen… and my fellow Thief OG’s 🐱👤💵,

Tonight’s grand heist is in the Soybeans Vault 🌱💰 vs. the Mighty Dollar 💵.

We move Bullish 📈 – the loot is ripe, and the guards are weak!

🎯 The Master Heist Plan

Entry (Breakout Trigger): ⚡ 1065.00

👉 Once the vault door cracks open at 1065, we sneak in with Thief Layer Entries 🕶️🔪:

1063.00

1060.00

1055.00

1052.00

(Keep layering your entries, thief-style… the deeper the pullback, the fatter the loot 💎💸).

Stop Loss (Thief Escape Plan): 🏃♂️💨

📍 The secret tunnel is at 1040.00.

But hey thieves, adjust your SL 🔑 based on your strategy & risk appetite.

Target (Police Barricade 🚔):

👉 1088.00 – That’s where the cops set up the roadblock, so escape with the bag before they catch you 🏆💰✈️.

🕶️ Thief Trading Wisdom

Multiple buy limit layered orders = professional thief entry strategy.

Always confirm the breakout before layering in.

Police (market makers) will try to trap you – stay one step ahead 🐱👤⚡.

🔥 Boost our Robbery Plan if you’re part of the crew 💣💵!

The more likes & views, the bigger the gang grows 🚀.

#ThiefTrading 🕶️ #SoybeansHeist 🌱💰 #CommodityLoot 💸 #SwingTradePlan ⚡ #DayTradeRobbery 🐱👤 #USDvsSoybeans 💵 #BreakoutStrategy 📈 #LayerEntry 🔑 #TradingViewHeist 🚔 #MarketLootPlan

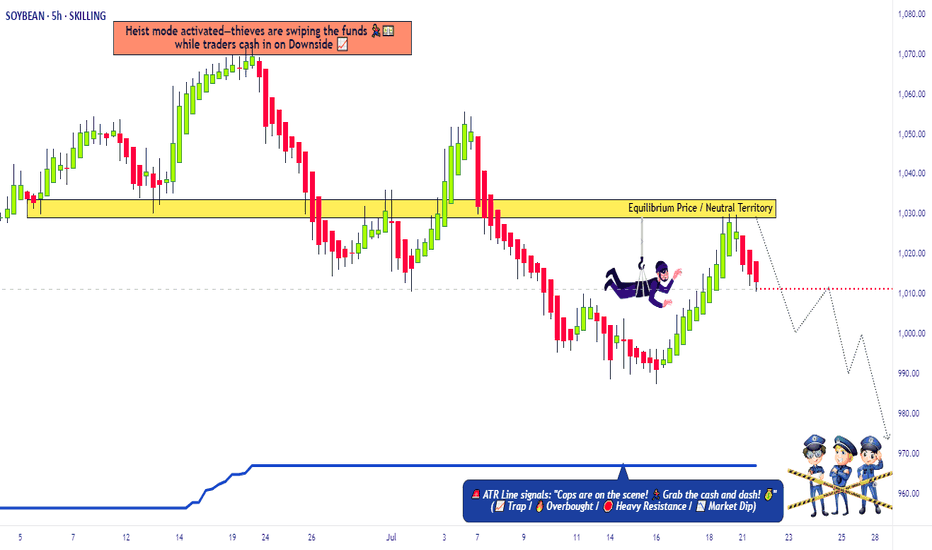

SoyBeans Price Reversal – Time to Swipe Bearish Profits🔓 Operation SoyBeans: Vault Breach Underway! 💼🌾

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Calling All Market Bandits, Scalping Buccaneers & Swinging Looters 🕵️♂️💰💣

We've marked our next robbery target—the "SoyBeans" Commodities CFD Market.

This isn’t just a trade, it’s an orchestrated heist built off Thief Trading intelligence: a mix of technical traps, fundamental cues, and criminal market psychology. 🧠💸

🔎 🎯 Entry Point - Where the Safe Cracks Open:

The vault is wide open—grab bearish loot at any price!

But for maximum stealth, layer in buy limit orders on the pullback using the 15m or 30m timeframe near swing highs/lows.

(We thieves call this: DCA under the radar.) 🕳️📉

🛡️ 🚨Stop Loss - Our Escape Hatch:

Set SL at the nearest 4H candle wick swing high (1040.00).

Customize it based on your loot size (lot size), order count, & risk appetite.

A smart thief knows when to vanish! 🏃♂️💨

🏁 💰Target - The Vault Cash-Out Point:

Main Heist Target: 970.00

Or exit early if the cops (volatility) show up! 🚔🎯

💡 Scalper’s Note - Quick Grab & Dash:

If you’ve got a heavy bag 💼💸, scalp short aggressively.

If not, roll with the swing crew—use trailing SLs to lock the loot and flee clean. 💨📦

📉 Thief Insight – Why We're Robbing This Vault:

"SoyBeans" showing bearish breakdowns due to:

📰 COT Positioning

📦 Inventory & Storage Data

🕰️ Seasonal Weakness

💭 Sentiment Drift

🔗 Intermarket Signals

Get the full scoop—go dig deeper into your own thief intelligence sources. 📚🕵️♂️

⚠️ Stay Alert – Market Mayhem Incoming!

News drops = surveillance upgrades. Avoid new trades during major releases.

Protect running loot with tight trailing SLs—guard your stolen goods! 🛑🗞️📉

❤️🔥 Show Some Love to the Robbery Crew!

💥Smash that BOOST button💥 to fuel the Thief Army.

Together, we rob smarter. 💰🚀

🔔 Stay Tuned, Looters:

Another heist is being planned. Don't miss the next setup.

Money is out there… we just have to take it the thief way. 🧠💎

📜 Disclaimer:

This plan is for chart criminals in training 📉🕵️♂️ – not personalized financial advice.

Always assess your own risks before raiding any market vault.

Soybean Breakout – Time to Steal Profits!🚨 "SOYBEAN HEIST ALERT: Bullish Loot Ahead! 🎯💰 (Thief Trading Strategy)"

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to plunder the 🌱🍃SOYBEAN CFD market! Here’s your master plan for a smooth heist."

🔎 TRADE SETUP (Thief Edition)

Entry 📈: "Buy the dip or chase the breakout—bullish momentum is ripe for stealing!"

Pro Tip: Use buy limits near 15-30min pullbacks (swing lows/highs) for optimal theft.

Stop Loss 🛑: "Hide your loot!" Set SL at nearest 4H swing low (1030.00). Adjust based on your risk appetite.

Target 🎯: 1085.0 — or escape early if bears ambush!

⚡ SCALPERS’ NOTE:

"Only long scalps allowed! Rich? Raid now. Poor? Join swing thieves & trail your SL!"

🔥 WHY SOYBEAN? (Bullish Catalysts)

Technicals + fundamentals align for a bullish heist.

Check: COT reports, seasonals, macro trends, and intermarket signals (links below 👇).

⚠️ WARNING: NEWS = VOLATILITY

Avoid new trades during major news.

Trailing SLs = your escape rope! Lock profits before the cops (bears) arrive.

💎 BOOST THIS HEIST!

"Smash 👍 LIKE, hit 🔔 FOLLOW, and share the loot! Your support fuels our next raid."

🎯 Final Tip: "Profit is yours—take it and vanish! 🏴☠️"

📢 Stay tuned for the next heist! "Market thieves never sleep…" 😉

"SOYBEAN" Commodities CFD Market Bearish Heist (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🥔🍀🍃SOYBEAN🍃🥔🍀 Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (1015) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1060 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join Day traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🥔🍀🍃"SOYBEAN"🍃🥔🍀Commodities CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"SoyBeans" Commodities CFD Market Robbery Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SoyBeans" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (975.0) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (1015.0) Swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 935.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🥔🍀🍃"SoyBeans" Commodities CFD Market Heist Plan is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Soybeans Under PressureSoybeans

Technicals (May)

May soybean futures broke back below support yesterday which accelerated the selling pressure and keeps the door open for a retest of the February lows in play, that comes in from 1128 1/2-1133 1/2.

Bias: Neutral

Resistance: 1155-1160***, 1170-1175***

Pivot: 1150

Support: 1128 1/2-1133 1/2****

Fund Positioning

Friday's Commitment of Traders report showed Funds were net sellers of roughly 1k contracts, putting their net short position at 139,310 contracts. Broken down that is 54,057 longs VS 193,367 shorts.

Seasonal Trends

(Past performance is not necessarily indicative of future results)

Below is a look at price averages for November soybeans, using the 5, 10, 15, 20, and 30 year averages.

Check out CME Group real-time data plans available on TradingView here: www.tradingview.com

Disclaimers:

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

Futures trading involves substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

Soy beans Futures ( ZS1! ), H1 Potential for Bearish dropType : Bullish Rise

Resistance : 1716'4

Pivot: 1702'6

Support : 1675'4

Preferred Case: Price is moving below the ichimoku cloud which supports our bearish bias that price will drop from the pivot at 1702'6 where the overlap resistance and 23.6% fibonacci retracement are to the 1st resistance at 1716'4 in line with the swing high resistance, 50% fibonacci retracement.

Alternative scenario: Alternatively, price may break pivot structure and drop to the 1st support at 1675'4 in line with the swing low support, 100% fibonacci projection and 50% fibonacci retracement .

Fundamentals: Since both countries, Russia and Ukraine, are major exporter of agriculture goods and their persistent war will lead to a shortage of agricultural goods and give us a bullish bias for soybean.

Soy beans Futures ( ZS1! ), H1 Potential for Bullish bounceType : Bullish Bounce

Resistance : 1693'2

Pivot: 1672'4

Support : 1662'4

Preferred Case: With price moving above our ichimoku cloud , we have a bullish bias that price will rise to our 1st resistance at 1693'2 in line with the 61.8% Fibonacci projection from our pivot of 1672'4 in line with the horizontal swing low support.

Alternative scenario: Alternatively, price may break pivot structure and head for 1st support at 1662'4 in line with the horizontal overlap support and 23.6% Fibonacci retracement .

Fundamentals: No Major News

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

Soybeans Futures ( ZS1! ), H1 Bullish rise!Type : Bullish rise

Resistance : 1642'2

Pivot: 1633'0

Support : 1610'6

Preferred Case: With price expected to bounce off the stochastics indicator, we have a bullish bias that price will rise to our 1st resistance in line with the 38.2% Fibonacci retracement from our pivot in line with the horizontal swing low support.

Alternative scenario: Alternatively, price may break pivot structure and head for 1st support in line with the 127.2% Fibonacci extension.