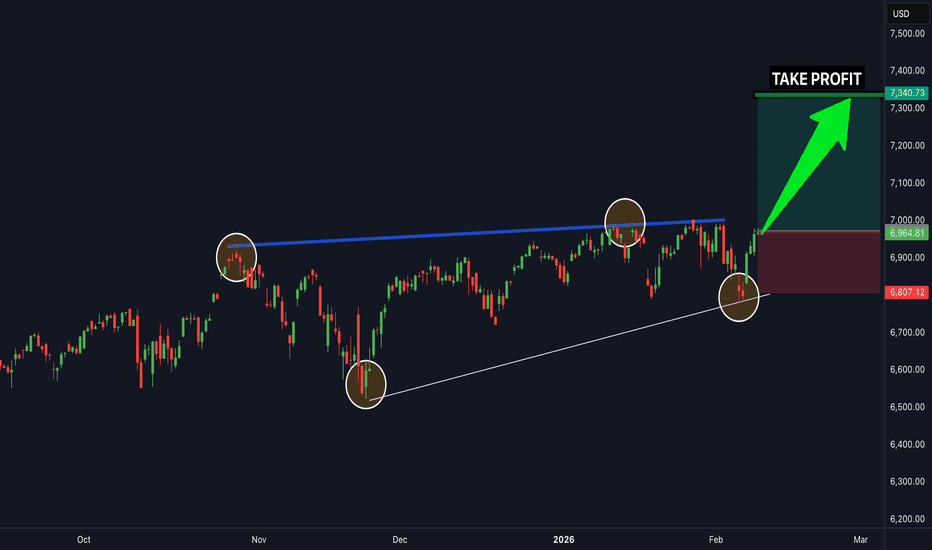

S&P 500: Retest Done — Next Push to New ATH?The S&P 500 index ( SP:SPX ) completed its downward movement as I expected in the previous idea (full target) .

Currently, the S&P 500 index has managed to break the resistance zone($6,956-$6,918) and is completing a pullback to this zone.

In terms of Elliott wave theory, it seems that the S&P 500 index has managed to complete the main wave 4 and is currently completing the main wave 5.

I expect the S&P 500 index to succeed in forming a new All-Time High(ATH) after breaking the resistance lines.

First Target: $7,031

Second Target: Resistance lines

Stop Loss(SL): $6,896

Points may shift as the market evolves

Note: This week, important indexes will be released from the US, which could have a significant impact on the S&P 500 index trend.

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌 S&P 500 Index Analyze (SPX500USD), 4-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Spx500long

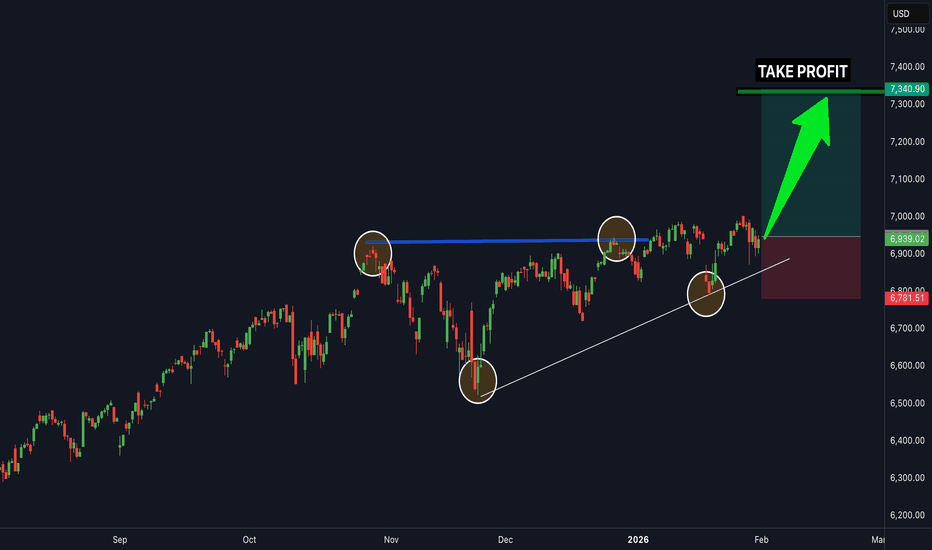

SPX.. Time to buy nowSPX 500 is in a clear upwards channel and has broken the last bit of resistance (white trendline line shown) - this is a clear confirmation that the next target will be the next resistance zone to the upside shown above (this is a great buy trade opportunity) - time to buy SPX 500 now...

SPX.. time to buy nowSPX 500 is in a clear upwards channel and has broken the last bit of resistance (white trendline line shown) - this is a clear confirmation that the next target will be the next resistance zone to the upside shown above (this is a great buy trade opportunity) - time to buy SPX 500 now...

SPX500: Bullish Push to 7000?As the previous analysis worked exactly as predicted, FX:SPX500 is eyeing a bullish breakout on the 4-hour chart , with price rebounding from a key support zone near the upward channel's lower boundary, converging with a potential entry area that could ignite upside momentum if buyers defend against dips. This setup suggests a continuation opportunity amid the ongoing uptrend, targeting higher resistance levels with 1:2.5 risk-reward .🔥

Entry between 6860–6890 for a long position (entry at current price with proper risk management is recommended). Target at 7000 . Set a stop loss at a daily close below 6845 , yielding a risk-reward ratio of 1:2.5 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging the index's resilience in the channel.🌟

📝 Trade Setup

🎯 Entry (Long):

6860 – 6890

(Entry at or near current levels is valid with proper risk & capital management.)

🎯 Target:

• 7000

❌ Stop Loss:

• Daily close below 6845

⚖️ Risk-to-Reward:

• ~ 1:2.5

💡 Your view?

Does SPX500 defend the channel support and break toward 7000 — or do we see another consolidation before the next leg higher? 👇

S&P 500 | SPX | When should fear really exist for the investor?In recognition of surpassing 500 followers, I thought I would take a moment to write about when I plan to fully exit equities, stockpile cash, and continue to acquire into 20-year treasury bonds (which I have started with TLT ). This post is not encouraging others to do as I do. Instead, it's an attempt to answer a common question I am asked: "When do you think this rally will be over?"

The answer is: "I do not know. But, using technical analysis, I can estimate a personal 'fear' indicator."

My 'Fear' Indicator

I use technical analysis to make informed decisions about entries and exits. It reduces emotional trading, chasing, and FOMO. My technical analysis does not conform to the "standard" 50-, 100-, 200-simple moving averages (SMA). In fact, back testing these standard SMAs show they are (arguably) traps for retail traders. The system wants your money, so why on earth would they share their secrets with such basic numbers as 50, 100, etc.?

Instead, the "devil" is in the details. What I will call my "historical SMA". That's as much as I will share because... well... I want your money too ;)

I view my historical SMA as primary support. It's the white line on the chart. Around that area is a range of values that the price can bounce around in (or slightly out) without causing panic or fear that support has been lost. From the historical SMA, other bands can be extended out to estimate additional support or resistance. If you follow me, you've seen I often trade using a "crash" and "major crash" SMA. These zones often indicate bottom areas for price reversal (i.e. algorithmic trading kicks in and pre-programmed computers quickly accumulate shares). Personally, it's a great indicator by taking out guesswork and letting time work for you instead of against you. It's not perfect, but the odds of success have been extremely high.

So, what's the opposite of my crash or major crash SMA? The "fear" SMA. I call it that because it's when people should ***really*** be fearful of their market exposure (unlike the crash and major crash SMAs which are opportunities). It's currently on the chart as purple lines near 7,600 and 7,800 (and rising). This band is where I am moving out of equities completely and going cash and NASDAQ:TLT . The throttle is maxed and headed for a wall, as they say. Does that mean once price hits that zone the market has topped and it's only down from there? Absolutely not. It may ride that level or jump higher for a few months, year, etc. But it's a fool's game at that point. Time will not be on investor's side. FOMO will be real for those who exit, but this is why technical analysis is important. It uses data for informed decision-making. Not emotions. Profits made from reaching the purple bar will be great. More is just glutinous.

Important Note

Obviously, the conditions above are predicated on no major wars, pandemics, global catastrophes, etc. I view any further dips in the market, not due to said conditions, as opportunities. But, as always, stay cautious, trade using your own strategies, and protect yourself and your money at all times.

SPX.. time to buy nowSPX 500 is in a clear upwards channel and has broken the last bit of resistance (white trendline line shown) - this is a clear confirmation that the next target will be the next resistance zone to the upside shown above (this is a great buy trade opportunity) - buy the SPX 500 now...

SPX.. buy now it's going upSPX 500 is in a clear upwards channel and has broken the last bit of resistance (white trendline line shown) - this is a clear confirmation that the next target will be the next resistance zone to the upside shown above (this is a great buy trade opportunity) - buy the SPX 500 now... it's going up

S&P 500 index at PRZ — Next Bullish Rally!!!In general, I place significant importance on the S&P 500 index( SP:SPX ), especially over the past month, because of its strong correlation with the crypto market, particularly Bitcoin( BINANCE:BTCUSDT ). When sharp movements occur in the S&P 500 index, we often see a mirrored effect in the crypto market and Bitcoin’s chart.

Currently, the S&P 500 index is moving near the support zone($6,776_$6,712) and the Potential Reversal Zone(PRZ) , and it appears to have successfully broken the upper line of the descending channel, which is a positive sign for a continued bullish trend in the coming days.

From an Elliott Wave perspective, it seems that the S&P 500 has completed a zigzag correction(ABC/5-3-5) within the descending channel, and we can expect an upward wave towards the resistance zone($6,853_$6,823).

I expect that the S&P 500 will begin to rise again from the Potential Reversal Zone(PRZ) and could climb at least up to $6,816. If it breaks resistance zone($6,853_$6,823), we can expect even more gains, which can also positively impact the broader markets.

What’s your outlook on the S&P 500 index and the U.S. stock market?

First Target: $6,816

Second Target: $6,834

Stop Loss(SL): $6,739(Worst)

Note: During U.S. trading hours, market volatility and emotions tend to increase. Please make sure to apply strict risk and capital management.

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌S&P 500 Index Analyze (SPX500USD), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

SPX...time to buySPX 500 is in a clear upwards channel and has broken the last bit of resistance (white trendline line shown) - this is a clear confirmation that the next target will be the next resistance zone to the upside shown above (this is a great buy trade opportunity) - time to buy the SPX 500 now

SPX500 Eyes 7000 — Breakout or Bull Trap Ahead?🦸♂️ SPX 500 Heist: The 7K Bull Run Playbook (Swing Trade Setup) ✅

Alright, crew, listen up! The market is a vault, and we're here to make a strategic withdrawal. The SPX 500 is showing us the blueprints for a potential bullish breakout. This is our plan to ride the wave.

🎯 The Master Plan: BULLISH

We're looking for a classic breakout play. The gates are at 6780, and once they're open, we're going in.

⚡ Entry Signal (The "Go" Signal)

Action: Consider long positions ONLY AFTER a confirmed daily breakout and close above the key level of 🎯 6780.00.

Translation: Don't jump the gun. Wait for the market to show its hand.

🚨 Stop Loss (The "Escape Route")

Location: My suggested escape hatch is down at 🛡️ 6600.00. Place it after the breakout we talked about.

A Note from the OG: "Dear Ladies & Gentleman (Thief OG's), I am not recommending you set only my SL. It's your own choice. You can make money, then take money at your own risk." 😉

💰 Profit Target (The "Loot Bag")

Destination: We're aiming for the major resistance zone at 🎯 7000.00. This is a psychological magnet and a previous area where sellers stepped in.

Why Here? It's a zone of strong resistance, potential overbought conditions, and traps for the greedy. Be smart and escape with your profits!

Another OG Note: "Dear Ladies & Gentleman (Thief OG's), I am not recommending you set only my TP. It's your own choice. You can make money, then take money at your own risk." 😎

🔍 Market Intel: Pairs to Watch

A master thief always checks the surrounding area. Keep an eye on these correlated assets:

AMEX:SPY (SPDR S&P 500 ETF): The direct tracker. Moves almost tick-for-tick with the SPX.

NASDAQ:NDX (Nasdaq 100): Tech-heavy cousin. If NDX is strong, it often pulls SPX up with it.

TVC:DXY (U.S. Dollar Index): Our usual antagonist. A stronger dollar can be a headwind for large-cap stocks.

CME_MINI:ES1! (S&P 500 E-mini Futures): The real-time action. This is where the big moves often happen first.

✨ Community Boost

If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#SPX500 #SP500 #SwingTrading #MarketPlaybook #PriceAction #ThiefTrader #IndexAnalysis #TechnicalAnalysis #TradingStrategy #US500 #Equities #BreakoutStrategy #TradingView #StockMarket #RiskManagement

SPX Is going up...time to buySPX 500 is in a clear upwards channel and has broken the last bit of resistance (white trendline line shown) - this is a clear confirmation that the next target will be the next resistance zone to the upside shown above (this is a great buy trade opportunity) - buy the SPX 500 now

BUY SPX NOW...time to buySPX 500 is in a clear upwards channel and has broken the last bit of resistance (white trendline line shown) - this is a clear confirmation that the next target will be the next resistance zone to the upside shown above (this is a great buy trade opportunity) - Time to buy the SPX 500 now

BUY SPX NOW...time to buy nowSPX 500 is in a clear upwards channel and has broken the last bit of resistance (white trendline line shown) - this is a clear confirmation that the next target will be the next resistance zone to the upside shown above (this is a great buy trade opportunity) - Time to buy SPX 500

SPX500 Bullish Plan in Motion with SMA + Kijun Confirmation🚀 US500/SPX500 INDEX MARKET SWING TRADE MASTERCLASS 🎯

📊 ASSET: S&P 500 Index (US500 | SPX500)

Timeframe: 4H-Daily | Strategy Type: Swing Trade | Market Context: Bullish Pullback Confirmation

🎲 TRADE SETUP: THE "THIEF PROTOCOL" STRATEGY ⚡

✅ TECHNICAL CONFIRMATION

🔹 Primary Signal: Simple Moving Average (SMA) Pullback Retest

🔹 Secondary Confirmation: Kijun-sen (Ichimoku MA) Retest

🔹 Market Structure: Higher Lows Formation + Bullish Consolidation

🔹 Bias: LONG with Layered Entry Methodology

💰 ENTRY STRATEGY: MULTI-LAYER LIMIT ORDER APPROACH

The "Thief Layering Method" - Stack multiple buy limit orders for optimal risk distribution:

🟢 Layer 1 Entry: $6,750.00 - Initial Probe Entry (30% Position Allocation)

🟢 Layer 2 Entry: $6,800.00 - Aggressive Add (35% Position Allocation)

🟢 Layer 3 Entry: $6,850.00 - Final Confirmation Entry (35% Position Allocation)

Entry Flexibility: Adjust layers based on your account size & risk tolerance. Spread entries across pullback zones for superior fill pricing.

🛑 STOP LOSS MANAGEMENT

Recommended SL Level: $6,720.00 - Placed below the support trendline + SMA confluence

⚠️ IMPORTANT DISCLAIMER: Dear Traders! This is YOUR trading journey. We strongly recommend adjusting stop loss based on YOUR risk management rules. Account sizing is crucial - never risk more than 2-3% per trade. Your SL placement = YOUR decision, YOUR responsibility. Use proper position sizing ALWAYS.

🎯 PROFIT TARGET ZONES

Primary Target: $7,050.00 ⚡

📊 Technical Reasoning: This level represents strong resistance confluence zone, historical supply level in overbought territory, and creates a risk/reward sweet spot of 1:3+ return potential. Alert: Trap zone exists here - smart money reversal area confirmed.

Exit Strategy Recommendation: Close 50% of position at $7,000-7,020 to lock partial profits. Hold remaining 50% with trailing stop or until $7,050 for maximum upside capture. Lock profits incrementally to secure gains.

⚠️ CRITICAL REMINDER: Your profit target = YOUR choice! This TP represents technical confluence, but market conditions evolve. Trade YOUR plan, manage YOUR risk, protect YOUR capital.

🌍 CORRELATED PAIRS TO WATCH 🔗

📈 PRIMARY CORRELATIONS

1️⃣ QQQ (Nasdaq-100 ETF) - 0.99 Correlation 💻

This is the tech-heavy composition that typically leads SPX rallies. Current focus remains on AI/Mag7 momentum and overall growth stock sentiment. Key watch: QQQ strength = SPX bullish confirmation signal. When QQQ breaks out, SPX follows closely.

2️⃣ IWM (Russell 2000 ETF) - 0.95 Correlation 📍

Small-cap composition with high tariff sensitivity. Current status shows small-cap underperformance zones vulnerable to trade policy shifts. Trading tip: IWM weakness = Sector rotation risk, so watch for divergence from SPX strength.

3️⃣ DXY (US Dollar Index) - Inverse/Mixed Correlation 💵

Recent positive correlation emerging in 2025 market dynamics. Current dynamic shows dollar strength now sometimes supports equities due to policy-driven factors. Risk factor alert: DXY spike above 108 = potential SPX headwind to monitor.

📊 SECONDARY WATCH PAIRS

SPY (S&P 500 ETF) - Mirror of SPX, use for volume confirmation and institutional positioning.

DIA (Dow Jones ETF) - Large-cap value barometer, less tech-sensitive than QQQ, shows rotation signals.

VIX (Volatility Index) - Above 25 = caution mode, below 15 = complacency warning.

📱 KEY CORRELATION INSIGHTS FOR THIS TRADE

🔴 RED FLAGS - Watch These Closely:

VIX spiking above 30 signals potential fear spike. DXY breaking above 108 creates dollar strength pressure. QQQ failing to confirm breakout indicates tech weakness divergence. IWM hitting new lows signals broad market weakness.

🟢 GREEN LIGHTS - Trade Confirmation:

QQQ and SPX moving in sync above SMA is bullish. IWM holding key support levels confirms breadth. DXY consolidating means no headwind pressure building. VIX below 20 indicates low fear environment.

🎯 TRADE PSYCHOLOGY & EXECUTION TIPS

✅ Pre-Trade Checklist:

Confirm SMA pullback on 4H chart before entry. Verify Kijun retest on Ichimoku indicator. Check QQQ alignment for correlation confirmation. Monitor DXY to avoid strong dollar days. Set alerts at all 3 entry layers for execution readiness.

✅ During Trade Management:

Take partial profit at 50% move up to secure gains. Move SL to breakeven after hitting first target. Trail stop every 50-pip move in your favor. Document your execution for journal review and performance tracking.

🔥 TRADE EXECUTION SUMMARY

Signal Type: Bullish Pullback Retest ✅ Confirmed

Entry Method: 3-Layer Limit Orders 🎯 Optimized for Best Fill Pricing

SL Level: $6,720.00 🛑 Defined and Placed Below Support

TP Level: $7,050.00 🎯 Defined at Resistance Confluence

Risk/Reward Ratio: 1:3+ 💰 Favorable Trade Structure

Best Tradeable Window: Next 48-72 Hours ⏰ Active Setup Zone

Good Luck, Traders! 🚀 Trade Smart. Trade Safe. Trade Often.

Remember: Your SL = Your Protection | Your TP = Your Goal | Your Risk = Your Responsibility

#SPX500 #SwingTrade #TechnicalAnalysis #TradingIdea #S&P500 #MarketAnalysis #TradeSetup #RiskManagement

SPX500: Bullish Push to 6927?As the previous analysis worked exactly as predicted, FX:SPX500 is eyeing a bullish breakout on the 4-hour chart , with price rebounding from a key support zone near recent lows , converging with potential entry area that could ignite upside momentum if buyers defend against dips. This setup suggests a continuation opportunity amid the ongoing uptrend, targeting higher resistance levels with favorable risk-reward.🔥

Entry between 6700–6720 for a long position. Targets at 6880 (first), 6927 (second). Set a stop loss at a close below 6643 to limit exposure, yielding a risk-reward ratio of approximately 1:2 to first target and up to 1:2.5 overall. Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging the index's resilience near ATH.🌟

Fundamentally , the S&P 500 is pushing toward new highs in November 2025, driven by bets on Fed rate cuts and strong global demand, though underlying issues like market concentration (top 10 companies over 40% of the index) and recent weekly dips (~2%) highlight volatility. Positive factors include liquidity, consumer strength, and earnings growth, with forecasts eyeing upside to 7000 amid election stability and AI investments. 💡

📝 Trade Setup

🎯 Entry (Long):

6700 – 6720

🎯 Targets:

• TP1: 6880

• TP2: 6927

❌ Stop Loss:

• Any 4H candle close below 6643

⚖️ Risk-to-Reward:

• ~1:2 to the first target

• Up to 1:2.5 if full target is hit

👇 Share your thoughts below! 👇

SPX Idea 23.11.2025I also have several scenarios for SPX, unfortunately for this one, it's not possible otherwise. I would consider a potential short first when the SFP is above the weight at the price level of 6883 and then above the new ATH. I would open a long position at the level around Vwap 6453, where the daily level is also nearby, and then at the level of 6200, where the Vwap and weekly levels are located for context, and then a little lower, the Fibo level of 0.382.

A Historic Shift in the S&P 500 Is BeginningFriends, in my view, the unstoppable rally in the S&P 500 has finally come to an end. The market has completed a massive five-wave structure with an extended fifth wave — and now we’re witnessing a historic moment as an exceptionally large correction begins.

As always, I’m watching two possible scenarios: the orange path and the purple path. But despite their differences, both point to the same outcome — my target at 5200. And that’s only the first target out of several.

Make sure to follow and subscribe, so you don’t miss the upcoming updates and deeper breakdowns.

This is just my personal market outlook — not financial advice. More updates coming soon.

SPX 500: Bullish Rebound to 6760?FX:SPX500 is priming for a bullish rebound on the 4-hour chart , where price has pulled back to a critical support zone following a sharp decline, forming a potential bounce setup amid a broader uptrend—highlighted by the rebound pattern near key levels that could ignite buying if buyers defend against further downside. This confluence at the support offers a high-reward long opportunity in the index's volatile range.

Entry zone between 6530-6550 for a buy position. Target at 6760 🎯near the resistance zone, delivering a risk-reward ratio greater than 1:4 .Set a stop loss on a close below 6500 📊 to manage risk effectively. Watch for confirmation via a strong bullish candle with rising volume above the entry, capitalizing on the index's resilience despite recent pressures🌟.

Fundamentally , the S&P 500 closed at around 6646.7 on November 19, 2025, down over 2% in November amid economic concerns and high valuations, particularly in AI stocks, with the index dipping below its 50-day moving average for the first time since April—yet historical patterns suggest a median 15% upside to 7710 over the next year if it follows median rebounds. Earnings growth remains robust at 16.9% YoY, beating estimates, supporting potential recovery despite tariff worries. 💡

📝 Trade Setup

🎯 Entry Zone (Buy): 6530 – 6550

🎯 Target:

• TP: 6760 (major resistance)

❌ Stop Loss: Close below 6500

⚖️ Risk-to-Reward: Greater than 1:4

What's your outlook on this rebound? Drop your thoughts below! 👇