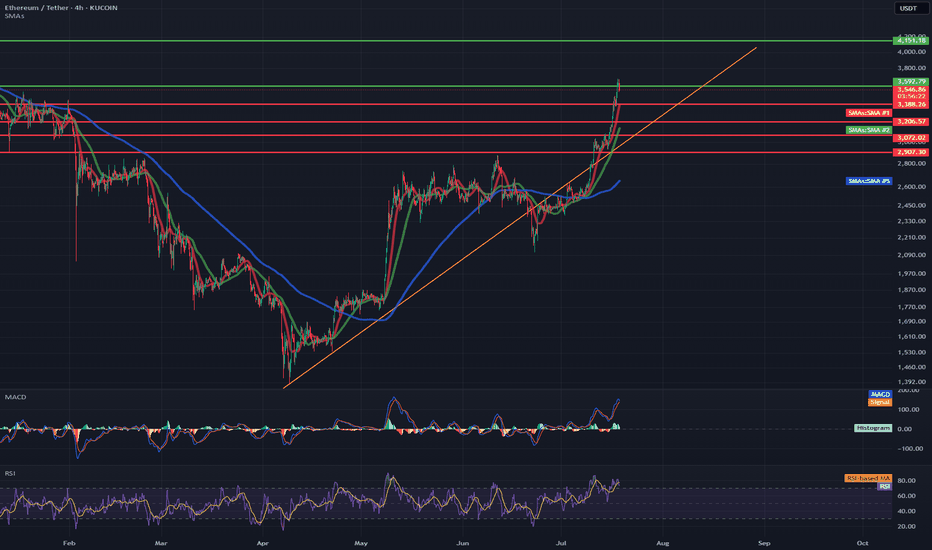

ETH/USDT 4H Chart✅ Market Trend and Structure:

Uptrend: The highlighted orange trend line shows continuous growth since mid-April. The price is trading above the 50- and 200-period moving averages (EMA and SMA), confirming bullish sentiment.

Current price: around 3556 USDT – very close to local highs.

Resistance break in the 3200–3300 USDT area, which now acts as support.

📈 Technical Levels:

Resistance (red horizontal lines):

3600–3650 USDT – local resistance resulting from market reaction.

3888 USDT – next historical resistance level.

4133 USDT – established long-term target (green dashed line at the top).

Support:

3300 USDT – strong support after a previous breakout.

3080 USDT – previous high, now the next support level.

3070 / 2900 USDT – key technical support levels in the event of a larger correction.

📊 Indicators:

MACD:

The MACD is in a strongly bullish zone, but:

The histogram is flattening.

A bearish crossover pattern is possible in the following candles – a signal of weakening momentum.

RSI:

RSI ~74 – is in the overbought zone, which often heralds a correction or at least consolidation.

A value above 70 confirms the bullish trend but may suggest that momentum is overheated.

📌 Conclusions and Scenarios:

🔼 Upside Scenario (trend continuation):

If the price remains above 3300–3350 USDT, it could move towards 3888, and then 4133 USDT.

A break above 3650 USDT on heavy volume will be a strong continuation signal.

🔽 Corrective scenario (short-term pullback):

The RSI and MACD suggest a possible correction.

Potential pullback to:

3300 USDT (retest of previous resistance as support).

SMA 200 (~2600 USDT) with a deeper downward move.

Support

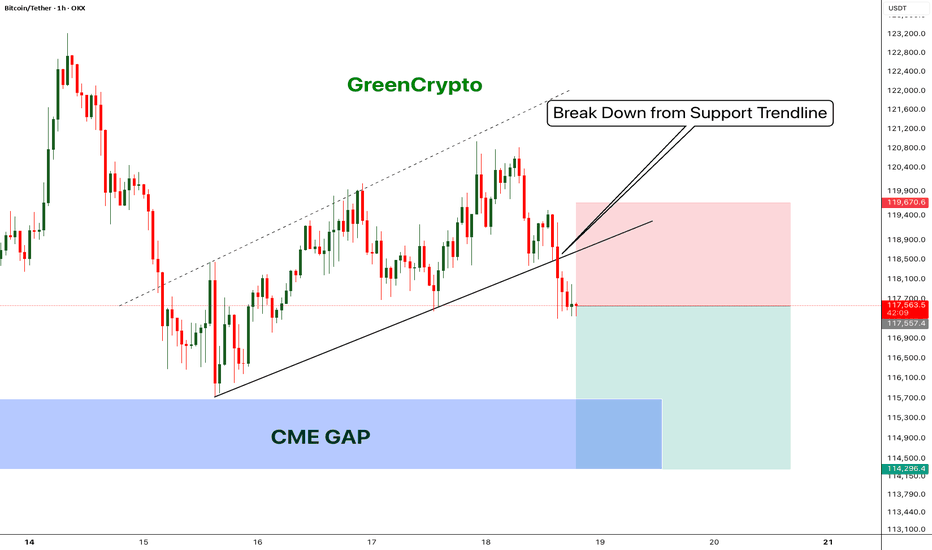

Bitcoin - Bears will push the price fill CME Gap- Bitcoin has broken down from the trending support,

- Price has been going down without any retracement on 1H candle.

- Looks like bitcoin will CME gap before going up further.

- A high risk Short Trade opportunity is here

Entry: 117,431

Stop Loss: 119,670

TP1: 116152.8

TP2: 114403.6

Move SL to Breakeven on TP1 hit

Don't forget to like and follow

Cheers

GreenCrypto

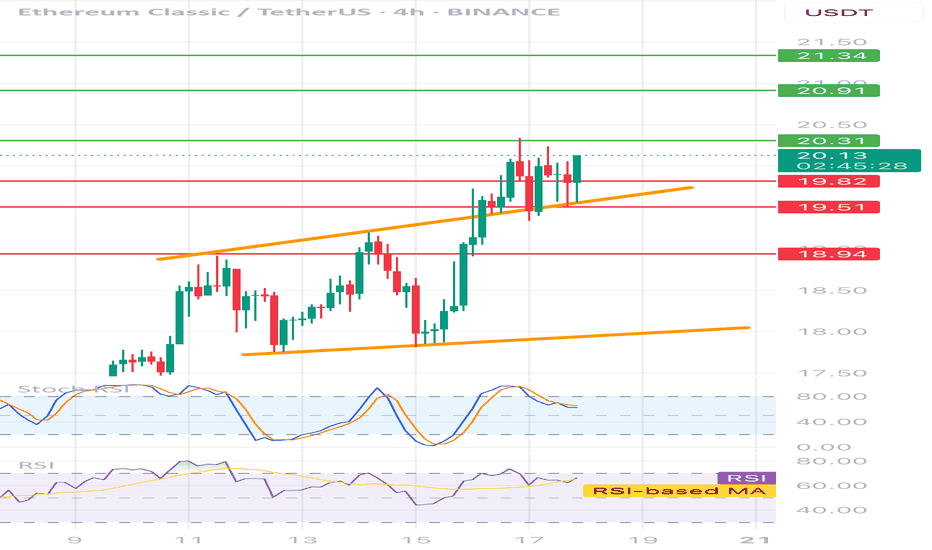

ETCUSDT 4H📊 Price:

Currently around 20.05 USDT

⸻

🔶 Technical formation:

• Ascending channel - clearly marked with two orange trend lines.

• The price is currently testing the upper edge of the channel - it is possible to break or correction.

⸻

📉 Support and resistance:

• ✅ Support:

• 19.73 (local, on the closure of the candles)

• 19.51 (technical, tested several times)

• 18.94 (stronger, historical)

• 🚫 resistance:

• 20.31 - the closest local resistance

• 20.91 - key level

• 21.34 - strong resistance from higher intervals

⸻

🔄 oscillators:

• STOCHASTIC RSI - in the inheritance phase (descent from buying), possible local decline / correction.

• RSI (14) - approx. 60, slightly positive trend, but without exaggeration - no purchase, place for further increases.

📌 Fast strategy:

• 🟢 Long: After breaking and Retescia 20.31 → TP 20.91 / 21.34

• 🔴 Short: after rejection 20.31 or the upper line of the channel → TP 19.73 / 19.51

• 📉 SL: In both cases, it is best 0.3–0.4% above the last high/low

SEIUSDT Rebounds from Key Support - Pump Loading?BINANCE:SEIUSDT Rebounds from Key Support - Pump Loading?

BINANCE:SEIUSDT just touched a major support level on the 4H chart and is now showing signs of a bullish reversal after breaking above the descending trendline. This setup looks similar to previous price actions where NYSE:SEI delivered sudden explosive moves post-breakout. If history repeats, we could be looking at another strong rally ahead.

Entry looks promising, but as always, manage your risk wisely and set a proper stop loss to protect your capital.

BINANCE:SEIUSDT Currently trading at 0.265

Buy level : Above $0.263

Stop loss : Below $0.243

Target : $0.337

Max leverage 5x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

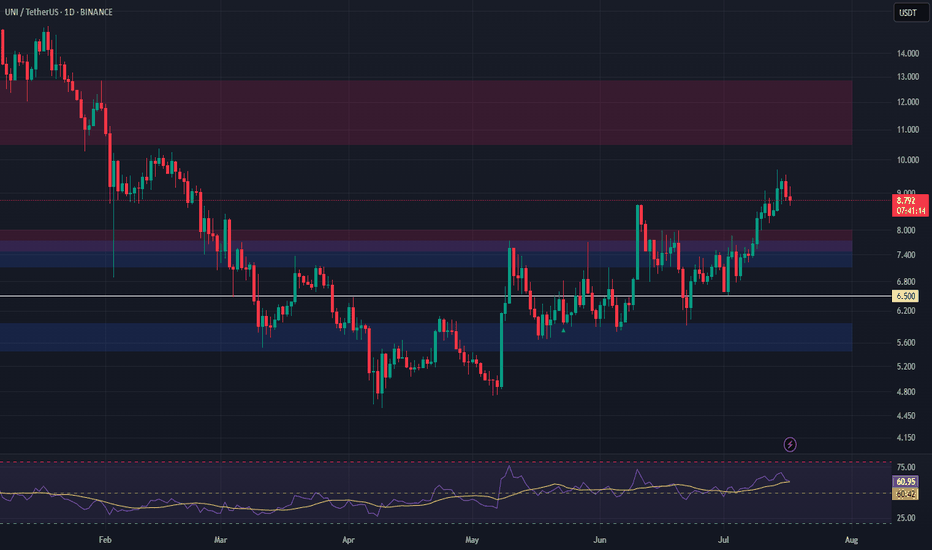

UNI Long Setup – Breakout Retest into High-Confluence SupportUniswap (UNI) has broken out of resistance and is now pulling back into a high-confluence zone, forming a strong bullish structure. The $7.13–$7.73 area presents a favorable entry on the retest.

📌 Trade Setup:

• Entry Zone Around: $7.13 – $7.73

• Take Profit Targets:

o 🥇 $10.50 – $12.85

• Stop Loss: Daily close below $6.50

TON - Locked and Loaded for a perfect Reversal- TON is reversing perfectly from its long tested support

- On weekly chart we have clear bounce back and perfect candle.

- This is an excellent opportunity to enter

Entry Price: 3.17

Stop Loss: 2.15

TP1: 4.0796

TP2: 5.2629

TP3: 6.8383

TP4: 8.3298

TP5: 11.0191

Stay tuned for more updates.

Cheers

GreenCrypto

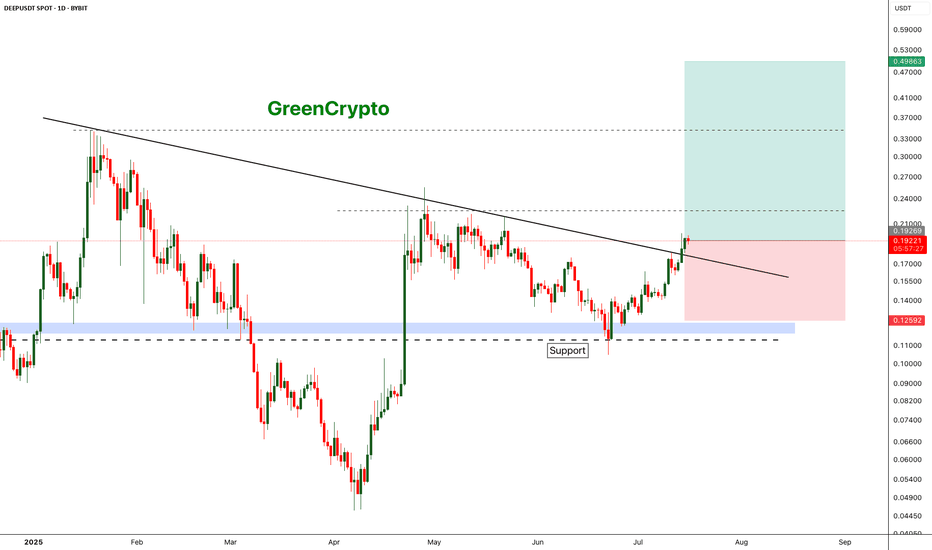

DEEP is deep Bullish DEEP has broken out from the resistance trend line and headed towards the next resistance around 0.22

We have good opportunity for a long trade here

Entry Price: 0.19219

Stop Loss: 0.12592

TP1: 0.22558

TP2: 0.27615

TP3: 0.34703

TP4: 0.49342

Don't forget to keep stop loss

Cheers

GreenCrypto

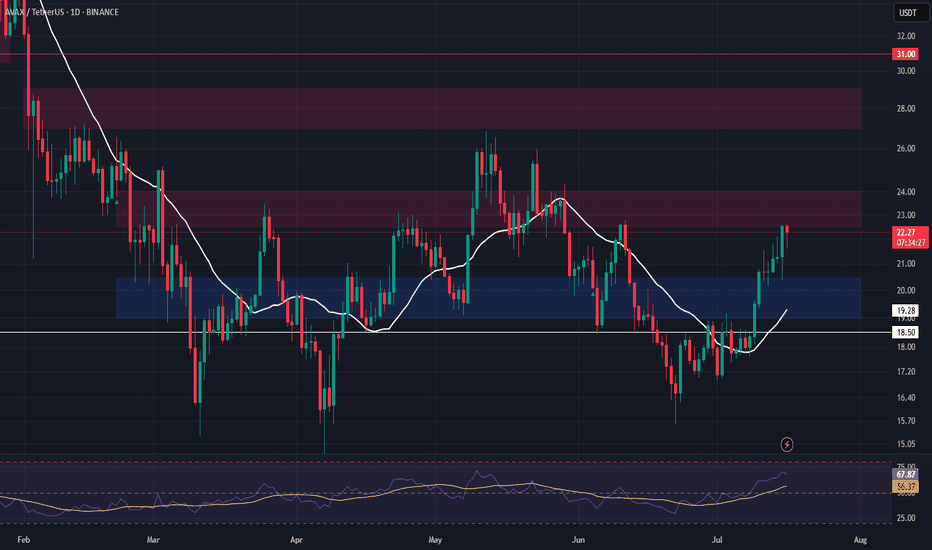

AVAX – Watching for Support Retest After Resistance TestAVAX is currently testing a major resistance level, and we’re anticipating a potential retrace into support. The $19.00–$20.45 zone offers a strong area to enter a long swing position on confirmation of the retest.

📌 Trade Setup:

• Entry Zone: $19.00 – $20.45

• Take Profit Targets:

o 🥇 $22.50 – $24.00

o 🥈 $27.00 – $30.00

• Stop Loss: Daily close below $18.50

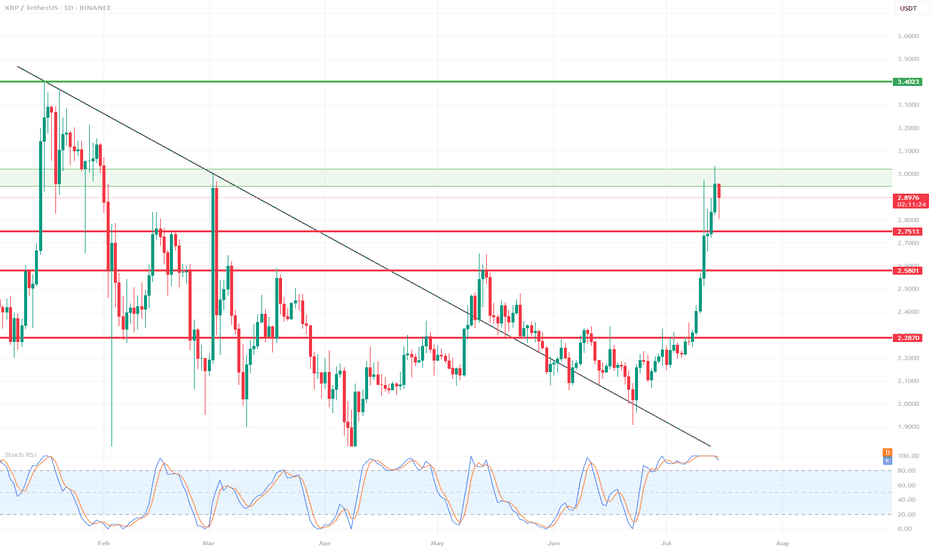

XRP 1D Chart Review📊 Support and Resistance Levels:

🔼 Resistance:

$2.95 - $3.02 – currently being tested, a local resistance zone. Price slightly rejected.

$3.40 – another strong resistance level from the previous high (visible on the left side of the chart).

🔽 Support:

$2.75 – the closest, recently broken support level.

$2.58 – another local support level.

$2.28–$2.30 – a very strong support zone that has been tested multiple times.

📈 Pattern and Momentum:

A breakout from a wedge-shaped downtrend with very high volume and long bullish candles indicates strong demand.

We are currently observing a correction/rejection at $3.02 – a possible short-term pullback.

🔄 Oscillator – Stochastic RSI:

The Stochastic RSI oscillator is in the overbought zone (near 100) – indicating possible consolidation or correction.

The curves are starting to curve downwards – a potential signal for a slight correction in the coming days.

🧠 Scenarios:

✅ Bullish (continued growth):

If the $2.95–$3.02 level is broken strongly and confirmed (e.g., by a daily candlestick closing above it), the target will be $3.40.

In this case, a quick rally to $3.40 is possible without major obstacles.

⚠️ Bearish (correction):

If the $3.02 zone holds as resistance, the price could retrace to $2.75 (the first local support).

If downward pressure persists, $2.58 could be tested.

📌 Summary:

XRP is in a strong uptrend after breaking out of long-term resistance.

In the short term, overbought prices on the Stoch RSI could trigger a correction to $2.75.

Key resistance: $3.02 – breaking it could signal further gains towards $3.40.

It's worth monitoring price reaction in this zone and candlestick confirmation.

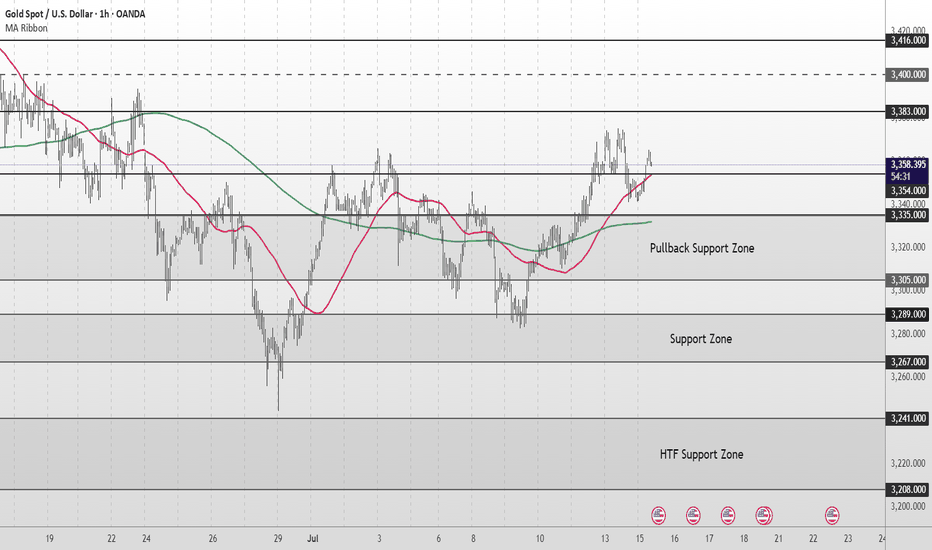

Gold Short Term OutlookGold has extended its recovery after holding above the Pullback Support Zone and is now trading around 3,359, attempting to build momentum toward higher resistance levels.

The structure remains bullish with price trading above both the 50MA and 200MA , which are starting to slope upward and act as dynamic support.

A confirmed break and hold above 3,354 would open the path toward the next resistance cluster at 3,383 and potentially 3,400, with 3,416 and 3,440 as higher-timeframe resistance targets.

If price fails to hold above 3,354 and begins to fade, watch the Pullback Support Zone (3,335–3,305) closely for signs of renewed buying interest.

A clean break below that zone would shift focus to the deeper Support Zone (3,289-3,267) and potentially the HTF Support Zone (3,241–3,208) if selling pressure builds.

📌 Key Levels to Watch

Resistance:

‣ 3,364

‣ 3,383

‣ 3,400

‣ 3,416

Support:

‣ 3,354

‣ 3,335

‣ 3,305

‣ 3,289

‣ 3,267

‣ 3,241

‣ 3,208

🔎 Fundamental Focus

All eyes are on today’s U.S. CPI release

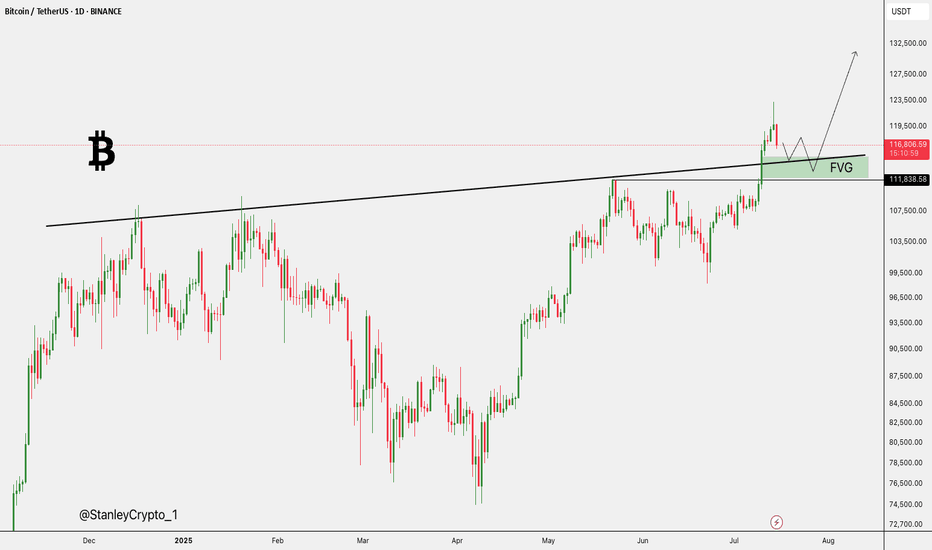

Bitcoin – Rising channel with critical support at $119.000!The chart presented shows Bitcoin in a well-defined rising channel, highlighting a strong bullish momentum over recent trading sessions.

Rising channel

The price action is currently oscillating within the boundaries of this upward sloping channel, marked by parallel trendlines. The channel suggests that Bitcoin has been consistently making higher highs and higher lows, with the current price hovering around $121,794. The upper boundary near $123,200 acts as potential resistance, while the lower boundary of the channel provides dynamic support, suggesting a continuation pattern if this structure holds.

Uptrend

The overall uptrend is clearly visible and remains strong, especially since July 10th, where a significant bullish breakout occurred. The breakout was followed by steady gains, with minimal pullbacks, indicating strong buying interest and market confidence. The momentum shows a healthy bullish structure with minimal price overlap, characteristic of a trending market, which favors continuation as long as critical support levels remain intact.

Support area

A critical element in this chart is the key support area, highlighted in green. This support zone is located between approximately $118,500 and $119,600. This zone was previously a resistance level that has now turned into support following the breakout. It also aligns with the mid-level of the rising channel, reinforcing its significance. Should the price retrace, this area is likely to act as a cushion where buyers may step in again to defend the trend.

Fibonacci

Additionally, the chart features a Fibonacci retracement drawn from the swing low to the current swing high. The 0.618 Fibonacci level is particularly noteworthy, sitting at around $119,623. This level is known as the “golden ratio” in technical analysis and often acts as a strong retracement level during corrections. Below it, the 1.0 level is marked at $116,669, which represents a full retracement of the move and a deeper correction scenario if the support fails. These Fibonacci levels coincide with the key support zone, further validating it as an area of high confluence and likely buying interest.

Final thoughts

Overall, the technical structure remains bullish within the rising channel, with key levels of interest lying around $119,600 for support and $123,200 for potential resistance. A successful defense of the support area could propel the price higher toward the channel’s upper bound, while a breakdown may lead to a test of deeper Fibonacci retracement levels.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like and leave a comment, I’d love to hear your thoughts!

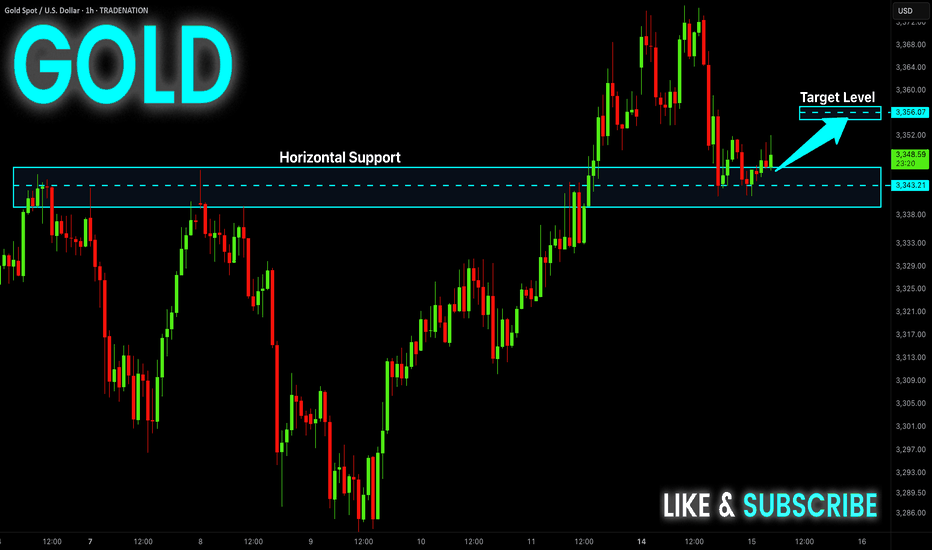

GOLD Local Rebound Ahead! Buy!

Hello,Traders!

GOLD made a retest of

The horizontal support

Level of 3343$ and as

We are locally bullish

Biases we will be expecting

A local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTC/USD 1H ShortTerm🔍 Trend:

The short-term uptrend remains in effect, supported by the orange trendline.

The price has tested dynamic support but has not yet broken it.

🟥 Supports (Important Levels):

🔻 1. 119.550

Key support.

The price is currently testing it. Holding = potential upside rebound.

Breaking = greater downside risk.

🔻 2. 117.260–118.040 USD

Clear demand zone (reinforced by prior consolidation).

If the price breaks below current support, this is the next logical stopping point.

🔻 3. 115.237–115.500 USD

Strong weekly support – very important in the event of a stronger correction.

Historically, it has responded many times.

🟩 Resistance:

🔼 1. USD 121.673

The nearest local resistance – this could pose a problem for further growth.

🔼 2. USD 123.961

The last local high. Breaking it confirms the continuation of the uptrend.

🔼 3. USD 125.785

The next resistance – a potential target after a breakout to the upside.

📈 Technical Indicators:

RSI (classic):

Still below 50, but starting to reverse slightly upward – neutral with a slight potential for a rebound.

Stochastic RSI:

Gives a long signal – the lines have crossed in the oversold zone and are pointing upward.

📊 Scenarios:

🟢 Bullish:

Maintaining the current support zone (119.5–120k).

Breakout above 121.673 → target: 123.961.

Breakout of 123.961 = trend confirmation and target: 125.8k+

🔴 Bearish:

Break of the trend line and support at 119.550 → possible quick decline to 117.2k–118k.

If this doesn't hold, target: 115.2k

✅ Summary:

Decisive moment – tested trend line + support = rebound or breakout point.

The Stochastic RSI indicates a potential upside breakout, but the RSI needs confirmation.

Careful monitoring of volume and reaction to 120k in the coming hours.

XRPUSDT Breaks Out of Bullish Flag - Big Moves Ahead!BINANCE:XRPUSDT has broken out of a classic bullish flag pattern on the weekly chart, signaling a strong continuation to the upside. This textbook setup is known for its high success rate, and the breakout suggests the potential for significant gains if momentum continues.

The CRYPTOCAP:XRP community remains strong, with long-term holders showing confidence and resilience. With the current market structure and support from loyal investors, there’s a real possibility for the price to double from this breakout zone.

The strategy is simple. Buy and hold for the long term. But as always, traders must manage risk carefully and use a proper stop loss. Let the flag fly high. CRYPTOCAP:XRP could be ready for a major pump from this level.

BINANCE:XRPUSDT Currently trading at $2.43

Buy level : Above $2.4

Stop loss : Below $1.9

Target : $5

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

EURUSD is ready to break supportCMCMARKETS:EURUSD

The Euro fell to 1.1670 on Friday, positioning for nearly a 1% weekly loss 📊, as investors recalibrated risk exposure amid escalating trade tensions ⚔️ and shifting monetary policy signals 🏦.

📉 Market Structure:

🔻 EURUSD has traded in a bearish trend since July 1.

🔹 Support levels: 1.1680 and 1.1590.

🔹 Retested the 1.1680 support zone on Friday.

💡 How to Trade This:

✅ If the pair rebounds from support 🔄, consider BUYING with a Take Profit near the next resistance level.

❌ If the support breaks with confirmation 🩻, consider SELLING to target lower support zones.

📰 What’s Driving the Move?

🏦 Monetary Policy:

Chicago Fed President Austan Goolsbee pushed back against calls for aggressive rate cuts 🗣️, reaffirming the Fed’s focus on its dual mandate of maximum employment and price stability ⚖️. His cautious stance adds uncertainty 🤔 to the policy outlook for the second half of the year as markets weigh inflation risks vs. growth slowdown signals.

💼 Economic Data:

The labor market remains solid 💪, but recent jobless claims data show early signs of cooling 🧊, following last week’s strong NFP report.

💵 Dollar Strength:

The dollar advanced sharply against the euro 🚀, driven by risk aversion, relative yield advantages, and investor positioning ahead of upcoming inflation data and the Fed’s next policy signals 📈.

🚨 Watch for:

🔸 A confirmed breakout or rebound at 1.1680 to guide trade entries.

🔸 Upcoming U.S. inflation data 🪙 for direction on Fed policy and USD strength.

🔸 Further developments in trade tensions 🌐, which could drive risk sentiment.

Gold price surge, today will have a decline✏️ OANDA:XAUUSD The recovery of the D1 candle and the closing candle above 3313 means that the market's downtrend has almost been broken.

The reaction at the current trendline 3284 is still very strong. The price is strongly supported by the buyers, causing gold to return to trading in a wide range.

The 3328 zone will be important in the near future. If it does not break, there will be a decline to the Gap price zone this morning. Trading according to the top-bottom method is suitable for the current market.

Support: 3312-3295-3279

Resistance: 3328-3339-3349-3363

Sell trigger: rejection from 3328–3,340 resistance block

Target: 3295 Support zone, followed by 3279 lower zone

Leave your comments on the idea. I am happy to read your views.

MKR/USDT 4H Chart🔍 1. Technical Pattern:

The chart shows a descending wedge (orange lines) that has broken out upward.

The breakout occurred on increasing volume (a signal of bullish strength).

The price is currently trading above a resistance line, which is now acting as support (~1980 USDT).

📊 2. Support and Resistance Levels:

Support (red lines):

1903 USDT – local consolidation support.

1801 USDT – strong support at the previous bottom.

1727 and 1632 USDT – fallback zones in case of strong declines.

Resistance (green and blue lines):

2120 USDT – first target after the breakout.

2168 USDT – another strong resistance from the previous consolidation.

2312 USDT – high resistance, potential target if the uptrend continues.

📈 3. Indicators:

🔹 Stochastic RSI:

Close to the overbought zone, but not yet giving a sell signal.

A short consolidation or correction may occur in the coming hours.

🔹 MACD:

The MACD line is above the signal and the histogram is still rising – a buy signal.

No signs of weakening momentum.

🔹 RSI:

The RSI is rising, but not yet in the overbought zone (>70).

Shows the strength of the trend, but there is room for further upward movement.

🧠 Summary and scenarios:

✅ Bullish scenario:

If the price remains above 1980 USDT, the next targets are:

2120 USDT

2168 USDT

Potentially 2312 USDT with continued demand

⚠️ Bearish scenario (less likely at this time):

If the price returns below 1980 USDT and does not regain this level:

Possible return to 1903 or lower (1801 USDT).

EURUSD Eyes Key Levels Ahead of DataFOREXCOM:EURUSD

EURUSD is trading within the 1.1680 – 1.1810 range 📊, continuing its upward momentum during the Asian and early European sessions 🌏⬆️.

⚡️ Markets are now focusing on potential trade negotiations with India and the EU 🤝, which could shape near-term currency moves and risk sentiment 🌐.

📈 Today at 12:30 p.m. UTC 🕧, the U.S. Jobless Claims report 📑 may trigger volatility across all USD pairs ⚠️. Stronger-than-expected data could delay Fed rate cuts 🕰️🔻 and push EURUSD below 1.1700 🩻, while weaker figures may weigh on the U.S. dollar 💵⬇️ and lift EURUSD above 1.1800 🚀.

👀 We will monitor these levels closely for potential breakout opportunities. Stay tuned for live updates!

POSSIBLE BEARISH MOVE SCENERIO Currently we're monitoring 30M time frame chart. I’m expecting a sell move from the P.O.I zone marked on the chart. Since today is the first day of the week, the market volume is a bit low. Now let's see when the price reaches our P.O.I zone, and once it does, how the price behaves. We'll be watching for any bearish signs or confirmations. We’ll only enter the trade after getting a proper bearish confirmation. We'll also wait for the NY session to open before making any decisions. Let's see how this trade setup plays out.

Let's delve deeper into these levels and potential outcomes.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

#GOLD 30M Technical Analysis Expected Move.

LINK/USDT (Chainlink to Tether) from the 4H interval⚡️ Technical situation – quick overview

✅ Breakout from the descending channel (purple lines)

✅ Resistance zone 14.42 – currently being tested

✅ Target within the breakout range – around 17.73 USDT

⚠️ Stochastic RSI in the overbought zone – local correction possible

🟪 Descending channel – broken!

The descending channel that has been in place since mid-May has been broken upwards.

Such breakouts often signal a change in the local trend.

Theoretical range of movement = channel height (~3.30 USDT) added to the breakout point (around 14.42) = ~17.73 USDT – perfectly aligned with your resistance level.

🟢 Key Resistance Levels (green):

Level Meaning

14.42 USDT Current tested resistance – psychologically significant

15.65 USDT Local high + June price gap

17.73 USDT Potential target after a breakout – range from the formation

🔴 Support Levels (red):

Level Meaning

12.73 USDT Support from the pre-breakout consolidation

11.91 USDT Key defensive level of the uptrend

11.07 / 10.12 USDT Historical support with strong demand reactions

📉 Stochastic RSI (oscillator):

Currently deep in the overbought zone (above 80).

This may indicate local exhaustion of momentum and a short correction before further upward movement.

However: in strong trends, the RSI may remain high for an extended period – it does not automatically provide a sell signal.

📈 Bullish scenario:

Retest of the 14.42 level as support → confirmation of the breakout

Then a move towards:

15.65 – local stop

17.73 – final target from the channel breakout

🟩 Stop-loss: e.g., below 12.73 USDT (loss of key support)

📉 Bearish scenario:

False breakout and decline below 14.42

Loss of the 12.73 level → possible quick decline to 11.91–11.07

🔴 In this case, a new swing low could open the way to 10.12 USDT.

📌 Summary:

Element Rating

Technical Pattern ✅ Breakout from a descending channel (bullish signal)

Current Level ❗ Test of Key Resistance – Decision Point

RSI (Momentum) ⚠️ Overbought – Correction Possible

Upside Potential (Target) 📈 17.73 USDT

Threat ❌ False breakout and return to below 12.73 USDT

🧠 My suggestion (not investment advice):

Observe the price reaction at 14.42 – if it holds above and consolidation forms → a signal to continue.

If the 4H/1D candle closes below, consider caution, as this could be a bull trap.