Stocks at Records Ahead of Big Week of Fed & Tech. What to WatchRecord highs, rate-cut optimism, five tech giants on deck — what a time to be a market participant!

It’s Monday, and Wall Street is back doing what it does best — setting new records and pretending not to worry about what comes next.

After a cooler-than-expected inflation print and some diplomatic smiles from Washington and Beijing, all three major indexes are kicking off the week in full throttle.

Last Friday, the Dow Jones Industrial Average TVC:DJI finally closed north of 47,000 for the first time ever, rising 472 points, or 1%.

You know that feeling when you hit every green light on the way to work? That’s what Friday felt like. The S&P 500 SP:SPX climbed 0.8%, and the Nasdaq Composite NASDAQ:IXIC gained 1.2%. Together, the trio ended the week at record highs.

The spark? September’s Consumer Price Index ECONOMICS:USCPI rose 3.0%, slightly below the 3.1% expected. Traders took that as a nod from the economy that the Federal Reserve can keep easing off the monetary brakes.

Odds of at least a half-point in rate cuts by year-end jumped to nearly 97%, according to the CME FedWatch Tool.

Soft inflation, strong sentiment, and new highs — *insert feelsgoodman meme.*

🤝 A Trade Truce (For Now)

Adding to optimism, US and Chinese negotiators sounded unusually positive over the weekend. The two sides reportedly hammered out a trade framework, setting the stage for President Donald Trump and Chinese leader Xi Jinping to meet in South Korea later this week.

Treasury Secretary Scott Bessent said the talks “ought to pave the way” for a broader discussion on tariffs, tech transfers, and everything in between — the kind of vague optimism that markets eat up like comfort food.

For now, investors are choosing to focus on the handshake rather than the fine print. After all, in the markets, hope is often more powerful than details.

🏦 The Fed’s Big Moment

The main event, however, comes midweek. The Federal Reserve is widely expected to cut interest rates ECONOMICS:USINTR by a quarter point on Wednesday. But the real show starts after the decision, when Jerome Powell takes the mic.

Traders will be parsing every word of his press conference for hints on how much further the Fed is willing to go. The tone of his remarks could determine whether markets keep coasting at record highs — or finally take a breather.

So far, Powell has managed to thread the needle: easing just enough to keep growth alive without letting inflation flare back up. But with stocks at all-time highs and job data still missing due to the government shutdown, he’s got a tough balancing act.

💻 Big Tech Takes the Stage

Anyway, peak earnings season is here and if macro policy is the first act this week, Big Tech earnings are the broader narrative.

Five members of the Magnificent Seven — Microsoft NASDAQ:MSFT , Alphabet NASDAQ:GOOGL , Meta NASDAQ:META , Apple NASDAQ:AAPL , and Amazon NASDAQ:AMZN — will all report their latest results.

That’s roughly $12 trillion in combined market cap stepping into the spotlight.

After a few solid years of sky-high expectations around AI, cloud, and advertising recovery, investors are craving proof that the hype is translating into actual earnings.

The question isn’t whether these companies are still dominant — it’s whether they can keep growing fast enough to justify valuations that have already priced in perfection.

Microsoft, Meta and Alphabet kick things off Wednesday, Apple and Amazon step up Thursday. Somewhere between all that, expect social media feeds to explode with charts, hot takes, and the occasional meme about “buying the dip” before it even happens.

🌍 Markets in a Mood

It’s one of those rare weeks when every major force — central banks, geopolitics, and tech earnings — converge into a single market narrative. And, by the looks of it, that narrative is leaning bullish.

Still, keep an eye out for surprises.

Off to you : Where do you think markets are heading this week? Are you excited to snap up some tech shares ahead of the updates or looking to play defense? Share your thoughts in the comments!

Techearnings

Tech Earnings Preview: What, Who, When and How Much Money Again?“ I don’t know, probably at least around $600 gazillion dollars ,” Zuck, probably if you asked him how much Meta NASDAQ:META will spend over the fiscal year.

It’s earnings season , which means Wall Street’s most expensive hobby — guessing how much the tech giants will make while pretending it’s about “long-term fundamentals” — is back in full swing.

💥 Welcome to Earnings Season

Happy third-quarter earnings, everyone. The candles are lit, the spreadsheets are out, and $1.6 trillion vanished from US stock valuations last Friday. Perfect timing.

Markets are reeling from tariff shocks and macro jitters, but traders have already shifted their gaze to the next big thing: Big Tech .

As is tradition, the Magnificent Seven — those trillion-dollar titans who make up roughly one-third of the S&P 500’s SP:SPX weight — are once again the main characters in this quarterly drama.

You’ve got AI. You’ve got spending. And you’ve got spending on AI.

🔔 Here We Go Again

This quarter, the storyline hasn’t changed much — it’s still “show me the money” season for artificial intelligence. Investors have spent the better part of two years rewarding CEOs for throwing the AI acronym in all their earnings calls. Is this time different?

• Amazon NASDAQ:AMZN reports the week of October 21, with everyone eyeing AWS — the quiet moneymaker funding Jeff Bezos’ rocket ambitions and your Prime Day discounts.

• Apple NASDAQ:AAPL , Microsoft NASDAQ:MSFT , and Meta NASDAQ:META follow around October 29. Investors will be laser-focused on who’s turning AI hype into product and revenue.

• And let’s not forget Alphabet NASDAQ:GOOGL , which already set the tone with a capex number that could fund a small country — $85 billion in 2025 alone , largely for AI infrastructure.

The question now: how much longer can these companies throw billions at Jensen Huang GPUs before shareholders start asking for a receipt?

🏗️ The AI Arms Race: Spending as a Strategy

The Magnificent Seven are still in an all-out hardware and data-center build-out. Meta’s Mark Zuckerberg is burning through cash to create the metaverse (yes, that still exists), but this time, powered by AI.

Nearly every megacap tech firm is building power plants to feed OpenAI. And Nvidia NASDAQ:NVDA — the company selling shovels in the AI gold rush — is counting every dollar.

Together, these firms are expected to spend hundreds of billions in the second half of 2025 just on computing power. Investors will be parsing every line of guidance for capex updates — because right now, spending is the strategy.

But the logic is sound (for now): If AI really does drive the next wave of productivity and profit, then whoever builds the infrastructure owns the future.

📊 The Numbers Game: What Wall Street Expects

Across the S&P 500 SP:SPX , earnings are projected to grow 8.8% year-over-year this quarter, on revenue growth of 6.4%, according to Seaport Research Partners. That may sound modest, but it’s for a reason: two-thirds of companies usually beat estimates.

Keep them achievable, and markets will celebrate. Pin them too high, and markets will be disappointed.

What’s more, earnings aren’t expected to stall anytime soon. FactSet data shows analysts projecting:

• 6.4% average annual sales growth for the S&P 500 through 2027

• 14% average annual earnings growth over the same period

That’s what rate cuts are supposed to do — a little liquidity trick, some risk-on mood, and suddenly even industrials and Buffett’s picks start looking interesting again.

Still, there’s one elephant in the room: valuation. The S&P 500 trades at 23 times forward earnings, which is, to use the technical term, “a lot.” At that level, even a small earnings miss could send stocks tumbling.

🧮 Winners, Losers, and the Market’s Short Memory

Some IPOs may have stolen headlines this year — looking at you, Figma NYSE:FIG and Circle NYSE:CRCL — but earnings season is where the real judgment happens.

A good report can add hundreds of billions in market cap overnight. But a bad one can do the same in the opposite direction .

Meta is under pressure to prove its huge spending on Superintelligence Labs is actually worth it. Apple’s got to show iPhone sales didn’t flatline in China. And Microsoft? Well, all it has to do is keep being Microsoft.

Amazon remains the dark horse. Its cloud business is stabilizing, retail’s humming along, and AI integration is just starting to take off. Traders are betting AWS will deliver, as it usually does.

🧘♂️ What Traders Should Watch

To navigate this volatility buffet, focus on:

• Forward guidance — Companies might beat earnings but guide lower, which can trigger pullbacks.

• Capex updates — Follow where the AI billions are flowing.

• Market reactions, not just results — The “sell the news” trade is real.

Sometimes the earnings game isn’t just about who made money — it’s about who surprised the market.

💡 Final Thought: Hype or Habit?

Big Tech’s gravitational pull on the markets isn’t fading anytime soon. Whether you’re bullish on AI or skeptical of its trillion-dollar promises, one thing’s certain — every move these companies make will ripple through every portfolio, index, and ETF on the planet.

As Q3 earnings hit full throttle, keep one eye on the charts and the other on the headlines . Because if there’s one thing Wall Street loves more than good earnings, it’s the story that comes after.

Off to you : How are you preparing to navigate the earnings season and the tech updates? Share your thoughts in the comments!

IOT Earnings Alert: 8/8 Beat Streak + Big Upside! 37 Call Play

🚀 **IOT Earnings Trade Alert – High Conviction!** 📈

**Market Bias:** **Moderate Bullish** 💪

**Confidence:** 78% ✅

**Trade Idea:**

🎯 **Instrument:** IOT (Samsara)

🔀 **Direction:** LONG CALL

💵 **Strike:** \$37.00

📅 **Expiry:** 2025-09-05 (Weekly)

💰 **Entry Price:** \$2.15

📈 **Profit Target:** \$6.45 (200% return)

🛑 **Stop Loss:** \$1.08 (50% of premium)

📏 **Size:** 1 contract

⏰ **Entry Timing:** Pre-earnings close (AMC on 2025-09-04)

**Rationale:**

* 8/8 historical earnings beat streak 💥

* Very large average surprises → asymmetric upside ⚡

* Secular tailwind in IoT/software infrastructure 🌐

* Defensive put hedging in options market indicates upside potential, not bearish flow 🛡️

**Key Levels:**

* Short-term support: \$34–\$35 🛡️

* Resistance: 50DMA \~\$36.76 🔝

* Expected post-earnings move: \~\$40+ (implied 13.4%)

**Risk/Reward:**

* Max loss: \$215 per contract

* Reward potential: \$430+ → **4:1 R/R vs 50% stop**

* Breakeven: \$39.15

**Execution Notes:**

* Enter **pre-close** at ask \$2.15; consider mid-limit for better fills

* Exit **by market open post-earnings** or at profit/stop triggers

* Expect **30–50% IV compression**; strict stop discipline required

**Options Liquidity:**

* 37.00 call OI: 472 ✔️

* Ask/Bid: 2.15 / 2.05

📊 **Trading JSON (for exact execution)**

```json

{

"instrument": "IOT",

"direction": "call",

"strike": 37.0,

"expiry": "2025-09-05",

"confidence": 78,

"profit_target": 6.45,

"stop_loss": 1.08,

"size": 1,

"entry_price": 2.15,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-09-04",

"earnings_time": "AMC",

"expected_move": 13.4,

"iv_rank": 0.80,

"signal_publish_time": "2025-09-04 13:51:00 UTC-04:00"

}

``

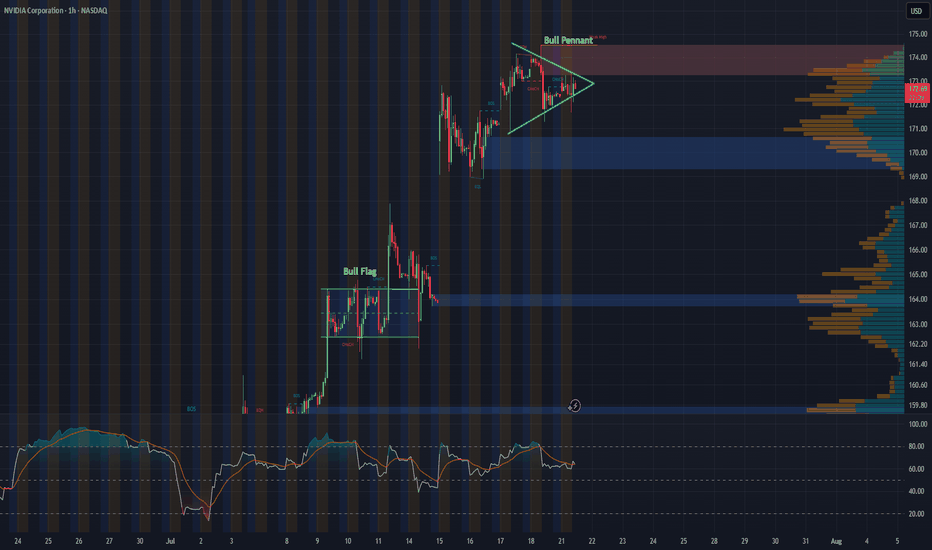

NVDA 1-Hour Chart UpdateHey everyone, just wanted to share a quick update on NVDA’s 1-hour chart. Following last week’s bull flag breakout, the stock appears to be consolidating into what looks like a solid bull pennant formation.

With major tech earnings on the horizon and the recent approval to sell H20 chips to China, this pattern could be setting the stage for another breakout. Will NVDA continue its impressive rally, or is this just a breather before the next move?

$GOOG Key Levels, Analysis, & Targets $GOOG Key Levels, Analysis, & Targets

—-

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

IF you need anything analyzed Technically just comment with the Ticker and I’ll do it as soon as possible…

IMPORTANT WEEK! MARKET VOLATILITY EXPECTED!TICKER:$SPY

We closed friday with a big red day; Largest red day since October 1st of 2019. This is due to the financial sector (XLF) topping out at the all time high.

Next week is a very important week for the market. FOMC is on Wednesday in addition to tech earnings ($AAPL, $AMZN, $FB, $MSFT, etc...). I expect high volatility this coming week and depending on this week, the market will either consolidate or continue to reach all time highs.

Regardless if its bulls or bears, I am looking to go aggressive this coming week. If XLF continue to dump with spy breaking the low of friday (327.36), I will play TVIX.

However, bulls still have complete control on the daily and weekly time frame. Anything above 320.15 is just a daily HL.