BTCUSD H4 — Range Compression After Selloff, Bullish Path On the Bitcoin H4 chart, price has completed a sharp impulsive markdown from the prior distribution area and is now stabilizing between a clearly defined demand zone below and an overhead resistance zone around the 89.5k–90.5k region. The reaction from demand was strong enough to stop the selloff, but structurally the market is still in repair mode, printing overlapping candles and lower highs beneath resistance a classic post-impulse consolidation, not yet a trend reversal. For a bullish continuation, BTC must first hold above the demand zone, then break and accept above the local resistance, which would open the path toward the premium resistance/target zone near 95k as projected. That upside scenario implies absorption of supply and a successful range expansion. However, failure to reclaim resistance and a breakdown back below demand would invalidate the bullish path and signal continuation of the broader corrective structure. Key point: this is a transition phase confirmation comes only with acceptance, not anticipation.

Technical

EURUSD H4 — Breakout Area Under TestOn the EURUSD H4 timeframe, price has delivered a strong impulsive rally from the lower support zone, breaking the prior bearish structure and shifting short-term momentum to the upside. However, the market is now reacting around the 1.1670–1.1700 breakout area, which is a critical decision zone. This level represents former resistance turned potential support, and price behavior here will determine continuation versus failure. As long as EURUSD holds above the break level, the structure favors a bullish continuation with upside targets toward 1.1780 and 1.1800, following a higher-high / higher-low sequence. That said, rejection and acceptance back below the break would signal a failed breakout, opening the path for a deeper pullback into the broader H4 support zone around 1.1580–1.1600. In short, this is a textbook break-and-retest phase continuation is possible, but only confirmation above the reclaimed level validates the bullish scenario.

GOLD is in “blue-sky” mode… but the next move will be decided Price just ripped higher and is now pausing near ~5,09x — the kind of compression that looks like it wants to launch again. Your projection to ~5,203 is plausible, but it’s not “provable.” The market still has to confirm the continuation by defending the GAP / reclaim zone.

GAP support zone ≈ 4,990–5,000

This is the “line in the sand.”

If price revisits this band and reclaims / holds, the uptrend structure stays intact and the breakout thesis remains valid.

If price loses this band with acceptance, the chart flips from “continuation” to “pullback / fill” mode.

Trade Plan

✅ Scenario A — Bull continuation (only with confirmation)

Trigger: Price pulls back into the GAP zone (~4,990–5,000) and prints a clear hold (strong bounce / reclaim close).

Entry idea: Buy the reclaim (or the first higher low after the reclaim).

Targets:

T1: prior high area (~5,09x)

T2: ~5,203 (your “NEW TARGET” zone)

Invalidation: Clean breakdown and acceptance below the GAP zone.

⚠️ Scenario B — GAP fails

Trigger: Breakdown below ~4,990 + weak retest (can’t reclaim).

Targets below (step-by-step magnets):

4,917

4,880

4,838

4,775

Execution note: don’t over-hold shorts into support take partials at each shelf.

Macro context

Gold can keep trending if the market keeps pricing:

softer real yields / rate-cut expectations,

USD weakness (or even just USD instability),

geopolitical headline risk (spikes + re-pricing),

persistent safe-haven allocation.

But none of that guarantees this path. Price confirmation at the GAP is the proof.

Bottom line

bullish path is credible but the market must validate it.

If the GAP holds → we trade continuation. If the GAP breaks → we trade the fill.

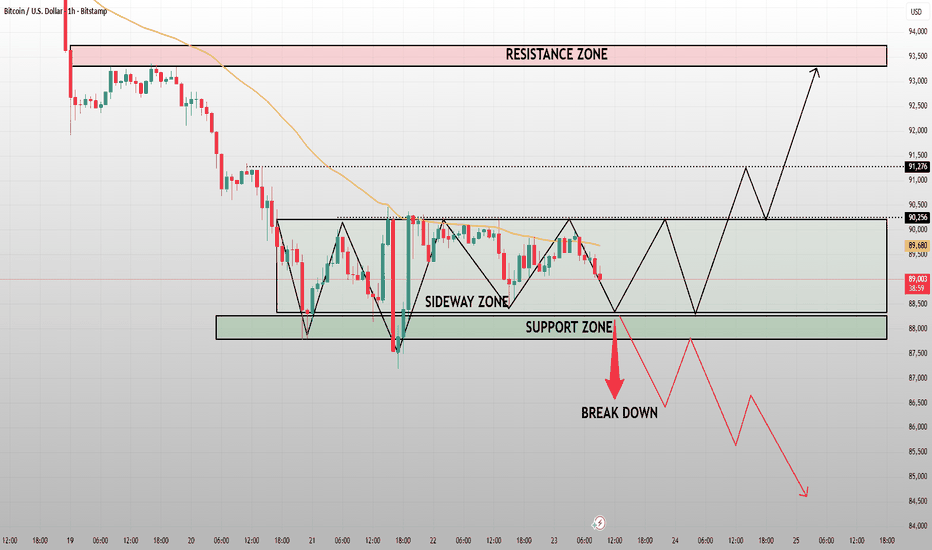

BTC Compresses Inside Accumulation – Breakout or Final Shakeout On the 45-minute chart, Bitcoin is clearly transitioning from an impulsive sell-off into a broad accumulation phase, with price now rotating inside a well-defined range between roughly 88,400–90,400. The sharp downside move into the demand zone near 87,800–88,200 indicated sell-side exhaustion, and the strong reaction from that level confirms that buyers are actively defending lower prices. Since then, price has shifted into sideways behavior, marked by overlapping candles and repeated rejections at both range extremes — classic signs of balance after distribution, not immediate trend continuation.

Structurally, BTC remains below the declining EMA, which tells us that the broader short-term trend is still bearish. However, the failure to make new lower lows, combined with repeated absorption near demand, suggests that selling pressure is weakening. This type of compression often precedes a volatility expansion. As long as price holds above the demand zone, downside follow-through becomes increasingly difficult, favoring range continuation or a base-building process.

From here, two scenarios matter. If price continues to accept above 89,000–89,300 and eventually breaks and holds above the 90,400 range high, the structure shifts into a bullish breakout from accumulation, opening upside targets toward 91,200 → 92,800, where higher-timeframe liquidity sits. Conversely, a clean loss of 88,400 would invalidate the accumulation thesis and expose BTC to another sell-off toward 86,900–86,500.

In summary, Bitcoin is coiling inside accumulation after a completed markdown, with both buyers and sellers temporarily balanced. The market is no longer trending — it is preparing. Until a range break occurs, patience is key, but once expansion begins, the move is likely to be fast and decisive.

EURUSD Rejects Major Supply – Bullish Structure Pauses, PullbackOn the H1 chart, EURUSD is showing clear signs of exhaustion at a higher-timeframe resistance zone around 1.1755–1.1765. The prior move into this area was impulsive and well-supported by EMA alignment, confirming a short-term bullish trend. However, once price reached this supply zone, upside momentum stalled and candles began to compress, signaling seller absorption and profit-taking rather than clean continuation.

Structurally, this is a bullish leg meeting higher-timeframe supply, which often results in a corrective phase. The initial rejection from resistance suggests buyers are no longer aggressive at premium prices. As a result, the market is likely to rotate lower to rebalance liquidity. The most immediate downside magnet sits around 1.1710–1.1720, followed by the 1.1690–1.1700 zone, where prior structure and the EMA cluster converge. These levels are critical for determining whether the trend can sustain higher lows or transitions into a deeper correction.

As long as price remains below the resistance zone, upside attempts should be treated cautiously. A clean break and acceptance above 1.1765 would invalidate the pullback scenario and reopen bullish continuation. Until that happens, the projected path favors choppy corrective price action, potentially forming a lower high before another leg down toward support.

In summary, EURUSD remains bullish on structure, but is currently in a distribution phase at resistance. The bias in the near term favors a pullback rather than immediate breakout, with buyers expected to re-enter only if price holds and reacts cleanly from key support levels below.

BTCUSD H1 – Compression Inside Range, Expansion Is ComingOn the H1 timeframe, Bitcoin is currently trapped in a well-defined sideways range after a sharp impulsive sell-off from the higher resistance area. That initial drop clearly shifted short-term momentum bearish, but instead of continuation, price has transitioned into range-bound behavior, signaling absorption and indecision between buyers and sellers. The market is now oscillating cleanly between the upper range resistance (~90,200–90,300) and the lower support zone (~87,800–88,200), with repeated wicks and overlapping candles — classic signs of balance, not trend.

From a structural perspective, this is not a trend yet, but a preparation phase. Liquidity is being built on both sides. The EMA is flattening and running through the middle of the range, reinforcing the idea that momentum is neutral and price is waiting for a catalyst. As long as BTC remains inside this sideways zone, trading the middle carries poor risk-reward, and patience is required.

Key scenarios going forward:

If buyers manage to hold above the support zone and break decisively above the range high, the upside opens toward the 93,000–94,000 resistance zone, where prior supply sits. That would confirm a successful absorption of sell pressure and a bullish range expansion.

However, a clean breakdown and acceptance below the support zone would invalidate the range and likely trigger a bearish continuation, opening the door toward deeper downside levels in the mid-85,000s, as indicated by the projected path.

BTC is in compression mode. The range will not last forever the next impulsive move will come from a confirmed breakout or breakdown, not from guessing inside the box. Let price show its hand, then act. Risk management remains key.

XAUUSD 4H: Structured Markup, Gaps as Support, ATH in SightOANDA:XAUUSD H4 – Structured Markup, Gaps as Support, ATH in Sight

On the H4 timeframe, Gold remains firmly in a strong bullish market cycle, progressing cleanly through a multi-phase markup structure. The chart clearly shows Phase 1 → Phase 2 → Phase 3, each marked by higher bases, shallow pullbacks, and strong continuation candles. This is not emotional buying. it’s controlled institutional accumulation transitioning into expansion.

A key technical feature here is the series of unfilled bullish gaps (inefficiencies) left behind during impulsive legs. These gaps align closely with prior consolidation ranges and the rising EMA, effectively acting as dynamic demand zones. As long as price remains above the most recent gap (~4,680–4,700), the bullish structure stays intact. Pullbacks into these areas should be viewed as corrective pauses, not trend failure.

Price is now approaching the psychological 5,000 zone, marked as both resistance and a projected new ATH target. From a structural standpoint, continuation is favored after consolidation, not immediately. The most probable path is stair-step price action: brief pullbacks, higher lows, then renewed expansion. A clean break and acceptance above 5,000 would confirm the next leg higher, opening the door for trend extension beyond ATH.

Invalidation only occurs if Gold loses the upper gap support decisively, which would imply deeper mean reversion toward lower inefficiencies. Until that happens, this remains a trend-following market, and chasing tops is riskier than waiting for pullbacks into structure.

Gold is not overextended it is well-structured, trend-aligned, and supported by inefficiencies below. This is a textbook bullish continuation environment, with patience being the edge.

EURUSD H1 – Rejection at Resistance, Pullback Toward On the H1 timeframe, EURUSD has completed a clean impulsive leg up from demand, breaking the prior descending structure and confirming a short-term bullish shift. However, price is now stalling directly inside a well-defined resistance zone, where upside momentum has clearly weakened. The recent candles show hesitation and rejection rather than continuation a typical sign of profit-taking and short-term exhaustion, not a full trend reversal.

Structurally, this move looks like an impulse → corrective pullback sequence. The market has already delivered the expansion; what’s missing now is rebalancing. With price extended away from the EMA and failing to hold above the mid-level, a controlled pullback toward the 1.1700–1.1695 demand zone becomes the higher-probability scenario. This area also aligns with previous structure and dynamic support, making it the logical zone for buyers to step back in.

If price reacts positively at demand and forms a higher low, the bullish structure remains intact and another attempt toward the 1.1760–1.1780 resistance can follow. On the flip side, a clean break and acceptance below the demand zone would invalidate the immediate bullish thesis and open the door for a deeper correction toward the lower range.

EURUSD is not breaking down it’s cooling off after an impulse. Until resistance is decisively reclaimed, the market favors a pullback to demand first, with continuation only confirmed by reaction and structure, not prediction.

Bullish Structure Intact, Pullback = OpportunityOn the H1 timeframe, EURUSD is maintaining a bullish continuation structure after a strong impulsive rally. Price has already shifted market structure to the upside, with higher highs and higher lows clearly established. The recent pause is corrective, not bearish — momentum has slowed, but structure has not broken.

The highlighted demand zone around 1.1675–1.1690 is the key area to watch. This zone aligns cleanly with the rising EMA, reinforcing it as a high-probability reaction area rather than random support. As long as price holds above this demand, the bullish bias remains valid.

From a price-action perspective, the market is likely to pull back into demand, form a higher low, and then continue its upside rotation. Liquidity sits above recent highs, making 1.1764 → 1.1779 the next logical upside objectives. The projected path on the chart reflects a classic impulse–correction–continuation sequence.

Invalidation:

A clean break and acceptance below 1.1663 would weaken the bullish thesis and open the door for a deeper retracement toward the lower demand zone.

This is not a top it’s a pause. EURUSD remains a buy-the-dip structure, favoring patience and confirmation at demand rather than chasing strength near resistance.

ATH Under Pressure: Continuation or Distribution?Gold is currently trading at a critical inflection point near the All-Time High (ATH) after completing a strong impulsive rally from the lower accumulation zone. The bullish leg was clean and well structured, driven by sustained higher highs and higher lows, confirming strong buyer control throughout the advance. However, upon reaching the ATH region, price has begun to stall and reject, signaling that supply is actively responding at this premium area.

Structurally, the market is now compressed between two key forces. On the downside, the upper demand zone around 4,880–4,900 has already proven its importance, acting as a reaction level where buyers previously stepped in aggressively. On the upside, the ATH resistance band is capping price and preventing immediate continuation. This creates a classic decision zone, where Gold must either absorb supply and break higher, or fail and rotate lower.

From a bullish continuation perspective, a clean breakout and acceptance above the ATH zone would confirm that buyers remain in full control. In that scenario, the projected expansion toward the 5,100 target becomes technically valid, following range-expansion and momentum continuation logic. This would imply that the recent pause is merely consolidation before another markup phase.

Conversely, if price breaks decisively below the upper demand zone, the structure starts to resemble a potential Head & Shoulders distribution, as highlighted on the chart. A confirmed breakdown would likely trigger a deeper corrective move toward the lower demand zone around 4,730–4,760, where the broader bullish structure would be tested. As long as this lower demand holds, the higher-timeframe uptrend remains intact, but momentum would clearly shift from expansion to correction.

Key takeaway: Gold is not weak, but it is no longer in free-flow markup. This is a high-stakes area where confirmation matters more than prediction. Either the ATH breaks and opens the door to 5,100, or failure here leads to a controlled but meaningful pullback. Traders should stay patient and let price confirm direction before committing risk.

Pullback Into Demand After ATH, Trend Still ConstructiveOn the H1 timeframe, Gold remains in a strong bullish context despite the recent pullback. The market previously delivered a clean impulsive expansion, breaking structure and printing a new ATH, which confirms higher-timeframe bullish control. The current retracement should be read as profit-taking and liquidity rebalancing, not a trend reversal. Price is now reacting inside the key demand zone around 4,760–4,780, which aligns with the prior breakout base and sits well above the EMA 98 a classic bullish pullback into value. The sharp rejection wick into this zone shows buyers are still active, absorbing sell pressure. As long as price continues to hold above this demand, the structure remains intact and the move is best classified as continuation consolidation. From a price action perspective, the ideal scenario is sideways-to-higher rotation above demand, followed by a renewed push toward the ATH at ~4,888, and if momentum expands again, continuation toward 4,900–4,920 becomes technically reasonable. The projected green path on the chart reflects this expectation: higher low formation → reclaim momentum → breakout attempt. Invalidation is clear and clean: a decisive H1 close below the demand zone would signal acceptance back into the previous range and open a deeper pullback toward the gap / demand premium below. Until that happens, bias remains bullish with patience, not chase.

trend is still up, pullback is constructive, and this zone is where continuation setups are built not where fear should dominate.

“EURUSD Pulls Back — Structure Still Favors the UpsideEURUSD H1 — Bullish Structure Holds, Pullback Is Still Corrective

On the H1 timeframe, EURUSD remains in a bullish market structure, with price continuing to respect the EMA 98 and holding above a clearly defined support zone around the 1.1680–1.1700 region. The previous impulsive rally shifted structure to the upside, and the current price action is best interpreted as a corrective pullback, not a trend reversal.

The recent rejection from the local high near 1.1750–1.1760 shows short-term profit taking, but importantly, the pullback is overlapping and controlled, lacking bearish momentum. This type of retracement typically serves to rebalance liquidity and attract fresh buyers, especially while price remains above both the EMA and the demand/support zone.

As long as the support zone holds, the bullish scenario remains valid. A reaction from this area would likely produce another leg higher, with price targeting a retest of 1.1768, and if that level is broken and accepted, continuation toward higher highs becomes increasingly probable.

However, if price loses acceptance below the support zone and the EMA 98, that would invalidate the bullish continuation thesis and shift focus back to deeper consolidation or a range.

EURUSD is still in a buy the dip environment, not a sell-the-rally market. Bias remains bullish, with continuation dependent on support holding and momentum returning on the next push up.

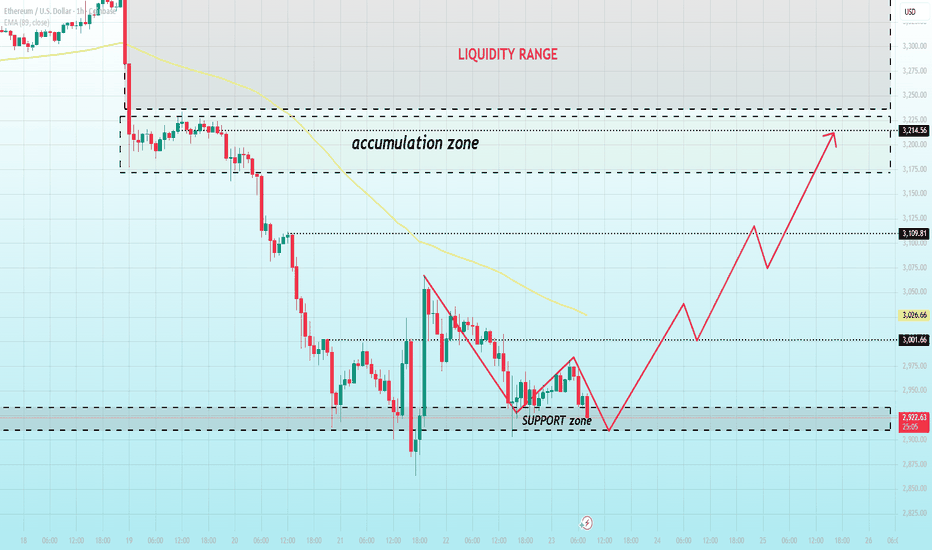

ETH After the Flush — Correction Phase or Just a PauseETHUSD H4 — Capitulation Complete, Is a New Impulse Wave Loading?

ETH on the H4 timeframe has completed a clear distribution → breakdown → impulsive sell-off, followed by a developing Elliott Wave corrective structure at lower prices. The prior accumulation range at the top failed decisively, triggering a strong bearish impulse that unfolded cleanly into a 5-wave decline (1–2–3–4–5), confirming a completed impulsive leg to the downside.

Price is now transitioning into a corrective phase, currently mapping out an ABC correction. Wave (A) has already formed with a sharp rebound from the lows, while the market is now probing for a Wave (B) retracement, likely into the lower liquidity pocket near the recent lows. This is typical post-impulse behavior, where the market retests demand to confirm whether sellers are exhausted.

The key technical detail here is that price remains below the EMA 98, which is still sloping downward a strong sign that macro control remains bearish. As long as ETH trades below this dynamic resistance, any upside move should be treated as corrective, not trend reversal.

If Wave (B) holds above the recent low and structure remains intact, the market opens the door for Wave (C) a corrective expansion targeting the 3,200–3,250 region, aligning with prior structure and the EMA zone. That area would be a high-probability reaction zone, not a blind breakout level.

Invalidation occurs if price loses acceptance below the Wave (B) low, which would signal continuation of the bearish trend rather than correction.

ETH has likely completed a bearish impulse and is now in a textbook Elliott Wave correction (ABC). Upside is possible, but it remains corrective until the EMA 98 and prior structure are reclaimed.

XAUUSD 23 JAN: Market Analysis & Future DevelopmentTODAY'S LIMITED STRATEGY JAN 23

Intraday trading: Adjust

📌 SET UP 1. Timming Sell Zone

XAUUSD SELL ZONE: 5005 - 5008

💰 Take Profit(TP): 5002 - 4997

❎ Stoploss(SL): 5012

Note capital management to ensure account safety

📌 SET UP 2. Timming Buy Zone

XAUUSD BUY ZONE: 4880 - 4883

💰 Take Profit(TP): 4886 - 4891

❎ Stoploss(SL): 4876

Note capital management to ensure account safety

Current Market Analysis & Future Developments Today (Gold – XAUUSD)

- Currently, gold is maintaining a predominantly bullish structure on the H4 timeframe, following its previous strong breakout. However, the upward momentum is slowing as the price approaches key technical resistance zones, evidenced by short periods of volatility and corrections.

✅ Current Status

- The price is moving around the intermediate Fibonacci retracement zone (0.5 – 0.618), indicating that the market is in a phase of absorbing selling pressure and re-accumulating.

- Momentum remains positive but is no longer overly volatile, signaling the possibility of a technical correction before determining the next trend.

- The oscillator is in the high zone → not suitable for FOMO chasing the price.

✅Today's Scenario

- Main Scenario: Price continues to correct or move sideways, retesting the nearest support zone to accumulate more momentum. If the structure holds firm, the possibility of continuing the upward trend to higher levels remains.

- Alternative scenario: If stronger selling pressure emerges at the resistance zone, the market may retrace further to the lower support zone before forming a clear signal for the next move.

✅ Trading Strategy

- Prioritize waiting for price reactions at support/resistance zones, trading based on confirmation signals.

- Avoid haste during the market's "direction-choosing" phase.

- Manage risk strictly; do not trade emotionally.

👉 Summary: The overall trend remains upward, but in the short term, the market needs time for correction and consolidation. Those who are patient and disciplined will have a clear advantage today.

Demand Defended, But Structure Still Needs ConfirmationOn the Bitcoin (BTCUSD) H1 chart, price has completed a full bearish impulse and is now stabilizing after a strong reaction from the demand zone around 87,700–88,200. The sharp bullish rejection from this area confirms that buyers are active and defending value, not a passive bounce. This demand reaction broke the immediate downside momentum and forced price into a tight consolidation above demand, which is a constructive behavior after a sell-off.

However, structurally, Bitcoin is not bullish yet. Price is still trading below the declining EMA cluster, and the broader market structure remains corrective. What we are seeing now is absorption and base-building, not expansion. The current sideways movement between roughly 89,000–90,300 suggests the market is rebalancing liquidity after the sell side sweep, allowing larger players to accumulate without pushing price aggressively higher.

From a scenario perspective:

- Bullish case: Holding above the demand zone and building higher lows would allow price to rotate upward toward 91,200 → 92,800 → 93,500, where major prior supply and resistance reside. A clean reclaim of 91.2k would be the first real confirmation of trend recovery.

- Neutral / corrective case: Continued range-bound action with shallow pullbacks is still healthy and supports accumulation.

- Bearish risk: Failure to hold the demand zone would reopen the downside toward 86,900, but current price action does not yet support this outcome.

This is a post-impulse stabilization phase, not a reversal yet. The market has clearly stopped going down, but it must prove strength through structure reclaim, not prediction. Until BTC reclaims key resistance with acceptance, the correct mindset is patience and reaction, letting the market confirm the next expansion leg.

BTC Reacts at Demand After Sharp Sell-Off Relief Bounce On the H1 chart, Bitcoin remains in a clear bearish short-term structure following the impulsive sell-off from the 93,000–93,500 resistance zone. That rejection marked the start of a strong markdown phase, with price breaking multiple minor supports and staying consistently below the EMA, confirming seller control. The move down was fast and directional, characteristic of distribution resolving to the downside, not a healthy pullback.

Price has now reached and reacted from a key support zone around 87,800–88,300, where downside momentum has visibly slowed. The strong rejection wick from this area suggests sell-side exhaustion, making a technical relief bounce reasonable. Current consolidation just above support indicates short-term balance after the impulse, rather than immediate continuation lower.

From a structural perspective, any upside at this stage should be treated as corrective. The first logical upside target sits near 90,200–90,500, followed by 91,200–91,300, where prior structure and the descending EMA align. The major resistance remains the 93,000–93,500 zone, and as long as price trades below it, the broader bearish bias remains unchanged.

Only a sustained reclaim above 91,300 would suggest a deeper corrective phase. A full bullish shift would require acceptance back above 93,000, which currently appears unlikely without a clear change in momentum.

In summary, Bitcoin is bouncing from strong demand after a completed markdown, making a short-term recovery plausible. However, until key resistance levels are reclaimed, this remains a relief rally within a bearish trend, favoring cautious longs and a continued sell-the-rally mindset for trend traders.

ETH Pauses at Key Support After Breakdown —Relief Bounce or TrapETH (1H) is still trading within a clear bearish structure, with price holding below the former accumulation range and remaining capped by the declining EMA. The sharp sell-off from the upper range confirms that distribution has already played out, and the market is now in the markdown → stabilization phase. Currently, price is reacting inside a well-defined support range around 2,900–2,930, where selling pressure has slowed and short-term bids are absorbing supply. This explains the sideways-to-slight-bounce behavior, but it should be read as technical stabilization, not a trend reversal.

As long as ETH stays below 3,180–3,230 (previous range low / resistance flip zone), any upside move is best classified as a corrective pullback. The projected bullish path on the chart only becomes valid if price can reclaim and hold above that zone with acceptance; otherwise, rallies into the 3,000–3,080 area are likely to face rejection from EMA and prior structure. Failure to hold the current support range would reopen downside risk toward 2,850 and lower, completing another bearish leg. In short, support is active but fragile the market is pausing, not flipping. Directional confirmation must come from either a clean reclaim of former structure above, or a decisive breakdown below the current support base.

Liquidity Compression Before FLY ? Key Support Holds the LineOn the H1 chart, ETHUSD is currently trading inside a well-defined liquidity range, following a sharp impulsive sell-off that transitioned the market into a controlled accumulation phase. After the aggressive downside move, price began compressing between clear upper and lower boundaries, signaling liquidity absorption rather than continuation selling. This behavior suggests that large players are building positions, not chasing price lower.

Structurally, the support zone around 2,920–2,950 is the most important area on the chart. Price has already reacted multiple times from this level, confirming it as a defended demand zone. Each reaction from support has been followed by higher internal lows, indicating selling pressure is weakening. Although ETH is still trading below the EMA, momentum loss on the downside and range compression often precede expansion, not continuation.

From a price-action standpoint, as long as ETH holds above the support zone, the current structure favors a range breakout to the upside, targeting the upper liquidity band around 3,100 → 3,215. A clean break and acceptance above the accumulation range would confirm bullish intent and open the door for a broader recovery move. However, if support fails decisively, price risks being pulled into a deeper liquidity sweep below the range.

Invalidation:

A strong breakdown and acceptance below 2,900 would invalidate the accumulation thesis and confirm bearish continuation.

ETH is not trending yet it’s coiling. This is a classic liquidity-building environment, where patience pays. Watch the support closely: hold = expansion higher, lose = continuation lower.

Bounce From Demand, Trend Still Bearish Until Proven OtherwiseOn the H4 timeframe, Bitcoin has completed a clear distribution-to-markdown transition. After failing to hold the prior range high around 95–96k, price compressed, broke structure, and accelerated lower confirming trend exhaustion and supply control. The impulsive sell-off that followed was not corrective in nature; it was a clean markdown leg, taking out multiple intraday supports and pushing price directly into a higher-timeframe demand zone around 87–88k.

At this location, the market is doing what it typically does after a sharp displacement: pause and react. The current bounce should be read as a technical reaction from demand, driven by short-covering and liquidity absorption not a trend reversal. Structurally, BTC remains in a lower-high / lower-low sequence, and any upside from here is best treated as a retracement into resistance, with key levels stacked around 91.9k → 93.3k → 95k (prior breakdown levels and supply).

As long as price fails to reclaim and hold above the 93–95k resistance band, the broader bias stays bearish, and the rally scenario remains corrective. A clean acceptance back above that zone would be required to invalidate the bearish structure. Until then, this is a sell-the-rally environment, with demand acting as a temporary floor not a foundation for continuation higher.

Elliott Wave: Bearish Impulse Done — But This Is a CorrectionOn the H4 timeframe, Bitcoin is displaying a textbook Elliott Wave bearish impulse followed by a developing corrective structure. The prior bullish trend clearly terminated near the highs, where momentum stalled and price began distributing before the decisive breakdown.

The sell-off from the top unfolds cleanly as a 5-wave impulsive decline:

- Wave (1) breaks structure and decisively loses the EMA 98, signaling a trend shift.

- Wave (2) is a weak corrective retracement into dynamic resistance (EMA 98), failing to reclaim it a key bearish tell.

- Wave (3) extends sharply to the downside with strong momentum, confirming bearish dominance.

- Wave (4) forms a shallow, overlapping correction, respecting prior structure and maintaining bearish pressure.

- Wave (5) completes the impulse with a final sell-off leg, typically driven by capitulation and late short entries.

With Wave (5) now printed, the impulsive bearish cycle is considered complete. What follows is not an immediate trend reversal, but a corrective ABC recovery phase:

- Wave (A): an initial counter-trend rally, currently developing.

- Wave (B): a pullback that may retest or slightly undercut recent lows, designed to trap premature longs.

- Wave (C): a stronger recovery leg, with a realistic upside magnet toward the EMA 98 / ~92,000 zone, which aligns with prior breakdown structure.

Crucially, this recovery should still be viewed as corrective unless price impulsively reclaims and holds above the EMA 98. Failure at that level would imply the larger bearish structure remains intact, opening the door for renewed downside later.

The downside impulse is done, but the upside is reactionary, not trend-confirming trade the bounce with caution.

ETHEREUM H4 — Decision Point Inside Premium DemandOn the ETH 4H chart, price has completed a full Cup & Handle expansion and topped at the pivot high before transitioning into a sharp corrective leg. The selloff was impulsive, not corrective, confirming that the move is a higher-timeframe pullback, not random volatility. ETH is now trading directly inside a premium demand zone, which is a critical decision area for the next multi-session move.

Structurally, this zone is important because it is the origin of the prior expansion leg. If demand holds and price forms a base here (compression, higher lows, failed breakdowns), ETH can re-accumulate and rotate higher toward Target 1 → Target 2 → Target 3, with the first key reclaim being the handle-low region and then the mid-range resistance. That scenario would signal absorption of sell pressure and continuation of the broader bullish structure.

However, if price fails to hold this demand zone and we see a clean breakdown with acceptance below it, the bearish scenario activates. That would confirm a distribution-to-expansion failure, opening the door for a deeper markdown toward lower liquidity levels, as projected by the red path.

ETH is at a make-or-break level. This is not the place to chase . it’s the place to wait for confirmation. Hold demand → bullish continuation. Lose demand → deeper correction. Let price show its hand before committing.

ATH Reclaim Is the Only Thing That Matters Before the $5,000 On the Gold H1 chart, price has completed a strong impulsive rally into a fresh All-Time High (ATH) zone, followed by a healthy pause rather than aggressive distribution. This behavior is constructive. After such a vertical expansion, the market is not collapsing — instead, it is compressing just below ATH, which signals acceptance, not rejection.

Structurally, the prior resistance has flipped into a clear support zone around 4,875–4,900, aligning with short-term demand and trend support. The projected pullback into this zone is logical: it allows price to rebalance liquidity, shake out late buyers, and invite stronger hands before continuation. As long as this support holds, the bullish market structure remains intact with higher highs and higher lows still respected.

The key level to watch is the ATH band near ~4,960–4,980. A clean reclaim and hold above this range especially after a shallow retest would confirm continuation and open the path toward the psychological $5,000 target, which aligns with momentum extension rather than overextension.

This is not a top. it’s a pause. Gold is consolidating under ATH, building fuel. Hold above the support zone → reclaim ATH → expansion toward $5,000. Failure only occurs if price loses acceptance below support; until then, the bias remains firmly bullish.

ETH at Major Support After Distribution BreakdownOn the H1 chart, Ethereum has clearly completed a distribution → markdown cycle after failing at the upper boundary of the accumulation range around 3,330–3,380. The sharp bearish impulse that followed confirms that the prior sideways structure was not continuation, but distribution. Once price broke below 3,286, selling pressure accelerated and ETH transitioned into a clean bearish trend, with the EMA rolling over and acting as consistent dynamic resistance.

After the initial breakdown, price paused briefly inside the sideway zone near 3,180–3,230, but this consolidation failed to attract meaningful demand. The loss of 3,180 acted as confirmation of trend continuation, leading to another impulsive leg down that drove price directly into the higher-timeframe support range around 2,900–2,950. The speed and structure of this move strongly suggest liquidation-driven selling rather than healthy pullbacks.

At current levels, ETH is reacting off major support, and the slowdown in downside momentum indicates sell-side exhaustion. This makes a technical rebound highly plausible, especially after such an extended impulsive decline. Structurally, a corrective bounce toward 3,020–3,050 is reasonable, with a deeper retracement potentially targeting the prior breakdown area around 3,150–3,180, which now represents the most important resistance cluster.

However, it is critical to frame this move correctly: any upside from here remains corrective unless proven otherwise. As long as price stays below 3,180–3,230, ETH remains in a bearish short-term structure. Only a sustained reclaim and acceptance back inside the former sideways zone would invalidate the distribution thesis and signal a potential trend shift.

In summary, Ethereum is currently in a relief-rally phase after a completed markdown, reacting at a strong support range. A bounce is technically justified, but until former support is reclaimed, this should be treated as a sell-the-rally environment, not a confirmed bullish reversal.