Gold’s Staircase Trend: Is the Road to $5,000 a Stretch📈 Primary Structure: Clean Uptrend Channel

Gold is trading inside a well-defined ascending channel, with:

- Higher highs

- Higher lows

- Respect for both channel boundaries

- Strong trend efficiency (impulse → correction → continuation)

This is textbook trend maturity, not exhaustion.

Each pullback has been:

- Corrective, not impulsive

- Contained within the lower channel boundary

- Followed by a renewed expansion leg

That stair step behavior you drew is exactly how strong macro trends behave. They advance through controlled rotations, not vertical pumps.

🧠 EMA & Trend Health

The rising long-term EMA (yellow) remains far below price, acting as a trend anchor, not resistance.

Price has not even threatened this EMA yet a strong signal that buyers remain in control on the higher timeframe.

As long as:

- Daily closes hold above the channel midline

- Pullbacks remain overlapping and corrective

👉 The trend remains structurally bullish.

🎯 About the $5,000 Target

The projected $5,000 ATH zone is not unrealistic, but it represents:

- A late-stage expansion target

- Likely reachable only after multiple rotations, not one impulse

Markets do not go from $4,600 → $5,000 without:

- Time-based consolidation

- Partial profit-taking

- Volatility compression → expansion cycles

So yes — $5,000 is feasible, but it would likely come after:

1. Several pullbacks toward the channel support

2. Continued acceptance above prior highs

3. No daily structure breakdown

⚠️ What Would Invalidate This Scenario?

This bullish roadmap fails only if:

- Price breaks and accepts below the ascending channel

- A daily lower low forms below the prior structural base

- Pullbacks shift from corrective to impulsive

Until that happens, calling a top is counter-trend trading.

🧩 Professional Conclusion

This is not a fantasy chart.

It is a trend-extension hypothesis grounded in structure, momentum, and market behavior.

➡️ Bias: Bullish continuation

➡️ Style: Trend-following, not breakout chasing

➡️ Expectation: Rotation → continuation → rotation → expansion

Gold does not need hype to reach $5,000. it only needs to keep doing exactly what it’s doing now.

Technical

EUR/USD at a Decision Wall: Relief Bounce or Just Another SellEUR/USD on the H1 timeframe is currently in a corrective phase within a broader bearish structure, and the chart you shared captures this context very clearly. After the sharp impulsive sell-off, price found temporary acceptance inside a well defined demand (support) zone around 1.1595–1.1600, where selling pressure stalled and short-term buyers stepped in. This reaction produced a technical bounce, but it is important to note that this bounce has remained corrective in nature, not impulsive.

Price has now pushed back toward the 1.1635–1.1640 resistance zone, which aligns closely with:

- Prior breakdown structure

- The downward-sloping EMA acting as dynamic resistance

- A lower-high formation relative to the previous swing high

This confluence significantly weakens the bullish case.

The current candles show overlapping price action and rejection wicks, suggesting that buyers are struggling to regain control. As long as EUR/USD remains below the resistance zone, the probability favors a rotation back toward the support zone, not continuation higher.

The projected path you drew a pullback followed by a retest of the 1.1600 demand area is structurally sound. This would represent a normal bearish continuation pattern: relief rally → lower high → rotation lower.

Only a clean H1 close above the resistance zone with acceptance would invalidate this bearish bias and open the door for a deeper recovery. Until that happens, upside attempts remain selling opportunities, not trend reversals.

Key takeaway:

This market is not building strength it is distributing under resistance. Unless buyers prove otherwise, the dominant bias remains bearish continuation toward the support zone.

Bitcoin Breaks the Range: Dead-Cat Bounce or Smart Money Reload?On the BTC/USD H1 timeframe, price has just delivered a clean range failure, and the structure now shifts into a new decision phase. For an extended period, Bitcoin was rotating inside a clearly defined accumulation price range around the 95,000–95,600 zone. Price respected both range highs and lows with overlapping candles a classic sign of balance and liquidity building, not trend continuation. Importantly, the EMA flattened inside this range, confirming market indecision and absorption.

That balance has now been violently resolved to the downside.

The strong bearish impulse candle slicing through the range low is a distribution confirmation, not a random spike. This move indicates that smart money used the range to offload positions, triggering sell stops below the range and accelerating downside momentum. The EMA has rolled over and price is now trading decisively below it, reinforcing bearish control.

Price is currently reacting from the 92,200–92,500 support zone, where short-term buyers are attempting to stabilize the move. The bounce you’ve projected is technically valid but context matters. This reaction is corrective, not impulsive. There is no structural shift yet: no higher high, no acceptance back inside the range, and no reclaim of the EMA.

As long as Bitcoin remains below the former accumulation range (now resistance around 94,700–95,000), any upside move should be treated as a sell-the-rally scenario. A pullback toward the 93,600–94,000 liquidity zone, followed by rejection, would align perfectly with a bearish continuation model.

Only a strong reclaim and H1 acceptance back inside the old range would invalidate the bearish bias and signal a potential trap. Until then, the dominant narrative is clear:

Bitcoin has exited accumulation and the path of least resistance remains corrective up, then continuation down.

This is no longer a ranging market. It’s a post-distribution environment, and patience will be key for confirmation at the next resistance test.

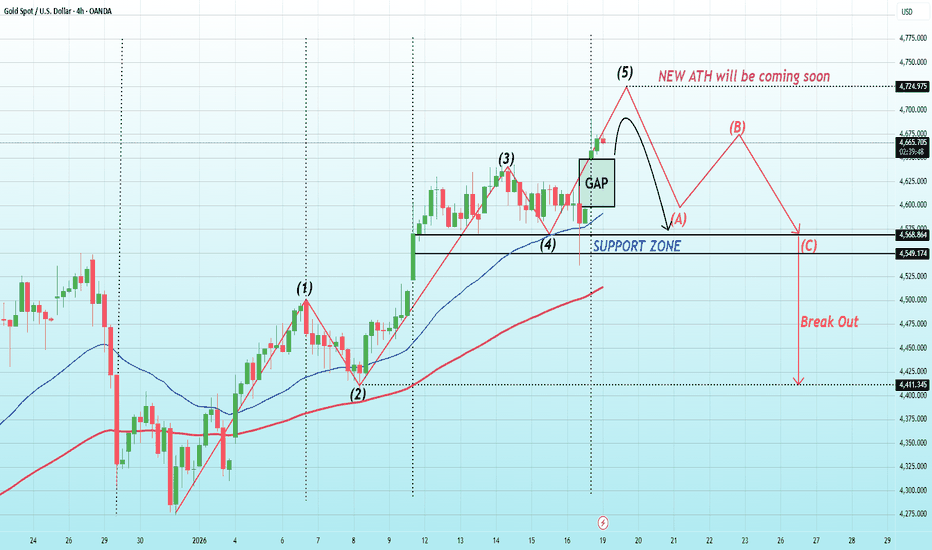

GOLD Near the Final Push? Breakout Above the Gap Could Open ATHOn the H4 timeframe, Gold is trading within a strong bullish macro structure, and the current price action suggests the market is transitioning into a late-stage expansion phase rather than distribution. The overall trend remains firmly bullish, with price holding well above the rising medium and long-term moving averages a key sign that buyers still control the higher timeframe flow.

From a structure perspective, Gold has already completed a clean impulsive advance from the previous base, forming a classic higher-high / higher-low sequence. The recent consolidation just below the highs is constructive, not weak. Price is compressing above a well defined support zone (around 4,55x–4,56x) while respecting the EMA, showing that sellers are unable to push price meaningfully lower.

A critical technical detail is the unfilled GAP zone above current price. This gap aligns with the upper resistance band and acts as a liquidity magnet. Historically, in strong trending markets like this, gaps are often revisited before any deeper correction occurs. This supports the idea of one more bullish leg toward the highs.

The projected structure on the chart reflects two clear scenarios:

Primary scenario (bullish continuation):

If price holds above the support zone and reclaims momentum, Gold is likely to push through the gap and challenge the previous high, completing the final impulsive leg. A clean breakout and acceptance above this area would strongly increase the probability of a new All-Time High (ATH) in the coming sessions.

Alternative scenario (corrective pullback):

If price fails to hold the support zone, a corrective ABC-style pullback could unfold. In this case, the (A)-(B)-(C) structure would target deeper liquidity below, with the 4,41x area acting as the next major downside support. This would still be considered a correction within a broader bullish trend, not a trend reversal, unless key higher-timeframe supports are decisively broken.

Key Takeaways:

– Trend: Bullish (H4)

– Market state: Consolidation after impulse

– Bullish trigger: Hold support + break above the gap

– Bullish target: Retest highs → New ATH potential

– Bearish risk: Loss of support → deeper corrective leg

📌 Conclusion:

Gold is not showing signs of distribution yet. This is a high level consolidation under resistance, often seen before continuation. As long as the support zone holds, the market is building energy not topping out.

ETH Just Collapsed Into Support — Relief Bounce or Start Break1. Market Structure & Impulse Context

ETH has just printed a strong bearish impulse from the upper range, breaking decisively below the EMA cluster (fast + slow EMAs). This move is not corrective — it is an impulsive sell-off, signaling aggressive distribution from the resistance zone near 3,360–3,380.

When price leaves a range with this level of momentum, the first reaction into support often determines whether the move is: a trend continuation, or a liquidity sweep before reversal

Right now, ETH is at that decision point.

2. Key Zones on the Chart

Resistance Zone: 3,360 – 3,380 → Major supply + prior rejection area

Mid-Level / Reaction Zone: ~3,240 → Previous structure support turned resistance

Support Zone: 3,160 – 3,180 → First meaningful demand after the breakdown

Price is currently compressing just above the support zone, not bouncing strongly yet this is important.

3. EMA & Trend Alignment

Both EMAs have now rolled over and crossed bearish, with price trading well below them. This confirms:

- Short-term trend has flipped bearish

- Any upside move from here is counter trend unless price reclaims the EMA zone decisively

As long as price remains below the EMAs, rallies should be treated as pullbacks, not trend reversals.

4. Price Action & Liquidity Read

Current candles are small, overlapping, and indecisive classic pause after impulse behavior. This often leads to one of two outcomes:

- A technical relief bounce to rebalance liquidity

- Or support failure once weak buyers are absorbed

Liquidity is clearly resting below the support zone, while unmitigated supply remains above.

5. Scenarios to Watch

🔼 Bullish Relief Bounce (Corrective Scenario)

Support at 3,160–3,180 holds

Price pushes back toward 3,240 reaction level

Extension toward 3,350–3,360 resistance if momentum builds

⚠️ This would still be a counter-trend move unless structure flips.

🔽 Bearish Continuation (Higher Probability)

Clean break and acceptance below 3,160

Acceleration toward 3,120 → 3,080 liquidity zone

Confirms that the impulse was the start of a larger markdown

This scenario aligns with EMA structure, impulse behavior, and broader distribution context.

6. Trading Perspective

Bias: Bearish continuation unless proven otherwise

Aggressive longs are risky inside support without confirmation

Shorts favored on:

Weak bounce into 3,240

Or confirmed breakdown below 3,160

Summary

ETH has transitioned from range → distribution → impulse. The current pause at support is not yet a reversal signal. Until price reclaims key structure and EMAs, the market remains vulnerable to another downside expansion.

This is a classic moment where patience pays let the market show whether this support is real demand… or just a stop before the next drop.

EURUSD Pressed Against the Downtrend On the H4 timeframe, EURUSD remains firmly locked in a bearish market structure, with price continuing to respect a well-defined descending trendline that has capped every recovery attempt. The broader picture is clear: this is a controlled downtrend, not a capitulation move.

Structurally, the market has been printing lower highs and lower lows, while price consistently trades below the EMA cluster, reinforcing bearish trend alignment. Each bullish swing has been corrective in nature, lacking impulsive follow-through a classic sign of weak demand and dominant sellers.

The recent sell-off pushed price into the 1.1575–1.1580 support zone, where we are now seeing a short-term reaction. This bounce is technically expected, as this level has previously acted as demand and liquidity support. However, context matters: support inside a downtrend is not a buy signal it is a decision zone.

From here, two scenarios stand out clearly:

Corrective bounce scenario: Price may grind higher toward the descending trendline and EMA resistance zone around 1.1650–1.1665. If bullish momentum stalls there, that area becomes a high-probability sell zone, aligned with trend continuation logic.

Bearish continuation scenario: Failure to build acceptance above the current support, or a clean breakdown below 1.1575, would signal renewed sell pressure and open downside continuation toward 1.1520 and lower liquidity pools.

Importantly, the rounded corrective structures drawn on the chart highlight distribution behavior, not accumulation. Buyers are reactive, not proactive — while sellers remain positioned at premium levels.

➡️ Trend bias: Bearish

➡️ Key resistance: 1.1650–1.1665 (trendline + EMA)

➡️ Key support: 1.1575

➡️ Best approach: Sell rallies, not chase bounces

Until EURUSD breaks and holds above the descending trendline with strong momentum, any upside should be treated as corrective not reversal.

ETH Lost the Accumulation – This Breakdown Shifts the BearishHello Traders....On the H1 timeframe, Ethereum has just delivered a critical structural signal by breaking decisively below the prior accumulation zone, confirming that the range was not continuation but distribution. The sharp impulsive sell off from the upper boundary of the range is not random volatility it reflects a clear rejection from value and a transition into a bearish phase.

For an extended period, ETH was compressing inside the 3,260–3,400 region, where price respected the EMA and rotated cleanly. However, the most important detail is how the breakdown occurred. Price did not drift lower gradually; instead, it collapsed impulsively through the range low and the EMA 98, signaling that buyers were no longer defending value. This type of move typically marks the start of a markdown cycle, not a temporary stop run.

After the breakdown, ETH is now attempting to stabilize around the 3,210 area, but this should be viewed as a weak corrective pause, not a base. Former range support has flipped into resistance, and price is struggling to reclaim it. This behavior is consistent with bearish market structure, where rebounds are sold and upside follow-through remains limited.

The next key area of interest lies at the 3,150–3,160 support zone, which represents the first meaningful demand below the range. If price continues to fail below 3,220, a rotation toward this zone becomes the higher-probability scenario. Any shallow bounce into the 3,240–3,260 region would likely serve as liquidity for sellers, rather than a signal of renewed strength.

From a cycle perspective, ETH has transitioned from accumulation → distribution → markdown. Until price can reclaim the broken range low and hold above it with acceptance, the path of least resistance remains to the downside. Buyers had their opportunity inside the range the market has now made its decision.

In summary, Ethereum is no longer consolidating it has resolved lower. As long as price remains below the former accumulation zone, bearish continuation toward deeper support levels remains the dominant technical scenario, and rallies should be treated with caution rather than optimism.

EURUSD Is Still Bearish – This Bounce Is Just a ReactionOn the H1 timeframe, EURUSD remains firmly in a bearish market structure, with price continuing to respect the descending trendline and trading below the EMA 98. The broader context is clear: sellers are still in control, and recent bullish candles should be read as corrective reactions, not a change in trend.

The impulsive drop into the 1.1585–1.1590 support zone triggered a sharp bounce, but this move is best classified as a liquidity reaction after an extended sell-off. Price quickly rebounded from demand, yet failed to reclaim the broken trendline or establish acceptance above dynamic resistance. This behavior is typical in downtrends, where markets bounce to rebalance before resuming the primary direction.

Structurally, EURUSD continues to form lower highs beneath the descending trendline, and the EMA is acting as a ceiling rather than support. The zone around 1.1628–1.1640 is particularly important, as it aligns with both horizontal resistance and dynamic trend resistance. As long as price remains below this area, upside attempts lack structural backing.

The projected path highlights a likely scenario where EURUSD attempts a modest push higher into resistance, then rolls over and resumes its bearish trajectory. If selling pressure returns, the market is likely to revisit the 1.1585 support zone, and a clean break below this level would open the door for a deeper continuation lower toward 1.1550 and beyond.

From a cycle perspective, this market is still in a distribution-to-markdown phase. Buyers are reacting at support, but they are not strong enough to shift control. Until EURUSD breaks the descending trendline and holds above resistance with acceptance, rallies should be viewed as selling opportunities, not confirmation of a trend reversal.

In summary, EURUSD is not stabilizing it is pausing within a downtrend. The structure remains bearish, momentum favors sellers, and unless key resistance is reclaimed, the path of least resistance continues to point lower.

Liquidity Sweep Complete — Is Gold Preparing for the Next ATH Market Structure & Context

Gold continues to trade within a well-defined horizontal range that has been respected for multiple sessions. Price recently executed a clean downside liquidity sweep into the lower support zone, immediately followed by a sharp bullish reaction. This behavior strongly suggests stop hunt absorption, not genuine bearish continuation. The impulsive rebound from the lower boundary confirms that buyers are still active and defending structure, keeping the broader bullish bias intact.

Support, Gap & Acceptance

After the liquidity grab, price impulsively broke back above the mid-range support zone, leaving behind a clear price gap / inefficiency. This gap now acts as a bullish demand pocket, signaling that the move higher was aggressive and unbalanced a common precursor to continuation.

As long as price holds above this support zone and the gap remains unfilled, the structure favors buy-the-dip logic, not selling strength.

Momentum Shift & Bullish Intent

The push into New All-Time High (ATH) territory is not random. The market first cleared internal resistance, paused briefly to consolidate, and is now showing higher lows above prior structure, indicating acceptance rather than rejection.

This is typical markup behavior following a successful accumulation and liquidity sweep phase.

Forward Scenarios

🟢 Primary Scenario — Bullish Continuation:

If price continues to respect the support zone and holds above the gap, Gold is likely to expand higher, targeting:

- Previous ATH area

- Extension toward the 4,720 – 4,740 zone

This scenario aligns with strong bullish order flow and unresolved upside liquidity.

⚠️ Alternative Scenario — Healthy Pullback:

A controlled retracement into the gap / support zone would still be considered constructive. As long as price does not lose acceptance below the range, any pullback is likely corrective, offering re-accumulation before continuation.

This is not distribution. The structure shows classic signs of liquidity engineering → impulse → acceptance. Sellers failed to capitalize on the breakdown, while buyers responded decisively — a key clue that smart money positioning remains bullish.

Conclusion

Gold is behaving like a market preparing for another expansion leg, not a reversal. Until the support zone is decisively broken, the bias remains bullish toward new highs.

ETH 4H Cup & Handle Fails at the Pivot 1. Higher-Timeframe Structure Context

On the 4H chart, ETH previously developed a well-defined Cup & Handle structure, with a clean rounded base, midpoint recovery, and a strong impulsive rally into the pivot resistance zone near 3,400. This move initially signaled accumulation transitioning into markup. However, price failed to sustain above the pivot, and the rejection was sharp and impulsive a critical warning sign that buyers were not yet in full control.

2. Cup & Handle Breakdown Dynamics

Instead of holding above the handle low and grinding higher, ETH lost the handle support decisively, invalidating the bullish continuation in the short term.

Key observations:

- The handle breakdown occurred with large bearish candles, not compression

- This indicates supply dominance, not a healthy pullback

- The “current close” sits below the handle low — structurally bearish

When a Cup & Handle fails like this, price often rotates back toward the base, rather than immediately resuming higher.

3. Key Levels & Zones

Pivot Resistance: ~3,400 → Major rejection, unmitigated supply

Handle Low / Flip Zone: ~3,260 → Now acting as resistance

Midpoint of Base: ~3,160 → First reaction level

Base Demand Zone: 3,000 – 3,050 → High-probability liquidity target if selling continues

The projected path on the chart aligns with a distribution → markdown rotation, not immediate continuation.

4. Trend & Momentum Assessment

The impulsive rally into the pivot was followed by:

Failure to form higher highs

Breakdown of short-term structure

Loss of bullish momentum

This sequence typically reflects bull exhaustion, especially after a pattern becomes obvious and crowded.

Unless ETH can reclaim and hold above 3,260–3,300, upside attempts remain corrective.

5. Scenarios Going Forward

🔽 Bearish Continuation (Primary Scenario)

Price fails to reclaim handle low

Weak bounce followed by continuation lower

Rotation toward 3,100 → base demand zone (~3,000)

🔼 Bullish Recovery (Lower Probability)

Strong reclaim of 3,260, followed by acceptance

Compression below pivot

Only then does a renewed breakout attempt toward 3,400+ become valid

Without that reclaim, bullish bias is premature.

6. Trading Perspective

Bias: Cautiously bearish / corrective

Failed Cup & Handle favors mean reversion, not breakout chasing

Shorts favored on:

Weak pullbacks into 3,260–3,300

Longs only justified after clear structure reclaim

Summary

ETH’s Cup & Handle has failed at the most important level the pivot. This is not a normal pullback; it’s a structural rejection. Until buyers prove strength by reclaiming key levels, the path of least resistance remains downward toward the base, where real demand must step in.

In this phase, discipline matters more than prediction let structure confirm before committing bias.

BTC Stalls Below Resistance — Distribution Before the Next Bitcoin on the H1 timeframe is showing clear signs of exhaustion beneath a well-defined resistance zone around 95,700–96,000, following the strong impulsive rally from the lower range. The initial breakout was clean and aggressive, but price has since transitioned into choppy, overlapping price action, signaling a loss of momentum rather than continuation.

Structurally, BTC has failed to reclaim the previous high near 97,600–98,000, and each rebound into the resistance zone has been met with selling pressure and weak follow-through. The short-term structure now resembles a lower-high sequence, suggesting that buyers are no longer in control of expansion, but instead distributing positions at premium prices.

From a trend and EMA perspective, price is still hovering above the EMA 89, but the distance between price and EMA has narrowed significantly. This often precedes a mean reversion move, especially when price is repeatedly rejected from resistance. The EMA itself is acting as a magnet rather than support, increasing the probability of a pullback toward the 94,000–94,100 demand zone, where stronger bids may reappear.

If BTC fails to break and hold above 96,000 with strong volume, the current structure favors a bearish continuation toward lower liquidity, with 93,100–93,200 as the next major downside objective. Any upside attempts without a decisive breakout should be viewed as sell-the-rally opportunities rather than trend resumption.

➡️ Market state: Distribution / range at resistance

➡️ Bias: Bearish below 96,000

➡️ Key downside targets: 94,000 → 93,100

➡️ Invalidation: Strong acceptance above 96,000–96,200

At this stage, Bitcoin is not trending it is deciding, and the structure currently favors a downside resolution unless buyers regain control decisively.

XAUUSD Market Update | January 19, 2026XAUUSD | January 19, 2026

Market Update

➤ Gold continues to respect a bullish market structure on the H1 timeframe. After a strong impulsive move that printed a new All-Time High (ATH), price is currently in a healthy pullback and re-accumulation phase.

➤ Gold has now clearly shifted into a bearish intraday structure. After failing to hold above recent highs, price has started forming a sequence of Lower Highs and Lower Lows, confirming that short-term market control has shifted to sellers.

This move is not a normal pullback, but rather a distribution → sell-off phase, where bearish momentum is expanding.

➤ The current decline is liquidity-driven, not emotional selling. Smart Money is actively sweeping late buy-side liquidity, forcing weak long positions to exit. As a result, price is being pushed away from premium levels and guided into a cleaner discount environment where market efficiency can be restored.

➤ At this stage, panic-selling near the lows is not optimal. After a strong bearish impulse, markets typically pause or retrace to rebalance price inefficiencies. Entering sells too late often results in poor risk-to-reward and exposure to corrective pullbacks.

🔹 Key Rebalance Zones – Fair Value Gaps (FVG)

FVG 1 (Upper): 4616 – 4618

• Origin of strong bearish displacement

• Previous intraday supply reaction

• High-probability zone for mitigation and seller re-entry

FVG 2 (Lower): 4602 – 4605

• Inefficient price delivery during sell expansion

• Likely short-term rebalance zone before continuation

• Key area to watch for rejection or liquidity sweep

➡️ Price may retrace into one of these FVG zones to rebalance inefficiencies and reload sell-side positions before the next bearish leg develops.

🔹 Market Expectation

➤ As long as price remains below recent structure highs, the bearish bias remains intact.

➤ Any retracement into FVG zones should be treated as a potential sell opportunity, not a signal to chase buys.

➤ Confirmation is required: rejection, BOS, or liquidity sweep, aligned with institutional order flow.

🔹 Session Context

Liquidity tends to be muted during the Asian session, often resulting in corrective or choppy price action.

Cleaner displacement and higher-quality setups are more likely to form during the European session, when institutional participation increases.

Geopolitical Risk & GoldGeopolitical Risk & Gold

Geopolitical risk has risen sharply following the U.S. capture of Venezuela’s President Nicolás Maduro, increasing political uncertainty across Latin America and driving a broader risk-off tone in markets. Given Venezuela’s strategic role in energy and its ties to non-Western powers, the event may trigger secondary volatility across financial assets.

In this environment, gold continues to benefit as a primary safe haven. Historical precedents (e.g., Ukraine 2022, Crimea 2014) show that geopolitical escalation typically supports gold demand. This dynamic is reinforced by muted market confidence, with the Fear & Greed Index near 48 (neutral)—limiting appetite for risk assets and supporting short-term flows into gold.

Gold Technical Outlook (XAU/USD)

Trend: Dominant bullish structure intact since late August 2025; no meaningful corrective selling to threaten the trend.

Momentum:

RSI holding above 50 → bullish momentum remains dominant.

MACD bullish crossover with histogram above zero → short-term momentum has turned positive.

$4,546 – Major resistance (ATH). A sustained break could accelerate upside.

$4,300 – Neutrality/near-term reference zone.

$4,200 – Critical support (near 50-SMA). A break would risk the bullish structure into early 2026.

Bottom line: Elevated geopolitical tension and neutral confidence conditions support continued demand for gold, with the prevailing bias remaining bullish while key supports hold.

EURUSD: Trendline Rejection Confirms Bearish ControlFX:EURUSD Is currently trading in a clear short-term downtrend, defined by a sequence of lower highs and lower lows. The dotted descending trendline is acting as a dynamic resistance, and price has respected it with high accuracy.

Two key moments stand out:

- The first rejection from the trendline marked the start of bearish momentum.

- The second retest and rejection (highlighted by the orange circle) confirms that sellers remain firmly in control and that bullish pullbacks are corrective, not impulsive.

This behavior reinforces the idea that the market is not accumulating for reversal, but rather distributing before continuation to the downside.

🟢 Demand Zone – Reaction, Not Revers al

Price has now reached a short-term demand/support zone, where we see a temporary slowdown and small consolidation candles. However, it’s important to note:

The move into the demand zone was impulsive and aggressive, indicating strong sell-side pressure.

The current bounce lacks volume expansion and structure → no clear bullish confirmation.

This type of price action typically represents pause + absorption, not a trend change.

In strong trends, demand zones are often broken on the second or third test, especially when they are approached with momentum.

🧠 Probable Scenarios

Primary scenario (higher probability):

Price makes a weak corrective bounce from the demand zone.

Fails below the descending trendline.

Breaks and closes below the demand zone → continuation lower toward 1.158x – 1.156x liquidity.

Alternative scenario (lower probability):

Price forms a clear higher low, breaks the trendline with acceptance, and reclaims prior structure.

Only then would a short-term bullish correction be considered valid.

il that happens, any upside is corrective.

🎯 Key Takeaway for Traders

As long as EURUSD remains below the descending trendline, the market structure favors sell-the-rally logic, not bottom fishing. The demand zone is being tested under bearish pressure, and without strong confirmation, it is more likely to fail than hold.

Trend first, zones second. And the trend is still bearish.

Trade patiently, wait for confirmation, and manage risk accordingly.

Bitcoin Completes an Impulsive CycleHello traders! Here’s a clear technical breakdown of BTCUSD (1H) based on the current chart structure. Bitcoin has completed a full impulsive Elliott Wave sequence (1–5), with wave (5) marking the local top and momentum exhaustion point. The advance into wave (5) was strong, but notably lacked continuation follow-through afterward, which is a classic early warning of a trend transition.

Following the completion of wave (5), price has shifted into a corrective market phase, forming an ABC structure. The price action is now characterized by overlapping candles, lower highs, and weaker rebounds, confirming that bullish momentum has faded and the market is no longer in impulse mode. This transition signals a cycle shift from expansion to correction, not just a random pullback.

SUPPLY & DEMAND – KEY ZONES

Major Distribution / Wave (5) Supply Zone:

The region around the wave (5) high represents distribution at premium, where smart money typically exits long exposure. The sharp rejection from this zone confirms strong seller presence.

Corrective Structure Levels (ABC):

Wave (A): Initial impulsive sell-off, breaking bullish momentum

Wave (B): Weak corrective bounce, failing to reclaim prior highs

Wave (C): Ongoing decline, currently developing with expanding downside risk

Macro Support / Cycle Low:

The 90,000–90,300 zone stands out as a critical higher-timeframe support, aligned with the base of the prior accumulation range and the projected completion zone of wave (C).

🎯 CURRENT MARKET POSITION

Currently, BTC is trading inside the corrective phase, with price action suggesting wave (C) is still unfolding. The inability to reclaim prior structure highs confirms that bounces are corrective, not impulsive.

Momentum structure now favors continuation lower, unless the market invalidates the corrective count by reclaiming key resistance levels with strength.

🧠 MY SCENARIO

As long as Bitcoin remains below the wave (B) high and fails to re-enter the impulsive structure, the probability favors continued downside toward the 90,000 support zone, where wave (C) may complete.

That area is critical:

- A strong reaction there could mark cycle reset and re-accumulation

- A clean breakdown would signal deeper corrective extension and broader trend weakness

Only a decisive reclaim above the corrective highs would invalidate the ABC scenario and reopen the path for bullish continuation.

For now, Bitcoin is in correction after impulse, not in trend continuation.

⚠️ RISK NOTE

Corrective phases are volatile and deceptive. Trade reactions, not predictions, respect key invalidation levels, and always manage your risk.

Bitcoin Compressing at Demand Bitcoin on the 45-minute timeframe is currently holding above a well-defined demand zone around 95,180–94,700, while price continues to respect a descending trendline acting as dynamic resistance. This structure reflects compression, not weakness.

Price has already completed a corrective pullback from the prior impulse and is now stabilizing above demand, with downside attempts failing to gain follow-through. The yellow EMA is flattening and aligning closely with current price, signaling loss of bearish momentum and a transition into balance.

As long as Bitcoin defends the demand zone, the market is positioned for a bullish resolution. A clean break and acceptance above the descending trendline would confirm a shift in short-term structure, opening the path toward 96,800 → 97,600 → 98,600 as upside objectives.

However, a decisive breakdown below 94,700 would invalidate the bullish setup and expose deeper downside liquidity.

➡️ Support: 95,180–94,700

➡️ Key trigger: Break & close above descending trendline

➡️ Bias: Neutral → Bullish on breakout

➡️ Invalidation: Acceptance below demand zone

Bitcoin is not trending yet it’s loading liquidity.

Ethereum Holding the Line — Range Compression Before ExpansionEthereum on the H1 timeframe is currently trading inside a clear consolidation range after a strong impulsive rally. Price is oscillating between a key support band around 3,280–3,300 and multiple overhead resistance levels at 3,397 → 3,433 → 3,475. This is classic post-impulse behavior, where the market pauses to rebalance liquidity before choosing direction.

From a price action perspective, buyers have repeatedly defended the same horizontal support zone, with several clean rejections to the downside but no sustained acceptance below it. Each pullback into this zone is met with demand, suggesting that sellers lack strength to extend a deeper correction. The structure inside the range is overlapping and corrective a sign of consolidation, not distribution.

The EMA (yellow) is rising and running directly through the support area, reinforcing this zone as dynamic support. As long as price holds above this EMA and the horizontal base, the broader bullish structure remains intact. The recent downside probe labeled “BREAK” appears more like a liquidity sweep rather than a true breakdown, as price quickly reclaims the range.

Bullish scenario:

If ETH continues to respect the 3,280–3,300 support and builds acceptance, a push toward 3,397, followed by 3,433 and ultimately 3,475, becomes the higher-probability path. A clean breakout and close above the upper resistance would confirm continuation.

Bearish scenario:

A decisive H1 close below 3,280, with acceptance under the EMA, would invalidate the range support and expose the lower liquidity pocket near 3,180–3,200.

➡️ Key support: 3,280–3,300

➡️ Key resistance: 3,397 → 3,433 → 3,475

➡️ Market state: Consolidation after impulse

➡️ Bias: Neutral → Bullish while support holds

Ethereum is not trending yet it’s coiling energy for the next expansion.

EURUSD Trapped in a Descending ChannelOn the H4 timeframe, EURUSD continues to respect a well-defined descending price channel, confirming that the broader structure remains bearish. Since topping near the 1.1800 region, price has consistently printed lower highs and lower lows, with each recovery leg being capped by the upper boundary of the channel.

From a price action standpoint, every bullish push is corrective in nature. We can clearly see sharp impulsive sell-offs followed by weaker, overlapping pullbacks — a textbook sign that sellers remain dominant, while buyers are only reacting, not leading. The most recent rebound attempt was once again rejected near the channel resistance, reinforcing this zone as a strong area of supply.

The EMA (yellow) is sloping downward and sitting above price, acting as dynamic resistance. As long as EURUSD trades below this moving average and remains inside the channel, bullish scenarios are considered counter-trend and higher risk. Momentum remains aligned with the downside, and there is no structural evidence of accumulation at this stage.

Currently, price is drifting toward the lower boundary of the channel, with a key horizontal level near 1.1500 acting as the next major downside magnet. This level aligns with prior liquidity and structural support, making it a logical target if bearish pressure persists. A minor bounce from the channel base is possible, but unless price breaks and holds above the channel resistance, any upside should be viewed as a selling opportunity rather than a trend reversal.

Bearish continuation scenario:

– Rejection from channel resistance → continuation lower

– Targets: 1.1550 → 1.1500

Invalidation / shift in bias:

– A strong H4 close above the descending channel and EMA, followed by acceptance, would be the first signal that bearish control is weakening.

➡️ Trend: Bearish

➡️ Structure: Descending channel

➡️ Key resistance: Channel top + EMA

➡️ Key support: 1.1500 zone

At this stage, EURUSD is not bottoming it is grinding lower within a controlled bearish structure.

EURUSD Compresses at Demand — Breakdown Trap or Reversal Setup?EURUSD on the H1 timeframe remains in a clear short-term downtrend, defined by a descending trendline and a sequence of lower highs. Each bullish attempt into the trendline has been firmly rejected, confirming sellers remain in control of structure.

Price is now pressing into a well-defined demand zone around 1.1590–1.1600, where selling momentum has slowed and candles are beginning to compress. This behavior suggests selling pressure is being absorbed, rather than accelerating lower, which is typical ahead of a reaction or short-term reversal.

The key level to monitor is the trendline break.

– A clean break and close above the descending trendline, followed by acceptance above 1.1624, would confirm a bullish shift, opening room toward 1.1655–1.1690.

– Failure to hold the demand zone would invalidate the rebound scenario and expose liquidity below 1.1590 before any meaningful recovery.

➡️ Market state: Downtrend testing demand

➡️ Bias: Neutral → Bullish only on trendline break

➡️ Bullish trigger: Break & close above 1.1624

➡️ Bearish invalidation: Sustained break below 1.1590

At this point, EURUSD is at a decision zone either forming a base for reversal or preparing for one final liquidity sweep before turning higher.

ETH Trapped Between Supply & Demand On the H1 timeframe, Ethereum is clearly transitioning from impulsive strength into a balanced range environment. After a sharp bullish breakout, price stalled inside a well-defined resistance zone around 3,380–3,420, where repeated attempts to push higher have been rejected. This behavior confirms that sell-side liquidity is actively defending the highs, preventing continuation for now.

Structurally, ETH is printing overlapping swings with equal highs and shallow pullbacks, a textbook sign of consolidation rather than trend continuation. On the downside, the support zone around 3,260–3,280 continues to attract buyers, aligning closely with the rising EMA structure. As long as this zone holds, downside pressure remains corrective, not impulsive.

However, momentum has noticeably weakened. Each push into resistance lacks follow-through, while bounces from support are becoming less aggressive. This suggests buyers are absorbing supply, but not yet strong enough to force a breakout. The market is effectively coiling, compressing volatility between supply and demand.

From a trading perspective, ETH is currently in a high-risk middle-range zone. The higher-probability opportunities will come from reactions at the extremes:

A clean rejection from resistance keeps the bias short-term bearish, opening room for a deeper pullback toward 3,200–3,150.

A strong breakout and acceptance above 3,420 would invalidate the range and signal trend continuation toward higher expansion targets.

➡️ Market state: Range / consolidation

➡️ Key resistance: 3,380–3,420

➡️ Key support: 3,260–3,280

➡️ Bias: Neutral-to-bearish below resistance, bullish only on confirmed breakout

Until the range resolves, ETH is best treated as a reaction-based market, not a directional one.

EURUSD at a Make-or-Break Demand Zone — Bounce Setup bearish impulsive move from the prior supply zone near 1.1660–1.1670. The sell-off was aggressive, breaking structure cleanly and confirming that sellers remain in control on the H1 timeframe. However, after reaching demand, price has shifted into short-term consolidation, signaling hesitation rather than immediate continuation.

From a structure and trend perspective, the market is still bearish overall. Price remains below the descending trendline and below the EMA, both of which are acting as dynamic resistance. Any bullish movement from the current demand zone should be treated as a corrective pullback, not a trend reversal, unless price can reclaim the trendline and hold above it with strong momentum.

Scenario-wise, there are two clear paths. If buyers manage to defend the demand zone and push price upward, the most likely upside reaction would be a pullback toward the trendline and EMA confluence, where sellers are expected to re-enter from a premium area. Failure at that level would reinforce the bearish continuation narrative. On the other hand, if the demand zone fails to hold, a clean breakdown below 1.1590 would likely trigger another bearish expansion, opening the door toward lower liquidity levels around 1.1560 and below.

➡️ Market bias: Bearish, corrective bounce possible

➡️ Key focus: Reaction at demand zone vs. trendline rejection

➡️ Invalidation: Strong acceptance above trendline and EMA

This is a classic sell the rally environment, with demand acting as a temporary pause rather than a confirmed reversal zone.

Ethereum Is Completing a Classic Head & Shoulders1. Current Market Structure

Ethereum has transitioned from a strong bullish impulse into a clear distribution structure on the H1 timeframe. After the vertical rally from the 3,100 area, price formed a well defined Head & Shoulders pattern, signaling exhaustion rather than continuation. The left shoulder and right shoulder are symmetrical, while the head marks the final aggressive push that failed to attract sustained demand. Since then, price has shifted into lower highs and overlapping candles, confirming loss of bullish control.

This is no longer an impulsive uptrend it is a corrective-to-distributive phase.

2. Key Zones & Market Positioning

Major Supply / Head Zone: 3,390 – 3,420 → Strong rejection, distribution confirmed

Neckline / Key Support: ~3,280 – 3,265 → Structural decision level

Intermediate Demand: ~3,220

Final Downside Liquidity Target: 3,080 – 3,100

Price is currently hovering just above the neckline, which is typical behavior before a decisive breakdown in classical H&S structures.

3. EMA & Momentum Context

The EMA 98 is still rising and located below price, which explains the temporary pauses and bounces. However, price is now trading below prior momentum highs, and EMA support is flattening. This often occurs before deeper pullbacks as late buyers get trapped above the neckline.

Momentum is clearly weakening bullish candles are corrective, not impulsive.

4. Liquidity & Pattern Psychology

The Head & Shoulders structure reflects a distribution of long positions:

- Early buyers took profit near the head

- Late buyers entered near the right shoulder

- Liquidity now rests below the neckline

Once the neckline breaks and acceptance occurs, price typically accelerates quickly as stop-loss liquidity is released.

5. Market Scenarios

🔽 Primary Scenario – Bearish Continuation (High Probability)

Clean break and close below 3,265

Retest of neckline fails

Expansion toward 3,220 → 3,080

This move would be a healthy correction within the broader uptrend, not a macro reversal.

🔼 Invalidation Scenario

Strong reclaim and acceptance above 3,360

Break of right-shoulder structure

This would neutralize the H&S pattern and reopen bullish continuation — currently unlikely without volume.

6. Trading Perspective

Bias: Bearish (short-term)

Avoid longs near the neckline

Shorts favored on rejection or confirmed breakdown

Best long opportunities appear after liquidity is swept lower

Summary

Ethereum is no longer in expansion it is distributing.

The Head & Shoulders pattern is mature, momentum is fading, and liquidity is clearly building below the neckline. As long as price remains capped below the right shoulder, the roadmap remains straightforward:

Distribution → Neckline Break → Liquidity Expansion Downward

Bitcoin Is Losing Momentum at Range Mid1. Higher-Timeframe Context & Trend Quality

Bitcoin remains structurally bullish on the higher timeframe, but the current H1 structure is no longer impulsive. After a strong vertical expansion from the 91k area, price failed to hold above the prior highs and has now transitioned into overlapping, corrective price action. This signals that momentum has slowed and the market is digesting liquidity, not trending cleanly.

The EMA 98 is still rising and located well below price, meaning the broader trend is intact however, short-term control has shifted away from buyers.

2. Key Supply & Demand Zones

Major Resistance Zone: 96,700 – 97,800 → Clear supply absorption, repeated rejections, failure to hold highs

Mid-Range Resistance (Now Acting as Cap): ~96,000 → Price repeatedly stalls here, showing weak follow-through

Key Support Zone: 94,600 – 94,800 → First meaningful demand aligned with EMA 98 trajectory

Deeper Demand / Liquidity Pool: 92,300 – 92,500 → Likely downside magnet if support breaks

Price is currently trapped between resistance overhead and weakening demand below, which is a classic environment for stop-hunting and fake recoveries.

3. Price Action & Liquidity Behavior

The recent bounce attempts are corrective in nature shallow, overlapping candles with no impulsive bullish continuation. This suggests buyers are reactive, not proactive.

The curved downside projection on the chart reflects a typical distribution → breakdown → expansion sequence:

First, price holds sideways to trap late buyers

Then, liquidity is taken below local lows

Finally, price accelerates toward deeper demand zones

Importantly, no higher high has been formed since the rejection from the upper resistance zone, confirming loss of bullish control on H1.

4. Scenario Outlook

🔽 Primary Scenario – Corrective Breakdown (Higher Probability)

Failure to reclaim and hold above ~96,000

Loss of 94,600 support

Acceleration toward 92,300 – 92,500 liquidity zone

This would still be a pullback within a broader uptrend, not a trend reversal.

🔼 Alternative Scenario – Bullish Reclaim (Lower Probability)

Strong impulsive reclaim above 96,800

Acceptance above the prior range highs

Opens path back toward 97,800+

Without volume and momentum, this scenario remains secondary.

5. Trading Perspective

Bias: Neutral → Bearish (short-term)

Avoid longs in the middle of the range

Shorts only make sense on rejection from resistance or confirmed breakdown

Best longs are patience-based, waiting at deeper demand zones

Summary

Bitcoin is not breaking down yet but it is clearly distributing momentum after a strong rally.

As long as price remains below key resistance and momentum stays corrective, downside liquidity remains the more attractive target.

This is a cooling phase, not a continuation leg and the market is preparing for its next decisive move.