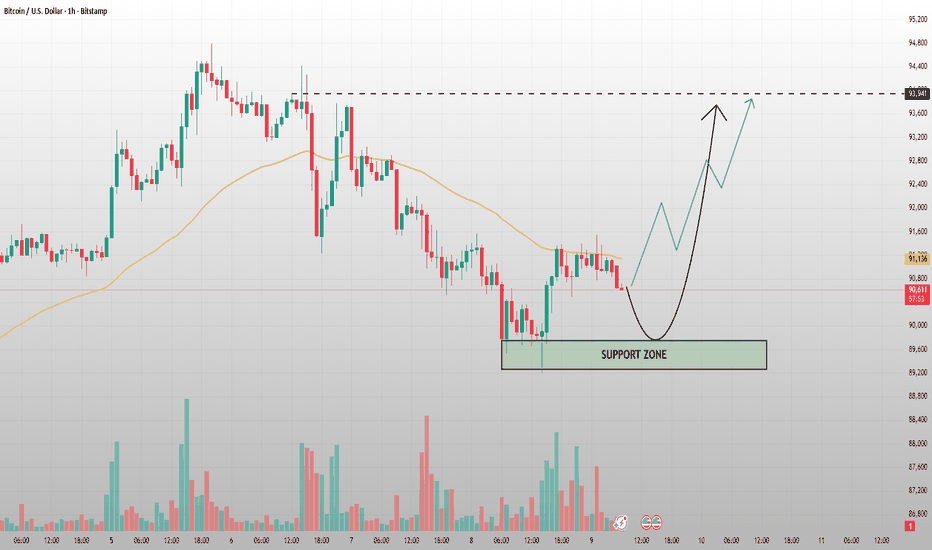

Bitcoin Is At Supply – This Rally Looks ExhaustedBITSTAMP:BTCUSD on the M30 timeframe is currently trading into a clearly defined supply zone, and the context of the move strongly suggests this is a corrective rally within a broader distribution range, not the start of a new bullish leg. The recent impulsive push higher was sharp and emotional, but price has now stalled exactly where sellers previously stepped in aggressively a classic warning sign.

From a market structure standpoint, BTC has not established a clean bullish trend. Instead, price continues to oscillate between premium (supply) and discount (demand) zones, forming a range-like structure with liquidity runs on both sides. The current push into the 92,400–92,600 region represents a move into premium, where risk to reward for fresh longs becomes unfavorable and selling pressure typically increases.

The interaction with the moving averages further supports this view. Price is extended above the short-term EMA while the longer EMA is still lagging below, a configuration that often precedes a mean reversion move. In bearish or neutral conditions, these extensions into supply tend to attract profit-taking from late buyers and short positioning from more patient sellers.

The rejection wick printed inside the supply zone is particularly important. It signals sell-side interest and rejection of higher prices, suggesting that smart money is distributing positions rather than accumulating. This behavior aligns with the projected path: a short-term pullback, a weak corrective bounce, and then a continuation move lower as liquidity below the range becomes the next target.

On the downside, the 90,200–90,400 demand zone stands out as the primary magnet. This area previously triggered strong buying reactions and remains unmitigated, making it a high-probability destination if price rolls over from supply. A move back into this zone would not be surprising — it would simply complete another rotation within the broader structure.

In summary, Bitcoin is not breaking out it is reacting at supply. As long as price remains capped below the supply zone and fails to build acceptance above it, the higher-probability scenario favors downside continuation toward demand. In this market, patience is rewarded, and chasing strength near supply is exactly where traders tend to get trapped.

Technical

EURUSD Breaks the Correction Channel — Momentum Is Quietly ShiftOn the 30-minute chart, EURUSD is showing early signs of a trend transition from corrective to bullish continuation, rather than a simple technical bounce. After a prolonged bearish phase, price printed a strong impulsive bullish leg, signaling the first meaningful change in momentum and order flow. Since that impulse, the market has been consolidating inside a descending corrective channel, a structure that typically represents profit-taking and rebalancing rather than renewed selling pressure. Importantly, price has now broken above the upper boundary of this channel, while simultaneously reclaiming and holding above both the fast and slow EMAs, which are beginning to flatten and curl upward a classic indication that bearish control is weakening. The current price behavior suggests buyers are absorbing remaining sell-side liquidity within the correction, preparing for a continuation toward higher resistance levels. As long as price maintains acceptance above the EMA cluster and does not fall back into the channel, the bullish scenario remains favored, with upside expansion toward the 1.1695–1.1714 zone likely to unfold through a stair-step structure of higher highs and higher lows. A failure back below the broken channel would delay, but not immediately invalidate, the bullish thesis unless accompanied by strong bearish displacement.

Symmetrical Triangle Signals an Imminent ExpansionGold is currently trading in a high-compression environment on the H1 timeframe after a strong impulsive rally that printed a fresh all-time high (ATH). Following this aggressive bullish expansion, price has transitioned into a symmetrical triangle consolidation, reflecting a temporary balance between buyers and sellers rather than a structural reversal.

The triangle is forming above the rising EMA, which is a key bullish characteristic. This indicates that the broader trend remains intact and that the current consolidation is likely a pause for continuation, not distribution. Higher lows are being respected, while lower highs reflect profit-taking and short-term supply entering the market near the ATH.

From a price action perspective, the triangle is developing after an impulsive leg higher — a classic continuation setup. Each rejection from the upper trendline has been met with shallower pullbacks, suggesting sellers are losing strength while buyers continue to absorb supply near the apex. This behavior typically precedes a volatility expansion.

The bullish scenario favors a clean breakout and acceptance above the descending trendline, which would confirm continuation toward the next upside objective near 4,648 and potentially beyond, as breakout traders and trapped shorts add momentum. Given the ATH context, upside liquidity remains largely untapped, increasing the probability of an expansion move once price escapes compression.

Alternatively, a temporary downside sweep toward the lower triangle boundary or EMA could still occur as a liquidity grab, but as long as price holds above the rising EMA and the structure remains intact, such a move would be considered corrective rather than bearish.

In summary, Gold is coiling tightly beneath ATH in a symmetrical triangle continuation pattern. The broader bias remains bullish, and the market is approaching a decisive moment where compression is likely to resolve into a strong directional move with upside continuation currently holding the technical advantage.

Bitcoin at a Critical EMA Test — Break Higher or Fade Back Price is reacting around the EMA zone near 90,600–90,800, a key dynamic level that previously acted as support before the sharp sell-off. Current price behavior shows hesitation, suggesting the market is at a short-term decision point rather than in clear trend mode. A clean break and sustained close above the EMA would confirm bullish follow-through, opening upside potential toward the 91,600 sideways range, with further extension into the 92,200–92,400 supply zone. However, failure to reclaim the EMA keeps the risk tilted to the downside. A rejection from this area would likely send price back toward the 90,300 demand zone, and a breakdown there could expose deeper liquidity toward 89,800–89,200. Until the EMA is decisively broken, choppy and reactive price action should be expected.

EURUSD Is Trapped Below Resistance — Accumulation 1. Market Structure

EURUSD remains in a clear bearish structure on the H1 timeframe. Price continues to form lower highs and lower lows, with the EMA 89 acting as dynamic resistance, confirming sellers are still in control.

The recent bullish impulse is corrective, not impulsive — there is no structural break to suggest a trend reversal.

2. Key Technical Zones

Resistance Zone: 1.1695 – 1.1700

→ Previous support turned resistance, aligned with EMA

Accumulation Zone: 1.1670 – 1.1685

→ Price is currently compressing here

Demand Zone: 1.1615 – 1.1620

→ Next high-probability downside liquidity target

3. Price Action Insight

Price is currently accumulating below resistance, showing signs of distribution rather than strength. Repeated failures to hold above the EMA signal that buyers are getting absorbed, while smart money prepares for continuation lower.

This type of tight consolidation below resistance often precedes a bearish expansion.

4. Trading Scenarios

🔴 Primary Scenario – Bearish Continuation (High Probability)

- Rejection from 1.1685–1.1700

- Breakdown below accumulation range

- Targeting the demand zone at 1.1618

🟢 Invalidation Scenario

- Only a strong H1 close above 1.1700

- Followed by acceptance above EMA

- Would shift bias to short-term bullish correction

🔹 Summary

As long as EURUSD trades below the EMA and below 1.1700, the bearish bias remains dominant. The current structure favors patience for short setups, not chasing longs.

📌 Market favors sellers — wait for rejection, then continuation.

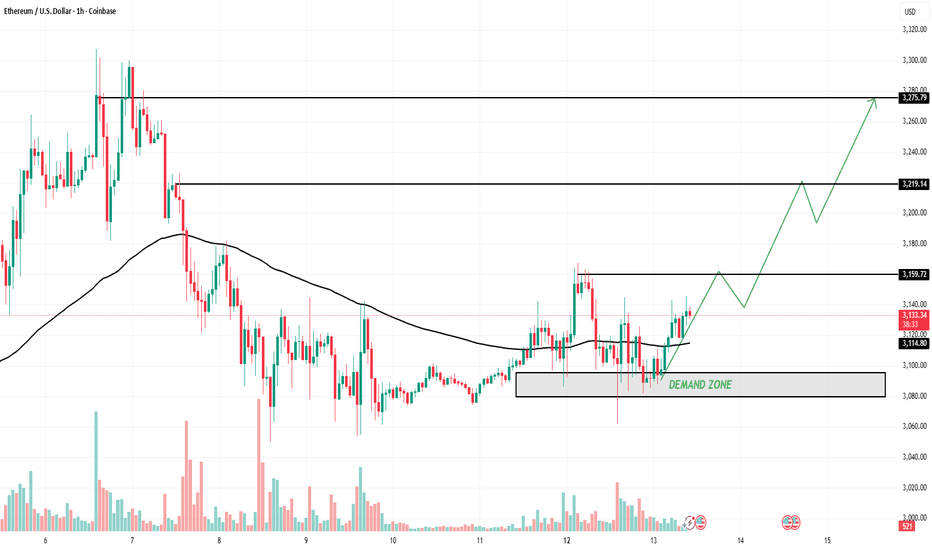

ETH Is Holding the Line — A Technical Reversal Toward Multi-Leve1. Current Market Structure

Ethereum is currently transitioning from a short-term bearish correction into a potential recovery phase on the H1 timeframe. After a prolonged decline, price has stabilized and formed a base above a well-defined support zone, suggesting selling pressure is weakening. Although price is still trading below the EMA 89, momentum has started to shift as buyers defend key levels.

2. Key Support & Resistance Levels

Primary Support Zone: 3,085 – 3,100

→ Strong demand reaction, multiple rejections

EMA 89 Resistance: ~3,115

→ Needs to be reclaimed for bullish continuation

Upside Targets:

🎯 Target 1: 3,178

🎯 Target 2: 3,221

🎯 Target 3: 3,254

🎯 Target 4: 3,297

These targets align with previous supply levels and structural highs, making them logical take-profit zones.

3. Price Action Insight

The market has shown a clear rejection from the lower support zone, followed by higher lows, which is often an early signal of accumulation. The projected green path highlights a step-by-step bullish progression, not a straight breakout meaning pullbacks are expected and healthy if support continues to hold.

4. Trading Scenarios

🟢 Primary Scenario – Bullish Recovery (Preferred)

Price holds above 3,085–3,100

Break and acceptance above EMA 89

Gradual push toward Target 1 → Target 4

🔴 Invalidation Scenario

A strong H1 close below 3,085

Would invalidate the bullish setup

Opens risk of continuation toward lower liquidity zones

🔹 Summary

Ethereum is currently at a technical inflection point. As long as price respects the highlighted support zone, the structure favors a controlled upside recovery toward higher resistance targets.

📌 Bias: Cautiously bullish confirmation comes with EMA reclaim.

Gold Confirms Cup and Handle Breakout — Price Enters ATHGold on the H4 timeframe is now confirming a classic Cup and Handle continuation pattern within a well-established bullish market structure. After a strong impulsive advance, price transitioned into a deep but orderly correction, forming a rounded base that clearly reflects accumulation rather than distribution. This rounded recovery phase represents the cup, where sell-side pressure was gradually absorbed and demand rebuilt above the higher-timeframe support zone.

As price returned to the prior highs, bullish momentum paused instead of breaking out immediately. This led to the formation of a handle, visible as a relatively shallow consolidation and minor descending structure near the top of the range. From a theoretical perspective, this handle served as the final liquidity shakeout, removing weak longs and allowing stronger hands to position before expansion. The fact that this pullback held well above the cup’s midpoint reinforces the strength of the underlying trend.

The recent impulsive move above the handle resistance confirms the completion of the Cup and Handle pattern, signaling a transition from consolidation into a fresh markup phase. The breakout occurred with strong momentum and clear acceptance above former resistance, indicating that supply has been fully absorbed and buyers are now in control of price discovery.

Based on classical Cup and Handle projection theory, the measured move from the depth of the cup projects a price objective near the 4,660–4,670 region, which aligns closely with the marked price objective and the potential formation of a new all-time high. This confluence between pattern theory and higher-timeframe liquidity adds credibility to the bullish continuation scenario.

As long as price holds above the breakout zone and does not fall back into the handle structure, the bullish bias remains intact. Any short-term consolidation above former resistance should be viewed as acceptance rather than weakness. Overall, Gold is no longer in a corrective phase, but firmly in expansion mode, with the Cup and Handle structure acting as a clear roadmap for continuation toward higher price discovery levels.

EURUSD at a Structural Turning Point — Reversal Confirmation On the H1 timeframe, EURUSD is showing early signs of a potential trend transition, but the market is still positioned at a highly sensitive decision zone where confirmation is critical. The broader context remains bearish, as price has respected a well-defined descending structure and stayed below the dynamic resistance represented by the moving average. The recent sharp bullish candle from the 1.1618 support zone indicates a liquidity sweep and aggressive short covering, suggesting that sellers may be temporarily exhausted. This impulsive move breaks the immediate bearish momentum and introduces the possibility of a short-term bullish cycle starting to form. However, from a structural perspective, this alone is not enough to confirm a full reversal. Price is currently reacting around the 1.1670–1.1695 resistance zone, which aligns with prior breakdown structure and acts as a key supply area. This level will determine whether the move is a genuine change of character or simply a corrective retracement within the larger downtrend. If EURUSD can achieve clean acceptance above the 1.1695 level, followed by a higher low, the market would officially transition into an early bullish cycle. In that scenario, upside expansion toward the 1.1720 and 1.1750 liquidity targets becomes highly probable as buyers take control. Conversely, failure to hold above current levels would strongly suggest a bearish continuation scenario. A rejection from resistance would likely send price back toward the 1.1618 support, where liquidity rests. A breakdown below that level would invalidate the reversal attempt and confirm continuation of the bearish cycle.

In summary, EURUSD is currently sitting at a cycle inflection point. Bulls have made their first statement, but the market still requires structural confirmation. Until price proves acceptance above resistance, this move should be treated as a corrective phase rather than a confirmed trend reversal.

Market Analysis & Today's TrendCurrent Market Analysis & Today's Trend

- Currently, the gold market is entering a distribution phase after a strong upward move (Markup) originating from the previous accumulation zone. Prices are fluctuating within a narrow upper range, indicating weakening buying pressure and the emergence of profit-taking pressure.

TODAY'S LIMITED STRATEGY JAN 13

Intraday trading: Adjust

📌 SET UP 1. Timming Sell Zone

XAUUSD SELL ZONE: 4629 - 4632

💰 Take Profit(TP): 4626 - 4621

❎ Stoploss(SL): 4636

Note capital management to ensure account safety

📌 SET UP 2. Timming Buy Zone

XAUUSD BUY ZONE: 4559 - 4562

💰 Take Profit(TP): 4565 - 4570

❎ Stoploss(SL): 4555

Note capital management to ensure account safety

🔎 Market Structure:

- The upper zone is forming a sideways distribution pattern; prices are no longer creating clear new highs.

- Upward momentum is gradually decreasing, with weaker upward rallies → a sign of dwindling buying power.

- Prices are far from the lower liquidity zone, raising the risk of a correction to balance supply and demand.

📉 Preferred Scenario for Today:

- If the market fails to break through the upper distribution zone, it is likely to reverse and correct (Mark Down) to:

- Nearest support zone / liquidity zone

- Major MA area – where money flow previously accumulated

- Only with a clear break and a strong closing candle above the distribution zone will the uptrend continue.

🎯 Trading Strategy:

- Avoid FOMO buying at high levels.

- Prioritize observing price reactions at the distribution zone:

- Weakness signal → look for short-term sell opportunities during corrections.

- Strong break, volume & confirmation candle → follow the trend, manage risk carefully.

👉 The current market offers many opportunities, but it is only suitable for those who are patient and disciplined. At this stage, reading the structure is more important than finding entry points.

Ethereum Is Defending Demand — A Base Is Forming for the Next UpEthereum on the H1 timeframe is showing clear signs of stabilization and early bullish rebuilding after a prolonged corrective phase. Following the sharp sell-off from the highs, price has transitioned into a sideways-to-recovery structure, with downside momentum slowing significantly as ETH continues to respect a well-defined demand zone around 3,080–3,100. Each dip into this zone has been met with strong buying interest, confirming that sellers are losing control and that sell-side liquidity has largely been absorbed. Price is now reclaiming short-term structure above this demand area and attempting to build higher lows, signaling a shift from pure bearish continuation into a corrective bullish phase. As long as Ethereum holds above the demand zone, the market bias favors further upside toward the first resistance around 3,160, followed by 3,220, and potentially a deeper extension toward the upper liquidity zone near 3,270–3,280 if momentum accelerates. Any short-term pullback into the demand zone should be viewed as constructive price action, not weakness. Only a decisive breakdown and acceptance below the demand zone would invalidate this recovery structure and reopen the downside scenario.

EURUSD at a Cycle Decision Point — Accumulation Break or BounceOn the H1 timeframe, EURUSD is currently sitting at a critical transition point within the market cycle, where price must choose between continuing a new bullish phase or reverting back into bearish continuation.

From a cycle theory perspective, the market previously completed a markdown phase, visible through the sustained series of lower highs and lower lows. Selling pressure dominated, and price consistently accepted lower value until it reached the 1.1620–1.1650 area, where downside momentum began to noticeably weaken.

This zone marks the end of the markdown phase and the beginning of accumulation behavior. Price stopped trending impulsively and instead formed a compressed structure with smaller candles and reduced volatility, indicating that sellers were losing control and liquidity was being absorbed by stronger hands.

The recent sharp bullish impulse from the lows represents a preliminary sign of markup initiation. This move is important from a cycle standpoint, as it often acts as a “change of character,” signaling that the market may be transitioning from accumulation into early expansion. However, cycle theory also reminds us that not every impulse automatically confirms a full trend reversal.

At this stage, EURUSD is reacting around a mid-range decision zone, where two scenarios are valid: If price can hold above the impulse origin and continue forming higher lows, the cycle will shift into a confirmed markup phase, targeting the upper liquidity levels near 1.1710 and potentially extending toward the 1.1740–1.1750 region. This would confirm that accumulation is complete and demand has taken control. On the other hand, failure to maintain acceptance above the current structure would indicate that this move was merely a corrective rally within a larger bearish cycle. In that case, price is likely to rotate back down toward the lower liquidity pool around 1.1620, completing a secondary test of demand before any sustainable bullish cycle can begin.

In summary, EURUSD is no longer purely bearish, but it is not yet fully bullish either. According to cycle theory, the market is transitioning from accumulation toward markup, but confirmation depends on structure holding. Until a clear continuation is established, this remains a high-impact decision zone where patience and confirmation are critical.

Bitcoin at Range EquilibriumBitcoin at Range Equilibrium: Re-Accumulation for a Push Higher or Another Liquidity Sweep Below?

Hello traders! Here’s a clear technical breakdown of BTCUSD (1H) based on the current chart structure. Bitcoin is currently trading within a broad consolidation range following a strong bullish impulse earlier in the session. After reaching the upper boundary of the range, price faced heavy selling pressure and rotated lower, signaling profit-taking and short-term distribution, not a full trend reversal. Since that rejection, BTC has entered a low-volatility, sideways structure, with overlapping candles and reduced momentum. This price behavior typically reflects balance and absorption, where the market is building liquidity before the next directional expansion. Importantly, there has been no impulsive bearish follow-through, suggesting sellers are active but not yet in full control.

UPPLY & DEMAND – KEY ZONES

Upper Supply / Range High:

The 93,800–94,000 zone remains a major supply area, where previous bullish attempts were aggressively rejected. This is the key level that must be reclaimed for upside continuation.

Mid-Range Resistance (Flip Zone):

The 92,000–92,200 level acts as an important structure flip. Failed acceptance above this zone confirms ongoing range conditions.

Major Demand / Range Low:

The 89,500–89,800 area is a well-defined demand zone and liquidity base. This zone has repeatedly absorbed selling pressure and represents the downside boundary of the current range.

A break on either side of these zones will define the next trend leg.

🎯 CURRENT MARKET POSITION

Currently, BTC is trading near the middle-to-lower portion of the range, where directional conviction is typically weakest. This is a decision area, not an optimal breakout zone, as price can rotate aggressively in either direction. The market is compressing, indicating energy buildup rather than trend confirmation.

My scenario:

As long as Bitcoin holds above the 89,500–89,800 demand zone, the broader structure remains neutral-to-bullish. A successful defense of this demand could lead to a rotation back toward 92,000, and acceptance above that level would open the path for a test of the 93,800–94,000 supply zone. However, if price fails to hold the range low and accepts below demand, this would confirm a liquidity sweep and bearish continuation, exposing lower prices before any meaningful recovery attempt. For now, Bitcoin is ranging and waiting for confirmation, not trending.

⚠️ RISK NOTE

Range conditions often produce false signals. Let price confirm acceptance or rejection at key zones, avoid overtrading the middle of the range, and always manage your risk.

Bullish Continuation Still on the Table After the PullbackBitcoin on the H1 timeframe is currently trading within a broader bullish context, despite the recent sharp pullback from the local highs. The overall structure suggests that price is undergoing a corrective phase rather than signaling a full trend reversal. After a strong impulsive rally toward the upper resistance band, BTC faced profit-taking and short-term selling pressure, which pushed price back toward a clearly defined support zone.

This support area, located around the 90,000–90,200 region, represents a key liquidity pocket where buyers previously stepped in. The reaction from this zone is critical, as it acts as the decision point between continuation and deeper correction. So far, price has respected this support, indicating that sell-side momentum is weakening and that the market may be absorbing supply rather than accelerating lower.

The rejection from higher resistance levels aligns with a healthy market rotation, allowing Bitcoin to reset momentum before the next directional move. As long as price continues to hold above the support zone and does not establish acceptance below it, the bullish continuation scenario remains valid. In this case, the market is likely to rotate higher again, with successive upside targets lining up around 91,500, 92,200, and ultimately the upper resistance near 93,700.

From a structure and liquidity perspective, the recent dip can be interpreted as a pullback to demand, offering stronger hands an opportunity to accumulate before the next expansion phase. A clean bullish reaction from support would confirm this outlook and open the path toward the marked upside targets.

However, a decisive breakdown and sustained trading below the support zone would invalidate the bullish continuation scenario and expose Bitcoin to a deeper retracement. Until that occurs, the technical bias remains cautiously bullish, with the market favoring higher prices after this corrective reset.

ETH Is Reclaiming Structure – A Clean Path Toward 3,250 COINBASE:ETHUSD on the H1 timeframe is showing a clear shift in behavior, suggesting that the market has completed its corrective phase and is preparing for a continuation move to the upside. After the strong sell-off from the previous high, ETH spent several sessions stabilizing and building a base, and price is now starting to reclaim key technical levels rather than being rejected from them.

The most important observation here is how price is reacting around the 3,110–3,120 demand zone. This area has acted as a reliable support, absorbing selling pressure multiple times without allowing a structural breakdown. Instead of making new lows, ETH has formed higher lows and gradually compressed, which is a classic sign of accumulation rather than distribution.

From a trend perspective, price is now trading back above the short-term moving average and is actively pressing into the longer-term EMA. This interaction often acts as a decision point, and the current price action favors a bullish resolution. The inability of sellers to push price back below the demand zone signals weakening bearish momentum and increasing buyer control.

If ETH holds above this reclaimed support, the first logical upside objective sits around 3,167, where prior resistance and liquidity rest. A clean break and acceptance above this level would confirm a short-term bullish structure, opening the door for continuation toward the 3,225 area. Beyond that, the final upside target near 3,260 aligns with previous highs and unmitigated supply, making it a natural destination for an impulsive expansion.

The projected path highlights a shallow pullback into support before acceleration higher, which fits well with a typical market cycle: correction → base → expansion. As long as price continues to defend the current demand zone and avoids closing back below it, pullbacks should be viewed as opportunities within a bullish context, not signs of weakness.

In summary, Ethereum is no longer in a reactive phase it is transitioning into continuation. Structure is stabilizing, momentum is rebuilding, and the upside levels are clearly defined. If buyers remain in control above support, the move toward 3,250 is not a matter of if, but when.

EURUSD Hits Resistance After Sharp Rebound EURUSD Hits Resistance After Sharp Rebound — Correction or Just a Liquidity Grab?

EURUSD on the H1 timeframe remains within a broader bearish structure, with price continuing to trade below the declining moving averages that have consistently acted as dynamic resistance. The overall market context reflects sustained selling pressure, as the sequence of lower highs and lower lows remains intact despite short-term volatility.

The recent sharp bullish impulse from the lower liquidity range appears to be a liquidity-driven rebound rather than a confirmed structural reversal. Price aggressively swept sell-side liquidity near the 1.1620 area before rebounding, a move often associated with stop-hunting and short covering. However, this recovery has now carried price directly back into a clearly defined resistance zone, where prior selling activity and the descending EMA converge.

At this resistance area, bullish momentum has begun to stall, suggesting that buyers are encountering active supply. Without sustained acceptance above this zone, the current move is best interpreted as a corrective pullback within a bearish trend. In this context, a rejection from resistance could lead to renewed downside pressure, with price rotating back toward the lower liquidity range to retest the recent lows.

If sellers regain control, a continuation toward the 1.1620 support area remains the higher-probability scenario, aligning with the prevailing trend and the broader liquidity framework. Such a move would confirm that the rebound was corrective rather than the start of a trend shift.

Alternatively, only a clean break and sustained acceptance above the resistance zone and the declining moving averages would invalidate the bearish continuation outlook. Until that occurs, EURUSD remains technically bearish, with the market likely using rallies into resistance as opportunities for distribution rather than accumulation.

Gold Builds Liquidity Before the Next Break Current Market Structure

On the 30-minute timeframe, Gold remains in a clear bullish structure following a strong impulsive breakout from the lower base. The market is now transitioning into a controlled consolidation phase, forming a well-defined liquidity range rather than showing signs of distribution. Price is holding above both the fast EMA (blue) and the slow EMA (red), with the EMAs still positively sloped. This confirms that the higher-timeframe bullish momentum remains intact, and the current pause is corrective in nature.

Liquidity & Range Behavior

The highlighted zone represents a liquidity accumulation range between roughly 4,579 – 4,601. Within this range:

- Sell-side liquidity has already been partially swept

- Buyers continue to defend higher lows

- Pullbacks are becoming increasingly shallow

This behavior is typical of re-accumulation after expansion, where smart money absorbs remaining supply before initiating the next impulsive leg higher.

Price Action & Cycle Logic

From a cycle perspective:

- Impulse → consolidation → continuation is clearly visible

- The rounded pullback structure suggests time correction over price correction

- No structural lower low has been formed, preserving bullish market control

The curved projection illustrates a potential liquidity dip toward the lower range, followed by strong bullish continuation a classic liquidity grab → expansion sequence.

Bullish Scenario (Primary Bias)

If price holds above the liquidity range low and reclaims the 4,601 resistance, the bullish continuation scenario opens:

- First upside objective: 4,629

- Extension target: 4,669 and above, aligning with higher-timeframe expansion levels

A confirmed breakout and acceptance above range highs would likely trigger momentum buying and stop-loss runs, accelerating the move.

Invalidation / Alternative Scenario

A clean breakdown and sustained acceptance below 4,562 would be the first warning sign of deeper correction. However, as long as price remains above the rising EMAs, any downside move is considered corrective, not trend-reversing.

Gold is currently coiling inside a liquidity range on M30, above key dynamic support and within a broader bullish cycle. The structure favors continuation to the upside, with the market likely preparing for another expansion phase once liquidity is fully absorbed.

Patience during consolidation is key expansion typically follows compression.

Gold at a Critical Decision Point — Break Down First or Fake Gold is no longer trending impulsively price has entered a clear distribution phase after a strong bullish expansion. The current structure suggests the market is deciding between a final liquidity grab or a breakdown continuation.

1. Market Structure Overview

The prior move was a strong bullish impulse, leaving behind a visible gap / imbalance below.

After the impulse, price stalled and formed a range between resistance and support.

Current structure is range-bound at the top, which statistically favors distribution rather than continuation.

2. Key Technical Zones

Resistance Zone (Supply)

The marked resistance zone around 4,620–4,630 is rejecting price multiple times.

Upper wicks + inability to hold highs = selling pressure absorbing buyers.

This is a classic sell-side liquidity trap area.

Support Zone (Decision Level)

The support zone near 4,560–4,570 is the key level holding price for now.

This level is acting as a range low, not a strong demand yet.

A clean break below this zone will confirm bearish continuation.

Gap / Imbalance Below

The GAP area around 4,520–4,510 remains unmitigated.

Markets are highly attracted to inefficiencies this level is a high-probability magnet if support fails.

3. Scenarios in Play

🔴 Primary Scenario — Bearish Breakdown (High Probability)

A weak bounce from support followed by a break and close below 4,560 would confirm:

Range breakdown

Transition from consolidation → markdown

Target path:

First objective: 4,520

Extension toward 4,510 (gap fill)

This scenario aligns with Wyckoff distribution behavior after an impulsive rally.

🟡 Alternative Scenario — Liquidity Sweep Fir st

Price may briefly push back toward 4,600–4,610:

To trap late buyers

To rebalance short-term liquidity

If price fails again under resistance, it strengthens the bearish case even further.

⚠️ Only a clean break and acceptance above 4,630 would invalidate the bearish setup.

4. Trading Insight

❌ Chasing longs inside resistance is low R:R

✅ Best shorts appear:

- On rejection from resistance

- Or on a confirmed support breakdown

- Patience is key let the market show its hand.

Conclusion

Gold is no longer trending it is distributing at the highs. As long as price remains capped under resistance, the odds favor a breakdown toward the gap and lower liquidity zones before any meaningful bullish continuation.

💬 Do you expect Gold to sweep liquidity one more time, or break support directly?

Bitcoin Defends Key Demand — Is a Trend Reversal Taking Shape?Bitcoin (BTCUSD) on the H1 timeframe is showing early signs of stabilization after a corrective decline from the recent highs. The prior bearish leg lost momentum as price tapped into a well-defined support zone around 89,400–89,700, where buyers stepped in aggressively and absorbed sell-side pressure.

Structurally, price has stopped making lower lows and is now attempting to build a base. The sharp reaction from the support zone suggests this move is more likely a corrective pullback within a broader bullish context, rather than the start of a new bearish trend.

At the moment, BTC is trading just below the EMA 50, which continues to act as dynamic resistance around 91,100–91,300. This area is a critical short-term decision point: acceptance above it would signal a momentum shift back to the upside, while rejection keeps price ranging.

Above current price, the 93,800–94,000 level stands out as the next major liquidity target and resistance. A reclaim of this level would confirm bullish continuation and restore confidence in trend resumption..

Bullish scenario: Holding above the 89,400–89,700 support zone, followed by a clean break and acceptance above the EMA 50, opens upside toward 92,000, then 93,800–94,000.

Bearish scenario: Failure to hold the support zone and a confirmed breakdown below 89,400 would invalidate the recovery idea and expose deeper downside toward 88,000–87,500.

For now, Bitcoin is sitting at a high-impact demand area. Patience is key — the next high-probability move will come from confirmation above resistance or a clean loss of support, not from trading the middle of the structure.

EMA Reaction Sparks a Bounce — Correction or the Start of TrendEURUSD is still operating inside a broader bearish structure, with the dominant trend defined by a clear sequence of lower highs and lower lows. However, the most recent price action shows a counter-trend corrective bounce emerging from oversold conditions rather than a confirmed trend reversal. The strong bullish candle from the recent low signals short-term short covering and reaction buying, but this move should be treated as corrective within a downtrend until proven otherwise.

EMA Reaction & Technical Confluence

Price has just reacted precisely from the EMA zone, which has acted as dynamic resistance throughout the downtrend. The current push above the EMA reflects momentum relief rather than structural change.

Importantly:

- The EMA is still sloping downward

- Price remains below major prior supply

- No higher high has been formed yet

This setup often leads to a pullback–continuation sequence, where price retests higher resistance levels before sellers reassert control unless strong acceptance occurs above key levels.

Key Levels

Resistance:

1.1698 – 1.1713 (prior supply / corrective target)

1.1750 – 1.1760 (major structure resistance / trend invalidation)

Support:

1.1650 – 1.1660 (EMA reaction zone)

1.1620 (recent swing low / bearish continuation trigger)

EMA / Dynamic Level:

EMA acting as short-term balance, still bearish in slope

Scenarios

➡️ Primary Scenario (Corrective Bounce):

Price continues the corrective move toward the 1.1698–1.1713 resistance zone. This area is expected to attract selling interest, where the market may form a lower high before resuming the broader downtrend.

⚠️ Risk Scenario (Trend Shift Attempt):

A strong breakout and acceptance above 1.1750 would weaken the bearish structure and signal a potential transition into a broader range or trend shift. Until that level is reclaimed, bullish moves remain corrective.

ETHUSD At a Critical Support Test — Accumulation or Breakdown?On the H1 timeframe, ETHUSD is currently trading at a key decision zone, where market structure, EMA positioning, and liquidity dynamics are all converging. From a broader perspective, the market previously completed a clear bearish cycle, with price trending below the EMA and producing lower highs and lower lows. This confirms that the dominant structure before the current phase was bearish, not impulsively bullish.

As price reached the lower area around 3,080–3,100, selling pressure began to weaken. The market transitioned into a sideways accumulation phase, marked by compressed candles and reduced downside follow-through. This zone now acts as a critical support and liquidity base, where buyers and sellers are actively battling for control.

Currently, price is trading below the EMA, which is an important technical detail. As long as ETH remains below this dynamic resistance, upside moves should be treated as corrective pullbacks, not confirmed trend reversals. The recent push up and rejection back into the support zone reinforces the idea that the EMA is still capping price.

Two primary scenarios are now in play:

In the bullish cycle continuation scenario, if price holds above the highlighted support zone and forms a higher low, this would signal successful absorption of sell-side liquidity. A reclaim and acceptance above the EMA would then shift the structure into early markup. In this case, the first upside target sits near 3,163, followed by a higher liquidity objective around 3,218, where previous supply and imbalance remain untested.

In the bearish continuation scenario, a clean break and close below the support zone would confirm that accumulation has failed. This would open the door for a renewed markdown phase, with price likely targeting the lower liquidity pool around 3,036–3,026, where unfilled demand and stops are resting.

In summary, ETHUSD is sitting at a cycle inflection point. The support zone is the line between accumulation and further distribution. Traders should remain patient and wait for confirmation — either a strong reclaim above the EMA for bullish continuation, or a decisive breakdown below support to confirm bearish expansion.

Bitcoin Rejected at EMA — Bearish Continuation Still in PlayPrice has failed to reclaim the EMA around 90,900, confirming the EMA as dynamic resistance within a broader downtrend. The sharp rejection from this level signals that buyers lack follow-through and sellers remain in control. As long as BTC stays below 90,900–91,000, downside pressure is favored, with a move toward 90,200 as the first reaction level. A clean breakdown below 90,200 would likely accelerate selling into the 88,500–88,400 target zone. Only a strong close back above the EMA would invalidate this bearish continuation setup.

ETHUSD Completing a Cycle Reset — Is the Next Expansion Loading?On the H1 timeframe, ETHUSD appears to be progressing through a classic market cycle reset, where the market transitions from a completed markdown phase into early accumulation and potential markup preparation.

Structurally, the left side of the chart clearly shows a strong markdown phase, characterized by impulsive bearish legs and weak corrective rallies. Selling pressure dominated until price reached the lower support area around the 3,085–3,100 region. This zone acted as a cycle low, where downside momentum stalled and volatility compressed, signaling seller exhaustion.

Following this, price entered an accumulation phase, visible through sideways price action, overlapping candles, and multiple failed attempts to push lower. This behavior aligns with cycle theory, where smart money absorbs liquidity before initiating a new directional move. The recent dip back toward this support area appears corrective rather than impulsive, suggesting it may function as a final test within the accumulation range.

The projected curved path on the chart reflects a cycle-based expansion scenario. If ETH holds above the 3,085 support and forms a higher low, the market would transition into an early markup phase. In this bullish cycle scenario, the first upside objective sits near the 3,164 liquidity level, where prior supply and internal structure reside.

Acceptance above 3,164 would confirm strength and open the path toward the upper cycle target near 3,216, which aligns with previous distribution and unfilled liquidity from the prior bearish leg. This level represents a natural magnet during early markup as price seeks equilibrium at higher value.

However, from a cycle perspective, failure to hold the 3,085 support would invalidate the accumulation thesis and suggest the market is still stuck in a prolonged markdown or re-accumulation phase. In that case, price may rotate lower again before any sustainable bullish cycle can begin.

In summary, ETHUSD is currently positioned at a cycle inflection zone. The broader bearish phase appears complete, accumulation is underway, and the market is now waiting for confirmation to transition into markup. The next higher low will be the key signal that determines whether this projected expansion becomes reality or remains a delayed cycle rotation.

Ethereum Enters a New Market Cycle — Accumulation CompleteOn the H1 timeframe, Ethereum is showing a classic market cycle transition, aligning well with Wyckoff / cycle theory rather than random price movement. The recent structure strongly suggests that ETH has already completed a full corrective cycle and is now rotating into a new bullish expansion phase.

From a cycle perspective, the market first experienced a distribution phase near the previous highs around the 3,280 region, where strong selling pressure entered and ended the prior uptrend. This was followed by a markdown phase, clearly visible in the sustained bearish leg where price traded below the fast and slow moving averages, confirming bearish control and momentum continuation to the downside.

As price approached the 3,050–3,080 area, selling pressure began to weaken. This zone marked the accumulation phase of the cycle. Price action shifted from impulsive bearish candles into a rounded, basing structure, forming a smooth curvature that reflects smart money absorption rather than panic selling. This rounded bottom is a textbook sign that supply is being absorbed and that the market is preparing for a trend transition.

The current price action shows Ethereum moving into the early markup phase. This is confirmed by higher lows, improving structure, and price reclaiming and holding above the faster moving average while compressing toward the slower one. The slope of price is now turning upward, indicating momentum rotation from bearish to bullish control.

From a cycle continuation standpoint, as long as ETH holds above the basing area and maintains acceptance above the moving averages, the bullish cycle remains intact. The projected path aligns with a healthy expansion structure: impulsive pushes higher followed by shallow pullbacks, targeting the previous liquidity high near 3,280 as the next major cycle objective.

In summary, Ethereum is no longer in a corrective or bearish phase. The cycle has reset, accumulation appears complete, and the market is transitioning into markup. Unless price aggressively re-enters the accumulation range, the dominant expectation remains higher highs as the bullish cycle unfolds.