Gold Is Expanding After Accumulation — Bulls Eye the Next Major Price has successfully broken out of the accumulation price zone around 4,450, confirming a strong bullish continuation after a prolonged consolidation and liquidity absorption phase. The EMA alignment and impulsive candles signal smart money participation and trend expansion.

The recent pullback and consolidation near 4,580–4,600 (POC area) appear corrective, forming a healthy pause (wave 4) rather than distribution. As long as price holds above this zone, bullish control remains intact.

A clean continuation above 4,600 opens the path toward the next upside target near 4,650–4,670, completing the next expansion leg. Only a sustained breakdown back below 4,550 would weaken the bullish structure, but for now, the trend clearly favors further upside continuation.

Technical

Bitcoin at a Long-Term Inflection Point — Hold the Base or RESETBTCUSD 1W – Long Term Market Analysis

1. Current Market Structure (Macro View)

On the weekly timeframe, Bitcoin remains in a macro bullish structure, but is currently in a late-stage consolidation / distribution phase below major resistance.

After the strong impulsive rally from the 2022–2023 accumulation base, price expanded aggressively and is now digesting gains rather than reversing.

However, momentum has clearly slowed, and recent weekly candles show overlapping ranges, signaling indecision and profit-taking.

Importantly:

- The primary uptrend is still valid

- But BTC is no longer in impulsive expansion it is in a decision zone

This is where long-term trends either:

- Continue after re-accumulation, or

- Correct deeply to reset structure

2. Key Long-Term Zones & Market Positioning

Major Resistance Zone: 120,000 – 126,000

→ Previous weekly highs, strong sell pressure

→ This zone must be broken and accepted to unlock the next macro leg up

Current Distribution / Range Zone: 85,000 – 100,000

→ Price is compressing here, showing balance between buyers and sellers

Critical Macro Support: 67,000 – 69,000

→ Previous breakout level

→ Confluence with EMA 200 on weekly

→ This level defines bull vs bear control

Bearish Breakdown Support (Last Line): 49,000 – 50,000

→ Loss of this zone would signal a full macro trend reset

As long as BTC holds above 67K, the macro bullish thesis remains intact.

3. Liquidity, Volume & Smart Money Behavior

Volume has declined significantly compared to the impulsive rally phase

This confirms the market is not in expansion, but in absorption

Multiple failed pushes near resistance indicate:

- Profit distribution

- Liquidity building above highs

The key insight:

Smart money is not aggressively selling but they are not buying breakouts either

This behavior aligns with re-accumulation below resistance, not a top yet.

However, failure to hold support would trigger sell-side liquidity acceleration.

4. Long-Term Market Scenarios

🔼 Primary Scenario – Bullish Continuation (High Probability if Support Holds)

Expected macro flow:

- BTC holds above 67K

- Extended consolidation (weeks to months)

- Momentum rebuilds

- Clean weekly break and acceptance above 126K

- Next macro expansion phase begins

➡️ This scenario supports new all-time highs later in the cycle.

🔽 Secondary Scenario – Deep Correction (Still Within Bull Market)

If BTC: Loses 67K decisively on a weekly close

Then expect:

- Sharp correction toward 50K

- Long-term EMA retest

- Full reset of leverage and sentiment

This would not immediately invalidate the bull market, but it would delay the next expansion significantly.

5. Long-Term Trading & Investment Perspective

- Macro Bias: Bullish above 67K

- Investor Strategy: Accumulate fear, not euphoria

- Trader Strategy: Avoid chasing highs near resistance

- Risk Zone: Between 100K–126K without confirmation

Bitcoin is currently at a structural crossroads, not a breakout zone.

Patience is the edge here.

WHAT DO YOU THINK ABOUT BITCOIN IN 2026?

Gold Rebuilds Strength on H4 — New All-Time Highs Back in SightOANDA:XAUUSD on the 4-hour timeframe remains firmly embedded in a strong bullish macro structure. Despite the sharp corrective drop seen previously, price has successfully absorbed selling pressure and rebuilt a sequence of higher lows, confirming that the pullback was corrective rather than a trend reversal.

The recent recovery leg has reclaimed multiple key structure levels, with price now consolidating above the 4,470–4,490 region, a former resistance that is transitioning into support. This behavior signals bullish acceptance, not distribution. Buyers continue to step in on dips, keeping momentum constructive.

Structurally, the market is now compressing below the 4,520–4,545 resistance band, which represents the final barrier before price explores new highs. The consolidation here is healthy and typical before continuation, especially after a strong expansion leg.

Importantly, no major bearish displacement is present. Candles → pullbacks remain shallow, volume stays supportive, and downside attempts are quickly absorbed — all signs of a market preparing for another upside leg.

Bullish scenario (preferred): As long as price holds above 4,450–4,420, continuation toward 4,520, then 4,545–4,560, is favored. A clean breakout above this zone opens the path toward new all-time highs.

Bearish scenario: Only a sustained breakdown below 4,418 with acceptance would signal a deeper correction, potentially targeting 4,380–4,350. Until then, bearish moves remain corrective.

Overall, Gold is coiling beneath resistance in a bullish environment. This is not a topping structure it’s a pause before expansion. Patience favors trend continuation, with confirmation at breakout levels rather than anticipation.

Reversal or Breakdown Will Define the Next Major MoveBitcoin is currently trading at a critical decision zone, where price action will determine whether the market stages a bullish reversal from demand or transitions into a deeper bearish continuation.

1. Market Structure Overview

- BTC has been in a short-term corrective / bearish structure, trading below the EMA 50, which continues to act as dynamic resistance.

- After the recent impulsive drop, price is now pressing directly into a well-defined demand zone around 89,600 – 90,000.

This area has previously triggered strong reactions, making it a high-probability response zone, not a place to chase entries.

2. Demand Zone Significance

The highlighted demand zone represents:

- Prior accumulation

- Strong historical buying interest

- Liquidity resting below recent lows

Current price action shows selling pressure slowing down as BTC enters this zone, which increases the probability of at least a technical bounce.

3. Two Key Scenarios to Watch

Bullish Scenario (Reversal from Demand)

If price holds above the demand zone and prints bullish confirmation (strong rejection wicks, bullish engulfing, or structure shift):

BTC could rotate back toward:

- 92,464

- 92,976

- 93,745

- Extension toward 94,416 if momentum builds

This would align with a range-to-expansion move, trapping late sellers below demand.

Bearish Scenario (Breakdown & Continuation)

A clean breakdown and acceptance below 89,233 would invalidate the reversal idea.

This would open downside liquidity targets toward:

- 88,415

- 87,269

The red arrow on the chart highlights this bearish expansion risk if demand fails.

4. EMA & Momentum Insight

EMA 50 remains overhead any upside move will need to reclaim and hold above it to shift short-term bias bullish.

Without that reclaim, rallies should still be viewed as corrective.

5. Trading Plan

❌ Avoid trading in the middle of the zone.

✅ Wait for:

Bullish confirmation at demand for longs

Or confirmed breakdown below demand for continuation shorts

Let price show its hand this is a reaction zone, not a prediction zone.

Conclusion

Bitcoin is at a make-or-break level. Demand zones like this often produce sharp reactions, but only confirmation separates reversals from traps. The next impulsive move — up or down — will likely be fast and decisive.

💬 Do you expect BTC to defend this demand zone, or is a deeper sell-off coming? Share your bias below!

Ethereum Is Building a Base — Accumulation Before...FLYEthereum is currently transitioning from a strong bearish impulse into a clear accumulation phase, as shown on the 1-hour timeframe. After an aggressive sell-off from the highs, price has slowed down significantly and begun to compress within a defined range, suggesting that distribution has paused and the market is absorbing sell pressure.

1. Market Structure & Context

- ETH previously respected a bearish structure, trading below the EMA and printing lower highs.

- However, the recent price action shows loss of bearish momentum: candles are overlapping, ranges are tightening, and volatility is contracting.

This behavior is typical of accumulation, especially after a strong markdown.

2. Key Zones on the Chart

- Support Zone: ~3,060–3,080

This zone has been tested multiple times with strong rejection, indicating buyers are actively defending this level.

- Accumulation Range: ~3,080–3,180

Price is rotating inside this box, building liquidity on both sides.

- Upper Resistance / Range High: ~3,160–3,180

A break and acceptance above this level would confirm bullish intent.

3. EMA & Momentum Insight

- Price is currently interacting with the EMA 50, which is flattening — another sign of trend transition, not continuation.

- The failure to aggressively break below the EMA after multiple attempts suggests selling pressure is weakening.

4. Scenario Outlook

Bullish Scenario (Primary):

A successful hold above the support zone, followed by a breakout and acceptance above 3,180, could trigger an expansion toward: 3,240 - 3,280 (next major liquidity target)

Bearish Invalidation:

A strong breakdown and close below 3,060 would invalidate the accumulation idea and reopen downside risk.

5. Trading Plan

Avoid trading inside the middle of the range.

Focus on:

- Longs after confirmed breakout above range high

- Or reaction trades at support with clear bullish confirmation

- Patience is key accumulation phases reward discipline, not anticipation.

Conclusion

Ethereum is no longer trending it is preparing. The current structure favors a range-to-expansion model, where smart money builds positions quietly before the next directional move. Until price leaves the accumulation box, expect choppy conditions — but once it breaks, the move is likely to be decisive.

💬 Do you see ETH breaking up from this range, or is this just a pause before another leg down? Let’s hear your view.

EURUSD Is Reclaiming Structure — Support Flip1. Current Market Structure

- EURUSD has been trading in a short-term bearish structure, respecting a descending trend and staying below the EMA 50 for most of the session.

However, the most recent price action signals a potential structural shift.

- Price aggressively swept the lows, then reclaimed the key support zone with strong bullish displacement, breaking the sequence of lower lows. This move is not corrective in nature — it shows intent and strength from buyers.

- While the broader trend was bearish, the latest impulse suggests the market is transitioning into a corrective to bullish phase, rather than immediate continuation to the downside.

2. Key Zones & Market Positioning

Support Zone (Structure Flip Area):

1.1654 – 1.1659

→ Previous resistance turned support

→ Strong reaction and acceptance above this zone

Immediate Resistance Zone:

1.1700 – 1.1705

→ Key supply area

→ Likely pause or reaction zone on first test

Upside Target / Liquidity Pool:

1.1740 – 1.1744

→ Unfilled liquidity and prior high

→ Main upside objective if bullish momentum holds

As long as price holds above 1.1654, the bullish corrective structure remains valid.

3. Liquidity & Price Behavior

The sharp bullish candle from the lows indicates a sell-side liquidity sweep, followed by strong buy-side absorption.

Key observations:

Long lower wick at the lows → stop-hunt confirmation

Strong close above support → acceptance, not rejection

Rising volume on the bullish impulse → real participation

This behavior aligns with a liquidity grab followed by a reversal, not a weak bounce.

4. Today’s Market Scenarios

🔼 Primary Scenario – Bullish Continuation (Corrective Rally)

Expected flow:

- Price holds above 1.1654 – 1.1659

- Minor pullback into support

- Higher low formation

- Push toward 1.1700 – 1.1705

If broken and accepted → extension toward 1.1740+

This scenario favors buying pullbacks, not chasing the initial impulse.

🔽 Alternative Scenario – Range / Failed Follow-Through

If price:

- Fails to reclaim 1.1700

- Starts printing lower highs below resistance

Then expect:

- Sideways consolidation

- Range between 1.1655 – 1.1700

- Market waiting for new liquidity

❌ Invalidation Scenario

Only if price:

- Breaks and closes below 1.1654

This would invalidate the bullish reversal thesis and signal continuation of the broader bearish trend.

5. Trading Perspective

Bias: Short-term bullish (corrective)

Execution: Buy pullbacks above support

Risk: Chasing price into resistance

EURUSD is not trending aggressively yet but it is shifting control from sellers to buyers.

Gold Has Broken ATH — Momentum Is Strong, But Structure Demands 1. Current Market Structure

- Gold has officially broken above its previous all-time high (ATH) on the H1 timeframe, confirming a strong bullish continuation in the short-term structure.

- The impulsive move labeled (1) → (3) shows aggressive buy-side dominance, with wide-range bullish candles and minimal pullback — a clear expansion leg.

However, after the breakout, price has transitioned into a post-expansion consolidation, forming higher lows but with reduced momentum.

This is a critical distinction:

- The trend is bullish

- But the market is no longer in the impulse phase

- It is now entering a rebalancing / digestion phase after the breakout

2. Key Zones & Market Positioning

Broken ATH / Flip Zone:

~4,550 – 4,560

→ Previous resistance now acting as support

→ Key level to judge bullish continuation vs deeper pullback

Current Price Area:

~4,585

Higher-Timeframe Support / EMA Confluence:

~4,505 – 4,520

→ Strong dynamic support

→ Likely magnet if a deeper correction unfolds

Upside Expansion Target (Wave 5 Projection):

~4,645 – 4,665

→ Marked as NEW TARGET

→ Requires renewed momentum and clean acceptance above ATH

As long as price holds above 4,550, the bullish structure remains valid.

3. Liquidity & Price Behavior

The ATH breakout likely cleared buy-side liquidity and triggered breakout traders to enter late.

Current overlapping candles indicate:

- Profit-taking by early buyers

- Liquidity being rebuilt below price

- No panic selling or aggressive distribution yet

This behavior is typical after a major breakout, where the market pauses to absorb orders before deciding the next leg.

Importantly:

- There is no strong bearish displacement

- Pullbacks remain corrective, not impulsive

4. Today’s Market Scenarios

🔼 Primary Scenario – Bullish Continuation After Consolidation

Expected flow:

- Price holds above 4,550

- Sideways or shallow pullback structure (wave (4))

- Momentum rebuilds

- Break above consolidation high

- Expansion toward 4,645 – 4,665 (wave (5))

This scenario favors patience, not chasing current highs.

🔽 Alternative Scenario – Deeper Post-Breakout Pullback

If price:

- Fails to hold 4,550

- Shows increasing bearish momentum

Then expect:

- A deeper retracement toward 4,520 – 4,505

- Retest of EMA support

- Potential higher-low formation before continuation

This would still be bullish within structure, not a reversal.

❌ Invalidation Scenario

Only if price:

- Breaks and closes below 4,505 on H1

This would signal a short-term structural shift and delay further upside expansion.

5. Trading Perspective

Bias: Bullish, but selective

Execution: Buy pullbacks, not ATH breakouts

Risk Zone: Chasing price inside post-breakout consolidation

Gold is not weak it is digesting a major structural breakout.

Accumulation Before Expansion or Breakdown Into Liquidity?Hello traders! Here’s a clear technical breakdown of BTCUSD (1H) based on the current chart structure.

Bitcoin previously delivered a strong bullish impulsive move, establishing clear upside momentum and pushing price into premium territory. Following the peak, the market transitioned into a corrective phase, marked by controlled selling pressure and a gradual loss of bullish momentum rather than panic distribution.

The recent decline brought price back toward a key structural support, where selling pressure has noticeably slowed. Current price action is showing compression and stabilization, suggesting the market is deciding between continuation of the broader bullish trend or a deeper corrective leg.

Major Support / Demand Zone:

The 90,700–91,000 area is a strong support zone, where price has repeatedly reacted and volume has increased. This zone also aligns with previous consolidation and acts as a structural pivot for the broader trend.

Liquidity Range Below:

Below current price sits a liquidity-rich zone near 86,900, corresponding to the prior accumulation range. A breakdown into this area would indicate acceptance of lower prices and a shift toward a bearish continuation phase.

Overhead Resistance Levels:

If price holds support, upside targets are layered at:

- 92,200 – first structure resistance

- 93,200 – prior reaction high

- 94,400–94,800 – major liquidity and range high

These levels define the bullish roadmap if support holds.

Currently, BTC is trading directly on top of a strong support level, with price holding above the EMA and failing to extend lower despite prior sell pressure. This behavior often reflects absorption by buyers, rather than aggressive sell-side continuation.

The market is compressing, not accelerating typically a precursor to expansion.

As long as Bitcoin holds above the 90,700–91,000 support zone, the broader bullish structure remains valid. In this case, current price action can be treated as accumulation after correction, with potential for a push toward 92,200, followed by continuation into the 93,200 and 94,400+ resistance zones.

However, a decisive hourly close below support, followed by acceptance, would invalidate the bullish continuation thesis. That scenario would likely send price into the previous accumulation area near 86,900, confirming a deeper corrective or trend transition phase.

For now, support is holding but it must be respected, not anticipated.

Gold Respects EMA 50 — Short-Term Bullish Continuation in FocusGold (XAUUSD) on the 30-minute timeframe is showing early signs of bullish continuation after completing a healthy pullback within a broader recovery structure. Following the prior impulsive leg higher, price corrected in a controlled manner and has now reacted cleanly from the EMA 50, confirming it as dynamic support.

The recent higher low formed along the ascending trendline indicates that buyers are still in control of the short-term structure. This pullback appears corrective rather than impulsive, suggesting the market is reloading for the next expansion phase instead of reversing.

Price is currently trading back above the EMA 50 and holding above the 4,458–4,460 intraday support area, which acts as a key pivot zone. As long as this level holds, bullish continuation remains the preferred scenario.

On the upside, the next liquidity objectives are clearly defined. The 4,495–4,500 zone marks the first resistance and reaction area, followed by the higher-timeframe target near 4,545–4,550, where previous highs and resting liquidity sit.

Trading Plan:

Bullish scenario: Holding above the EMA 50 and the 4,458 support opens the door for continuation toward 4,495, with extension toward 4,545–4,550 if momentum accelerates.

Bearish scenario: A loss of the EMA 50 followed by acceptance below 4,440 would invalidate the short-term bullish setup and expose a deeper pullback toward 4,420–4,400.

Overall, Gold is behaving technically clean on M30. As long as price respects dynamic support, the bias remains buy-the-dip, with confirmation favored over anticipation.

EURUSD Is Pressing the Channel Low — Liquidity Grab or Trend 1. Current Market Structure

- EURUSD remains in a well-defined bearish market structure on the H1 timeframe.

Price is trending lower inside a descending channel, consistently respecting lower highs and lower lows.

- The recent sell-off has pushed price into the lower boundary of the channel, where downside momentum has started to slow. However, there is no confirmed bullish structure break yet.

- The moving averages remain stacked bearishly, reinforcing that the broader intraday trend is still controlled by sellers.

2. Key Zones & Market Positioning

Descending Channel Support: ~1.1620

→ Key intraday demand & potential liquidity sweep zone

Immediate Support (Liquidity Pool): 1.1620 – 1.1619

Immediate Resistance / Pullback Zone: 1.1659 – 1.1669

Upper Resistance / Structure Level: 1.1683

As long as price remains below 1.1669 – 1.1683, bearish structure remains intact.

3. Liquidity & Price Behavior

The sharp move into channel support suggests sell-side liquidity is being tested.

Wicks near the lows indicate some buy-side absorption, but follow-through has been limited so far.

This opens two possibilities:

- A short-term liquidity grab below support before continuation

- Or a temporary corrective bounce into resistance

Importantly, the market has not shown accumulation characteristics yet volume remains neutral and rebounds are corrective.

4. Today’s Market Scenarios

🔽 Primary Scenario – Bearish Continuation (Structure-Aligned)

Expected flow:

- Price briefly consolidates near 1.1620

- A minor pullback fails below 1.1659

- Breakdown continuation within the channel

- Extension toward the lower channel projection

This remains the favored scenario while price stays below channel resistance.

🔼 Alternative Scenario – Corrective Bounce (Counter-Trend)

If price:

Holds above 1.1620 and reclaims 1.1659

Then expect:

A corrective move toward 1.1683

Sellers likely re-enter at that zone

This would be a pullback, not a trend reversal.

❌ Invalidation Scenario

Only if price: Breaks and closes above 1.1683

This would invalidate the immediate bearish continuation and signal a deeper correction or range formation.

5. Trading Perspective

Bias: Bearish, with caution near channel support

Execution: Sell rallies into resistance

Market Intent: Trend continuation unless proven otherwise

EURUSD is not reversing yet.

It is testing liquidity at the lower channel boundary.

EURUSD Stays Under Pressure — Bearish Continuation Still in PlayEURUSD on the H1 timeframe continues to trade within a clear bearish trend, with price respecting a descending structure and printing consistent lower highs and lower lows. The overall market context remains firmly bearish, with sellers maintaining control.

Price is currently trading below the EMA, which is acting as dynamic resistance. The recent pullback into the EMA area was met with rejection, confirming classic sell-the-rally behavior rather than any meaningful bullish recovery. This reaction reinforces the idea that the move up was corrective, not impulsive.

Structurally, the market has now pushed back toward the 1.1640 area, and downside pressure remains active. As long as price stays capped below the EMA and the descending trendline, the path of least resistance continues to favor further downside.

Below current price, the next key liquidity objectives sit around 1.1590 and 1.1555, where resting demand and prior reaction lows are located. These levels are natural downside magnets if bearish momentum persists.

Bearish scenario (preferred): As long as price remains below the EMA and the descending trendline, continuation toward 1.1590 is favored, with extension toward 1.1555 if selling pressure accelerates.

Bullish invalidation: Only a strong reclaim and acceptance above 1.1670–1.1680, followed by a clear structure break, would invalidate the bearish continuation bias.

At this stage, EURUSD remains in a controlled bearish environment. Patience is key — the highest-probability opportunities continue to come from selling pullbacks into resistance, not from attempting to catch bottoms in a trending market.

The Next Break Could Unlock a Fresh Expansion1. Current Market Structure

On the H4 timeframe, Gold remains in a clear bullish market structure.

After a strong impulsive rally, price experienced a sharp corrective leg that swept liquidity below previous lows, then immediately rebounded a classic stop-hunt followed by strong demand response.

Since that liquidity grab, price has been forming higher lows, confirming that buyers have regained control. The market is no longer in free correction; it has transitioned into a re-accumulation phase within an uptrend.

The recent consolidation just below resistance suggests compression, not weakness.

2. Key Zones & Market Positioning

Major Demand Zone: 4,260 – 4,300

→ Strong institutional buying zone

→ Origin of the impulsive recovery

Intermediate Support (Buy-on-Dip Area): 4,390 – 4,420

→ Previous resistance turned support

Immediate Resistance / Range High: 4,470 – 4,480

→ Area of repeated rejection, liquidity resting above

Upside Expansion Target: 4,550 – 4,560

As long as price holds above 4,390, the bullish structure remains fully valid.

3. Liquidity & Price Behavior

Price action shows overlapping candles and shallow pullbacks, a textbook sign of buy-side absorption.

Key observations:

- No strong bearish follow-through after pullbacks

- Buyers consistently step in above demand

- Liquidity is clearly stacked above the range high

This behavior confirms the market is loading positions, not distributing them.

4. Market Scenarios

🔼 Primary Scenario – Bullish Continuation (High Probability)

Expected flow:

Continued consolidation above 4,390

Minor pullbacks to support

Break and acceptance above 4,480

Expansion toward 4,550 – 4,560

This is a buy-the-dip environment, not a chase-the-breakout market.

🔽 Alternative Scenario – Deeper Pullback (Still Bullish)

If price:

Sweeps liquidity into 4,390 – 4,360

Then:

Look for strong rejection

Higher-low formation

Bullish continuation afterward

❌ Invalidation Scenario

Only if price:

Breaks and closes below 4,260 on H4

This would signal a structural shift and delay the bullish expansion.

5. Trading Perspective

Bias: Bullish

Execution: Patience at support zones

Market Intent: Re-accumulation before expansion

Gold is not topping.

It is rebuilding strength for the next impulsive leg.

EURUSD Breakdown Confirmed — Sellers Remain Firmly in ControlEURUSD on the H1 timeframe continues to respect a clear bearish market structure, with price consistently printing lower highs and lower lows. The broader trend remains firmly to the downside, reinforced by sustained trading below the EMA 50, which is acting as dynamic resistance.

The recent price action shows a textbook sell the rally behavior. Each corrective bounce into previous supply zones has been met with strong rejection, forming a sequence of bearish consolidation boxes that ultimately resolve lower. This confirms that sellers are actively defending value areas and distributing positions on pullbacks.

Price has now broken and held below the 1.1670 structure level, confirming a continuation of bearish momentum rather than a false break. The current consolidation around 1.1640–1.1650 appears to be a pause before the next leg down, not a reversal signals.

Momentum indicators also support the bearish bias, with downside pressure remaining dominant and no meaningful bullish divergence present. As long as price remains capped below prior supply zones, the path of least resistance stays to the downside.

Bearish scenario (preferred): As long as price holds below 1.1670, continuation toward the 1.1620 liquidity zone is likely. A confirmed breakdown below this area opens further downside toward 1.1600–1.1580.

Bullish invalidation: Only a strong reclaim and acceptance back above 1.1700, with a structural shift, would invalidate the bearish continuation setup.

Overall, EURUSD remains in a controlled bearish expansion phase. Patience and discipline are key the highest-probability opportunities continue to favor selling pullbacks, not attempting to catch bottoms.

just Follow the Trend — EURUSD Downtrend Remains in ControlEURUSD is trading in a clear and well-defined downtrend, which is the core narrative on the H1 timeframe. Market structure shows a consistent sequence of lower highs and lower lows, confirming sustained bearish control rather than temporary weakness.

The recent bullish attempts are shallow and corrective, failing to break the descending trendline. This price behavior indicates that buyers are not in control; instead, they are providing liquidity for sellers to re-enter positions in line with the dominant trend.

The descending trendline has been respected multiple times, acting as dynamic resistance. Each pullback into this trendline has resulted in rejection, followed by continuation to the downside a textbook example of trend-following price action.

Price is currently trading below the trendline and hovering near a minor consolidation area. This suggests bearish continuation, not reversal. As long as price remains capped below the trendline, the probability favors further downside.

Resistance:

Descending trendline resistance

1.1650 – 1.1660 (recent pullback rejection zone)

Support:

1.1620 – 1.1630 (near-term reaction level)

1.1600 – 1.1590 (next major downside target)

➡️ Primary Scenario (Downtrend Continuation):

Price remains below the descending trendline and continues to print lower highs. A minor pullback into trendline resistance followed by rejection would offer continuation opportunities toward the 1.1620 level first, with extension toward 1.1600 and below.

⚠️ Risk Scenario:

Only a decisive breakout and acceptance above the descending trendline would weaken the bearish bias. Until that happens, any upside move should be treated strictly as a corrective pullback within a downtrend.

Ethereum Breaks Descending Structure — Is a Fresh Bullish Leg UnEthereum (ETHUSD) on the H1 timeframe is showing a notable shift in short-term structure after breaking cleanly above a well-defined descending trendline. This trendline had capped price throughout the recent corrective phase, so the breakout signals that bearish momentum is fading and buyers are beginning to regain control.

The prior move down now appears corrective within a broader bullish context rather than the start of a trend reversal. Price has formed a higher low after the breakout and is stabilizing above the 3,080–3,100 support zone, confirming this area as a key demand base and structural pivot.

With the trendline broken, the market is transitioning from sell-the-rally behavior into a potential buy-the-dip environment, provided price continues to hold above the breakout area.

Overhead, ETH faces a sequence of clear resistance levels that will define the strength of any continuation:

- 3,180 – first reaction and intraday structure resistance

- 3,260 – prior consolidation high and liquidity magnet

- 3,300–3,320 – major resistance and key upside objective

Bullish: As long as price holds above 3,080–3,100 and respects the broken trendline, continuation toward 3,180, then 3,260, becomes likely. Acceptance above these levels opens the path toward 3,300+.

Bearish: A failure to hold above the breakout zone and a sustained move back below 3,080 would invalidate the bullish shift and suggest a return to range or deeper correction.

At this stage, Ethereum is at a post-breakout validation phase. Patience is key the highest-probability opportunities come from holding above the broken trendline or clean continuation through resistance, not from chasing price mid-structure.

Gold at Resistance While Riding the EMAHello traders! Here’s a clear technical breakdown of XAUUSD (4H) based on the current chart structure.

Gold remains within a broader bullish trend, established by a strong sequence of higher highs and higher lows. After an impulsive rally into the upper range, price is now stalling beneath a key resistance zone, signaling a pause in bullish momentum rather than an immediate reversal.

The recent candles show compression and reduced follow-through, suggesting buyers are becoming cautious as price trades near premium levels. At the same time, sellers have not yet delivered a decisive bearish impulse, keeping the structure technically bullish but vulnerable to a corrective move.

🟦 SUPPLY & DEMAND – KEY ZONES

Major Resistance / Supply Zone:

The 4,520–4,550 area is a well-defined resistance zone, where prior rallies were rejected. This zone represents strong overhead supply and is the main barrier for bullish continuation.

Dynamic Support (EMA Confluence):

Price is currently hovering near the EMA 34 and EMA 89, a critical dynamic support cluster. The EMA 89, in particular, has acted as a reliable trend support during previous pullbacks.

Key Support Zone:

Below current price, the 4,270–4,300 region stands out as a major demand zone. A move into this area would represent a deeper but still healthy correction within the broader uptrend.

🎯 CURRENT MARKET POSITION

Currently, Gold is trading just below resistance while sitting on dynamic EMA support, placing price at a high-impact decision area. This positioning often precedes either a continuation breakout or a corrective rotation lower to rebalance liquidity.

The market is no longer impulsive; it is waiting for confirmation.

🧠 MY SCENARIO

As long as Gold fails to break and hold above the 4,520–4,550 resistance zone, the probability favors a corrective pullback toward the EMA 89, and potentially into the 4,270–4,300 support zone, before buyers attempt another push higher.

If price can accept above resistance with strong bullish momentum, that would invalidate the pullback scenario and open the door for trend continuation toward new highs.

For now, this remains a bullish market in correction mode, not a trend reversal.

⚠️ RISK NOTE

Price is trading at a premium decision level. Wait for confirmation at resistance or support, avoid chasing breakouts, and always manage your risk.

The Wyckoff Trading MethodThe Wyckoff Trading Method

The Wyckoff Method is a classical approach to market analysis designed to help traders understand trend development, market cycles, and potential reversals. Despite being developed over a century ago, it remains highly relevant in modern financial markets and is widely used across stocks, forex, and cryptocurrencies.

What Is the Wyckoff Method?

The Wyckoff Method is a form of technical analysis created in the early 20th century by Richard D. Wyckoff, a pioneering trader and market analyst. The core idea behind this method is that price movements are governed by supply and demand, and that large institutional participants (often referred to as “composite operators”) leave identifiable footprints on the chart.

Wyckoff believed that by studying price, volume, and time, traders could anticipate future price behavior rather than react to it.

Core Principles of the Wyckoff Method

The Wyckoff methodology is built around several foundational concepts:

1. Supply and Demand

Price rises when demand exceeds supply and falls when supply exceeds demand. Observing how price responds to changes in volume helps traders identify who is in control of the market.

2. Market Structure and Phases

Markets move in recurring cycles, typically broken down into:

- Accumulation

- Markup

- Distribution

- Markdown

Recognizing these phases allows traders to align with institutional activity rather than trade against it.

3. Price and Volume Relationship

Volume acts as a confirmation tool. Strong price movement with weak volume often signals exhaustion, while strong volume supports trend continuation.

4. Liquidity and Institutional Behavior

The method emphasizes how large players accumulate or distribute positions over time, often through range-bound price action designed to absorb liquidity.

The Market Cycle

The Wyckoff Market Cycle

The Wyckoff methodology describes market behavior as a repeating four-phase cycle driven by supply and demand. These phases help traders understand where the market is in its process, rather than simply reacting to price movements.

Accumulation Phase

Accumulation typically appears as a range-bound market after a decline. During this phase, large institutional participants quietly build long positions while price remains relatively stable. To most traders, the market appears directionless, but in reality, buying is taking place without pushing price higher. The true intent of the market is concealed until accumulation is complete.

Markup Phase

Once sufficient long positions have been accumulated, institutions begin to drive price higher. This phase is characterized by a clear uptrend as increased demand attracts additional buyers. Breakouts from accumulation ranges often trigger momentum traders and breakout strategies, reinforcing the trend. Markups may include re-accumulation phases, where price pauses and consolidates before continuing higher.

Distribution Phase

Distribution occurs after an extended advance, when upward momentum begins to slow. During this phase, large players gradually offload long positions and build short exposure. Price often moves sideways in a range, giving the illusion of stability, while smart money exits positions. This phase prepares the market for the next directional move lower.

Markdown Phase

The markdown is the declining phase that follows distribution. Selling pressure overwhelms demand, leading to a sustained downtrend. As price falls, traders are encouraged to enter short positions, further accelerating the move. Similar to markups, markdowns may include redistribution phases, where price consolidates before continuing lower.

Why the Wyckoff Model Works

Large financial institutions must execute trades of significant size, which requires liquidity. Liquidity is often found around stop losses, breakout levels, equal highs and lows, and key support or resistance zones. By intentionally pushing price into these areas, institutions can fill large orders efficiently without excessive slippage. This interaction between liquidity and market psychology forms the foundation of the Wyckoff model across all asset classes.

Core Principles of the Wyckoff Method

A key concept in Wyckoff theory is the Composite Man, a symbolic representation of institutional or “smart money” participants. Traders are encouraged to analyze price action as if a single, highly informed entity is controlling the market. The Composite Man accumulates or distributes positions strategically before allowing price to trend.

The Law of Supply and Demand explains that price rises when demand exceeds supply and falls when supply exceeds demand. The Law of Cause and Effect states that the size and duration of accumulation or distribution determine the magnitude of the subsequent price move, with higher-timeframe structures producing larger effects. The Law of Effort versus Result compares volume (effort) with price movement (result), highlighting potential trend continuation or exhaustion when these two factors diverge.

Wyckoff Schematics

Wyckoff schematics visually represent accumulation and distribution structures. Although these patterns may appear complex at first, they are mirror images of each other, with accumulation and distribution sharing identical phases and logic—only inverted. Studying these schematics helps traders recognize institutional behavior and align their trades with the dominant market process.

Type 1 Schematics

Accumulations

Phase A: Stopping the Downtrend

Phase A marks the transition from a markdown to the beginning of accumulation, where selling pressure starts to weaken.

- Preliminary Support (PS) : After a prolonged decline, initial buying emerges and temporarily halts the downtrend. Volume increases as early demand appears, signaling that selling pressure is no longer dominant.

- Selling Climax (SC) : Panic selling accelerates as long positions are stopped out and breakout traders enter short positions. At this point, the Composite Man absorbs this excess supply. The SC often leaves long lower wicks, reflecting strong buying interest.

- Automatic Rally (AR) : Once selling pressure is exhausted, price rebounds quickly as shorts cover and new buyers step in. The high of the AR establishes the first resistance boundary of the accumulation range.

- Secondary Test (ST) : Price revisits the SC area to test remaining supply. This test may form equal or slightly higher/lower lows, usually with reduced volume, confirming that selling pressure has diminished.

Phase B: Building the Cause

Phase B is where accumulation develops over time. The Composite Man continues to build long positions while price fluctuates within a range.

- Sign of Strength in Phase B (SOS(b)): In some cases, price rallies above the AR, creating a higher high within the range. This move suggests improving demand but still remains below preliminary resistance.

- Secondary Test in Phase B (ST(b)): A sharp decline follows, designed to trigger stop losses below prior lows and attract breakout sellers. This “liquidation” move provides the liquidity institutions need to continue accumulating, forming the underlying cause for the next trend.

Phase C: The Final Shakeout

Phase C is the critical phase that distinguishes accumulation from continuation lower.

- Spring: Price makes a final push below established support, sweeping remaining stop losses and trapping late sellers. This move briefly violates the range before quickly reversing.

- Test: After the Spring, price retests the area to confirm that supply has been fully absorbed. These tests typically form higher lows and occur on lower volume, signaling reduced selling interest.

Phase D: Transition to Markup

Phase D confirms that accumulation is complete and the market is ready to trend higher.

- Last Point of Support (LPS): Following the test and a rally, price pulls back shallowly, forming a higher low. This pullback reflects strong demand and is often the final opportunity before markup.

- Sign of Strength (SOS): Price breaks above the accumulation range with expanding volume, confirming bullish control. After this breakout, the market enters the markup phase, where the effect of prior accumulation is realized through sustained upward movement.

Distributions

Phase A: Stopping the Uptrend

Phase A marks the transition from an uptrend into distribution, where demand begins to weaken and supply quietly enters the market.

- Preliminary Supply (PSY) : After a sustained advance, large operators start unloading positions, causing the first noticeable pause or pullback in price.

- Buying Climax (BC): Buying pressure reaches an extreme as late buyers enter aggressively, often accompanied by very high volume. This is where smart money sells into strength.

- Automatic Rally (AR): Once buying is exhausted, price pulls back sharply as demand fades. The AR typically forms below the BC and defines the first support boundary of the distribution range.

- Secondary Test (ST): Price revisits the BC area to test remaining demand, usually failing to make a new high. Volume is generally lower, indicating reduced buying interest and building liquidity for later phases.

Phase B: Building the Distribution

Phase B is where the Composite Man continues distributing positions while price fluctuates within a range.

- Sign of Weakness in Phase B (SOW(b)): A decline below the AR signals that supply is beginning to dominate. This move does not always appear, but when it does, it establishes a second support boundary.

- Upthrust (UT): Price briefly breaks above resistance to trigger buy stops and attract breakout buyers. This false breakout allows institutions to sell into increased demand and build short exposure.

Phase C: The Final Liquidity Grab

Phase C completes the distribution process by targeting remaining demand.

- Upthrust After Distribution (UTAD): Similar to a Spring in accumulation, UTAD is the final false breakout above resistance. It is designed to capture the last wave of liquidity before the true bearish move begins.

- Test: Price often revisits the UTAD area to confirm that demand has been fully absorbed. These tests typically occur on lower volume, signaling weakening bullish participation.

Phase D: Transition to Markdown

Phase D confirms that distribution is complete and bearish control is established.

- Last Point of Supply (LPSY): After price begins to decline, weak rallies attempt to test demand. These rallies are shallow and usually represent the final bullish reactions before the markdown.

- Sign of Weakness (SOW): Price breaks decisively below the range, confirming a bearish structure. Additional LPSYs may form, but this phase marks the final transition into the markdown.

Type 2 Schematics

Type 2 Wyckoff schematics contain the same structural components as Type 1, but without a Spring (in accumulation) or a UTAD (in distribution). In these cases, the market does not perform a final liquidity sweep before trending.

A Type 2 schematic can be identified by observing a direct transition into trend confirmation:

- In accumulation, price forms a Secondary Test (ST) and possibly an ST(b), then proceeds directly into a Sign of Strength (SOS) followed by markup.

- In distribution, price forms an ST or Upthrust (UT), then transitions directly into a Sign of Weakness (SOW) followed by markdown.

If markup or markdown begins without a Spring or UTAD, the structure should be classified as Type 2. Importantly, Type 2 schematics are traded using the same principles and execution logic as Type 1 structures.

The Five-Step Wyckoff Trading Strategy

Richard D. Wyckoff proposed a structured five-step approach to applying his methodology in real market conditions. This framework helps traders align with market structure and institutional intent.

1. Determine the Market Trend

Identify whether the broader market environment is bullish or bearish. Trading in alignment with the dominant trend increases probability.

2. Select a Suitable Market

Choose an asset or trading pair that clearly reflects the identified market trend and shows strong structural clarity.

3. Identify Accumulation or Distribution

Focus on assets that are currently forming a Wyckoff accumulation or distribution structure rather than those already trending.

4. Assess Readiness for a Move

Analyze the current Wyckoff phase and volume behavior. Events such as a Spring, UTAD, SOS, or SOW help confirm whether the market is prepared for markup or markdown.

5. Execute the Entry

Entries are commonly taken on Tests, Last Points of Support (LPS), or Last Points of Supply (LPSY), where risk can be controlled and structure is clear.

Does the Wyckoff Method Still Work?

- Despite being developed nearly a century ago, the Wyckoff Method remains highly relevant in modern markets. Its core principles supply and demand, market structure, volume analysis, and liquidity behavior are universal and apply across forex, stocks, commodities, and cryptocurrencies.

- When combined with complementary tools such as support and resistance, indicators, or pattern analysis, Wyckoff can form the foundation of a robust and disciplined trading approach. Its enduring value lies in teaching traders how markets move, not just where price is going.

Educational Disclaimer

This material is provided for educational purposes only. It reflects a general interpretation of the Wyckoff methodology and should not be considered financial advice, investment recommendations, or an offer to trade. Traders should always conduct their own analysis and manage risk responsibly.

Ethereum Stuck Below Trendline — Bearish Pressure Price is continuing to respect the descending trendline and trading below the EMA, confirming a sustained bearish market structure. Recent bullish attempts have failed near the trendline, showing clear seller defense and lack of upside follow-through.

As long as price remains capped below 3,140–3,160, any bounce is likely corrective and vulnerable to renewed selling pressure.

A bearish continuation below 3,100 keeps downside targets active toward 3,050 → 3,000, with a deeper liquidity objective near 2,970–2,960. Only a decisive breakout and close above the descending trendline would invalidate the bearish scenario and signal a potential trend shift.

Bitcoin Hits High-Timeframe Demand — Bounce or Breakdown?Price is reacting from a well-defined high-timeframe demand zone around 89,400–89,700, where sell-side momentum has slowed after a sharp bearish impulse. This area is a key liquidity pool that previously fueled strong upside expansion.

A bullish reaction from this demand zone could trigger a corrective recovery toward 90,800–91,600, with further upside extension possible toward 92,300 and 93,200 if buyers regain control.

However, a decisive break and close below 89,400 would invalidate the demand, exposing deeper downside toward 88,800–88,400. Price behavior at this zone will be critical in determining whether this move is accumulation or the start of a larger bearish continuation.

Ethereum Slips: Distribution Phase or Setup for a Higher Low?Ethereum on the H1 timeframe has transitioned from a clean bullish expansion into a corrective bearish structure after failing to sustain momentum near the recent highs. The prior series of consolidation boxes highlights a clear stair-step advance, but the loss of bullish follow-through at the top marked the beginning of distribution, followed by a decisive break into a descending channel.

Price is currently trading within this downward-sloping channel, respecting both the upper and lower boundaries with consistent lower highs and lower lows. The recent bearish impulse pushed ETH back toward the 3,100 area, a level that previously acted as a reaction zone during the earlier consolidation phase. This suggests the market is revisiting prior liquidity rather than entering an immediate trend reversal.

As long as price remains capped below the upper boundary of the descending channel, the corrective structure stays intact. Any short-term rebound from current levels is likely to be corrective in nature, potentially rotating back toward the mid-channel region where selling pressure may re-emerge. Failure to reclaim and hold above the channel resistance keeps downside risk active.

If selling pressure resumes, ETH could extend lower toward the 3,000 psychological level and potentially deeper into the 2,900 region, where the lower channel boundary aligns with a larger liquidity pool. Such a move would represent a deeper correction within the broader structure rather than confirmation of a full bearish trend shift, provided higher-timeframe support remains intact.

Alternatively, a strong bullish reaction from current levels followed by a clean break and acceptance above the descending channel would invalidate the bearish corrective scenario. In that case, Ethereum could transition back into expansion mode, targeting higher resistance zones and resuming its broader bullish trajectory.

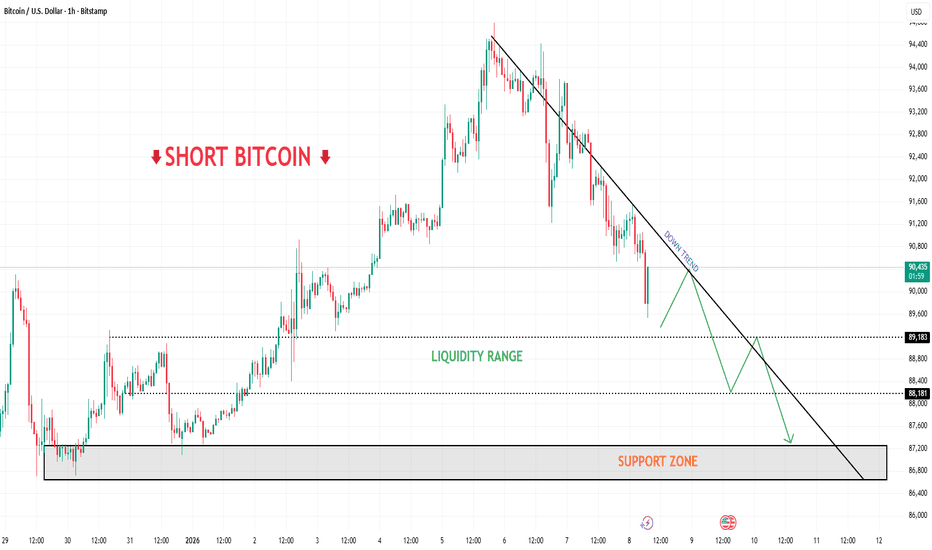

Bitcoin Breakdown Confirmed — Liquidity Below Is CallingPrice is firmly respecting the descending trendline, confirming a clear bearish market structure after the breakdown from the prior high. Selling pressure remains dominant, with each recovery failing to reclaim structure.

A corrective pullback toward the 90,400–90,600 area may occur, but this zone is expected to act as sell-side resistance as long as price remains below the downtrend line.

Failure to reclaim the trendline keeps the bearish bias intact, opening the path toward the liquidity range at 89,200–88,200. A decisive break below this range would expose the major support zone around 87,000–86,800, where a stronger reaction may finally emerge. Only a strong close above the trendline would invalidate the short-term bearish scenario.

Bitcoin Is Building a Base — Accumulation Before the Next PushPrice is consolidating above the key support zone around 89,800–90,000, showing clear signs of selling pressure absorption after the recent sell-off. Volume behavior suggests potential accumulation rather than aggressive distribution.

As long as price holds above 89,800, the bullish scenario remains favored. A clean break and acceptance above 91,200–91,500 would confirm upside momentum, opening the path toward 93,000, followed by the major target near 94,700–95,000.

Only a decisive breakdown below 89,800 would invalidate the bullish setup. For now, buyers appear to be positioning for the next expansion leg to the upside.

A Familiar Scenario — Downtrend Remains the Dominant BiasBitcoin is now firmly trading in a clear downtrend, which is the main narrative on the H1 timeframe. After failing to hold above the prior highs, price has transitioned from a bullish expansion into a sequence of lower highs and lower lows, confirming that sellers have taken control of market structure.

Recent price action shows repeated rejection from former support levels, which are now acting as resistance. Each recovery attempt is corrective and short-lived, reinforcing the idea that the broader bias remains bearish rather than range-bound or bullish.

The structure clearly favors continuation to the downside. Pullbacks lack momentum, while bearish legs are impulsive and decisive a classic sign of trend strength. Price is currently consolidating below a key resistance area, suggesting distribution before continuation, not accumulation.

The highlighted range between $80,000 – $91,000 reflects temporary consolidation within a downtrend, not a stable trading range. As long as price remains capped below the upper boundary, downside pressure is expected to persist.

Resistance:

91,000 – 91,500 (key structural resistance)

94,800 (major trend invalidation level)

Support:

87,500 – 88,000 (next downside target)

Below this zone opens room for further bearish extension

➡️ Primary Scenario (Downtrend Continuation):

Price remains below the 91k resistance and continues to form lower highs. A breakdown from the current consolidation would likely trigger the next bearish leg, extending toward the 87.5k area and potentially lower.

⚠️ Risk Scenario:

Only a strong bullish breakout and acceptance back above 91.5k would invalidate the downtrend narrative. Until that happens, upside moves should be treated as corrective rallies within a bearish trend.