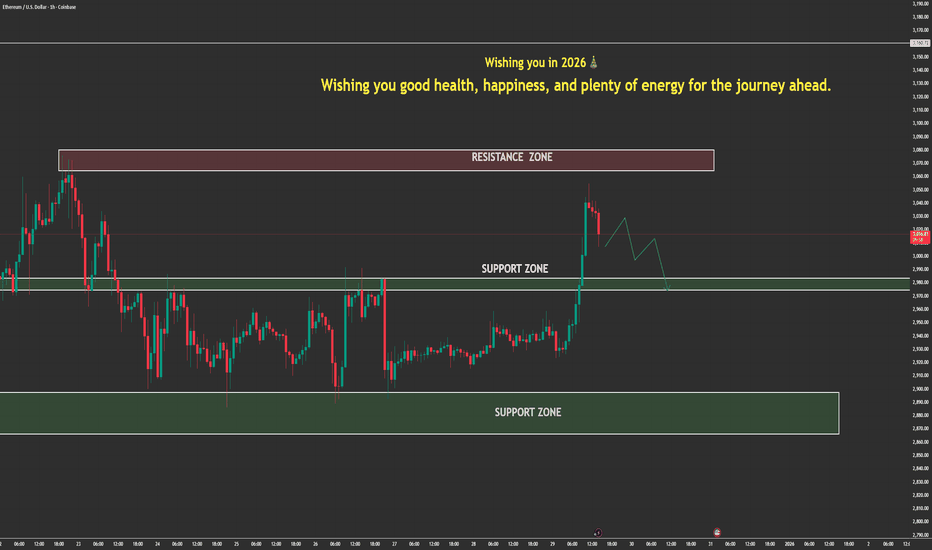

ETH Is at a Make-or-Break ZoneEthereum is currently trading inside a clearly defined range, capped by major resistance around 3,160 and supported by a key demand zone near 2,980, with a deeper structural support around 2,780. The recent impulsive rally was decisively rejected at resistance, confirming that sellers are still defending the upper boundary of this range.

From a technical perspective, price action shows classic range behavior. After the rejection, ETH rotated back toward the mid-range and is now hovering just above support (~2,980). As long as this level holds on a closing basis, the market structure remains neutral-to-bullish within the range. A successful defense here would likely lead to a rebound toward 3,060 and a retest of the 3,160 resistance zone.

However, a clean breakdown below 2,980, especially with strong volume and a 1H/4H close, would invalidate the range floor and open downside continuation toward 2,900, followed by the major liquidity pocket around 2,780.

On the macro side, year-end conditions are playing a critical role. Holiday liquidity is thin, which statistically increases the probability of false breakouts and liquidity sweeps rather than clean trend continuations. At the same time, recent Federal Reserve adjustments to liquidity conditions and easing expectations around monetary policy have kept risk assets supported, but without enough conviction to force a decisive breakout. Crypto markets are therefore reacting more to positioning and short-term flows than to long-term macro repricing.

For Ethereum specifically, the broader narrative around institutional adoption, staking yield, and ETF-related expectations continues to provide medium-term support. That said, these factors are not yet strong enough to override the current technical range in the short term.

Bottom line: ETH remains a range-bound market. As long as 2,980 holds, upside rotations toward 3,060–3,160 remain the higher-probability scenario. A confirmed break below support would shift control back to sellers and expose 2,900 → 2,780. Until a decisive breakout occurs, traders should expect sideways price action with sharp intraday swings, typical of the Christmas trading period.

Technicalindicators

Bitcoin Is Trapped — One Break Will Decide Everything.BTC (Bitcoin) – 4H | Key Points

Market State: Clear range / consolidation

Resistance Zone: ~89,500 – 90,500

Support Zone: ~85,800 – 86,500

Structure: Repeated range highs & lows → liquidity building

Bias: Neutral inside range

Scenarios:

Bullish: Clean 4H breakout above resistance → momentum expansion toward 92k+

Bearish: Breakdown below support → range failure, deeper pullback

Bottom line: This is a waiting game. The breakout not prediction will define the trend.

XAUUSD H1 – Short-Term SELL Opportunity Looking for a Short-Term SELL Move Inside the Uptrend Channel

Gold is entering a technical pullback phase after losing momentum near the upper boundary of the rising channel. For today, the focus is to look for short opportunities on reactions, using Volume Profile levels and the recent break of short-term support.

TECHNICAL CONTEXT

On H1, price is still inside a rising channel, but the market has shown a clear loss of short-term bullish structure, signalling profit-taking pressure.

The POC–VAH area above is now acting more like a sell-on-rally zone rather than an immediate continuation point.

Weak rebounds during the Asian session can offer better timing for short setups in a corrective phase.

PRIORITY SCENARIO – MAIN PLAN

Sell the pullback into value

Primary sell zone: 4497 – 4500 (Sell VAH)

Confirmation sell zone: 4465 – 4468 once price confirms a break of support during the Asian session

Expected behaviour:

Price rebounds into high-volume areas, shows rejection, then continues lower toward the next liquidity pocket.

CORRECTION TARGETS

Nearest support: around 4431

Potential buy zone: 4399 – 4396 (Fibonacci extension 1.618 plus lower-channel support)

This area is a key liquidity confluence where a bullish reaction could appear and the corrective move may complete.

WHY THE SELL IDEA MAKES SENSE

H1 structure shows short-term momentum fading

Volume Profile highlights the POC–VAH region as a high-probability sell-on-rally area

This move is treated as a correction within a broader bullish trend, not a long-term reversal

MACRO BACKDROP AND USD

The US Dollar Index (DXY) has extended its weekly decline for three straight sessions, reaching the lowest levels since early October. Key drivers include:

US CPI for November coming in weaker than expected

Signs of cooling in the US labour market

Rising expectations that the Fed could deliver two additional rate cuts in 2026

A softer USD supports gold in the medium to long term, but short-term technical corrections remain normal as the market rebalances.

SUMMARY VIEW

Priority is to sell rallies into 4497–4500 and 4465–4468

The downside move is viewed as a technical correction

Watch 4399–4396 closely for a potential bullish reaction and end of the pullback

Gold Is Compressing — The Real Move Comes After ThisGOLD – 1H | Key Points

Structure: Price is moving inside a rising channel, maintaining higher highs & higher lows → bullish structure intact.

Behavior: Current pullbacks are corrective, not distribution. Buyers keep defending the lower channel trendline.

Key Levels:

Support: ~4,460–4,480 (channel base)

Resistance: ~4,550–4,570 → breakout opens 4,600+

Market Logic: This is bullish compression, volatility contracts before expansion.

Bias: UP continuation after a shallow pullback.

Invalidation: Clean break below channel support.

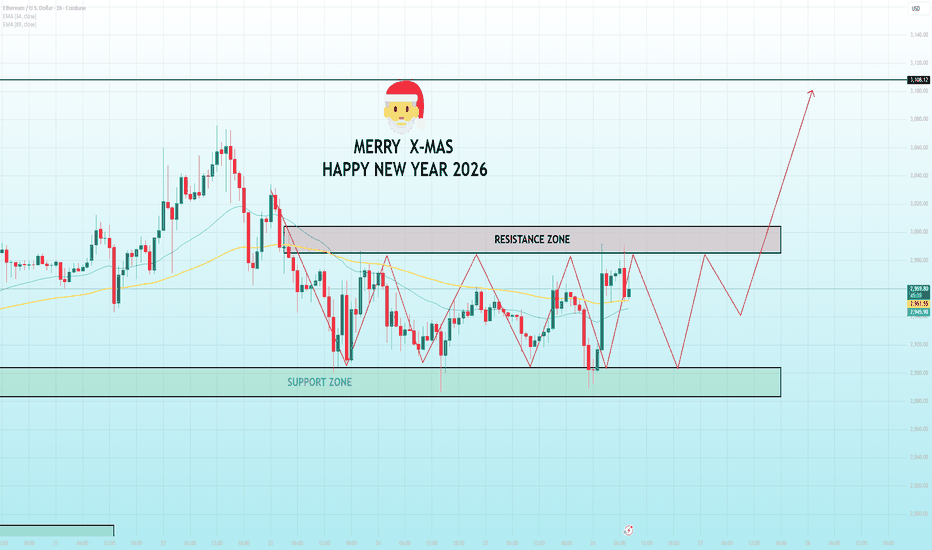

Ethereum Trapped Between Supply and DemandETH/USD (4H) — Market Analysis

Market Structure

Ethereum is stuck in a broad sideways range after a strong rejection from the upper resistance zone (~3,000–3,050).

The sharp sell-off from the top confirms strong supply pressure at premium prices.

Current price action shows range rotation, not trend continuation.

Key Zones

Strong Resistance: 3,000–3,050

→ Previous rejection zone, heavy sell orders remain.

Mid Resistance: ~2,960–2,980

→ Short-term cap where price repeatedly fails.

Support Zone: 2,880–2,910

→ Buyers defended this area multiple times.

Major Support: 2,760–2,800

→ Last demand before structure turns bearish.

Probable Scenarios

Base Case (Higher Probability):

Price continues sideways consolidation, bouncing between support and resistance to absorb liquidity.

Bullish Scenario:

A clean 4H close above 2,980–3,000 opens upside continuation toward the upper resistance zone again.

Bearish Scenario:

Loss of 2,880 support exposes ETH to a deeper drop toward 2,760–2,800.

Momentum & Trend Context

EMAs are flattening, confirming range conditions.

No impulsive follow-through yet → market is waiting for a catalyst.

Macro Context

Risk assets remain sensitive to USD strength and bond yields.

With no strong bullish macro trigger, ETH is more likely to range than trend aggressively in the near term.

Bottom Line

Ethereum is in balance mode.

Until price clearly accepts above resistance or breaks support, expect choppy, two-sided price action rather than a sustained trend.

Gold Is Compressing at the Highs — The Next ExpansionCURRENT MARKET ANALYSIS – GOLD (XAUUSD, H1)

1. Market Structure

Gold remains in a clear bullish structure on the H1 timeframe. Price is holding well above the key moving averages (EMA 34 & EMA 89), confirming that buyers still control the dominant trend.

The recent price action shows sideways compression near the highs, not a reversal. This behavior typically appears before a volatility expansion, especially after a strong impulsive leg.

2. Key Price Zones

Major Resistance: 4,525 – 4,530

Intermediate Support / Pivot: 4,490 – 4,495

Major Support: 4,425 – 4,430

Dynamic Support: EMA 34 & EMA 89 zone below price

Price is currently rotating between the 4,49x support and the 4,52x resistance, forming a tight range.

3. Price Behavior & Order Flow

Rejections from the resistance zone are corrective, not impulsive

Each pullback holds above previous demand → higher-lows intact

Liquidity is building both above the range highs and below the mid-range

This is a classic accumulation / re-accumulation phase within an uptrend.

4. Probable Scenarios

Primary Scenario (Trend Continuation):

Price holds above 4,49x

Range compression resolves upward

Break and acceptance above 4,525

Expansion toward 4,55x+

Alternative Scenario (Liquidity Sweep):

Short-term fake breakout or rejection

Sweep toward 4,46x–4,47x

Strong bullish reaction from demand

Continuation higher afterward

Only a clean break and acceptance below 4,425 would invalidate the bullish structure.

5. Trading Bias

Main Trend: UP

Intraday Focus: Buy pullbacks, avoid chasing highs

Risk Note: Expect volatility expansion — manage position size carefully

Conclusion

Gold is not topping it is loading energy.

The market is compressing near resistance, and the next breakout will define the next impulse leg. As long as price remains above key supports, the bias stays firmly bullish.

The Breakout Is LoadingHELLO TRADERS

ETH (Ethereum) – 4H | Key Points

Market Structure: Clear range / accumulation between support and resistance.

Resistance Zone: ~3,040 – 3,080 → supply still active, repeated rejections.

Support Zone: ~2,780 – 2,820 → strong demand, buyers defending lows.

Price Behavior: Sideways oscillation (high liquidity range), no breakout yet.

Bias: Neutral → Slightly bullish while holding above support.

Bullish Trigger: Clean 4H close above resistance → upside expansion.

Bearish Risk: Breakdown below support → deeper retracement.

Bottom line:

ETH is consolidating. Patience > prediction — wait for a confirmed breakout from the range.

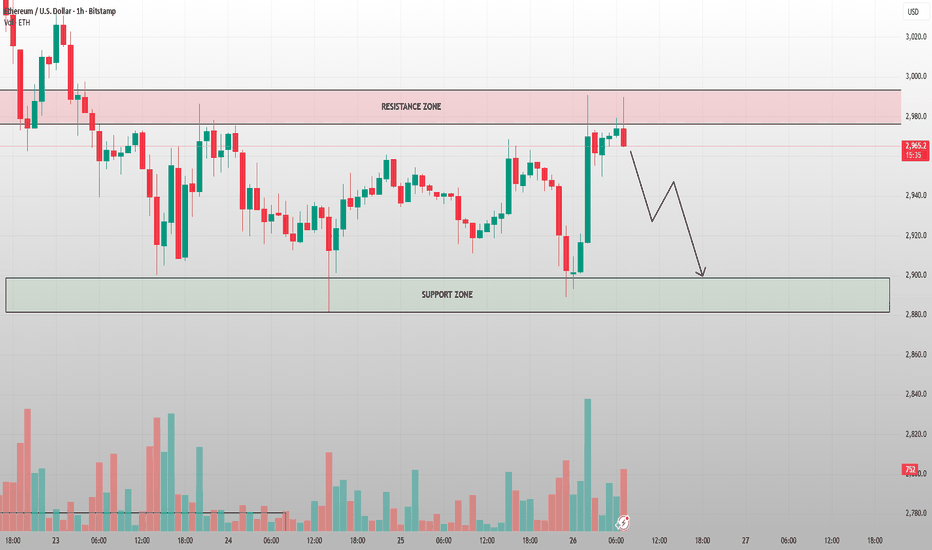

ETH Is Trapped Between Liquidity WallsETHEREUM MARKET ANALYSIS (ETHUSD – H1)

1. Market Context

Ethereum is currently trading inside a clear consolidation range after a previous corrective move. Price is oscillating between a well-defined support zone and a heavy resistance zone, showing classic liquidity accumulation behavior rather than trend continuation or breakdown.

This type of structure often precedes a strong directional expansion, especially during low-liquidity holiday sessions.

2. Key Technical Zones

Major Resistance Zone: 2,980 – 3,020

Key Support Zone: 2,880 – 2,920

Current Price Area: ~2,950–2,970

Dynamic Levels: EMA 34 & EMA 89 converging → compression

Price has repeatedly failed to accept above resistance, but sellers are also unable to push below the support zone decisively.

3. Price Structure & Behavior

Sideways structure with higher volatility swings inside the range

Multiple liquidity sweeps on both sides

No impulsive follow-through yet → confirms range environment

EMAs flattening → market is waiting for a catalyst

This is not a trend market at the moment — it is a pre-expansion phase.

4. Scenario Outlook

Primary Scenario (Bullish Expansion):

Price holds above 2,900–2,920

Strong breakout & acceptance above 3,020

Upside expansion toward 3,080 → 3,120+

Alternative Scenario (Final Liquidity Sweep):

One more dip into 2,880–2,900

Absorption of sell orders

Sharp reversal → breakout higher afterward

Invalidation:

Clean breakdown and acceptance below 2,880 would shift bias to a deeper correction.

5. Trading Bias

Market State: Accumulation / Compression

Best Strategy: Trade the range edges or wait for confirmed breakout

Risk Note: Holiday sessions = sudden spikes → reduce position size

Conclusion

Ethereum is coiling tightly between support and resistance.

This is a decision zone, not a random range. Once liquidity is fully absorbed, the next move is likely to be fast and directional. Patience here is a position.

Wait for confirmation the breakout will not be subtle.

ETH Is Trapped at Resistance — The Next Move Is Likely Down ETHUSD (1H) — Public Market Commentary

Ethereum is currently retesting a well-defined resistance zone around the 2,980–3,000 area. Price has failed multiple times to hold above this zone, signaling that sellers remain in control at higher levels.

Key Observations

Repeated rejection at resistance shows clear supply absorption failure.

The latest impulsive move up lacked follow-through and was quickly sold.

Market structure remains range-bound, not trending.

Probable Scenario

From a structural perspective, a pullback toward the support zone (≈ 2,880–2,900) is the higher-probability path.

This move would serve to rebalance liquidity before any sustainable upside attempt.

A clean breakdown into support would not be bearish continuation yet — it would be normal corrective behavior inside a range.

Invalidation

Only a strong H1 close above the resistance zone, followed by acceptance, would shift momentum bullish.

Macro Context

Risk sentiment remains fragile:

Strong USD and elevated US yields continue to pressure crypto.

Absence of fresh ETF inflows or bullish macro catalysts limits upside expansion.

Until macro liquidity improves, ETH rallies are likely to be sold at premium zones.

Conclusion:

This is not a breakout market. Until resistance is clearly reclaimed, expect downside probing before any meaningful upside continuation.

DOW THEORY – THE FOUNDATION OF TREND READINGDOW THEORY – THE FOUNDATION OF TREND READING

1. The Market Moves in Trends – Not Randomly

- Price does not move randomly. What looks like chaos is actually structured movement driven by collective behavior.

A trend exists when the market consistently creates:

+ Higher Highs & Higher Lows → Uptrend

+ Lower Highs & Lower Lows → Downtrend

As long as this structure remains intact, the trend remains valid regardless of news, opinions, or emotions.

2. Every Trend Has Three Levels of Movement

- Understanding timeframe hierarchy is critical.

Markets move in three simultaneous layers:

+ Primary Trend – the dominant direction (weeks to months)

+ Secondary Move – corrective phases against the main trend

+ Minor Swings short-term noise

Most traders lose money because they trade against the primary trend, reacting to minor swings and mistaking them for reversals.

3. The Three Phases of a Trend

A trend does not start or end suddenly. It evolves through three psychological phases:

1️⃣ Accumulation Phase

Smart money quietly builds positions

Price moves sideways, volatility is low

Public interest is minimal

2️⃣ Participation Phase

Trend becomes clear

Breakouts occur

Most trend-following profits are made here

3️⃣ Distribution Phase

Late buyers enter emotionally

Volatility increases

Smart money exits

Understanding these phases helps traders avoid buying tops and selling bottoms.

4. Structure Is the Only Valid Trend Confirmation

A trend is not confirmed by indicators alone.

A trend is confirmed when:

+ Price breaks structure in the trend direction

+ Pullbacks respect previous swing levels

+ Momentum continues after corrections

If structure is not broken, there is no reversal only a correction.

This is why predicting tops and bottoms is dangerous.

5. Volume Confirms Direction, Not Timing

Volume does not tell you when to enter — it tells you whether the move is real.

- Rising volume in the direction of the trend = confirmation

- Weak volume during pullbacks = healthy correction

- High volume against structure = warning sign

Price leads. Volume confirms.

6. A Trend Continues Until Proven Otherwise

This is the most ignored rule and the most important.

A trend does NOT end because:

- Price “already went too far”

- Indicators are overbought/oversold

- Social media says “top is in”

A trend ends only when structure breaks and fails to recover.

HOW TO APPLY THIS IN REAL TRADING

Simple, repeatable framework:

- Identify the dominant trend (HH/HL or LH/LL)

- Wait for a correction not a reversal

- Enter only after structure resumes in trend direction

- Place stop-loss where structure becomes invalid

- Hold until the market changes structure

No prediction. No guessing. Just reading what price is already telling you.

FINAL THOUGHT

Most traders don’t lose because they lack indicators.

They lose because they don’t understand trend behavior.

When you stop predicting and start reading structure,

the market becomes clear, calm, and repeatable.

Gold Is PausingGOLD (XAUUSD) – 1H |

Trend: Strong bullish structure intact. Price is consolidating above key breakout zone.

Support: 4,48x–4,47x area + rising EMA → healthy pullback, buyers still in control.

Resistance: Short-term cap near 4,52x–4,53x — compression below this level favors continuation.

Price Behavior: Sideways after impulse = bullish absorption, not distribution.

Scenario:

Hold above support → push toward 4,53x → 4,58x+.

Only lose structure if price breaks cleanly below 4,47x.

Bias: Bullish continuation. Pullbacks are opportunities, not warnings.

BTC Is Not Trending — It’s Loading LiquidityBTC/USD – QUICK ANALYSIS (1H)

Market Structure

Clear range / consolidation phase

Price oscillates between defined support and resistance

No confirmed breakout → sideways market

Key Levels

Support zone: ~86,800 – 87,200

Resistance zone: ~90,000 – 91,000

Price Behavior

Repeated reactions at both edges = liquidity absorption

EMAs flatten → lack of directional momentum

Macro Context

Market waiting for new catalyst (Fed tone, USD move, ETF flows)

No strong risk-on or risk-off trigger → chop continues

Bias

Range trading only

Wait for clean breakout + volume before trend bias

Avoid FOMO inside the box

BTC Is Not Weak Liquidity Is Being CollectedBTCUSD – 1H |

Market Structure: Clear range-bound market inside a high-liquidity box. No trend breakdown yet.

Current Price Action: Sharp pullback from range high → price now reacting at range support (~86.8K).

Key Zones:

Support: 86.8K – 87.0K (buyers defending).

Resistance: 90.5K (range high / liquidity target).

Scenario:

Hold above support → rebound back into range → retest 90K–90.5K.

Lose 86.5K → range failure → deeper correction toward 85.2K.

Macro Context:

USD strength is not accelerating, risk assets remain bid → supports range continuation rather than breakdown.

➡️ Bias: Range trade. Favor longs near support, patience until liquidity is taken at the top.

XAUUSD: This Is a Breakout PreparationXAUUSD – 1H |

Structure: Strong impulsive rally followed by bullish consolidation below previous high → classic continuation pattern.

Key Zone: Former resistance ~4,350–4,380 flipped into strong support. Price keeps respecting this base.

Momentum: Higher highs & higher lows intact → buyers still in control. No distribution signal yet.

Next Objective: Clean continuation opens the path toward 4,700 (new ATH projection).

Macro Drivers (Supporting the Move):

Fed rate-cut expectations in 2025 keep real yields pressured.

USD lacks strong upside momentum, reducing headwinds for gold.

Ongoing geopolitical & fiscal uncertainty sustains safe-haven demand.

➡️ Bias: Bullish continuation. Pullbacks into support are buy-the-dip, not reversal signals

Bitcoin Is Not Weak — It’s Reloading LiquidityBTC/USD – QUICK ANALYSIS (1H)

Structure

Price is rotating inside a high-liquidity range

Recent sell-off did not break structure → liquidity grab

Buyers defended the range low / intraday support

Key Zones

Support: ~87,000 – 86,800

Range Mid: ~88,300

Resistance: ~90,500 – 90,800

Price Behavior

Sharp drop = stop-hunt, not trend reversal

Current bounce shows absorption + acceptance back into range

Outlook

Base case: Range continuation → push back to range high

Bullish trigger: Acceptance above 88.5k

Invalidation: Clean breakdown below 86.8k

Bias

Neutral → Bullish within range

Strategy: Trade the range, not the breakout

A Christmas Setup: Is the Breakout Gift Coming?ETH/USD – 1H | Key Points:

Market State: Range consolidation after a sharp pullback.

Support Zone: ~2,900–2,920 → buyers defending repeatedly.

Resistance Zone: ~3,030–3,060 → strong supply overhead.

Structure: Higher lows forming from support → recovery attempt.

Bias: Neutral → bullish only if price reclaims 3,000+.

Context (Macro / Holiday):

Low Christmas liquidity → slow, choppy price action.

Real momentum likely comes after a clean breakout.

Plan:

Buy reactions at support.

Confirm longs only on break & hold above resistance.

Quiet Christmas range — volatility is being delayed, not cancelChristmas Liquidity Trap – BTC Is Loading the Next Move

BTC/USD – 1H | Key Takeaways:

Market State: High-liquidity range consolidation.

Support Zone: ~86.7k–86.8k → buyers defending well.

Resistance Zone: ~90.3k–90.5k → major supply cap.

Structure: Higher lows forming inside the range → pressure building.

Bias: Neutral → breakout-dependent.

Holiday / Macro Context:

Christmas = thin liquidity, slow flows.

Smart money accumulates quietly inside ranges.

Real expansion often comes after the holiday lull.

Playbook:

Range trade only until breakout.

Bullish continuation only on clean break & hold above 90.5k.

Santa’s Pause: Markets Waiting for the Next BreakoutETH/USD – 1H |

Structure

Price is holding above the key support ~2,900–2,920.

Current move is a sideways-to-up consolidation, not a breakdown.

Momentum

Price is compressing around 2,940–2,960 (EMA cluster).

This is typical pre-expansion behavior after a sell-off.

Scenario

Base case: Hold support → grind higher → retest 2,980–3,000.

Break & hold above 3,000 → continuation toward 3,080–3,120.

Invalidation: Clean breakdown below 2,900.

Macro Context

No fresh bearish macro trigger.

Risk sentiment stable → downside moves likely corrective.

Bias

Bullish above support.

Trade the range, wait for breakout confirmation.

Christmas Range: BTC Is Waiting for the Real Move🎄 Christmas Market Update – BTC/USD (1H)

Key Points :

Market State: Range-bound / consolidation.

Resistance: Upper zone holding strong → no breakout yet.

Support: Lower zone still respected → buyers defending dips.

Structure: Sideways with lower volatility typical for Christmas liquidity.

Bias: Wait for a clean breakout. No FOMO inside the range.

Macro / News Context:

Christmas week = thin liquidity, reduced institutional activity.

No major U.S. data → price driven mainly by technical levels, not fundamentals.

Volatility likely after the holidays, not during.

Execution Note:

Trade the range only if experienced.

Otherwise, stay patient and wait for post-Christmas expansion.

Bitcoin Is Quietly Absorbing — The Real Move Comes After ThisBTC/USD – 1H |

Market State: Clear range-bound consolidation between strong support and resistance.

Support Zone: Price is testing the lower liquidity band (~86,400–86,700) — selling pressure is slowing → signs of absorption.

Resistance Zone: Major supply sits around 89,800–90,500 — the level that defines the next directional break.

Structure: Current dip is corrective, not a breakdown. Momentum compression favors a range expansion soon.

Scenario:

Hold above support → bounce toward 88,500 → 90,000.

Clean break above resistance → trend continuation.

Lose support → range remains, not a crash.

Bias: Neutral → bullish only after confirmation. Patience here pays.

Christmas Calm Before the Breakout – ETH Is Still WaitingKey Points :

Structure: Range / consolidation between support and resistance.

Bias: Neutral → waiting for expansion.

Support Zone: Holding so far, buyers still defending.

Resistance Zone: Major cap; breakout needed to confirm upside.

Liquidity: Thin Christmas liquidity → false moves possible.

Macro Context:

Holiday period = low volume, reduced institutional flow.

No strong macro catalyst → price driven mainly by technical levels.

Trading Note:

Avoid overtrading during Christmas.

Best opportunity comes after the holidays, not during.

ETH Is Not Weak — This Is Smart Money Reloading Before the PUSHETH / USD – 1H

1. Market Structure (What Price Is Really Doing)

ETH has returned precisely into the previous range support zone (~2,900–2,930).

The sell-off did not break structure impulsively — instead, price formed compression + shallow lower wicks, signaling sell-side liquidity absorption.

The recent down move is corrective, not a trend reversal:

Lower highs are short-lived

No strong bearish expansion

Buyers step in immediately at range low

➡️ This is range re-accumulation, not distribution.

2. Key Levels

Primary Support (High-Probability Demand): 2,900 – 2,930

Range High / Resistance: 3,050 – 3,080

Upside Liquidity Target: 3,100 – 3,150

As long as ETH holds above 2,900, bullish structure remains intact.

3. Price PatH

Expected Flow:

Minor dip or sweep below 2,920 (liquidity grab)

Sharp reaction back into range

Expansion toward range high

Break above 3,080 → 3,100+

This is a classic “sell the fear, buy the base” setup inside a higher-timeframe range.

4. Macro & Crypto-Specific Tailwinds

Macro Alignment

USD momentum is weakening as markets price Fed easing in 2025.

Risk assets remain supported → ETH benefits disproportionately vs BTC during rotations.

Crypto-Specific

ETH continues to gain from:

ETF narrative speculation

Reduced net issuance (post-merge supply dynamics)

Capital rotation from BTC into ETH during consolidation phases

➡️ Macro does not support sustained downside here.

🧠 Final Takeaway

ETH is not breaking down — it is reloading at the most logical level.

Structure: Neutral → Bullish

Location: Optimal (range low)

Liquidity: Below price already taken

Bias: Upside continuation toward 3,100+

Unless ETH accepts below 2,880, this remains a buy-the-dip environment, not a short-the-rally one.

XAUUSD (H4) – Today’s Overview Bull trend holds after the ATH break, prefer buying the pullback into liquidity

Strategy snapshot

Gold is still holding a strong bullish structure after breaking a key all-time-high (ATH) resistance. At current elevated prices, I’m not chasing. The higher-probability plan for today is to wait for a pullback into sell-side liquidity and look for long continuation. On the upside, the 1.618 Fibonacci zone remains a realistic area for profit-taking / short-term reaction.

1) Technical view (from your chart)

Key ATH resistance level broken: the previous ATH zone has flipped into a supportive reference level.

After a vertical push, the market often prints a liquidity sweep / reset pullback before continuation.

The chart highlights Sellside Liquidity around 4423.796 — that’s the main area I’m watching for a dip-buy setup.

2) Trading plan (trade the level)

Scenario A (priority): BUY after a liquidity sweep

✅ Buy zone: 4423 – 4425 (sellside liquidity)

SL (guide): below the zone (refine on lower timeframes)

TP1: back towards 4485

TP2: 4572 – 4576

Logic: In a bull trend, a dip into sellside liquidity is a common “shakeout” before the next leg higher — especially when price is extended.

Scenario B: SELL reaction at premium Fibonacci (short-term)

✅ Sell zone: 4572 – 4576 (1.618 Fibonacci)

SL (guide): above the zone

TP: back towards value / the 44xx pullback area

Logic: Premium Fibonacci zones often attract profit-taking when price accelerates.

3) Trend target (if momentum continues)

If the bull leg remains intact, the next upside reference on the chart is 4680.

4) Macro backdrop (why metals remain hot)

Gold, silver, copper and platinum are all printing record highs — strong sector-wide flow into metals.

US data is mixed, which keeps volatility elevated:

US Q3 GDP up 4.3% (fastest in two years) — can support USD and create short-term headwinds for gold.

ADP: private employers added an average 11,500 jobs per week over the four weeks to 6 December — labour still holding.

Consumer confidence down for a fifth straight month — growth concerns keep safe-haven demand supported.

Bottom line: Expect noise and sweeps — let price come to your levels.

5) Risk management (Liam rule)

No FOMO at highs.

Only act at the levels: 4423 for longs, 4572–4576 for reaction shorts.

Risk per trade: max 1–2%.

Which side are you leaning today: buying the 4423 pullback, or waiting for 4572–4576 to sell the reaction?