EUR/USD Pulls Back — This Is Support, Not a ReversalEUR/USD – 1H QUICK ANALYSIS

Technical

Price rejected from the upper resistance zone (~1.1800–1.1810).

Current move is a healthy pullback toward the support zone (~1.1760–1.1770).

Structure remains higher highs & higher lows → bullish continuation favored.

Expected path: support hold → higher low → retest resistance.

Key Levels

Support: 1.1760–1.1770

Resistance / Target: 1.1800 → 1.1850

Macro Drivers

USD softness as markets price in 2025 Fed rate cuts.

ECB remains relatively hawkish vs Fed, supporting EUR.

Risk sentiment stabilizing → favors EUR over USD.

Bias

Buy on pullbacks at support.

Bullish invalidation only if price breaks below 1.1760.

Technicalindicators

EURUSD Pullback Is a TrapCURRENT MARKET ANALYSIS – EUR/USD (H1)

Market Structure

EURUSD is maintaining a clear bullish intraday structure. The recent pullback is corrective in nature, forming a higher-low sequence above the key demand area, not a trend reversal.

Price is currently retracing from the short-term high and rebalancing liquidity before the next directional move.

Key Technical Levels

Support Zone: 1.1760 – 1.1770

Immediate Resistance / Target: 1.1800 – 1.1805

Extended Level (Open / Expansion): 1.1818 – 1.1820

The highlighted support zone aligns with:

Previous breakout base

Prior demand reaction

Structure support (HL confirmation)

Price Behavior Insight

Selling pressure is weak and overlapping, not impulsive

Buyers defended the previous pullback aggressively

Current move resembles a bullish flag / continuation pullback

This is typical trend continuation behavior, not distribution.

Probable Scenarios

Primary Scenario (High Probability):

Price holds above 1.1760–1.1770

Shallow pullback completes

Continuation toward 1.1800 → 1.1820

Invalidation Scenario:

Clean break and acceptance below 1.1760

Would signal a deeper correction toward lower demand

Trading Bias

Main Trend: UP

Intraday Bias: Buy pullbacks, avoid chasing highs

Strategy: Wait for confirmation at support before continuation entry

Conclusion

EURUSD is not reversing it is reloading.

As long as the support zone holds, the path of least resistance remains to the upside.

Bitcoin Is Not Weak — This Is Liquidity CompressionCURRENT MARKET ANALYSIS – BTC/USD (H1)

Market Context

Bitcoin is currently trading in a compressed structure after a prolonged sideways range, following a strong rejection from the upper resistance zone. This move is not a trend reversal, but a liquidity-driven correction within a broader consolidation phase.

Structure & Price Behavior

The market previously formed a clear range between resistance (upper red zone) and support (lower gray zone), with multiple liquidity sweeps on both sides.

Price has now returned to the lower boundary of the range, where demand historically stepped in.

The recent sell-off shows weak follow-through, suggesting selling pressure is decreasing, not accelerating.

Technical Signals

Price is currently below EMA 34 and EMA 89, indicating short-term bearish pressure.

However, price is reacting at the range support, not breaking impulsively — a key sign of absorption rather than distribution.

The structure suggests a potential spring / false breakdown, commonly seen before range expansion.

Probable Scenarios

Primary Scenario (Higher Probability):

Price holds the 86.5k–87.0k support zone

Short-term base formation

Rotation back into the range

Continuation toward 88.8k → 89.5k → 90.6k

Invalidation Scenario:

A strong impulsive breakdown below the support zone with volume

This would open risk toward deeper downside liquidity

Market Conclusion

Market State: Sideways → Compression

Current Phase: Liquidity absorption at range support

Bias: Cautious bullish reversal from support

Strategy: Patience — wait for confirmation, do not chase volatility

👉 Bitcoin is not breaking down it is building energy. The next expansion will be clear once the range resolves.

Ethereum Isn’t Breaking Down — It’s Absorbing SupplyETH/USD – QUICK ANALYSIS (1H)

Market Structure

ETH remains inside a well-defined range

Current pullback = healthy retracement, not trend failure

Structure still favors higher low formation

Key Levels

Support zone: 2,930 – 2,950

Range high / Resistance: 3,040 – 3,080

Major resistance above: ~3,180 – 3,200

Price Behavior

Sellers failed to push price below support → absorption

Buyers stepping in near range low = re-accumulation

Volatility contracting → expansion likely next

Outlook

Base case: Bounce from support → retest range high

Bullish continuation: Acceptance above 3,080

Bearish risk only if: Clean break below 2,930

Bias

Neutral → Bullish

Strategy: Buy support, sell resistance until breakout

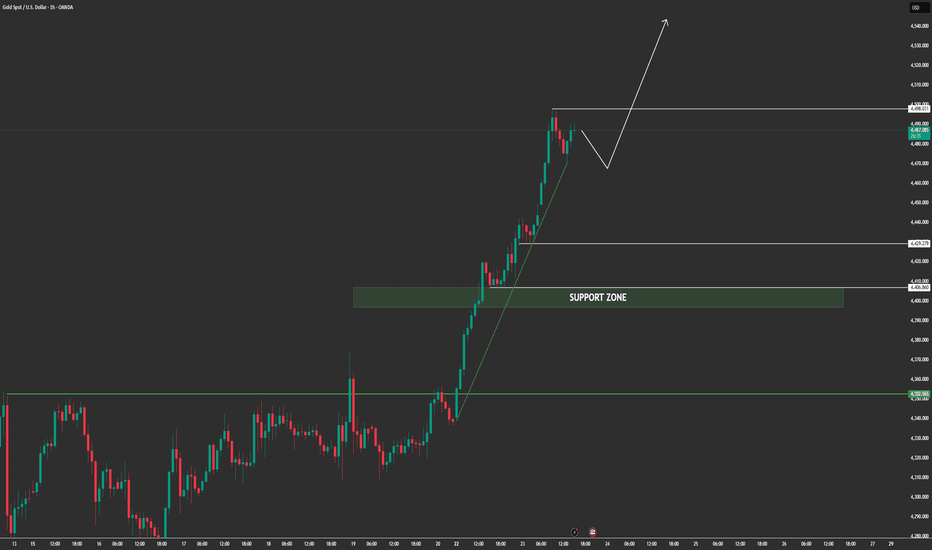

Gold Is Repricing, Not PumpingGOLD (XAUUSD) – KEY POINTS

Technical

Clean break & hold above previous high (~4,380)

Old resistance → new support confirmed

Structure shows higher highs, higher lows

Pullbacks are continuation, not reversal

Macro / Financial Drivers

USD softening → supports gold

Real yields compressing → bullish for XAUUSD

Central bank buying absorbing dips

Year-end defensive flows into safe havens

Outlook

Bias: Bullish continuation

Strategy: Buy pullbacks, avoid FOMO

Gold Isn’t Topping — This Is a PauseGOLD (XAUUSD) – H1

Technical Structure + Macro Context

1. Price Action & Structure

Gold just delivered a strong impulsive breakout, accelerating vertically from the 4,35xx base.

Current price action is consolidating just below the recent high, not rejecting.

This behavior = bullish continuation, not distribution.

Key observation:

➡️ Strong moves don’t reverse at the high — they pause, absorb liquidity, then expand.

2. Key Levels on Chart

Immediate Resistance / Pause Zone: ~4,485 – 4,500

Support Zone (Buyers’ Control): ~4,400 – 4,415

Trend Support: Rising impulse trendline remains intact

As long as price holds above 4,400, the bullish structure remains valid.

3. Market Psychology

Sellers failed to push price back below the support zone.

Pullbacks are shallow and corrective, showing weak selling pressure.

Liquidity is being absorbed above former resistance → acceptance at higher prices.

This is a textbook bullish flag / continuation pause.

4. Macro & Financial Drivers

USD Weakness:

Market expectations are shifting toward slower Fed tightening / future easing bias.

Real yields are stabilizing → USD momentum fades.

Safe-Haven & Inflation Hedge Demand:

Ongoing geopolitical uncertainty keeps risk premium priced into gold.

Central bank gold accumulation remains structurally supportive.

Inflation expectations remain sticky → gold retains long-term demand.

➡️ Macro environment continues to favor gold upside, not aggressive selling.

5. Forward Scenarios

Primary Scenario (High Probability):

Short-term pullback into 4,440–4,460

Continuation toward 4,520 → 4,550 zone

Invalidation:

Clean breakdown and acceptance below 4,400 would pause the bullish cycle.

🧠 Final Takeaway

Gold is not overextended it is repricing higher.

EUR/USD Is Not Chasing the TopEUR/USD – 1H

1. Technical Structure

EUR/USD has cleanly bounced from the demand zone (1.1700–1.1720), confirming strong buyer defense.

Price has now broken above the former resistance zone (~1.1755–1.1765), flipping it into short-term support.

The sequence of higher lows + impulsive bullish candles confirms a trend continuation phase, not a mean reversion.

➡️ This is a post-breakout consolidation, not exhaustion.

2. Key Levels

Immediate Support: 1.1750–1.1760 (previous resistance → support)

Major Support: 1.1700

Upside Liquidity / Target: 1.1800–1.1820 (equal highs & resting buy stops)

Price behavior suggests acceptance above the range, which statistically favors continuation.

3. Projection Scenarios

Primary Scenario (High Probability):

Shallow pullback into 1.1755–1.1760

Higher low formation

Expansion toward 1.1800+

Potential liquidity sweep above prior highs

Invalidation:

Acceptance back below 1.1735

Would signal a false breakout → range re-entry

4. Macro & Fundamental Drivers

USD Side Weakness

Markets are increasingly pricing Fed rate cuts in 2025, reducing USD yield attractiveness.

Recent US data shows cooling inflation momentum, limiting further USD upside.

EUR Side Support

ECB remains more cautious on easing, keeping rate differentials from widening further against EUR.

Risk sentiment has improved → capital rotates out of USD safety and into EUR exposure.

➡️ Macro context supports EUR strength, not fights it.

🧠 Final Takeaway

EUR/USD is not overextended it’s transitioning from compression to expansion.

Structure: Bullish

Momentum: Controlled

Macro: Supportive

Liquidity: Above current price

As long as price holds above 1.1750, the bias remains up, with 1.1800–1.1820 acting as the next magnet.

Ethereum Isn’t Pulling Back — It’s Building the LaunchpadETHEREUM (ETHUSD) – 1H

1. Market Structure

ETH remains in a broader bullish structure, with price holding well above the major support zone (~2,760–2,800).

The recent decline from the local high is corrective, not impulsive — showing controlled profit-taking.

Current price is stabilizing around 2,960–2,980, forming a higher low relative to the previous swing.

➡️ This is a bullish pullback inside an uptrend, not a reversal.

2. Key Zones

Support Zone: 2,900–2,940

→ Buyers are actively defending this area.

Resistance Zone: ~3,160

→ This is the next major liquidity target and prior supply zone.

Price is compressing between support and mid-range — a classic pre-expansion structure.

3. Price Path Scenarios

Primary Scenario (Bullish Continuation):

Hold above 2,900

Push back toward 3,040 → 3,100

Final breakout attempt toward 3,160 resistance

If liquidity above 3,160 is taken → continuation toward higher highs

Invalidation Scenario:

Clean acceptance below 2,880

Would open downside toward 2,820–2,780 support

Only then would structure turn neutral

4. Momentum & Context

No signs of aggressive selling or distribution.

Pullback shows overlapping candles, indicating sellers lack conviction.

ETH is still tracking Bitcoin’s range behavior, suggesting synchronized expansion when BTC breaks.

➡️ Market conditions favor patience + positioning, not panic.

🧠 Final Takeaway

Ethereum is not rejecting resistance it’s absorbing it.

Bitcoin Isn’t Weak — It’s Reloading Inside LiquidityBITCOIN (BTCUSD) – 1H

1. Market Structure

BTC is clearly range-bound, trading between a well-defined support zone (~85,100–85,500) and resistance zone (~90,200–90,500).

The recent drop from resistance was impulsive but controlled, stopping cleanly at mid-range support — not a breakdown.

Current candles show stabilization near support, suggesting sellers are losing momentum.

➡️ This is rotation inside a range, not trend failure.

2. Liquidity Logic

The range is acting as a high-liquidity environment:

Buy stops above 90K

Sell liquidity pooled below 86K

Price is likely to sweep liquidity on both sides before committing to direction.

➡️ Sideways markets exist to build fuel, not to trap strong trends.

3. Scenarios Ahead

Primary Scenario (High Probability):

Hold above 85,800–86,200

Rotate higher toward 88,500 → 90,000

Possible liquidity sweep near range highs before decision

Bearish Invalidation:

Acceptance below 85,000

That would open downside toward 83,500–84,000

4. Macro & Financial Context

USD remains mixed, with no decisive strength limiting downside pressure on BTC.

Risk sentiment is neutral, favoring consolidation rather than panic selling.

Spot demand remains steady; no signs of forced deleveraging.

➡️ Macro conditions support compression, not breakdown.

🧠 Final Takeaway

Bitcoin is not breaking down it’s ranging with intent.

Gold Breaks the Channel — Momentum Is Still BuildingGOLD (XAUUSD) – 1H QUICK VIEW

Technical

Clear breakout above ascending channel resistance → bullish continuation signal.

Price holds above EMA34 & EMA89, confirming strong trend control.

Current move = breakout → shallow pullback → potential next impulse.

As long as price stays above the broken trendline, upside bias remains valid.

Key Levels

Immediate support: ~4,450 – 4,430 (retest zone)

Upside extension: 4,520 → 4,580+

Macro / News Context

USD remains under pressure as markets price in future rate cuts.

Real yields stay soft, supporting non-yielding assets like gold.

Ongoing geopolitical tensions & central bank gold accumulation keep demand elevated.

Bias

Buy pullbacks, not breakouts.

Trend remains bullish unless price falls back inside the channel.

Gold Is Not Overbought — This Is a Controlled ExpansionGOLD (XAUUSD) – SHORT ANALYSIS (1H)

Technical

Strong impulsive uptrend with shallow pullbacks → bullish strength.

Price holds well above EMA34 & EMA89 → trend intact.

Previous resistance (~4,430–4,450) flipped into key support.

Current move = impulse → brief consolidation → continuation.

Key Levels

Support: 4,430 – 4,450

Upside continuation: 4,520 → 4,580+

Macro / News Drivers

USD softness and easing real yields support gold.

Ongoing rate-cut expectations keep dip-buying active.

Persistent geopolitical risk & central bank demand underpin bullish bias.

Bias

Buy the pullbacks, not chase highs.

As long as price holds above the new support, trend continuation remains the base case.

EUR/USD Is Resting, Not Reversing.EUR/USD – SHORT & CLEAN ANALYSIS (1H)

Structure

Clear trend shift: break of descending trendline → higher highs & higher lows

Current move = bullish continuation, not exhaustion

Key Zones

Support: 1.1740 – 1.1760 (former resistance + EMA cluster)

Upside target: 1.1800 – 1.1810

Price Action

Pullbacks are shallow → buyers in control

No strong rejection candles → selling pressure weak

Macro Context

USD remains soft as markets expect a slower Fed path into year-end

EUR supported by stable ECB stance and risk-on sentiment

Bias

Bullish

Focus on buy-the-dip above support, avoid chasing tops

EURUSD Is Building MomentumEUR/USD (H1) — MARKET STRUCTURE & TECHNICAL ANALYSIS

1. Market Structure

EURUSD has clearly shifted from consolidation to an intraday bullish structure.

Price formed a base → impulsive leg → higher low

Current structure shows bullish continuation sequencing

No bearish displacement after the last push → trend integrity remains intact

This is trend continuation, not a mean-reversion setup.

2. Key Technical Zones

Support Zone: 1.1740 – 1.1750

→ Previous breakout base & demand zone

→ As long as price holds above this area, buyers remain in control

Mid Resistance / Target: ~1.1800

Upper Target (Open Path): ~1.1820 – 1.1830

Above 1.1800, liquidity opens cleanly with little historical resistance.

3. Price Action Behavior

Pullbacks are shallow and corrective

Each retracement is followed by immediate bullish response

Candles show strong closes near highs, confirming demand absorption

This is classic bullish stair-step price action.

4. Scenario Outlook

Primary Scenario (High Probability):

Short-term pullback toward 1.1765–1.1770

Continuation toward 1.1800 target

Minor consolidation → breakout toward 1.1820+ (open liquidity)

Invalidation:

Strong H1 close below the support zone

Acceptance below 1.1740 would pause the bullish sequence

Until that happens, bias remains bullish.

5. Market Context

USD remains soft-to-neutral

No immediate high-impact USD news forcing risk-off behavior

EUR strength aligns with intraday risk-on flows

This supports trend-following long positions, not counter-trend shorts.

Conclusion

EURUSD is not topping it is preparing.

Trend: Bullish

Structure: Higher high – higher low

Strategy: Buy pullbacks above support, avoid chasing highs

The chart is offering structure, momentum, and clean targets discipline now matters more than prediction.

Bitcoin Is Not Trending — This Is a Liquidity RangeBTC/USD (H1) — MARKET STRUCTURE ANALYSIS

1. Market State: Range-Bound, Not Trending

Bitcoin is currently trading inside a well-defined sideways range, bounded by a clear resistance zone above and a support base below. Price action confirms range rotation, not a directional trend.

Repeated rejections from the upper resistance zone

Multiple bounces from the same support area

No sustained impulsive follow-through beyond the range

This behavior signals liquidity accumulation, not trend continuation.

2. Moving Averages & Structure

EMA34 and EMA89 are flat and intertwined, confirming a non-trending environment.

Price oscillates around the MA cluster → classic consolidation signature.

The latest pullback returned price to range support, where buyers are reacting.

As long as price remains trapped between these boundaries, mean-reversion dominates.

3. Price Action Behavior

High wicks near resistance → aggressive sell-side defense

Strong reactions at support → demand absorption

Expansion attempts are repeatedly faded

This is textbook institutional range control, where liquidity is built on both sides before a decisive move.

4. Scenarios Ahead

Primary Scenario (High Probability):

Continued oscillation between support and resistance

False breaks to collect liquidity

Compression builds toward a future expansion

Breakout Scenario (Confirmation Required):

A clean H1 close above the resistance zone, followed by acceptance

Only then does upside continuation toward the next major liquidity zone become valid

Bearish Breakdown Scenario:

A decisive breakdown below support with strong volume

This would open a deeper corrective leg toward lower demand zones

5. Trading Logic

Avoid trend-chasing inside the range

Favor reaction-based trades at extremes

Patience is key until the market reveals direction

Conclusion

Bitcoin is not weak and not strong either. It is controlled, balanced, and preparing.

This range is a decision zone, and the real opportunity will come after price commits outside of it.

Until then, discipline and structural awareness outperform prediction.

Gold Is Not Overextended — This Is Wyckoff Markup in ProgressXAUUSD (H1) — MARKET ANALYSIS

1. Market Structure (Wyckoff Context)

Gold has clearly completed a Wyckoff accumulation cycle and is now operating inside a confirmed Markup Phase.

Phase A: Selling pressure was absorbed, volatility expanded, and downside momentum was halted.

Phase B: Price transitioned into a broad consolidation, where supply was systematically absorbed while holding above key moving averages.

ST in Phase B: The final liquidity test confirmed strong demand.

Current State: Price has broken out decisively and is now in trend continuation, not distribution.

This structure validates that the current rally is institutionally driven, not a retail spike.

2. Trend & Moving Averages

Price is trading well above EMA34 and EMA89, both sloping upward.

Pullbacks remain shallow and corrective → no structural damage.

Each retracement forms higher lows, confirming trend strength.

As long as price remains above the rising EMA cluster, trend control stays with buyers.

3. Price Action Behavior

Strong impulsive legs followed by brief consolidations.

No aggressive rejection candles at highs → buyers remain active.

The current pause near 4,480–4,500 is bullish digestion, not exhaustion.

This is classic trend continuation behavior, where the market pauses to absorb supply before the next expansion.

4. Key Levels

Immediate Support: 4,350 – 4,380 (previous resistance turned support)

Structural Support: 4,260 – 4,280

Upside Target Zone: 4,530 – 4,560

A controlled pullback into support followed by continuation would be the highest-probability scenario.

5. Forward Scenario (Preferred)

Short-term consolidation or shallow pullback

Higher low formation above 4,380

Continuation toward 4,530+, as projected on the chart

Only a decisive breakdown below 4,260 would invalidate the bullish structure — currently low probability.

Conclusion

Gold is not peaking it is executing a textbook Wyckoff markup phase. The trend remains clean, momentum is controlled, and pullbacks are opportunities, not warnings.

Gold Isn’t Chasing Price — It’s Following a Macro Cycle GOLD (XAUUSD) – H1 | Cycle-Based + Macro Analysis

1. Market Cycle Structure

Gold is moving inside a clean ascending channel, confirming a healthy bull cycle, not an exhaustion phase.

Each impulse leg is followed by controlled pullbacks that stay above prior structure.

No aggressive rejection at highs → acceptance near the upper channel, which is bullish.

This is a trend-continuation cycle, not a blow-off top.

2. EMA Behavior (Trend Validation)

EMA 34 & EMA 89 are stacked bullish and sloping upward.

Price consistently reclaims EMA 34 after shallow pullbacks.

This indicates institutional trend participation, not retail-driven spikes.

➡️ As long as price holds above EMA 34 on pullbacks, the cycle remains intact.

3. Price Action Logic (Cycle Progression)

The current structure shows:

Impulse → flag → impulse

No lower low printed inside the channel

Pullbacks are time-based, not price-based (sideways instead of deep drops)

This behavior typically precedes:

An expansion leg toward the upper channel boundary → new ATH attempt

4. Macro Context (Why Gold Keeps Rising)

Gold’s cycle is supported by macro tailwinds, not speculation:

Real yields remain under pressure → bullish for non-yielding assets

Central banks continue net gold accumulation

USD strength is no longer suppressing gold aggressively

Risk hedging demand remains elevated globally

➡️ This is structural demand, not short-term fear buying.

5. Outlook & Scenario

Primary Scenario (High Probability):

Shallow consolidation near current highs

Brief pullback toward channel midline / EMA support

Continuation breakout toward the upper channel → new ATH zone

Invalidation:

Only a clean break and hold below the channel + EMA 89 would break the cycle

Until then, dips are buy-the-structure, not sell signals

🧠 Final Takeaway

Gold is not overextended.

It is cycling higher in a controlled institutional trend, and price behavior strongly suggests new highs are a matter of timing, not direction.

Gold Is Not Topping — It’s Loading for $4,500XAUUSD – H1 Analysis

Market Structure:

Gold is maintaining a strong bullish structure, consolidating tightly below the previous high. This is a classic continuation setup, not a distribution phase.

Key Zones:

- Resistance Zone: The former high area has now been tested and absorbed. Price acceptance above this zone signals strength.

- Support Zone: Buyers continue to defend the higher support band, confirming higher lows and trend control.

Price Action Insight:

Sideways movement under resistance = bullish consolidation.

No aggressive sell-off after breakout → sellers are weak.

Volume remains stable, suggesting institutional accumulation rather than exhaustion.

Primary Scenario:

A brief pullback to retest the breakout zone, followed by continuation toward new highs, with $4,500 as the next psychological magnet.

Risk Scenario:

Only a strong breakdown back below the consolidation range would invalidate the bullish bias.

Conclusion:

Gold is building energy above key levels. As long as price holds above support, dips are opportunities the trend favors continuation, not reversal.

Bitcoin Isn’t Stuck — It’s Trapping Liquidity BTCUSD – H1 Technical Analysis

Market Structure:

Bitcoin is trading inside a high-liquidity range, holding firmly above the key support zone. The sharp rejection from support followed by strong recovery confirms buyers are still in control.

Key Levels:

Support Zone: ~85,200 — aggressively defended, forming a solid base.

Liquidity Range: 86,800 – 89,500 — price is compressing here to absorb orders.

Resistance Zone: ~90,500 — the next major breakout trigger.

Price Action Insight:

Sideways movement after a strong bounce = accumulation, not weakness.

Higher lows inside the range indicate building bullish pressure.

No heavy selling despite repeated tests → supply is being absorbed.

Primary Scenario:

Continuation toward the 90,500 resistance, followed by a breakout targeting new highs above 91,000 once liquidity is cleared.

Invalidation:

Only a clean breakdown and acceptance below 85,200 would shift the bias bearish.

Conclusion:

Bitcoin is not ranging randomly it is coiling. As long as support holds, the path of least resistance remains upward.

ETH Is Compressing — Breakout or Another Trap?ETH/USD – H1 Analysis

Market Structure:

ETH is moving sideways after a strong recovery from the lower support zone. Price is now compressing just below a key resistance band, signaling indecision and liquidity build-up.

Key Levels:

Resistance: The upper red zone is the main barrier. Multiple rejections here confirm heavy supply.

Support: The green support zone below remains intact and continues to attract buyers on pullbacks.

Price Action Insight:

Sideways movement under resistance = accumulation, not weakness.

Higher lows are forming, showing buyers are gradually gaining control.

This structure often precedes a sharp expansion move.

Primary Scenario:

A clean break and hold above resistance opens the path toward the higher resistance zone above.

Alternative Scenario:

Failure to break may trigger a pullback toward support to reset momentum before the next attempt.

Conclusion:

ETH is in a decision zone. Stay patient wait for confirmation. The next move is likely to be fast and directional.

BTC Is Absorbing Supply — The Breakout Is Being EngineeredBTCUSD (H1) — MARKET ANALYSIS

1. Market Structure

- Bitcoin is currently trading inside a well-defined range, bounded by a strong support zone around 85,100 – 85,800 and a major resistance zone near 90,200 – 90,600. After the sharp rejection from support, price has shifted into a higher low structure, indicating that buyers are gradually regaining control.

This is no longer panic selling it is structured accumulation.

2. Price Behavior & Order Flow

Multiple re-tests of the resistance zone without aggressive rejection show sell pressure is weakening.

Each pullback is being bought higher than the previous one → classic demand absorption.

Volatility compression inside the range suggests the market is preparing for expansion, not continuation sideways.

3. Key Zones

Support Zone: 85,100 – 85,800

→ Strong demand base where liquidity has already been cleared.

Mid-Range Pivot: ~87,800 – 88,000

→ Acceptance above this level keeps bullish structure intact.

Resistance Zone: 90,200 – 90,600

→ Break & hold above confirms trend continuation.

Invalidation: Strong H1 close below 85,000.

4. Primary Scenario (High Probability)

- Continued consolidation above mid-range support

- Formation of higher lows

- Breakout above the resistance zone

- Momentum expansion toward 92,000 – 94,000

This matches the breakout projection drawn on the chart: pullback → continuation → expansion.

5. Alternative Scenario (Lower Probability)

Rejection at resistance

Short-term pullback toward 87,500 – 88,000

As long as price holds above support, this remains a bullish re-accumulation, not a reversal.

Conclusion

BTC is not hesitating it is absorbing supply under resistance. This type of structure typically precedes a clean breakout, not a breakdown. Traders chasing emotions will get trapped; traders respecting structure will be positioned ahead of the move.

The market is not asking if it will break only when.

ETH Is Holding the Line —Consolidation Before the Expansion MoveETHUSD (H1) — MARKET ANALYSIS

1. Market Structure

Ethereum has successfully reversed the previous downtrend after breaking the descending trendline and reclaiming structure above the key support zone (~2,760–2,800). Since that breakout, price has transitioned into a range-to-accumulation structure, forming higher lows and holding above the mid-range equilibrium.

This is no longer a corrective bounce it is trend repair in progress.

2. Price Action & Behavior

Strong impulsive leg from the support zone confirms aggressive demand entry.

Current price is consolidating around 3,000–3,040, showing acceptance rather than rejection.

Pullbacks are shallow and controlled → no panic selling, supply is being absorbed.

This type of sideways price action after an impulse typically precedes continuation, not reversal.

3. Key Zones

Major Support Zone: 2,760 – 2,800

→ Structural base; as long as price holds above, bullish bias remains valid.

Mid-Range Acceptance: 2,980 – 3,020

→ Holding above this zone keeps momentum intact.

Resistance Zone: 3,150 – 3,170

→ Liquidity target and decision zone for the next expansion.

Invalidation: Clean H1 close back below 2,900.

4. Primary Scenario (Preferred)

Short-term pullback / consolidation above 3,000

Higher low formation

Expansion toward 3,100 → 3,160 resistance zone

If resistance is absorbed, continuation toward higher highs follows.

The projected path on the chart reflects this logic: pullback → continuation → breakout attempt.

5. Alternative Scenario (Lower Probability)

Failure to hold 3,000

Deeper pullback toward 2,920–2,950

Still considered re-accumulation, unless support is decisively broken.

Conclusion

ETH is not topping it is building energy above reclaimed structure. The market is respecting support, absorbing supply, and compressing volatility beneath resistance. This behavior strongly favors an upside continuation, not a reversal.

Patience here is key the move is being prepared, not rushed.

BTC Isn’t Breaking Out — It’s Hunting LiquidityBTC/USD – 1H Quick Read

Bitcoin remains trapped inside a defined range between support and resistance. Price is holding near the range mid, showing balance, not momentum.

Repeated wicks at both extremes confirm liquidity sweeps, not trend acceptance. Buyers defend support aggressively, but upside attempts still lack follow-through.

Key Points

Range market = rotation, not trend

Breakouts are faded, pullbacks are absorbed

Liquidity is prioritized over direction

Outlook

Expect continued chop and false moves until BTC clearly accepts above resistance or loses support.

Bottom Line

No breakout yet.

Trade the range wait for confirmation for direction.

Bitcoin Is Being Absorbed, Not RejectedBITCOIN (BTCUSD)

Technical Structure

Price is compressed inside a well-defined sideways range, capped by the resistance band above.

Multiple failed breakdowns into support confirm strong demand absorption.

Short-term EMAs are flattening and curling up, signaling balance shifting toward buyers.

This is range trading with accumulation characteristics, not distribution.

A clean hold above support keeps the structure constructive; expansion only comes with acceptance above resistance.

Market Logic

Repeated wicks and rotations inside the box indicate liquidity being built, not trend exhaustion.

Volatility is contracting → energy is being stored, not released yet.

The projected path suggests range continuation first, then directional expansion once liquidity is cleared.

Macro Backdrop

No aggressive USD or yield shock at the moment → macro pressure is neutral.

Risk assets are in wait-and-see mode, aligning with BTC’s compression behavior.

Takeaway

This is a patience market.

Edge appears at range extremes or on a confirmed breakout, not in the middle.

Bitcoin is preparing direction comes after liquidity is fully harvested, not before.