THE - BULLISH TSX:THE - My medium term outlook is playing well! 📈

Daily momentum is shifting! - Solid & clean uptrend reversal! 📈

It can be an ascending accumulation here before to see a big move toward following levels:

🎯0.2450

🎯0.2550

🎯0.2730

🎯0.2940

Daily uptrend might keep supporting prices📈

#trading #the

The

THE Analysis (1H)Considering that THE is currently accumulating liquidity and approaching the supply zone, we can look for sell / short positions in this area.

The targets are marked on the chart.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

THEUSDT UPDATE#THE

UPDATE

THE Technical Setup

Pattern: Bullish Falling Wedge Pattern

Current Price: $0.1779

Target Price: $0.298

Target % Gain: 65.80%

TSX:THE is breaking out of a falling wedge pattern on the 1D timeframe. Current price is $0.1779 with a target near $0.298, showing nearly 66% upside potential. The breakout confirms bullish momentum with structure favoring continuation. Always use proper risk management.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

THEUSDT Forming Falling WedgeTHEUSDT is currently displaying a falling wedge pattern, which is one of the strongest bullish reversal signals in technical analysis. After a prolonged downtrend, the price has started to compress within converging trendlines, suggesting that selling pressure is weakening and buyers are preparing to step back in. This setup often precedes a strong upward breakout, making THEUSDT an attractive opportunity for traders closely watching the charts.

The trading volume remains solid, which adds weight to the bullish outlook. When volume holds up during consolidation phases, it indicates that market participants are actively positioning themselves for the next move. If THEUSDT successfully breaks out of this wedge formation, a sharp rally could follow, with an expected gain in the range of 80% to 90%+. Such moves are usually backed by both technical confirmation and renewed market sentiment.

Investor interest in this project continues to rise, with more participants recognizing the potential upside in this setup. The combination of a bullish wedge formation, good liquidity, and improving sentiment provides a favorable environment for a significant breakout. Traders should keep an eye on key resistance levels, as surpassing them could unlock strong bullish momentum in the coming sessions.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Ethena ENA Coin Price Prediction and Technical AnalysisTHE/USDT just broke out strongly from the 0.3594 resistance zone, surging toward the 0.4287 area before facing rejection. The breakout highlights renewed bullish momentum after a long consolidation. If buyers defend 0.3594 on a retest, continuation toward the 0.4640 resistance is likely. However, if the level fails, price could dip back into the 0.3223 demand zone before attempting another leg higher.

📈 Key Levels:

Buy trigger: Retest/hold above 0.3594 support

Buy zone: 0.3223 – 0.3594 region

Target 1: 0.4287 resistance (recent high)

Target 2: 0.4640 resistance

Invalidation: Daily close below 0.3223 (would weaken bullish structure)

👉 Follow me for More Real Time Opportunities.

Share your Thoughts if you have any?

Bullish on THEUSDTTHE is a hidden gem. It has retraced 95% from ATH and did a nice first pump in July. Volume is coming in and we can expect a further growth as soon as we break out this triangle - above EMAs and a high volume node as a backup. This is your chance for a 5x Spot trade in next weeks / months.

For more trade ideas check and insights check our profile.

Disclamer: only entertaining purpose, no financial advice - trading is risky.

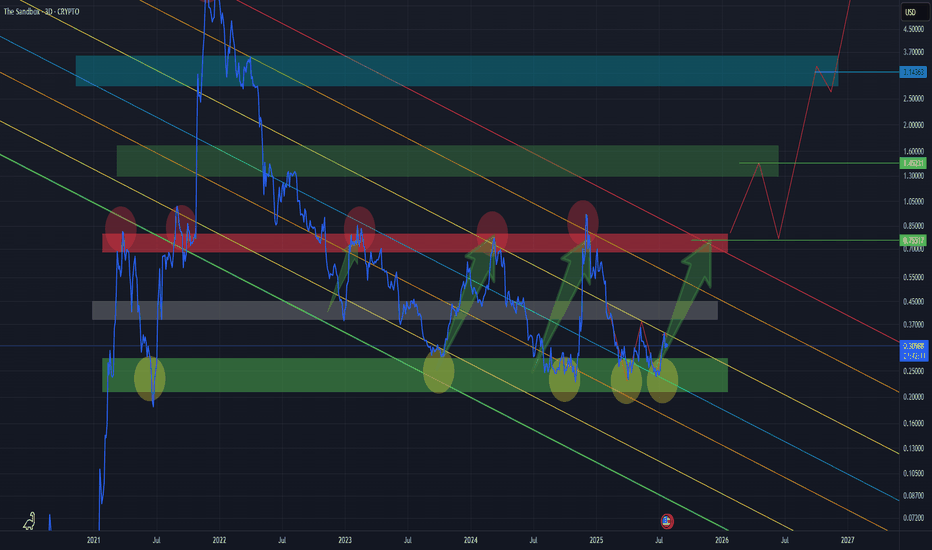

THE SANDBOX mid - to long - termThis might seem obvious to some, but it’s worth emphasizing —

📌 When analyzing charts like this, switch to a Line Chart instead of Candlesticks.

Why?

It filters out market noise and shake-outs

You can clearly see how price respects key zones and levels

Candles often distort the picture with wicks — line charts show the real body movement

Bullish Setup:

Market has printed a clean W-bottom, confirming bullish intent.

We are currently retesting the neckline of the pattern — a common and healthy move before continuation.

A successful retest could lead to an impulsive move upward toward target zones.

🎯 Target Zones:

Green zone (top) — this is the maximum target in the current structure.

Anything above the red line already carries increased risk, and should be approached with caution.

Above green zone = extreme risk / high-probability rejection unless backed by strong fundamentals.

Thena: Hold Until The End (1,337% Profits Potential)Which one will you take? Endless opportunities the Cryptocurrency market has to offer; which one will you take?

Doesn't need to be just one can be many. You can choose many pairs to trade.

Countless opportunities are available now and these will be generating huge profits in the coming days.

The first burst forward will produce 100%, in 1-3 days. And this will be followed by sustained long-term growth. It will grow so much and for so long, that you will become bored. It won't be exciting anymore... Until the correction of course.

Thena here has more than 1,000% potential for growth. Right now this pair, THEUSDT, is sitting on a higher low or double-bottom, in this case it is the same.

This is the same pattern produced by Ravencoin, remember?

That project that grew more than 150% in a single day. "Altcoins Market Bull Market Confirmed, Ravencoin." And it is true, watch everything grow.

This same pattern is present on so many altcoins, not all of them but many and we know exactly what will happen next because what one does, the rest follows.

THEUSDT is about to go bullish, can take a few weeks or less, a few days.

When the bullish wave starts it will go for months, months of sustained growth. You simply hold until the end.

Thank you for reading.

Namaste.

Thena Ready To Move Now! Strong Short- & Long-Term (1,155% PP)I don't like to post the same charts because there are just too many options and we cannot even get close to looking at all those, specially with a limit of only ten post per day. But, with that said, here we have Thena again, THEUSDT, why? Because it is ready to move and a great time-based opportunity only comes around so often.

When it comes to Cryptocurrencies opportunities are endless is true, but some tend to move faster than others and this one looks good. It looks good short-term and has huge potential also long-term. So good on all sides. Risk is very low. We have a classic local higher low and the stage is set, the world is ready; watch it grow.

Nothing is pointing down. Everything is pointing up.

No plan, no strategy, no complexities... Just buy and hold.

Namaste.

NO.1 MEME COIN ON KASPA IS NACHO THE KAT - DYORThe chart shows a symmetrical triangle pattern forming after a falling wedge. A falling wedge is typically seen as a bullish reversal pattern, indicating that the price may break out to the upside after the convergence of the trendlines. The symmetrical triangle, which is forming after the falling wedge, suggests consolidation before the breakout, likely pointing towards higher price action.

Key Points

Price Action and Trend:

NACHO has been in a downtrend, creating a falling wedge. The falling wedge has converging trendlines, which is a common setup for a bullish breakout.

Currently, the price is consolidating within a symmetrical triangle pattern, with lower highs and higher lows, indicating indecision in the market. The breakout from this triangle is likely to be significant, either continuing the previous downtrend or initiating a bullish reversal.

Volume Analysis:

The volume profile at the bottom shows an increase in volume as the price approaches the apex of the symmetrical triangle, suggesting potential strength behind the breakout.

It's important to monitor if volume increases further upon breakout to confirm the strength of the move.

Key Indicators:

RSI (Relative Strength Index): The RSI is currently around 50.39, suggesting a neutral market sentiment. The RSI has been ranging between oversold and overbought territories, which indicates that NACHO has not yet entered a strong trend but may be preparing for one.

Stochastic RSI: The Stochastic RSI is hovering around 37.57, showing a neutral stance, but it is closer to the oversold region, which could indicate that NACHO is near a potential reversal.

Money Flow Index (MFI): The MFI is at 35, indicating that the market is not yet in a strong buying or selling pressure zone. This shows that there is room for price movement based on volume.

VMC Cipher B Divergences: Positive divergence could suggest bullish momentum emerging, even if the price remains in consolidation.

Target and Resistance Levels:

If NACHO breaks out to the upside from the symmetrical triangle, the target is likely near the upper trendline of the wedge, which aligns with previous highs, possibly reaching the 0.00004500-0.00005000 USDT range.

Immediate resistance is near the 0.00004300 price level.

Support levels to watch are 0.00003000 and 0.00002000, which are key levels from previous price action.

Trading Plan

Entry Strategy:

Breakout Strategy: A strong breakout above the upper trendline of the symmetrical triangle would be a potential buy signal. If the price breaks and closes above 0.00004200, consider entering a long position with a target at 0.00004500-0.00005000.

Volume Confirmation: Ensure that the breakout is accompanied by an increase in volume. A low-volume breakout could be a false signal.

Stop-Loss Strategy:

Initial Stop-Loss: Place a stop-loss just below the symmetrical triangle's lower trendline or 0.00003000. This provides a reasonable distance to avoid being stopped out on small fluctuations.

Trailing Stop: As the price moves up towards your target, consider adjusting your stop-loss to lock in profits, especially if the price exceeds the 0.00004300 resistance level.

Take-Profit Strategy:

First Profit Target: Set a take-profit order around 0.00004500, the first resistance level. This is a key point based on the historical price action and previous swing highs.

Secondary Target: If the price breaks past 0.00004500, adjust the target to 0.00005000, which is the next logical resistance zone.

Risk Management:

Position Sizing: Risk no more than 1-2% of your total capital on this trade. For example, if your trading account is $5,000, you should risk no more than $100-$150 per trade.

Risk-Reward Ratio: Aim for a minimum 2:1 risk-to-reward ratio. For example, if you risk $150 on a trade, aim for a potential reward of $300 or more.

Additional Considerations:

Market Sentiment: As NACHO is a meme coin, market sentiment plays a huge role. Watch for social media trends and any news related to meme coins or Kaspa-based coins that could drive the price action.

Macro Conditions: Stay updated on the general market conditions for cryptocurrencies, as a broader downtrend in the market could limit the upside potential, even if technicals suggest a breakout.

NACHO THE KAT presents a technical setup with the potential for an upward move following a breakout from the symmetrical triangle. A close watch on volume and key price levels will be critical for confirming the breakout and determining the right moment for entry.

bASED ON THE SCIENTIFICALLY PROVEN NUMBER KNOWN AS FIVE (5) Now, don't blame me if this financial advice works. It is highly scientific and has a record of generating a staggering amount of wealth to the most undeserving of individuals leaving them in a drunken stuppor and awash in a really indecent amount cash. I want no part of this.

You would be far better off getting yourself a nice girlfriend who owns sensible shoes and has an interest in sheep farming rather then leading the crypto life.

See you in 5 months and bring cash.

wmw

Thena: Simply Bullish (555% Potential)It is no longer necessary to proof that the bottom is in for the Altcoins market, this is clearly confirmed as it happened a while ago, more than three weeks ago.

Here, on the THEUSDT (Thena) chart, it can be seen as a low hit 3-February. With a higher low hit Tuesday (25-Feb), this pair is turning green.

This is easy, simple but bullish.

The blue line on the chart marks the downtrend. A descending trendline. As soon as the action moves above this line the downtrend is confirmed broken. The market bias changes from bearish to bullish. THEUSDT is now in the bullish zone with bullish potential. The higher low reinforces this notion/signal.

Notice how after the 12-February bullish breakout there are three reactions on the same down-trendline that was once a strong resistance. Resistance turned support. This trendline was tested and it holds. Now that it holds prices can easily move up. It is still early though.

Another signal comes from the 0.148 Fib. extension level. The action is moving above this level today. A close above this level further strengthens a bullish case.

Finally, we have EMA13, the orange line on the chart. Once the day closes above it bullish tendencies are confirmed. Simple, yet bullish.

We have two targets mainly based on the short- and mid-term. One target goes for 325% and the next one goes for 555%.

Patience is key.

Buy and hold.

The Altcoins market is bullish now.

Thank you for reading.

Namaste.

New Thena project from Binance!Thena reminds me of Lista, which was also made for pumping Binance bags. So far it's only 130 million capitalization, but knowing Binance, it will easily grow into 1 billion! I expect a Thena partnership with one of the market makers soon. So far, I haven't detected any MM presence... TVL is also good, I would expect a price around 7$ per coin, this just correlates with the thought of 1 billion, and also technically fits well with the chart technicals.

Horban Brothers.

Thena ($THE): A Rising Star in BNB Chain's DeFi EcosystemIn the dynamic world of decentralized finance (DeFi), Thena ( TSX:THE ) has emerged as a notable player on the BNB Chain, showcasing remarkable growth and innovation. With a recent surge that has seen its value increase by approximately 1774% over the past week, Thena is not just a token to watch but a case study in the power of well-executed DeFi strategies and market dynamics.

Innovative Liquidity Model

Thena introduces the ve(3,3) model, a novel approach within its Liquidity Marketplace, allowing DeFi protocols to influence liquidity through voting on reward distributions. This system incentivizes liquidity providers by enabling them to earn TSX:THE tokens, thereby fostering a healthier liquidity environment. This strategic use of tokenomics has been pivotal in attracting significant Total Value Locked (TVL) to the platform. (www.dai.com)

Strategic Positioning

Positioned as the native liquidity layer for the BNB Chain, Thena is not just a DEX but a fundamental infrastructure provider. Its integration with major DeFi activities and its offerings of both spot and perpetual trading options have made it an essential part of the ecosystem. This broad scope enhances its utility and relevance in the market, potentially leading to sustained growth if the BNB Chain continues to expand.

Market Sentiment and Airdrop Impact

Recent listings on major exchanges like Binance have significantly boosted TSX:THE 's visibility and market cap. The enthusiasm was further amplified by an airdrop event for BNB holders, which not only increased its circulation but also community engagement. The market's reaction was immediate, with a price surge reflecting strong investor interest and speculative buying driven by these developments.

Technical Analysis

Thena's price has experienced an unprecedented rise, with a 24-hour increase of 37.68% and a weekly surge of 1774%. This makes TSX:THE the standout performer in the crypto landscape over this period. The coin's current market cap stands at $275,197,639 USD, with a circulating supply of 78,124,682 THE coins, indicating robust market participation.

With an RSI (Relative Strength Index) of 77 it suggests that Thena might be in overbought territory, hinting at a possible near-term correction. Investors should be cautious as this indicator often precedes a price retreat, providing a potential entry point for those who missed the initial surge.

Volume and Market Dynamics

With a 24-hour trading volume of over $2 billion, Thena's liquidity and market interest are undeniable. Such volume supports the price action and indicates strong trader engagement, which is critical for maintaining price levels and reducing volatility spikes

Investment Considerations

The innovative liquidity management strategies and its integral role in the BNB Chain ecosystem provide Thena with a strong foundation for growth. For investors looking at long-term potential, these fundamentals suggest a platform with significant utility and staying power.

The current hype and price momentum could lead to further partnerships and integrations, enhancing Thena's offerings and increasing its adoption rate.

Risks:

The high RSI indicates immediate risk of a correction, which could be sharp given the recent rapid ascent. also, the crypto market's volatility means that even fundamentally strong projects can experience significant price drops due to broader market sentiment or regulatory news.

The competition within the DeFi space on BNB Chain is fierce, and sustaining growth amidst new entrants will require continuous innovation and community engagement.

Conclusion

With all cryptocurrencies, potential investors should approach with caution, considering both the technical indicators suggesting a potential correction and the fundamental strengths that could lead to long-term value creation. As the market evolves, keeping an eye on how Thena adapts to changing conditions will be key for those looking to leverage its current momentum.

TLong