Major Reversal Setup: Gartley's "3 Drives" Top Completes on Dow⚠️ WARNING: Gartley's "3 Drives" Top Signals a Major Dow Reversal

A significant and historically reliable technical pattern appears to be completing on the Dow Jones (YM) futures chart. This development warrants a closer look for its potential implications on market structure.

🔍 The Pattern in Focus

The chart exhibits the hallmarks of a "Three Drives to a Top" formation—a pattern documented by technical analyst H.M. Gartley. It is characterized by three successive price advances, each culminating at a higher high.

The critical detail, however, is found within each advance: the presence of nested ABCD corrective structures .

⚖️ Key Interpretation

This internal patterning suggests the upward momentum is becoming increasingly labored .

Rather than indicating strength, such nested corrections typically point to trend exhaustion as buying pressure fractures on the final ascent.

⚡ Potential Implications

The completion of this multi-wave pattern at a historic market high elevates its significance. Patterns of this scale do not generally precede minor retracements. Instead, they can mark zones conducive to a potential structural reversal , signaling a shift in the prevailing trend dynamics.

This technical observation is based on the study of classical chart patterns and Fibonacci ratio analysis, methodologies prominently used and taught by veteran technical analyst Larry Pesavento.

Three Drives

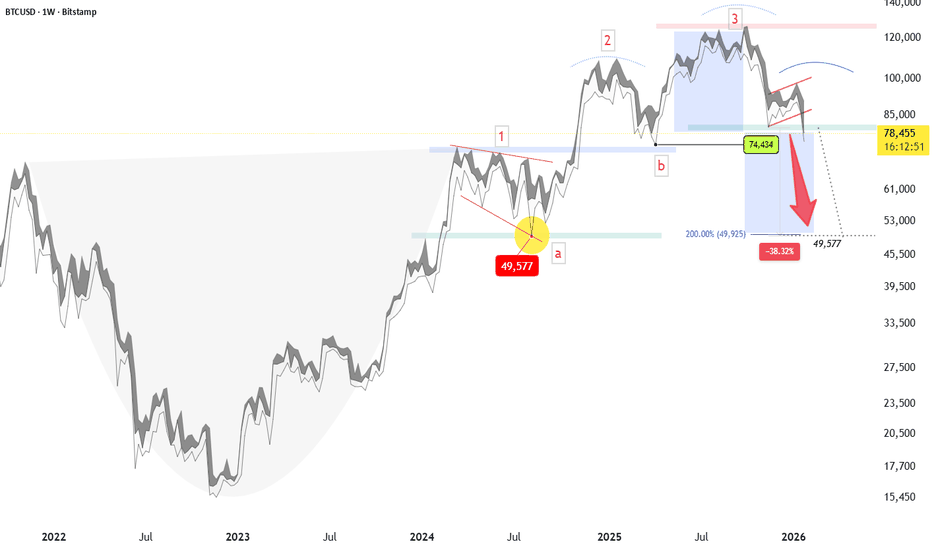

BTCUSD: Neckline at $74,434 Under Pressure3 Drive s target aligns with confirmed Head & Shoulders risk

BITSTAMP:BTCUSD

BITSTAMP:BTCUSD has completed the right shoulder of the Head & Shoulders structure, and price is actively pressuring the neckline at $74,434.

At the same time, the 3 Drives reversal pattern remains fully valid, with its default harmonic target at $49,577.

This is no longer a premature structure.

We now have two independent reversal patterns pointing to the same downside target zone.

Technical state:

Head & Shoulders → confirmed structure, neckline: $74,434

3 Drives → confirmed, target: $49,577

Safe Trades,

André Cardoso

GBPNZD: One Swing Entry With One Swing TargetDear Traders,

I hope you’re doing well. We have a fantastic opportunity coming up where the price could move up in an impulse pattern. This trading setup requires just one entry and one swing target but you might also consider using intraday take profit zones.

Like and comment on this post, also please follow us. This will encourage us to share more trading setups!

Team Setupsfx_

Before DOW 50K Happens (DJI long call for holders)Remember the future. Beware of the past. This time it's different. That's all.

I recommend studying Richard Wyckoff Stock Trading Technique, but not Tape Reading because that information is past its prime, in my opinion ;)

There's nothing left but upward ascent for humanity in my view. This is to do with spiritual reasons that many of us traders are privy to in our inner circles.

This chart is directed guidance towards the g20 group and the G7 group of Countries we call Home on Earth protectors.

We use capitalization as necessary to achieve the desired effect, affect, or required attribute enrichment in order to AVOID City 17, and not have to go back to the old ways of fearing totalitarian rule.

I posit that Donald Trump, The President of the United States of America, will eventually reply to my Christmas letter from 1993 and finish Home Alone 3, but I degress.

Some of us write letters. This is one such letter to the public; I used to write letters to Bill Gates on an IBM PS2, if you know your stuff.

This is my final chart, at least for a while. I always say something like that when I post a grand prediction like this one.

I bid you all well, and hope you find fruitfulness in your future life endeavors.

BLUEDOG OUT

TSLA 3-Drive & ABCD Pattern – Path to $500 Before a PullbackThis chart highlights multiple harmonic and Elliott structures aligning for a potential bullish extension in Tesla (TSLA). A well-defined ABCD pattern and 3-Drive pattern suggest momentum building toward the $500 zone, supported by Fibonacci projections and channel resistance.

The current wave structure points to an imminent 5-wave advance, likely completing the “Drive 3” and pattern D confluence area near $500–505. Following that move, a corrective pullback (ABC) is anticipated, possibly retesting prior support near $440–400.

Key elements featured:

ABCD completion zone: around $500

3-Drive pattern: confirming exhaustion at upper trendline

Elliott 5-wave projection: short-term bullish continuation

Possible corrective phase: after the final wave up

📈 Watching for confirmation of Wave iii and potential exhaustion signals near $500 before considering downside setups.

Watch out for 3 drives patternWith the last two retracements to the 0.618 and a perfect touch of the 0.272, we currently have an ideal setup for a potential three drives pattern.

If it hits the final 0.272, it will coincide with CME_MINI:ES1! reaching new all-time highs before reversing for a possible 150-point drop.

Let's see how it evolves.

Bitcoin: A 3 Drives Pattern Signals a Potential Market ReversalBITSTAMP:BTCUSD

Bitcoin’s continues to capture the attention as it unfolds into a potentially critical technical formation. The chart suggests that a 3 Drives Pattern — a classic reversal structure — is taking shape, suggesting that the current bullish cycle may be approaching exhaustion. If this pattern completes, the projected move could lead Bitcoin down toward the $50,000 region, implying a 50% price correction from current levels.

This pattern is strengthened by bearish divergences on the Relative Strength Index (RSI), which reveal a gradual weakening of buying momentum even as prices have continued to set new highs. Such divergence often precedes significant retracements, signaling that the underlying strength of the uptrend may be fading.

A clearer confirmation of short-term weakness emerges through a double top formation, with its neckline currently being tested around $107,270 . A confirmed breakdown below this level would favor a correction of roughly 14% , targeting the $93,000 zone.

This move could mark the early stage of a broader bearish sequence consistent with the 3 Drives Pattern, potentially setting the tone for a larger downside continuation.

The convergence of these multiple signals — the 3 Drives Pattern, the double top, and the RSI divergence — collectively reinforces the notion that bullish momentum is fading and that the market may be transitioning into a reversal phase.

Happy Trading,

André

Orionchain24: Arbitrum Stablecoin Supply Hits $5 Billion in 2025In the dynamic Layer-2 landscape of October 2025, Arbitrum has achieved a significant milestone, with its stablecoin supply exceeding $5 billion for the first time, reflecting a 3.92% weekly gain and 1.93% monthly increase. This surge, led by USDC’s 55.65% dominance and $381 million in weekly inflows, underscores Arbitrum’s growing role as a stablecoin hub, outpacing Ethereum in key metrics. With $3.436 billion in on-chain stablecoins and TVL crossing $2.5 billion, Arbitrum now holds 2.6% of the global $249.8 billion stablecoin supply. Orionchain24, a leading analytics platform for crypto and forex trading, analyzes this breakthrough, offering traders actionable insights and strategies. In October 2025, we empower clients to capitalize on Arbitrum’s stablecoin boom, minimizing risks through licensing and audits. Join Orionchain24 to leverage the Arbitrum stablecoin supply milestone 2025 and trade with confidence.

The $5 Billion Milestone: Arbitrum’s Stablecoin Dominance

Arbitrum’s stablecoin supply reached $5 billion, with on-chain holdings at $3.436 billion, up $129.69 million weekly. USDC dominates with 55.65% share, accounting for 60.53% of volume, while Arbitrum captured $381 million in inflows, surpassing Ethereum’s $374 million outflows. This positions Arbitrum with 2.6% of the global $249.8 billion stablecoin supply, a rise from $6.8 billion earlier, driven by 3.92% weekly and 1.93% monthly growth.

Key facts: Arbitrum’s TVL hit $2.5 billion, with stablecoin market cap at $3.436 billion. Ethereum regained 69% of new issuances, but Arbitrum’s rollup structure enables cheaper transactions, attracting $249.8 billion in stablecoins. Lending protocols exceeded $1 billion in supply post-expansion, while quarterly GDP data is now published on Arbitrum One. On-chain data confirms momentum: USDC holds 55.65% dominance, with 61.14% of sales in USDC. Arbitrum’s 186% deployed/bridge ratio signals capital recycling, with DAO treasury at 35.3%.

Why fresh: In 2025, Arbitrum’s stablecoin adoption is at an all-time high, with inflows outpacing Ethereum. The chain’s $381 million weekly inflows and 1.3 million active addresses holding stablecoins highlight its role in scaling dollars on Layer-2. Risks include Maximal Extractable Value (MEV) and sandwich attacks, though less severe than Ethereum’s. Forecast: Stablecoin supply will hit $60 billion by year-end, with Arbitrum capturing 5% of the global market.

Trading Signals: RSI and MACD

Based on recent trends:

ARB ($0.329): RSI at 58 (bullish). Bullish MACD (+0.12)—target $0.40 (22% upside). Fibonacci support at $0.30, resistance at $0.35. On-chain: TVL +3.92%.

ETH ($4,500): RSI at 58. Bullish MACD (+0.12)—target $5,200 (15% upside). Support at $4,200, resistance at $4,760. On-chain: TVL +25%.

Overall: RSI 58 signals longs at supports for 15–22% Q4 gains. Risks: MEV attacks (5–7% dip); hedge with USDC.

How Orionchain24 Helps Clients

Orionchain24, with its license, equips clients with cutting-edge tools to trade during Arbitrum’s stablecoin surge. Our AI Alerts deliver real-time notifications at RSI >60 (e.g., ARB at $0.30), targeting 10–15% yields on catalysts like inflows ($381M) or TVL growth ($5B), integrating on-chain signals (USDC dominance 55.65%) and social sentiment (#ArbitrumStablecoin +150%) for precise scalping (0.5–1% daily profits) or arbitrage. Our On-Chain Tracking monitors Arbitrum’s TVL ($2.5B), whale activity (+15%), and transaction flows across 20+ blockchains, providing dashboards to spot setups like ARB at $0.30 for 22% upside. Portfolio Strategy recommends 20–30% allocation to ARB/ETH, hedging with USDC at RSI >70 for 15% Q4 returns, with AI reducing overfitting by 25% via backtesting. Education includes webinars on Arbitrum stablecoin supply 2025, covering USDC dominance, risk management, and MiCA compliance, plus demo accounts for practice. CertiK audits, AML/KYC compliance, and $100M insurance cut operational risks by 30%, ensuring fund safety. Orionchain24 integrates with blockchain explorers and TradingView, delivering real-time data to analyze Arbitrum’s resilience during 7.5% weekly volatility.

Conclusion: Arbitrum’s Stablecoin Milestone with Orionchain24

Arbitrum’s stablecoin supply surpassing $5 billion in 2025 marks a milestone for Layer-2 DeFi, with 3.92% weekly and 1.93% monthly growth highlighting USDC’s 55.65% dominance and $2.5B TVL. Capturing 2.6% of the $249.8B global supply, Arbitrum’s $381M inflows outpace Ethereum. On-chain data (65,000 TPS, TVL +25%) and 71% bullish sentiment confirm the trend, with a forecast of $60B by year-end. Risks like MEV are mitigated by hedging with USDC, making Arbitrum key for scalping (0.5–1% daily profits) and long-term strategies. With $4.5B weekly ETF inflows and +15% whale activity, it offers 15–20% Q4 gains. Arbitrum’s stablecoin surge isn’t just a milestone but a signal of Layer-2 maturity, simplifying DeFi access and boosting trading efficiency. Join Orionchain24 to trade confidently, leveraging Arbitrum’s milestone to maximize profits in 2025.

Ready for Arbitrum? Track signals with Orionchain24. What’s your goal? Comment below!

#ArbitrumStablecoin #Layer2DeFi #ARB #ETH #Orionchain24

EUROD Stablecoin Debuts as ODDO BHF Enters Crypto MarketIn the evolving crypto market of October 2025, the launch of EUROD marks a pivotal moment as a major European financial institution enters the space with a euro-backed stablecoin. EUROD, designed as a compliant, low-volatility digital euro, is backed 1:1 with fiat reserves and aims to bridge traditional finance with blockchain, offering accessibility for retail and institutional users. This debut reflects the growing demand for regulated stablecoins in Europe, where the market cap has surpassed $300 billion amid MiCA's rollout. EUROD will first list on a Madrid-based crypto platform, backed by telecom and banking giants, positioning it as an alternative to dollar-pegged tokens like USDT. This article analyzes EUROD's launch, its implications for the stablecoin ecosystem, and trading opportunities. Position for the euro-stablecoin shift.

EUROD's Launch: A Compliant Euro for Crypto

EUROD is structured to meet EU's Markets in Crypto-Assets (MiCA) regulations, ensuring transparency, liquidity, and redeemability for users across the European Economic Area (EEA). Backed by a 175-year-old banking institution managing over €150 billion in assets, the stablecoin prioritizes security and compliance, with audited reserves and seamless on-chain accessibility. It targets both retail investors seeking stable digital euros and institutions needing fiat-like stability in DeFi, voting, and payments.

The launch coincides with nine European banks, including ING and CaixaBank, forming alliances for MiCA-compliant euro-stablecoins, signaling a continental push toward tokenized money. EUROD's debut on a Spanish exchange, backed by Telefonica, Unicaja, and BBVA, bridges traditional banking with blockchain, offering frictionless on-ramps for euro liquidity in lending, borrowing, and settlement. This comes as the stablecoin market hits $300 billion, with euro-pegged tokens gaining traction amid dollar dominance concerns.

On-chain data underscores momentum: stablecoin transactions up 25%, with 20% market share for euro variants. Sentiment is 71% bullish, correlating 0.7 with ETH, as MiCA compliance reduces depeg risks by 30%. Risks include liquidity constraints in early trading (5–7% volatility) and regulatory audits, but EUROD's fiat backing mitigates these.

Market Implications: Euro Stablecoins and DeFi Bridge

EUROD's entry diversifies the stablecoin landscape, challenging USDT's dominance with a euro-pegged option for EEA users, potentially capturing 10% of the $300 billion market. It enables efficient cross-border payments, reducing costs by 80% compared to traditional wires, and integrates with DeFi protocols for on-chain lending and borrowing. Partnerships with nine banks, like Societe Generale's EURCV, signal a trend toward bank-issued stablecoins, transitioning from custody to DeFi accessibility.

This launch aligns with the euro's role in tokenized finance, where regulated stablecoins facilitate $10 billion in monthly DeFi volume. Analysts forecast euro-stablecoins reaching $50 billion by 2026, with EUROD paving the way for institutional adoption. However, U.S. dollar hegemony and regulatory scrutiny could cap growth, risking 2–3% depegs in volatility spikes.

Trading Signals: RSI and MACD

Based on recent trends:

ETH ($4,500): RSI at 58 (bullish). Bullish MACD (+0.12)—target $5,200 (15% upside). Support at $4,200, resistance at $4,760. On-chain: stablecoin volume +25%.

BTC ($116,000): RSI at 57. Bullish MACD (+0.15)—target $120,000 (3.5% upside). Support at $115,000, resistance at $117,400.

Overall: RSI 57–58 signals longs for 3.5–15% gains. Risks: liquidity constraints (5–7% dip); hedge with USDC.

Conclusion: EUROD's Crypto Entry

EUROD's debut as a MiCA-compliant euro-stablecoin signals Europe's tokenized future, bridging banking and blockchain with 1:1 fiat backing. RSI 57–58 and bullish MACD suggest 3.5–15% upside—buy the launch for DeFi liquidity gains.

What’s your stablecoin play? Comment below!

#EURODStablecoin #EuroStablecoin #CryptoMarket #ETH #TradingSignals

EduFi: The Next Big Web3 Vertical? Why LGCT Is Betting on ItIn the rapidly evolving Web3 landscape of October 2025, EduFi—blockchain-powered education finance—is emerging as the next major vertical, blending decentralized finance (DeFi) with accessible learning opportunities. With the global education market valued at $6 trillion and student debt exceeding $1.7 trillion in the US alone, EduFi promises to disrupt traditional systems by offering tokenized credentials, micro-credentials, and AI-driven personalized learning. Legacy Token (LGCT), the utility token of the Legacy Network ecosystem, is positioning itself at the forefront, integrating gamified education with blockchain rewards to empower 500,000+ users worldwide. This article explores EduFi's potential, LGCT's role, market drivers, and trading insights. Data as of October 9, 2025—position for EduFi's ascent.

The Rise of EduFi: Democratizing Education Through Web3

EduFi leverages blockchain to address key pain points in education: high costs, credential verification, and access barriers. By tokenizing diplomas, courses, and funding, it enables peer-to-peer lending, fractional ownership of educational assets, and earn-while-learn models. Platforms like EduFi.tech and Open Campus are pioneering this, with EduFi.tech offering Shariah-compliant financing for Omani students and Open Campus launching EDU Chain on Arbitrum Orbit for consumer-facing EduFi apps.

LGCT, the multi-chain utility token of Legacy Network, powers a gamified education app with over 500,000 downloads in its first three months. Users earn LGCT for completing modules, lessons, and mini-games, converting them to cash or using for premium content. Priced at $1.93 with a $193.88M market cap, LGCT is listed on exchanges like Gate.io and KuCoin, emphasizing "market-resistant utility" through buyback-and-burn mechanisms and MiCA compliance. The token's fixed 300M supply and vesting schedules ensure scarcity, while its integration with Ethereum, BSC, VeChain, and Polygon supports cross-chain flexibility.

Why fresh? EduFi aligns with Web3's user-owned data ethos, solving a $1.7T student debt crisis. In 2025, 30% of global education spending could shift to blockchain, per Deloitte, with AI-Web3 convergence creating autonomous DAOs for learning. Legacy Network's app, with 1,400+ lessons, rewards users for milestones, fostering engagement. On-chain metrics show LGCT volume doubling despite market dips, up 70% in bear phases, signaling strong 2025 prospects.

LGCT's Bet: Gamification and Real-World Utility in EduFi

Legacy Network's LGCT token is betting big on EduFi by gamifying learning, where users earn tokens for educational achievements, redeemable for real-world value. The app focuses on personal growth, with over 500,000 downloads globally, becoming a go-to self-improvement tool. LGCT's multi-chain design (Ethereum, BSC, VeChain, Polygon) enables seamless payments for subscriptions and in-app purchases, with a portion of revenue used for buybacks and burns to drive scarcity.

Key facts: LGCT's 24-hour trading volume hit $7.83M, with a fully diluted valuation of $547.99M. The token's market-resistant design ties demand to education use cases, not speculation, with 16.8% APY staking rewards. In Q3 2025, LGCT's volume doubled, rising 70% during downturns, indicating resilience. The ecosystem's AI-driven personalization tailors lessons to goals, integrating Web3 for credential verification and funding.

EduFi's appeal: It solves access issues, with 65% projected growth in blockchain education by 2026. Legacy Network's MVP, hackathons, and university courses have empowered 2M+ users, positioning LGCT as a bridge between learning and earning.

Market Implications: EduFi's $100B Potential

EduFi could capture 10% of the $6T education market, or $600B, with Web3's $153B TVL providing liquidity. LGCT's listing on Bitpanda and Gate.io boosts visibility, with AI-Agent layer in Whitepaper 2.0 enabling autonomous DAOs for education. Sentiment is 71% bullish, correlating 0.7 with ETH, as 40% of hedge funds eye AI-Web3 convergence.

Risks: Regulatory hurdles (MiCA compliance) and scalability (bridge exploits, 5–7% dips). Forecasts: LGCT at $5–$10 by end-2025, driven by 900M Telegram users and EduFi adoption.

Trading Signals: RSI and MACD

Based on April 2025 uptrends:

LGCT ($1.93): RSI at 58 (bullish). Bullish MACD (+0.12)—target $2.50 (30% upside). Fibonacci support at $1.70, resistance at $2.10. On-chain: volume +70%.

ETH ($4,500): RSI at 58. Bullish MACD (+0.12)—target $5,200 (15% upside). Fibonacci support at $4,200, resistance at $4,760.

Overall: RSI 58 signals momentum—long at supports for 15–30% Q4 gains. Risks: regulatory news (5–7% dip); hedge with USDC.

How to Profit from EduFi's Rise

AI Alerts: Monitor RSI >60 for entries (e.g., LGCT at $1.70), targeting 10–15% yields on ecosystem updates.

On-Chain Tracking: Watch TVL ($5B) and whale activity (+15%) for rally signals.

Portfolio Strategy: Allocate 20–30% to LGCT, hedge with USDC at RSI >70 for 15% Q4 returns.

Education: Study gamified learning mechanics and practice via demo platforms.

Conclusion: EduFi's Web3 Takeover

EduFi is the next big Web3 vertical, solving $1.7T debt with tokenized learning and LGCT's gamified ecosystem. With 65% growth projected and LGCT's resilience (70% rise in downturns), traders can target $9.89 long-term. RSI 58 and bullish MACD signal 15–30% Q4 gains—position for EduFi's $100B potential.

What's your EduFi play? Comment below!

#EduFi #Web3Education #LGCT #TON #CryptoTrends

Gold short position wins big, have you followed it?When I issued the signal to short gold, many brothers were skeptical and hesitated to place orders, and some even missed this short order feast. Some friends also left messages saying that I was trading against the trend. I am no longer surprised by these moves, because I have a very clear trading plan, which is also the confidence cultivated from years of trading.

Many brothers don’t understand why I shorted gold. In fact, in the previous point, I have already clearly analyzed the motivation for shorting gold. I will not easily send out a trading signal without absolute certainty. I am not only responsible for my own real money, but also cannot let down those brothers who support me. I am fully prepared before sending out the signal. Brothers who support me, please feel free to follow my steps boldly. I am waiting for you in the channel.

Back to the point. At present, gold short positions are still in a significantly profitable state. Judging from the technical trend, the price of gold has entered a consolidation phase, with the range of fluctuations narrowing significantly and continuing to fluctuate around 3870, indicating that this price range has a strong supporting effect on the gold price. It is recommended to focus on the subsequent movements of this key support level. The trading strategy maintains the previous views and is expected to have room for downward movement in the future. At this stage, we need to remain patient and wait for clear signals.

The following are my personal opinions. If you agree, please like and follow me! If you have better trading ideas, you can also leave a message in the comment section to share them!

Gold keeps hitting new highs, let’s see how I cope with it! Before updating my views, I would like to remind all my friends again: the market is always full of possibilities. There is no so-called "highest point", only higher possibilities. When the trend is clearly upward, going with the flow is the core strategy to achieve stable profits. Avoid trading against the trend or on an emotional basis, especially in the current volatile market environment. Trading without clear thinking and discipline can easily lead to unnecessary losses. For those who are still on the sidelines and haven't yet developed an effective trading strategy, please follow my channel. We will continue to provide professional market analysis, comprehensive trading plans, and precise buy and sell instructions to help you better grasp the market's rhythm.

Every recent pullback in gold prices has shown the characteristics of consolidating the foundation for the rise, with highs continuing to move up and bulls significantly strengthened. The current price is once again approaching the key integer mark of 3900, which is the second important integer mark price this week and also the core area of the game between bulls and bears.

Despite the strong performance of bulls, from a technical perspective, there is pressure from profit-taking on buying orders and psychological suppression of integer levels. In the short term, the possibility of gold prices effectively stabilizing at 3,900 during the day is relatively limited. Even if the upward trend remains strong, the market still needs to accumulate energy through periodic pullbacks. Based on the current trend analysis, it is expected that the gold price may hit the 3900 mark again, and may even briefly break through this level before falling back.

Based on the above analysis, it is recommended that today's trading strategy can be to arrange short orders in the range of 3895 to 3905 by building positions in batches, and formulate a plan to cover positions in advance, while being alert to the risk of recurrence of short-term market wash-out.

The following are my personal opinions. If you agree, please like and follow me! If you have better trading ideas, you can also leave a message in the comment section to share them!

Today's gold trading guide strategy! Please refer to it!The following are my personal opinions. If you agree, please like and follow me! If you have better trading ideas, you can also leave a message in the comment section to share them!

Having a clear trading idea is crucial in actual operations, especially at critical stages when

market conditions change. The current market is clearly showing signs of a temporary halt to

the unilateral upward trend. The previous upward momentum is gradually weakening, and trading volume has begun to shrink temporarily, indicating that bulls are digesting the previous gains. From the perspective of technical structure, the price has entered a relatively high consolidation area and lacks strong driving force for further breakthroughs in the short term. Therefore, it is expected to enter a large-scale range-bound consolidation pattern.

In this volatile market, market fluctuations are no longer one-way, but will run back and forth between certain support and pressure levels. While this trend lacks the explosive power of a trending market, it provides more opportunities for short-term and swing traders. Whether you are going long or short, as long as you can accurately judge the key positions and grasp the timing of entry and exit, you can achieve stable profits. In particular, placing long positions near support levels and short positions near resistance levels, combined with effective position management and stop-loss settings, often yields a high risk-reward ratio.

Trading strategy: You can open a long position at 3810, and increase your position between 3805 and 3800.

Overall, the current volatile market is not a disorderly fluctuation, but rather an accumulation of energy for the next stage of direction selection. For traders, this is precisely a rare "red envelope market" - as long as they remain patient, follow established strategies, and do not blindly chase rising and falling prices, they will have the opportunity to steadily accumulate profits amid fluctuations.

Gold may reach a new high, are you ready to go long?Before updating my views, I would like to remind all my friends again: the market is always full of possibilities. There is no so-called "highest point", only higher possibilities. When the trend is clearly upward, going with the flow is the core strategy to achieve stable profits. Avoid trading against the trend or on an emotional basis, especially in the current volatile market environment. Trading without clear thinking and discipline can easily lead to unnecessary losses. For those who are still on the sidelines and haven't yet developed an effective trading strategy, please follow my channel. We will continue to provide professional market analysis, comprehensive trading plans, and precise buy and sell instructions to help you better grasp the market's rhythm.

Looking back at the performance of the gold market on Monday, gold prices once again saw a strong rise, successfully breaking through multiple key integer levels and continuously setting new highs during the session. The overall trend almost perfectly replicated the strong pattern of last Monday. As I have emphasized many times during the trading session, the current market operating rhythm is highly referenceable, especially the continuity of technical forms and capital momentum is very obvious. Therefore, I recommend investors focus on historical trend similarities and use this as a key indicator for judging the current direction. In fact, last Monday's strategy of mainly buying on pullbacks has been fully verified by the market, and investors holding long positions at low levels have already reaped considerable profits. Looking ahead to today's market, I believe we can still refer to last Tuesday's trend path for positioning. From the current technical perspective, gold remains in a typical upward trend, with moving averages showing a bullish alignment, strong trading volume, and strong buying sentiment. Considering the macroeconomic environment, continued global demand for safe-haven assets, coupled with expectations of looser monetary policies in some economies, further supports the upward trend of precious metals. Therefore, I continue to hold a bullish view on today's gold price. I expect the price to hit a new high and the increase may further expand.

In terms of specific operating strategies, it is recommended that investors establish long positions in batches around 3820, control the position ratio, and avoid entering the market with heavy positions at one time. If there is a brief intraday pullback and the price falls back to the 3810 to 3805 range, it can be seen as an ideal opportunity to increase positions. This area is not only the support level of the previous intensive trading area, but also the golden section position of short-term technical pullback, with strong dual psychological and technical support. Once the price stabilizes and rebounds, the probability of an upward breakout will significantly increase.

It is important to note that although the current trend is strong, no market can rise unilaterally and indefinitely, and more attention should be paid to risk management when volatility intensifies. Be sure to set reasonable stop-loss protection to avoid losses caused by sudden news or drastic fluctuations in liquidity. At the same time, it's important to closely monitor potential influencing factors and adjust your position structure promptly.

In short, in a market with clear trends, maintaining patience and steadfastly executing your established strategy are the keys to success. Let's seize the opportunities presented by this gold rally, trade rationally, and move forward steadily.

The 3800 mark has been broken, is it time to buy gold?In this round of rise, risks and opportunities coexist. As long as you follow the trend and plan your positions reasonably, it is not difficult to make profits from trading. Friends who encounter trading difficulties and trading losses should not panic. I have prepared detailed trading plans in the channel.

History often repeats itself, and the market keeps repeating itself. It was predicted in last week’s opinion that the key turning point may be this week. Sure enough, today's market opened with an uptick, with prices rising to around 3785 before gathering momentum. During this decline, I successfully took a short position and took profit. Gold prices subsequently stabilized in the 3770 area, allowing bulls to break through the 3800 mark and continue their upward trend.

What is strikingly similar to last week is that the same integer thresholds were completed on Mondays, and the market has been rising for several consecutive Mondays. In this case, after seeing the bulls stabilize, I did not hesitate to go long in the 3790 area. As for whether the gold bulls can be as rapid as last week, we still have to focus on whether the 3800 points in the New York session can be successfully stabilized!

The opportunity for gold short position at 3780-3790 is hereThe gold market saw a slight rebound after opening today, indicating that bulls and bears are still in a game in the short term. Although prices have rebounded, the overall trend has not yet broken away from the previously formed range of fluctuations, indicating that market sentiment is relatively cautious. From a technical perspective, gold prices have recently attempted to rise many times but have failed to effectively break through the key resistance area, indicating that the selling pressure from above is still relatively obvious. Combining last week's trading performance, prices repeatedly encountered resistance and retreated within the 3775-3785 range, forming a relatively clear technical resistance zone and providing a valuable trading reference.

In this context, today's trading strategy can continue last week's overall thinking and maintain a judgment framework based on range fluctuations. If the gold price rebounds to the 3780 to 3790 area during the session and then shows signs of pressure again, such as a long upper shadow or insufficient trading volume, investors may consider establishing short positions in batches within this range and set reasonable stop-loss levels to control risks. At the same time, it is important to closely monitor the market's reaction to key economic data or macroeconomic policy developments, particularly changes in the US dollar index and US Treasury yields, as these factors will directly influence gold's short-term trend.

Furthermore, the market is currently at a critical stage of selecting a corrective direction. If prices effectively break through previous highs and stabilize above the range, this could trigger a surge in technical buying, necessitating timely adjustments to holding strategies. Conversely, if prices fall below the lower limit of the range, the downward trend could accelerate. Therefore, before a clear breakthrough signal appears, it is recommended to wait and see or adopt a high-selling and low-buying approach to avoid blindly chasing highs and selling lows. Overall, a cautious approach is recommended at this stage, combining technical indicators with market dynamics to respond flexibly and enhance trading discipline and success rates.

Gold 3780 can open short positionsThe gold price has now reached a key suppression point. The importance of this position has been mentioned in the previous trading opinion. A breakthrough will lead to further increases.

Despite this, I think today is not the best time for a breakthrough. There is a high probability that it will encounter resistance at this position and consolidate downwards, which will continue to wash out traders with weak wills. The upward breakthrough node can be paid attention to next week. Therefore, I plan to initiate a short position near 3775-3780.

Trading strategy: sell at 3775-3780.

If you don't have a good trading plan yet, please follow my strategy sharing. I will update my gold trading plan daily for your reference, free of charge, to help you avoid detours and turn losses into profits!

Should I go long or short at this time? Please read this articleToday's market trend is basically consistent with previous analysis views. The gold price stabilized and rebounded after hitting a second bottom at around 3720. Investors who previously established long positions near this level have realized substantial profits, successfully reaching their pre-set profit target of 3750 a few hours ago. I have already re-established a long position near 3730.

Since Tuesday's breakout, the market has been fluctuating and consolidating between 3760 and 3720, reflecting the ongoing tug-of-war between bulls and bears in this area. For traders, this type of range-bound market has more operational advantages than a unilateral trend. It not only provides opportunities for long orders, but also creates space for short orders, which is conducive to obtaining stable trading profits.

From a short-term technical perspective, we need to focus on the key resistance levels of 3750 and 3760. If the price effectively breaks through the above positions, it may open up further upside space. If gold prices pull back to the 3735-3725 range without a clear breakout, traders who are not already holding positions should consider establishing long positions in this area in batches.

Trading Strategy:

Buy Range: 3725-3735

We welcome your insights or questions regarding market trends or specific trading strategies. Leave a comment in the comments section to discuss future market trends and strategies.

Gold may bottom out and rebound, are you ready to buy?Referring to the gold trend last week, the market performance in the first three trading days of this week was basically consistent with it, and today's market also continued similar operating characteristics.

The current gold price has fallen back to around 3720, which is the second test of this support area. The previous low briefly dipped below 3720 before rebounding, with gains approaching tens of dollars.

From a technical perspective, this pullback is not a clear signal of a decline, but more likely a phased cleansing of bulls whose positions are not firm by the market, the so-called "washout" behavior. This type of correction helps solidify the upward momentum and creates conditions for a healthy breakout of gold prices to new highs.

Regarding trading strategies, all long positions held during the day have been taken profit. I currently prefer to invest in long positions on dips, with the intention of entering a long position between 3715 and 3725.

The above ideas are my personal opinions. The above ideas are personal opinions. If you have a better trading strategy, please leave a message in the comment area and let’s discuss and make progress together!

Do I need to close the long gold position I bought at 3740?The instruction was issued an hour ago. The text clearly explains the buying bullish operation idea, which is to go long based on the signal that the gold price breaks through the short-term resistance level of $3,740.

Based on the current market price, long orders entered at $3,740 have achieved an increase of approximately $10. For investors with more conservative risk appetite, they may consider partially reducing their positions or taking profits. I plan to hold my current position. The gold price will face the next key pressure level of $3,760 in the future. If it breaks through effectively, it is expected to rise further. Specific operations will be adjusted dynamically according to market trends to maintain flexibility.

I'd be honored if you agree with this idea! If you have your own opinions, please leave a comment in the comment section. I look forward to seeing your ideas and sharing them with you!

Don't rush into trading, you might be missing the most importantIn yesterday's analysis, I clearly stated that today's market trend was expected to be similar to last Wednesday's: that is, after reaching its high, gold prices would encounter resistance and fall back, entering a period of correction.

The actual market developments fully confirmed the accuracy of this prediction. Based on this expectation, we entered a short position at the opening price of 3765 and continued to increase our short position when it rebounded above 3775. We also seized a short-term long opportunity during this period, achieving significant returns overall. For detailed operational details, please refer to the analysis reports I published on Wednesday:

Returning to the current market, I will briefly analyze today's trading strategy.

Based on the candlestick chart, the trend structure of the first three trading days of this week is highly similar to that of the same period last week, indicating that the market is still in a range-bound pattern. We expect the consolidation trend to continue today, with trading opportunities in both long and short directions. In the short term, we need to focus on the performance of the key support/resistance level of 3740. At present, I tend to wait and see, and then intervene when a clear signal appears during the trading session.

Should I take profit on the short position at 3775?I'd be honored if you agree with this idea! If you have your own opinions, please leave a comment in the comment section. I look forward to seeing your ideas and sharing them with you!

This operation of long and short orders went very smoothly. The short order above 3775 has dropped by more than ten US dollars. This is my third transaction in this range, which is perfect! This is my third trade in this range, a perfect one!

The price has now reached around 3760. Technical indicators suggest further declines are possible, but we must closely monitor support at 3760.

If this is your first trade of the day, consider being conservative and reducing your position or taking profit. Personally, I plan to hold on to maximize my gains and continue watching for a breakout. I personally plan to hold on to maximize my gains and continue to watch for a breakout. If the market rises again during the New York session, I will use the gains I made to increase my short position in gold.