TQQQ potential Long 1/15/2026There is a couple of key reactions shown on Daily and Weekkly timeframes. Both bearish and bullish. However tomorrow friday will introduce to us another Daily candle as well as wil close Weekly candle which will confirm our thesis

decision zone is between $53.20 and $54.16.

the entry is at 0.786 of the H1 range

to avoid manipulation the stop is 2.5x of Daily ATR

TQQQ

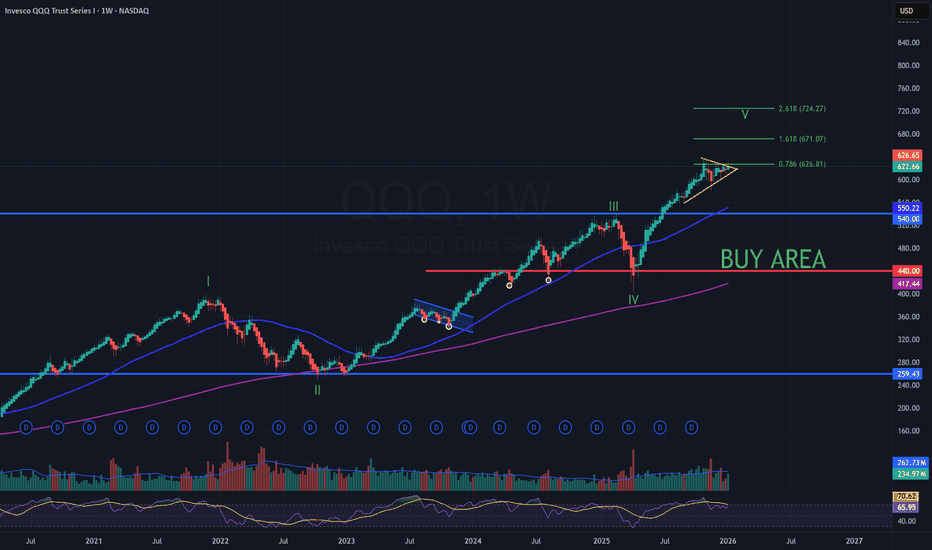

QQQ – Weekly Update | Breakout Being TestedThesis

QQQ remains in a late-stage bullish structure. Price is testing the upper boundary of a bullish wedge, with Wave 5 still the primary scenario while key supports hold.

Context

- Weekly timeframe

- Long-term bull trend intact

- Market approaching the final phase of the broader cycle

What I see

- Price tested the wedge breakout level twice this week

- Weekly close held right on the breakout line near $623

- 50-day MA has now been tested and appears to be flipping to support

- Structure remains compressive, not distributive

What matters now

- Breakout level needs to be clearly flipped to support to confirm continuation

- Market is not pricing near-term event risk (tariff ruling next week) as bearish

- As long as price holds above the $600 area, upside structure remains intact

Buy / Accumulation zone

- No aggressive adds at current levels

- Long-term accumulation remains near the $440 area (200WMA confluence)

Targets

- Primary Wave 5 reference: $720–$725 area (2.618 Fib)

Risk / Invalidation

- Loss of $600 and failure to hold the wedge breakout would shift the structure to consolidation

the nasdaq descends down to 13260.00gm,

i'm predicting the nasdaq loses 50% of its value over the next 2 years.

---

the global liquidity cycle is the recurring expansion and contraction of money and credit across the world, driven mainly by central bank policy, interest rates, and financial conditions. when liquidity expands, borrowing becomes easier, money moves freely, and risk assets like stocks, crypto, and real estate tend to rise as optimism and leverage increase. when liquidity contracts, credit tightens, money retreats, leverage unwinds, and risk assets fall as fear replaces confidence. this cycle acts like the financial system’s breathing pattern, quietly setting the backdrop for booms, bubbles, corrections, and resets long before most people notice.

---

to put it simply, the global markets go through phases of inflows and outflows, it's cyclical by nature. 2026 has always been the expected top year using michael howell's global liquidity cycle oscillator.

---

i'm not saying the market is going to crash, just saying i think it will bleed out for multiple years. "easy money" as you might be used to, will become "hard money" for awhile. don't let this deter you, just exercise more caution and higher levels of risk management during the times which are to come.

---

as for an ewt perspective - nasdaq could have potentially finished a macro ending diagonal on a weekly frame. if my postulation is correct, the breakdown from this diagonal could be violent, and it will have a minimum downside target of 13260.00

---

🎯 = 13260.00

Market SignalMarket Signal is an algorithm that evaluates statistical trends in price action of QQQ and its holdings to determine whether QQQ is currently in an uptrend (📈) or downtrend (📉)

Every day after market close, our Market Signal algorithm returns a numerical market sentiment value, ranging from -9 (most bearish) to +9 (most bullish), with 0 being a neutral score.

📈 QQQ is considered to be in an uptrend during consecutive days of positive Market Signal values

📉 QQQ is considered to be in a downtrend during consecutive days of negative Market Signal values

See full screen chart -> www.tradingview.com

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Risk-on Phase 1, high-volatility zone

Risk-on Phase 2, high-volatility zone.

Critical Sensitivity Zone

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Risk-on Phase 1, high-volatility zone

Risk-on Phase 2, high-volatility zone.

Critical Sensitivity Zone

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

A signal for catching a bounce has emerged.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

A signal for catching a bounce has emerged.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positionsQQQ : Stay heavy on positions (QLD, TQQQ)

Entering a risk-on, high-volatility zone.

A signal for catching a bounce has emerged.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positionsSPY : Stay heavy on positions (2x leverage)

Entering a risk-on, high-volatility zone.

A signal for catching a bounce has emerged.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

QQQ : Stay heavy on positions (QLD, TQQQ)- System metrics show the market transitioning into the initial phase of overheating.

In stay light on positions zones, I hold QQQ and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of QLD and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.

SPY : Stay heavy on positions (2x leverage)- System metrics show the market transitioning into the initial phase of overheating.

In stay light on positions zones, I hold SPY(+QQQ) and reduce exposure.

In stay heavy on positions zones, I increase allocation using a mix of SSO(+QLD) and TQQQ.

** This analysis is based solely on the quantification of crowd psychology.

It does not incorporate price action, trading volume, or macroeconomic indicators.