EURGBP Trade Recap -1% 15.12.25In this recap I break down my EURGBP short position I took last week using the 1H in combination with the 5M to refine my entry. There was also a valid 4H RE to take as well in line with my short.

Full explanation as to why I executed on this position and this also being a textbook example of the type of bread and butter trades I take as part of my main setups within my trading plan.

Any questions you have just drop them below 👇

Traderecap

AUDNZD Trade Recap 09.12.25In this recap I break down my AUDNZD short position I took last week using the 4H in combination with the 5M to refine my entry.

Full explanation as to why I executed on this position, using the 4H to my advantage but also understanding why I managed the way I did for a breakeven.

Any questions you have just drop them below 👇

EURCAD +3% Trade Recap 10.10.25 In this recap I break down my EURCAD short position I took yesterday morning. I fully forecast this setup in the morning as per my forecast video, and then executed later that day. Manually closing for just under 3% profit at the intended target.

Full explanation as to why I executed on this position, using the 4H to my advantage but also understanding price was due a deeper pullback, but these pullbacks do not always happen.

Any questions you have just drop them below 👇

Two EURCAD Positions Trade Recap 10.09.25Two positions covered in this recap.

EUR / CAD -1%

EUR / CAD Re-Entry BE

Full explanation as to why I executed on these positions and how I maintained my mindset to allow me to get back into the second position after taking the loss. Something I have been working on the past month or so is maintaining the executional mindset after being taken out of a trade, and if it is still intact to actually get back in to the market.

Any questions you have just drop them below 👇

AUDJPY & CADJPY Trade Recaps 08.08.25A long position on AUDJPY taken Monday for a -1%, the trade had great potential but one of those ones that didn't have enough steam to commit. Followed by a CADJPY short taken yesterday for a +2% manual close.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

AUDCAD / GBPAUD Trade Recaps 01.08.25A tester trade on AUDCAD with the reasons explained as to why this was a test position, and a short position executed on GBPAUD. Solid setup that this time around just didn't commit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

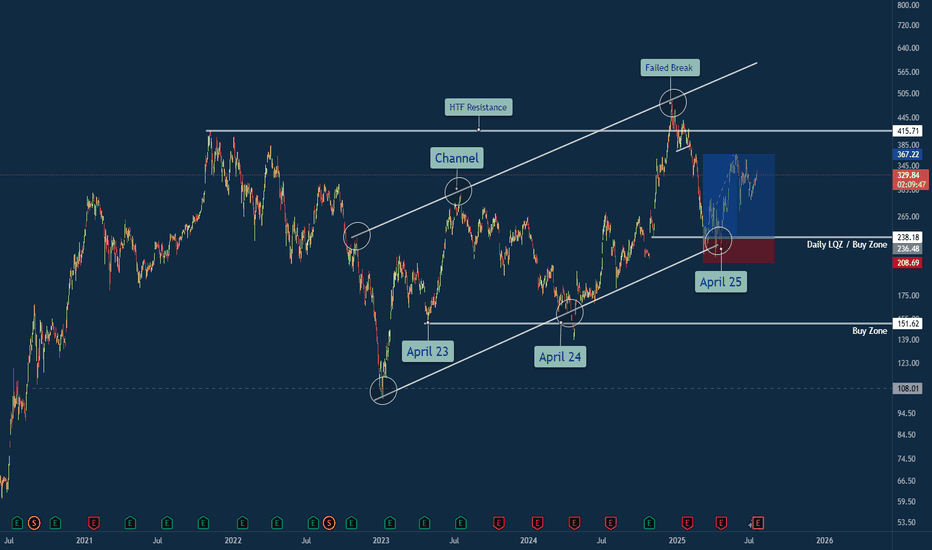

Tesla Trade Breakdown: The Power of Structure, Liquidity & ...🔍 Why This Trade Was Taken

🔹 Channel Structure + Liquidity Trap

Price rejected from a long-standing higher time frame resistance channel, making a false breakout above $500 — a classic sign of exhaustion. What followed was a sharp retracement into the lower bounds of the macro channel, aligning with my Daily LQZ (Liquidity Zone).

🔹 Buy Zone Confidence: April 25

I mapped the April 25th liquidity grab as a high-probability reversal date, especially with price landing in a confluence of:

Demand Zone

Trendline Support (from April 23 & April 24 anchor points)

Volume spike + reclaim of structure

🔹 Risk/Reward Favored Asymmetry

With a clear invalidation below $208 and targets at prior supply around $330+, the R:R on this trade was ideal (over 3:1 potential).

Lessons Reinforced

🎯 Structure Always Tells a Story: The macro channel held strong — even after a failed breakout attempt.

💧 Liquidity Zones Matter: Price gravitated toward where stops live — and then reversed sharply.

🧘♂️ Patience Beats Precision: The best trades don’t chase. They wait. This was one of them.

💬 Your Turn

How did you play TSLA this year? Were you watching the same channel? Drop your insights or charts below — let’s compare notes 👇

#TSLA #Tesla #SwingTrade #PriceAction #LiquidityZone #FailedBreakout #TechnicalAnalysis #TradingView #TradeRecap #ChannelSupport #SmartMoney

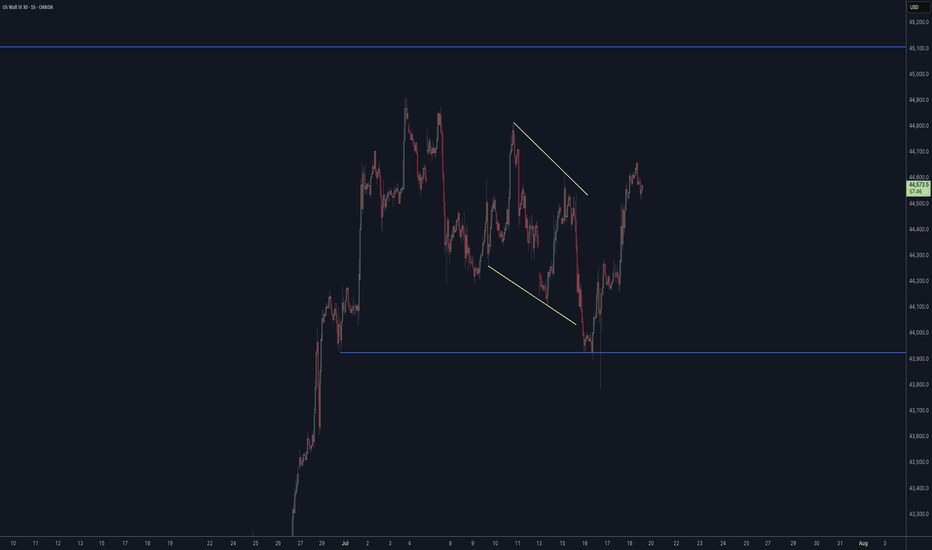

EURUSD & US30 Trade Recaps 18.07.25A long position taken on FX:EURUSD for a breakeven, slightly higher in risk due to the reasons explained in the breakdown. Followed by a long on OANDA:US30USD that resulted in a loss due to the volatility spike that came in from Trump.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

11.07.25 USDJPY Trade Recap + Re-Entry for +2.5%A long position taken on USDJPY for a breakeven, followed by a premature re-entry that I took a loss on. I also explain the true re-entry I should have taken for a 2.5% win.

Full explanation as to why I executed on these positions and also more details around the third position that I did not take.

Any questions you have just drop them below 👇

EURAUD -0.7% Short and AUDUSD MistakeA short position taken on EURAUD for a small loss after manually closing before swaps. I have also included a breakdown of a +4% AUDUSD long I was looking at taking but a small error on my behalf that caused me to stay out of the trade. Full explanation as to why I executed on this position and made the decision to manually close at the level I did.

Any questions you have just drop them below 👇

-1% GBPAUD & +2.5% GBPCHF Trade RecapsTwo positions I took over the last 10 trading days, both 4H entries, one long and one short.

FX:GBPAUD Short -1%

FX:GBPCHF Long +2.5%

Top down analysis explained in the video and also my thought processes behind playing both entries as limit orders to maximise R:R and protect stops much better.