Trend Analysis

Ethereum Watchlist: Green Zone Long Setup in FocusThe green area offers a potential long opportunity on Ethereum, subject to valid confirmation. Alternatively, if price fails to reach the green zone, a bullish engulf of the yellow zone followed by a pullback to the current node could provide a favorable long entry.

For now, the primary focus is on Scenario 1 — watching closely to hunt a long opportunity inside the green zone.

Rebounding resistance at 5113, retesting the trendline.✍️ NOVA hello everyone, Let's comment on gold price next week from 02/16/2026 - 02/20/2026

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) price makes a U-turn on Friday and trims some of Thursday’s losses, rising nearly 2% following the release of a softer-than-expected inflation report in the US, which increased speculation that the Federal Reserve (Fed) could lower rates. At the time of writing, XAU/USD trades above the $5,000 milestone.

XAU/USD rallies nearly 2% after cooler US inflation data fuels renewed expectations of a June rate reduction

The US Bureau of Labor Statistics reported that the Consumer Price Index (CPI) in January fell below estimates of 2.5%, coming at 2.4% YoY, down from December’s 2.7%. Initially, the print is good news for the economy, but the so-called core CPI remains sticky at 2.5% YoY, also aligned with forecasts and below the previous print of 2.6%.

⭐️Personal comments NOVA:

Gold prices are consolidating, retesting the breakout zone of the trendline and resistance at 5115.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $5113, $5236, $5454

Support: $4878, $4654

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

PEPE WILL START MEMECOIN SEASON🔥 Fortune AI Radar — CRYPTOCAP:PEPE

Fresh activity detected on CRYPTOCAP:PEPE today.

Data suggests increasing market interest & buyers stepping in.

Technicals currently lean bullish, with momentum trending upward.

Whales showing hints of accumulation and hype rising among trader

Ethereum —Long-term higher low, a new all-time high is possibleTo be fair and honest, I am a bear and a pessimist, I truly belief nothing good can ever happen and the market is set to crash forever—forever down. But, we have to be objective when looking at these charts. It is not about personal beliefs... You know what I mean?

A bullish impulse —1,2,3,4,5— leads to a correction —ABC.

A correction, ABC, leads to either another correction (an inverted correction) or a new bullish impulse. But we have to be objective when looking at these charts.

Let's go a bit deeper.

April 2025 hit bottom at $1,385. February 2026 hit bottom at $1,748. Here we have a higher low and this is a long-term bullish development. This supports bullish action regardless of my bearish view or pessimistic nature. Let's be objective for a minute so that we can focus on the chart.

Last week the low was $1,748, a major low and the highest bearish volume in years. The session close though ended up being $2,090. Buyers were waiting; buyers showed up.

This week the low is $1,897. I might be a pessimist but people are buying. They must be optimist or they must know something that I do not know. Why are they buying?

This week failed to move below last week's low, showing a lack of strength on the sellers side. Instead, this week is about to turn green. Green or red, the correction failed to produce a new low long-term and it is now also failing at producing new lows short-term. This all implies buyers being present. These signals support a rising wave.

Ok. My attitude is changing, I can see what you mean. I am bullish now but, how far up can prices go?

This is a great question.

The limit we put on the market is only based on past action, our own beliefs and conditioning; there is nothing on this chart that puts a limit on growth.

If it wasn't for the fact that the year is 2026 and people are conditioned to see 'blood', I would be saying that a new all-time high is possible, even if it happens in only three months.

Why the three months cap? I don't know. It has to do with people that force their assumptions on the market and charts.

There is nothing that prohibits Ethereum entering a new market phase. There is nothing that prohibits a very strong bullish wave.

The truth is that 2025 was not what we expected based on past cycles, based on the assumptions that we love.

If 2025 was different, a weak all-time high, what is to say that 2026 should perform in some pre-conceived way?

If Ethereum didn't hit $10,000 in 2025, why would it go below $1,000 in 2026? For what reason? For what purpose? Where is the law of finance that says this is a must?

Where in the world does it say that a lower low must happen in the coming months?

Where is the limit to size, time and duration for the next market phase?

We are still missing the bull-run phase. Why is a bull run now impossible?

We are getting a bull run next.

Ethereum is set to hit a new all-time high. Higher lows lead to higher highs.

Namaste.

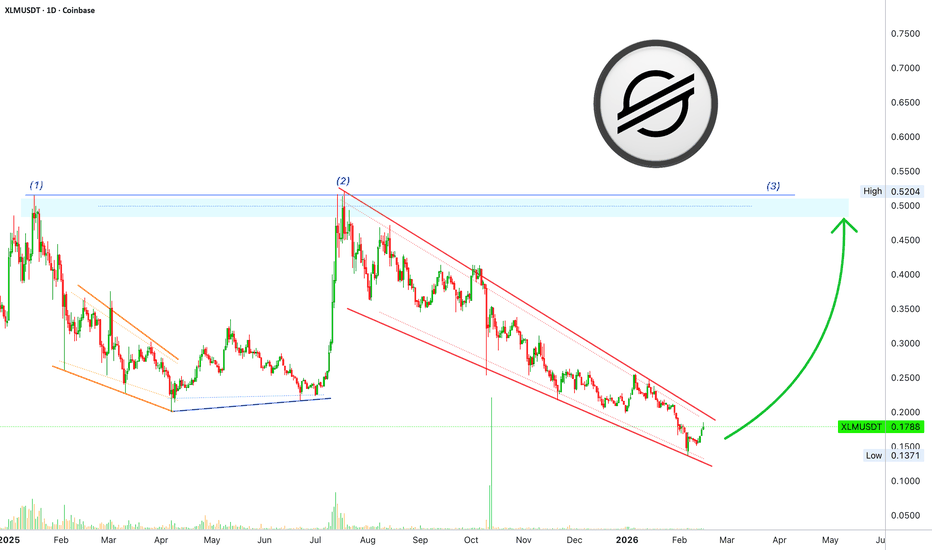

Stellar bullish signals and market conditions —$0.52 Next targetAs part of a long-term correction and bearish cycle, Stellar hit a major low recently, less than two weeks ago. This low managed to produce some of the worst market conditions seen in years... But there is some good news.

While Stellar, XLMUSDT, hit bottom this same month, 6-February 2026; its daily MACD hit bottom 10-February 2025, a year ago. This is giving us a very strong, long-term, bullish divergence. A clear signal showing that lower is no longer possible, a reversal comes next.

Here is the chart for the daily MACD:

Bullish signals tend to pile up on top of each other, making them hard to miss.

As XLMUSDT produces long-term lower lows, the MACD has been doing higher lows.

Recently, two days ago, on the 13th of February, we have a bullish cross. This means the MACD is about to shoot straight up, and this in turn supports rising prices.

Another signal that tends to lead to a price reversal is the falling wedge pattern, shown here in red. And the double-top is what gives us the main target for this bullish wave. A strong resistance level, it rejected growth in January and July 2025, it needs to be challenged again to see if it holds. This is to say that XLMUSDT is about to grow to $0.52 minimum. That's a strong advance and opens up 190% profits potential on the way up.

It can go higher of course, but this is the target that cannot be missed. Next, the market goes up.

Thanks a lot for your continued support.

Namaste.

US30 BEARS WILL DOMINATE THE MARKET|SHORT

US30 SIGNAL

Trade Direction: short

Entry Level: 49,449.0

Target Level: 48,076.7

Stop Loss: 50,359.3

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

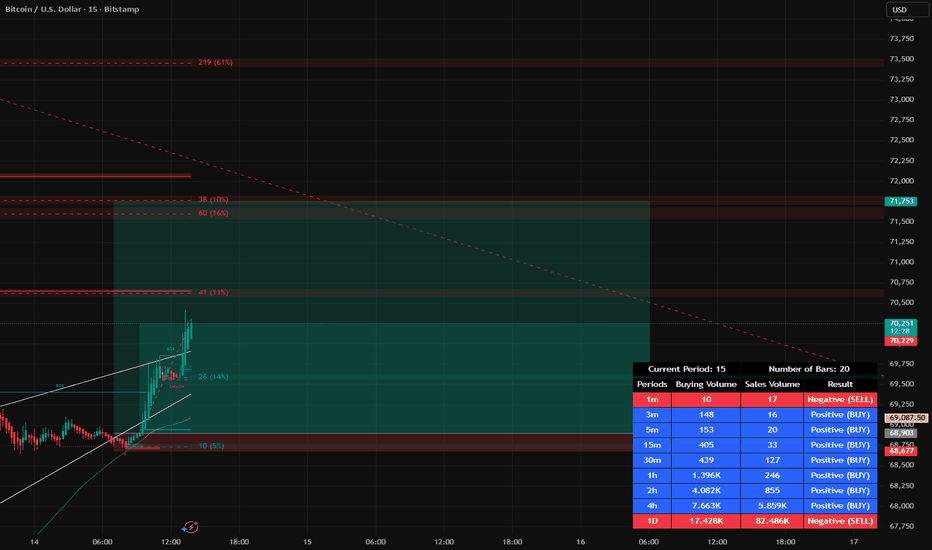

BTC Liquidity Building Before a Key Breakout

Most indicators are starting to turn positive, especially liquidity behavior, which suggests accumulation around the current zone.

The bounce from this area is technically strong, but the real trigger remains clear:

A sustained move above 75K opens the path toward:

🎯 $80,000

🎯 $85,000

From a time perspective, February 18 is an important cyclical date and could act as a catalyst for a decisive move — either acceleration or rejection.

For now:

Structure is attempting to shift.

Liquidity is improving.

Momentum is stabilizing.

The next few sessions will be critical.

📅 I’ll update the chart and may go live depending on how price reacts around the 75K level.

Let’s see how the market responds.

#Bitcoin #BTC #Crypto #Gann #PriceAction #Liquidity #TradingView

NASDAQ: Risk of a 10–12% Correction — For and AgainstThe index is trading around 24,700, having almost touched the 200-daily MA (~20,000) — a bearish signal in itself. Nasdaq hasn't made a new high since last October, which is a textbook sign of fading momentum in a mature bull market.

The case for a correction:

The index is dangerously concentrated in a handful of megacaps — when even one or two of these names stumble, the whole thing gets dragged down hard. February has already shaped up to be the worst month for the tech sector in nearly a year, with software names selling off on valuation concerns and growing doubts about hyperscaler spending sustainability.

Add tariff uncertainty and trade policy noise on top, and you've got a fragile setup.

Also, it concerns me to see a fractal pattern on the chart above. The previous two times we got a consolidation >90 days without any certain direction, the index lost 24-36% over the next 1-2 quarters. The possible targets for this correction are on the chart.

The case against a deep selloff:

Historically, most NASDAQ corrections since 2003 have stayed under 10% — only 13 exceeded that threshold.

Asset manager positioning has been net-long since late 2022, with no signs of extreme crowding or panic.

Wall Street houses like Morgan Stanley, Deutsche Bank, and Goldman Sachs are calling for 7–17% upside by year-end, leaning on the AI supercycle and double-digit earnings growth from megacaps.

The technical picture is flashing warning signs that shouldn't be ignored. A 10–12% pullback toward the 22,000–22,500 zone looks increasingly probable — not as a trend reversal, but as a painful shakeout within the longer-term uptrend. The most likely trigger is disappointing AI spending guidance in Q1, or an external macro shock that catches a complacent market off guard.

Yes, fundamentals provide a floor, but an extremely thin one. The risk-reward here leans bearish in the near term. Do you think the same?

#DYDX/USDT Breakout from Falling Wedge |#DYDX

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.1027, and the price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.0160

First Target: 0.1100

Second Target: 0.1150

Third Target: 0.1198

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For any questions, please leave a comment.

Thank you.

#WLD/USDT Pump Anticipated#WLD

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.4000, and the price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.4088

First Target: 0.4180

Second Target: 0.4314

Third Target: 0.4497

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For any questions, please leave a comment.

Thank you.

XRP Recovery Rally Approaches Key 1.57–1.67 ResistanceXRP update (4H)

XRP is bouncing inside a rising channel after the sharp drop, but it’s still trading below the bigger descending trendline, so this looks like a recovery within a broader weak structure.

Price is now heading toward the 1.57–1.67 resistance zone. There aren’t many liquidation levels sitting above this area, but we could still see a bit more upside. The main reason is correlation XRP often follows BTC, and if BTC pushes toward the 72K area, XRP could get a short-term bounce as well.

That said, this zone still looks like a likely reaction area. If price gets rejected here, the expectation would be a move back down, potentially targeting the lower liquidation zone around $1.30.

DYOR, NFA

#XRP #XRPUSDT

FOR DA BOIS!!!A guide that is similar to the xrp chart. I believe the lows are in keep liquidations below 8c. Build your longs for the long term and join me for the rise to Valhalla!!! The journey has just started and we have a long path ahead of us. I am happy you are all here and am ready for this ADVENTURE!

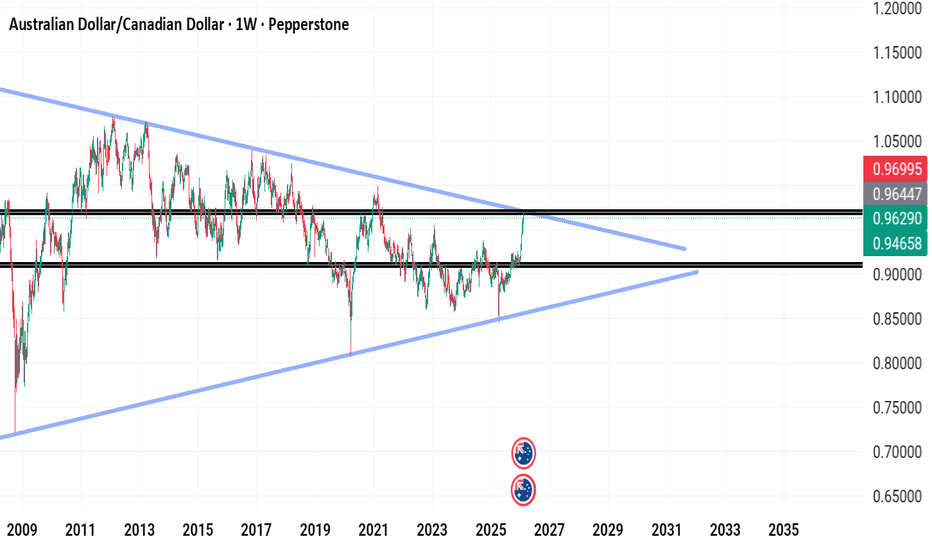

AUDCAD1. Price is reacting to a weekly timeframe down trend line.

2. Price is also reacting to a weekly supply level.

3. In the H4 timeframe, there is bearish engulfing candle already closed signaling price may come down.

4. Early sellers could enter the trade or wait for retest of the supply level.

BTC/USDT Liquidity Map & Order Block Analysis🚀 BTC/USDT Bullish Setup | Bitcoin vs Tether Technical Roadmap

📊 Asset: BTC/USDT — Bitcoin vs Tether

Market: Cryptocurrency

Style: Day Trade / Swing Trade

Bias: Bullish Continuation Structure

🔎 Market Structure Overview

BTC/USDT is holding above key higher-timeframe support, maintaining a bullish market structure with:

✅ Higher Highs & Higher Lows (4H / Daily)

✅ Price respecting dynamic Moving Average support

✅ Liquidity sweep completed below recent swing low

✅ RSI recovering from mid-zone (bullish momentum rebuild)

✅ Volume expansion on upside impulse

The broader crypto market sentiment remains constructive as long as BTC defends key structural demand zones.

🎯 Trade Plan

Entry:

Flexible execution — look for pullbacks into intraday demand zones, previous breakout levels, or dynamic MA support for refined risk positioning.

Target: 75,000 USDT

Major psychological resistance

Previous liquidity pool

Potential distribution zone

Overbought condition likely near that level

If price approaches this region with weakening momentum or bearish divergence, profit protection is recommended.

Stop Loss: 67,000 USDT

Below key structural swing low

Below liquidity cluster

Invalidates bullish continuation structure

⚠️ Always adjust risk based on your account size and strategy. Risk management defines survival.

📈 Technical Confluence

🔵 50 & 200 Moving Averages acting as dynamic support

🔵 Bullish order block respected on 4H

🔵 MACD momentum building

🔵 Market structure intact above previous breakout zone

🔵 Liquidity imbalance partially filled

As long as BTC trades above the 67K structural support, upside continuation toward 75K remains technically valid.

🔗 Related Pairs to Watch (Correlation Insight)

Monitoring correlated assets strengthens conviction:

ETH/USDT → Ethereum strength confirms broader crypto risk appetite. If ETH outperforms BTC, bullish continuation probability increases.

BTC/USD → Spot USD pricing gives additional macro perspective vs stablecoin pricing.

TOTAL (Crypto Total Market Cap) → Expansion confirms risk-on environment.

DXY (U.S. Dollar Index) → Inverse correlation. Strong USD = pressure on BTC. Weak USD = supportive for crypto.

NASDAQ (US100) → Positive correlation with risk assets. Equity rally often supports BTC upside.

If DXY weakens while NASDAQ and ETH push higher → bullish confluence strengthens.

🌍 Fundamental & Macro Drivers

Key economic and crypto-specific catalysts influencing BTC:

🏦 U.S. Macro Factors

Federal Reserve interest rate expectations

CPI (Inflation Data)

Core PCE

NFP (Non-Farm Payrolls)

Treasury yields movement

🔎 Lower inflation + dovish Fed tone = supportive for BTC

🔎 Strong USD + rising yields = short-term pressure

💰 Crypto-Specific Catalysts

Spot Bitcoin ETF inflows/outflows

Institutional accumulation data

On-chain exchange reserve changes

Mining hash rate trends

Stablecoin liquidity expansion (USDT supply growth)

Growing ETF inflows + declining exchange reserves = bullish supply dynamics.

🧠 Trading Psychology Reminder

Markets reward discipline, not emotion.

Secure profits when momentum weakens.

Protect capital before chasing targets.

This plan outlines structure — execution and risk control remain personal responsibility.

If this setup aligns with your analysis:

👍 Drop a like

💬 Share your target in comments

🔔 Follow for structured crypto breakdowns

Precision. Patience. Profit.

UAMY 1D: Antimony Testing Its BackboneUnited States Antimony is a U.S.-based producer of antimony and related metals, a raw materials asset with pronounced cyclicality and high sensitivity to industrial demand. The company operates in the strategic materials segment, which makes it particularly attractive during commodity cycle upswings and periods of rising geopolitical demand for rare metals.

On the daily chart United States Antimony transitioned from the expansion phase toward 19.71 into a controlled corrective structure. The failed acceptance above 14.52 confirmed supply dominance at that level and initiated a sequence of lower highs. Price is now rotating back into the 5.95–6.55 demand zone.

This area aligns with the 0.786 Fibonacci retracement and a rising diagonal support originating from the 4.35 low. That trendline has acted as dynamic support throughout the prior impulse and is now being tested again.

Momentum conditions suggest compression rather than acceleration. RSI is printing bullish divergence against recent price lows. Stochastic remains in oversold territory and is attempting to turn higher. MACD histogram is contracting, signaling weakening downside momentum. ADX remains subdued and does not confirm a strengthening downtrend. Volume between 6 and 7 shows clustering rather than capitulation.

As long as 5.95–6.55 and diagonal support hold, the base scenario allows for a structural rotation toward 12.00 as the first liquidity reaction. Acceptance above that level opens space toward 15.69, aligning with the 1.618 Fibonacci expansion. A sustained break below the demand zone would invalidate the compression thesis.

Heavy metal, light structure. The decision zone is here.

Prosus N.V. – diversified global internet & tech invest💹 Current Price: ~R875 (≈ 87 500 ZAc) – delayed price from recent data.

📈 All-Time High: ~125 581 ZAc (≈ R1 255.81) – historical peak.

📉 All-Time Low: ~31 044 ZAc (≈ R310.44) – March 2022 low.

📰 Latest News & Market Drivers:

• Prosus and Naspers plan to remove their cross-holding structure – a structural corporate action that could affect valuations.

• Recent interim financial results and updates on the share repurchase programme released via SENS reflect ongoing capital return initiatives.

• Ongoing buybacks and insider confidence continue to support sentiment amid structural discount concerns.

CSB, Cashbuild Ltd | SA home improvement retailer📌 **CSB | Cashbuild Ltd (JSE: CSB)**

🏗️ SA home improvement retailer with regional footprint across SADC.

💹 **Current Price:** ~R140

📈 **52-Week High:** R200

📉 **52-Week Low:** R120

📊 **All-Time High:** ~R504 (chart reference)

✍️ **Latest News:** Q2 FY2026 update reflects operational trends; dividend yield remains ~4.3%.

.

📰 Latest News & Drivers:

• Cashbuild released a second quarter FY2026 operational update in late Jan 2026.

• Dividends remain part of returns — paid semi-annually with ~R6.26 total last year (~4.29% yield).

• Recent sentiment has been weighed by economic pressures and consumer demand weakness, impacting margins.

.

.

#JSE #CSB #Cashbuild #SAEquities

Breaking through the trend line will go 100%As you can see from the descending channel, it's approaching the upper channel ceiling. All indicators point to accumulation at the line, which has been tested as shown in the circle. Now, all indicators are accumulating towards overbought territory. If it fails to break through, it will return to the channel's midline, allowing the indicators, especially on the daily chart, to recover. Alternatively, after a long candle, it could reach 100%, which is what I personally expect, before retracing to the 0.045 level.