Trxusdt

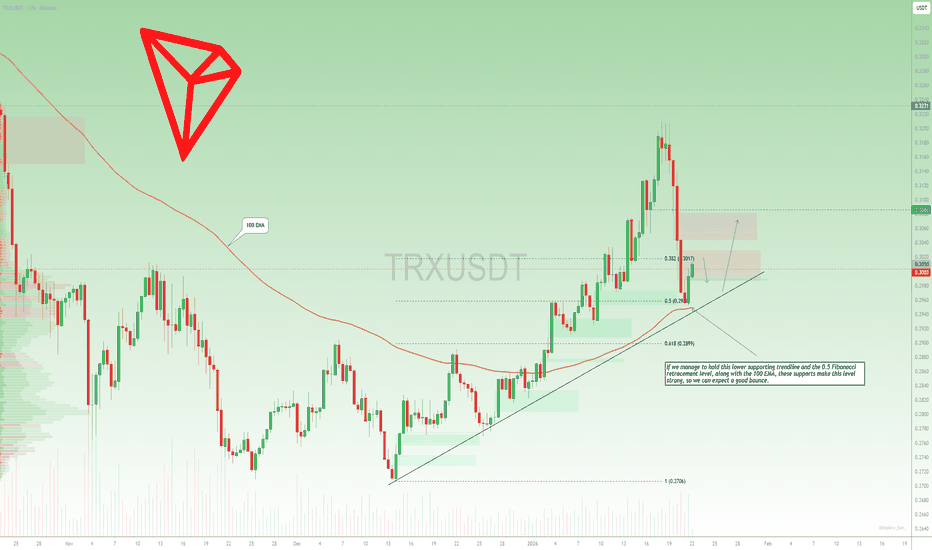

$TRX at a key support confluenceAMEX:TRX is pulling back after the strong impulse and is now testing a high-confluence support zone around $0.29–$0.30.

This area lines up with the ascending trendline, 0.5 Fib retracement, and the 100 EMA, making it an important level for bulls.

If this zone holds, we could see a solid bounce, with upside back toward $0.31–$0.32 and potentially higher on continuation.

As long as this support holds, pullbacks remain buyable. A clean breakdown would invalidate the setup.

#TRX

$TRX – Structure Break in ProgressBINANCE:TRXUSDT has broken out of a long descending wedge after weeks of compression and is now holding above the descending trendline.

Key levels from the chart:

Entry zone: 0.300 – 0.306 (retest of breakout area)

Invalidation / SL: Below 0.286

Upside targets:

0.330

0.355 – 0.360 (next major supply zone)

Structure has flipped bullish:

- Selling pressure has been absorbed

- Breakout came from compression, not hype

- Risk is well defined below support

As long as price holds above the breakout zone, bias remains upward.

TRX/USDT: Controlled Accumulation at the $0.30 GateTRON (TRX) is exhibiting a textbook example of "controlled continuation" on the 4H timeframe following a successful reclaim of the prior resistance zone around $0.298. Instead of rejecting at the psychological $0.30 handle, the market is compressing directly below it, keeping the structure of higher lows intact. This suggests a phase of accumulation rather than distribution.

Why this setup is on our radar:

Structure Integrity: The price action is strictly respecting the rising channel structure. The ability to hold above the recent breakout level ($0.298) confirms that previous resistance has successfully flipped into support (Change of Polarity).

Volatility Compression: We are seeing volatility contract as price hugs the $0.30 resistance. Typically, higher lows grinding into a flat resistance level indicates buying pressure is absorbing the overhead supply.

Volume Profile: Current volume is below average (82M vs 172M Avg), which is characteristic of the "calm before the storm" often seen during consolidation phases before an expansion move.

Technical Levels & Plan:

Buy Zone: The current consolidation range (0.298 - 0.2995) offers an entry aligned with the trend.

Invalidation Level: A 4H close below the yellow demand box and lower trendline support (~0.288) would signal a failure of the rising structure and a return to range-bound trading.

Structural Resistance (Targets): Short Term: 0.305 - 0.312 (Immediate Channel Resistance) Mid Term: 0.340 - 0.370 (52-Week Highs)

Macro / Moonbag: Acceptance above the 52-week high ($0.37) places TRX in macro price discovery territory.

Risological Note: We view the $0.30 level not as a ceiling, but as a "gate." The repeated tests weaken the resistance. We are positioned for the breakout, not the rejection.

Disclaimer: This analysis is for educational purposes only. Crypto assets are highly volatile. This is not financial advice.

TRXUSDT – 4H Chart Update & Analysis. TRXUSDT – 4H Chart Update & Analysis

Price is compressing inside a descending broad channel with a short-term ascending triangle forming → volatility squeeze near the apex.

Price is hovering around the 50 MA

Immediate Support: 0.278 – 0.275

Major Support: 0.268 – 0.265

Resistance: 0.285 – 0.288

Breakout Zone: 0.295 – 0.305

Higher lows + flat resistance = pressure building.

A 4H close above 0.288 can trigger a sharp upside expansion (as projected).

Rejection keeps the price ranging inside the structure.

⚠️ Trade only after confirmation.

NFA | Risk management required

TRX/USD Swing Opportunity After Technical Breakout!🚀 TRX/USD - "TRON VS U.S. DOLLAR" | Crypto Swing Trade Blueprint 📈

💎 CURRENT MARKET STATUS (December 30, 2025)

TRX is trading at $0.2818 USD with 24-hour volume of $566.75M and market cap of $26.68B, ranked #8

📊 TRADE SETUP ANALYSIS

Plan: BULLISH momentum confirmed

Simple Moving Average pullback pattern identified

TRX holding higher timeframe supports with accumulation signs on daily chart

Weekly chart shows bullish engulfing pattern suggesting strong buyer momentum

Entry: Market execution at current levels (~$0.2818)

TRX has high correlation with Bitcoin, positioning it for amplified gains during BTC bull runs

Smaller market cap makes percentage expansions more feasible than BTC

Stop Loss: $0.27900

⚠️ Risk Disclosure: Ladies & Gentlemen, this is MY protective stop level. Adjust YOUR stop loss based on YOUR strategy, risk tolerance, and portfolio size. I'm NOT recommending you copy my exact levels - manage your own risk!

Take Profit Target: $0.28900 (Triangular MA resistance zone)

📌 Profit Management Note: This target represents strong resistance + potential oversold bounce correlation. However, YOU decide when to secure profits. This is NOT financial advice - take profits at YOUR comfort level based on YOUR trading plan!

🔗 CORRELATED PAIRS TO WATCH

Direct Pairs:

TRX/BTC - Analyst notes TRX less than 2 days from fresh breakout on monthly vs BTC, with 465 satoshi conservative target

TRX/USDT - Primary trading pair, highest liquidity

TRX/ETH - Cross-correlation play

Market Correlation Analysis:

TRX demonstrates high correlation with Bitcoin measured by Pearson coefficient; tokens with strong BTC correlation tend to amplify gains during bull cycles. Recent market saw $242M liquidations with BTC at $87,000 and TRX at $0.285, showing synchronized movement.

Related Assets to Monitor:

BTC/USD - Lead indicator for TRX direction

ETH/USD - Layer-1 competitor gauge

USDT dominance - TRON surpassed Ethereum in USDT volume, with over $80B USDT on TRON network

📰 FUNDAMENTAL & ECONOMIC FACTORS

Recent Bullish Catalysts:

Network Growth 📊

TRON accounts reached record 355.4M in December 2025, with 240,000 new accounts created daily

Perpetuals volume hit $1.1B on December 23, showing heightened leveraged trading interest

Institutional Integration 🏦

TRON integrated with Base (Coinbase's Layer 2) via LayerZero in December 2025

TRON DAO announced real-world settlement powered by USDT on TRON with RealOpen Crypto on December 26, 2025

Technical Upgrades 🔧

GreatVoyage v4.8.1 mainnet upgrade deployed with improved EVM compatibility

Token-agnostic gas payments launched late 2024, allowing any TRC-20 token for fees

Stablecoin Dominance 💵

TRON leads in USDT/USDD utility with cross-chain liquidity expansion

T3 Financial Crime Unit froze over $300M in criminal assets, strengthening ecosystem trust

Market Sentiment:

Price prediction models suggest 12-18% increase potential, reaching $0.32-$0.34 by December 2025

RSI at 67.87 indicates approaching overbought territory but still accumulation phase

Bearish Risks:

TRX down 16% in Q4 2025, tracking worst quarterly performance despite network growth

Centralization concerns regarding token distribution

Resistance at $0.30 zone with potential liquidity traps

⚡ KEY TAKEAWAYS

✅ Strengths:

Dominant stablecoin infrastructure

Record user growth and network activity

Major institutional integrations (Coinbase/Base)

High Bitcoin correlation for bull-run amplification

⚠️ Watch Out For:

Resistance clusters at $0.30-$0.31

Broader crypto market volatility

BTC price action as lead indicator

💬 Let me know your TRX targets in the comments! Are you bullish or bearish? 🚀📉

🔔 Follow for more crypto swing trade setups and market analysis!

TRX TRON Technical Analysis and Trade Idea I’m currently watching TRX / TRON 👀💎.

We can clearly see bullish price action developing on both the Daily and 4H timeframes 📈🔥, which keeps TRX firmly on my radar for a potential buy setup.

That said, I’m not chasing price — I have specific conditions that need to be met ✅📊:

🔹 Scenario 1 – Pullback Entry

If price pulls back into a previous support zone from current levels 🔄📉, I’ll be looking for a bullish break of structure as confirmation before considering an entry 🚀📌.

🔹 Scenario 2 – Continuation Entry

If price continues higher from here 📈, I’ll want to see TRX create a higher high, followed by a healthy retracement back into the current level, which would then act as new support for a possible buy entry 🧠📍.

As always, patience is key — I let price come to me and confirm the bias 🔒📈

⚠️ Not financial advice. Trade responsibly and manage risk at all times.

TRX / USDT PERP – 4H Trade IdeaTRX is currently trading below a bearish order block, after a clear market structure break (MSB) to the downside.

🔴 Short bias

Rejection from bearish OB

MSB confirmed

No bullish displacement yet

Short idea

Entry: rejection at current OB zone

Invalidation: clean 4H close above the OB high

Targets:

This setup only remains valid as long as price stays below the OB.

What’s your bias here?

MrC

$TRX — The “protected child” of Justin SunOnce again, AMEX:TRX has proven it’s the “favorite child” of its creator, Justin Sun.

Despite the market chaos, OKX:TRXUSDT dropped only ~10%, showing exceptional resilience while many altcoins suffered deep crashes.

The next key support zone is $0.25–0.27, (based on trend line) which previously marked bottoms during the COVID crash (March 2020) and November 2022.

If buyers defend this level, it could act as a strong base for a rebound — possibly up to $1.7.

This structure continues to reflect steady demand and long-term accumulation rather than exit pressure.

💭 Will #Tron repeat its historical bounce from this range, or is the sentiment shifting this time?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

TRX/USD Breakout Watch – Can Bulls Sustain This Move?🔥 TRX/USD — "TRON vs U.S. Dollar" 🚀

Crypto Market Opportunity Blueprint (Swing Trade Edition)

💎 Plan: Bullish

🎯 Entry: Any price level after a confirmed breakout — patience is profit, my friends!

🛑 Stop-Loss: This is the Thief SL @ 0.28500 ⚔️

Dear Ladies & Gentlemen (Thief OG’s), please adjust your SL based on your own strategy & risk tolerance. Trade smart — not just fast!

💰 Target: Aim for 0.31000 — but remember, the police barricade might show up before that! 🏃♂️💨

Escape with profits before they catch you! Not financial advice — your bag, your plan, your escape route.

🧠 Note:

Dear Ladies & Gentlemen (Thief OG’s), these are my personal setups. You’re free to customize entries, exits, and targets to fit your strategy. Always manage your own risk like a pro!

⚡ Trade with discipline. Escape with profits.

#TRXUSD #TRON #CryptoTrading #SwingTrade #ThiefTrader #CryptoBlueprint #BullishSetup #TradePlan

TRON Short Strategy – Breakout Signal or False Alarm?💥 TRX/USDT "TRON vs TETHER" Crypto Market Profit Playbook (Day Trade) 💥

🧭 Idea: Bearish Market Flow Strategy

🔻 Plan Overview

This setup focuses on a bearish momentum play following a moving average breakout confirmation. TRON is showing weakness under key resistance, signaling potential for a short-term downside push.

Entry Zone: After confirmation of a moving average breakout below 0.29000

Stop Loss (SL): Thief’s Protective Stop @ 0.29800

🧠 Note to Dear Ladies & Gentlemen (Thief OGs): I’m not recommending you stick only to my SL — manage your own risk!

Take Profit (TP): Aim for the 0.27000 region — strong support + oversold pressure + potential trap zone.

🧠 Note to Dear Ladies & Gentlemen (Thief OGs): Take your profit your way! Move smart, stay safe, and trade at your own risk.

⚙️ Technical Breakdown

Trend Direction: Bearish bias under moving average structure

Momentum: Bear side gaining control — RSI sliding toward oversold territory

Support/Resistance:

Resistance: 0.29800 – 0.30000 (Breakout failure zone)

Support: 0.27000 (Major liquidity zone)

Confluence Factors:

✅ Price rejection at upper MA band

✅ Lower highs confirmation

✅ Strong correlation with overall crypto market cooldown

📊 Correlated Pairs to Watch

Keep an eye on these to confirm sentiment and volatility sync:

BINANCE:BTCUSDT → Market direction driver; weakness supports TRX bearish momentum

BINANCE:ETHUSDT → Mirror sentiment pattern — if ETH stays weak, TRX likely follows

BINANCE:XRPUSDT → Often moves in tandem with TRX liquidity cycles

BINANCE:BNBUSDT → Tracks overall crypto rotation and investor confidence

These correlations help confirm whether TRX’s move is isolated or market-wide.

🧩 Key Takeaways

Wait for MA breakout confirmation before jumping in 🕵️

Risk management > prediction — protect capital first 💼

Trap zones = opportunity + danger — play it smart ⚡

Don’t chase — let the setup come to you 👑

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer: This is a Thief Style Trading Strategy — crafted for fun and educational sharing. Always do your own research and manage risk responsibly.

#TRX #TRXUSDT #TRON #CryptoTrading #DayTrade #BearishSetup #TechnicalAnalysis #CryptoMarket #TradingView #ThiefTrader #CryptoStrategy #BTC #ETH #XRP #BNB

The key is whether it can rise above 0.2851

Hello, fellow traders!

Follow us to get the latest information quickly.

Have a great day.

-------------------------------------

(TRXUSDT 1M Chart)

From a long-term perspective, the price needs to remain above 0.18-0.2011 to continue the uptrend.

If it encounters resistance at 0.2851 and declines, we should check for support near the M-Signal indicator on the 1M chart.

If further declines occur, support around 0.18-0.2011 will be crucial.

-

(1W chart)

Looking at the 1W chart, we should examine whether it finds support near 0.2548-0.2851 and can rise.

If it finds support near 0.2548-0.2851 and rises, the key question is whether it can break above the 0.3379-0.3614 range.

-

(1D chart)

Therefore,

1st: 0.2548-0.2851

2nd: 0.18-0.2011

When support is found near the 1st and 2nd levels above, it indicates a period of partial buying.

It is falling below the HA-Low indicator, showing a stepwise downward trend.

Therefore, you should consider either waiting for the stepwise downward trend to stop or increasing the number of coins (tokens) that can be profited through day trading.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

TRX: Bullish with high confidenceHey guys, let's break down what's happening with Tron on the 1-hour timeframe because we're seeing some textbook oversold conditions that could set up a solid mean reversion play.

TRX is currently trading at $0.2772, down 1.29% over the last 24 hours and sitting dangerously close to the daily low at $0.2767. The price action has been grinding lower throughout the session, but what's really catching my eye is the confluence of extreme oversold readings across multiple momentum oscillators. RSI has crashed to 19.2, Stochastic is pinned at 9.7, and Money Flow Index is absolutely wrecked at 11.3 - these are capitulation-level numbers that we don't see every day.

When you get RSI below 20 and Stochastic under 10 simultaneously, you're typically looking at selling exhaustion rather than the start of a fresh breakdown. The ADX reading of 59.1 confirms we're in a strong trending environment, but here's the thing: strong trends paired with extreme oversold conditions often mark the final flush before a bounce. Price is literally kissing the lower Bollinger Band at $0.2766, which has been acting as a technical support floor. The 4.5% lower wick on recent candles tells us buyers are already starting to defend these levels, even if hesitantly.

From a moving average perspective, the picture is clearly bearish. TRX is trading below the EMA20 ($0.2795), EMA50 ($0.2811), and EMA200 ($0.2825), with a confirmed lower high formation that validates the downtrend structure. The HMA55 sits at $0.2795, creating a resistance cluster right around that EMA20 level. This convergence zone between $0.2795 and $0.2801 (Bollinger middle band) is going to be your first major hurdle on any bounce attempt. The MACD remains bearish with the histogram negative (MACD at -0.0011, Signal at -0.0008), so we're definitely fighting against the prevailing momentum here.

But here's where it gets interesting: volume analysis is showing a completely different story. Current volume sits at just $3.26M compared to the 24-hour average of $8.43M - that's only 39% of normal activity. When you see price making new lows on significantly below-average volume, it's a red flag that the move lacks conviction. Sellers aren't piling in with force here; instead, we're seeing passive drifting lower, which often precedes reversals. The 24-hour volume of $64.7M is decent, but the intraday weakness in participation suggests this decline is running on fumes.

Let's talk support and resistance levels because these are critical for framing any trade setup. Immediate support is the 24-hour low at $0.2767, which coincides almost perfectly with the lower Bollinger Band at $0.2766. This is your line in the sand - hold here and we're looking at a bounce; break below with volume and the oversold condition could extend further (though that seems less likely given current momentum exhaustion). On the upside, first resistance is that EMA20/HMA55 cluster at $0.2795, followed quickly by the Bollinger middle band at $0.2801. These levels will likely act as magnets for any mean reversion move.

Beyond that initial resistance zone, the EMA50 at $0.2811 and EMA200 at $0.2825 represent more substantial barriers. The EMA200 in particular is significant because it's been capping rallies and would mark a full retracement of today's decline. The 24-hour high at $0.2834 sits just above that and represents the upper boundary of today's range - breaking above that would flip the short-term structure and potentially signal a trend reversal rather than just a bounce.

For a trading setup, I'm favoring a counter-trend long position here with tight risk management. Entry zone would be in the $0.2770 area, essentially current price levels while we're testing support. Your stop loss needs to be tight given we're fighting the trend - I'd place it below $0.2760 to give about 10 pips of breathing room below the support cluster. That's roughly a $0.001 risk per unit. Take profit targets would be layered: TP1 at $0.2795 (EMA20/HMA55, about 2.5:1 RR), TP2 at $0.2801 (Bollinger middle band, about 3:1 RR), and TP3 at $0.2825 (EMA200, roughly 5.5:1 RR) for those wanting to ride extended bounces.

The risk-reward here is favorable if you're disciplined with your stops. This isn't a high-conviction trend-following setup - it's a tactical mean reversion play based on extreme oversold conditions and weak selling volume. The confidence level sits around 73%, which reflects the fact that we're trading against the prevailing trend but with strong technical justification from momentum indicators. You're essentially betting that the rubber band has stretched too far and needs to snap back toward the mean.

One scenario to watch: if we do get that bounce to the $0.2795-$0.2801 zone and price gets rejected hard with increasing volume, that would actually be a great short setup for continuation lower. But right now, at these oversold levels with price testing support, the path of least resistance for a short-term move appears to be up rather than down. The bearish structure remains intact on higher timeframes, so this would be a scalp rather than a swing trade - get in, take profits at resistance, and don't overstay your welcome.

What are you thinking on this setup? Are you comfortable fading this weakness for a bounce, or would you rather wait for confirmation above $0.2795 before getting involved?

TRX Breakdown Incoming? This Trendline Retest Could Be the FinalYello Paradisers, could this be the final warning before #TRX breaks down completely? Or is the market setting up for a savage fakeout that will trap late sellers and then rip higher?

💎#TRXUSDT is currently retesting the ascending trendline after pulling back from the supply zone around $0.2820, a level that has consistently acted as strong resistance. Price action remains within a clearly defined ascending channel, with the lower trendline still providing solid technical support; however, momentum is beginning to shift. The MACD is starting to show signs of developing bearish pressure, supporting the likelihood of a potential downside continuation in the short term.

💎If the current retest fails and confirms a rejection from this supply zone, the probability of a move lower increases significantly. In that case, the price could first target the minor support around $0.2720, and if selling pressure continues, we would be eyeing the stronger support zone near $0.2660 as the next key level to watch. On the flip side, a confirmed breakout above $0.2900 would completely invalidate the bearish setup and instead favor a bullish reversal scenario, opening the door for a more aggressive leg up.

💎Right now, the market structure presents a clean and high-probability short setup. The risk is clearly defined above the $0.2820 supply zone, and if the rejection confirms, the setup offers a very favorable risk-to-reward ratio for disciplined traders.

Trade smart, Paradisers. The market is never generous for long, and only those who combine strategy with discipline will reach the winner’s circle.

MyCryptoParadise

iFeel the success🌴

TRX/USDT — Long-Term Trendline Test: Bounce or Breakdown?TRX has maintained a multi-year higher-high, higher-low structure, making it one of the most stable altcoins in a volatile market cycle. But now, price is sitting directly above the primary ascending trendline — the same trendline that has supported TRX’s entire bullish expansion since early 2023.

This weekly zone is a major decision point:

Will TRX extend its long-term bullish structure, or will it break down and enter a deeper correction phase if the trendline and the $0.212 support fail?

---

The long-term uptrend remains intact as long as the trendline holds.

The price is currently retesting the trendline — a zone that historically triggers strong reactions (powerful bounce or sharp breakdown).

The horizontal level at $0.212 acts as the critical structural support.

Current movement looks like a healthy pullback, not a full reversal (unless the trendline breaks).

---

📈 Bullish Scenario — “The Continuation Rally”

If TRX successfully holds the trendline and forms a bullish reaction, the next leg of the uptrend may begin.

Bullish Confirmation Signals:

Strong weekly close above the trendline

Bullish reversal candle (pin bar, hammer, or engulfing)

Increase in buy volume during the trendline retest

Bullish Targets:

1. $0.32 – $0.35 → first resistance zone

2. $0.45 → major 2025 peak

3. Break above $0.45 → potential long-term price discovery

Bullish Narrative:

“As long as the trendline holds, this is not a correction — it’s a refueling phase before the next rally.”

---

📉 Bearish Scenario — “Trendline Breakdown Phase”

If TRX loses the trendline on a weekly close, the long-standing bullish structure may break for the first time since 2023.

Bearish Confirmation Signals:

Weekly close below the trendline

Retest of the trendline turning into resistance

Weekly close below $0.212 → full structure breakdown

Bearish Targets:

Deeper correction into the next major demand zones

Larger volatility due to long positions liquidating below the trendline

Bearish Narrative:

“A trendline breakdown is not a pullback — it signals a structural reversal.”

---

📌 Pattern Summary

Primary Pattern: Long-term rising trendline

Current Phase: Controlled weekly pullback

Possible Outcomes:

Bull Flag continuation (if price bounces)

Trendline Breakdown (if price closes below support)

---

🎯 Final Conclusion

TRX is positioned at a critical structural level where the market will decide between a continuation of the multi-year uptrend or a macro correction phase.

The next few weekly candles will be decisive.

---

#TRX #TRXUSDT #CryptoAnalysis #TechnicalAnalysis #Trendline #WeeklyChart #Altcoins #BullishScenario #BearishScenario

FireHoseReel | TRX Technical Outlook After Resistance Break🔥 Welcome to FireHoseReel!

Let’s jump into the TRX market structure analysis.

👀 TRX – 4H Overview

TRX has successfully broken above the $0.2824 resistance and is now pushing higher.

Over the past 24 hours, TRX trading volume has dropped by 20%.

📊 Volume Analysis

Watch the volume closely on the chart. Every time price previously reached $0.2824, it faced strong sell pressure and sell orders were heavily filled.

On the third and current test, fewer sell orders were present, and with a slight increase in volume, this resistance was finally broken.

✍️ TRX Trading Scenarios

Below are the active scenarios you can use alongside your trading strategy:

🟢 Long Scenario

Since TRX has broken this resistance, you can enter a long position, placing your stop-loss below the current low.

Alternatively, wait for better consolidation above this level and enter on the pullback for a safer setup.

🔴 Short Scenario

A break below the $0.2791 support, accompanied by strong selling pressure, could lead to a deeper drop and offers a valid short setup.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

TRX Approaching Key Breakout Zone as Structure TightensTRX is approaching a critical decision point inside a compressing structure where price is being held between diagonal resistance and a rising support line. The market has printed a clean series of higher lows while repeatedly testing the same resistance, suggesting growing pressure beneath the price.

The current reaction inside the grey fib zone shows that buyers are active, and as long as this support holds, TRX can attempt another push into the supply region highlighted above. The behaviour inside this zone will determine whether price continues upward or rejects for a deeper pullback.

The zone around 0.282 to 0.286 is the important breakout region to watch. If price reclaims it, momentum can shift upward rapidly toward the next liquidity pockets.

Key Notes

• Price is compressing into an apex between support and diagonal resistance

• Fib retracement region is holding as intraday support

• Liquidity sits above the 0.282 to 0.286 supply region

• Higher lows suggest accumulation behaviour

Bullish Scenario

If TRX continues to hold the fib support and breaks above 0.282, the structure opens room for a move toward the upper supply zone with potential follow through.

Bearish Scenario

Failure to hold the grey support region can push price back to retest the lower trendline around 0.270.

Invalidation

A clean break and continuation below 0.270 invalidates the bullish setup and delays any potential breakout.

Simple explanation

TRX is squeezing into a decision point. Holding support gives it room to break out. Losing support sends it back to the lower trendline. Watch how price behaves around 0.282 because that level decides everything.

TRON: an inverse Head and Shoulders Hi!

Trend Overview:

The chart shows a prolonged downtrend, highlighted by the steady descending trendline. Price has been making lower highs and lower lows, consistent with a bearish market structure.

Trendline Break:

Recently, a shorter-term descending trendline was broken to the upside, signaling potential bullish pressure and a shift in momentum.

Pattern Formation:

A classic inverse head and shoulders pattern has formed:

Left Shoulder: 0.2900 level

Head: 0.2765 level

Right Shoulder: ~0.2920 level

This pattern suggests a potential reversal from the prior downtrend to an upward move.

Target Zone:

The target of the head and shoulders pattern is marked around 0.3140–0.3180, representing the measured move from the head to the neckline. This is a key resistance zone where sellers might appear.

$TRX Tron’s Tightrope – Support Snap or Channel Escape?BINANCE:TRXUSDT CRYPTOCAP:TRX Tron’s Tightrope – Support Snap or Channel Escape?

Altcoin Pioneers! 🌐 TRX/USDT 1H is hugging that black descending channel lower boundary, price dipping to probe support at ~0.288 after a clean rejection at resistance 0.300. TRON's utility play shining through the noise, but macro headwinds keep the lid on – volume's muted, signaling caution.

Hold support? Bullish bias if it bounces with conviction; oversold RSI at 28 begging for relief. Breakout above resistance? Tease of upside to 0.305 on DPoS buzz, but needs >0.302 close. Deeper dip risk? Elevated – breach targets 0.282 (channel extension), altcoin drag.

Target: Mild pop to 0.295 if holds, probe 0.285 on fail. Tracking: MACD histogram flatten, Fibonacci retraces for confluence, and TRX/BTC for pair weakness. Tron on! ⚡📊

#TRX #TronNetwork #CryptoTA

TradeCityPro | TRX Pressured at Key Breakdown Level👋 Welcome to TradeCityPro!

In this analysis, I want to review the TRX coin, one of the oldest projects in the crypto space, with a market cap of $27.65 billion, currently ranked 8th on CoinMarketCap.

⏳ 4-Hour Timeframe

On this timeframe, as you can see, TRX is facing a very strong resistance zone, from which it has recently been rejected and has started a minor correction.

⭐ The support level currently holding this coin is at 0.2893, and during this correction phase, the price has already tested this level several times with long wicks.

✔️ At the moment, the price is hovering close to this support zone.Breaking below 0.2893 could serve as a solid short trigger.

🎲 The next support zone, if 0.2893 breaks, is around 0.2784, which can be used as the target for the short position.

💥 For long positions, the current trigger is the breakout of the resistance zone. A successful breakout above this area could mark the start of a new bullish trend for TRX.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

$TRX Channel Compression Nearing Support BreakdownBINANCE:TRXUSDT CRYPTOCAP:TRX Channel Compression Nearing Support Breakdown

TRX coiling in descending channel, probing support at $0.285 after rejection at $0.30 resistance.

Hold here for rebound to $0.305 target; break risks dip to $0.27.

RSI neutral but flattening, MACD bearish crossover, low volume hints at volatility spike. 📊🔻

#TRX #CryptoTrading #AltcoinUpdate

$TRX Trendline Tug-of-War – Support Showdown?BINANCE:TRXUSDT CRYPTOCAP:TRX Trendline Tug-of-War – Support Showdown?

Current trend: TRX's respecting the descending trendline from 0.31 highs, now probing the 0.291 support amid BTC bleed—sellers probing, but low-volume wicks scream buyer lurking 🛡️.

Hold support? High conviction yes; confluence with 50 EMA and prior lows positions for a clean defense.

Breakout above resistance? Bullish if 0.303 closes above trendline—could spark 4-6% rip to 0.315 🚀.

Dip risk? Capped at 0.285 on weak hold, with oversold preventing cascade.

Target: Short-term 0.305 on bounce; extended 0.32 with momentum.

Indicators tracking: RSI (40, neutral bounce), Trendline slope, and Stochastic oversold 📊.

#TRXTrading #CryptoSupport #AltcoinPioneers