UNH Momentum Play ¦ MA Breakout + Structure Aligning for Bullish📈 UNH – UNITEDHEALTH GROUP INC. (NYSE) | Swing Trade Profit Playbook 🟢

🧠 Trade Thesis

UNH is building momentum after clearing major pressure zones, and the chart structure hints at a bullish continuation once price powers above the breakout zone. Trend strength + MA positioning + momentum shift = a clean technical setup for swing traders. ⚡📊

🚀 Trade Plan (Bullish Breakout Play)

🔓 Breakout Entry Zone

Primary Entry: Above $340.00 breakout level

OR: Any price after a clean MA breakout confirmation 🔥📈

(Whichever comes first with volume is valid.)

🛑 Stop-Loss (Thief SL)

SL: $300.00

💬 "Dear Ladies & Gentlemen (Thief OGs), I’m NOT recommending you copy my SL blindly. Entry & SL are your own choice — you make money, you take money at your own risk." 😎🔐

🎯 Take-Profit Zone

Targeting $420.00

Why?

Kijun Line acting as strong resistance

Overbought conditions aligning

Likely bull trap zone → perfect place to escape with profits 🏃♂️💨💰

💬 "Dear Ladies & Gentlemen (Thief OGs), TP is YOUR choice too — this is just my map. Manage your bag wisely." 😉

📌 Additional Market Notes

Kijun MA = heavy ceiling.

Price currently sitting in a trap-prone region, so trade execution timing matters.

Breakout confirmation + sustained volume = stronger conviction.

🔍 Related Pairs / Correlations to Watch

These assets often reflect broader US healthcare / insurance sector flows or large-cap market sentiment:

NYSE:CVS – Healthcare services correlation; weakness/strength often echoes UNH structure.

NYSE:HUM – Similar managed-care trend behavior; watch for sector rotation.

NYSE:ELV – Moves in tandem with medical insurance majors; confirms sector direction.

AMEX:SPY – Large-cap market momentum; strong SPY = supportive wind for UNH.

AMEX:XLV – Healthcare ETF; acts as a sector-strength indicator.

Key Point:

If AMEX:XLV & AMEX:SPY are trending bullish while $HUM/ NYSE:ELV ** show momentum, UNH breakout continuation becomes more reliable. Sector rotation → strong confirmation tool. ⚖️📊

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Disclaimer: This is thief-style trading strategy just for fun. 🕵️♂️💸

#UNH #SwingTrade #NYSE #BreakoutStrategy #ThiefStrategy #HealthcareStocks #StockMarket #TechnicalAnalysis #MomentumTrading #TrendTrading #Investing #TradingView

Unhshareslong

UNH Swing Alert: $365 Call Ready to Run!

🚀 **UNH Swing Trade Alert | 2025-09-11** 🚀

**📈 Directional Bias:** Moderately Bullish (60% Confidence) ✅

**Why This Trade?**

* 🔹 Strong short-term momentum: Daily RSI 82.3 → overbought but bullish

* 🔹 Multi-timeframe gains: 5d/10d +15%/+18%

* 🔹 Low VIX favors directional call trades

* ⚠️ Weak volume (1.0x avg) → caution, risk of mean reversion

* ⚠️ Options flow neutral → no institutional confirmation

**💡 Recommended Trade:**

* **Instrument:** UNH

* **Strike:** \$365 CALL 💰

* **Expiry:** 2025-09-26

* **Entry Price (Mid):** \$5.55

* **Direction:** LONG ✅

* **Position Size:** 1 contract (scale to account risk)

* **Entry Timing:** Market open

**🎯 Targets & Stops:**

* **Profit Target:** \$10.00 (+80%)

* **Stop Loss:** \$3.60 (\~35% of premium)

* **Expected Hold:** 5–10 trading days (monitor daily; exit by Sep 24 if not hit)

**⚡ Key Risks:**

* Overbought RSI → potential mean-reversion pullback

* Weak volume → lack of institutional follow-through

* Put OI near \$350 → gamma friction may cap upside

* Naked call risk → premium-only loss possible if trade stalls

* Execution → use limit orders at mid to manage slippage

**💎 Trade Strategy:**

* Single-leg naked call

* Balanced delta (\~0.55–0.60) → probability vs leverage tradeoff

* Avoid deeper OTM or very cheap near-the-money calls

**📊 JSON Snapshot:**

```json

{

"instrument": "UNH",

"direction": "call",

"strike": 365.0,

"expiry": "2025-09-26",

"confidence": 0.60,

"profit_target": 10.00,

"stop_loss": 3.60,

"size": 1,

"entry_price": 5.55,

"entry_timing": "open",

"signal_publish_time": "2025-09-11 16:00:33 UTC-04:00"

}

UNH Options Alert: $340 Call Targets 100% Gain by Thursday!

🔥 **UNH Weekly Options Alert — Asymmetric Upside Play!**

**Directional View:** **Moderate Bullish** 💹

**Confidence:** 70%

**Trade Setup:**

* **Instrument:** UNH

* **Strategy:** BUY CALL (single-leg)

* **Strike:** \$340

* **Expiry:** 2025-09-12 (4 DTE)

* **Entry Price:** \$0.70

* **Entry Timing:** Market Open

* **Size:** 1 contract

**Targets & Risk:**

* **Profit Target:** \$1.40 (\~100% gain)

* **Stop Loss:** \$0.35 (\~50% loss)

* **Max Hold:** Close by Thursday midday/EOD to avoid gamma/theta acceleration

**Why This Trade?**

✅ Options Flow: Heavy call OI (11,025) and volume (10,119) → institutional directional bias

✅ Daily Momentum: RSI 73.5 — strong near-term bullish signal

✅ Volatility: Low VIX (\~15.3) supportive for directional buy

✅ Asymmetric Risk/Reward: Low premium, high upside potential

**Key Risks:**

⚠️ High gamma/short DTE → exit by Thursday mandatory

⚠️ Overbought daily RSI → potential mean reversion

⚠️ Weak weekly cash volume → trade may fail if stock doesn’t follow options flow

⚠️ Wide bid/ask on small OTM weekly calls → manage fills carefully

**Alternate Strikes:**

* \$337.50 call at \$0.91 → higher delta, slightly more expensive

* \$325 call at \$3.32 → near-ATM, higher probability but more capital required

**Quick Takeaway:**

* Strong options-driven setup for **short-term momentum play**

* Manage risk strictly with **50% stop + time-based exit**

* Exploit institutional call flow and low-cost asymmetric upside

---

📊 **TRADE DETAILS (JSON for precision)**

```json

{

"instrument": "UNH",

"direction": "call",

"strike": 340.0,

"expiry": "2025-09-12",

"confidence": 0.70,

"profit_target": 1.40,

"stop_loss": 0.35,

"size": 1,

"entry_price": 0.70,

"entry_timing": "open",

"signal_publish_time": "2025-09-08 12:38:03 UTC-04:00"

}

```

UNH Options Momentum Heating Up – Big Gains in Sight!

# 🚀 UNH Weekly Options Analysis (2025-08-17) – Don’t Miss Out!

### 🔎 Market Overview

UNH shows **strong bullish momentum**: Call/Put ratio at 2.56, rising daily RSI at 71.9, and institutional volume up 1.8x from last week confirm the bullish outlook. Weekly RSI at 37.5 suggests moderate resistance, so caution is advised. Low VIX (\~15) keeps gamma risk low, creating an optimal environment for directional trades.

---

### 📊 Key Model Insights

* **Call/Put Ratio:** 2.56 → strong bullish flow

* **Daily RSI:** 71.9 → strong short-term momentum

* **Weekly RSI:** 37.5 → moderate upward trend, watch resistance

* **Volume:** 1.8x previous week → institutional buying confirmed

* **Volatility:** Low VIX → low gamma risk

---

### 📊 Recommended Trade

* **Direction:** CALL (Long)

* **Strike:** \$310.00

* **Expiry:** 2025-08-22

* **Entry Price:** \$5.10 (aim for better at market open)

* **Stop Loss:** \$2.05 (\~60% of premium)

* **Profit Target:** \$7.65 – \$10.20 (50–100% gain)

* **Entry Timing:** Market Open

* **Confidence:** 75%

---

### ⚠️ Key Risks

* Momentum changes → monitor for trend reversal

* Gamma exposure → watch for VIX spikes approaching expiry

* Weekly close → exit by Thursday to avoid gamma decay Friday

---

📊 **TRADE DETAILS JSON**

```json

{

"instrument": "UNH",

"direction": "call",

"strike": 310.00,

"expiry": "2025-08-22",

"confidence": 0.75,

"profit_target": 7.65,

"stop_loss": 2.05,

"size": 1,

"entry_price": 5.10,

"entry_timing": "open",

"signal_publish_time": "2025-08-17 12:11:11 EDT"

}

```

UNH Ready to Rip – $265 Calls Set for Liftoff!🚀 **UNH Bulls Take Charge – \$265 Calls in Play!** 🚀

AI models flash **Strong Bullish** this week with a **5.17 Call/Put ratio** and **low VIX (15.9)** – perfect storm for upside momentum. 📈

**Setup:**

🎯 Strike: \$265C (Aug 15)

💵 Entry: \$0.80 | PT: \$1.20–\$1.60

🛑 Stop: \$0.39

⚡ Confidence: 65% – Watch volume!

Big Money Is Betting on UNH — Are You In Yet?## 🚀 UNH Weekly Trade Idea: Bullish Momentum Brewing at \$260! 📈💥

UnitedHealth Group (\ NYSE:UNH ) is flashing bullish signals across the board:

📊 **Call/Put Ratio: 3.12** → Heavy institutional bullish flow

📈 **Daily & Weekly RSI: Rising**

💰 **Volume Increasing** → Accumulation Mode?

⚠️ **Gamma Risk HIGH** → Perfect storm for explosive moves!

---

### 🔥 Trade Setup:

🟢 **Buy 260 Call** (Exp: 08/08)

💵 Entry: \$0.69

🎯 Profit Target: \$1.03 – \$1.38

🛑 Stop Loss: \$0.34

📈 Confidence: 65%

All models aligned on this: **Bullish Bounce Likely**

Range of strikes (\$255–\$260) show heavy interest = 🚨 breakout setup

💡 **Risk Management:** High gamma = fast moves. Lock profits or cut quick. Stay nimble!

---

### 📌 Suggested Hashtags/Tags:

```

#UNH #OptionsTrading #CallOptions #BullishSetup #RSI #GammaRisk #WeeklyTrade #StockSignals #MomentumPlay #HealthcareStocks

UNH Earnings Lotto Setup** (2025-07-28)

📊 **UNH Earnings Lotto Setup** (2025-07-28)

🎯 **Targeting a 2x return on post-earnings upside move**

---

### 💡 Trade Thesis:

**UnitedHealth (UNH)** is primed for a potential bounce on earnings:

* ✅ **Revenue Growth**: +9.8% YoY

* 🔥 **EPS Beat Rate**: 88% over last 8 quarters

* ⚠️ Margin compression risk from increased utilization

* 🧠 **Analyst Upgrades** trending positive

* 📉 RSI = **30.06** → Oversold territory

---

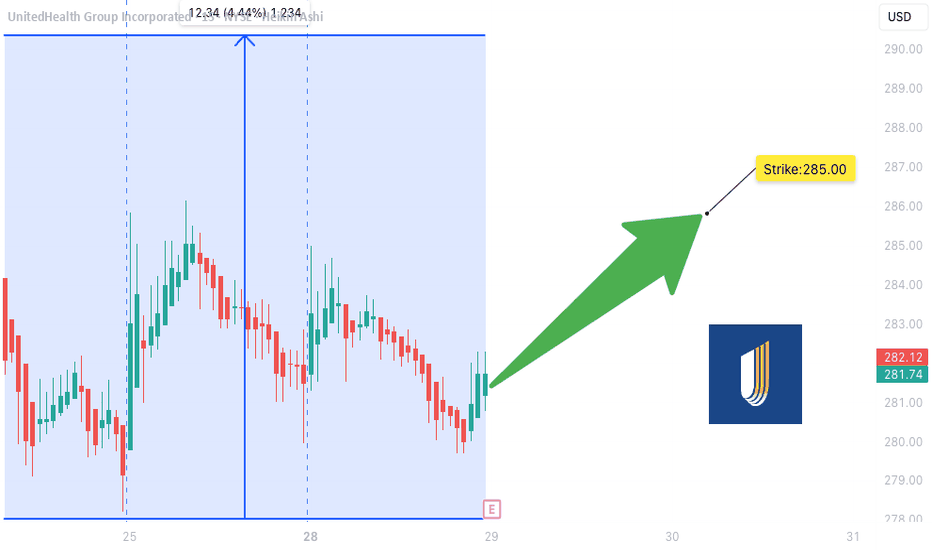

### 🔎 Options Flow & Technicals

* 🧲 Max Pain: **\$290**

* 🟢 Bullish call OI stacking at **\$285**

* ⚖️ IV Rank: **0.75** → Still has juice

* 🔻 Trading below 20D/50D MAs → Room for reversal

---

### 💰 Trade Setup

```json

{

"Instrument": "UNH",

"Direction": "Call (Long)",

"Strike": "$285",

"Entry Price": "$10.30",

"Profit Target": "$20.60 (2x)",

"Stop Loss": "$5.15 (50%)",

"Size": "1 contract",

"Expiry": "2025-08-01",

"Entry Timing": "Pre-Earnings Close (July 28)",

"Earnings Date": "2025-07-29 BMO",

"Expected Move": "±5%",

"Confidence": "70%"

}

```

---

### ⚖️ Risk/Reward

* Max Risk: 💸 \$1,030

* Max Gain: 🚀 \$1,030

* R/R Ratio: **1:2**

* Lotto-style with tight SL post-ER

---

### 🧭 Execution Plan

* 📅 Buy before close on **July 28**

* ⏰ Close same-day post ER **if target or SL hits**

* ❌ Exit manually if theta crush hits hard

---

### 🗣️ Final Note:

> “Oversold + Strong fundamentals + Positive consensus = Earnings bounce in the making.”

---

📌 Tag your UNH trades

💬 Drop your lotto setups

❤️ Like & repost if you're playing UNH this week!

\#UNH #EarningsPlay #OptionsTrading #TradingView #UNHEarnings #LottoTrade #CallOptions #HealthcareStocks #SwingTrade #RSI #IVRank #MaxPain