UNI/USDT – Bullish Momentum Builds But Resistance Looms at $6.26Uniswap (UNI) has surged nearly 35% from its December 18th low, igniting stop-loss runs above prior swing highs and establishing clear upside momentum.

The rally left behind a bullish daily gap between $6.06 and $5.38, which now serves as a key support zone.

🗳️ This price action coincides with the start of a new governance vote, adding fundamental interest. However, $6.26 – where sellers last pushed back on Dec 20th – remains the critical resistance bulls must flip for continuation.

🔼 Bullish Targets (if $6.26 breaks):

$6.57 – Prior distribution zone (week of Nov 10).

$6.73 – Bearish daily gap (Nov 20).

$7.18 – Major resistance (week of Nov 17), where bears previously regained control.

🔽 Bearish Scenarios (if support fails):

$5.20 – December 17 open; key line of defense.

Below that: $4.86 (Dec 18 swing low) becomes vulnerable.

These levels also align with the mid-point of last week’s long wick, adding further confluence.

📊 Momentum favors bulls for now, but watch how UNI reacts at $6.26—it's the gate to further upside or potential rejection.

UNI

UNI Analysis (4H)A trigger line has been broken on the chart. We have a bullish CH, and a Three Drive pattern is also visible at the bottom. These patterns usually push price upward toward the nearest supply zone. Price has been fueled from a strong origin, suggesting sufficient buy-side orders.

We currently have two re-buy entry points. If price pulls back to the downside, we can enter the position using a DCA approach.

The targets are marked on the chart.

Please note: if price reaches our entry zones before touching the red supply zone, we will enter the position. However, if price first reaches the supply zone and then returns to our entry area, we will not enter.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

UNI/USDT — Market StructureThe chart clearly shows a rising channel that price has respected for 3.5 years.

During the flash crash, there was a brief sweep below the lower boundary, but price quickly reclaimed it and has not broken down since.

As long as the weekly timeframe does not close below the lower boundary, the channel remains valid.

Accordingly, this is the logical stop level.

At current prices, the setup offers a solid risk/reward: price is sitting in an accumulation zone, and a bullish engulfing pattern has formed.

UNI also has strong fundamentals:

— positive tokenomics changes: 100M UNI scheduled to be burned,

— additional UNI burns planned from a portion of DEX platform revenues.

Suitable for adding to a long-term investment portfolio.

FireHoseReel | Uniswap Is Approaching a Market Decision Zone🔥 Welcome To FireHoseReel !

Let’s jump into Uni Swap (UNI) market analysis.

👀 UNI 4H Overview

UNI is currently trading inside a range box, with resistance at $5.858 and support at $5.445.

A breakout from either side can lead to a major move. Looking at the chart history, every strong upside move has been followed by a deep correction, yet the impulses themselves have been very sharp and aggressive.

📊 Volume Analysis

UNI volume on Binance is currently not very strong, so clear confirmation is still missing.

However, when UNI starts printing high volume on Binance as well, it signals increased trader attention.

A rise in volume would be a logical confirmation for the next price move.

✍️ UNI Trading Scenarios

🟢 Long Scenario:

A breakout above $5.858 can activate our long trigger, but this setup requires a clear increase in buying volume for confirmation.

🔴 Short Scenario:

A breakdown below the $5.44 support can push price toward the next demand zone.

This move should be confirmed with a strong rise in selling volume, making it a valid short opportunity.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

UNI Looks Bearish (1H)From the point where we marked the red arrow on the chart, the UNISWAP correction has begun, and the pattern appears to be a diametric.

The best area for wave F to complete is the highlighted red zone. If the price reaches this zone, we will look for Sell/Short positions.

The stop-loss and targets are also marked on the chart.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#UNI --- Uniswap to soar back into the 20'sAs a brand

how do u compete with a leader

Uniswap being the leader of on-chain exchange

Coke is the brand to invest in

(what stock did Buffet buy?)

not Pepsi

not RC cola

Do you get where I'm coming from

And I am not getting into to who, what or how

they have been infiltrated

but clearly they have

As an investor

you MUST pick the best of breed

That has historically been the best route to success.

UNI to rip is my prediction

UNI Rising Soon — Triangle in TuneThe situation in UNI right now looks almost identical to what I recently showed in my post about NEAR.

We’re seeing a corrective triangle, and a breakout to the upside seems likely.

As always, I see two possible scenarios — shown by the orange and purple arrows on my chart.

🎯 Targets:

• Target 1: 9.000

• Target 2: 9.400

• Target 3: 10.000

For now, my main focus remains on Target 1, since we’re still in a corrective phase.

❌ Invalidation zone: 8.142

⚠️ Disclaimer:

This is not a financial signal, just my personal view of the market.

Trade according to your own risk management, and never trade without stop-losses.

💬 Drop your comments and reactions below — and hit follow if you’d like me to keep sharing regular updates and forecasts on UNI!

UNI/USDT – Bullish Setup as Uniswap Expands Cross-Chain AccessUniswap just integrated Solana into its Web App, enabling swaps across Ethereum and 13+ other networks. This move significantly expands Uniswap’s ecosystem and could drive a surge in DEX volumes, adding fundamental strength to UNI.

Technically, UNI is trading near a key accumulation zone between $4.80–$5.10. A sustained hold within this range offers a potential long opportunity, especially as momentum picks up with this major protocol update.

🔹 Entry Zone: $4.80–$5.10

🔹 Targets: $6.00, $7.09

🔹 Stop Loss: Below $4.00

$UNIUSDT a good long oppotunity.The market is expected to cool down a bit after the recent CRYPTOCAP:BTC rally — that’s our chance to catch a solid long setup. Check the green box for the entry zone!

Entry in the green box as low as possible.

🎯 Target: $8.4, $9.7, $10+

If CRYPTOCAP:BTC corrects to around $120,000, it could drag altcoins lower, giving us a perfect opportunity for a juicy long position.

Always DYOR! 💪 #Crypto #Altcoins #BTC #Trading #TechnicalAnalysis #MarketUpdate #DYOR

TradeCityPro | UNI: Key Levels and Bullish Continuation Setup👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review UNI, one of the most popular DEX projects within the Ethereum ecosystem, with a market cap of $4.93 billion, ranking 28th on CoinMarketCap.

📅 Daily Timeframe

This coin has shown a strong upward move reaching 11.449 and then started a correction. After the failure at this level, a downward move began.

🧩 An important support zone around $8.5 has formed, which after breaking, is now acting as resistance.

✅ During this downward movement, the volume has been decreasing. Despite having two down legs so far, it can be said that the overall trend for this coin is still bullish.

📊 For a long position, the first trigger we have is the break of the Maker Seller level. Breaking this level will remove a lot of selling pressure, which could cause a sharp upward move in price.

🛒 The spot trigger for UNI is at 11.449. I recommend opening a long position after breaking the level, and using the profits from that position to buy this coin when the spot trigger is activated.

💥 For a short position, the trigger is 7.447. If the price ranges a bit longer in this area and then breaks the low, it would make a great position. However, if the price breaks the level right now, it would be a risky trigger.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Uniswap Holding above $7 — Bullish Setup AheadAfter the massive 90% drop from its 2021 peak, Uniswap has been consolidating within a wide range. Each attempt to break higher has so far been followed by a return toward the lower end of the structure — a clear sign of prolonged accumulation.

What’s particularly interesting is how the $7 zone has consistently acted as a median level. Every time price dipped below it, UNI found demand and reversed back up. Recently, a solid support base has been confirmed around $5, further strengthening the bullish technical structure.

With the majority of altcoins now positioned for potential upward continuation, Uniswap could also be preparing for a significant leg higher, with a medium-term target around $14 per coin.

However, negation of this bullish setup would come with a clear breakdown below the $7 zone, which could open the way for a retest of the $5 support once again.

From a trading perspective, this setup offers an attractive 1:5 risk-to-reward ratio, making it an opportunity worth keeping on the radar — provided the $7 level holds.

Important range: 10.626-12.130

Hello, traders!

Follow us to get the latest information quickly.

Have a great day!

-------------------------------------

Uniswap (UNI) is used on DEX exchanges.

This makes it connected to many ecosystems.

However, it's worth considering whether this coin (token) is worth holding in the medium to long term.

This is because if the DEX exchange fails to activate and fails, it could disappear completely.

Therefore, to trade this coin (token), I recommend holding it by gradually increasing the amount of coins (tokens) that represent profits.

-

(UNIUSDT 1M chart)

The key is whether it can break above the formed channel.

-

(1W chart)

The key is whether it can find support around 10.626 and rise above 14.233-17.073.

If it declines below 10.626, it should check for support around 5.448-6.940.

Therefore, if it falls below the M-Signal indicator on the 1M chart, trading should be halted and the situation should be assessed.

-

(1D Chart)

The key is whether the price can maintain support above 14.233, with support found around 10.626-12.130.

If the price fails to rise, we should check for support around 9.080.

If not, a decline to 6.940 is possible.

Since a short-term upward channel has formed, we should examine whether the price can rise along this channel.

--------------------------------------------------

Increasing the number of coins (tokens) for profit involves selling the original purchase price (+ transaction fees) to retain the coins (tokens) corresponding to the profit.

This increases the number of coins (tokens) with an average purchase price of 0, making it possible to hold them for the medium to long term.

This strategy is more effective in a downtrend than in an uptrend.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I'll explain more in detail when the bear market begins.

------------------------------------------------------

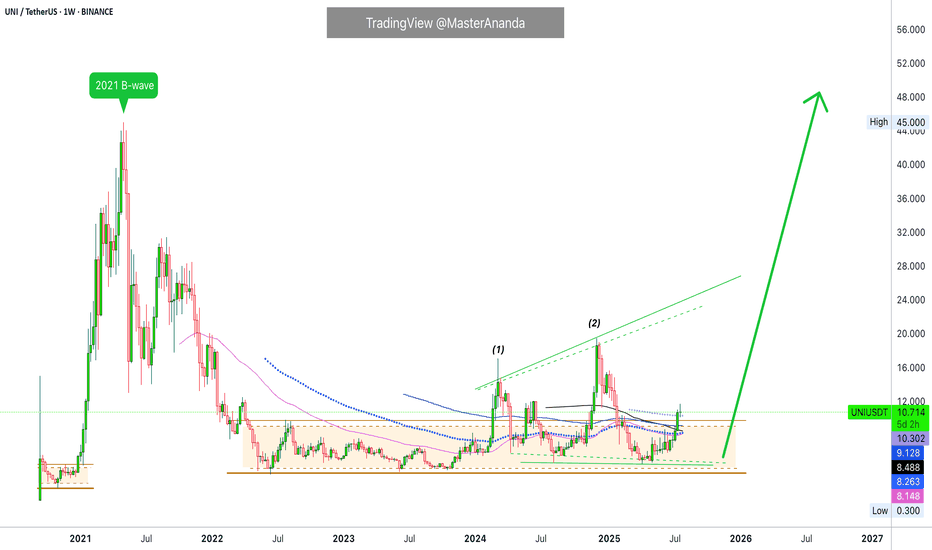

Uniswap Aims at $154, 1275% Profits PotentialUniswap is on track to hit a target of $45/$43. But, do not be surprised if later this year UNIUSDT trades at $112 or even $154. These are the numbers for this bullish wave. Seeing UNI at $11, means it is still early while trading volume has been rising.

Almost two years of rising volume.

Uniswap is now consolidating above the $10 resistance zone which is now support. This is interesting because the action on the chart can be seen as happening at random. When we extract the numbers, we can see clearly how trading is happening above an important fib level and this gives strength to the bullish case.

The indicators are good. These tools work. See here the moving averages:

UNIUSDT is now trading above EMA233, SMA200, EMA89, EMA55, etc. How different would it be if the action was happening below these levels rather than above, right? Or if the action is currently a bounce vs a break of resistance.

After years of consolidation and accumulation, after years of sideways, the Cryptocurrency market is ready for its next major bullish wave. The biggest ever please.

Namaste.

UNIUSDT Forming Bullish ContinuationUNIUSDT is currently presenting a compelling bullish continuation setup, as evidenced by the recent price action retesting a major support zone that previously acted as strong resistance. This key area, highlighted on the chart, has flipped to support—indicating a potential launchpad for the next impulsive move. The price has respected this zone and is already showing signs of a rebound, which may lead to a fresh leg upward in the near term.

The chart analysis points to a potential 52%+ gain from current levels, with a clear projection toward the $15.00 mark. The current pullback appears healthy within an overall bullish structure. UNI's steady volume during this phase further validates investor confidence, supporting the potential for a strong recovery rally. Technical traders often look for such clean price action following a breakout and successful retest of critical levels.

Fundamentally, UNI (Uniswap) remains one of the leading decentralized exchange protocols, and its continued development in DeFi space keeps it highly relevant. The market seems to be recognizing this with renewed buying interest. If current market sentiment remains bullish and broader conditions support altcoin growth, UNI could reach its projected upside in a relatively short timeframe.

With a strong technical setup, supportive volume, and renewed investor attention, UNIUSDT is shaping up to be a promising trade idea for mid-term swing traders and investors.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

UNI up 13% – is $10 the next stop?Hello✌

let’s dive into a full analysis of the upcoming price potential for Uniswap 📈.

BINANCE:UNIUSDT has maintained solid bullish structure within a well-formed ascending channel and is now approaching a key daily support zone. Recent volume spikes and a 13% price increase indicate growing buying interest. A breakout above the channel resistance could open the way toward the psychological target at $10, a level watched by many traders. Monitoring price action and volume confirmation here is essential for potential trend continuation. 📈🧠

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

Uniswap Exits Opportunity Buy Zone · $73 & $118 2025 ATH TargetUniswap is finally out of its long-term opportunity buy zone, a trading range that was activated first in 2022 and remained valid for a long time.

After October 2023, UNIUSDT produced two bullish moves but each time fell back into this zone. Orange/brown on the chart. Notice how this zone matches price action happening below EMA89, EMA55, MA200, EMA144 and EMA233. As Uniswap turned bullish and fully confirmed, it broke above all this major levels.

Last week, it managed to close above the really long EMA233 and this week the action is staying above. Currently $10.30.

Notice waves "1" and "2" these are relatively small waves. Something will happen with #3. The market evolves exponentially. Instead of another similar wave going a bit higher, it will be something like 2021. Not like 2021 in the sense that it will reach similar price levels, but in the sense that it will be completely out of proportion with what you saw in the last several years. Prices will go off-the chart.

We can think of resistance as a new all-time high being found around $73 and $118, but this time I only want to call your attention to this moment now. The fact that market conditions are changing and it is still early when we focus on the long-term.

I just realized that I might be seeing things differently and it is hard to visualize, for someone without the actual experience, what is about to happen. But despair not because that is the one reason why I am here and why you are reading this. I am here to alert you, remind you and prepare you for an event before it happens. In this way, you can profit and achieve your financial goals. I want to give you value in exchange for your trust. Will you trust? Uniswap is going up. Crypto is going up and it will be the best since 2021. Possibly the best bull market in the history of Crypto, the new regulatory framework and global adoption is saying so.

Thanks a lot for your continued support.

Namaste.

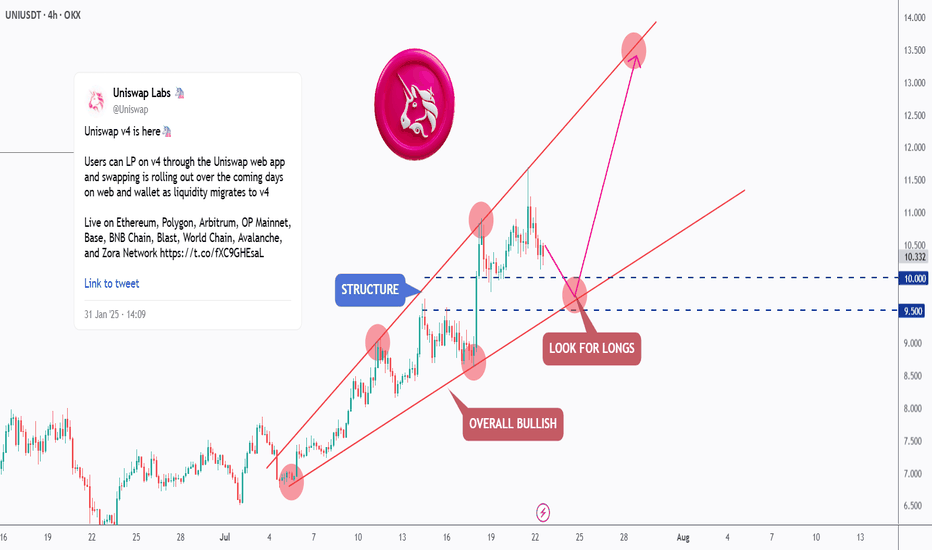

[Deep Dive] UNI – Edition 1: Retest. Reload. Rally?Uniswap (UNI) has been trading within a well-respected rising channel, showing consistent bullish structure across the 4H timeframe.

After a strong rally from the $7.50 region, price is now undergoing a healthy correction — retesting the lower boundary of the channel, which intersects with the $9.50–$10.00 demand zone.

📐 Technical Outlook

The market has printed a series of higher highs and higher lows, confirming the bullish momentum. The recent correction is testing a key support structure — previously a resistance zone — and this confluence aligns perfectly with the channel’s lower bound.

As long as this zone holds, UNI is well-positioned for a continuation toward the $13–$14 region, in line with the pink projected path.

🔥 Fundamental Boost

Uniswap has recently launched its V4 upgrade, introducing "hooks" — customizable smart contracts that allow developers to build more complex DeFi logic directly within liquidity pools. This upgrade not only enhances flexibility and capital efficiency, but also reduces gas costs — making Uniswap an even more dominant player in the DEX ecosystem.

Additionally, with Ethereum L2 adoption growing and Uniswap expanding across multiple chains (Arbitrum, Base, and Optimism), protocol usage and fees are on the rise again.

The UNI token may soon benefit from the proposed fee switch, which would redirect a portion of protocol fees to token holders — potentially adding new value accrual mechanics.

🟢 Conclusion

The technicals and fundamentals are aligning. UNI is in a bullish structure, trading at a key area of interest, and the latest upgrades may unlock new growth for the ecosystem.

Traders and investors alike should keep a close eye on this zone for long opportunities, as the next impulse could be just around the corner.

💬 What do you think — is UNI ready to break toward new highs, or will the demand zone fail? Let me know in the comments 👇

🔔 Disclaimer: This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Always do your own research and manage your risk accordingly.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

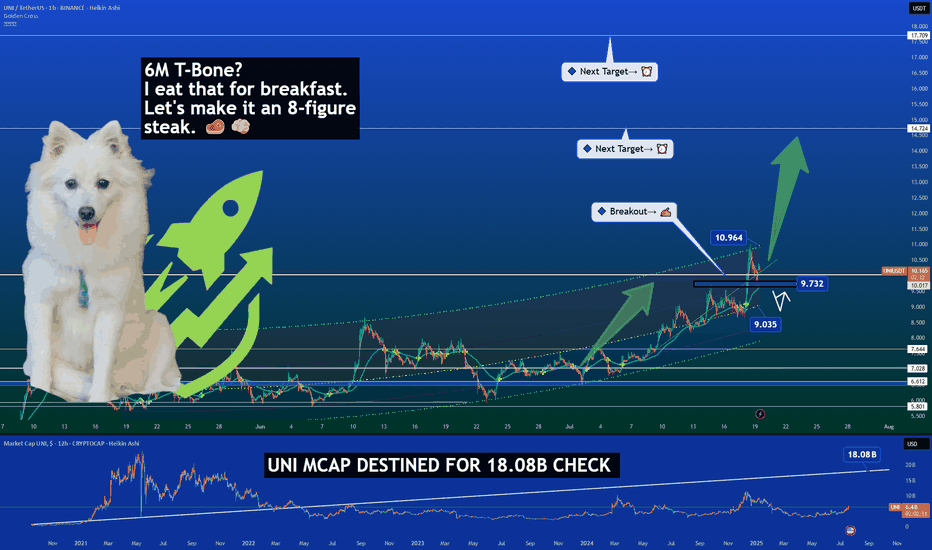

UNI Market Cap Breakout Signals Major Repricing Ahead 🚀📈 UNI Market Cap Breakout Signals Major Repricing Ahead 💥💹

Forget the December highs. That spike? It came with a bloated market cap and little real growth. T oday, it’s different.

UNI has reclaimed the key $10 level, but more importantly, its market cap structure is breaking out after years of compression — and that’s where the real alpha lives.

🔍 Technical View (Market Cap-Driven)

🔹 UNI broke above the $10.94 price zone with strong momentum

🔹 Currently retesting the $9.73 breakout base — a critical zone for bullish continuation

🔹 Market cap structure targets:

– Next milestone: $14.72 (aligned with local resistance)

– Macro extension target: $17.70, corresponding to a market cap near $18.08B

This puts UNI at the doorstep of a major repricing phase.

🧠 Why This Time Is Different

✅ Market Cap Breakout – We’re not just looking at price anymore. The structure on the market cap chart shows accumulation and a clean breakout from multi-year compression.

✅ Whale Activity – Addresses holding 1M+ UNI are growing fast. Over $60M in UNI was moved off exchanges in July alone.

✅ Protocol Expansion

– Uniswap v4 is imminent, introducing Hooks, dynamic fees & native ETH support

– Unichain L2 has now hit 6.3M wallets and 147M txs, growing faster than expected

✅ DeFi Rotation – Capital is rotating back into blue-chip DeFi. Uniswap isn’t just riding that wave — it’s helping define it.

🏁 What We’re Watching

🟦 Support: $9.73 – this must hold for continuation

🟩 Target 1: $14.72

🟩 Target 2: $17.70 (aligned with $18.08B mcap)

🟨 Risk zone below: $9.03 – invalidation if daily closes below

This is not about retesting old prices. It’s about rewriting the valuation story.

The UNI bulls aren't just hunting a T-bone — they’re after a full 8-figure steak. 🥩🧠

One Love,

The FXPROFESSOR 💙

D isclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈