US30

US30 | Bearish Pressure Below 49670US30 | Bearish Bias Below Pivot, Recovery Needs Breakout

The Dow Jones remains under pressure as price trades below a key pivot zone, keeping downside risk active unless buyers regain control.

Technical Outlook

The index maintains a bearish structure while trading below 49670.

As long as price remains below this level, downside pressure is expected toward 49240.

A break below 49240 would confirm bearish continuation toward 48840.

On the upside, a 1H candle close above 49680 would invalidate the bearish bias and support a bullish continuation toward 49980, followed by 50150.

Key Levels

• Pivot: 49530

• Support: 49240 – 48840

• Resistance: 49980 – 50150

DowJones awaits US Employment volatility Key Support and Resistance Levels

Resistance Level 1: 49490

Resistance Level 2: 49800

Resistance Level 3: 50110

Support Level 1: 48700

Support Level 2: 48480

Support Level 3: 48320

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Different Time, Same Pattern: Are Markets Repeating 1929?What if the Dow Jones isn’t just topping… but standing at the edge of a collapse similar to the Great Depression?

Could the 49,000 area actually be a historical peak, just like the levels we saw before the 1929 crash? Or is that comparison too uncomfortable to admit?

When we look at the chart structure before the 1929 collapse and compare it to today, is the similarity really a coincidence… or does history tend to repeat itself when everyone feels “safe”?

Back then, the bubble was called “technology.”

Today, is it simply wearing a new name: AI?

And here’s the unsettling question —

is what happened to RCA in 1929 now happening to NVDA, just in a modern version of the same story?

Are we witnessing innovation… or the final stage of euphoria before reality hits?

Maybe this time is different.

Or maybe that’s exactly what they said last time.

1h TF - Long on Dow Jones Industrial Average Index (Ticker DJI)TVC:DJI

Technicals:

Having the price consolidated between 48800 and 49600 during January, trade picture strongly depend on market sentiment and event occurence.

- Short-term Long scenario:

In case price decides to move above 49600 a descent amount of stop-losses will be collected, pushing / squeezing the price up to 50000. For that case a target is set according with recent price movements having reached a zone between 1.618 and 2.272 on fibo after breaking out from consolidation. After that price can find ressistance near ascending trend upper line. If further movement rejected, a probability of a short movement down to 48800 / 48400 increases

- Short-term Short scenario:

In my opinion this scenario is a positive one, as the price can go lower to collect some power for further impulse above 49600 and later do overhigh, signaling that industry is still ok. For that case beforewards price can go significantly lower that 49100 making risk-management for this particular position too high. For this reason the short stop is set only a few pips below recent bouncing candles and flying level (see orange circles on the screen)

Fundamentals:

- take care of 6th Feb friday`s report on employment in USA, cause the higher unemployment rate will mean that economy might struggle in nearest future, whereas the lower unemployment rate means directly the opposite

Conclusion:

- in my opinion the second scenario seems to be more likely as the US companies will continue to report in february on financials for recent 4th Quartal of 2025 as well as on earning estimation for 2026, letting the price being like soda in a bottle and consolidating before further breakout

- despite this I expect a stop-loss hunt in a nearest term and therefore open a short-term long on 1h tf with SL below recent bounce candles and TP targeting:

+ middle level of fibo 1.618 / 2.272 as well as

+ 1.53% breakout movement having multiplied recent breakouts benchmarks with 0.88 (because of 12% power reduction in a movement after breakout)

# - - - - -

⚠️ Signal - Buy ⬆️

✅ Entry Point - 49501.30

🛑 SL - 49161.27

🤑 TP - 50371.72

⚙️ Risk/Reward - 1 : 2.6 👌

⌛️ Timeframe - 1 day 🗓

# - - - - -

Good Luck! ☺️

# - - - - -

DISCLAIMER: Not financial advice. Everyone must make trading decisions at their own risk, guided only by their own criteria and strategy for opening or not opening a trade.

DOW JONESUS30 keeps breaking new highs

With SMA serving has strong support in the higher timeframes Daily-H4 to the lowest timeframe H1.

Also the fact that the price is respecting structure by:

1. Breaking of the previous high : price createda hew high and by breaking it gives confirmation of bullish continuation.

2. Price retrace and obyed the 50%-60% Fibonnacci level

3. Liquidity to the Up side have been created.

DowJones testing resistance at 49490Key Support and Resistance Levels

Resistance Level 1: 49490

Resistance Level 2: 49800

Resistance Level 3: 50110

Support Level 1: 48700

Support Level 2: 48480

Support Level 3: 48320

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DowJones range bound capped at 49490 resistanceKey Support and Resistance Levels

Resistance Level 1: 49490

Resistance Level 2: 49800

Resistance Level 3: 50110

Support Level 1: 48700

Support Level 2: 48480

Support Level 3: 48320

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30 | Below ATH Keeps Bearish Pressure ActiveUS30 | Below ATH Keeps Bearish Pressure Active

The Dow Jones is trading below its all-time high at 49590, keeping short-term pressure tilted to the downside unless buyers regain control on a higher timeframe.

Technical Outlook

As long as price remains below 49590, the index is expected to trade in a bearish mode toward 49240.

A break below 49240 would confirm bearish continuation, opening the way toward 48840.

On the upside, only a 4H candle close above 49590 would invalidate the bearish bias and support a bullish continuation toward 49985, followed by 50100.

Key Levels

• Pivot: 49590

• Support: 49240 – 48840

• Resistance: 49985 – 50100

DOW JONES giving a strong Sell Signal at the top.Dow Jones (DJI) has been consolidating for exactly the past 1 month, ranging within Resistance 1 and the Support Zone, with the current rebound coming off its 1D MA50 (grey trend-line) as well.

The 4H RSI is testing its Lower Highs trend-line and every time the index touched it, we had a strong Sell Signal. As a result, we turn bearish here yet again on the short-term, targeting 48400.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

DOW JONES INDEX (US30): Consolidation Completed?!

Dow Jones Index violated a resistance line of a symmetrical

triangle pattern on a daily time frame.

It indicates a highly probable completion of a bullish accumulation.

The market may continue rising now and reach 50000 level soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

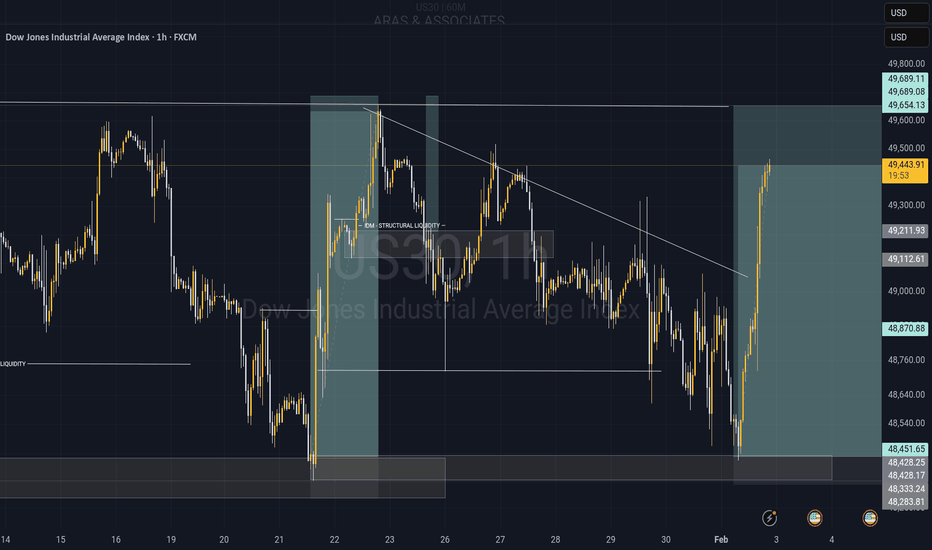

US30 FREE SIGNAL|SHORT|

✅US30 taps premium HTF supply with bearish displacement and rejection. Expect sell-side delivery toward equal lows after liquidity sweep above recent highs.

—————————

Entry: 49,443$

Stop Loss: 49,691$

Take Profit: 49,085$

Time Frame: 7H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅