USDCAD Eyes Breakout | New Fed Chair Boosts USD BiasHey Traders,

In the coming week, we are closely monitoring USDCAD for a potential buying opportunity around the 1.36100 zone. While USDCAD has been trading in a broader downtrend, recent US Dollar strength suggests the pair may be attempting a bullish breakout from that structure.

From a fundamental perspective, the recent appointment of a new Fed Chair is expected to provide short-term support to the US Dollar, as markets anticipate a more conventional and fiscally disciplined policy stance. This USD strength could help fuel a trend reversal or continuation higher in USDCAD.

Technically, if price can establish acceptance above the descending trendline, we will be watching for a pullback or retracement toward the broken trendline / 1.36100 area as a potential buy-the-dip setup, targeting further upside continuation.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

USD

What actually happened with silver and gold?📉 🔥 Historic sell-off in precious metals

Silver plunged roughly 30% in a single session, one of the steepest drops in decades.

Gold also fell sharply, down ~10% on the same day.

This wasn’t a gradual pullback, it was an explosive repricing event tied to market structure and narrative shift.

📌 The main trigger, Fed politics and policy expectations

🎯 Fed chair nomination reset risk pricing

President Trump’s announcement of Kevin Warsh as the next Federal Reserve Chair triggered the move.

Warsh is widely viewed as someone who would not pursue aggressive rate cuts or “soft dollar” policy.

Markets interpreted the news as reducing the likelihood of sustained monetary easing.

This altered expectations about:

- future rate cuts

- the strength of the USD

- how attractive non-yielding assets like gold & silver are

💵 Dollar and rates link

Silver and gold rallied heavily earlier this year on the weak dollar / low-rate narrative (inflation fears + Fed independence concerns).

After the Fed chair news:

- USD strengthened (DXY saw among its biggest single-day gains in months).

- Stronger dollar = precious metals face headwinds because they’re priced in USD globally.

- That dynamic mechanically pressured the metals complex.

🧨 Structural and technical catalysts

There were additional amplifiers beyond the headline:

1) Overextension

Silver was coming off a parabolic run. Parabolic moves tend to have sharp corrections once the narrative shifts, especially in leveraged markets.

2) Leverage unwind and margin effects

Many speculative positions were highly leveraged.

Once price started dropping, margin calls and algorithmic stop-loss triggers can cascade into rapid, large moves.

This is exactly how big crashes can happen even without fundamental supply/demand changes.

3) Monthly liquidity dynamics

Friday, Jan 30 was the final trading day of the month for many accounts, liquidity tends to thin at month-end and amplify volatility.

🧠 Market behavior tells a macro story, not just a metal story

1) Narrative shift from debasing dollar / easy money to policy uncertainty

Before: markets discounted a scenario of future rate cuts and dollar weakening → commodities soared.

After: a perceived shift in Fed leadership removed some of that expectation → safe haven flows unwound.

This is why silver and gold can drop even as risk assets also weaken, it’s not a simple risk-off trade.

2) Silver’s structure makes it more volatile than gold

Industrial component + safe-haven component

Overextension + technical stops = exaggerated moves

This aligns with macro liquidity swings rather than fundamentals abruptly changing.

📌 How this fits within a macro narrative

Your macro framework emphasizes relationships and regime context, not isolated moves. This event reinforces that:

➤ Monetary policy expectations are still central

Today’s moves weren’t driven by CPI or GDP data, they were driven by policy narrative shifts.

➤ Markets can unwind risk assets outside classic risk-off

Here we saw:

- Dollar strengthening

- Metals collapsing

- Stocks weakening

- Volatility rising

This is not pure risk-off, nor pure risk-on, it’s a repricing of policy risk across decision trees.

➤ Carry and liquidity still matter

When narrative shifts quickly, the weakest crowded trades unwind first, in this case, highly leveraged precious metals. Even ahead of the broader regime shift.

🧩 What this means for the short–medium term

1) Silver and gold volatility will stay elevated

Sharp moves tend to be followed by whipsaw behavior

Positioning is de-risking, not necessarily reversing yet

2) Dollar strength matters

Metals are discounted as the dollar index rebounds

Watch DXY behavior closely, if it stabilizes lower again, metals may find a footing

3) Policy risk is now priced more dominantly than macro data

Traders are reacting to expectations of future rate trajectories

This can create overshoots in both directions

📌 Key factual takeaways

Silver’s ~30% drop was one of the largest single-day declines in decades, driven by Fed chair nomination news and immediate re-pricing of monetary expectations.

A stronger USD and rising yields created headwinds for precious metals, which are priced in dollars and do not yield interest.

Technical and leverage factors (stop-losses, margin calls, overextended RSI) amplified the sell-off.

This was not a fundamental supply shock, but a macro sentiment and positioning unwind.

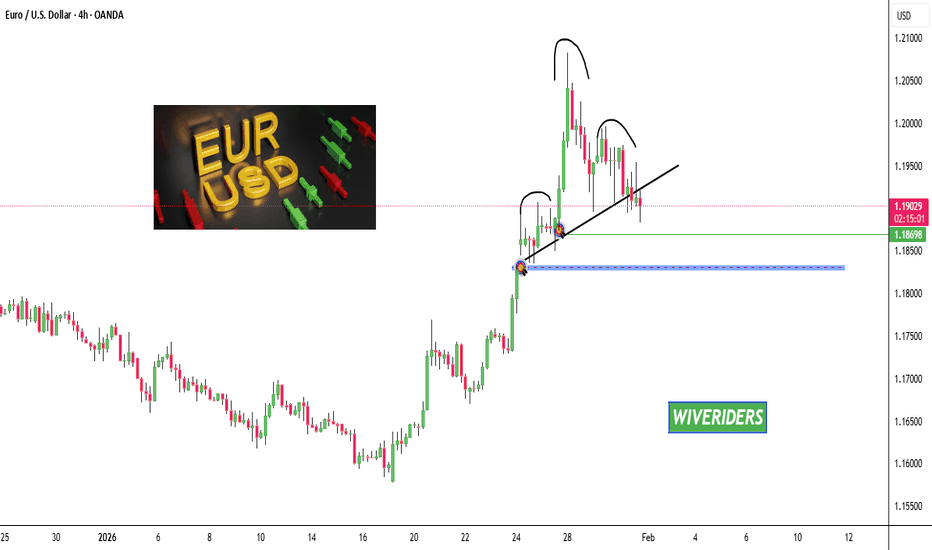

EURUSD has formed a bearish head and shoulders pattern on the 4H🚨📊 EURUSD Update

EURUSD has formed a bearish head and shoulders pattern

on the 4H timeframe .

Price has broken below the neckline ❌,

suggesting a downtrend continuation for the Euro 📉.

🔹 First target:

the green line level 🎯

🔹 After that, price could move toward

the blue support zone 🔵,

where a potential bounce may occur.

Structure remains bearish

until price reclaims key levels.

EURUSD Under Pressure? Warsh Fed Pick Puts 1.19500 in Play!Hey Traders,

In today’s trading session, we are closely monitoring EURUSD around the 1.19500 zone. EURUSD remains in a broader downtrend and is currently undergoing a corrective pullback, approaching a key trendline confluence and the 1.19500 support-turned-resistance area, which may act as a critical reaction zone.

From a fundamental perspective, markets are digesting President Trump’s announcement of Kevin Warsh as the new Fed Chair. Warsh is widely viewed as a conventional and fiscally disciplined choice, which could be USD-supportive in the near term. This shift in expectations may apply downside pressure on EURUSD, while also being short-term bearish for Gold, as tighter policy credibility supports the Dollar.

As always, wait for confirmation at key levels and manage risk accordingly.

Trade safe,

Joe.

NZDUSD hit its 1W MA200 for the first time after almost 4 years!Last time we looked at the NZDUSD pair (November 07 2025, see chart below), we gave a timely buy signal at the bottom of its Channel Down, which shortly after it hit our 0.57250 Target:

This time we move to the longer term time-frames, the 1W in particular as we have a critical Resistance test for the first time in almost 4 years. It's been the week of April 18 2022 when the pair last time hit its 1W MA200 (orange trend-line). At the same time, it hit the Lower Highs 1 trend-line that started on April 04 2022.

This is a strong Resistance cluster and given also that the 1W RSI touched its own 4-year Resistance (63.50), we are turning bearish on this pair, targeting 0.56000, which is just above the long-term Support Zone.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EUR/USD - Buy Entry (H1 - Flag Pattern)The EUR/USD Pair, Price has been trading within a Flag Pattern on the H1 chart, forming consistent higher highs and higher lows. Price action is now testing the upper boundary of the Pattern, signalling a possible breakout. FX:EURUSD

✅Market Context:

1️⃣Strong Upward Structure Inside the Pattern.

2️⃣Buyers are showing strength near Resistance.

3️⃣Breakout above the Trendline indicates Momentum continuation toward higher zones.

✅Trade Plan:

Entry: Buy after Confirmed Breakout above the Resistance (H1 candle close above trendline or retest of the breakout).

💰Take Profit (TP): At the Key Zone – a Major Resistance area identified ahead.

🛑Stop Loss (SL): Below the Pattern Structure.

✅Psychological Discipline :

1️⃣Stick to plan – No Revenge Trades.

2️⃣Accept losing trades as Part of the Strategy.

3️⃣Risk only 1–2% of your account balance per trade.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.

EURUSD potential LongsEURUSD is currently in a clear bullish market structure. This is a buy idea, not an active trade yet.

Price has not tapped my entry zone, so I’m patiently waiting for a retrace into the marked premium / supply area. Location aligns with prior lows and bullish imbalance, giving good upside potential if price delivers.

The setup only becomes valid once price reaches the zone and shows lower-timeframe bullish confirmation (structure shift or strong rejection). Until then, no entry. patience over forcing trades.

Bias remains bullish as long as structure holds.

AUDUSD potential SELLAUDUSD is currently in a clear bearish market structure after strong downside displacement. This is a sell idea, not an active trade yet.

Price has not tapped my entry zone, so I’m patiently waiting for a retrace into the marked premium / supply area. Location aligns with prior highs and bearish imbalance, giving good downside potential if price delivers.

The setup only becomes valid once price reaches the zone and shows lower-timeframe bearish confirmation (structure shift or strong rejection). Until then, no entry — patience over forcing trades.

Bias remains bearish as long as structure holds. Invalidation above the supply high.

RECESSION AHEAD?Hi, I’m Maicol, an Italian trader specialized in Gold since 2019.

I need your support.

Leave a like and follow me.

It’s a small gesture for you, but very important for my work.

🌞 GOOD MORNING EVERYONE 🌞

📌 Today requires extremely strict risk management.

📌 No trades until today’s PPI release at 14:30.

We’ll review it live together after the data.

⚠️ Pay close attention to what I shared, both in the trading idea and here.

These are key levels.

We are at the monthly close.

First and last week of the month are usually the worst periods to trade.

🚨 TRUMP UPDATE:

Donald Trump is very likely preparing to appoint Kevin Warsh, former Federal Reserve Governor, as the new Fed Chair, replacing Jay Powell.

Why?

The assumption is that he may be easier to influence.

This could allow Trump to indirectly benefit from interest rate management, even though the Fed is meant to be independent.

🥶 This would be a very serious issue.

But for now, no rushed conclusions. We wait and observe.

❌ Then we have the Microsoft bubble and everything connected to it.

This is causing strong gold selling to raise liquidity and cover losses in other assets.

Gold remains bullish on higher timeframes in the long term.

But watch these liquidations closely.

Especially if major assets start shifting trend.

Today we have very important data for gold.

All details are explained in the trading idea.

🔔 Turn on notifications

so you don’t miss anything.

📬 For any doubts or questions,

write to me. I’ll reply.

🔍 NEXT APPOINTMENTS 🔍

As usual, live at 14:00

to follow the market in real time.

🔍 REMINDER 🔍

I avoid trading during the Asian and London sessions.

I focus on news at 14:30

and New York open at 15:30.

Have a great day.

-GOOD TRADING

-MANAGE RISK

-BE PATIENT

GOLD H4 | Could We See A Bounce?Based on the H4 chart analysis, we could see the price fall to our buy entry level at 4,854.29, which is a pullback support that is slightly above the 61.8% Fibonacci retracement.

Our stop loss is set at 4,530.22, which is an overlap support that aligns with the 78.6% Fibonacci retracement.

Our take profit is set at 5,557.89, whichis a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

USDJPY H1 | Bullish Bounce OffThe price is falling towards our buy entry level at 152.99, which is an overlap support.

Our stop loss is set at 152.14, which is a swing low support.

Our take profit is set at 154.73, which is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Pullback resistance ahead?Loonie (USD/CAD) is rising towards the pivot and could reverse to the 1st support.

Pivot: 1.3651

1st Support: 1.3464

1st Resistance: 1.3792

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Heading towards 38.2% Fib resistance?USD/JPY is rising towards the pivot, which is an overlap resistance that aligns with the 38.2% Fibonacci retracement and could reverse to the 1st support.

Pivot: 154.67

1st Support: 152.16

1st Resistance: 156.21

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish continuation?Kiwi (NZD/USD) is falling towards the pivot, which is a pullback support and could bounce to the 1st resistance.

Pivot: 0.5991

1st Support: 0.5913

1st Resistance: 0.6121

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish momentum to extend?WTI Oil (XTI/USD) is falling towards the pivot, which is a pullback support and could bounce to the 1st resistance.

Pivot: 62.49

1st Support: 60.76

1st Resistance: 66.48

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

EUR/USD Bull Pennant Breakout into Support TestWhile USD/JPY was providing much of the push for USD pairs EUR/USD put in its first test above the 1.2000 handle in more than four years. It didn't last for long, however, as price retreated a day later and now we get to see what the trend is made of.

Right now there's a support test at prior resistance, taken from the swing highs last year at 1.1909-1.1919. As of this writing there's still four hours until the daily close but currently the daily bar is working on a doji, and a sign of indecision after a sell-off like we saw on Wednesday takes an optimistic appearance for bulls looking for a 1.2000 re-test.

I think the spark point here remains USD/JPY and whether we see greater signs of carry unwind. And while Scott Bessent's comments yesterday that the US did not intervene have helped USD/JPY to hold up a bit, the larger matter is one of positioning and whether longer-term longs use the current bounce to reduce exposure given that there's both a theoretical line in the sand that the MoF and BoJ can defend (at 160.00) and there's the expectation for narrowing rate differentials between the two economies. - js

USD - The Oversold TestRSI on the daily chart of DXY got down to extreme levels earlier in the week with a Tuesday close below the 25-level. This would be the lowest value for the indicator since 2020 when, at the time, the Fed was pushing loose monetary policy to stimulate growth despite much of the globe still being shut down. That instance soon led to a significant low and that was followed by a roaring rally in 2021 and 2022 as the Fed finally reacted to inflation.

RSI is not a great timing indicator - but it can be fantastic context and that's what I'm taking this as currently. It doesn't mean automatic reversal but it does mean caution if chasing the trend lower.

As for drivers, I think it's obvious what would need to push to allow the sell-off to continue and that's continued unwind of the USD/JPY carry trade, which for the past two days has been stalled. Going into Friday the big question is whether we see another push of weakness in USD/JPY which can have an outsized impact in DXY and, in-turn, USD-pairs, even something like EUR/USD despite the fact that the Euro is a much larger component of the DXY basket. - js

AUDUSD Buy Setup | 0.69800 Support + Bullish Gold Prices!Hey Traders,

In today’s trading session, we are closely monitoring AUDUSD for a potential buying opportunity around the 0.69800 zone. AUDUSD remains in a well-established bullish trend and is currently undergoing a healthy corrective pullback, approaching a key trendline confluence and the 0.69800 support-turned-resistance area, which may act as a strong demand zone for trend continuation.

From a fundamental perspective, the Australian Dollar often benefits from its positive correlation with Gold. With Gold prices maintaining a constructive bullish tone, this relationship could provide additional upside support for AUDUSD, reinforcing the bullish technical setup and favoring a continuation toward higher levels.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

#USDCAD , First one after many month !📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #USDCAD

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality Setup as EJ ... just will observe it .... no need to rush on it

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

AUDUSD - When Structure Meets RealityAUDUSD is now retesting a strong technical intersection:

the weekly resistance marked in green is lining up perfectly with the upper bound of the weekly rising channel in blue.⚔️

On top of that, price is sitting in an over-bought zone after an extended push higher.

As long as this intersection holds, the odds favor a bearish correction, with price rotating lower toward the lower bound of the channel. This wouldn’t be a trend reversal, but a healthy reset within the bigger structure.

If this zone gets cleanly broken and accepted above, then the narrative changes.

Until then, I’m respecting resistance and letting structure lead the bias.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

EURUSD— FRGNT DAILY CHART FORECAST.Q1 | W4 | D29 | Y26📅 Q1 | W4 | D29 | Y26

📊EURUSD— FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURUSD

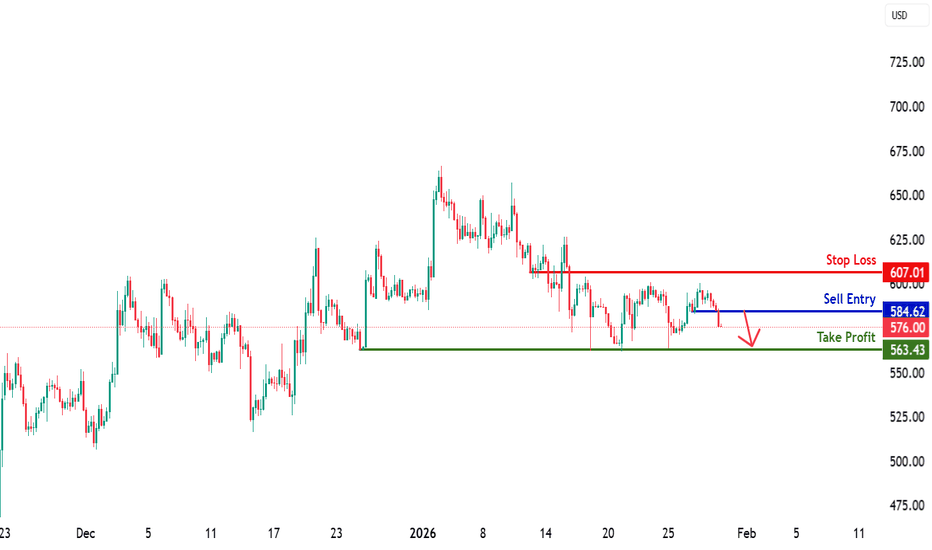

BCHUSD H4 | Bearish Drop OffThe price could rise to our sell entry level at 584.62, which is a pullback resistance.

Our stop loss is set at 607.01, which is a pullback resistance.

Our take profit is set at 563.43, which is a multi swing low support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com