USDCHF H4 | Could We See A ReversalThe price is reacting off our sell entry level at 0.7992, which is an overlap resistance that lines up with the 61.8% Fibonacci retracement and the 78.6% Fibonacci projection.

Our stop loss is set at 0.8025, which is a pullback resistance that is slightly below the 78.6% Fibonacci retracement.

Our take profit is set at 0.7942, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

Usdchf!

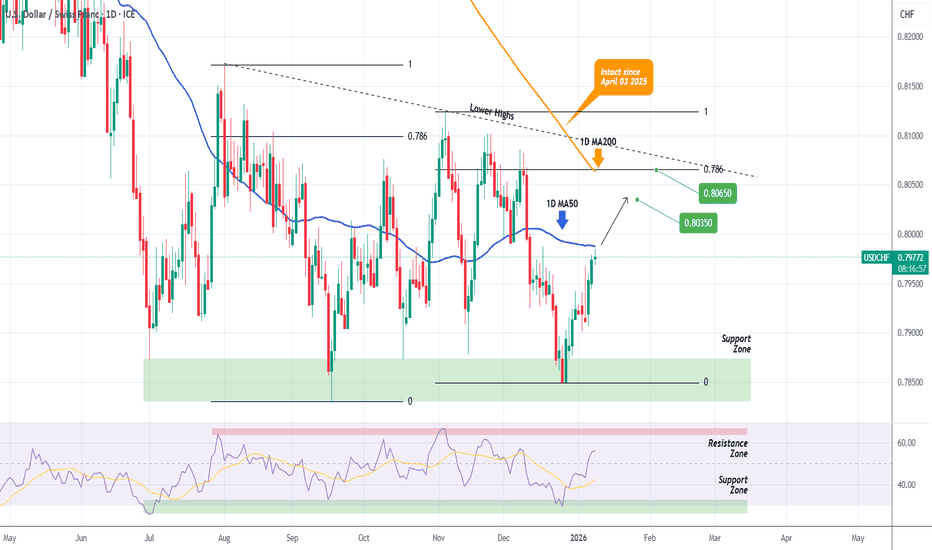

USDCHF Moment of truth on the 1D MA200 is coming.The USDCHF pair is on a strong rise since its December 26 2025 Low, which is technically the Bullish Leg of the long-term Descending Triangle. Today it is testing the 1D MA50 (blue trend-line) and if broken, will be the perfect buy continuation signal.

If it breaks, buy and target a potential 1D MA200 (orange trend-line) test at 0.80350. This will be the market's most important test for 2026 as the 1D MA200 has been untouched since April 03 2025.

If it breaks, the long-term trend most likely shifts to bullish, but even on the short-term we can again engage into a quick buy, targeting the top (Lower Highs trend-line) of the Descending Triangle at 0.80650, which is also the 0.786 Fibonacci retracement level (where the previous Lower High was priced).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDCHF Is Very Bullish! Long!

Take a look at our analysis for USDCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 0.788.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 0.796 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

Stop!Loss|Market View: USDCHF🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the USDCHF currency pair☝️

Potential trade setup:

🔔Entry level: 0.79758

💰TP: 0.78838

⛔️SL: 0.80276

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: At the end of this week, at least until tomorrow's non-farm data release, we should expect further strengthening of the USD across all major currencies. However, the technical situation for USDCHF is different from the others, growth is also expected there, but the area around 0.79 will likely be tested before a more global strengthening of the USD. Targets around 0.78 are also being considered. The most reliable entry point for this could be a false breakout near the 0.8 resistance level.

Thanks for your support 🚀

Profits for all ✅

Bearish reevrsal off Fib confluenceSwissie (USD/CHF) is rising towards the pivot, which is an overlap resistance and could reverse to the 1st support, which is a pullback support.

Pivot: 0.7992

1st Support: 0.7934

1st Resistance: 0.8025

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDCHF 📉 OANDA:USDCHF Technical Analysis (4H Timeframe)

The overall trend for USD/CHF is currently bearish, as the price remains below the downward-sloping EMA 200 (black line) and has consistently formed lower highs 📉. Looking at the momentum, we saw large-bodied bearish candles during the previous impulsive waves, indicating strong selling pressure. However, the last 5 waves show a corrective pullback as the price bounces from the major grey demand zone at the bottom. Currently, the price is testing the EMA 50 (red line) and a local structural resistance at 0.79600 USD. Since the EMA 50 is cutting through the price without a clear slope, it suggests a short-term neutral or consolidating phase within the larger downtrend. A rejection here could signal a continuation of the bearish trend toward the lower liquidity zones.

🔑 Key Levels to Watch:

Major Resistance Zone (Grey Box): 0.81100 USD 🚩

Structural Resistance: 0.80500 USD (Dashed Line) 🎯

Dynamic Resistance / Flip Zone: 0.80100 USD (EMA 200 & Grey Box) ⚡

Immediate Pivot Level: 0.79600 USD (Dashed Line) 💡

Recent Support Level: 0.79000 USD 🛡️

Primary Demand Zone (Grey Box): 0.78300 USD – 0.78630 USD 📥

Ultimate Downside Target: 0.77900 USD 📉

USDCHF key support at 0.7913The USDCHF remains in a bullish trend, with recent price action showing signs of an oversold bounce back within the broader sideways consolidation.

Support Zone: 0.7913 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.7913 would confirm ongoing upside momentum, with potential targets at:

0.7990 – initial resistance

0.8000 – psychological and structural level

0.8020 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.7913 would weaken the bullish outlook and suggest deeper downside risk toward:

0.7880 – minor support

0.7860 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the USDCHF holds above 0.7913 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USD/CHF BEARS ARE GAINING STRENGTH|SHORT

USD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.796

Target Level: 0.794

Stop Loss: 0.798

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Is USD/CHF Preparing for a Momentum Shift Higher?🔥 USDD/CHF – “THE SWISSY” | Swing + DAY Trade Guide (Bullish Plan) 🇺🇸💵🇨🇭💎

📌 Current Context (London Time):

USD/CHF is hovering around key zones near 0.790-0.795 — showing volatility influenced by strong CHF demand and mixed USD data.

🧠 TRADE PLAN – THIEF LAYER STRATEGY

🎯 Bias: Bullish reversal play (swing & intraday)

Entry Strategy:

We’re stacking buy limits in thief layer style (take multiple fills instead of one entry):

🎯 Buy Limit Layers:

⚡ 0.79100

⚡ 0.79200

⚡ 0.79400

(You can add more layers based on your risk appetite)

📉 SL (Thief Style):

🚫 Stop Loss @ 0.79000 – designed as your last line of defense

📈 Target Zone (Take Profit):

🚀 Primary Target @ 0.79900

Price squeeze up to this level where resistance from moving averages + overbought pressure likely kicks in.

⚠️ Risk Advisory:

📌 All risk decisions are yours — trade your plan, not my words. Thief OG’s take profits and losses at their own risk.

🔗 PAIRS TO WATCH (Correlation & Confirmation)

📌 EUR/USD – Strong inverse correlation with USD/CHF; when EUR/USD falls, USD/CHF often rises.

📌 USD/JPY – USD strength gauge; strong USD often lifts USD/CHF too.

📌 XAU/USD (Gold) – Safe-haven proxy; gold up can signal CHF strength (USD/CHF down).

📌 EUR/CHF – CHF strength context; strong euro may push CHF pairs differently.

📊 TECHNICAL EDGE

🟦 Key SMA/EMA resistance around our target zone

🟩 Support cluster aligning with buy layers

🟨 RSI/OB levels suggest bounce potential

🧨 FUNDAMENTAL & ECONOMIC FACTORS (London Time)

🟢 Swiss Franc (CHF) Drivers:

• SNB continues steady policy stance → CHF stays strong as safe haven.

• Lower inflation / strong risk sentiment drives CHF strength.

• Any Swiss GDP/ZEW survey or SNB commentary can spike moves.

🔵 US Dollar (USD) Drivers:

• Fed policy outlook + US GDP & unemployment data shape USD strength.

• USD weakening as Fed easing bets grow puts downward pressure on USD/CHF.

📅 Watch Key Events (London Time):

🕐 US GDP releases

🕐 Fed meeting minutes / speeches

🕐 Swiss ZEW expectations survey

🕐 CPI / inflation prints from USD & CHF regions

💡 Thief Vibe Final Words

🚨 This setup is built for smart layering, patient fills and disciplined exit runs.

📈 Stack entries, defend your risk, and exploit the natural dynamics of USD ↔ CHF flows.

USD/CHF needs to be watchedAfter forming a low at 0.7829 in September, the USD/CHF has refused to fall any further. With rates at zero in Switzerland, it wouldn't take too much improvement in US data to lift this pair from these lows, especially with the bearish momentum fading sharply. Let's see if this week's US employment data will be the trigger for a potential short squeeze rally. Short-term resistance levels that need to break are at 0.8000 and 0.81000.

By Fawad Razaqzada, market analyst with FOREX.com

USDCHF Will Fall! Sell!

Please, check our technical outlook for USDCHF.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.793.

Considering the today's price action, probabilities will be high to see a movement to 0.788.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

USDJPY: breakout to 162🛠 Technical Analysis: On the H4 chart, USDJPY continues to trade within a well-defined ascending channel, printing higher lows while price compresses beneath the key resistance zone around 158.0. The moving averages (SMA50/100/200 clustered near 156.1–156.4) are supporting the structure and keeping bullish momentum intact as price holds above the channel midline. The setup favors a buy continuation only after a confirmed breakout and hold above 158.00, turning that level into support. If the breakout is accepted, the next upside expansion projects toward 162.00.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: Buy on confirmed breakout above 158.00 (approx. 158.021)

🎯 Take Profit: 161.861

🔴 Stop Loss: 156.100

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

#USDCHF ? Lets see !📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #USDCHF

⚠️ Risk Environment: High

📈 Technical Overview:

Same as NU , Not a Quality Setup

Need valid Momentum Structure ... and a good LTF entry sign

NO RUSH !

🚀 Trading Plan:

• Wait for Momentum around key levels

• LTF ENTRY NEEDED

• Manage risk aggressively, protect capital first

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

Could we see a reversal from here?Swissie (USD/CHF) is falling towards the pivot, which acts as a pullback support and could bounce to the 1st resistance.

Pivot: 0.7892

1st Support: 0.7859

1st Resistance: 0.7967

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDCHF oversold bounce back targeting resistance at 0.7990?The USDCHF remains in a bullish trend, with recent price action showing signs of an oversold bounce back within the broader sideways consolidation.

Support Zone: 0.7913 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.7913 would confirm ongoing upside momentum, with potential targets at:

0.7990 – initial resistance

0.8000 – psychological and structural level

0.8020 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.7913 would weaken the bullish outlook and suggest deeper downside risk toward:

0.7880 – minor support

0.7860 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the USDCHF holds above 0.7913 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USDCHFUSDCHF: If the price can remain above 0.79259, there is a possibility of an upward price movement. Consider buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

This content is not financial advice. Always conduct your own financial due diligence.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

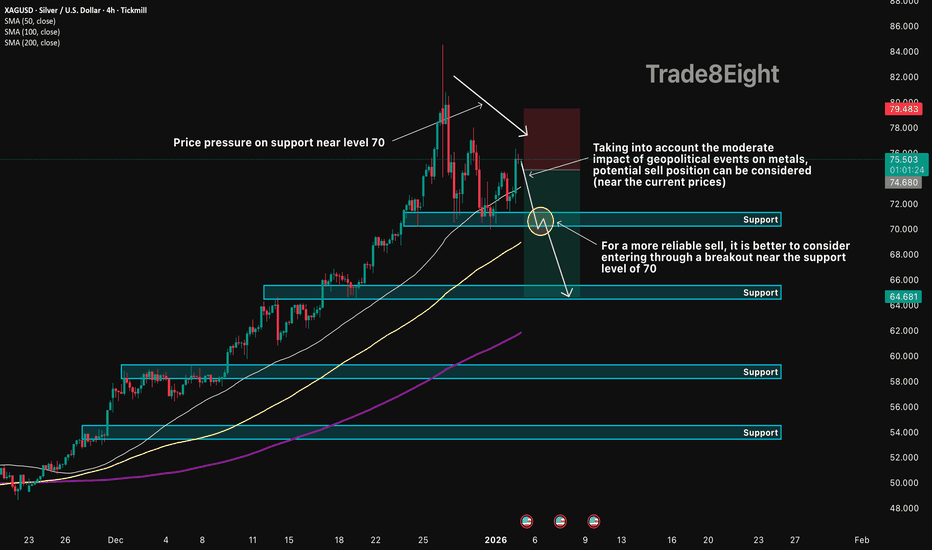

XAGUSD: pressure on $70 support🛠 Technical Analysis: On the 4-hour (H4) timeframe, Silver (XAGUSD) is showing a structural shift toward a corrective phase. Despite the broader uptrend, the price is currently exerting "pressure on the support in the 70 area".

While the long-term trend remains bullish, the "moderate influence of geopolitical events on metals" is currently favoring a pullback. For a "more reliable sell," the strategy recommends waiting for a confirmed breakdown of the 70.00 support zone, which would signal a move toward deeper liquidity levels.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Current market price ($75.498) or on a break of 70.00

🎯 Take Profit: 64.681 (Support)

🔴 Stop Loss: 79.483

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

USDCHF H1 | Falling Towards 50% Fib SupportThe price is falling towards our buy entry level at 0.7924, which is a pullback support that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 0.7900, which is an overlap support.

Our take profit is set at 0.7965, which is a pullback resistance that aligns with the 78.6% Fibonacci retracment.

High Risk Investment Warning

Stratos Markets Limited (