USDCHF Is Bullish! Buy!

Take a look at our analysis for USDCHF.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 0.780.

The above observations make me that the market will inevitably achieve 0.791 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

USDCHF

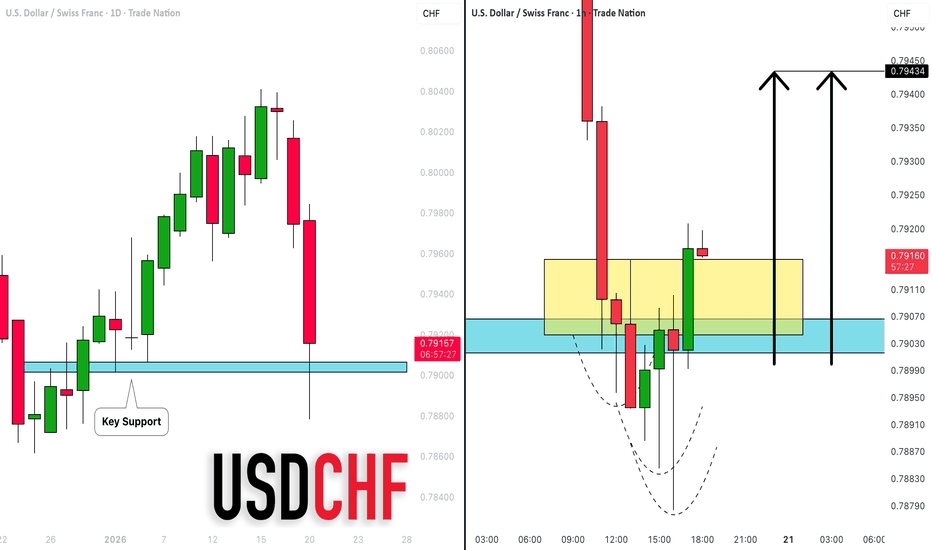

USD/CHF Price Outlook – Trade Setup📊 Technical Structure

OANDA:USDCHF USD/CHF remains under downside pressure after a sharp selloff from the recent highs. Price rebounded briefly from the 0.7888–0.7880 support zone but failed to sustain upside momentum, and is now stalling beneath the 0.7925–0.7936 resistance zone.

The broader structure still points to a bearish continuation bias. The recent recovery appears corrective in nature, forming a lower high beneath resistance. As long as price remains capped below the resistance zone, the pair is vulnerable to renewed selling pressure toward the lower support area.

🎯 Trade Setup (Bearish Bias)

Entry Zone: 0.7925 – 0.7936

Stop Loss: 0.7940

Take Profit 1: 0.7888

Take Profit 2: 0.7880

Risk–Reward Ratio: Approx. 1 : 2.41

📌 Invalidation

A sustained break and close above 0.7940 would invalidate the bearish setup and signal a deeper upside recovery.

🌐 Macro Background

The short-term macro backdrop remains unfavourable for USD/CHF. The US Dollar continues to weaken amid uncertainty surrounding President Trump’s upcoming announcement of the next Federal Reserve Chairman, raising concerns that future Fed leadership may lean toward a more politically accommodative policy stance.

Additionally, the Swiss Franc has found relative support after Swiss National Bank (SNB) Chairman Martin Schlegel warned that negative inflation prints are possible this year, while downplaying the likelihood of a return to negative interest rates. This has reinforced CHF’s defensive appeal in the near term.

Although the US Dollar briefly regained ground after the EU–US Greenland dispute was de-escalated and tariff threats were rolled back, broader sentiment toward the Greenback remains fragile, keeping downside risks dominant for USD/CHF.

🔑 Key Technical Levels

Resistance Zone: 0.7925 – 0.7936

Support Zone: 0.7888 – 0.7880

Bearish Invalidation: Above 0.7940

📌 Trade Summary

USD/CHF is trading beneath a key resistance zone after a corrective rebound from support. As long as price remains capped below 0.7936, the bias favours a sell-on-rallies approach, targeting a renewed move lower toward the 0.7900–0.7888 support region.

⚠️ Disclaimer

This analysis is for reference only and does not constitute investment or trading advice. Financial markets involve risk, and traders should manage positions according to their own risk tolerance.

Heading towards 50% Fib resisstance?Swissie (USD/CHF) could rise towards the pviot which has been identified as a pullback resistance that aligns with the 50% Fibonacci retracement.

Pivot: 0.7930

1st Support: 0.7878

1st Resistance: 0.7965

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Stop!Loss|Market View: USDJPY🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the USDJPY currency pair☝️

Potential trade setup:

🔔Entry level: 158.736

💰TP: 161.081

⛔️SL: 157.660

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Despite the current challenging situation for the USD, this pair is considered suitable for further growth towards 160 and 161. However, it's important to understand that if the price begins to test the 158 support level again, it's best to hold off on buying for a while. For now, buying is still appropriate, even at current prices.

Thanks for your support 🚀

Profits for all ✅

USDCHF Will Explode! BUY!

My dear friends,

Please, find my technical outlook for USDCHF below:

The instrument tests an important psychological level 0.7902

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.7922

Recommended Stop Loss - 0.7889

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDCHF H1 | Bearish Reaction Off Pullback ResistanceMomentum: Bearish

Price is currently below the ichimoku cloud.

Sell entry: 0.79578

- Pullback resistance

- 50% Fib retracement

- 161.8% Fib extension

Stop Loss: 0.79828

- Overlap resistance

Take Profit: 0.79283

- Pullback support

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

USDCHF - Let the Market Come to YouUSDCHF remains overall bullish, and price is now doing exactly what we want to see in a healthy trend.

We’re currently retesting a key intersection:

– the lower blue trendline

– and the green structure support

As long as this intersection holds, my focus stays on trend-following long setups. I want to see buyers step in again from here and defend structure before considering any entries.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

XAGUSD: downward correction🛠 Technical Analysis: Silver is consolidating right under a key resistance zone (~94.00–95.00) after a strong impulsive rally. The current structure looks like a topping wedge, which often precedes a corrective leg once buyers fail to push a clean breakout. With price extended above the faster MAs, a pullback toward the next demand area becomes more probable if we see rejection from resistance. Key downside magnet sits near the first major support around 83.20.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: 92.583

🎯 Take Profit: 83.205

🔴 Stop Loss: 97.245

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Bullish reversal?Swissie (USD/CHF) is falling towards the pivot which is a pullback support and could bounce to the 1st resistance.

Pivot: 0.7930

1st Support: 0.7879

1st Resistance: 0.7994

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDCHF Short-term bullish + potential break-out.Early this month (January 08, see chart below) we gave a strong buy signal on the USDCHF pair, which shortly after hit our 0.80350 Target:

As it got rejected just below the 1D MA200 (orange trend-line), the price pulled back to the 7-month Support Zone and turned into a buy opportunity again.

Now, we have Target 1 at 0.80100, just below the Inner Lower Highs trend-line. If we close a 1D candle above that as well, re-buy with Target 2 at 0.80650 (Fibonacci 0.786) just below the Lower Highs trend-line.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Heading towards overlap resistance?USD/CHF is rising towards the resistance level whic is an overlap resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.7966

Why we like it:

There is an overlap resistance level that aligns with the 50% Fibonacci retracement.

Stop loss: 0.7995

Why we like it:

There is a pullback resistance that is slightly below the 78.6% Fibonacci retracement.

Take profit: 0.7886

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDCHF sideways consolidation continuation The USDCHF remains in a bullish trend, with recent price action showing signs of an oversold bounce back within the broader sideways consolidation.

Support Zone: 0.7880 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.7880 would confirm ongoing upside momentum, with potential targets at:

0.7950 – initial resistance

0.7980 – psychological and structural level

0.8000 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.7880 would weaken the bullish outlook and suggest deeper downside risk toward:

0.7860 – minor support

0.7840 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the USDCHF holds above 0.7880 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USDCHF Will Go Lower! Sell!

Take a look at our analysis for USDCHF.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.792.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 0.787 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

USDCHF H4 | Bullish ReversalBased on the H4 chart analysis, we can see that the price has bounced off our buy entry level at 0.7895, which is a pullback support that aligns with the 78.6% Fibonacci retracement.

Our stop loss is set at 0.7863, which is a swing low support.

Our take profit is set at 0.7963, which is an overlap resistance that aligns with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

USDCHF: Time to Recover 🇺🇸🇨🇭

USDCHF is ready to recover after a test of a key daily support

and a bearish trap below that.

Expect a rise to 0.7943

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Falling towards 61.8% Fib support?Swissie (USD/CHF) is falling towards the pivot, which aligns with the 61.8% Fibonacci retracement, and could bounce to the 1st reistance, which acts as a pullback resistance.

Pivot: 0.7934

1st Support: 0.7898

1st Resistance: 0.7994

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

#USDCHF BullishI believe we are bullish on USDCHF. What I believe is going to happen right now is liquidate my Breakout Box to the sell side, or possibly just retest the equilibrium, and go bullish. As of now, we need to wait for more candles to be revealed to confirm where price really wants to move, and for that to happen we need to wait for the London session. We need to pay attention to the 4hour and 1hour timeframe when they are closing and how they are close/ forming. Knowing what the big timeframes are doing and OANDA:USDCHF let it all be in sync with the 15minute timeframe.

USD-CHF Free Signal! Buy!

Hello,Traders!

USDCHF Price reacts strongly from a well-defined demand zone after a corrective leg, showing bullish displacement and absorption of sell-side liquidity. Smart money accumulation favors continuation toward higher liquidity.

--------------------

Stop Loss: 0.7955

Take Profit: 0.7993

Entry: 0.7971

Time Frame: 4H

--------------------

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF oversold bounce support at 0.7957The USDCHF remains in a bullish trend, with recent price action showing signs of an oversold bounce back within the broader sideways consolidation.

Support Zone: 0.7957 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 0.7957 would confirm ongoing upside momentum, with potential targets at:

0.8050 – initial resistance

0.8068 – psychological and structural level

0.8094 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 0.7957 would weaken the bullish outlook and suggest deeper downside risk toward:

0.7940 – minor support

0.7915 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the USDCHF holds above 0.7913 A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USD/CHF BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

Bullish trend on USD/CHF, defined by the green colour of the last week candle combined with the fact the pair is oversold based on the BB lower band proximity, makes me expect a bullish rebound from the support line below and a retest of the local target above at 0.800.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅